Author: Jessy, Golden Finance

Vitalik disappeared from X for more than 20 days.

In the past 20 days, the price of Ethereum has repeatedly fallen below the psychological defense line of investors. On March 12, the exchange rate of ETH to BTC hit a new low, falling to 0.022676, a new low since June 2020. The exchange rate of ETH to BTC continued to fall, the giant whales of the ICO period fled, retail investors trampled, and Fud continued.

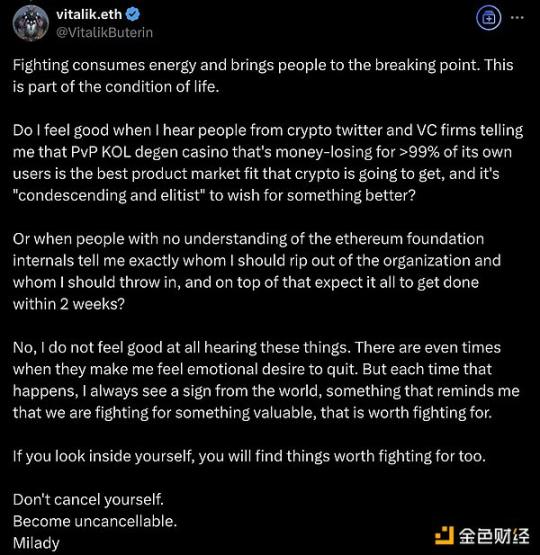

In February, a quarrel broke out in the Ethereum community, and the community wanted Vitalik to lower his noble head and see what the industry is doing now. Facing criticism, Vitalik said that he did not think that the current popular PVP was the best product of the blockchain, and that he and Ethereum insisted on making better products.

During the more than 20 days when Vitalik disappeared from the Internet, Binance’s two founders, CZ and He Yi, took the lead in making memes on X, taking advantage of the Abu Dhabi investment institution’s investment in Binance, and set off a "white cloth market" of memes on the BSC chain.

In this cycle, the meme track is hot and PVP is prevalent, and crazy gambler sentiment is flooding the crypto community. In addition, a broader sense of confusion hangs over the crypto community, and the real innovation that can lead the industry to flourish has disappeared.

The industry is in a state of desolation, and Meme has become the main narrative. People are beginning to miss the summer of 2020 when DeFi was popular on Ethereum.

Previously known as "V God", now called "Little V"

In the past, people called him "V God" and regarded him as a spiritual leader, relying on him to point out the direction of crypto development. Now people call him "Little V" and ask him to "get out" of Ethereum.

The last time Vitalik became the focus of public opinion was in early February. At that time, the community was full of FUD about Ethereum. Facing people's doubts, rational suggestions, or emotional abuse, Vitalik finally responded on X. The general idea of the response was: he did not agree that the current PVP model was the best product, and he was pursuing a better product. In the face of everyone's requirements and responsibilities for the reform of the Ethereum Foundation, Vitalik also expressed his tiredness for the suggestions of people who knew nothing about the foundation.

Vitalik has become the target of public criticism, which was unimaginable two years ago.

Groups often crave for a strong leader and are in urgent need of an object they can worship in order to gain psychological support and guidance. This prompts them to be keen on creating gods, infinitely magnifying the advantages of a certain individual, and shaping an omnipotent "god". Once this "god" that has been created fails to meet the people's excessive expectations, the group's attitude changes extremely quickly and cruelly. They instantly turn from blind worship to fierce criticism, pushing the "god" off the altar, and venting their disappointment and anger through verbal abuse and slander.

Vitalik has gone through a complete process of being deified and deified by the crypto community. Once upon a time, in the crypto community, Vitalik's words and ideas pointed out the direction of the crypto industry. Vitalik is happy to express various ideas, such as SBT and Cyber Nation in the early years, which are all concepts proposed or strongly supported by Vitalik. It was also under Vitalik's vigorous promotion that these new concepts were sought after and practiced by project parties in the industry at the time, becoming a trend for a while.

Especially in a bear market, major project owners will try their best to plan for tracks that will explode in a bull market. At that time, Vitalik was optimistic about Web3 social networking, and entrepreneurs flocked to it. However, after being popular for a while during the bear market, they all died down.

The bull market is coming, but the directions that Vitalik "pointed out" during the bear market have not ushered in a big explosion in the application level during the bull market. Chaos and confusion have become the feelings of most project parties.

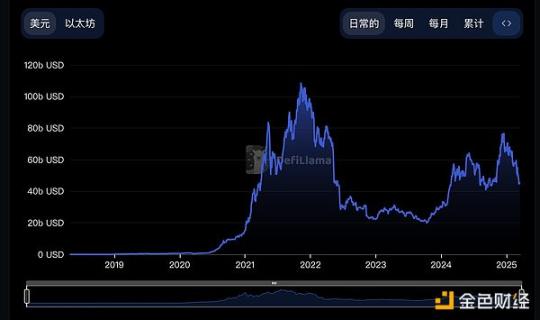

There is no real innovation, no new narrative that can excite the industry, and the grand event of DeFi Summer that once took place on Ethereum has never happened again in the crypto industry.

The infrastructure of blockchain has been built, and highways have been built, but there are no cars running on them. The core contradiction of the current blockchain industry has nothing to do with infrastructure. It is about what blockchain can bring to the world to change human life or the world's products. What is the answer to this question?

If the answer is payment, that was the answer given by Bitcoin in 2008. If the answer is DeFi, that was the answer given by Ethereum in 2020. The most practical application in the currency circle can be said to be stablecoin, which is truly changing the traditional world in various fields such as cross-border payments.

Apart from these, is there no more innovation in the blockchain industry? In this cycle, asset launch platforms on various chains are popular. This is just an innovation in the way assets are issued. The core of the casino has changed into a new coat. Another track that is favored by everyone is the blockchain AI track. This track has raised a large amount of funds, but the bubble was burst by the emergence of Deepseek. A more prominent problem of this track is that the main body of the narrative is still AI. Blockchain technology can help AI Agent obtain on-chain identity, build economic systems, etc., but it is always supporting AI. This track is not a crypto-native track.

In the midst of the wilderness, casinos are considered the best product in the crypto industry. Faced with many people's advice, Vitalik himself and Ethereum can devote more to the "casino" gameplay. Vitalik refused, "If I look inside myself, I will find something worth fighting for."

Vitalik also enjoyed the feeling of being worshipped by people. When Vitalik was pulled down from the altar, people also saw his side as a human being. Some people think that this side of him as a human being is stubborn, arrogant, and unwilling to listen to others' opinions. But it was these characteristics that made him create Ethereum.

The passion that made time fly when you were young can change the world

Jung once said, "When you are young, what do you do to make time pass quickly and make you happy? This answer is what you pursue in this world."

For Vitalik, what is worth fighting for has long been written in his childhood experience. At the age of 4, Vitalik received a computer from his father. While other children played computer games, he was obsessed with Excel software and soon was able to use Excel to write automatic calculation programs. At the age of 7, he created a "Rabbit Encyclopedia" document full of charts and mathematical formulas, and was soon determined to have a talent for mathematics and programming. At the age of 10, his three-digit mental arithmetic speed was more than twice that of his peers. At the age of 11, he began to study mathematics, programming, economics and other subjects in advance in the "Genius Youth Class"...

Programming technology itself makes Vitalik happy, and using technology to change the world is his pursuit. Compared with some speculators in the cryptocurrency circle, he is relatively conservative.

In 2018, Ethereum plummeted and was questioned by the community. Vitalik once warned not to let Ethereum become a "tulip" for speculators to make money. At that time, just like now, Vitalik also considered leaving Ethereum, "Should I dorp Ethereum and work for Google".

Doubts about Ethereum appear every time the price of the currency is low. Faced with doubts and abuses from the community, Vitalik always thinks of "leaving".

Vitalik has always been persistent. His persistence in technology and his vigilance against "bubbles" have never changed. It is these persistences that have brought changes and innovations to the crypto world.

Looking back at the history of crypto development, the most important innovations that have led the development of the industry have mostly occurred on Ethereum, the "world computer", in the past decade: Ethereum has widely adopted smart contracts, providing a platform for the prosperity of innovative financial mechanisms such as DeFi such as liquidity mining, the construction of various second-layer solutions such as Rollups and Plasma, the practice of Dao's governance model, and so on.

At present, more and more major institutions, such as the Trump family's DeFi project, Sony's Layer2, and Deutsche Bank's Layer2, are building Web3 applications and infrastructure solutions on Ethereum. The Ethereum ecosystem is mature and leading in terms of technical resource reserves, development team support, on-chain capital volume, and client security.

Moreover, Vitalik not only uses Ethereum to realize his technical ideals, but also places his social ideals on Ethereum, which is not limited to Ethereum. For example, the concepts he advocates, such as decentralization, resistance to censorship, and quadratic voting, involve democratic practice, Internet structure, business, and public welfare organizations. This makes his influence go beyond the crypto community.

Is Ethereum really doomed?

Is there still room for growth in Ethereum? The answer is yes.

In April, Ethereum will welcome the launch of the Pectra mainnet upgrade. This upgrade combines changes in the execution layer (Prague upgrade) and the consensus layer (Electra upgrade). Pectra introduces 11 key Ethereum Improvement Proposals (EIPs) to enhance scalability, staking flexibility, and user experience. Overall, after this upgrade, the performance and stability of the Ethereum network will be improved at the technical level; at the economic level, the Ethereum staking economic model will be changed, which will affect the supply and demand relationship and market price of Ethereum; at the application level, it will attract more developers and users to enter the Ethereum ecosystem, promote the innovation and development of decentralized applications, and so on.

In the United States, a staking Ethereum spot ETF may also be approved. In the first quarter of 2025, asset management company 21Shares submitted an application on behalf of CBOE BZX Exchange, planning to introduce staking functionality to its spot Ethereum ETF. In addition, Fidelity submitted an S-1 form for the proposed Ethereum spot ETF, which includes staking functionality. Grayscale has also applied to provide staking functionality for the spot Ethereum ETF.

The implementation of the Pectra upgrade is expected to shorten the unbonding period for Ethereum stakes, which was a significant obstacle when staking was initially introduced for spot ETFs.

This upgrade may become a catalyst for the approval of pledged ETFs.

There is a consensus in the industry that one of the main reasons why Ethereum spot ETFs are less attractive is that current ETFs do not have a staking function. The launch of the staking function will allow holders of Ethereum spot ETFs to receive rewards for staking Ethereum. After staking, investors will receive an annualized return of 3-3.5%. With the launch of the staking Ethereum spot ETF, the inflow of funds into the Ethereum spot ETF may be greatly increased, thereby pushing up the price of Ethereum.

Both of the above are substantial positive factors for Ethereum prices that can be foreseen this year.

But the other truth is that the changes that Ethereum is expected to see are just improvements on a foreseeable path. These changes are just making the highway wider and smoother. They are not disruptive industry innovations, or groundbreaking products or applications.

Ethereum’s use cases have actually reached their peak. In this cycle, no projects involving the participation of the entire population have emerged on the Ethereum main chain, and the price has not exceeded the previous high. The highest TVL volume still remains in 2021.

It used to be the first choice for building smart contract platforms. Now, when the infrastructure of the blockchain world has been fully developed, there are more convenient and cheaper platform public chains to choose from, and Ethereum is no longer the only one. In this cycle, public chains such as Solana, Sui, and TON have developed their own ecological characteristics. The leading Ethereum Layer2 such as Base has also made its own achievements.

Vitalik’s deification is a good thing for an industry. As the industry matures, Ethereum is no longer the only one, and more up-and-coming players can compete with it, which can stimulate a richer ecosystem. With the establishment of a rich blockchain ecosystem, the importance of Ethereum in the industry will inevitably decline.

Vitalik once said in an interview with Initium Media, "My life is to be a bridge for everything." Since 2015, the Ethereum Foundation has spent more on external funding than on internal operations. These grants have enabled Ethereum to connect more teams and promote the development of various projects in the crypto industry. Both Ethereum itself and Vitalik are laying the foundation for crypto.

Neither Ethereum nor Vitalik himself should bear the burden of people’s confusion and anger about the lack of innovation in the entire industry.

"If you look inside yourself, you will find things worth fighting for too." Vitalik, who knows what he is fighting for, will return again after a brief disappointment.

The confused and angry people in the crypto community will make a choice after questioning their own hearts: stay and become a "builder", and create something new in the wasteland, or leave and rush to the next outlet to continue to be a shrewd "speculator".