MSTR (MicroStrategy) has risen from $69 at the beginning of the year to a high of $543 last week, a much higher increase than Bitcoin! What impressed me most was that when BTC was being pushed to the ground due to the election correction, MSTR was still soaring. This made me rethink its investment logic: it is not just a BTC concept, but has its own gameplay and logic.

The core gameplay of MSTR: issuing convertible bonds to buy BTC

MSTR was originally engaged in BI (Business Intelligence Reporting System), but this has long been a sunset industry. Today, its core gameplay is: raising funds through the issuance of convertible bonds, buying a large amount of BTC, and using it as an important part of the company's assets.

1.What are convertible bonds?

Simply put, a company raises funds by issuing bonds, and investors can choose to receive the principal and interest upon maturity, or convert the bonds into company shares at an agreed price.

---If the stock price rises sharply, investors will choose to convert their shares, and their shares will be diluted accordingly.

---If the stock price does not rise and investors choose to get back the principal and interest, the company will need to pay a certain amount of capital cost.

2. Operation logic of MSTR:

---Use the money raised from issuing convertible bonds to buy BTC.

---In this way, MSTR's BTC holdings continue to increase, while the value of BTC per share also grows.

For example: According to data at the beginning of 2024, the BTC corresponding to every 100 shares increased from 0.091 to 0.107, and by November 16th it had risen to 0.12.

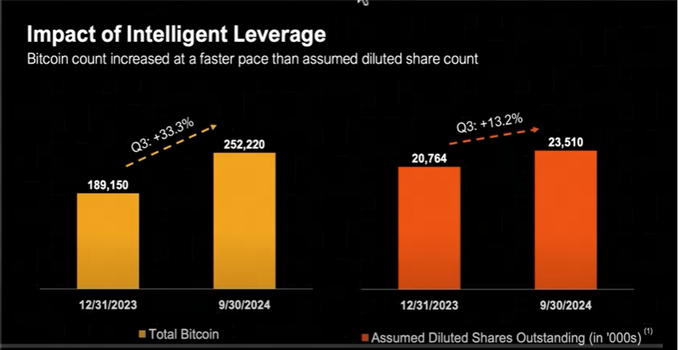

The following figure will make it clearer: The relationship between MSTR's BTC holdings and diluted shares issued through convertible bonds in the first three quarters of 2024

---In the first three quarters of 2024, MSTR increased its BTC holdings from 189,000 to 252,000 (an increase of 33.3%) through convertible bonds, while the total number of shares was only diluted by 13.2%.

---The BTC corresponding to every 100 shares has increased from 0.091 to 0.107, and the BTC holdings have gradually increased. We calculated based on the price at the beginning of the year: 100 shares of MSTR stock are priced at ($69) $6900, 0.091 BTC ($42,000) is priced at $3822, which seems to be very uneconomical compared to the value of buying BTC directly (-45%). However, according to this growth model, through continuous bond issuance, the number of BTC held per share will increase.

3. Latest data:

On November 16, MSTR announced that it had acquired 51,780 BTC for $4.6 billion, bringing its total holdings to 331,200 BTC. According to this trend, the BTC value for every 100 shares is close to 0.12. From a currency-based perspective, the BTC "equity" of MSTR shareholders is increasing.

MSTR is the “golden shovel” of BTC

From the perspective of the model, MSTR’s gameplay is similar to using Wall Street’s leverage to mine BTC:

---Continuously issue bonds to buy BTC, and increase the BTC holding per share by diluting the shares;

---For investors, buying MSTR shares is equivalent to indirectly holding BTC, and they can also enjoy the leveraged benefits brought by the rise in BTC stock prices.

I believe that smart friends have already discovered that this game is actually quite similar to Ponzi. The newly raised money is used to subsidize the rights and interests of old shareholders, and rounds of passing the parcel are passed to continue fundraising.

4. When will this model no longer be sustainable?

---Fundraising becomes more difficult: If the stock price does not rise, the subsequent issuance of convertible bonds will become difficult and the model will be unsustainable.

--- Excessive dilution: If the rate of additional shares issuance is higher than the rate of BTC increase, shareholders' equity may shrink.

---Model homogeneity: More and more companies are beginning to imitate MSTR's model, and its uniqueness may be lost as competition intensifies.

MSTR’s logic and future risks

Although the logic of MSTR is a bit like Ponzi, in the long run, it is strategically significant for big American capital to hoard BTC. The total amount of Bitcoin is only 21 million, and the US national strategic reserve may occupy 3 million. For big capital, "hoarding coins" is not only an investment behavior, but also a long-term strategic choice.

However, the current risk of MSTR's position outweighs the reward, so proceed with caution!

---If the BTC price falls back, MSTR's stock price may suffer a greater decline due to its leverage effect;

---Whether the high-growth model can be maintained in the future depends on the fundraising ability and market competition environment.

Uncle's reflection and cognitive upgrade

In 2020, when MSTR first hoarded BTC, I remember that Bitcoin rebounded from $3,000 to $5,000. I didn't buy it because it was too expensive, but MSTR bought a lot at $10,000. At that time, I still thought they were too stupid, but BTC rose all the way to $20,000, and the clown turned out to be me. Missing MSTR this time made me realize that the operating logic and cognitive depth of American capital bosses are worth studying seriously. Although the model of MSTR is simple, it represents a strong belief in the long-term value of BTC. It is not terrible to miss it. The important thing is to learn lessons from it and upgrade your cognition.