Author: Zen, PANews

The duck knows when the river water warms up in spring. The financing information of the project is an important signal of market development. It not only reflects the competitiveness of the project itself, but also shows the flow and confidence of market funds, and also indicates the direction and trend of innovation. PANews regularly launches the " Financing Weekly " column every Monday morning, continuously recording the weekly financing market information. At the end of the year, based on the financing information throughout the year, we review the overall primary market performance this year to provide reference for investors.

Overview of the investment and financing market in 2024

According to incomplete statistics from PANews, in 2024, the primary market of cryptocurrency and blockchain disclosed 1,259 investment and financing events, with a total capital scale of over US$9.3 billion. In terms of the total number and scale of financing, the investment and financing market situation this year is basically the same as that in 2023 , when 1,174 transactions completed a total of US$9.615 billion in financing. Compared with 1,660 investment and financing events in 2022 , with a total capital of over US$34.8 billion, a more stable situation has been formed in the past two years, and investment transactions tend to be more cautious and rational.

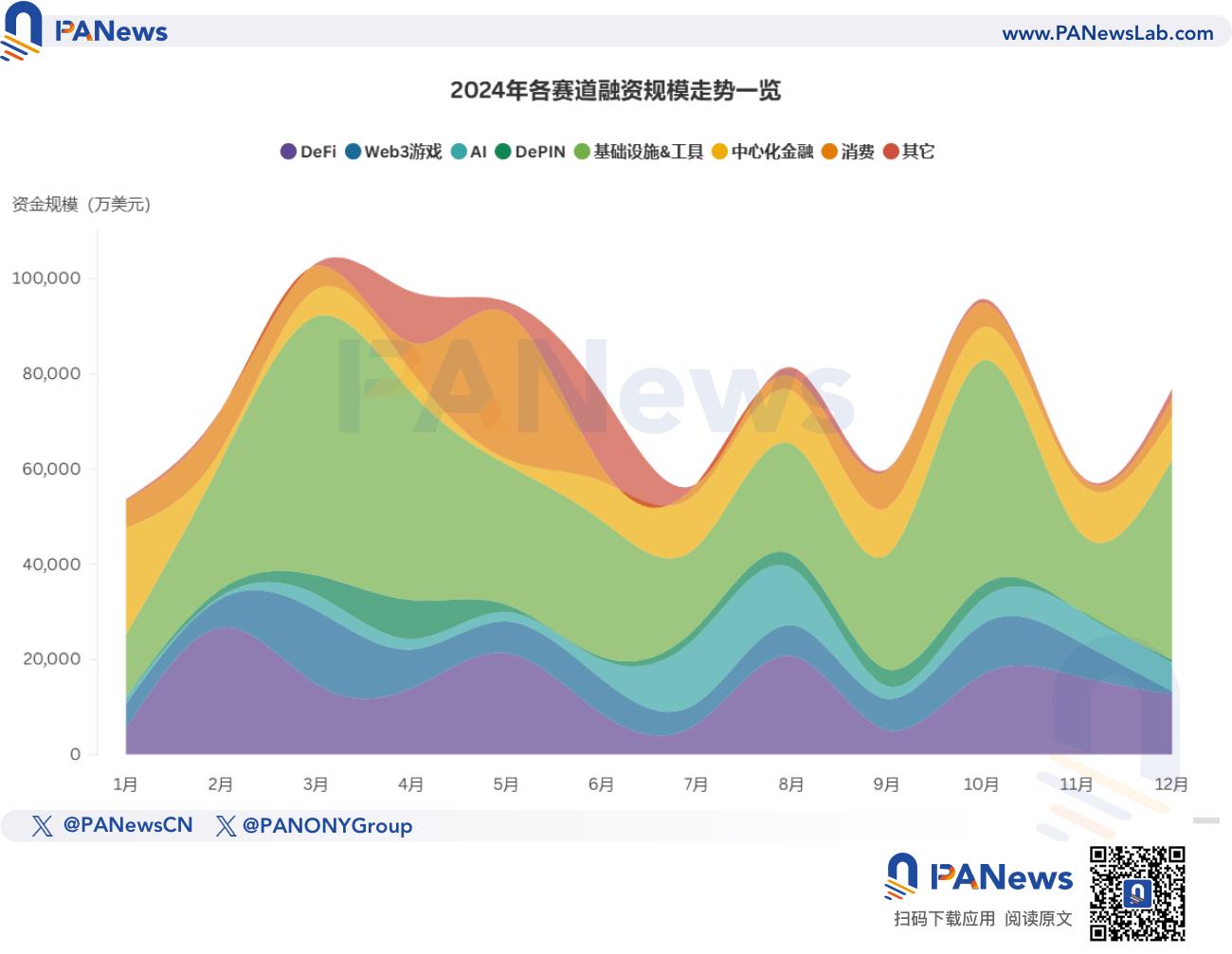

It is worth mentioning that in addition to the similar total amount, the fluctuation trends of "total financing amount" and "financing amount" this year and in 2023 are also very similar.

First, the crypto investment and financing market had another good start and reached its peak from March to May. The financing scale in March exceeded 1.03 billion US dollars, which was also the only month this year with a financing amount exceeding 1 billion US dollars. The same was true in April, May, and October, with the funding scale exceeding 950 million US dollars.

Second, after a strong start, the market began to lose momentum in the middle, entering a low period from June to September. During this period, the number of financing events disclosed each month exceeded 100 only in August, and the financing scale in July and September was less than US$600 million;

Third, there was a sudden surge after entering the fourth quarter, with 106 investment and financing events disclosed in October and over US$957 million in financing, the best performance in a single month in the second half of this year. Although it was weak again in November, the primary market performance in December was also impressive. As of December 22, the financing scale of that month had exceeded US$818 million.

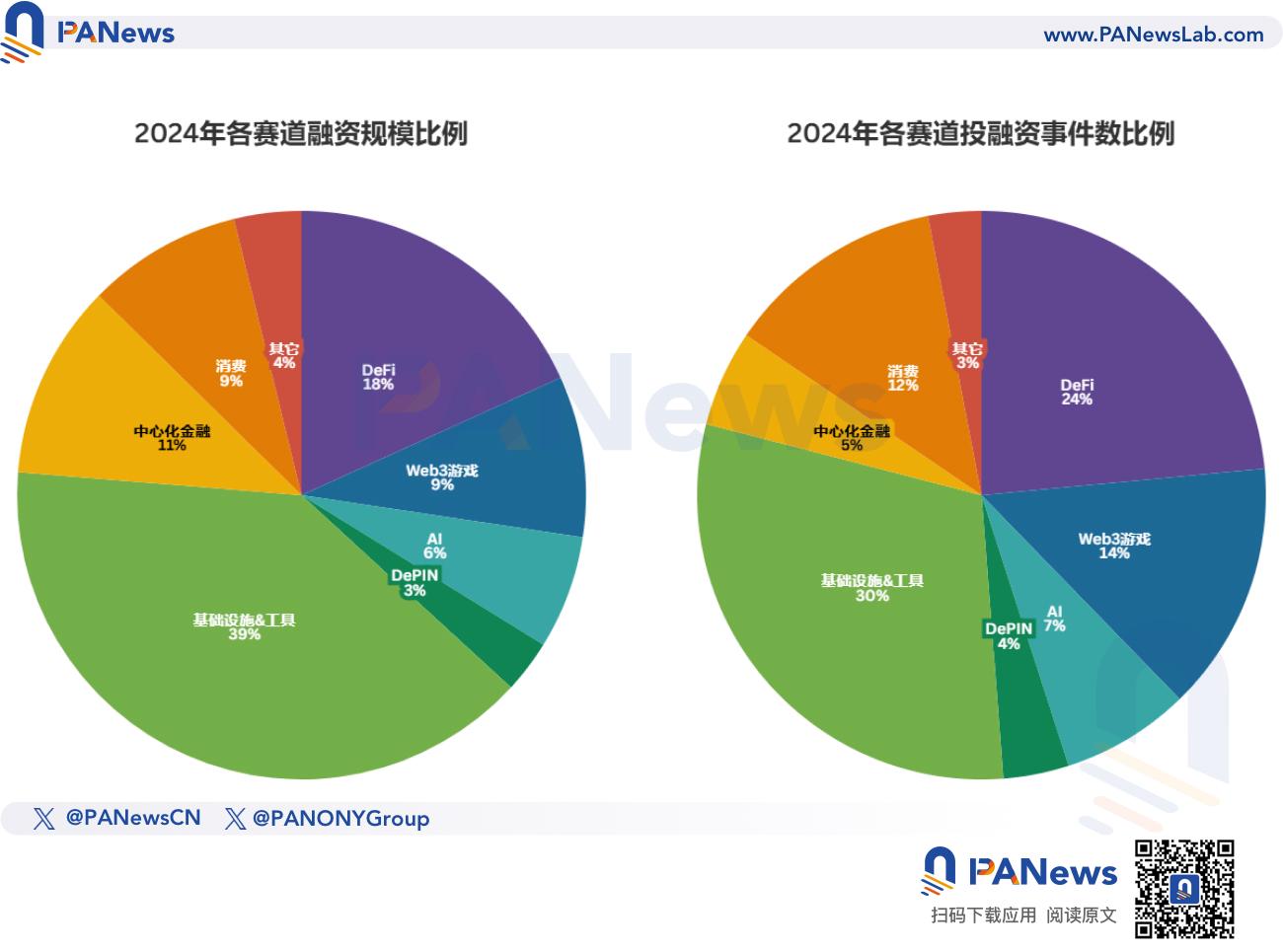

As the industry develops, the narrative themes and categories of startups are richer and more diverse than before. Based on market hotspots, PANews roughly divides projects into eight tracks: DeFi, Web3 games, infrastructure and tools, AI, DePIN, centralized finance, consumer, and others, and compiles statistics on the investment and financing of each track.

As the track that has long been the most favored by capital, the number and amount of investment and financing transactions in infrastructure and tools are the highest among all tracks, with 381 and US$3.66 billion respectively; the second most popular track this year is DeFi, with 296 and US$1.69 billion respectively, both ranking second; centralized finance is the only track other than infrastructure and tools and DeFi with a funding scale of more than US$1 billion, and its average financing amount is also the highest, reaching US$14.92 million; AI projects, as an emerging category, have grown rapidly this year, with nearly 100 disclosed financing events and a funding scale of around US$600 million.

The specific statistics of each track are detailed below.

Infrastructure & Tools

Among all the projects that completed financing this year, 30% belong to the infrastructure & tools track, and the amount raised accounts for 39.46% of the total. This track also announced the most large-scale financing news, with investment and financing events of tens of millions of dollars or more accounting for 27.82%, of which 6 financing scales reached hundreds of millions of dollars, and 106 financing scales were tens of millions of dollars.

The financing trend of the Infrastructure & Tools track is roughly the same as the overall trend. The track disclosed 48 financing news in February at most; its monthly financing peak occurred in March, exceeding US$543 million.

In December, the Avalanche Foundation raised $250 million in a private token sale, the largest single round of funding this year. The round was led by Galaxy Digital, Dragonfly, and ParaFi Capital, with participation from more than 40 other firms including SkyBridge and Morgan Creek Digital.

In addition, in October this year, payment company Stripe acquired the stablecoin payment platform Bridge for a high price of US$1.1 billion, which is also the largest acquisition in the crypto industry to date. Bridge aims to build a global payment network for stablecoins and provide companies with software tools and technical support for accepting stablecoin payments. It is worth mentioning that in this acquisition, Sequoia Capital, which owns 16% of Bridge’s shares, is expected to gain more than US$100 million from the acquisition transaction.

DeFi

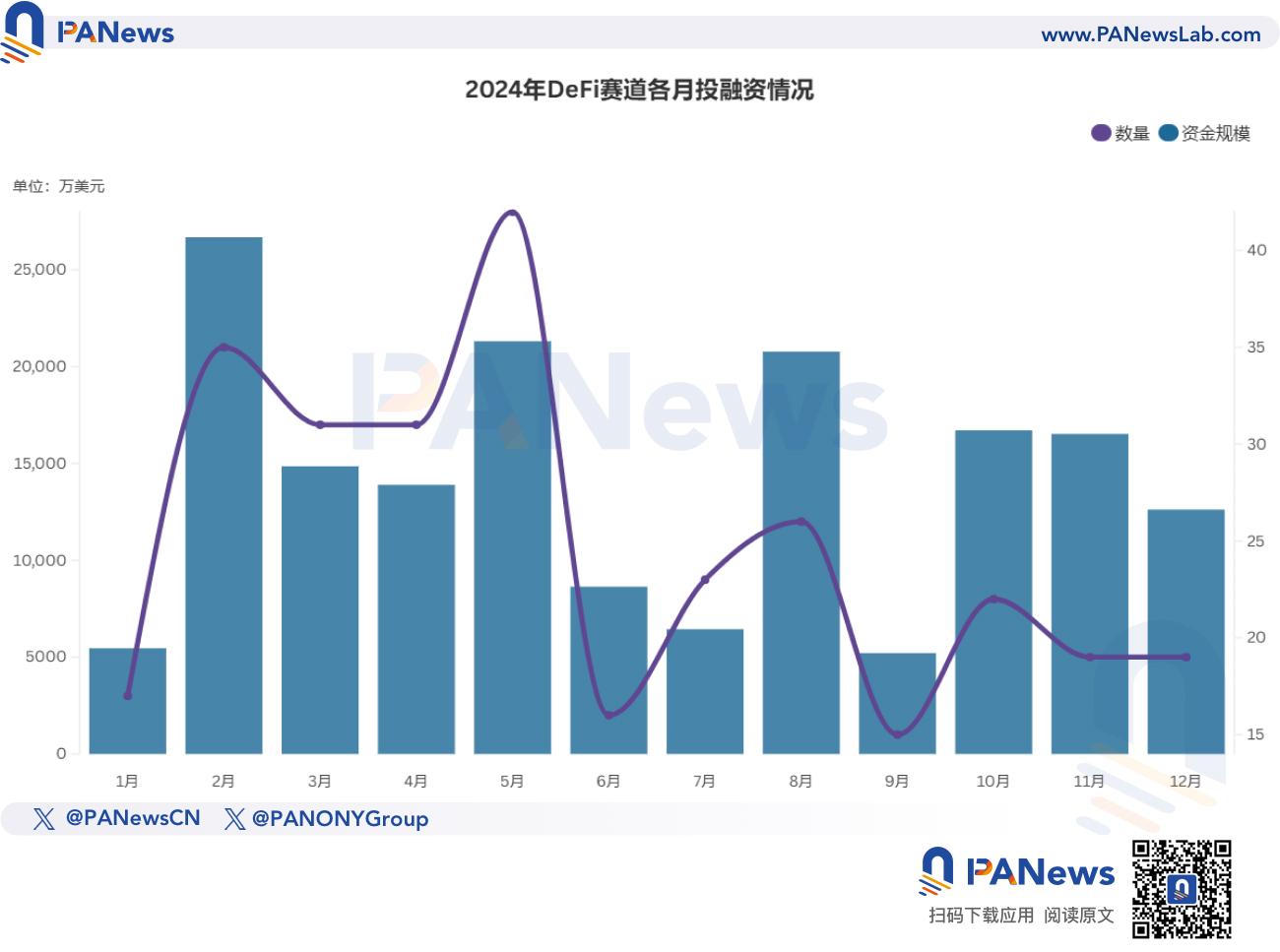

The DeFi track first broke out in February this year, with financing exceeding $266 million that month, the highest for the whole year. This is mainly due to a16z's investment of $100 million in the Ethereum re-staking protocol EigenLayer, which is also the only project in the track that has raised over 100 million this year. When the situation is still unclear, it boosted the confidence of the crypto venture capital market. Putting this factor aside, the best month for DeFi was May, with 42 disclosed investment and financing events, the most this year, and a financing scale of $213 million.

As mentioned above, the number of DeFi investment and financing events and the financing scale were 296 and US$1.69 billion, accounting for 23.51% and 18.22% respectively. Among the financing news disclosed by DeFi projects, there were 40 financing scales of tens of millions of dollars, accounting for 13.51%, and most of them were concentrated in the millions of dollars range.

Web3 Games

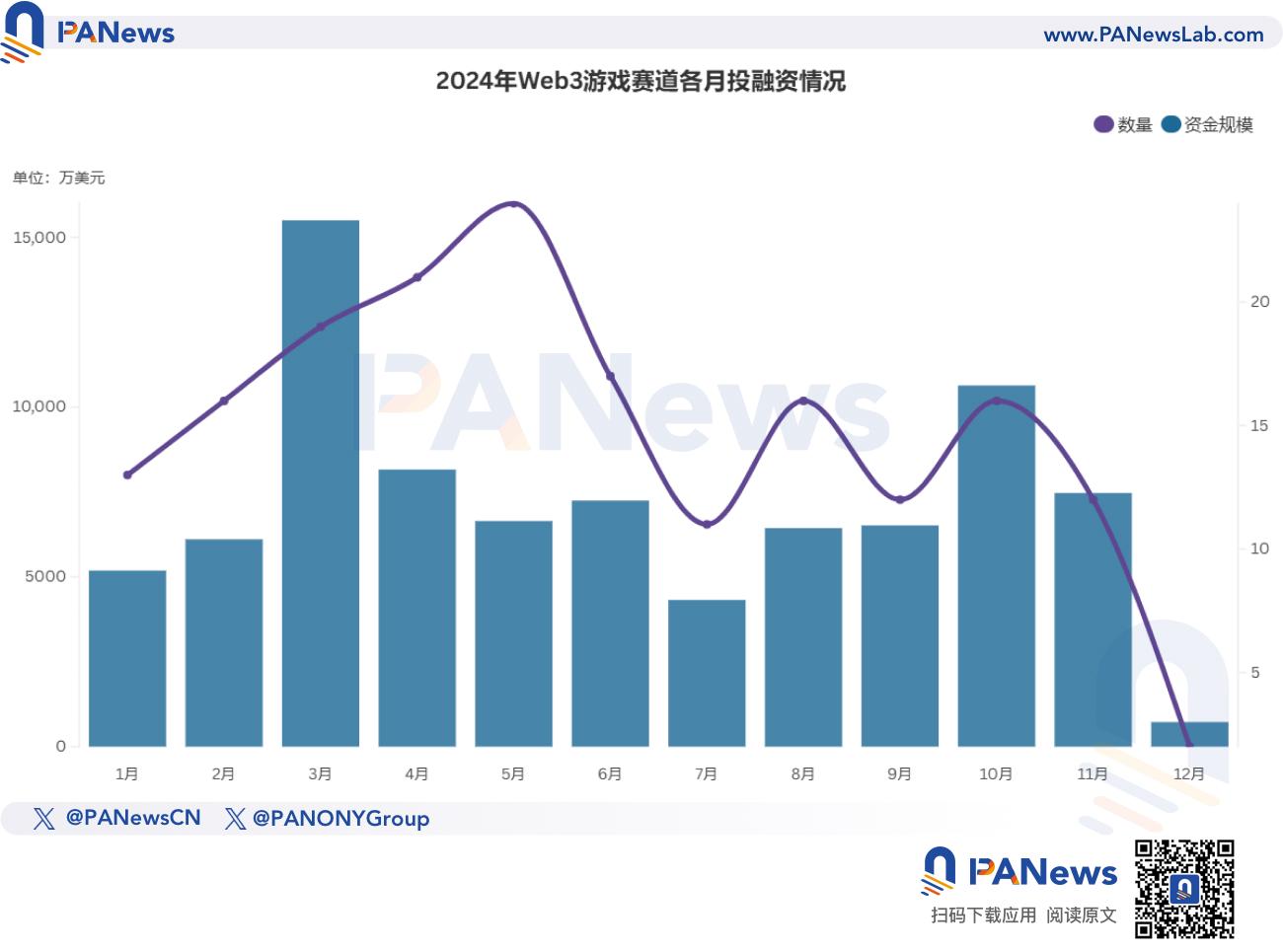

Compared with the booming 2022, the gaming track is much quieter this year. In 2022, the Web3 gaming track announced 334 investment and financing events, with a total financing scale of US$4.4 billion, of which projects with a scale of over US$10 million accounted for as high as 30%; in 2024, this proportion was only 13.41%. In addition, among the public financing events this year, the highest was the US$42.7 million Series A financing completed by blockchain video game development company Azra Games.

March was undoubtedly the most outstanding month for Web3 games this year, with total financing reaching a peak of $155 million. During this period, the market successively disclosed seven financings of tens of millions of dollars, including the NFT card game Parallel's $35 million, and there were 24 financings of over ten million dollars throughout the year.

Judging from the data statistics, perhaps due to the rise of other narratives such as AI and DeSci, and the fact that many game projects that received large amounts of financing in the last round are still under development and await market testing, Web3 games may no longer be the promising "star of hope"; on the other hand, as mini games on Telegram, especially point-to-earn games, have attracted tens of millions or even hundreds of millions of players, 3A blockchain games that require a lot of money and a long development cycle are becoming less attractive to investors.

Web3+ AI

As the mainstream narrative of the entire technology industry, the combination of AI, blockchain and cryptocurrency has also become the direction chosen by many startups. Different from the overall trend of the primary market, the AI track has expanded and developed rapidly this year and has basically been on an upward trend.

In terms of quarterly cycles, the AI track announced 34 financing events in the third quarter, with a funding scale of US$286 million, both of which are the highest this year. In the fourth quarter, although the overall enthusiasm has slightly declined, it is still much higher than the first and second quarters.

In terms of funding scale, 15.2% of AI projects received funding of tens of millions of dollars. Among them, the open source AI platform Sentient raised US$85 million in a seed round of financing led by Peter Thiel's Founders Fund, Pantera Capital and Framework Ventures, which is the largest financing in this field.

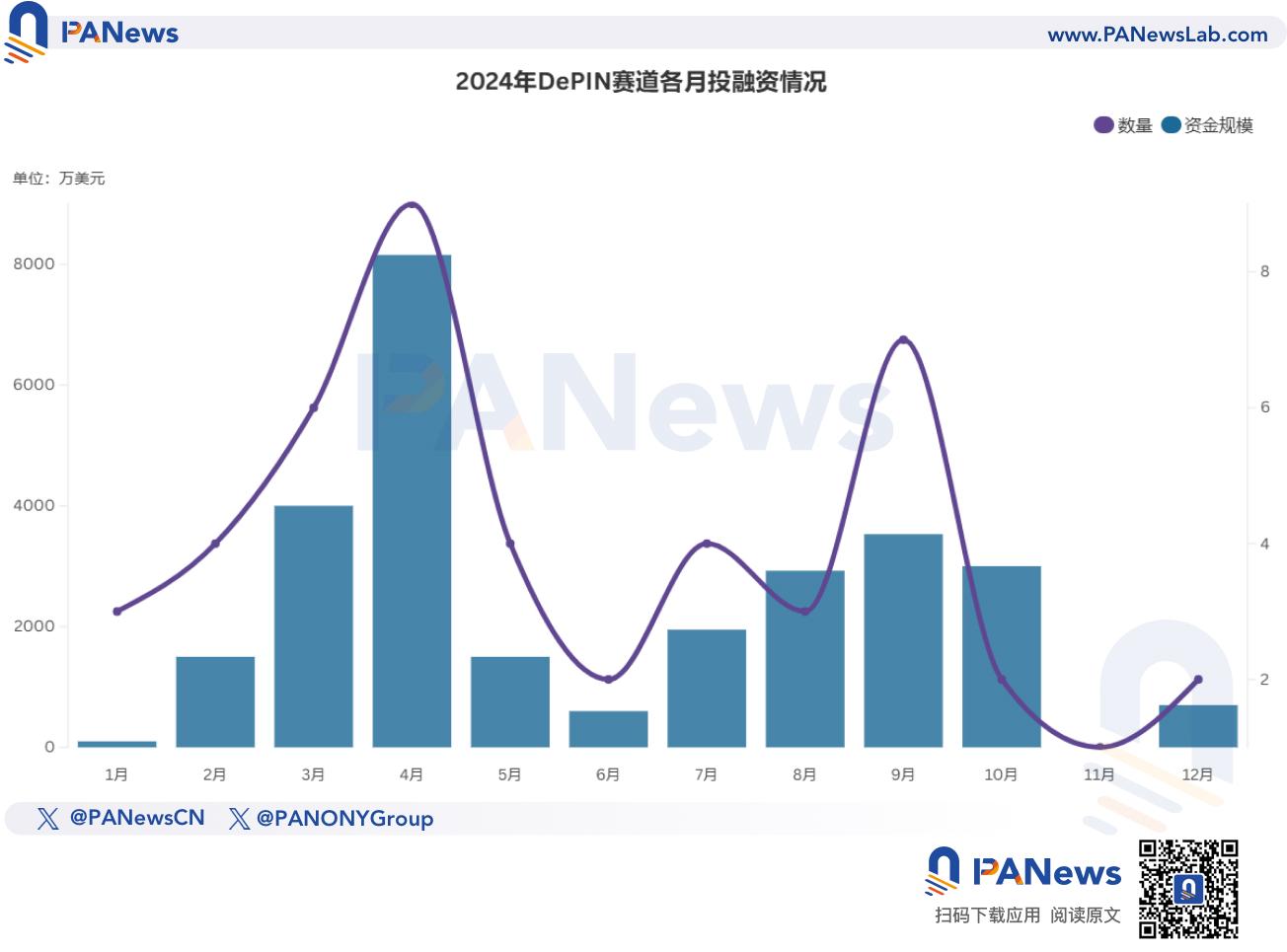

DePIN

DePIN projects are another track that has seen significant growth after AI, with a total of 47 investment and financing events throughout the year, with a financing scale of nearly US$280 million. Among them, 9 financing events were worth tens of millions of dollars, accounting for 19.56%.

IoTeX, an IoT blockchain platform, raised $50 million, the largest amount in the sector; Solana’s DePIN protocol io.net and Ethereum-based blockchain solar company Glow tied for second place with $30 million each in March and October, respectively. It is worth mentioning that the DePIN sector remained stable in the first and second half of the year, raising the highest amount of $84.05 million in the third quarter.

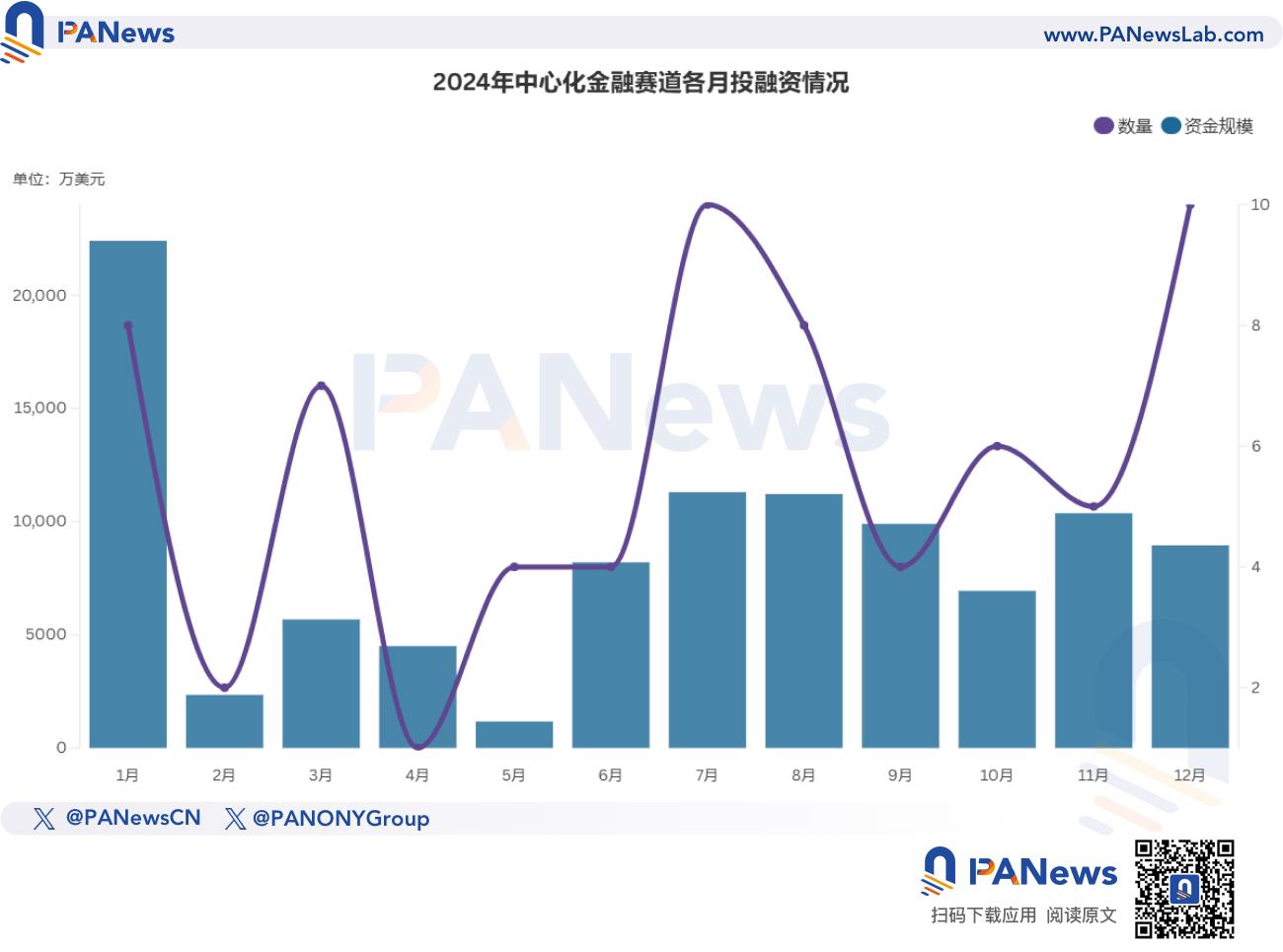

Centralized Finance

This year, there was only one case of financing close to 100 million in the centralized finance sector, namely, HashKey Group, a digital asset financial services group, completed a round A financing of nearly 100 million US dollars with a pre-investment valuation of more than 1.2 billion US dollars. In addition, there were 30 financings in this sector reaching 10 million yuan, accounting for 43.48%. Its average financing amount of 14.92 million US dollars was also the highest among all sectors. It is worth mentioning that in the second quarter when the overall market was the hottest, the performance of the centralized finance sector was mediocre, with both the number of financings and the scale of funds being the lowest in the whole year.

Consumer Applications

During the statistical process, consumer applications covered entertainment including music and streaming, SocialFi, NFT, prediction markets, media, gambling, education, insurance, research and information, etc. This category performed particularly well in May, with 26 investment and financing events announced in a single month, with a total funding of US$307 million. This was mainly due to the US$150 million financing completed by Farcaster, a Web3 social media platform announced in May, and the US$70 million financing completed by Polymarket, a prediction platform that shined in the US presidential election. These are also the two projects with the largest financing amounts in this track.

According to statistics, a total of 157 investment and financing events were disclosed in the consumer sector, with a total funding amount of US$817 million. In terms of funding amount, only 11.16% of consumer projects completed financing of tens of millions of dollars, ranking the lowest among all tracks.

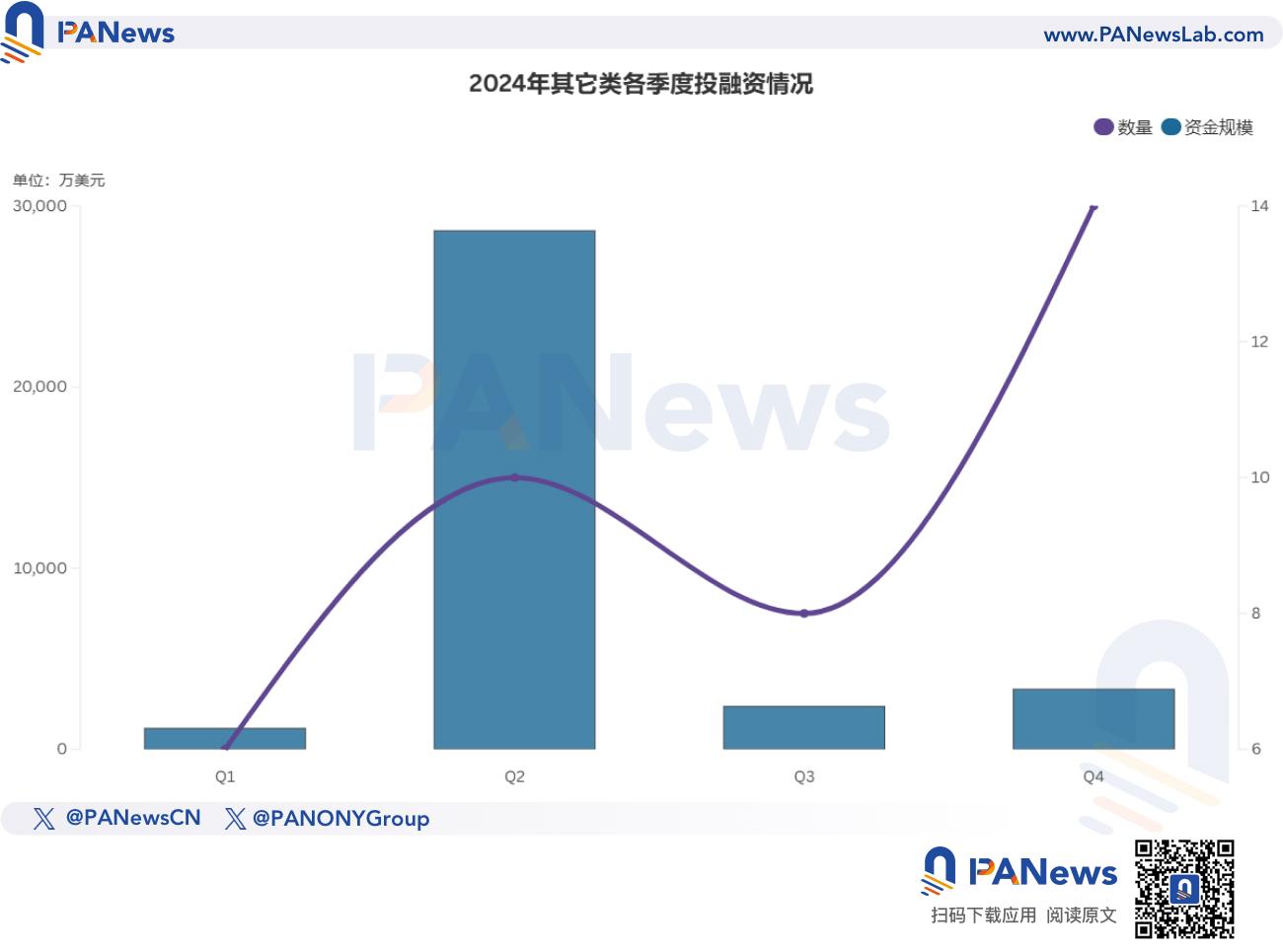

other

Other categories include blockchain applications in traditional industries such as crypto mining, DAO, DeSci, task reward platforms, medical care, logistics, etc., with 38 disclosed investment and financing events, the lowest in the entire track, with a funding scale of more than US$350 million. In this category, crypto mining companies are very important. In terms of funding scale, the US$150 million investment obtained by crypto miner Hut 8 and the US$80 million Series B financing completed by mining machine manufacturer Auradine ranked first and second, both of which were disclosed in the second quarter.

Investment institutions

According to incomplete statistics, a total of 47 crypto investment funds were launched in 2024, with a total scale of US$4.34 billion. Among them, 13 funds raised more than 100 million US dollars. Paradigm, which was once criticized for "defecting" from the crypto industry, announced in mid-June that it had raised US$850 million for its third fund, which will focus on early-stage crypto projects. This is also the largest fund in 2024.

It is worth mentioning that a16z announced in April that it had raised $7.2 billion, and the final total exceeded the company's earlier fundraising target by about 4%. Although it was not included in the statistics, as an investment institution with a top reputation in the cryptocurrency industry, a16z will certainly have a lot of funds to invest in industry-related projects in the future.

In addition, this year, many project parties have launched 15 ecological funds with a total scale of US$594 million. Among them, the US$150 million Open Loot Fund announced by Big Time Studios is the largest fund, which aims to promote game development on the Web3 game platform Open Loot and provide financial support, marketing and development guidance for game studios.