Babylon has raised US$96 million in three years, bringing together a number of top investment institutions such as Binance Lab, Polychain, OKX Ventures, and ABCDE Capital.

Every time the pledge quota is opened, BTC big holders will raise the Gas and rush to buy it, which has preliminarily verified the market's recognition of Babylon.

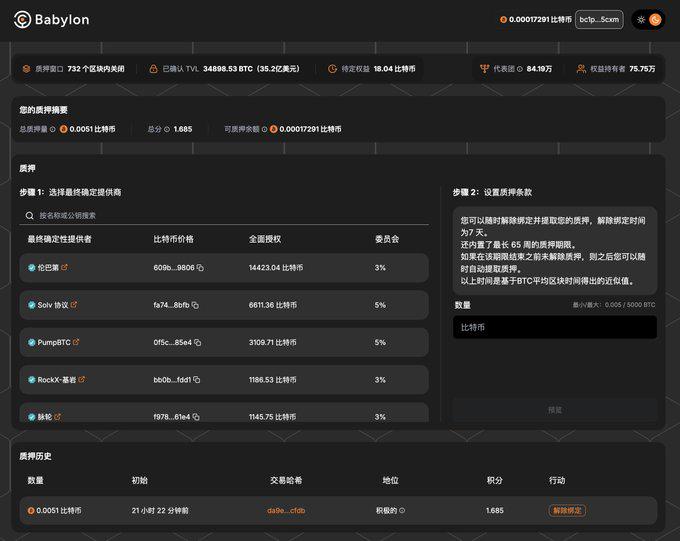

Now, Babylon has opened the third phase of staking, which will last for 1,000 blocks and about a week. The minimum staking amount is 0.005 BTC, which is about $500.

This time, it is clear that ordinary users are given the opportunity to participate, unlike the previous rounds where only institutions and large investors were allowed to rush in first. So this time, we ordinary users cannot miss it. Babylon will definitely be the number one asset in the BTC ecosystem in 2025.

Why do we say that Babylon must be big hairy?

Babylon can be compared with Eigenlayer, but Babylon's ceiling can even exceed Eigenlayer.

Babylon, like Eigenlayer, provides shared security, but Babylon combines Bitcoin's native technology to allow Bitcoin holders to lock Bitcoin in self-custody without a third-party bridge.

Eigenlayer shares the security of Ethereum, while Babylon shares the security of Bitcoin. Ethereum’s market value is currently about one-third of Bitcoin’s market value, so the security that can be released may also be lower than Bitcoin, so the market space is very large.

Babylon's emergence is timely, and it is solving another important proposition: how to turn Bitcoin into an interest-bearing asset?

In traditional financial markets, interest-earning assets account for more than 90% of total assets, so we can see the importance of interest-earning assets to the financial market.

Take Ethereum for example. After Ethereum switched from the PoW mechanism to the PoS mechanism, due to the staking scenario, Ether can obtain staking income, making Ether an interest-bearing asset. This has spawned a series of financial gameplays in the Ethereum ecosystem, including a series of innovative financial products such as liquidity staking, re-staking, and liquidity re-staking, which have attracted more liquidity into this ecosystem and brought a strong wealth effect.

The Bitcoin ecosystem also needs such interest-bearing assets as underlying assets, so that more new ways of playing can emerge and accelerate the vitality of the ecosystem. The Bitcoin ecosystem is like a forgotten ancient continent, which is all uncultivated virgin land, and more potential is waiting to be discovered.

At this time, this ancient continent needs a Tower of Babel to unite the Bitcoin ecosystem and connect it with other ecosystems to shine the miracles and glory of the crypto world.