By Lorena Nessi

Translation: Blockchain in Vernacular

2024 is shaping up to be a big year for the crypto industry, filled with exciting trends and moments that continue to get the community talking.

From memecoins grabbing headlines to the tokenization of real-world assets, the year was filled with stories that pushed blockchain into new areas.

Telegram games make cryptocurrencies more accessible to ordinary users, while prediction markets and liquid staking tokens provide new ways to interact with digital assets.

Add in rollups, modular blockchains, and the race to counter the quantum threat, and 2024 is undoubtedly going to be an unusual year.

These ten trends demonstrate the energy and innovation driving the crypto world forward.

1. The rise of Memecoin

Memecoins are an unprecedented social phenomenon. While some view them as simplistic, trivial, or even question their legitimacy as digital assets, believing them to be poor financial decisions or the product of a short-lived trend and viral marketing, they have carved out an undeniable niche in the crypto ecosystem, blending humor, community engagement, and innovative digital value creation with a broader cultural movement.

1) Grassroots Movement and Celebrity Effect

These tokens respond to various social, political and economic situations, reflecting the cultural spirit. They rely on celebrity culture and are promoted by influential figures, often increasing their visibility.

Memecoins often leverage grassroots movements where communities unite around shared ideas and values, inspiring collective action and forming viral trends. Memecoins also highlight the role of participatory culture, enabling users to drive token adoption and shape narratives through collective efforts. They can also sometimes just be trivial trends.

2) Memecoin in 2024: Milestones and Impact

In 2024, memecoins have solidified their place as the defining force in crypto. Tokens heavily influenced by the Shiba Inu (SHIB), such as Neiro (NEIRO) and FLOKI Inu (FLOKI) — the latter of which launched a debit card — and PepeCoin (PEPE), which draws on internet memes and nostalgia, demonstrate how humor and cultural relevance can inspire remarkable financial activity.

In 2024, a notable example of memecoin’s influence came when President-elect Donald Trump appointed Elon Musk to lead the newly created Department of Government Efficiency (DOGE). The advisory body, tasked with streamlining federal government operations and reducing inefficiencies, had an acronym that was a deliberate nod to Dogecoin (DOGE), which Musk was widely known to support.

3) The intersection of technology, culture and society

Memecoin reflects the intersection of technology, culture, society and politics, showing how seemingly whimsical ideas can challenge traditional values and innovation. For many people, they are a stepping stone into the world of crypto, providing an accessible entry point into technology-driven digital assets.

2. Predict market growth

In 2024, decentralized platforms like Kalshi and Polymarket have gained widespread attention for allowing users to predict events and earn rewards. These platforms cover topics as diverse as sports results, election outcomes, and cryptocurrency prices, using blockchain technology to ensure transparency and security.

Kalshi’s bets exceeded $100 million during the 2024 U.S. presidential election, demonstrating the potential of prediction markets in gauging public sentiment. However, this growth has also sparked criticism. Some analysts believe that low liquidity and susceptibility to manipulation undermine the reliability of prediction markets as a forecasting tool.

Regulatory scrutiny has also intensified. Kalshi won a legal battle with the Commodity Futures Trading Commission (CFTC), enabling it to offer contracts on political events, but concerns about legality and market manipulation remain. In addition, some have expressed moral objections, questioning the ethics of gambling on elections.

One user X expressed her concerns about election gambling, posting: "I think what the CFTC is pushing is actually correct. Why gamble on elections? I personally don't like the idea."

Despite these challenges, the rise of prediction markets highlights the need for decentralized solutions to real-world problems, solidifying their place as a significant trend in crypto for 2024.

3. Liquid Staked Tokens (LSTs) and Liquid Re-staked Tokens (LRTs)

In 2024, Liquid Staking Tokens (LSTs) and Liquid Re-staking Tokens (LRTs) gradually emerged and gained greater influence based on early innovations. Although EigenLayer launched its mainnet in mid-2023, its influence became more evident in 2024, with the gradual growth of re-staking adoption.

By mid-year, over 33.8 million ETH had been staked, demonstrating growing market confidence in Ethereum’s Proof-of-Stake (PoS) model and the viability of liquid staking.

LSTs allow users to stake assets while maintaining their liquidity, allowing them to engage in decentralized finance (DeFi) activities such as borrowing and trading. LRTs further enhance this concept by allowing validators to re-stake staked assets to other networks or support services such as rollups, increasing their functionality and rewards. Despite the surge in adoption in 2024, achieving full adoption in all areas remains an ongoing process.

Key platforms and competition

EigenLayer has made leading progress in re-staking, with over 4.1 million ETH already re-staking on its platform by April 2024. Other platforms such as Lido Finance, Rocket Pool, and Frax Finance have also made important contributions, expanding the application of LSTs and integrating them into the DeFi ecosystem. These projects have played a vital role in driving innovation and accessibility in the staking space.

Progress in 2024 has established LSTs and LRTs as key tools in the staking ecosystem, laying the foundation for future developments in blockchain technology and DeFi integration.

4. Quantum computing threat

In 2024, the discussion about the impact of quantum computing on blockchain security has become a hot topic. Although quantum computing technology offers great potential for scientific breakthroughs and innovation, it also poses a significant threat to the core of cryptocurrency: security.

1) Quantum Threat

Quantum computers use the power of quantum mechanics to potentially break the encryption algorithms that protect blockchain networks. Algorithms like Shor's algorithm could theoretically decrypt public-private key pairs, compromising the confidentiality and integrity of transactions. Imagine if a malicious attacker was able to steal a private key, they could perform a double-spending attack or launch a 51% attack to control a blockchain network.

This potential consequence has prompted industry leaders to proactively address the challenge. Professor Massimiliano Sala of the University of Trento in Italy served as a wake-up call during a speech at a Ripple event, highlighting the impending “Q Day,” when quantum computing could render traditional encryption ineffective.

2) Finding quantum-resistant solutions

Major companies like IBM and Google are leading the way in quantum technology while also pushing for the development of quantum-resistant cryptography. This race has spawned projects like the National Institute of Standards and Technology’s (NIST) post-quantum cryptography standardization process, which aims to create encryption methods that remain secure even in the face of quantum computing breakthroughs.

3) Blockchain’s quantum defense

The blockchain community itself is also actively exploring "quantum-safe" solutions. Lattice-based cryptography and quantum key distribution (QKD) are emerging technologies designed to protect blockchain communications from quantum attacks.

Although the industry is taking positive steps, transitioning to a quantum-resistant infrastructure remains a complex and resource-intensive challenge. Google's latest quantum chip, Willow, has made significant progress in error correction, laying the foundation for larger-scale quantum computers. While the power of this technology is undeniable, machines capable of breaking encryption are still far from being widely available.

Therefore, ensuring the long-term security of cryptocurrencies by developing and adopting quantum-resistant solutions is critical to the continued growth and stability of the crypto industry.

5. Decentralized Physical Infrastructure Networks (DePINs)

Decentralized Physical Infrastructure Networks (DePINs) are a major trend in 2024, connecting blockchain technology with real-world assets. These networks show the potential to reshape the energy, transportation, and logistics industries.

Examples include decentralized wireless networks like Helium, blockchain-powered ride-sharing platforms, and supply chain tracking systems. DePINs bring greater transparency, improved security, enhanced accessibility, and a sense of community engagement.

Despite these advantages, challenges such as interoperability, scalability, and regulatory uncertainty remain.

As DePINs develop and regulatory frameworks evolve, they are expected to change the way industries manage and access physical infrastructure, providing more equitable and efficient solutions for the future.

6. The popularity of trading robots and AI agents

The crypto market has witnessed a surge in the popularity of automated trading bots and AI agents in 2024. Designed to execute trades based on predefined algorithms or real-time market analysis, these tools have revolutionized the crypto trading landscape.

Key trends and innovations

AI-powered trading assistants/agents: AI-powered trading assistants, such as Near’s AI assistant, have become valuable tools for traders of all kinds. Additionally, Coinbase and Replit’s Based AI Agent templates allow developers to create crypto bots for automated trading and asset management. As trading bots and AI agents have become more popular, concerns about market manipulation and unfair advantages have also arisen.

Leading Trading Bots: Truth Terminal, an AI chatbot that rose to fame in the crypto community for promoting a meme-based religion (the “Goatse Gospel”). The launch of the GOAT meme coin was fueled by a massive Bitcoin donation, highlighting the potential impact of AI on crypto trends. While Truth Terminal itself cannot trade, its influence has sparked a debate about AI ethics, especially in the volatile meme coin market.

The increasing use of trading robots and artificial intelligence agents has undoubtedly reshaped the crypto trading landscape. Although these tools offer significant advantages, they should still be used with caution and a deep understanding of their limitations. As technology continues to develop, balancing automation and human oversight will be key to ensuring responsible and ethical trading practices.

7. Application of Rollups in Layer 2 Scaling

In 2024, Rollups became a cornerstone solution to Ethereum's scalability challenges. They solve network congestion and high fees while maintaining Ethereum's security. As a Layer-2 solution, Rollups move transaction processing off-chain and package them into a batch and submit them to the main chain, allowing for faster and cheaper operations.

Vitalik Buterin’s Standard

In September 2024, Ethereum co-founder Vitalik Buterin emphasized that the Layer-2 network must meet the "Phase 1" decentralization standards by 2025. These standards include anti-fraud mechanisms, security committee governance, and upgrade delays to ensure trust and transparency.

Rolling aggregation solutions like Optimism and zkSync have billions of dollars in locked value (TVL) while supporting DeFi, non-fungible tokens (NFTs), and decentralized applications (dApps).

It is worth noting that challenges such as interoperability and achieving full decentralization remain. However, rolling aggregation solutions continue to redefine Ethereum scalability in 2024, establishing their key position in the future growth and adoption of the Ethereum network.

8. Tokenization of Real World Assets (RWAs)

In 2024, the tokenization of real-world assets (RWAs) is developing rapidly, creating new opportunities for investors and businesses. Here is an overview of the current situation:

1) Raising credit market growth

The global raised credit market has reached $1.7 trillion and has expanded at a compound annual growth rate (CAGR) of 17% over the past five years. However, only about $500 million of assets have been tokenized, indicating that there is still huge room for growth in tokenizing these assets.

2) Global Tokenization Potential

The global physical asset market exceeds $867 trillion, and tokenizing these assets could significantly increase the economic impact of the crypto industry. By 2027, tokenized assets could account for 10% of global GDP, with the potential to expand the market size to $24 trillion (World Economic Forum).

3) Industry adoption and initiatives

DeFi platform Ethena has invested $46 million in tokenized RWA funds, including products like BlackRock's BUIDL and Superstate's USTB. Solana-based marketplace AgriDex has partnered with Stripe's Bridge and Circle's USDC to reduce cross-border agricultural trade costs from 2-4% to about 0.5%. Latin American banks such as Littio are adopting the Avalanche blockchain to manage RWA vaults, demonstrating the global appeal of tokenization.

4) Institutional initiatives

UBS Group, the largest financial holding company in Switzerland, launched its first tokenized fund, UBS USD Money Market Investment Fund Token, and released it on the Ethereum blockchain, marking a major shift in institutions towards tokenized assets. The Monetary Authority of Singapore is exploring tokenization through Project Guardian and developing standards for tokenized assets.

China is advancing its digital asset plans by issuing fully digitized structured products on the blockchain, reflecting the region’s demand for tokenization.

Launched in November 2024, Hadron is an asset tokenization platform launched by Tether that aims to simplify the creation, management, and trading of tokenized assets. Hadron aims to be an easy-to-use solution that can tokenize a variety of assets from real estate to financial securities. As the tokenization of RWAs continues to grow, Hadron is expected to redefine the global financial system, improve efficiency, transparency, and provide new investment opportunities for all walks of life.

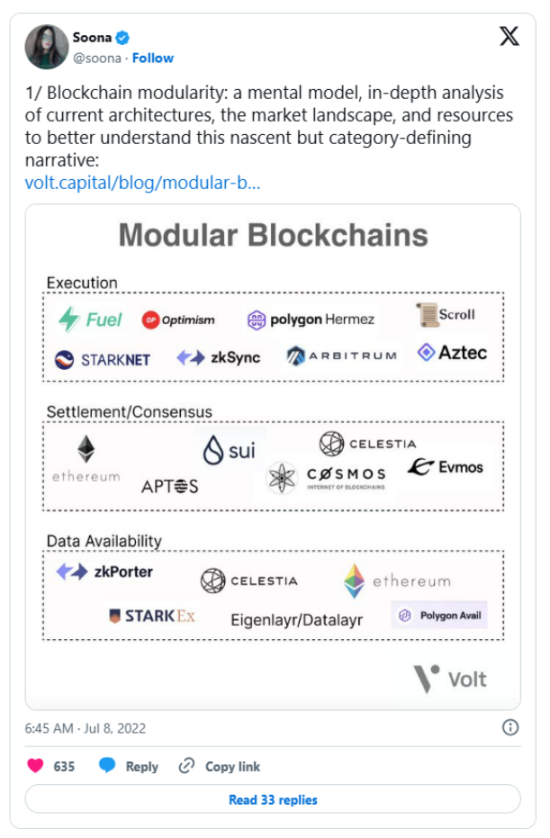

9. The rise of modular blockchain

In 2024, a revolution is taking place in the blockchain space, and the emergence of modular blockchains is driving this change. This innovative approach promises to revolutionize scalability, efficiency, and customization within the blockchain ecosystem.

1) Modular blockchain paradigm

Modular blockchain is different from the traditional monolithic architecture, which bundles all functions in a single layer. Modular blockchain adopts modular design, breaking down the blockchain into multiple specialized components. This functional separation provides blockchain with greater flexibility, scalability and innovation space.

2) Modular blockchain projects and application cases

Modular blockchains, represented by Ethereum, are well known. In recent years, a number of promising modular blockchain projects have emerged, each addressing specific challenges and opportunities:

Celestia: This project focuses on creating a decentralized data availability layer that ensures that all transaction data is accessible to all nodes in the network. This allows other modules (such as the execution layer) to be built on top of Celestia, leveraging its secure and scalable data infrastructure.

Fuel: The project is developing a modular execution layer that can process transactions in parallel, significantly increasing throughput and reducing transaction fees. Fuel’s modular design facilitates integration with other blockchain components, creating a versatile and efficient ecosystem.

Dymension: This project aims to build a modular blockchain network capable of supporting a variety of decentralized applications (dApps). By separating consensus, execution, and data availability into different layers, Dymension aims to achieve high scalability and high security.

10. Telegram Games: Attracting users into the crypto space

In 2024, Telegram becomes a key platform for crypto gaming. Independent developers launch “play to earn” (P2E) games that blend entertainment and crypto rewards. Telegram’s friendly bot infrastructure and large user base provide fertile ground for these projects.

Hamster Kombat: Players manage a crypto exchange operated by hamsters and earn HMSTRTokens on The Open Network (TON). Although player participation and token value dropped sharply at the end of the year, it demonstrated the appeal of P2E games, attracting up to 3 million players.

Catizen: This game allows users to earn CATIToken through creative gameplay. Although the concept resonates with many people, the volatility of the token price reflects the challenges of combining games with the crypto market.

PAWS: As a rising star in the P2E ecosystem, PAWS has attracted more than 25 million players through its virtual pet care model, accumulating a large number of users in just a few days.

While these games have faced criticism for repetitive gameplay, excessive time commitment, and the need for crypto investments to maximize rewards, they have played a key role in the crypto story of 2024. Their success highlights the potential and complexity of fusing gaming with digital assets, becoming an important chapter in the evolution of the P2E ecosystem.

CItizen Game | Source: Citizen

11. Conclusion

2024 is full of stories that are reshaping the crypto industry and setting the stage for future growth. Memecoin captivated audiences through humor and financial innovation, while prediction markets and Decentralized Physical Infrastructure Networks (DePINs) showed how blockchain can solve real-world problems. Telegram games attracted a large number of new users to the crypto space through an engaging “earn while playing” model.

Liquidity staking and re-staking tokens strengthen Ethereum’s staking ecosystem and provide users with more flexibility. Rollups solve the scalability problem and make Ethereum faster and more efficient, while modular blockchains introduce a new way to build decentralized systems with greater customization.

The industry has also taken steps to prepare for the era of quantum computing, with quantum-resistant solutions becoming a key focus. Tokenization of real-world assets has bridged the gap between traditional finance and blockchain, unlocking exciting opportunities and shaping the digital future. AI agents and trading bots have changed the way users interact with the market, driving automation and efficiency.

These developments highlight both the innovations and challenges in the blockchain world, demonstrating its potential to have far-reaching technological, financial, and cultural impacts. Only time will tell how the future will unfold.

Q&A

1) What will be the main crypto trends in 2024?

2024 highlighted several transformative trends, including the rise of memecoins, the popularity of prediction markets, progress in quantum-resistant cryptography, and the growth of decentralized physical infrastructure networks (DePINs). These stories played a key role in shaping the crypto space.

2) How will quantum computing impact the crypto industry in 2025?

Quantum computing poses a significant challenge by threatening traditional encryption methods used in blockchain. To address this challenge, the industry has accelerated the development of quantum-resistant solutions, such as lattice-based cryptography and quantum key distribution (QKD), to ensure the long-term security of blockchain networks.

3) Why are memecoins so influential in 2024?

Memecoins like FLOKI and PEPE continue to capture the crypto community’s attention through their combination of humor, cultural relevance, and community-driven initiatives. They also attract attention through high-profile endorsements, such as Dogecoin being mentioned in a government efficiency project involving Elon Musk.

4) What role will AI and trading bots play in the crypto market in 2024?

AI-driven trading bots and agents have revolutionized crypto trading by automating the decision-making process. These tools have increased market participation, but have also raised ethical and regulatory questions about market manipulation and fair trading.