On December 5, Bitcoin officially broke through the $100,000 mark, marking the beginning of a new wave of cryptocurrencies. Just as the market was boiling, on December 10, Bitcoin suddenly experienced a sharp drop. Within six hours, Bitcoin fell from $100,000 to a minimum of $94,100, a drop of 6%.

At the same time, altcoins excluding Bitcoin and Ethereum (Total 3) faced a more severe decline of up to 14%.

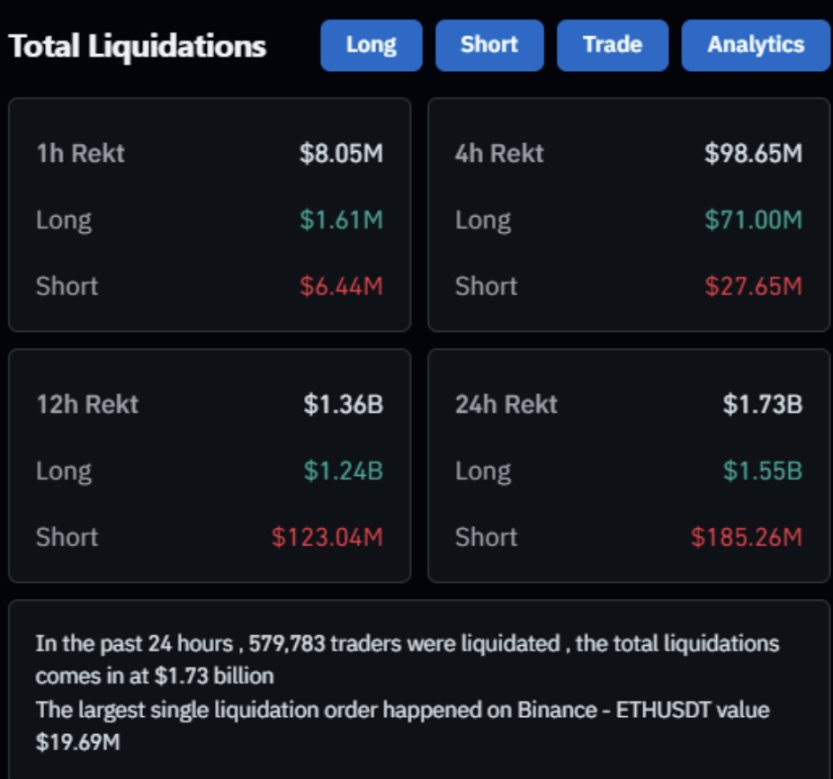

According to Coinglass data, the amount of liquidation in 24 hours was as high as US$1.734 billion, and the number of liquidations was as high as 580,000, far exceeding the scale of 100,000 people liquidated on March 12, 2020 when Bitcoin plummeted 50% on the same day.

This drop was unexpected. Although the price of Bitcoin subsequently rebounded to the level of $97,000, the positions that were forced to close could never be recovered. Is this drop just an ordinary correction? Or has the peak of this round been reached? Let WOO X Research take you to see the reasons behind the plunge and future prospects!

Source: Coinglass

The sentiment in the altcoin market is high, and there is huge leverage

On November 14, WOO X Research published an article predicting that the market cycle was on the eve of the "altcoin outbreak". At that time, Bitcoin's market share was about 61%. In less than a month, this figure had dropped to 55%. The current market cycle is set to be the altcoin outbreak stage.

At the same time, the total market value of Total 3 broke through 1 trillion US dollars, with a one-month increase of 55%.

The sector rotation to the rise of altcoins is not the main reason for the decline, but the overly optimistic sentiment has led to a large amount of leverage in the market.

ETH and SOL, which represent altcoins, have hit record highs in contract holdings, rising in tandem with token prices. This phenomenon can be interpreted as: crypto users do not actually own the currency, and use leverage to go long, and the higher the holdings, the stronger the bullish sentiment.

Before the plunge tonight, ETH's holdings were as high as 27 billion US dollars, compared to 17 billion US dollars a month ago, an increase of nearly 60% in one month. The price increase has not kept up with the huge increase in holdings, and speculative sentiment is strong.

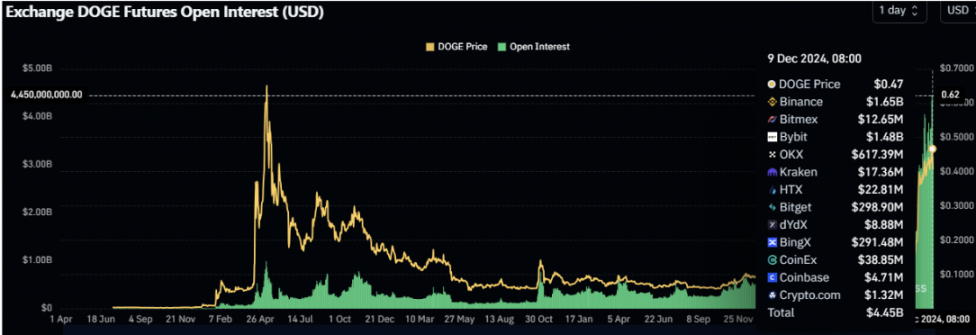

The example of ETH is just a microcosm. The changes in the holdings of most altcoins are more dramatic, such as Doge, Xrp, Pepe, etc. Altcoins can be regarded as "leveraged" Bitcoin. Coupled with the leverage characteristics of contract trading, there is too much leverage in the current market, and the market needs to be cleared before it can move forward.

Source: Coinglass

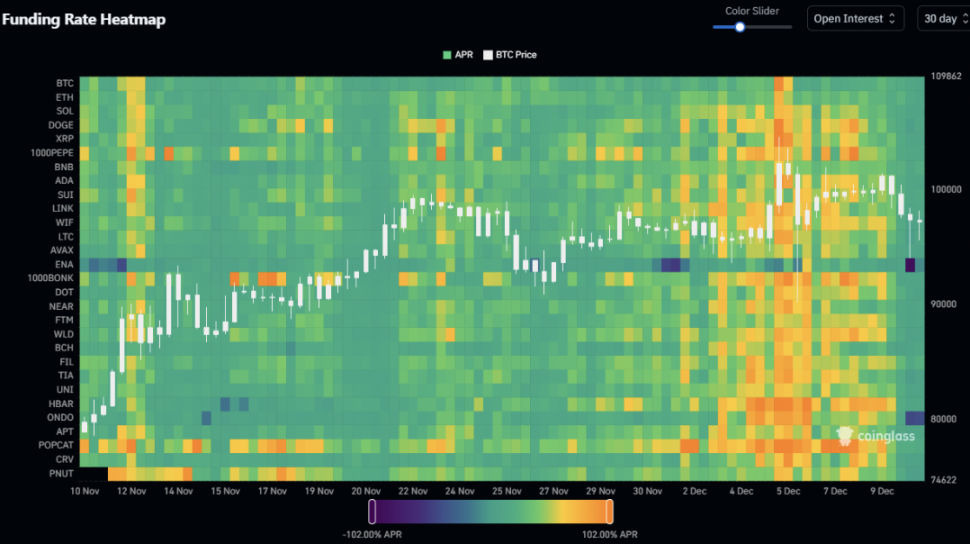

In addition, from the perspective of funding rate, it can also be observed that it was already overheated before the crash.

Reviewing the relationship between Bitcoin trend and altcoin funding rate in the past month, during the process of Bitcoin rising from $70,000 to $100,000, the funding rate of altcoins did not rise significantly, and the annualized interest rate mostly fell in the range of 10% - 30%, with only a few days of inconsistency and sporadic currencies exceeding 100%.

From the figure below, we can observe that after December 4, the altcoin market has seen consecutive days of skyrocketing funding rates for most altcoins, mostly falling in the 60% - 100% range.

The resonant increase in holdings and funding rates once again confirmed that there is a large amount of leverage in the market. The main reason for the decline is also very simple: it is the chain effect of high-leverage liquidation.

Source: Coinglass

External events: Hawkish rhetoric + Christmas holiday

The above mentioned that there is a large amount of leverage in the crypto market. As for the external event, the Federal Reserve recently released hawkish remarks. In this regard, analysts at Macquarie Bank, Australia's largest banking group, pointed out that the recent slowdown in the downward trend of US inflation, the lower-than-expected unemployment rate since September, and the optimistic performance of the US financial market are the main factors driving the Fed to a more hawkish stance.

In addition, the CPI and unemployment data will be released on December 11 and 12, and the Christmas holiday is approaching. Faced with many uncertainties, it is understandable that European and American investors have a need to take profits and hedge risks.

Summary: The bull market is still there, and liquidation is the norm

We are more inclined to believe that this decline is a leverage clearance, and our outlook for the 2025 bull market remains unchanged.

Whenever we talk about the cryptocurrency world, we can’t avoid speculation, and high leverage is the sentiment indicator of this market. Most of the overly high sentiment does not mean that the market can be driven forward, but new funds need to be injected into the market. Back to the essence of the rise in the price of coins, it is the law of supply and demand. It can be observed that the interest of various institutions in both Bitcoin and Ethereum has not decreased, and spot ETFs continue to have net inflows. Among them, Ethereum has had net inflows for 11 consecutive days, and even set a record on November 30, with a single-day net inflow exceeding that of Bitcoin spot ETFs.

In addition, various institutions have applied for ETFs of other currencies, such as SOL, XRP, etc. What is certain is that institutions still have a strong interest in the crypto market. When the supply remains unchanged and the external demand increases, the crypto bull market is expected to continue, whether it is Bitcoin or altcoins.

Source: sosovaule