Author: Twitter blogger Mosi

Compiled by: Tim, PANews

This article only represents the author's views and does not constitute investment advice.

In the cryptocurrency world, perception is everything. As Plato’s allegory of the cave reveals, many investors are like prisoners trapped in the shadows of the cave—misled by false values deliberately distorted by bad actors. This article will deeply expose how VC-backed project parties implement the following manipulation methods through systematic operations to pave the way for their token price manipulation:

- Make the "fake circulation" of their tokens as high as possible.

- Keep the "real circulation" of tokens as low as possible (to help them pump the market).

- By taking advantage of the fact that the actual circulation amount is extremely small, the price of the currency is driven up.

- From the trend of low flow/high FDV to the new trend of false flow/high FDV

No, no, no! We are not a low circulation/high FDV token, we are a "community first" token!

Earlier this year, meme-based meme coins surged in popularity, eclipsing traditional VC tokens. These tokens, dubbed "low circulation/high FDV" by the market, have become unworthy of investment with the launch of new derivatives exchange Hyperliquid. Unfortunately, some projects have not faced up to the fundamental flaws of their token economic models and have not focused on developing products with real value. Instead, they have intensified their efforts to artificially reduce circulation, contrary to their public claims.

Keeping the supply of tokens low is beneficial to these projects because it makes price manipulation extremely easy.

1) The foundation sells the locked tokens for cash first

2) Subsequent repurchase on the open market

3) Capital utilization efficiency will be greatly improved.

At the same time, this characteristic of low actual circulation makes the tokens extremely easy to be manipulated to surge or plummet, thus posing huge risks to short sellers and leveraged traders.

Let's look at some examples of what's happening, not a complete list:

1.Mantra Chain

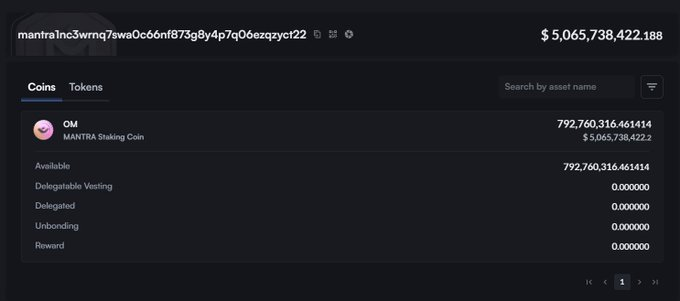

How can a project with a TVL of only $4 million have an FDV of over $10 billion? The answer is very simple: they control the vast majority of OM in circulation. Mantra holds 792 million OM (90% of the total circulating supply) in one wallet. This is a no-brainer, and they don’t even bother to spread the tokens out.

mantra1nc3wrnq7swa0c66nf873g8y4p7q06ezqzyct22

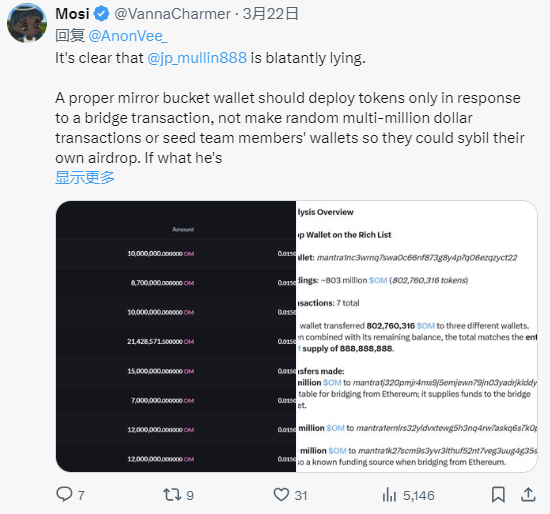

When I asked Mantra co-founder JP Mullin about this, he said it was bullshit and that this was a mirror wallet.

So, how do we know what the real circulation of Mantra is?

We can calculate it in the following way:

980 million (circulating supply) - 792 million OM (circulating supply controlled by the team) = 188 million OM

The simple calculation of OM token circulation of 188 million is probably also inaccurate. Because the project team still holds a large number of OM tokens, they have used Sybil attacks to forge accounts to defraud their own airdrops, squeeze more takeover funds, and further control the circulation. The team has deployed about 100 million OM tokens for airdrop Sybil attacks, so we will exclude this part of the data from the actual circulation. For more information, please refer to:

As a result, there are only 88 million OMs in circulation in the real market! (Assuming that the project does not control more tokens, but this assumption does not seem to be correct). This makes Mantra's actual circulation market value only $526 million. Compared with its $6.3 billion circulation market value shown on CoinMarketCap, it is a world of difference!

The low supply makes it much easier to manipulate the price of OM and liquidate all shorts. It should be scary for traders to short OM. The project team controls the majority of the supply and can pump or dump it at will. It's like trying to bet against DWF Labs in the shitcoin market. I suspect Tritaurian Capital, a company owned by Jim Preissler (SOMA Finance co-founder JP Mullin's boss at trade io), who loaned SOMA $1.5 million, along with some funds and market makers in the Middle East, may be behind the current price anomaly. This complex relationship further compresses the actual circulation, making it more difficult to calculate the true circulation.

This may explain their cautious attitude towards the airdrop plan and their decision to set a lock-up period. If they move forward with the airdrop plan, it will inevitably increase the actual circulation of tokens significantly, which is likely to cause the price of the coin to plummet.

This is not a complicated financial game, but it does seem like a deliberately planned trap whose purpose is to reduce the actual circulation of tokens and increase the price of OM.

2. Movement

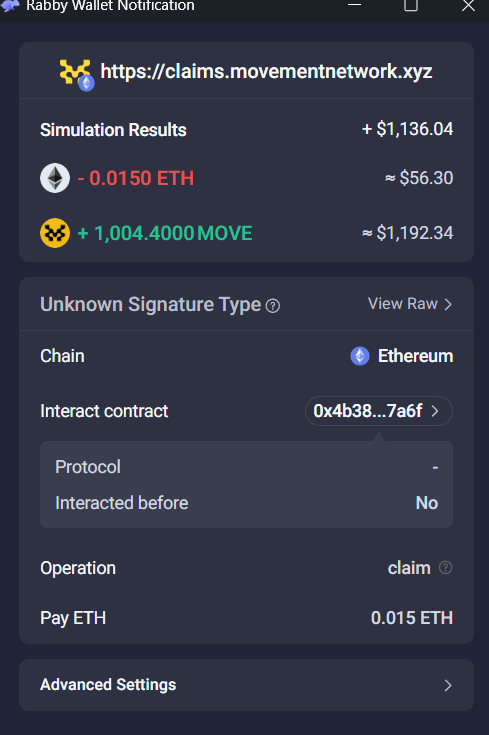

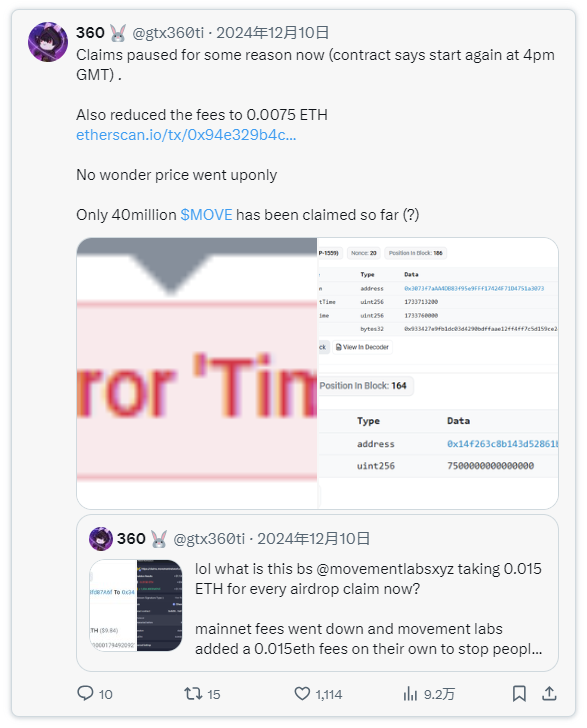

Movement Labs provided two options for users to claim the airdrop: users could claim the airdrop on the ETH mainnet, or choose to claim it on their mainnet, which has not yet been launched, to receive a small additional reward. However, a few hours after the claim channel was opened, the following happened:

- A new fee of 0.015 ETH (about $56 at the exchange rate at the time) was added when claiming on the Ethereum mainnet. This fee was charged in addition to the Ethereum network gas fee. This move caused most users who used small-amount interactions in the testnet to be unable to afford the high fees.

- While keeping the transaction fees unchanged, the allocation of the Ethereum mainnet was reduced by more than 80%.

- Claims have been stopped.

- Limited claims within extremely tight deadlines

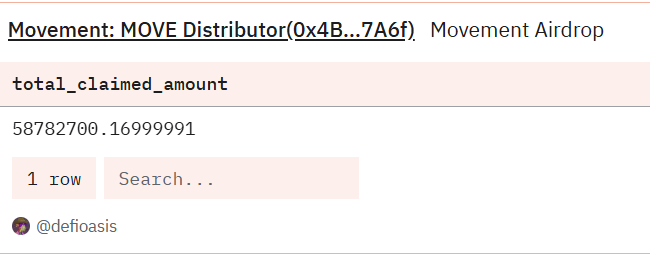

The result is obvious. Only 58.7 million MOVE tokens were claimed, accounting for 5% of the 1 billion MOVE tokens originally expected to be airdropped.

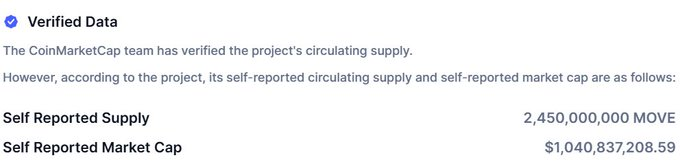

Let’s do the same as we did with Mantra. According to CoinMarketCap, MOVE tokens have a self-reported circulating supply of 2.45 billion.

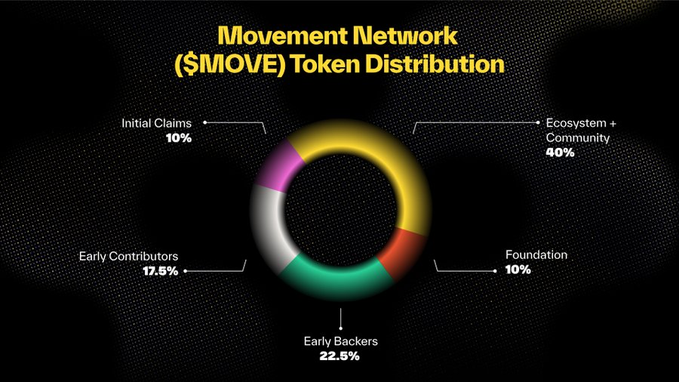

However, according to Move’s token economic diagram, after the token claim is completed, there should be only 2 billion tokens in circulation (foundation + initial claim portion), so the problem arises: there is a discrepancy of 450 million MOVE tokens.

2.45 billion MOVE (self-reported circulating supply) - 1 billion MOVE (foundation allocation) - 941 million MOVE (unclaimed supply) = 509 million MOVE or $203 million in actual circulating market value

The actual circulation is only 20% of the reported data. I find it hard to believe that all 509 million MOVE tokens in circulation are in the hands of users, but let’s assume this data is the real circulation for the time being.

What happened during this period when actual circulation was extremely low?

- Movement pays WLFI to buy its own tokens

- Movement pays REX-Osprey to submit ETF application for MOVE token

- Rushi goes to New York Stock Exchange for negotiations

- Movement used funds and market makers to illegally operate, selling locked tokens to the market to cash out and manipulate market prices.

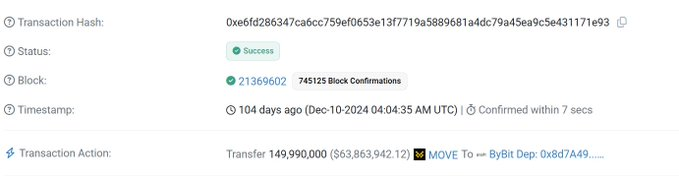

- The project team deposited 150 million MOVE tokens at the peak of the price on the Bybit exchange. They may have started selling at the peak of the price, as the token price has since fallen.

Before and after TGE, the team paid $700,000 per month to Chinese KOL marketing agencies in order to obtain the qualification to be listed on the Binance exchange and find someone to take over in the Asian market.

As Rushi often said:

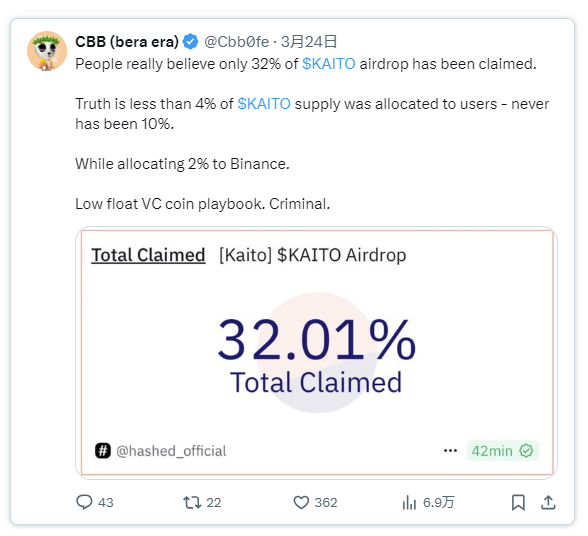

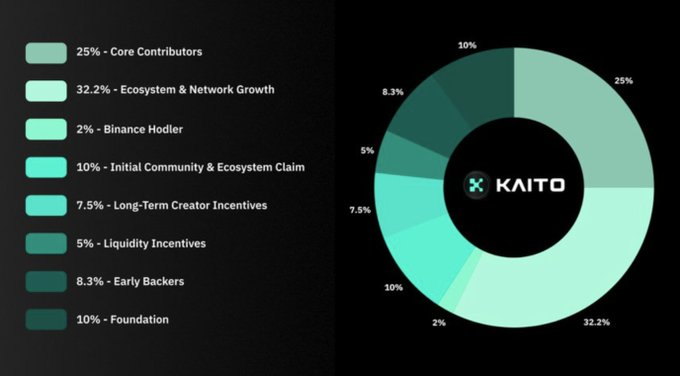

3. Kaito

Kaito is the only project on this list that has a real product. However, their current airdrop campaign also exhibits similar behavior.

As CBB pointed out above, Kaito distributed their airdrop, but only a small number of people claimed it. This also affects the actual circulation, let's calculate it:

According to Coinmarketcap data, Kaito's circulating supply is 241 million (corresponding to a market value of $314 million). I speculate that this number already includes the following: Binance exchange holders' holdings, liquidity incentive program tokens, foundation allocated tokens, and initial community shares and claimed tokens.

Let’s analyze it step by step to find out the real circulation:

Actual circulation = 241 million KAITO - 68 million (unclaimed tokens) - 100 million (foundation tokens) = 73 million KAITO

The actual circulating market value is equivalent to US$94.9 million, which is much lower than the data reported by CoinMarketCap (CMC).

Kaito is the only project on this list that I can trust, at least they do have a product that can generate revenue, and as far as I know, their team does not have as many shady behaviors as the other two teams.

Solution and Conclusion

CMC and Coingecko should show the real circulation of tokens instead of the nonsense data submitted by those teams.

Exchanges such as Binance should take active measures to punish such behavior. The current listing model has loopholes. Project owners can artificially raise the popularity of the Asian market by simply paying KOL marketing agencies before the TGE, just like Movement did.

Prices may have changed since I wrote this article, but for reference, the data I used are: Move is $0.4, KAITO is $1.3, and Mantra is $6.

If you are a trader, please stay away from these tokens because the project owners can manipulate the price at will. They control all the circulating supply, and thus control the liquidity and price of the tokens (this article is not an investment advice).