Author: YB , Crypto KOL

Compiled by: Felix, PANews

Collect a lot of AI agent-related tweets over the past month for future in-depth research. In the past two weeks, a large number of agent announcements have not even been related to Truth Terminal/Zerebro. For example, Stripe released documentation on adding payments to agent workflows; Circle released an in-depth tutorial on how developers can integrate USDC with various agents, etc.

You might be thinking… that’s nothing special, right?

Sure, these big tech companies are talking about proxies. But who isn’t?

For the first time, it feels like the crypto bubble is discussing the same things as the rest of the tech industry. Maybe a different style, but certainly the same narrative.

Of course, cryptocurrency has always felt weird to the average person. But even in the tech world, cryptocurrency is seen as a geeky industry. And rightfully so. The amount of crazy headlines generated by the crypto industry is simply incredible, and even most crypto people think that some trends are just bullshit.

The crypto industry doesn’t have much overlap with other tech verticals, at least in the short term. So far, the cryptocurrency narrative has mostly only appealed to artists and quants. But there feels like an opportunity to disrupt that.

Let’s dive into 3 topics:

- Relaxed cryptocurrency regulation

- Accelerationist Bubble

- Encryption-driven success stories

Relaxed cryptocurrency regulation

Gary Gensler, a member of the Securities and Exchange Commission, announced that he would resign on January 20. This news was as big as Harry Potter defeating Voldemort.

Over the past four years, Gensler has been almost the biggest bottleneck in the development of the U.S. crypto industry.

It’s not just that Gensler is heavily regulated, it’s that he’s attacking this emerging industry. Linda’s tweet illustrates this perfectly: Coinbase, Consensys, and countless other companies have been forced to spend hundreds of millions of dollars lobbying and fighting in Washington.

The chart below shows that this potential candidate is making a 180-degree turn.

SEC Chair candidate Teresa Goody Guillén says she wants to make crypto great again

Regardless of who succeeds the SEC chairman, one thing is clear: Trump is determined to embrace cryptocurrencies better than the previous administration. And to be honest, the bar isn’t that high.

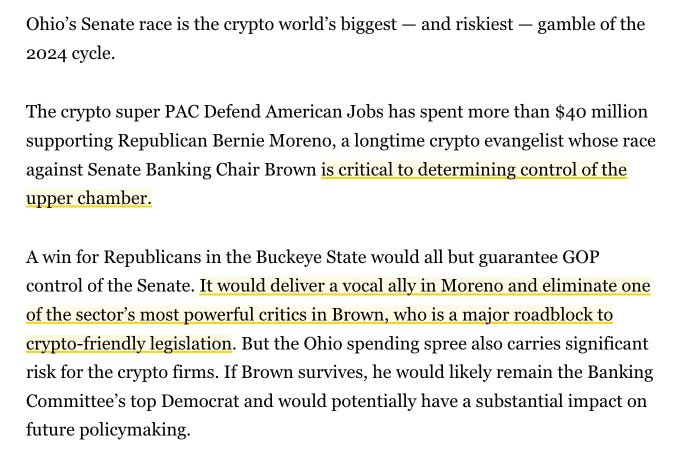

As mentioned earlier, Bernie Moreno (R) received $40.1 million in donations and defeated Sherrod Brown (D) in the Ohio Senate race.

Moreno ultimately won, which is objectively one of the biggest wins in the entire crypto space. He is a long-time crypto enthusiast, while Brown is a huge blocker of crypto regulation in the Senate.

Finally, it’s worth mentioning that the discussion around a potential U.S. strategic Bitcoin reserve is crazy. The momentum of cryptocurrencies has changed so much in the past few weeks, with rising prices, inflows into BlackRock ETFs, etc., that one has to seriously consider the fact that the federal government could have Bitcoin on its balance sheet.

OK, but what does all this regulatory news have to do with crypto crossing the chasm into wider technological adoption?

One of the main concerns for builders in other technology verticals is the uncertainty over whether cryptocurrency is a reliable technology in the U.S. With legitimate concerns about potential legal risks such as lawsuits and fines, the idea of combining such a volatile technology with their life’s work seems impractical.

But as this new administration begins to embrace cryptocurrencies and pass clear regulations, others will soon explore cryptocurrencies.

Vitalik summed it up nicely in this screenshot - it's the lack of regulatory clarity around projects that keeps builders from embracing the technology. People who aren't actively involved in building the ecosystem may be forming their opinions about crypto through embarrassing headlines about Moodeng and Bonk millionaires. Not exactly the best way to convince the talented engineers at Anthropic to use crypto, right?

Hopefully, over the next 4 years, pro-crypto politicians will do their best to make it easy and safe for people outside of crypto to adopt this technology.

Accelerationist Bubble

In his article "The Trump Bubble," Packy points out that the next four years will be a golden period for risk-taking, foresight and optimism.

I don't completely agree with the second half of the article, which feels a bit too excited and exaggerated. However, Packy makes some solid points about the shift in perceptions of progress. Things are going to get more efficient, crazier, and more experimental.

This phenomenon, as Byrne Hobart and Tobias Harris call it, is called an inflection bubble.

- Inflection point bubble: "Investors believe that the future will be radically different from the past." Think: the dot-com bubble. If you believe that the future will be radically different, you buy the stocks that you think will benefit most from that difference.

The reason I bring this up is that cryptocurrencies (not traditional venture capital) will be the financial backbone of the next inflection point bubble. Truth Terminal gives a good explanation:

It’s not that 90% of memecoins are ready to succeed right now — on the contrary, they are still very immature, and it will take some good design in the token economics for people to realize that memecoins can be comparable to what people traditionally think of as “good investments”.

As energy, AI, bioscience, and gaming verticals gain momentum, the combination of AI agents + crypto tokens could be 10x more effective at trying out new ideas.

Let's say you're a nuclear engineering veteran who has worked in the energy industry for decades and want to try to build your own vision. You might spend months convincing venture capitalists about your idea, building a team, and forming a community.

Or you can:

- Write a white paper detailing your background, thesis, plan, vision, etc.

- Deploy "brand agents" on Twitter to help you spread the word

- Raising initial funds through a token issuance

- Work with affiliates to build a real fan community (i.e. social tipping)

- Grow your team from this community and also use bounties

This is very similar to the ICO craze in 2017. But ICO may be too early for now.

In the author's opinion, changes such as improved crypto infrastructure, a crypto-supportive regulatory environment, market maturity, and institutional adoption are actually important.

That being said, the above framework will obviously still generate thousands of completely pointless projects. But how is this any different than the power law that VCs are always harping on about?

The author’s view is that there are currently no orthodox, senior institutional builders from other technology verticals intentionally trying to realize their vision by supporting crypto financing.

Definitely not in 2017. 2024 might see some early DePin & DeSci projects.

But, as mentioned at the beginning of this post, for the first time it feels like there is some overlap between the crypto narrative and the narratives that others in the tech world care about.

Not just agency, but even topics like bioscience research, GPU allocation, etc.

While I haven’t looked at Pump.science in detail, I’m not surprised that it has become one of the hottest topics in the space. There is definitely some wild speculation, legality and security issues, etc. that need to be sorted out over time (hopefully people in the crypto industry will acknowledge that). But it’s important to emphasize that people are generally excited about the concept of crypto financing for non-crypto tasks.

The key takeaway here is that the idea of crowdfunding has been proven since the early days of Kickstarter in the 2010s. Regardless, having the wisdom and support of the crowd is better than a closed-door boardroom. People want to be involved.

But in fact, the technical and social consensus around this model may take time to form. It seems that a perfect storm is gathering: positive changes in political governance + the increasing maturity of encryption and artificial intelligence technology + the accelerationist bubble generating a lot of ideas.

Even so, there was one thing missing for the concept to really take hold.

Encryption-driven success stories

One of the coolest things about on-chain AI and Goat Meta lately is “attracting” some AI/LLM developers into crypto.

No one could have predicted this interview between Threadguy and Andy Ayery.

If you step back and think about it, it’s really amazing.

Some people, like Nick Liverman (founder of Chaos), have spent their entire careers working on projects like robotics and transhumanism, and they may have made more money in the past month than they did in the past decade.

Beff Jezos promotes his friend Shaw, who is building ai16z and Eliza frameworks as a launchpad for agentic tokens. The point here is not Beff, but more about the fact that through LLM developers experimenting with on-chain AI, deep people in the AI field even have some idea of what is going on in cryptocurrency.

The key point I want to emphasize here is that the next year will see a number of people from different technology fields properly embracing crypto and demonstrating the efficiency of the proxy + token model for building large-scale projects.

Once you see a few successful examples, it’s only a matter of time before others are eager to try out their own ideas.

All of these token issuances and experiments we’ve seen so far are just “small fry.”

It only takes a few success stories to attract a large following.