Original article: Leon Waters , cryptonews

Compiled by: Yuliya, PANews

The cryptocurrency market is highly volatile and unpredictable, and future price movements cannot be guaranteed. Any investment decision should be based on personal research and risk tolerance, as cryptocurrency investments may result in the loss of some or all of your funds. The price predictions in this article are based on Cryptonews' analysis of market data and trends and should not be considered financial or investment advice.

Bitcoin Latest Market

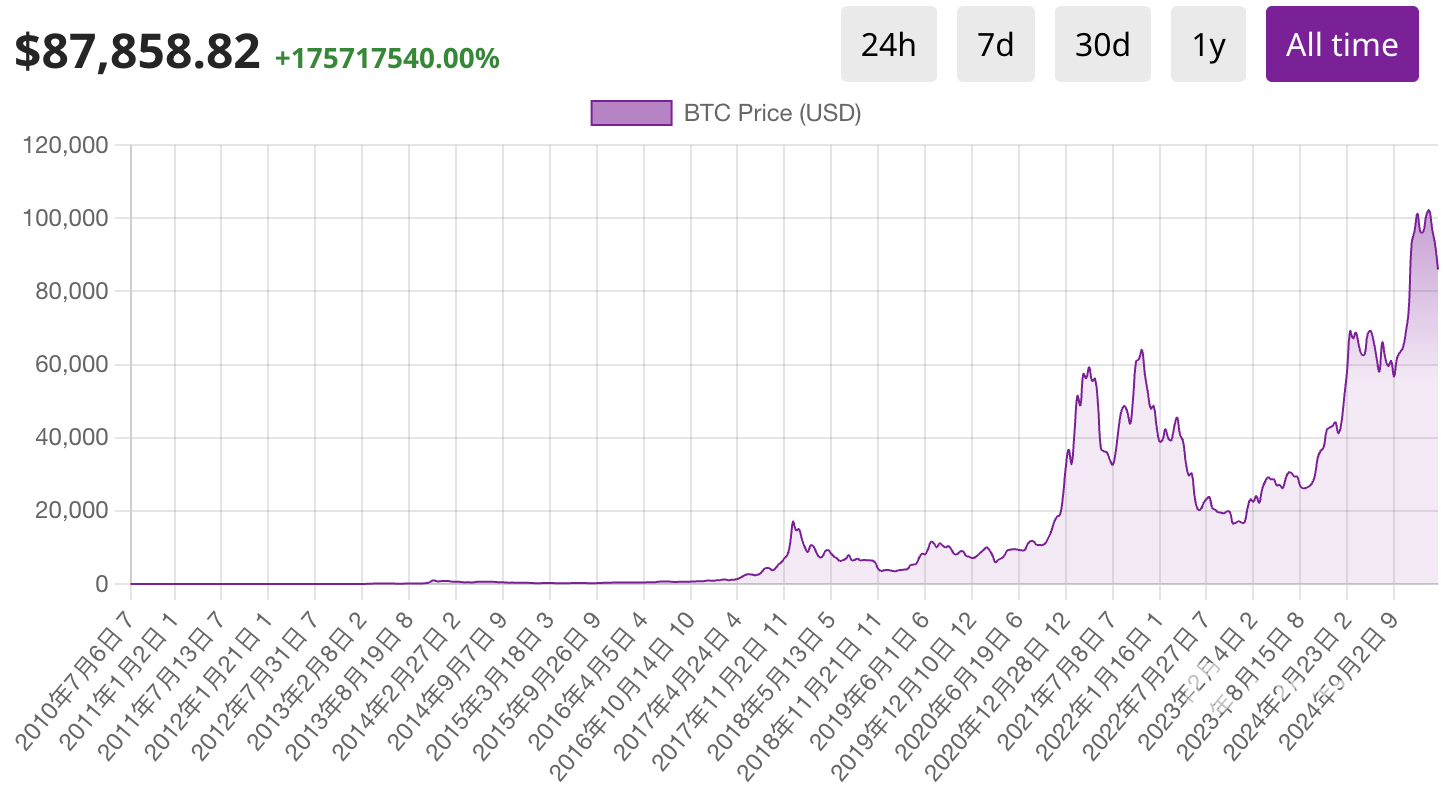

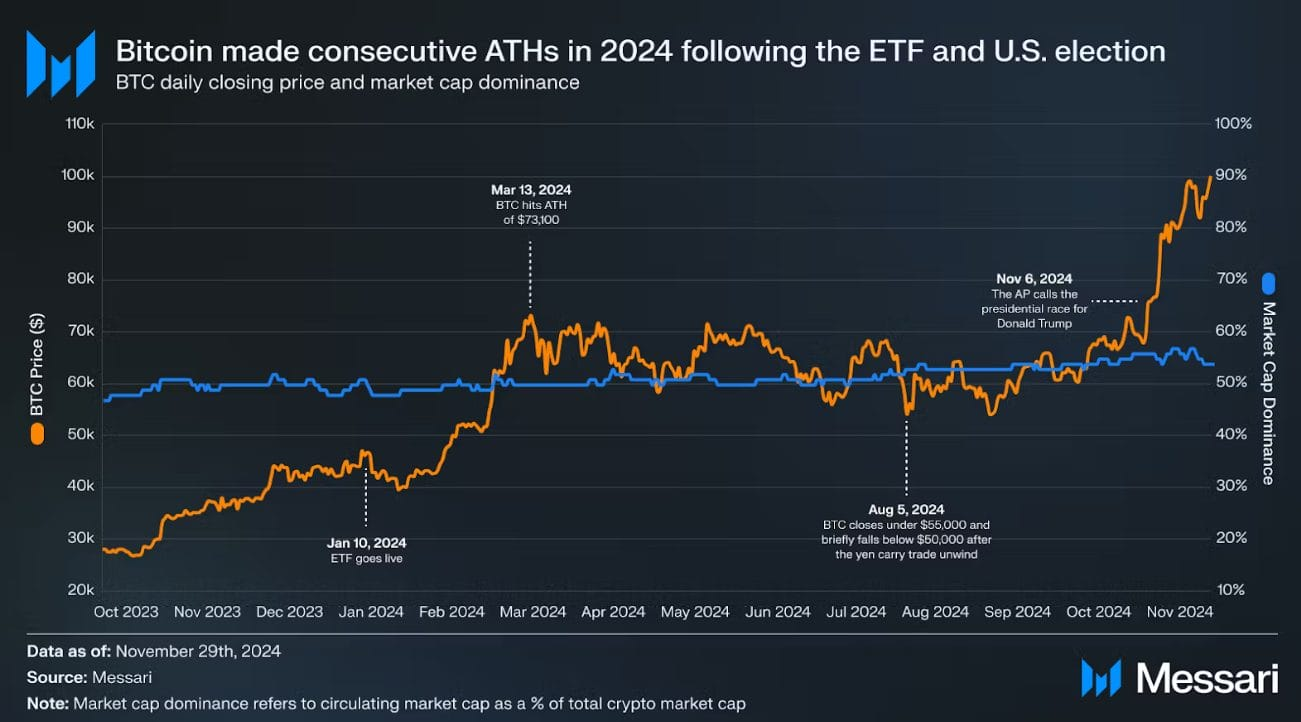

Since the 2024 US election, Bitcoin (BTC) has continued to rise strongly, breaking through the much-anticipated $100,000 mark and setting an all-time high (ATH) of $109,079.00 on December 4, 2024, with an increase of 33.46% in the past 12 months.

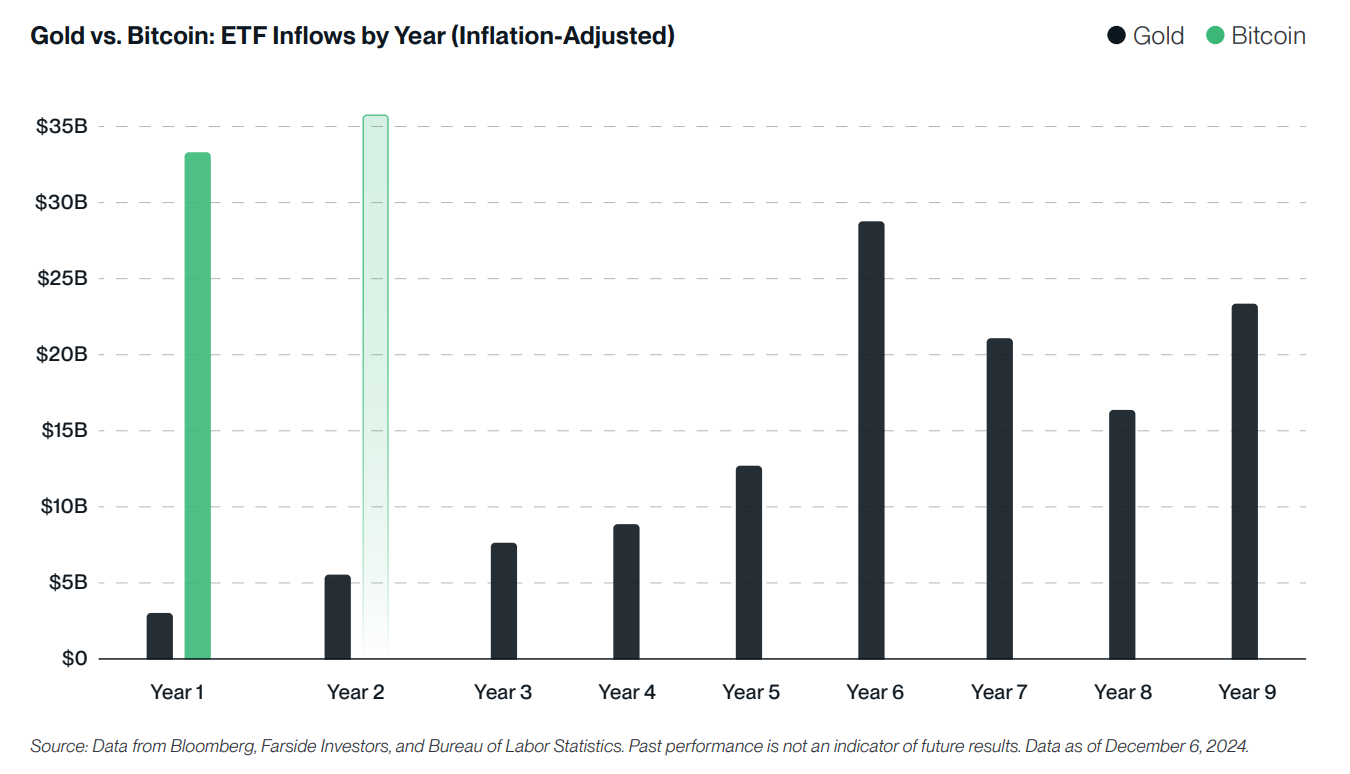

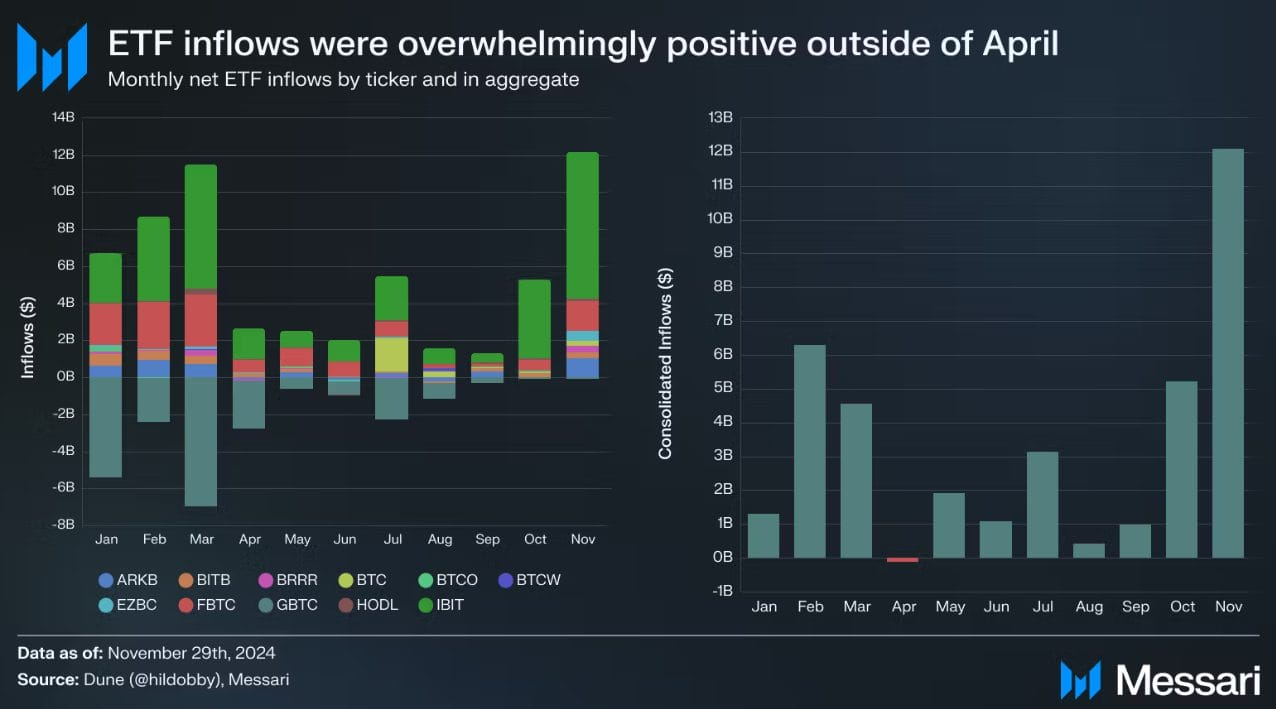

This trend is driven by multiple factors, including the Bitcoin halving effect, massive capital inflows into Bitcoin ETFs (approved on January 10, 2024), market expectations of more friendly cryptocurrency policies, and growing interest from institutional investors.

As of March 24, 2025, the price of Bitcoin is $87,858.82 and the market outlook remains positive. This forecast analysis covers Bitcoin price trends, expert opinions, and future outlook.

(Data is updated daily, and core analysis and content are reviewed monthly. All forecasts are based on current market trends, historical data, and proprietary estimation techniques, and may be adjusted as market conditions change.)

Forecast Overview

Bitcoin Price Analysis

Bitcoin's 30-day technical analysis shows an overall bullish bias, but there is a risk of a pullback.

Overbought Signals:

- The relative strength index (RSI) at 76 points to the overbought territory.

- The Stochastic %K is 88 and the Commodity Channel Index (CCI) has reached 163, indicating potential selling pressure in the market.

- Meanwhile, the momentum indicator is at 30,936, showing a certain bearish bias, suggesting that the upward momentum may weaken.

Bullish Momentum:

- The MACD indicator is 15,460, confirming that bullish momentum remains strong;

- Both the short-term moving average (EMA-10: 76,932) and the long-term moving average (SMA-30: 45,568) show a clear upward trend, and all moving averages are above the key support level;

- Moreover, the Hull Moving Average (100,746) also supports the current bullish trend.

Key points:

- The first resistance level facing Bitcoin is 121,662 (R1), while the important support level is close to 80,083 (P). A break above these key levels could trigger larger fluctuations.

- At the same time, the average directional index (ADX) is 38, which shows that the current trend strength is weak and we need to be alert to possible reversal.

Investors need to pay attention to overbought signals and the performance of the R1 resistance level so as to adjust their trading strategies in a timely manner and adapt to changes in market momentum.

Recent events affecting BTC prices

In the past three months, factors such as the US election, institutional funds flowing into ETFs, and changes in monetary policy have affected the price of Bitcoin.

November 2024

- Trump was re-elected as president in early November, and his pro-cryptocurrency stance and promise of friendly regulation boosted market sentiment.

- Hedge funds (Millennium Management, Capula Management, Tudor Investment) increased their investments in Bitcoin ETFs.

December 2024

- The market's optimistic expectations for crypto policies and institutional investment pushed Bitcoin above $100,000 for the first time (December 5).

- On December 24, Bitcoin fell back to $94,000, about 13% from its historical high, affected by changes in monetary policy and profit-taking.

January 2025

- On January 20, Bitcoin hit a new high of $109,140. (This came just hours before Trump’s inauguration as investors were optimistic about his expected pro-cryptocurrency policies.)

- Trump's inaugural speech did not mention cryptocurrencies, triggering a market correction, with Bitcoin falling to $102,093.

- The launch of meme coins such as “Trump Coin” ($TRUMP) and “Melania Coin” ($MELANIA) has caused market fluctuations.

- The Trump administration signed several executive orders on its first day, focusing on inflation, energy and immigration, but did not directly involve cryptocurrencies.

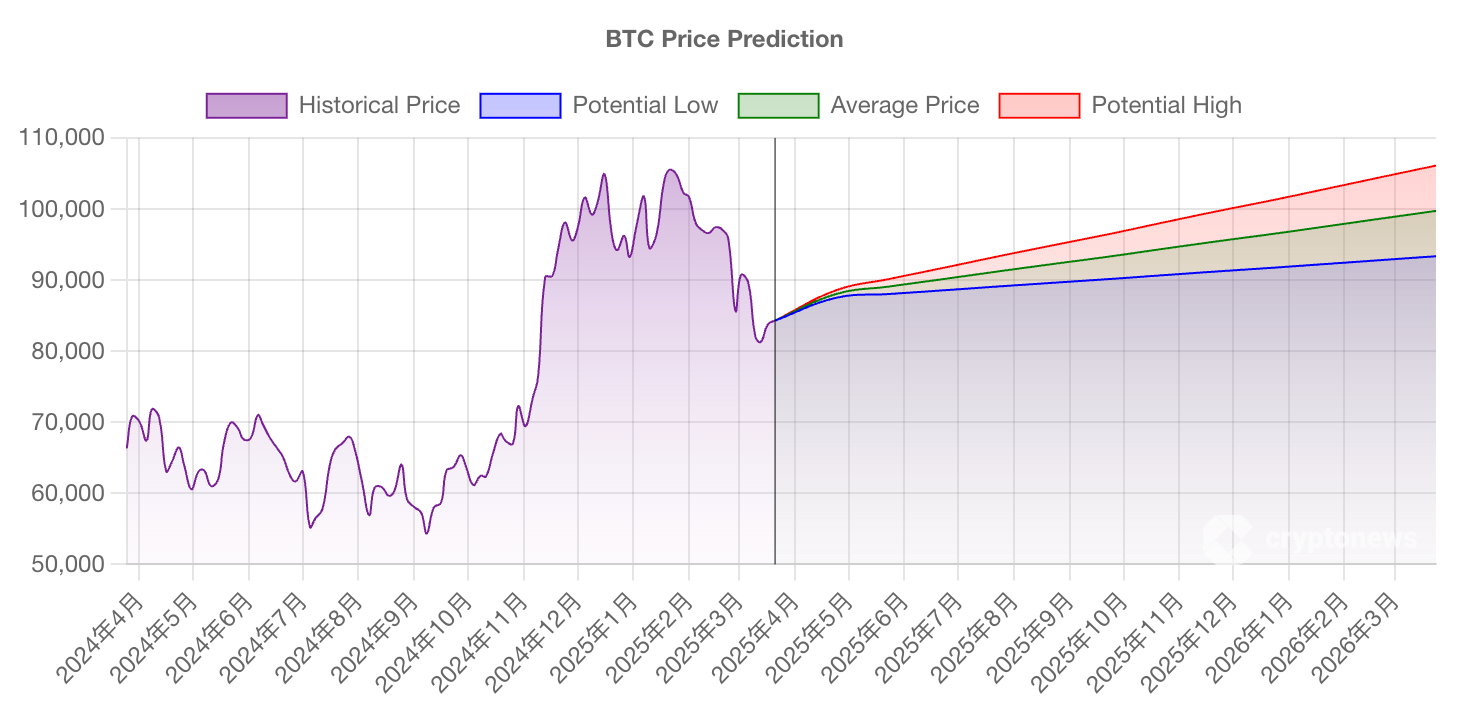

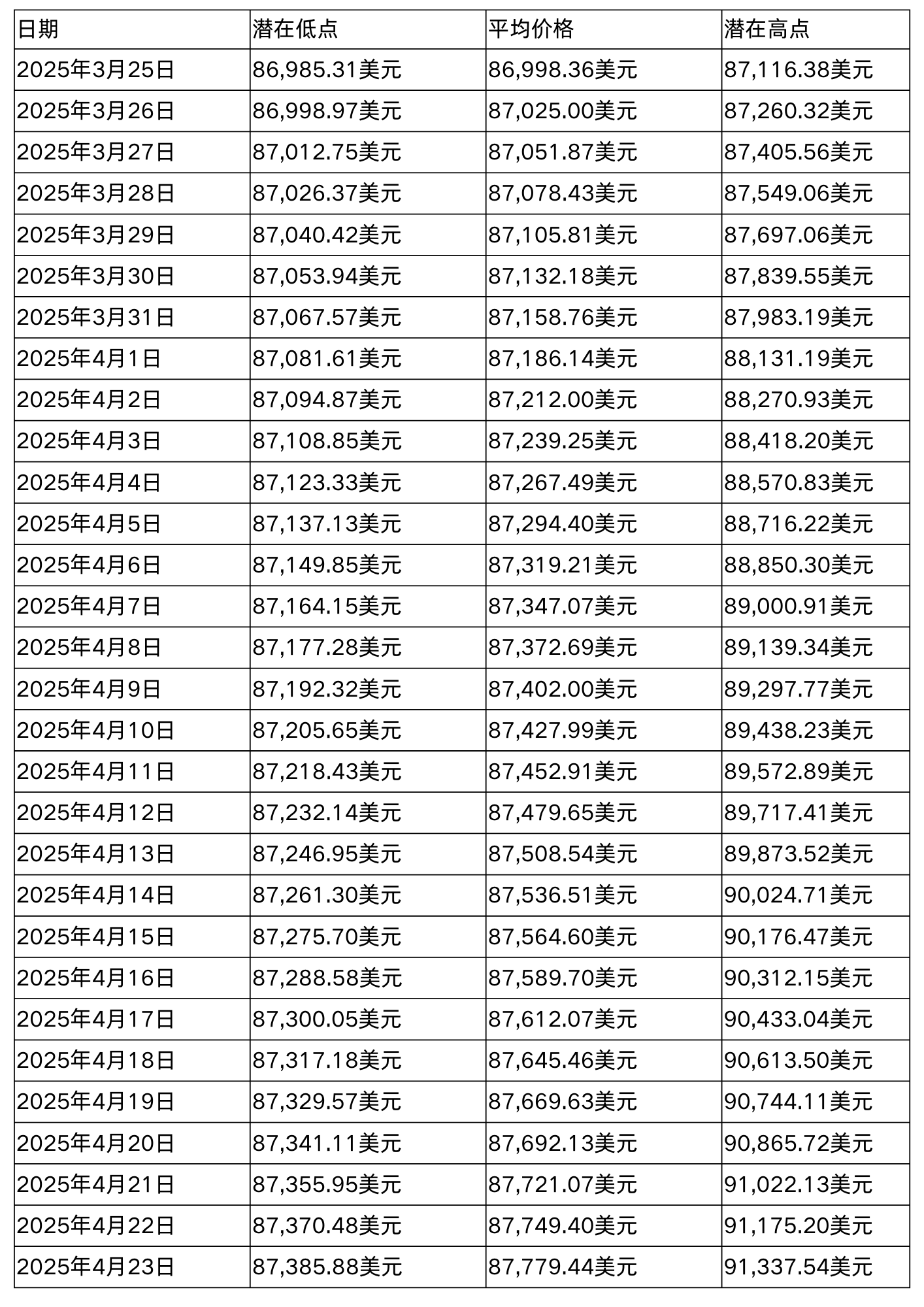

Bitcoin price prediction for the next 30 days

Since Bitcoin broke through the $100,000 mark and hit a record high (ATH), it has attracted much attention from the market. Investors and analysts have made predictions about its future trends, expecting its price to rise further. Based on mathematical and statistical analysis, the price of Bitcoin in the next 30 days (March 25 – April 23, 2025) is expected to be as follows:

Bitcoin long term price prediction

2025 Prediction

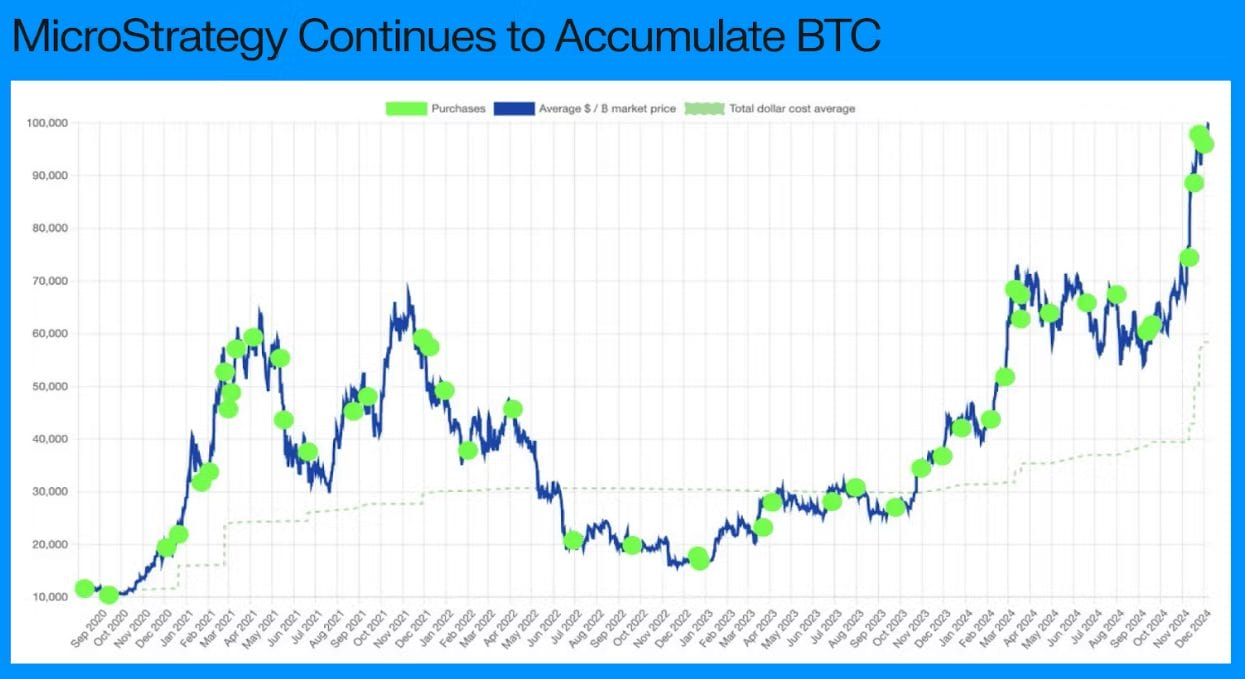

According to forecasts from institutional analysts such as Bitwise, Standard Chartered Bank and VanEck, the price of Bitcoin is expected to reach a new high of $180,000 to $200,000 in 2025. The approval of the Bitcoin ETF in 2024 has laid a solid foundation for the inflow of institutional funds and promoted the institutionalization of Bitcoin. MicroStrategy's continued increase in holdings and the supply restrictions after Bitcoin halving further strengthen this bullish argument.

If the new administration follows through on its promise to establish a strategic reserve of Bitcoin for the Federal Reserve, demand could surge, and more companies and countries turning to Bitcoin as a store of value could drive prices higher.

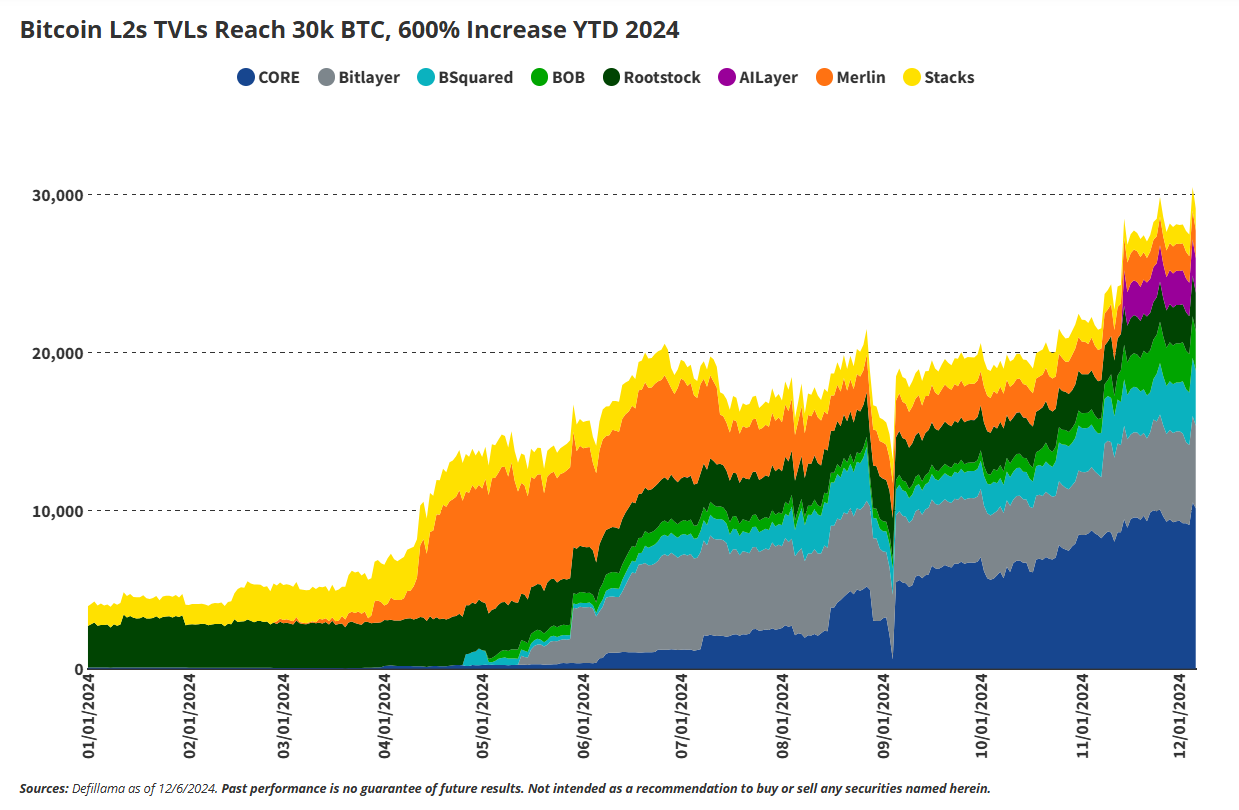

At the same time, technological advances in the Bitcoin ecosystem are also increasing its appeal, such as Layer 2 expansion through BitVM and staking capabilities supported by Babylon, which will enhance the practicality of Bitcoin and further drive demand growth. In addition, AI-driven innovation and the development of decentralized finance (DeFi) based on Bitcoin have also provided more support for Bitcoin prices.

Market risk analysis shows that if the Fed cuts interest rates more slowly than expected, U.S. Treasury yields may remain high, weakening the appeal of Bitcoin. At the same time, regulatory uncertainty and possible resistance from the Senate may also slow down the development of Bitcoin.

Market volatility is expected to remain high in 2025, and some analysts expect a 30% correction after the first quarter. However, driven by institutional and government demand, Bitcoin is expected to return to its highs by the end of the year. The market expects the average price of Bitcoin to reach $160,000 in 2025, with a maximum of $200,000 and a minimum of about $87,000.

2026 Forecast

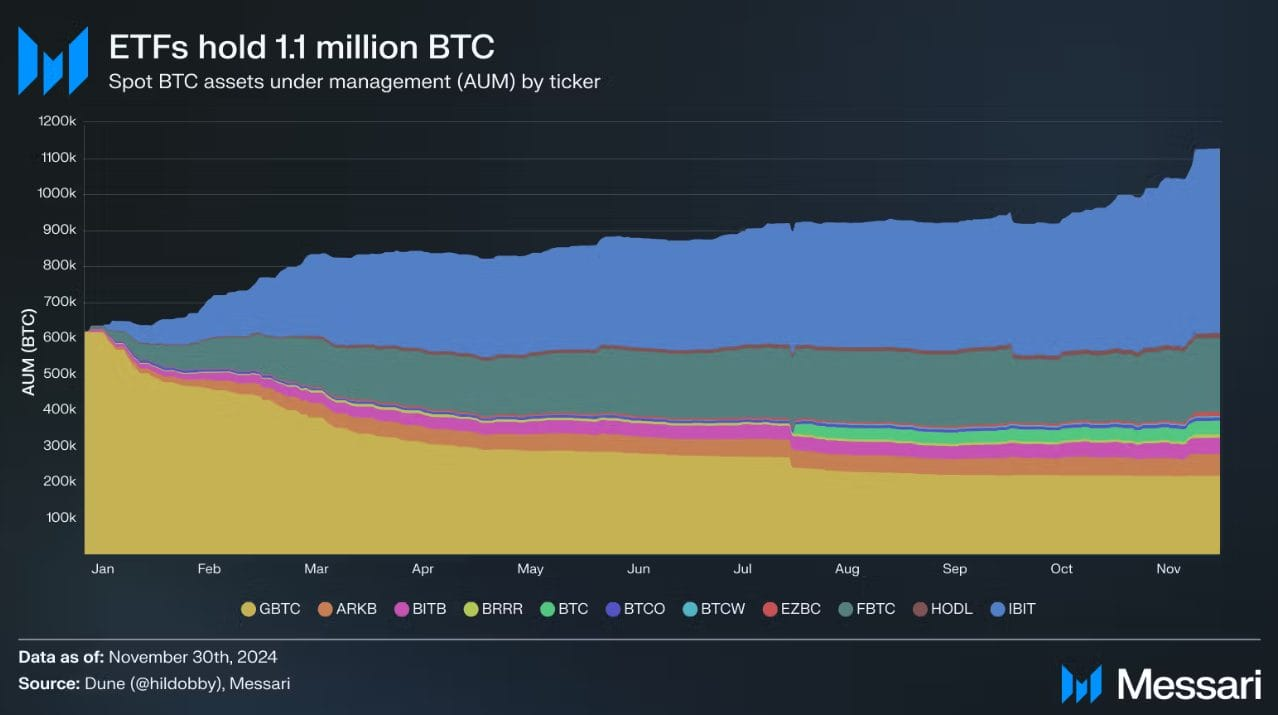

Institutional adoption and new technology development will be the main drivers of Bitcoin prices by 2026. Analysts at Bitwise and VanEck expect continued inflows into ETFs, with the number of Bitcoins held by ETFs expected to exceed 1.5 million by 2026. Publicly traded companies’ holdings of Bitcoin could exceed Satoshi Nakamoto’s holdings, which would be another important price catalyst.

Bipartisan support for stablecoin and blockchain legislation under the Trump administration’s regulatory framework could bolster institutional investor confidence. While less likely, a move by the U.S. to establish a strategic Bitcoin reserve could spark significant price growth.

The progress of Bitcoin programmability is expected to create new application scenarios and support higher valuations. However, the increasing competition from Ethereum and Solana in the programmability and DeFi fields may distract users and developers.

Other risk factors include higher Treasury yields or unexpected rate hikes from the Federal Reserve at the macroeconomic level, which could cause funds to shift away from the Bitcoin market. If global regulatory uncertainty or restrictive U.S. policies persist, such as the Senate's resistance to cryptocurrency legislation, it could slow momentum.

Although market volatility may persist, Bitcoin's supply constraints and growing institutional dominance may stabilize prices over time. If demand from ETFs and corporate buyers accelerates, Bitcoin's market value is expected to challenge gold and gradually approach Bitwise's long-term target of $500,000.

Based on the above analysis, the Bitcoin price in 2026 is expected to reach a maximum of US$179,922.44 and a minimum of US$117,955.19, with an average price of around US$148,938.81.

2030 Forecast

Supply constraints, institutional adoption, and macroeconomic factors will dominate Bitcoin price action by 2030. Jack Dorsey predicts Bitcoin will break $1 million, while Cathie Wood expects it to reach $1.5 million. These predictions are based on continued ETF inflows, increased global adoption, and the consolidation of Bitcoin's status as digital gold.

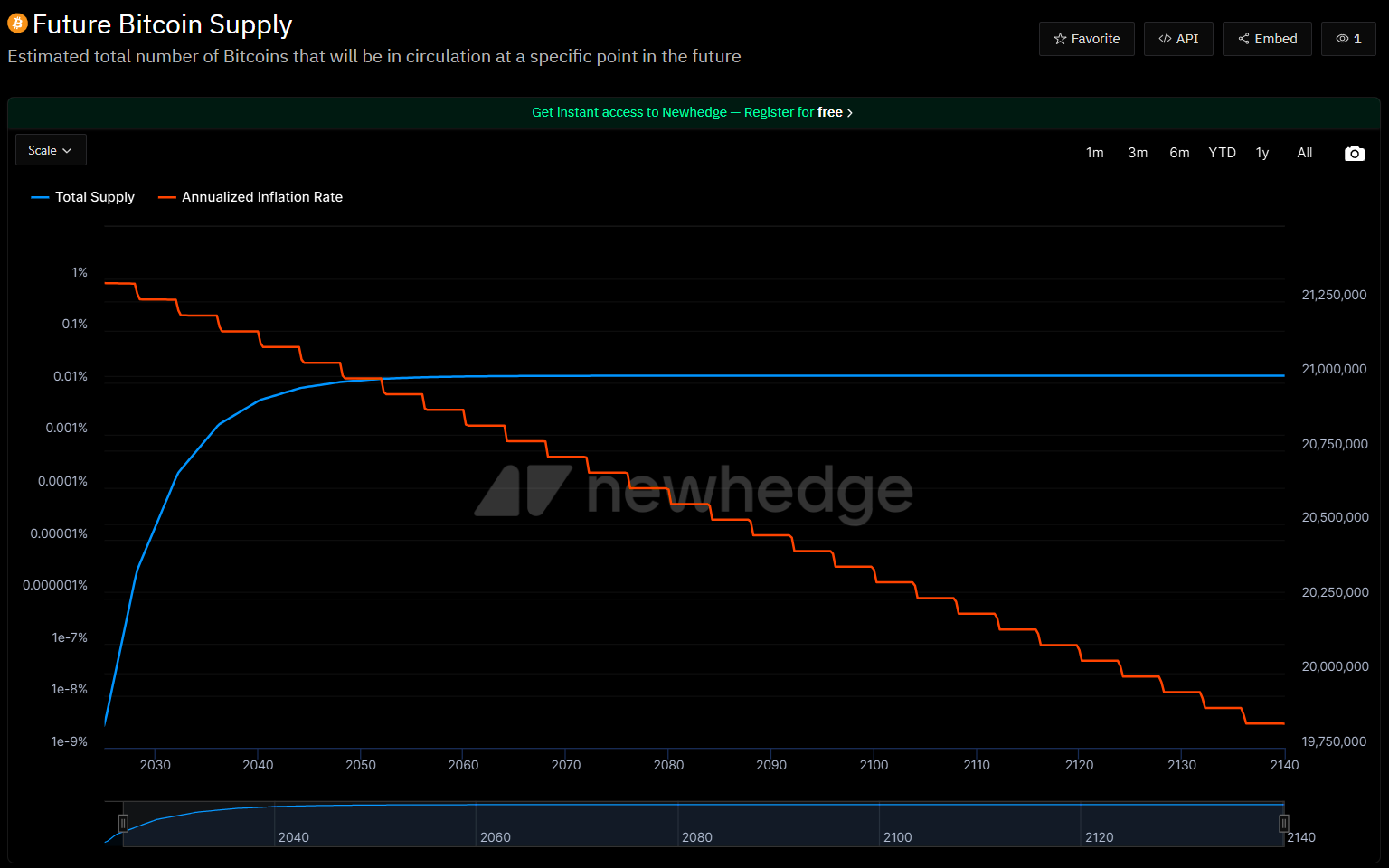

By then, Bitcoin will be close to its total supply limit of 21 million, with 98% of the supply already mined, further highlighting its scarcity. Demand from ETFs, companies, and sovereign states may accelerate hoarding, with countries such as El Salvador leading the adoption wave. The direction of US policy, such as the possible establishment of a national Bitcoin reserve under the Trump administration, remains a potential important variable.

In terms of technological progress, Bitcoin L2 expansion solutions may open up new application scenarios and drive demand growth. However, major risks include central bank digital currencies (CBDCs) weakening Bitcoin narratives, tightening regulations, or shifting to safe-haven assets.

Although Bitcoin may reach a valuation of $1 million by 2030, it still faces many challenges. For example, excessive volatility and regulatory risks may inhibit institutional capital inflows. Taking all factors into consideration, the average Bitcoin price in 2030 is expected to reach $809,985.86, with a maximum of $1,853,051.45 and a minimum of approximately $300,294.03.

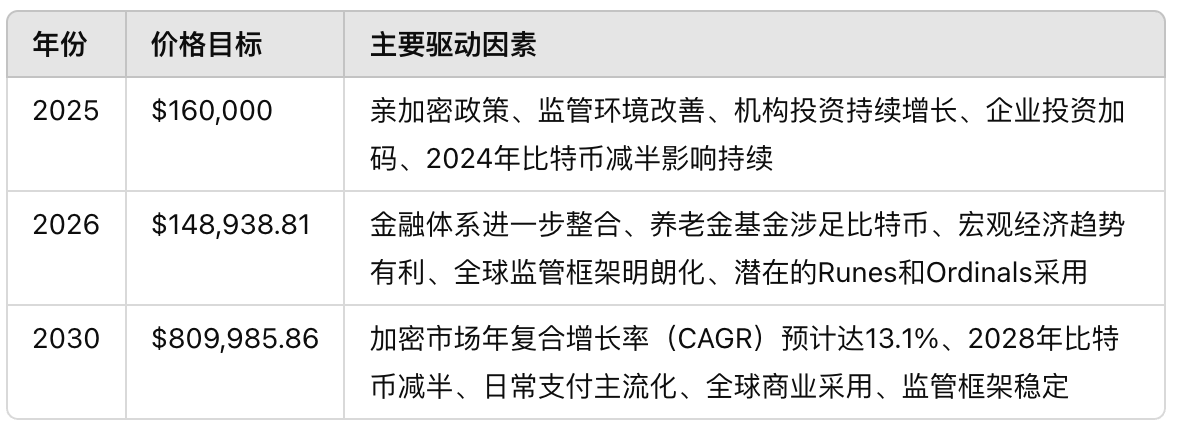

Here is a look at Bitcoin price predictions for the next few years:

Potential highs and lows

Bitcoin is likely to remain the market’s top cryptocurrency for the next few years. The table below provides an overview of Bitcoin price predictions for the next few years.

Analysts' forecasts

Many well-known analysts and institutions have made predictions on the future price of Bitcoin:

"Bitcoin will reach $150,000 by 2025 due to a favorable market and regulatory environment." - Gene Munster, founder of Deepwater Asset Management

"Bitcoin will reach $180,000 in 2025, but a correction of up to 30% could occur within the year." - VanEck analyst

"Bitcoin could surpass $200,000 by the end of 2025, driven by spot ETF inflows and growing institutional demand." - Bitwise analyst

"Bitcoin will reach $200,000 by 2025, driven by ETF demand and wider adoption by institutional investors." - Standard Chartered Bank analyst

"Given historical price action and likely regulatory changes under the Trump administration, Bitcoin will rise to $225,000 by the end of 2025." - HC Wainwright Analyst

"Bitcoin could surpass $1 million by 2030 due to the development of its ecosystem and growing adoption." - Jack Dorsey, former CEO of Twitter (now X)

"Bitcoin will reach $1.5 million by 2030, driven by institutional adoption and its status as digital gold." - Cathie Wood, CEO of Ark Invest

Bitcoin Price History

From its launch in 2009 to its all-time high in 2025, Bitcoin has grown from an experimental asset to a globally recognized financial instrument. Here are BTC’s important milestones and price history.

2009-2012: The Birth of Bitcoin

In 2009, Satoshi Nakamoto mined the genesis block of Bitcoin. Initial transactions were informal; the first retail transaction occurred in 2010, with 10,000 BTC used to buy two pizzas. The price of Bitcoin initially approached zero, reaching $1 in 2011 as adoption increased. By 2012, Bitcoin had gained credibility:

- Bitcoin Foundation established

- WordPress and over 1,000 merchants start accepting BTC as payment

- BTC price peaks at $13

2013: The first bull run

In 2013, Bitcoin experienced rapid adoption and price volatility. In February, Coinbase sold $1 million worth of Bitcoin at $22 per BTC. In April, the price plummeted from $266 to $76 due to a Mt. Gox trading glitch, but recovered to $160 within hours. Regulatory clarity began to emerge, with FinCEN classifying miners as money service businesses and Thailand banning Bitcoin trading.

Important events include the FBI seizing 26,000 BTC when shutting down Silk Road, and the launch of the first Bitcoin ATM in Vancouver. In November, Chinese Bitcoin exchanges led the world in trading volume, and the University of Nicosia began accepting Bitcoin for tuition payments. However, in December, the Chinese central bank banned Bitcoin trading, causing the price to fall from a peak of over $1,100.

2014-2015: Wider adoption and challenges

In 2014, companies like Overstock, TigerDirect, and Microsoft began accepting Bitcoin; Dell and Newegg followed. The CFTC approved a Bitcoin financial product, marking regulatory progress. Sponsored events like the Bitcoin St. Petersburg Bowl pushed Bitcoin into the mainstream. Major setbacks included the collapse of Mt. Gox after losing 744,000 BTC.

In 2015, adoption surged, with more than 100,000 merchants accepting Bitcoin. Coinbase closed a $75 million Series C round, a record for a cryptocurrency company. Confidence was restored despite hacks such as the Bitstamp loss of 19,000 BTC. Academic recognition increased, including the creation of the Ledger journal and a proposal to standardize the Bitcoin symbol.

2016-2017: The second bull run

In 2016, Bitcoin reached important milestones. Important technical updates included the CheckSequenceVerify soft fork, and the network computing power exceeded 1 exahash/second. Japan officially recognized Bitcoin as a quasi-currency asset, and Swiss ticket machines began accepting Bitcoin for ticket purchases at the end of the year.

However, Bitfinex suffered a hacker attack, resulting in the loss of 120,000 BTC (about $60 million), raising security concerns. But adoption continued to rise in 2017. BitPay transaction volume increased threefold year-on-year, Japan legalized Bitcoin payments, and Russia began to push for regulation.

Crucially, on August 1, Bitcoin split into BTC and Bitcoin Cash (BCH) due to a block size dispute. The price subsequently soared.

2018-2019: Bitcoin crash and recovery

In 2018, Bitcoin faced regulatory and adoption challenges. South Korea banned anonymous transactions, and Stripe phased out Bitcoin payments due to high fees. Price manipulation concerns led the U.S. Department of Justice to investigate fake transactions. In October, Bitcoin gained attention through public protests, such as Nelson Saiers' inflatable rat art installation near the Federal Reserve. After the 2018 crash, Bitcoin started 2019 below $4,000, but broke $12,000 in July and optimism returned. This period was characterized by regulatory scrutiny and market recovery.

2020-2021: Rebound in the Age of Pandemic

In 2020, institutional adoption progressed significantly. A Swiss company launched a Bitcoin ETP, and the Frankfurt Stock Exchange listed the first Bitcoin ETN. PayPal began supporting Bitcoin transactions with limited withdrawals.

In 2021, the price of Bitcoin surged on the back of endorsements from prominent figures. Musk’s support on Twitter (now X) and Tesla’s $1.5 billion Bitcoin purchase pushed the price to $44,141. Tesla later suspended Bitcoin payments due to environmental concerns, causing the price to fall 12%.

El Salvador made history in June by adopting Bitcoin as legal tender. Meanwhile, Zug, Switzerland, began accepting Bitcoin for tax payments, and the U.S. Department of Justice recovered $2.3 million in Bitcoin from a ransomware attack.

2022: Bear Market

In 2022, Bitcoin experienced a sustained bear market. In April, the price fell below $40,000, and in May it fell to $26,970 due to the Terra-Luna collapse. In June, Bitcoin fell below $18,000. High-profile collapses such as FTX hit trader confidence.

2023: Recovery and institutional interest

Bitcoin rebounded in 2023. It rose by more than 50% in the middle of the year amid a rebound in technology stocks and stable interest rates. The price rose from $16,530 in January to more than $42,000 at the end of the year, mainly driven by rumors that the SEC approved a Bitcoin ETF.

Bitcoin Ordinals are launched, introducing NFTs and utility to the network. Bitcoin remains resilient despite increased SEC regulation. Prices hover around $27,000, but recover strongly in October and break new highs.

2024: ETF approval, Bitcoin halving and renewed optimism

Bitcoin hits a milestone price record in 2024. The long-awaited approval of the Bitcoin spot ETF was a key turning point. On January 11, 11 ETF funds debuted, attracting a lot of institutional interest. Bitcoin broke through $49,000 before the announcement and reached $73,835 on Coinbase on March 1. The market consolidated at the end of March, trading around $70,000.

On April 19, Bitcoin underwent its fourth halving, reducing mining rewards from 6.25 to 3.25 BTC. This triggered a modest rise, with Bitcoin closing at $63,821. As the Federal Reserve made its first post-pandemic rate cut in September, market sentiment turned positive, with BTC rising from $60,000 to $64,000 in a matter of days.

November is a critical month. After Trump's reelection, Bitcoin surged due to his pro-crypto stance. It reached $76,999 on November 7 and broke through $91,000 on November 13. The market was full of optimism due to his promises, including the creation of a "strategic bitcoin reserve."

Bitcoin first surpassed the $100,000 milestone on December 9 and has since hit multiple new highs, closing the year at $93,425.

January 2025: New record high

Bitcoin started off strong in 2025, continuing the momentum of December 2024. The US spot Bitcoin ETF received $1.9 billion in inflows in early January, creating an imbalance between supply and demand, and the ETF received 51,500 BTC, far exceeding the 13,850 BTC mined that month.

This ETF-driven demand pushed Bitcoin to a record of $108,135 on December 17, 2024. However, rumors of the government selling Silk Road-seized Bitcoins caused a temporary drop in prices to $92,838 in January.

Speculation about a crypto-friendly executive order has reignited. On January 20, Bitcoin returned above $100,000 as institutional investors piled in. U.S. entities now hold 65% of global Bitcoin reserves.

MicroStrategy leads enterprise Bitcoin adoption, increasing holdings to 450,000 BTC, valued at over $45 billion. Japanese firm Metaplanet announced plans to increase reserves fivefold to 10,000 BTC, further highlighting Bitcoin's role as a strategic reserve asset. BlackRock expanded its Bitcoin ETF dominance by launching a spot ETF in Canada in January after its success in the United States. Bitcoin's correlation with the Nasdaq 100 hit a two-year high (0.77), highlighting its sensitivity to macroeconomic data. The drop in inflation to 3.2% also fueled optimism. The market is betting on further rate cuts from the Federal Reserve.

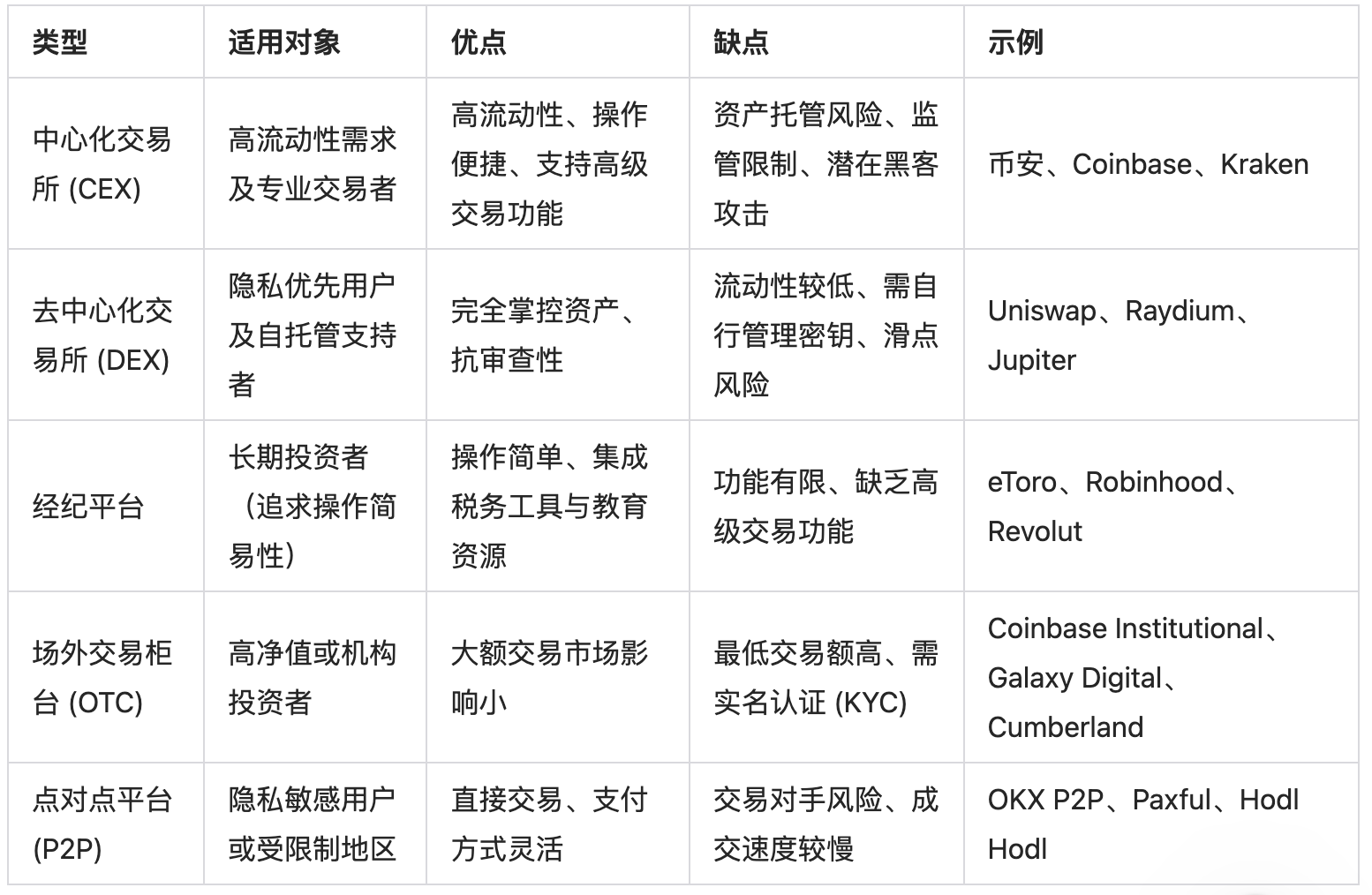

Where to buy

The best place to buy Bitcoin depends on the investor’s goals, expertise, location, and risk tolerance. Here’s a breakdown of the options for different types of investors.

Quick summary:

- Need trading and high liquidity? Use a centralized exchange like Binance or Kraken;

- Focus on privacy or advocate self-custody? Choose a decentralized exchange or P2P platform and store your assets in a non-custodial wallet;

- Simple long-term holding? Brokerage platforms such as eToro or Revolut are more suitable;

- Trading large amounts? The OTC desk offers best execution and privacy protection.

Evaluate fees, liquidity, features, and security to choose the best platform based on your needs and Bitcoin investment strategy.

in conclusion

Bitcoin has grown from an experiment to a global financial asset. ETF approvals and interest from institutional investors further establish BTC as an investment and store of value.

While challenges such as regulatory changes and high volatility remain, the long-term outlook for Bitcoin remains extremely positive. Innovation, increased scarcity, and integration with traditional finance are likely to drive value appreciation in the coming years.

However, investing in Bitcoin still carries risks, including market volatility and potential losses. Please conduct your own research and consider consulting a financial advisor before making an investment decision. Past performance is not indicative of future results.