作者:Nancy,PANews

曾几何时,TON生态凭借Telegram强大的流量加持,在“流量即价值”的狂热氛围中迅速崛起。然而,随着流量红利的逐渐消退,现实的帷幕被撕开,TON生态的增长引擎开始放缓。单一的叙事逻辑、资源分配的失衡、外部事件的冲击以及市场周期的波动,TON生态陷入了阵痛期。

眼下,TON或迎来流量退潮后的转机,顶级西方风投助阵买入4亿美元代币、与Telegram独家绑定后的利好频传等消息,为TON带来新的增长预期。

VC买入价值超4亿美元代币,独享Telegram流量

3月20日,Open Network Foundation(TON基金会)披露多家美国领先的美国风投公司VC持有超过4亿美元的TON代币,涉及投资方包括红杉资本(Sequoia Capital)、Ribbit Capital、Benchmark、Kingsway、Vy Capital、Draper Associates、Libertus Capital以及SkyBridge等多家知名风险投资机构。据悉,这笔融资并非通过传统的股权或现金形式,而是以购买TON代币的方式完成,这一形式被外界视为对TON增长潜力的认可。

公开资料显示,TON在此之前已完成六轮融资,多以场外交易(OTC)形式进行。从此前披露的融资情况来看,仅两轮公开OTC金额就达到3800万美元。尽管这笔涉及4亿美元代币的投资资金并非由TON基金会本身筹得,但西方顶级风投的参与值得关注,这些投资机构的资本背景非常深厚,且过往战绩也为TON叙事增加更多想象空间。

例如,Ribbit Capital,作为一家专注于金融科技和加密领域的风投,曾成功押注Revolut、Nubank、Coinbase和Robinhood等行业巨头;Benchmark则以精准眼光投资了eBay、Instagram等知名企业;而红杉资本的投资版图也非常广阔,涵盖了Stripe、Nubank、Klarna、Fireblocks和StarkWare等明星项目。

对于TON而言,这轮融资意义远超资金本身,西方传统资本的集体加持释放出TON被主流认可的信号,尤其是考虑到Telegram过往因监管压力给TON发展带来的不确定性。

除了获得了资本的背书,TON更迎来了生态层面的利好消息。尽管过去曾因监管困境,TON与Telegram分离独立,但如今双方已再次深度绑定,今年1月, Pavel Durov公开明确表示,TON将成为Telegram的独家区块链合作伙伴。作为独家合作伙伴关系,所有Telegram小应用程序必须迁移到TON生态系统,TON代币也将成为所有Telegram聊天服务的支付专属资产。

Telegram强大的流量支持将为TON带来更多发展空间。据Pavel Durov最新披露,Telegram现已拥有超过10亿月活跃用户,成为全球第二大通讯应用(不包括中国特有的微信)。用户活跃度也在上升,平均每个用户每天打开Telegram 21次,每天使用41分钟。同时,Telegram的收入增长显著,2024年盈利达到5.47亿美元。不仅如此,Telegram也在持续打磨产品,平台不断优化产品体验,比如近期宣布推出年度第三次重大更新,强化视频功能和AI贴纸搜索,并计划在自托管加密钱包中引入交易和收益功能,还将为TON持有者推出忠诚计划,进一步推动TON生态普及。

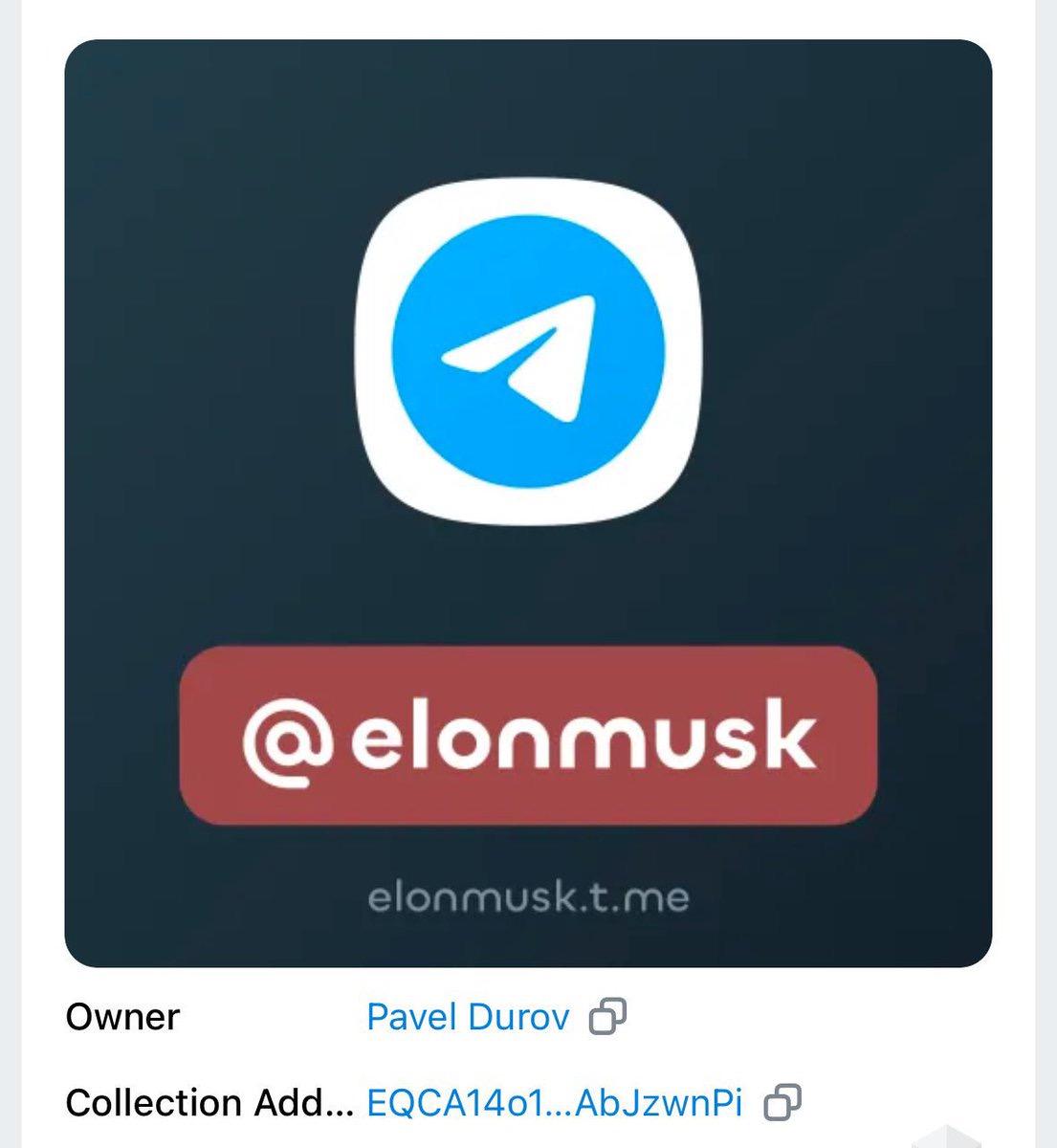

而近期Pavel Durov的回归也为TON注入新的信心和活力。Durov被视为TON的核心推动者,他的个人处境直接影响了社区信心和生态发展节奏。去年8月,他因Telegram涉嫌未充分监管非法内容而在法国被捕,市场信心一度受挫,导致当时TVL和币价暴跌。但近期法国当局调整司法监督条件,允许他返回长期居住地迪拜,TON社区情绪随之回暖。Durov回归后动作频频,例如花费5000 TON在Telegram收购“elonmusk”用户名,旗下xAI开发的AI机器人Grok现已登陆Telegram,免费向Premium订阅用户开放。

强大的资金支持、顶级风投的背书、与Telegram生态的深度绑定以及Durov的回归,这些因素共同推动了市场对TON叙事的高度看好。

生态热潮大退潮,多重困局亟待解决

然而,现阶段TON生态依旧面临着严峻挑战。过去一年,TON生态的多项关键指标呈现显著下滑趋势,已从昔日的繁荣逐渐步入冷却期。

Artemis数据显示,过去一年,TON代币较高点下跌超54.8%,市值从巅峰时期的252亿美元大幅缩水。与此同时,TON生态的锁定总价值(TVL)也遭遇了大幅回落,从最高超过7.7亿美元的高点骤降至如今的1.7亿美元,跌幅高达77.9%。

链上活跃度的下滑进一步凸显了TON生态的困境。Artemis数据显示,TON的每日活跃地址数从最高250万个锐减至当前的13.7万个,仅剩零头,跌幅超过94.5%。与此同时,日交易额也从一度高达23亿美元的峰值下滑至目前的3.2亿美元,跌幅达到86.1%。这些数据的急剧下降清晰地勾勒出TON生态内部经济活力的衰退,用户参与度和交易活跃度均已大幅萎缩。

TON生态当前的处境由多重因素交织而成。一方面,TON早期高度依赖Telegram生态中的小程序和小游戏,凭借社交平台的庞大用户基础迅速吸引了大量流量。然而,这种基于短期热度的增长模式在造富效应减弱和用户新鲜感消退后难以持续,失去了关键驱动力。尤其是早期通过“Tap To Earn”等机制吸引不少用户,但最终未能有效转化为长期稳定的生态参与者,反而导致流量红利迅速枯竭。

另一方面,TON的生态叙事主要围绕Telegram的社交属性和小游戏展开,相较于其他公链,其在DeFi、AI以及DePIN等多样化赛道的布局明显不足,竞争力相对薄弱。而从DeFiLlama追踪TON的TVL分布来看,过去一个月,仅流动性质押协议Tonstakers的TVL过亿美元,TVL达到百万至千万美元规模的项目也仅有13个,这一分布凸显了TON生态项目集中度过高以及在多元化发展上的短板问题。不仅如此,TON的技术开发门槛较高,其独特的编程语言和架构设计对开发者不够友好,导致生态内项目开发进展缓慢,难以吸引更多优质团队入驻,进一步限制了生态的多样性和创新能力。

除此之外,TON生态内部资源分配的不均衡也加剧了其困境。正如之前所说,TON在市场宣传和资源投入也多集中在Telegram小游戏,包括Catizen、Notcoin 和 Hamster Kombat等上线初期通过Telegram的病毒式传播获得了巨大成功,但类似的现象却未能在TON其他赛道得到成功复制。同时,由于大量资源集中于少数头部应用,导致其他中小型项目由于缺乏市场曝光和叙事支持,难以分享用户和投资者的关注。这种失衡不仅导致TON生态发展过于单一,也削弱了其抗风险能力。加之市场整体环境的变化和外部竞争压力,TON的困境进一步加剧。

总之,TON能否开启新的增长曲线,不仅取决于外部流量的持续赋能,更需要在生态多元化、技术创新和资源整合方面实现实质性突破。