When mentioning ve(3,3), we have to first introduce Solidly. As the originator of ve(3,3), Solidly is a project launched by Andre Cronje, known as the "Godfather of DeFi", on the Fantom network. Within two months of the announcement that Andre Cronje would launch Solidly on the Fantom chain, Fantom's total locked value (TVL) soared to third place on DefiLlama. However, after Andre Cronje announced his withdrawal from the DeFi world through his article "The Rise and Fall of Crypto Culture", the TVL of both Solidly and Fantom dropped significantly.

Despite this, the ve(3,3) mechanism applied in Solidly continues to have a significant impact on the DeFi space. According to DefiLlama, Solidly has been forked 40 times, ranking fourth in this metric and sixth in terms of TVL. If we include projects that did not directly fork Solidly but modified or improved the ve(3,3) mechanism, Solidly's influence will be more significant.

How is Solidly different?

Solidly is a self-optimizing decentralized exchange. What does it optimize for? Acquiring healthy TVL in a capital-efficient manner.

Unlike Uniswap or Curve (which return 0% or 50% of fees to UNI or veCRV respectively), Solidly allocates 100% of fees to its governance token. In turn, liquidity providers receive 100% of protocol issuance and LP bribes. Solidly improves on the best of both worlds: combining Uniswap’s pioneering AMM design with Curve’s vested custody and stability pool innovations, packaging them into a capital-efficient ve(3,3) reward incentive system to attract fee-generating liquidity. Solidly’s platform is designed to maximize returns for Solidly stakeholders and be an effective tool for deepening liquidity in the protocol. Another benefit of Solidly is predictable income for liquidity providers. Revenue is defined as a fixed weekly stream of tokens, including issuance allocations and LP bribes, regardless of trading volume.

How are emissions distributed?

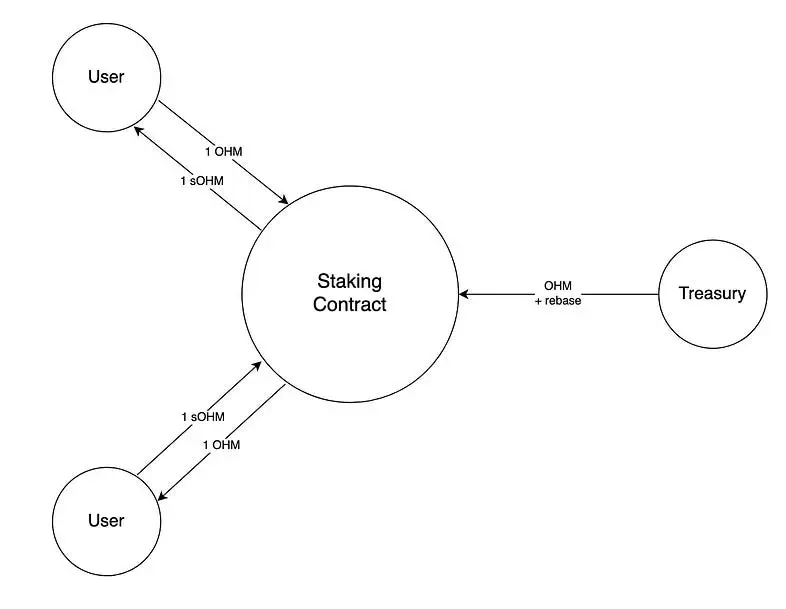

Liquidity providers earn SOLID tokens (ERC-20), which can be either sold or locked in veSOLID NFT positions (ERC-721), a type of financial NFT, with lock-up periods ranging from 1 week to 4 years. The longer the lock-up period, the higher the voting power, revenue sharing, and dilution protection. veSOLID can be used to vote for specific trading pairs, which will receive SOLID issuance in proportion to their votes, and in turn, voters will only receive fees from the pools they voted for, with fees proportional to the voting weight of each pool. Fees are paid in the underlying assets of the trading pairs, and the voting process is conducted once a week. Voters will vote for the pool that gives them the most rewards, and the cumulative rewards include bribes and fees, which in turn brings more incentives to LPs to bring them the highest returns for voters, thereby improving liquidity, reducing slippage, and achieving a better trading experience, thereby achieving "self-optimization". LPs are incentivized to earn SOLID rewards because veSOLID increases rewards by up to 2.5x and gives them control over the pairings that incentivize them, in addition to participating in future on-chain governance.

Dilution protection:

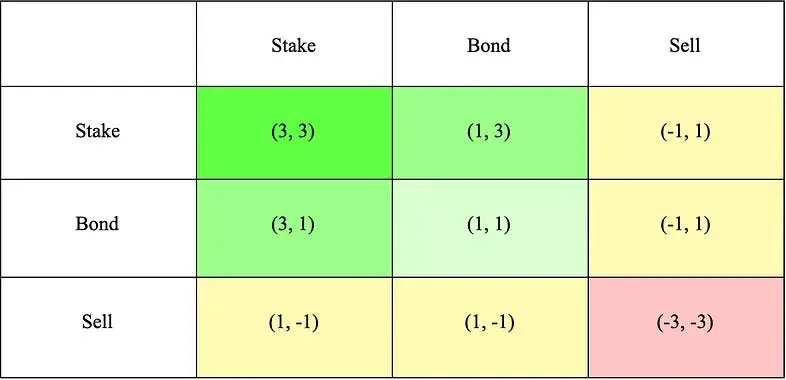

Solidly has solved the incentive structure problem that exists in Curve, but it still faces challenges. One important issue is the lack of an effective mechanism to prevent CRV inflation from causing the token value to decline. To combat the depreciation of SOLID, Solidly implemented a dilution protection mechanism based on the (3,3) model of Olympus DAO.

On other platforms, users' stake is almost always diluted. If they want to maintain influence, they must spend it indefinitely. In contrast, Solidly implements a unique feature within the cryptocurrency industry; our anti-dilution mechanism protects locked-in users from future inflation. veSOLID positions enjoy 100% anti-dilution rebalancing over the 4-year lockup period and shrink linearly.

How does THENA do it specifically?

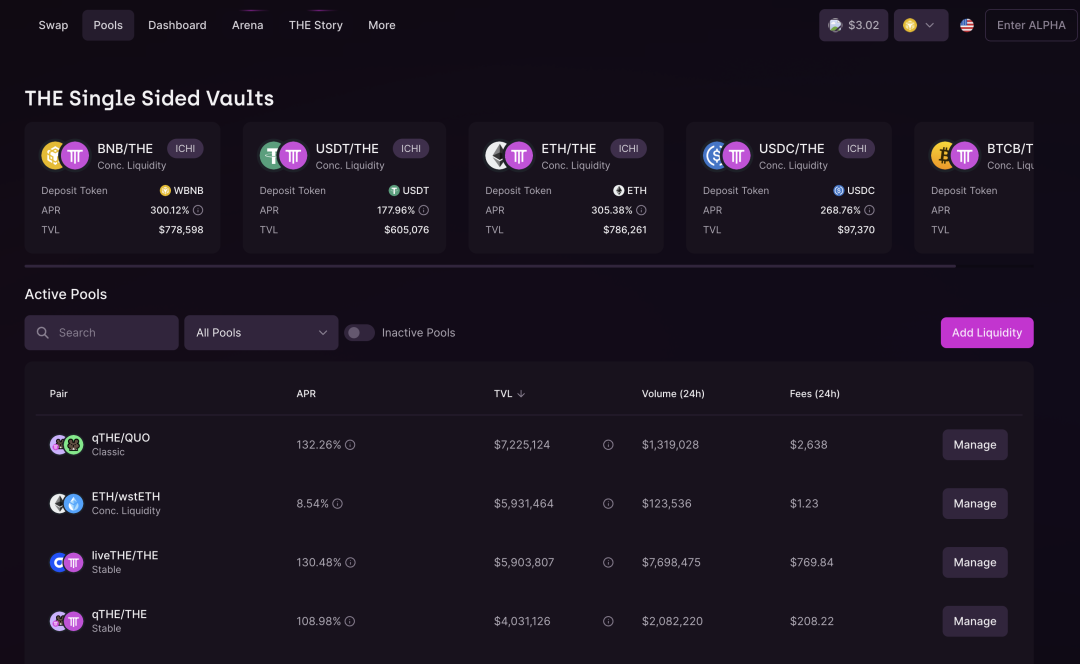

1) For the LP that provides tokens in the, the reward for emission is the token, which avoids uncompensated losses. Then the emission apy of the LP is determined by the vote of the lockers of the.

2) Voting is conducted weekly to determine the emission of the next week. Some project owners can choose to bribe voters in order to increase the emission of their own project lp, that is, add bribe in the voting interface. Therefore, the income of voters includes three parts: the inflation emission, transaction fees, and bribes from the project owner. Currently, the weekly voting income of the minimum is about 300,000 u (this is in an unknown case)

Since its launch, the has accumulated revenue of nearly 20 million US dollars. When the market is active, the highest volume has reached 1.2 million per week.

The characteristic of ve33 (flywheel 33) is that when the flywheel starts to rotate (getting support from the chain, similar to base's aero, bnb chain has invested in the last month), it will form a dimensionality reduction attack on the liquidity of the entire chain and other dexes. Gradually start to suck the liquidity, and eventually, just like aero, 80% of the TVL of the entire chain belongs to him.

Conclusion

Solidly has a big flaw. In actual applications, the lock-up period is only half a year, the stickiness is not enough, it is all PVP, and the flywheel cannot turn at all. Thena learned a lesson on this basis, extended the lock-up period, and chose to develop on the BNB chain. The advantage of BNB is that there are many project parties and retail investors, and the transaction volume on the chain is very large, which can support the flywheel to turn.

ve33's game has greatly improved the playability of MEME coins. It is a very promising solution for the current situation where PVP is so serious.