Author: Nancy, PANews

As the stablecoin market continues to expand, the fundamentals are undergoing multi-faceted upgrades. At present, from the ice-breaking cooperation between Binance and Circle, to the intensive layout of crypto giants, to the frequent financing activities and the gradual improvement of the policy environment, the liquidity and application scenarios of the stablecoin track are rapidly expanding, accelerating to become one of the core narratives of this cycle.

Binance and Circle reunited, and the leading giants accelerated the expansion of stablecoins

On December 11, Binance officially announced a strategic partnership with Circle, the issuer of USDC stablecoin, to expand the adoption of USDC and support the development of global digital assets and a wider financial services ecosystem. According to the agreement, Binance will deeply integrate USDC into its product line, provide trading, savings and payment services to 240 million users worldwide, and include USDC in the company's reserves. Circle will provide Binance with technical support, liquidity and supporting tools.

In this regard, Binance CEO Richard Teng said that the two sides will jointly promote stablecoin innovation and application scenario expansion. Circle CEO Jeremy Allaire emphasized that with the help of Binance's rapidly developing financial super application ecosystem, USDC is expected to be more widely used.

This "great settlement of the century" shocked the crypto community, especially in the context of the two companies being in opposition. Looking back at last year, the stablecoin BUSD jointly issued by Binance and Paxos was investigated by US regulators. This investigation forced Binance, an important business line, to withdraw from the center of the stablecoin stage. Circle is considered to be the "whistleblower" behind the investigation. According to Bloomberg, citing people familiar with the matter, Circle reported to the New York State Department of Financial Services (NYDFS) in the fall of 2022 that Binance did not have sufficient reserves to support its BUSD tokens issued through Paxos.

However, today’s collaboration not only marks a reconciliation between the two major competitors, but also lays a new foundation for the larger expansion of stablecoins.

In fact, the layout of the leading crypto companies in the field of stablecoins has become more frequent in recent times. For example, Binance has recently expanded the application of multiple stablecoins, including the integration of the stablecoin FDUSD in the Sui network and the integration of USDT in the Aptos network.

Tether has also released a number of important developments recently. For example, Tether has significantly increased the amount of USDT minted. The total amount of USDT minted this month has reached 4 billion US dollars. Currently, there are more than 100 million on-chain wallets holding USDT; USDT has been recognized as a virtual asset by the Abu Dhabi Global Market. At the same time, Tether has also accelerated its expansion on multiple blockchains, including the launch of USDT on the TON chain and the introduction of the Aptos network.

Circle is also accelerating its layout. Recently, Circle announced the launch of the cross-chain transmission protocol CCTP V2, which shortens the settlement time from minutes to seconds. It plans to support Ethereum, Base and Avalanche networks in early 2025, and will expand to more blockchains in the future. At the same time, Circle also announced that USDC will be launched on Aptos and plans to support platforms such as Unichain.

In addition, Ripple's stablecoin RLUSD also announced that it has been approved by the New York Department of Financial Services. The stablecoin will initially only be open to institutions.

These developments indicate that the stablecoin market is developing rapidly, especially the accelerated layout of leading enterprises will undoubtedly promote the penetration and application of this track in the global financial system. In addition, PANews recently reviewed the progress of the European market in the article " The EU has launched a stablecoin war: 21 issuers compete, Circle is the first to land, and Tether supports "agents" ".

The total market value of stablecoins has exceeded the 200 billion US dollar mark, and the ecosystem is becoming more prosperous driven by investment and financing

The stablecoin market has reached a milestone. DeFiLlama data shows that as of December 12, the total market value of stablecoins has reached a record high, exceeding the $200 billion mark. According to asset management company Bitwise, the market size of stablecoins may double to $400 billion next year.

In fact, the role of stablecoins in the global financial system is becoming increasingly prominent, and their application scenarios are becoming more diversified. According to the latest research report by Standard Chartered Bank, stablecoins are gradually evolving from being used only in cryptocurrency exchanges in the early days to becoming an important tool in the global financial field. Especially in emerging markets where traditional cross-border banking is limited, stablecoins provide a fast and reliable solution for transferring digital dollar assets. The survey shows that in countries such as Brazil, Turkey, Nigeria, India and Indonesia, 69% of respondents use stablecoins for currency substitution, 39% for payment of goods and services, and another 39% for cross-border payments.

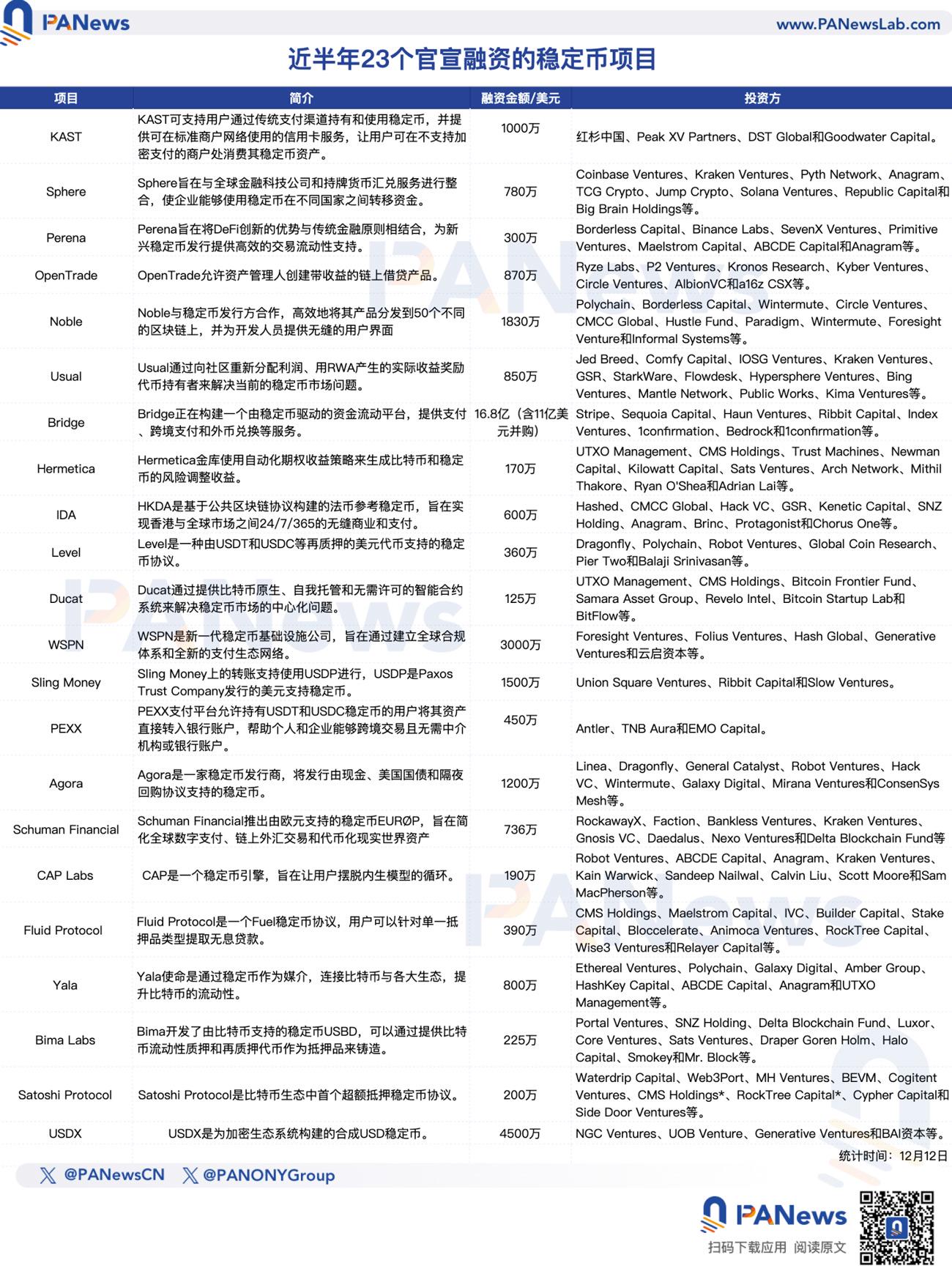

Especially now, with the rise of more innovative stablecoin projects and the increasingly rich ecosystem, the market demand for this tool continues to rise, and the influx of capital also provides more possibilities and imagination for the further development of stablecoins. According to PANews statistics, at least 23 stablecoins announced financing in the second half of this year, and these projects have received a total of more than US$1.86 billion in investment, of which Bridge raised as much as US$1.68 billion, mainly because it was acquired by payment giant Stripe for US$1.1 billion in October this year.

For example, Perena, a Solana stablecoin trading infrastructure project recently announced by Binance Labs, aims to solve the problem of stablecoin ecological fragmentation through its product Numéraire and reduce the capital requirements for the issuance of new stablecoins. Platform users can mint stablecoins through the protocol, obtain tokenized real-world asset returns, and use the layered collateralized debt position system to achieve customized risk-return configuration.

Stablecoin-driven financial platform KAST also announced the completion of a $10 million seed round of financing, led by Peak XV and HongShan, Indian and Chinese investment companies spun off from investment giant Sequoia. It can support users to hold and use stablecoins through traditional payment channels, and provide credit card services that can be used in standard merchant networks, allowing users to spend their stablecoin assets at merchants that cannot support crypto payments.

Sphere, a cross-border stablecoin payment company, has completed a $5 million financing round led by Coinbase Ventures and Kraken Ventures. The agreement enables cross-border payments in stablecoins between enterprises by working with global fintech companies and licensed remittance service providers, and allows stablecoins to be exchanged for local fiat currencies in supported regions.

The continuous advancement of these innovative projects has not only injected new vitality into the development of stablecoins, but also gradually expanded the role of stablecoins in the global financial ecosystem.

At the same time, the regulatory environment for global stablecoins is also gradually improving, and policy trends in various regions provide institutional guarantees for the development of stablecoins. Hong Kong's latest "Stablecoin Bill" will be submitted to the Legislative Council for the first reading on December 18, proposing a regulatory system for issuers of fiat stablecoins, which marks a substantial step forward in stablecoin regulation; the Brazilian central bank is expected to revoke the ban on self-custody of stablecoins, and the regulatory attitude tends to be more open; the EU's upcoming "Markets in Crypto-Assets Regulation Act" (MiCA) is also expected to become an important milestone in global stablecoin regulation, providing more compliance guarantees for the stablecoin market; and the United States's yet-to-be-approved "Payment Stablecoin Clarity Act" can provide licenses to issuers of stablecoins, and Trump's upcoming inauguration is believed to accelerate the introduction of this crypto bill.

In general, with the active layout of leading crypto companies and the continuous influx of capital, stablecoins are opening up more application scenarios to meet the urgent needs of the global financial market for convenient, secure and efficient payment tools, thereby accelerating the stablecoins from the edge of crypto to the mainstream financial market. At the same time, the gradual advancement of policies in various countries has also paved the way for the compliance and standardization of the stablecoin market.