By Alex Liu, Foresight News

In the early morning of November 26th, Beijing time, the Movement Foundation announced that it will launch the Movement network utility token MOVE. Movement is a Layer 2 public chain built on ETH, aiming to bring the Move language into the Ethereum ecosystem. At a time when Sui coin prices have repeatedly hit new highs, Aptos has made frequent moves, and the Move public chain is gradually gaining momentum, Movement has hit the right time.

When will the coin be issued?

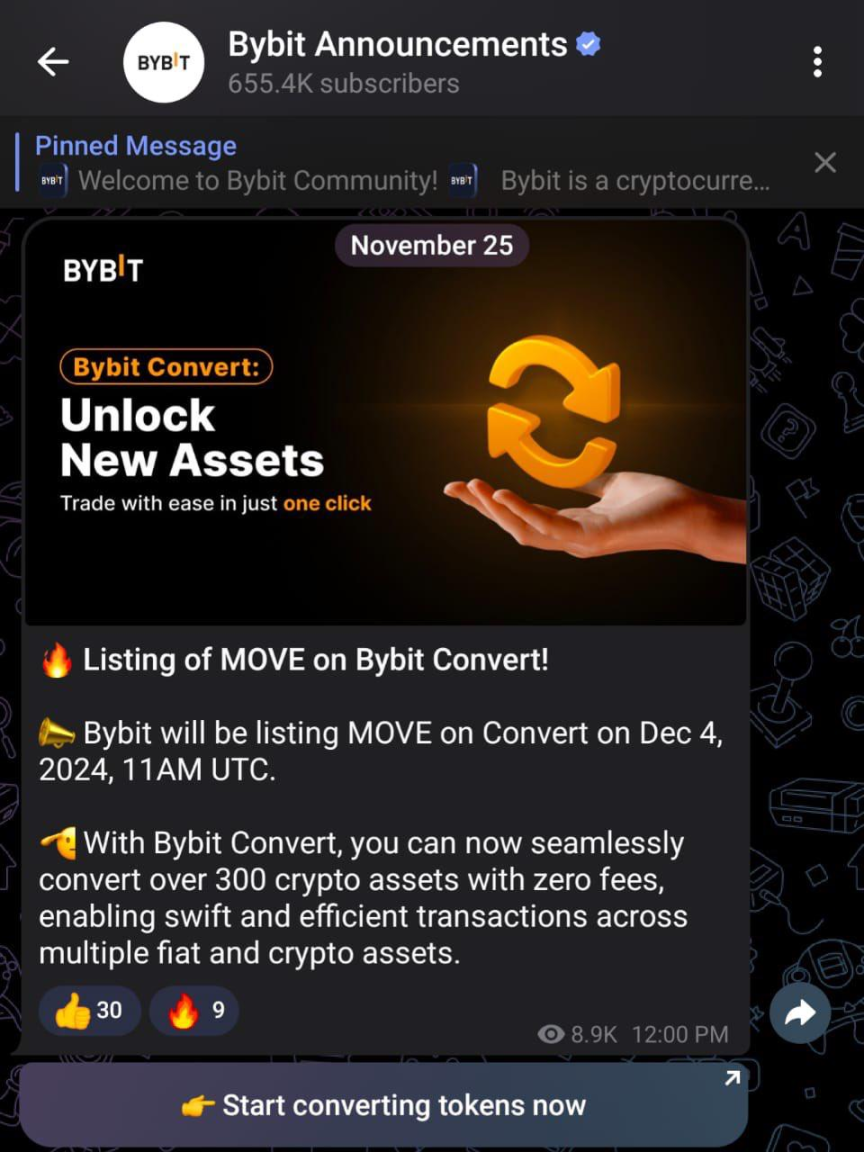

The Movement Foundation has not announced the specific time of TGE, but we can get some clues through the information related to the exchange - Bybit Convert will launch MOVE on December 4, and TGE will be earlier than this time, which is most likely two days at the end of this month or early December.

Token economics?

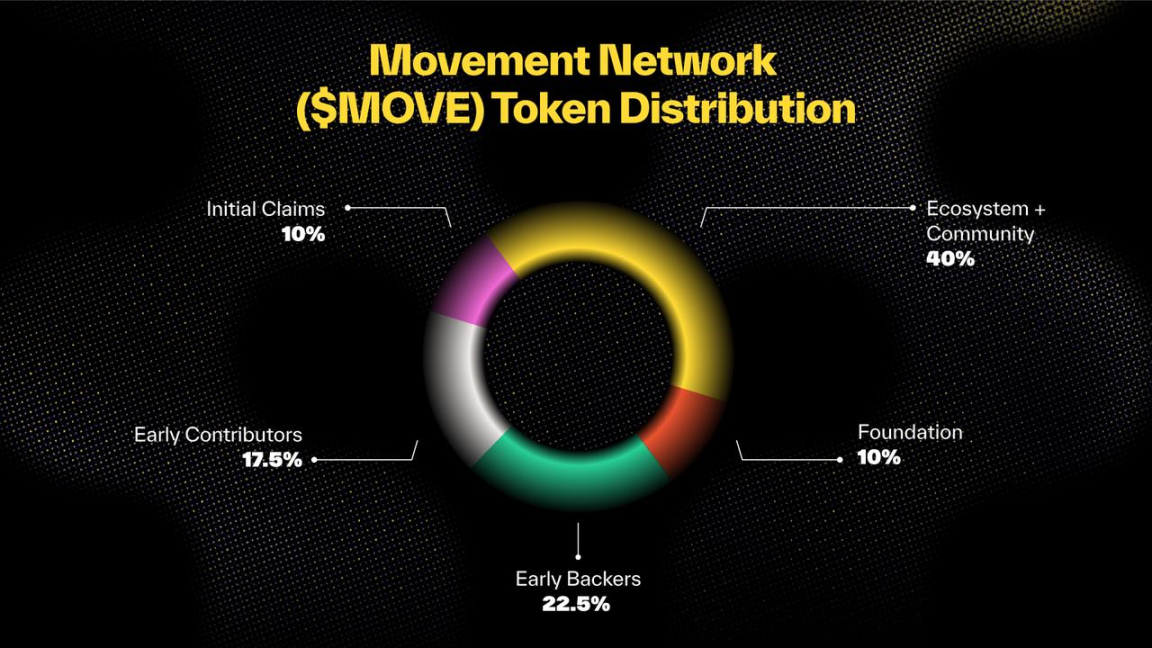

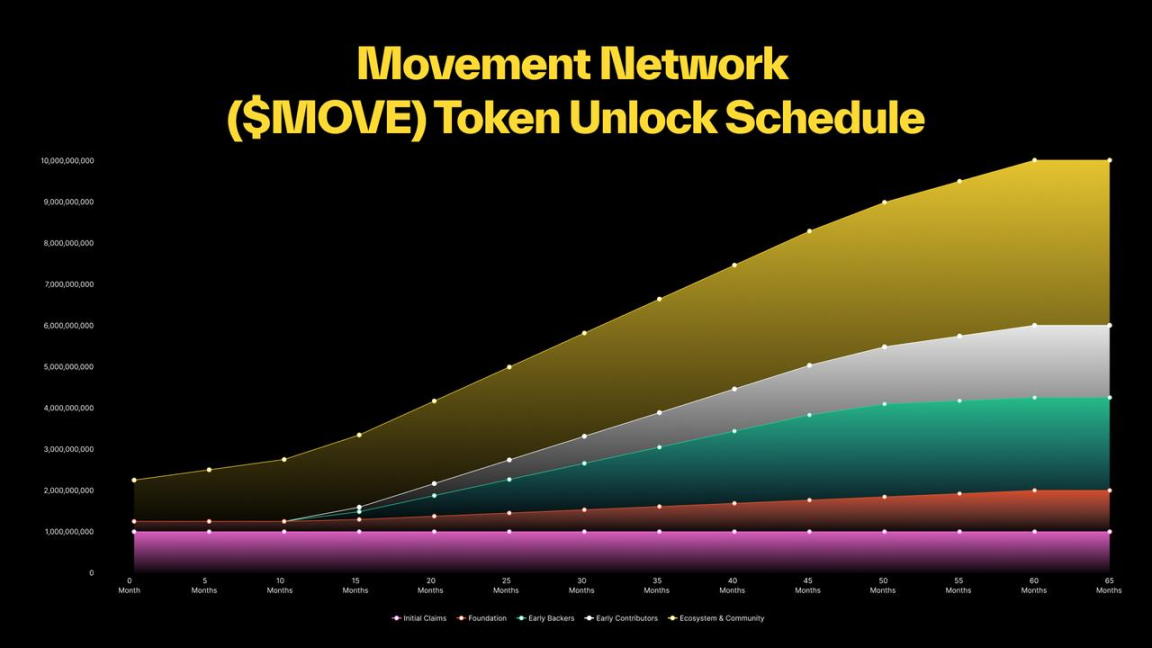

The total supply of MOVE tokens is 10 billion, with an initial circulation of approximately 22%. 60% of the total will be allocated to the community, including the ecosystem and community (40%), the foundation (10%), and the initial airdrop (10%).

Early contributors will receive 17.5% and early investors will receive 22.5%. MOVE tokens will be unlocked gradually over 60 months and will be TGE’d on the Ethereum mainnet. The team and investors will not be able to participate in staking in the early stages. The Movement Foundation said that after the MOVE token mainnet is launched (coming soon), MOVE holders will be able to cross-chain to the Movement Network.

The 10% initial airdrop ratio is quite good in comparison with other recently launched projects. The 60-month (5-year) lock-up period spans a complete cryptocurrency "4-year cycle". The longer token unlocking period can force the team to pursue long-termism and "BUIDL" rather than just sitting there after the token is listed.

The team and investors were unable to participate in staking in the early stages, so TIA was criticized for the fact that "investors can get their money back by selling staking rewards", and they gave corresponding measures, which is quite pragmatic.

Token utility?

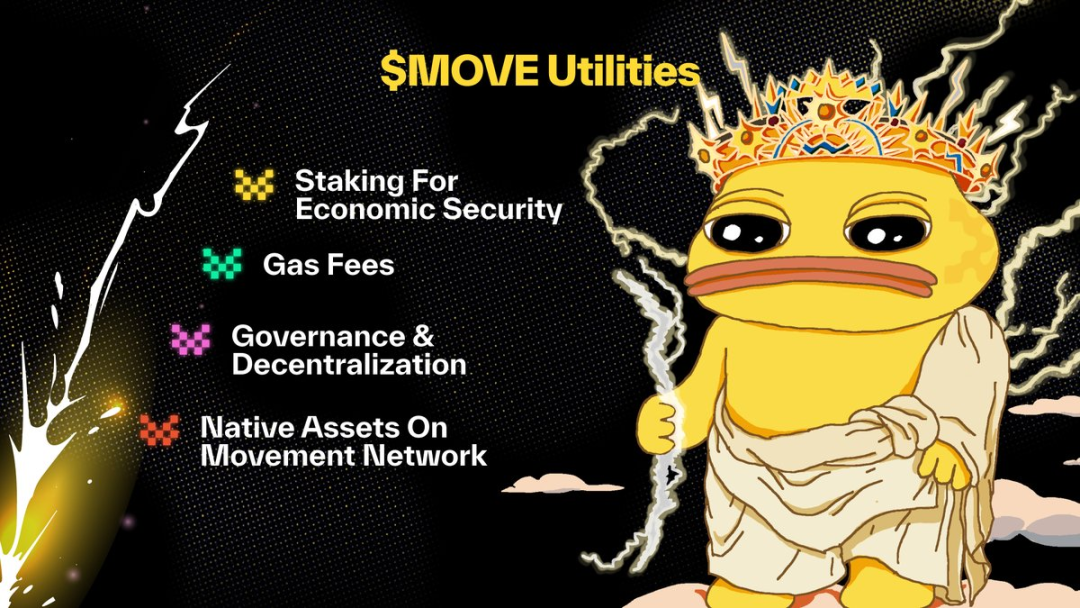

The MOVE token will serve as the native asset of the Movement network and participate in use cases such as staking, gas fees, and decentralized governance.

Staking for economic security

Once the Movement public mainnet is launched and staking is enabled, validators on Movement will be able to stake MOVE. In return for providing economic security for Movement, active validators will receive MOVE staking rewards.

Gas Fees

Gas fees on the Movement network will be priced and paid in MOVE, and a portion of the fees will be used to cover transaction settlement costs on Ethereum.

In the future, networks built using Move Stack are also expected to use MOVE to pay gas fees.

Governance and Decentralization

MOVE holders will be able to propose and vote on governance proposals to change certain network parameters.

Network Native Assets

MOVE will become the native asset of the Movement mainnet. Applications built on Movement can use MOVE for:

- Providing liquidity

- As collateral

- Payment

- More

Who will receive the airdrop?

The initial airdrop ratio is 10%, and it is expected that the main airdrop targets will include test network participants, cooperative ecological projects, etc.

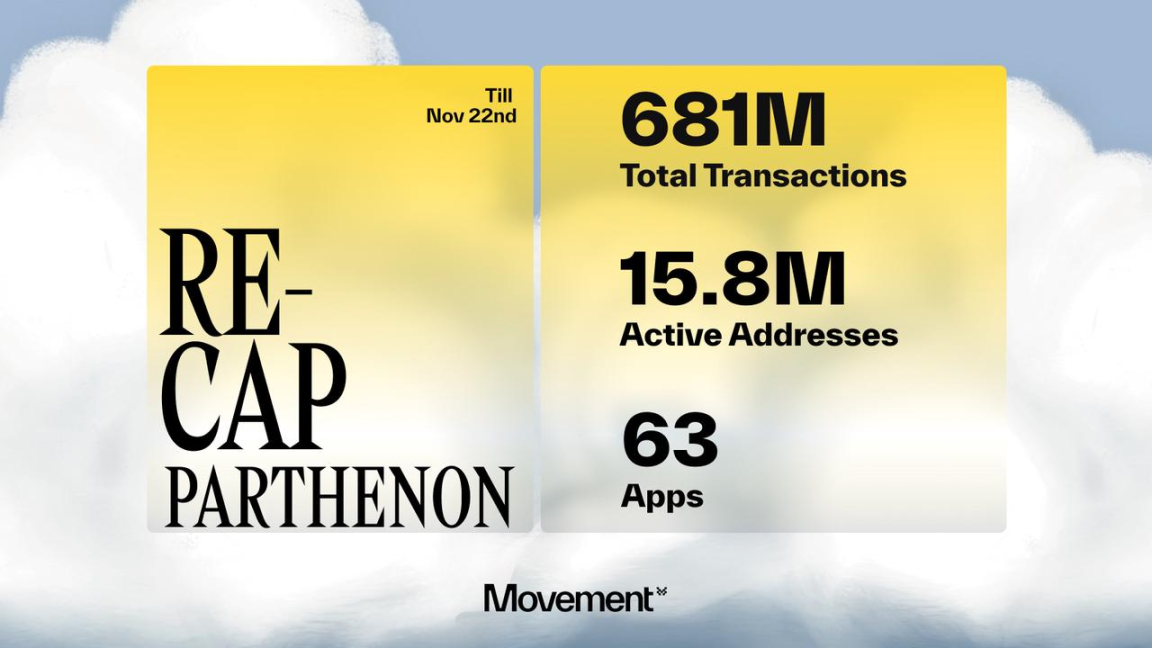

It is worth noting that the number of active addresses on the Movement test network has exceeded 15.8 million, and the total number of transactions has reached 680 million (an average of 40+ transactions per address). We should not have too high expectations for the airdrop income of the test network addresses.

The author's subjective guess on the share of cooperative ecological projects is:

- Active DeFi users in the Aptos ecosystem. Movement mainly supports Aptos Move, and most Aptos ecosystem projects are ready to be deployed to Movement.

- POL stakers. Movement will connect to Polygon’s AggLayer solution to solve the liquidity fragmentation problem.

TGE first, then mainnet?

Why is the MOVE token being launched before the Movement public mainnet launch?

In order to properly initiate postconfirmations, a mechanism that allows a Movement to reach finality in under a second (or less).

Movement’s post-confirmation mechanism requires pre-established economic security. After establishing economic security using MOVE tokens through a liquid deposit contract before the public mainnet, Movement will be able to have 1 second finality through the post-confirmation mechanism at launch.

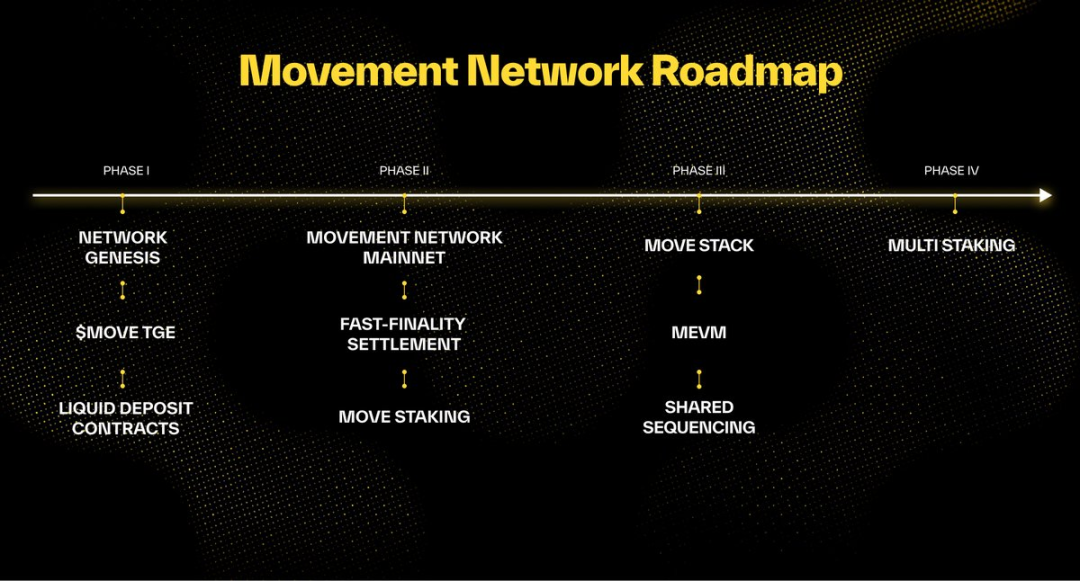

Roadmap

- Phase 1: Network Genesis, MOVE Token TGE, Launch of Liquid Deposit Contract

- Phase 2: Movement mainnet launch, fast finality, MOVE token staking

- Phase 3: MOVE Stack, MEVM, Shared Sorter

- Phase 4: Multi-asset staking