Author: IOSG Ventures

1. What does Stripe’s biggest acquisition, Bridge, mean for the crypto industry?

Stripe is one of the world's largest online payment service providers and processors, and the platform helps businesses accept online and in-person payments through its developer-friendly API. In 2023 alone, Stripe processed more than $1 trillion in transaction volume, ranking second only to Apple Pay in terms of adoption.

Last month, Stripe made a big acquisition, buying stablecoin platform Bridge for $1.1 billion, the largest acquisition in cryptocurrency history.

Recent crypto M&A activity, such as Robinhood’s $200 million acquisition of Bitstamp, is beginning to reflect the growing need among tech/financial giants to engage with 2B and 2C crypto businesses that prioritize compliance and have a mature user base. Bridge is no exception.

You may have noticed that stablecoin adoption has surged around the world. According to a16z, stablecoin transaction volume reached $8.5 trillion in the second quarter of 2024, more than double Visa’s $3.9 trillion in the same period.

Stripe believes that stablecoins have potential and are the perfect medium to achieve a smooth and efficient process of asset conversion. Although Bridge only generates $10 million to $15 million in revenue per year, Stripe paid a nearly 100-fold premium to acquire the company. This highlights that Stripe's motivation is not only related to Bridge's current revenue, but also to the compliance, partnerships, and technology that Bridge can bring to the Stripe ecosystem.

2. What is Bridge?

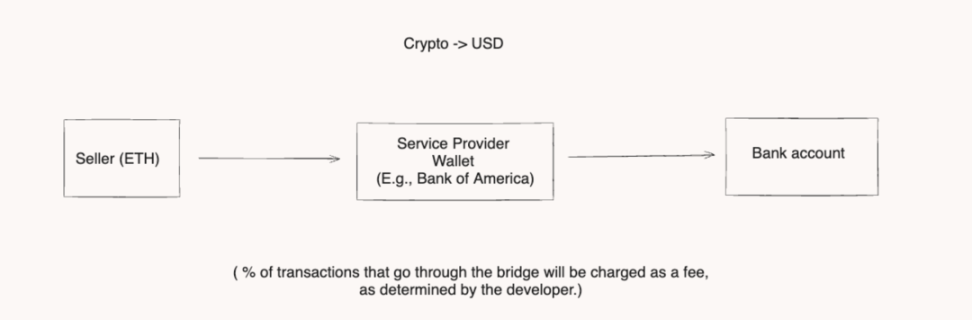

Bridge is a stablecoin platform that allows businesses or users to transfer tokenized dollars using blockchain. Users can buy cryptocurrencies with fiat currency via wire/ACH transfers to whitelisted banks, or sell cryptocurrencies for fiat currency by sending assets to designated wallets. It also provides custodial wallets to help businesses accept, store or transfer stablecoins through a simple set of APIs.

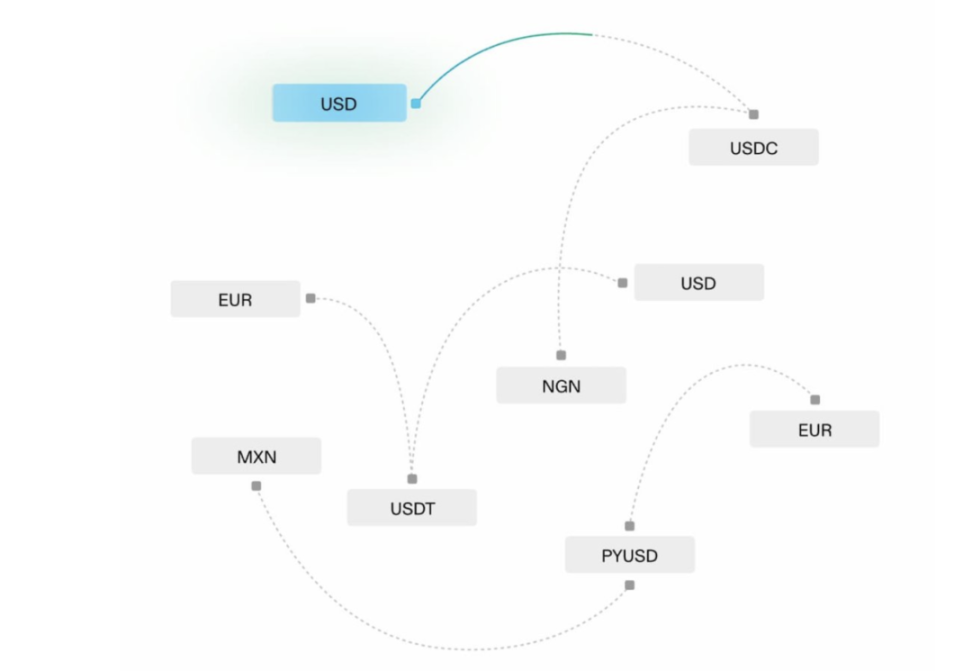

In the background, Bridge handles KYC, regulatory compliance, etc., allowing businesses to easily integrate and start accepting cryptocurrencies as a payment method. Currently, Bridge supports USD/EUR as legal currency payments and accepts 5 stablecoins on 9 different chains.

Regarding the team, Bridge founders Zach Abrams and Sean Yu worked at Coinbase as head of consumer products and senior developer, respectively. Before being acquired, Bridge raised a total of $58 million from various venture capital firms, of which about $40 million came from Sequoia Capital. This already shows that investors were confident in the product before the acquisition.

2.1 Bridge’s advantages and moat:

Bridge is not the first product to solve the problem of cross-border transaction services. In fact, Ripple (XRP) has been providing cross-border transfer and payment services for the past 3 years, but it relies on its own currency as a medium, and users must bear the downside risk of the currency. However, in an era where regulated stablecoins like USDC provide greater protection and resilience, such solutions are outdated. Bridge solves this problem in a more efficient and compliant way.

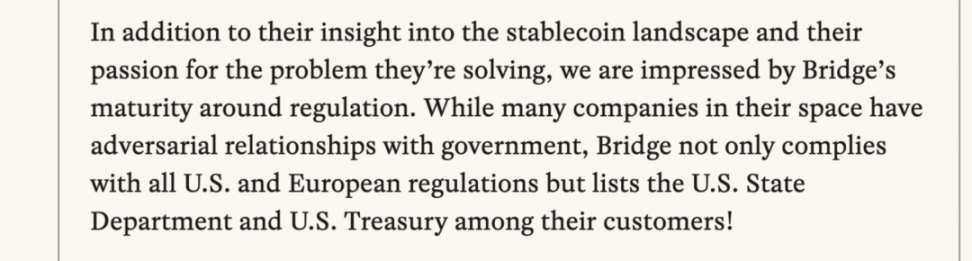

2.2 Compliance and Cooperation

Bridge's advantage lies in the compliance and cooperation it has gained. First, according to Sequoia's report, Bridge complies with all US and European financial regulations and anti-money laundering laws, holds money transmitter licenses in 22 states, and cooperates with the US State Department and Treasury Department for asset transfers. Before integrating with Bridge, companies need to provide ownership and formation documents to prove their credibility. For more information, please refer to the following document: Bridge As Story Protocol founder SY Lee pointed out, content companies often lack network effects, which forces them to rely on large content production and marketing budgets to survive. This overwhelming negotiating power makes it difficult for smaller IPs to be profitable, often causing them to fail before they even launch. Even large IP studios are hesitant to develop new IPs, choosing instead to focus on expanding existing IPs.

The credibility and reputation Bridge gains from compliance will significantly improve and expand its business channels, as seen in their recent partnership with SpaceX, which Bridge will use for stablecoin management in its global financial operations (Source: Ledger)

In addition to compliance, Bridge also allows enterprises to customize and issue stablecoins using Bridge's orchestration API, with the underlying US dollars invested in US Treasuries to earn a 5% yield or remain idle. This opens up the possibility for enterprises and even CBDCs to create and customize their tokenized dollars for various use cases while adhering to compliance, with all reserves held within Bridge in the form of cash and treasury bills.

2.3 Bridge use cases:

2.4 In today’s payment solutions:

The global demand for electronic payment solutions is rising, and the electronic payment industry is expected to grow at an annual rate of 9.9% and the market size will reach US$90 billion.

Today’s digital payment solutions, especially in the US, charge fees as high as 1.5-3.5% per transaction (Visa charges 1.5-3.5%, Stripe charges 3.4%, capped at ~0.3% in Europe, and ~2% for global payments like paypal).

Bridge fees are expected to be much lower as they are primarily composed of blockchain transaction fees and developer or issuer fees.

In October, Stripe launched a feature called “Pay with Stablecoins” in its customer checkout product, charging a 1.5% transaction fee. While it has not been confirmed that the feature was co-created with Bridge or that the fee was designed by Stripe, it shows that Bridge, as an alternative payment solution, has the potential to provide a more cost-effective option for digital payments.

In addition, data leakage has been a long-standing problem in the traditional electronic payment industry. The tamper-proof nature and security of smart contracts can effectively solve these problems. In addition to cost savings, Bridge also unlocks access to $180 billion in stablecoin liquidity in the blockchain ecosystem, enabling Stripe to expand its influence into the cryptocurrency market.

In the unbanked areas:

Bridge can provide a solution for businesses in underserved areas to store their dollars or euros in a custodial wallet, thereby building a better system for transferring, paying, or investing in tokenized dollars, depending on their needs.

Additionally, financial institutions can begin to offer more complex structured products that accept stablecoins as deposits, creating more business opportunities for them to leverage on-chain funds.

Since these transactions are conducted on the blockchain, the selected chain can also benefit from the associated transaction fees. Therefore, Bridge can enhance on-chain transaction activity and potentially improve the returns of validators and stakers.

In DeFi:

Businesses can also participate in DeFi to earn additional benefits. For example, they can borrow or lend tokenized dollars on platforms such as Aave to earn interest, or take advantage of potential gains on cryptocurrency investments.

Alternatively, users can provide liquidity for stablecoin pairs on Uniswap V2/V3 to earn transaction fees. Although DeFi investments come with huge risks, they provide opportunities to maximize the capital efficiency of idle assets.

Given the dominant position of USDC and USDT in the market, I believe that the integration of Bridge can further solidify their role in the growing cryptocurrency space.

3. Market Outlook

Until recently, the use case for cryptocurrencies has been largely hampered by their adoption as a payment solution. However, Stripe’s acquisition of Bridge has the potential to change the tide, making cryptocurrency payments as seamless and indistinguishable as traditional fiat currency transactions and potentially becoming the backbone of PayFi in the future.

The largest M&A in cryptocurrency history highlights that the stablecoin and regulated payments industries have achieved clear product-market fit and undeniable utility. Value transfer remains the most compelling use case for cryptocurrencies, and regulated stablecoins are becoming a dominant medium of payment.

4. Key points

Bridge is a stablecoin platform that enables businesses and users to transfer, store and pay tokenized U.S. dollars using blockchain technology. Bridge manages all compliance and regulatory issues in the background.

Bridge's strength lies in its compliance and acquired partnerships. It adheres to all US and European financial regulations and anti-money laundering laws and works with reputable partners such as the US State Department and Treasury Department.

Regions without direct access to the financial system can benefit greatly from Bridge because of the economic security that the U.S. dollar provides.

Enterprises can now participate in DeFi and maximize capital efficiency of idle assets. Bridge acts as a link to inject more capital into stablecoins, which is expected to promote the overall DeFi economy.

Lower fees, faster settlements, and data security are some of the main advantages of blockchain compared to today’s electronic payment solutions. Bridge has the potential to replace or become a better alternative to current payment systems.