Author: WOO

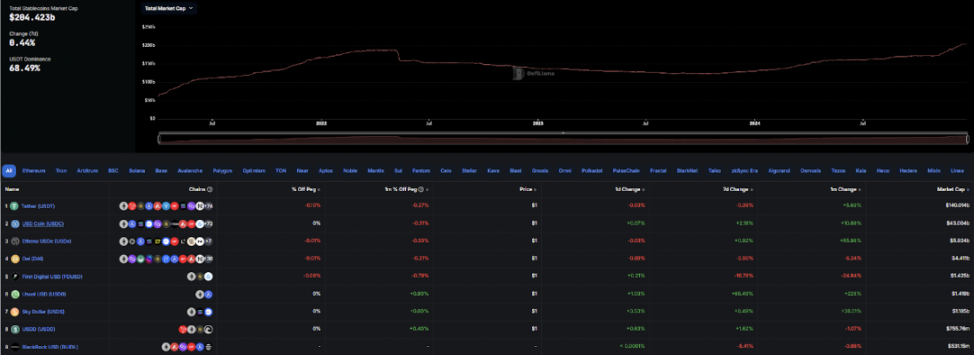

In recent years, the rapid development of stablecoins has attracted the attention of regulators in various countries. As a cryptocurrency pegged to legal tender or other assets, stablecoins have the characteristics of stable value and have been widely used in cross-border payments, DeFi and other fields. Especially in this round of cycle, RWA has performed well. Whether it is investment institutions in the traditional financial sector (such as BlackRock, etc.) or institutions/organizations from web 3 (such as Sky (formerly maker DAO), etc.), more and more investors have also paid attention to this track. Gradually forming a fluctuating upward trend.

Image source: https://defillama.com/stablecoins

"Without rules, there will be no order." As a result, governments and international organizations have begun to introduce policies to regulate stablecoins. This article briefly summarizes the current regulatory trends.

United States (North America)

The United States is one of the main markets for the development of stablecoins, and its regulatory policies are relatively complex. The U.S. stablecoin regulatory framework is mainly implemented by multiple agencies, including the Treasury Department, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC).

For some stablecoins, the SEC may consider them to have securities attributes and need to comply with the relevant provisions of the Securities Act. The Office of the Comptroller of the Currency (OCC) under the Treasury Department has proposed allowing national banks and federal savings associations to provide services to stablecoin issuers, but they must comply with anti-money laundering and compliance requirements. Recently, the U.S. Congress is discussing legislative proposals such as the Stablecoin Transparency Act, trying to develop a unified regulatory framework for stablecoins. After the election of Trump, an influencer known as the "crypto president", although policies have not yet been introduced, crypto regulation seems to be generally positive.

European Union (Europe)

The EU’s stablecoin regulation is mainly based on the Markets in Crypto-Assets Regulation (MiCA).

MiCA divides stablecoins into asset-referenced tokens (ARTs) and electronic money tokens (EMTs). Electronic money tokens (EMTs) are tokens pegged to a single fiat currency, such as stablecoins pegged to the euro or the US dollar. Asset-referenced tokens (ARTs) are tokens pegged to certain assets, such as fiat currencies, commodities or crypto assets. MiCA has formulated corresponding regulatory requirements for each. Entities issuing stablecoins must obtain permission from EU member states and meet requirements such as capital reserves and transparency disclosure.

Hong Kong (Asia)

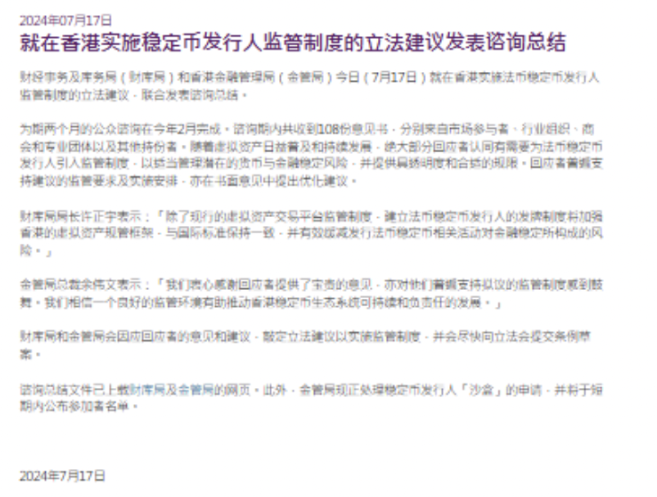

On July 17, 2024, the Hong Kong Monetary Authority and the Financial Services and the Treasury Bureau jointly issued a consultation summary, introducing the main contents of the upcoming stablecoin regulatory system. According to this system, companies that want to issue or promote legal currency stablecoins to the Hong Kong public must first obtain a license from the HKMA. This set of regulatory requirements includes the management of reserve assets, corporate governance, risk control, information disclosure, and combating money laundering and terrorist financing.

Image source link: https://www.hkma.gov.hk/gb_chi/news-and-media/press-releases/2024/07/20240717-3/

In addition, the HKMA has launched a "sandbox" program for stablecoin issuers to exchange views with the industry on proposed regulatory requirements. The first list of participants was announced on July 18, 2024, including JD CoinChain Technology (Hong Kong) Co., Ltd., Yuancoin Innovation Technology Co., Ltd., and a consortium consisting of Standard Chartered Bank (Hong Kong) Limited, Animoca Brands Limited and Hong Kong Telecom Limited.

Image source link: https://www.hkma.gov.hk/eng/key-functions/international-financial-centre/stablecoin-issuers/

Recently, on December 6, 2024, the government published the Stablecoin Bill in the Gazette, which aims to introduce a regulatory regime for issuers of fiat stablecoins in Hong Kong to improve the regulatory framework for virtual asset activities.

Singapore (Asia)

According to Singapore’s Payment Services Act, stablecoins are considered digital payment tokens, and their issuance and circulation require the permission of the Monetary Authority of Singapore (MAS). MAS provides a regulatory sandbox for startups to test stablecoin-related business models.

Japan (Asia)

In June 2022, Japan revised the Payment Services Act (PSA) to establish a regulatory framework for the issuance and trading of stablecoins. According to the revised PSA, stablecoins fully backed by fiat currencies are defined as "electronic payment instruments" (EPIs) and can be used to pay for goods and services. There are specific requirements for issuing institutions, namely: only three types of institutions can issue stablecoins: banks, money transfer service providers, and trust companies. Institutions that want to conduct stablecoin-related business must first register as electronic payment instrument service providers (EPISPs) before they can obtain the necessary licenses required to provide services.

Brazil (South America)

In October 2024, BCB President Roberto Campos Neto said that he planned to regulate stablecoins and asset tokenization in 2025. In November 2024, BCB proposed a regulatory proposal that would prohibit users from withdrawing stablecoins from centralized exchanges to self-hosted wallets. In December, BCB's deputy director of financial systems said that the central bank might revoke the ban if key issues such as transaction transparency could be improved.

Summarize

In addition, Russia and the BRICS countries are also considering using cryptocurrencies as a settlement method for cross-border financing. In general, whether it is setting up a regulatory sandbox for crypto companies or defining categories based on the different characteristics of stablecoins, more and more regulatory policies for stablecoins will be introduced in the future. And cross-border payments seem to be one of the most widely used scenarios for stablecoins.