introduction

We are in an era of crisis and rapid change. The pain of economic transformation and the twists and turns of the globalization process are intertwined, making the Chinese economy face an unprecedentedly complex situation. Insufficient effective demand coexists with oversupply, and geopolitical risks exacerbate asset uncertainty. These challenges have prompted us to re-examine the traditional logic and thinking mode of economic development. At the same time, Trump's return to politics has also made people worry about whether history will repeat itself - will he launch a trade war again and push China into a new round of economic crisis? Compared with 2016, today's international political landscape is more inclined to anti-globalization. From tariff barriers to manufacturing repatriation, the process of globalization is facing major resistance. Against the backdrop of insufficient domestic demand and oversupply, it is difficult for China to digest excess capacity by expanding exports, and the path of external demand expansion is becoming increasingly narrow.

This article will analyze the current economic situation from multiple aspects such as population structure, consumption capacity, interest rate status, economic growth status, and market supply and demand contradictions, combining data, and reveal the deep logic behind the data. At the same time, through reflection on asset allocation, economic policies, and globalization trends, it explores how to break away from inertial thinking in a complex environment and provide new perspectives and ideas for coping with current challenges.

1. Insufficient effective demand

1.1 Deterioration of the population age structure

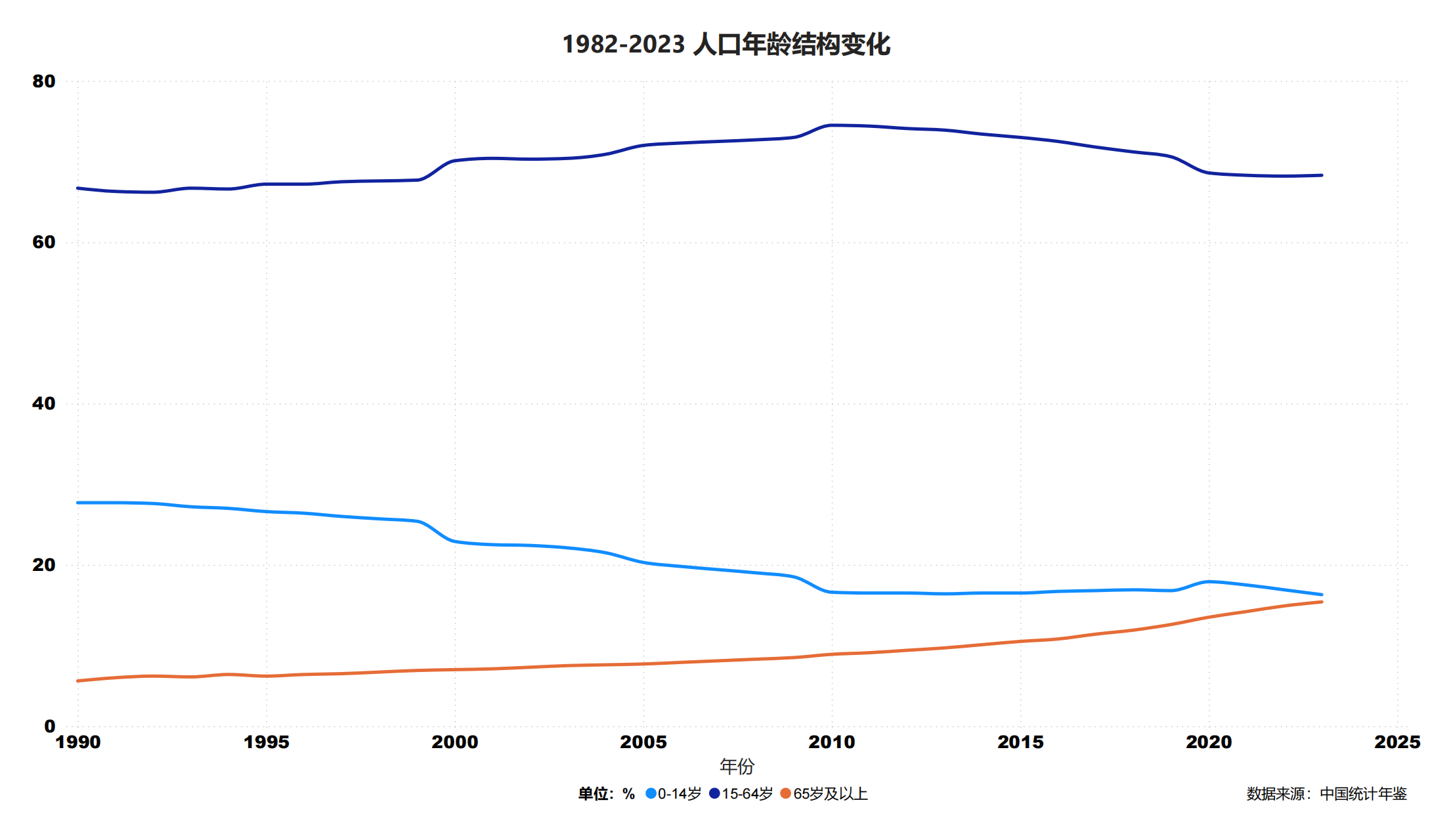

Source: China Statistical Yearbook Figure 1.1

From 1982 to 2023, China's population age structure has changed significantly. The proportion of the population aged 0-14 has gradually decreased from nearly 30% to about 16%, indicating a significant decline in the birth rate and a decreasing proportion of the young population. The proportion of the working-age population aged 15-64 has steadily increased from about 60% to nearly 70% between 1982 and 2010, and then began to gradually decline due to the low birth rate and the intensification of the aging trend. At the same time, the proportion of the elderly population aged 65 and above has climbed from about 5% in 1982 to 15% in 2023, and the aging of the population has become more and more obvious.

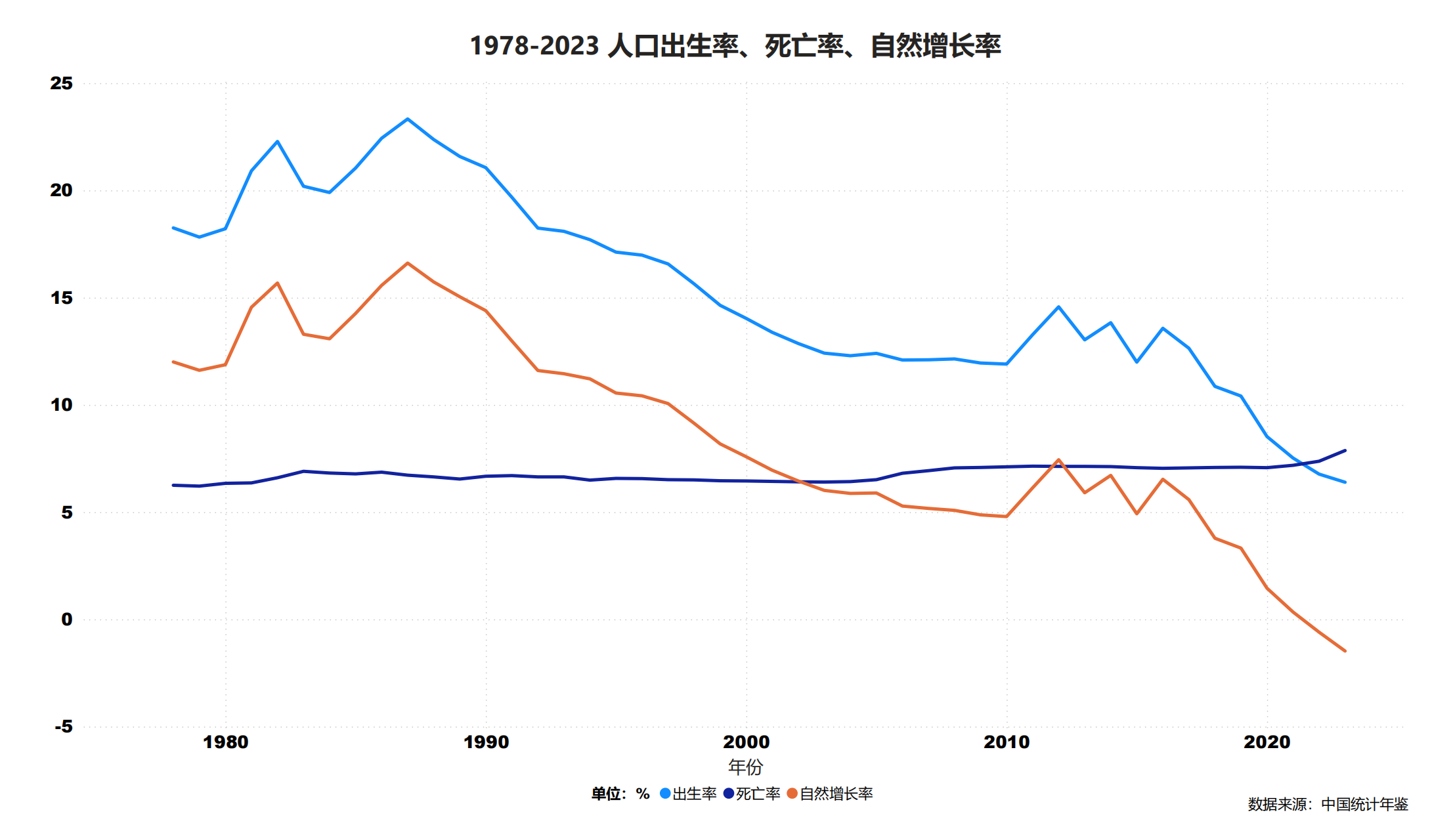

Source: China Statistical Yearbook Figure 1.2

Combining the changing trends of birth rate, death rate and natural growth rate, it can be seen that China's population growth is undergoing a transition from rapid growth to low growth and then to negative growth. The birth rate has dropped from more than 20% in 1978 to less than 10% in 2023, while the death rate has shown a gradual upward trend, from 6.25% in 1978 to nearly 8% in 2023. Affected by these two changes, the natural growth rate has rapidly shrunk from more than 15% to the current negative value.

The aging of China's population and the decrease in the number of young people are important reasons for the lack of effective demand. As the proportion of the elderly population continues to rise, the consumption capacity of the elderly is weakened, the savings tendency increases, and the driving effect on overall consumption is limited; at the same time, the decrease in young labor force, the continuous decline in marriage rate and fertility rate not only weakens the consumption expenditure of young families, but also suppresses the growth of demand for housing, education and other fields, thus inhibiting the overall improvement of social effective demand.

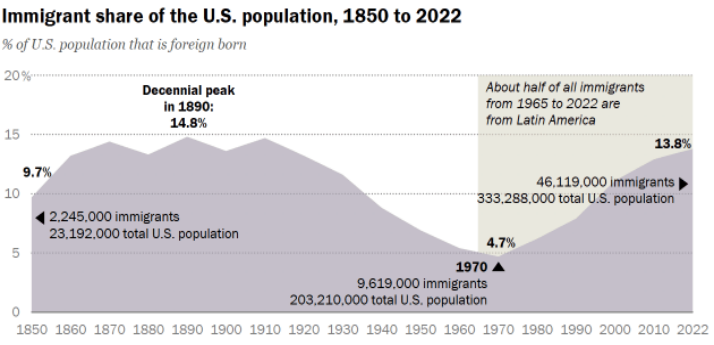

There are significant differences between China's population structure and that of European and American countries. This difference stems from different cultural traditions and development paths. China's population expansion mainly relies on its own fertility growth, while European and American countries rely heavily on immigration for population expansion. This enables European and American countries to alleviate the aging problem to a certain extent through the supplementation of foreign population, while China relies more on its own structural adjustment. Therefore, this different development model has also led to significant differences in the process and response methods of the two countries in the aging of the population.

Source: US Census Bureau Figure 1.3

1.2 The consumption capacity of the middle class is declining rapidly

China's effective demand relies heavily on the leverage of population income, and the middle class is the core force. As the largest and most dynamic group in the consumer market, their consumption capacity directly affects the stability and sustainability of economic development. Why? The rise of China's middle class is an important achievement of reform and opening up, thanks to rapid economic growth, urbanization and significant improvement in income levels. Since 1978, China's GDP has grown at an average annual rate of 9.5%, the urbanization rate has increased from 17.9% to more than 65%, and per capita disposable income has increased by about 138 times, laying the foundation for the formation of the middle class. By 2022, the size of the middle class has reached about 400 million, accounting for nearly 30% of the national population, becoming the main force in the domestic consumer market. Their consumption has upgraded from basic needs to quality needs, promoting the rapid development of industries such as education, health, and tourism, and further releasing consumption potential through the popularization of consumer credit and the Internet economy. The consumption capacity of this group has directly driven China's economic growth and injected lasting vitality into the consumer market.

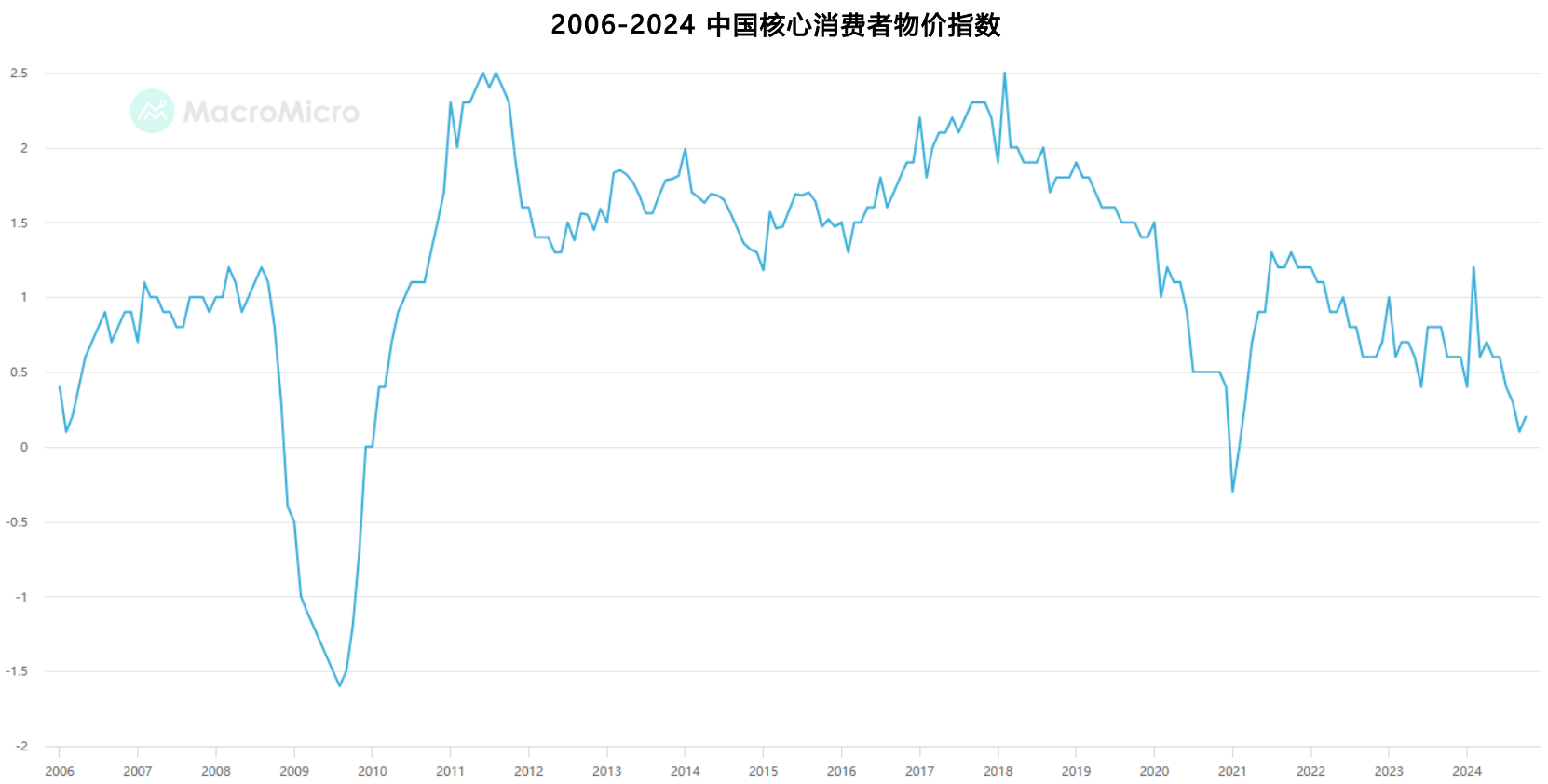

Source:MacroMicro.com Figure 1.4

As can be seen from Figure 1.4, China's core consumer price index (core CPI) has experienced many fluctuations in the past nearly 20 years. The global financial crisis in 2008 and the COVID-19 pandemic in 2019 had a significant impact on the core CPI, resulting in a negative index. This reflects the significant suppression of the consumer market by major economic shocks. However, in the absence of similar macroeconomic risks, the core CPI has shown a continuous downward trend. As of October 2024, the year-on-year growth rate of the core CPI is only 0.2%, close to 0. This trend shows that China's consumption growth momentum is weakening, especially the economic vitality of the middle class as the core force of the consumer market is shrinking significantly. At the same time, the high debt ratio and the weakening of asset appreciation space have further restricted their willingness to consume. This decline in consumption capacity has not only had a direct impact on the activity of the domestic consumer market, but also weakened the momentum of the internal circulation of the economy, thereby exacerbating the problem of insufficient effective demand.

Another point worth noting is that mass media such as TV dramas and movies, as "delayed describers" of social phenomena, have frequently presented visual expressions of the decline in the consumption capacity of the middle class in recent years. For example, in the recently popular "Song of Mortals" and "Reverse Life", there are plots in which senior managers and senior programmers are laid off or even switched to being deliverymen, which is actually a projection of social reality. In real life, such cases are common, even including some extreme events caused by layoffs. The mutual reflection of these plots and social phenomena, widely spread through the media, not only strengthened the public's perception of the economic downturn, but also aggravated the anxiety and insecurity of the middle class. The panic sentiment continued to expand through the communication effect, further prompting the middle class to adopt consumption downgrades to cope with economic pressure. This "forced economic contraction" behavior pattern not only reduced their consumption capacity, but also weakened the effective demand of the society as a whole, bringing more challenges to economic recovery.

2. Oversupply

The problem of oversupply is particularly prominent in the Chinese economy, which is closely related to the characteristics of our country's interventionist economy. Chinese companies are generally policy-oriented. When the state provides policy benefits or conveniences in a certain industry, this industry will usher in a large influx of capital and companies. The first movers to enter the market can often benefit from policy dividends and lower market competition, but as more and more companies join the market, competition gradually intensifies, forming a fierce internal circulation phenomenon.

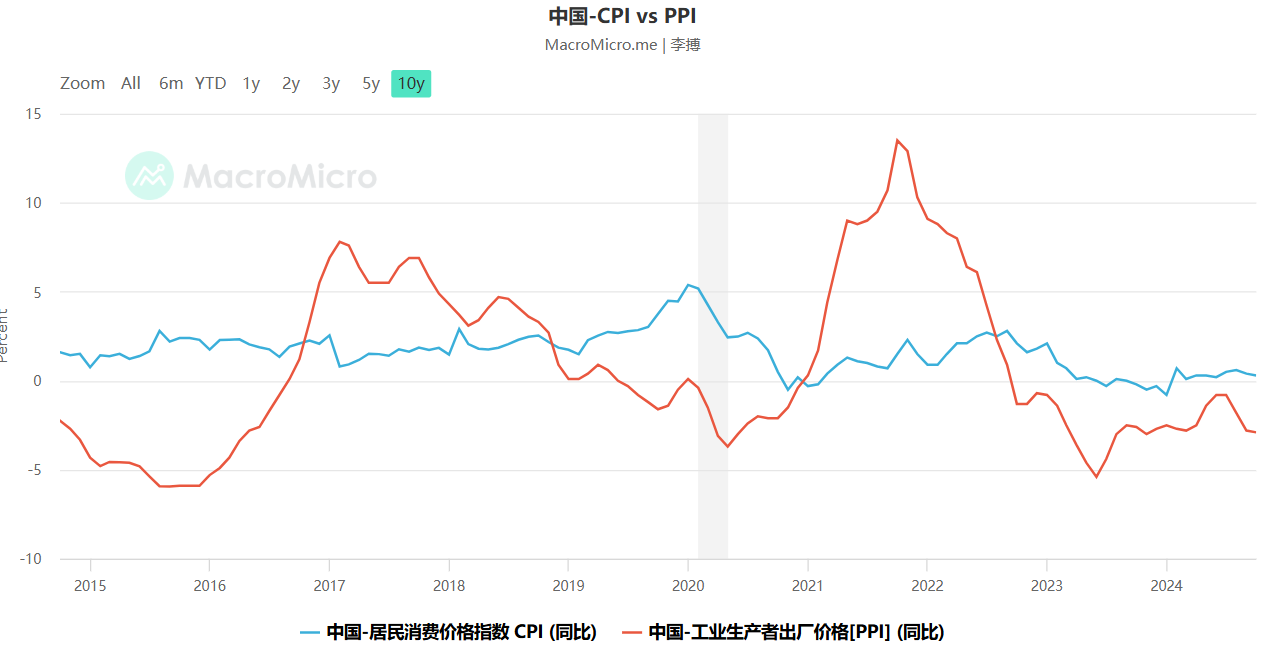

This involutionary market structure means that in order to seize market share, companies have to maintain their competitiveness by reducing prices, expanding production, and reducing costs, which ultimately leads to a significant reduction in the overall industry profit margin. At this point, when market supply far exceeds demand, the industry may reach a critical point and face the risk of systemic collapse. This phenomenon can be intuitively reflected through PPI (Producer Price Index) data. PPI reflects the profit level of enterprises. When PPI is negative, it means that corporate profits are generally declining and even facing losses.

Source:MacroMicro.com| LIBO Figure 2.1

It is worth noting that China's PPI has been in a negative state since the end of 2022. This shows that the overall profit level of enterprises has continued to decline, the price war in the industry has intensified, and the competition is extremely fierce. A large number of enterprises are struggling to survive with low profits or even losses, and only a very small number of enterprises with economies of scale, technological advantages or resource monopolies can survive. The long-term negative PPI not only reflects the severity of oversupply, but also has a profound impact on the stability and healthy development of the economic structure.

3. Current Interest Rate Status

In recent years, China's interest rate level has undergone significant changes. From the interest rate change chart in the past 10 years, it can be seen that the interest rate has shown a continuous downward trend. The government has lowered interest rates to "release money" to stimulate the economy and promote residents' consumption. In traditional cognition, interest rate cuts and low interest rates are usually regarded as "good news", which means more capital flow, lower borrowing costs and stronger consumption capacity. However, whether this logic is applicable in China requires in-depth thinking.

Source: TradingView Figure 3.1

3.1 The main income source affects the perception of interest rates

The perception of interest rates lies in the changes in the source structure of residents' income and the way of social wealth accumulation. Decades ago, when interest rates were high, people did not feel it strongly, because most residents' income came from labor, and the growth of wealth mainly depended on the accumulation of labor remuneration. However, with the development of the economy, the rise of the capital market has changed this situation. In recent years, more and more residents have turned their attention to the capital market, hoping to gain wealth through investment, while the proportion of labor income in total income has gradually decreased.

In sharp contrast is the United States. In the United States, a large part of residents' income comes from capital market returns, such as investment returns from stocks, funds, and retirement accounts. Due to this income structure, low interest rates are obviously beneficial to American residents. Low interest rates mean lower corporate financing costs and higher capital market returns, which in turn drives stock market prosperity. For American residents who rely on the capital market to gain wealth, low interest rates can not only increase investment returns, but also further stimulate consumption willingness, forming a positive "wealth effect."

In China, residents' consumption and investment behaviors are often affected by the negative "wealth effect". The root of this wealth effect lies in the huge attractiveness of the real estate market and the capital market. Most people enter the capital market or buy real estate not because the growth of labor income brings more investment capacity, but to quickly accumulate wealth through asset appreciation or speculation. In other words, the driving force of Chinese residents' investment comes more from the expectation of wealth appreciation rather than the investment capacity naturally generated by income growth. This phenomenon also reflects the irrationality of residents' asset allocation.

3.2 Capital Markets Did Not Meet Expectations

Source: TradingView Figure 3.2

Moreover, since the global financial crisis in 2008, the Shanghai Composite Index has experienced several fluctuations and small surges, but it is still in a long-term consolidation state. As of now, the level of the Shanghai Composite Index is almost the same as in 2009, which means that the returns of the capital market in the past decade are almost negligible. The policy goal of low interest rates has not reflected positive effects in the capital market, but has exposed the problem of inefficient allocation of capital flows within the market.

The key point is that if the increase in consumption level is not based on the increase in labor income, but relies on the volatile growth of the capital market, it will form a kind of "false prosperity". This kind of prosperity is not only unsustainable, but may also plant risks for the economy. When the driving force of consumption growth comes from the expansion of residents' debts rather than the increase in actual income, it will eventually lead to the economy falling into the dilemma of weak consumption, debt inflation and stagnant growth.

Therefore, the meaning of interest rates needs to return to its essence. If the rise in interest rates (interest rate hikes) is due to the overheating of consumption levels caused by the increase in labor income, then this is a healthy economic signal, representing the stability of economic development momentum. However, if the fall in interest rates is due to the bubble in the capital market, which leads to an artificially high consumption level, then it is extremely dangerous.

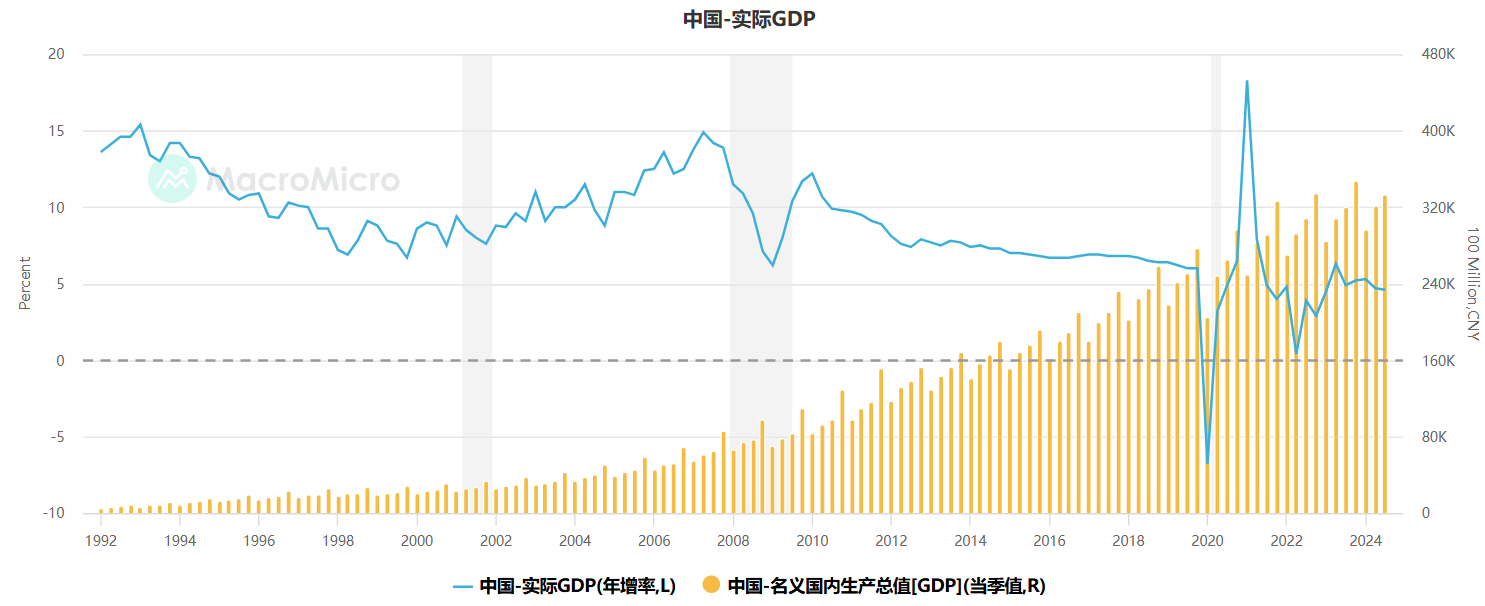

IV. Current Economic Growth

In recent years, China's GDP annual growth rate chart shows that, except for the short-term impact of the epidemic in 2019, China's economic growth rate has remained positive. This shows that our economy is generally growing. However, although the data shows that the economy is growing, the actual feelings of the general public are completely different. Many people feel the pressure of a sharp economic contraction. The phenomenon of "data and physical feelings are out of touch" deserves our in-depth thinking.

Source:MacroMicro.com Figure 4.1

Although GDP data continues to grow, the distribution of benefits from this growth shows a distinct "top-down" feature, benefiting more industries and assets where capital is controlled by the wealthy class. The pressure of economic contraction, however, is gradually transmitted to the lower-income people in a "bottom-up" manner. From real estate to capital market returns, most of the benefits of growth are concentrated in the upper income class. However, when economic growth slows down, the lower-income people are often the first to feel the impact of reduced income, employment pressure and reduced consumption capacity.

This "top-down" growth logic has led to an uneven distribution of social wealth. When the economy grows, the rise in asset prices benefits the rich more, and they get rich returns by investing in capital market assets such as real estate and stocks. The income of the lower-class people depends more on labor remuneration. When the economy shrinks, the reduction in labor income directly affects their living standards. For example, the real estate boom in the past few years has allowed the rich to accumulate a lot of wealth through real estate appreciation, but high housing prices have limited the ability of many ordinary residents to buy houses, and even require them to bear heavy debts.

Compared with the "top-down" growth, the impact of economic contraction is more likely to spread in the form of "bottom-up". From ordinary workers to small and medium-sized business owners, the grassroots people are often the first to feel the pressure of declining income and weakened consumption power. Over time, this contraction will gradually spread to the middle class and the rich, affecting the vitality of the entire economic system.

V. “Main Issues”

Behind economic growth, the middle class has always been responsible for the bulk of demand. However, with the dual pressures of negative population growth and excess leverage, the effective demand of the middle class is shrinking, which directly weakens their ability to support economic growth. On the one hand, negative population growth means a reduction in the new generation of consumers, which makes economic growth that relies on consumption face a natural demand gap. On the other hand, the high leverage and high debt levels formed over the past years have further limited the consumption space of the middle class, forcing them to cut spending and prioritize debt repayment.

In this case, the middle class cannot provide sufficient demand support for a new round of economic growth, and the supply generated by this round of growth cannot find enough consumers to digest it. This imbalance between supply and demand not only makes economic growth lose momentum, but also leads to a decline in the income of supply-side companies and increases the risk of bad debts. When corporate profits are not enough to cover debts, systemic financial risks may emerge. It can be said that the contraction of middle-class demand is becoming the most critical breakpoint in the economic cycle. If this problem cannot be effectively solved, it will lay a deep hidden danger for future economic growth.

6. Thinking: Break away from inertial thinking

Against the backdrop of drastic changes in the current global economic environment, we need to break away from inertial thinking and find new paths that adapt to future development.

1. “Making cakes” turns into “sharing cakes”

In the past, we focused on how to "make the pie bigger" and drive the expansion of the overall economy through the continuous rise of GDP. However, the dividends of growth have not been distributed fairly, resulting in the widening gap between the rich and the poor and the increasingly serious problem of insufficient consumption capacity of residents. Therefore, the focus in the future should shift to "dividing the pie". This requires not only redistribution in the form of tax adjustment and welfare transfer through government policies, but also solving the imbalance between residents' incomes and promoting the tilt of wealth from capital-intensive areas to labor-intensive areas. At the same time, it is necessary to reasonably adjust the debt and leverage levels to achieve resource reallocation between individuals and enterprises and between regions.

Many people may think that the capital market is essentially a redistribution of resources. However, the characteristics of the capital market determine that it cannot completely achieve fair redistribution. The capital market is at risk of being manipulated, and those experienced and well-funded investors are more likely to dominate the market, while young people, retail investors and less experienced investors are often at a disadvantage. In other words, in the process of resource redistribution, the capital market is more of a "splitting" of wealth rather than a "distribution". It actually forms a mechanism of "circular harvesting" of wealth, and capital tends to flow back from the young and inexperienced to those who already occupy an advantageous position.

Therefore, real resource redistribution should be achieved through more systematic and inclusive policy measures, rather than simply relying on the natural operation of the capital market. This will not only help narrow the gap between the rich and the poor, but also enhance the overall consumption capacity and economic vitality of society.

2. The ability to maximize the transfer of existing supply into effective demand

In the future, whether it is a company or an individual, their core ability lies in how to maximize the conversion of existing supply into effective demand. The current problem of oversupply is obvious, and how to activate market demand will be the key. Companies need to find a breakthrough in demand through innovative ways, such as through marketing models such as "MCN" or "personal IP" to further explore and attract potential consumers.

The entertainment industry plays an important role in this process. As a "painkiller" for ordinary people, it can provide emotional comfort and entertainment for the public under economic pressure. Therefore, the market demand in this field will continue to exist and become an important direction for companies to tap consumption potential.

3. Carry trading

Earn money in inflationary places and spend money in deflationary places. Carry trading is a new way to deal with changes in the global economic environment. In a globalized economy, inflation and deflation in different regions may be very different, and this difference provides new opportunities for individuals and businesses.

For example, the US capital market (such as US stocks and cryptocurrencies) has shown strong profit potential in an inflationary environment, especially as Trump may return to politics and the US is expected to start a new round of inflationary policies. This inflationary policy will further promote the prosperity of the capital market, and cryptocurrencies, as the "reservoir" of the capital market, have begun to operate in this environment, providing opportunities for investors. In addition, combined with the view of seeking overseas markets, cross-border e-commerce and other fields can also take advantage of the opportunities brought by the inflationary market and achieve profits by meeting global demand.

On the other hand, spending money in deflationary places means acquiring more resources or assets at a lower cost, such as the domestic consumer market and the depressed real estate market. In a deflationary environment, consumers can meet more needs with relatively less spending, thereby improving their quality of life. This "cross-market thinking" can help individuals and companies find a better path of action in global economic fluctuations.

4. Forward-looking investment

The profit margins of mature markets and industries are becoming increasingly narrow, and future wealth growth needs to focus on areas that are not yet mature. As the domestic real estate market becomes saturated and prices may fall, seeking overseas permanent property assets will become an option after satisfying the basic needs of living. For example, Singapore real estate, European forest resources, etc.

We also have to take into account the current turbulent international situation, the increasing risk of war and geopolitical conflict, which makes the issue of asset ownership particularly sensitive. In the case of national confrontation, it is difficult to ensure the stability of ownership of traditional assets (such as real estate, bank deposits, and even some gold reserves). In this case, the value of Bitcoin (BTC) becomes increasingly apparent. As a decentralized digital asset, Bitcoin does not rely on any country or institution, and its ownership is completely in the hands of individuals and will not be deprived or frozen due to geography, policy or war.

Source: TradingView Figure 6.1

The rise of Bitcoin in the market is also verified by the BTC/GOLD ratio chart. In the past few years, this ratio has grown rapidly, indicating that Bitcoin has gradually been endowed with similar safe-haven properties as gold, and even surpassed gold in some scenarios. As a traditional value-preserving asset, gold's physical properties determine that its liquidity and security are still restricted by geographical and political factors. Bitcoin's digital characteristics make it superior to gold in terms of circulation efficiency and security, so it is regarded as "digital gold" by more and more investors.

This trend not only reflects the market's recognition of Bitcoin, but also further strengthens the recognition of its value. Against the backdrop of increasing uncertainty in global assets, Bitcoin, as an asset that cannot be seized, exists permanently, and forms a global consensus, is providing people with a new way to hedge and store wealth.

5. Three elements of asset allocation

In asset allocation, valuation, return rate and volatility are the three key factors to measure investment choices. However, it is almost impossible for "high valuation, high return rate and low volatility" to exist at the same time in an ideal state. The market usually achieves balance by "killing valuation", "killing volatility" or "killing return rate". This dynamic adjustment also reveals the nature of risk in asset allocation.

“ The dynamic balance of the three elements: you can’t have the best of all ”

Conflict between high valuation and low volatility: When asset valuation is too high and volatility is low, it is easy to attract a large amount of capital inflow, especially in a low interest rate environment, and leverage to amplify returns becomes the mainstream of the market. However, this state is often fragile, and once market sentiment reverses or the external environment changes, a rapid "volatility reduction" may occur.

Conflict between high returns and low volatility: High-return assets are usually accompanied by high risks, and their characteristics are drastic price fluctuations. For investors seeking stability, such assets are difficult to provide sustained appeal.

Conflict between low volatility and high valuation: Low volatility usually means strong market confidence, but overly high valuations will make assets unattractive. The market may rebalance risks and returns by "killing valuations".

The U.S. stock market has long attracted global investors with its stable returns and relatively low volatility. However, this low volatility environment also encourages excessive leverage. In order to magnify returns, investors generally increase their exposure to low-volatility assets through financing or derivatives. For example, NVIDIA, as a star stock in the AI wave, once attracted a lot of funds with its high valuation and low volatility. However, NVIDIA experienced a flash crash. On September 3, NVIDIA fell 9.53%, the largest single-day drop since late April, and its total market value evaporated by US$278.9 billion (about RMB 1.99 trillion) in a single day, setting a new record for U.S. stocks.

This phenomenon shows that when an asset has the characteristics of high valuation and low volatility, the market is prone to extreme behavior. Once too much leverage accumulates, a slight market fluctuation will trigger a chain reaction, leading to a sharp correction or flash crash. This dynamic adjustment mechanism is not an isolated case, but the inherent logic of the modern capital market. In summary, the dynamic balance of valuation, return rate and volatility is the core logic of market operation. Investors need to realize that it is impossible to enjoy the ideal state of high valuation, high return rate and low volatility at the same time. Understanding the market's mechanism of rebalancing through "killing valuation", "killing volatility" or "killing return rate" is an important prerequisite for optimizing asset allocation and avoiding risks.

VII. Conclusion

With the tide of deglobalization and a complex economic environment, the challenges facing the Chinese economy are becoming increasingly severe. From changes in the demographic structure to the decline in consumption capacity, from the contradictions in the current interest rate situation to the imbalance in economic growth, to the mismatch between supply and demand, all signs indicate that we are in a critical period that requires deep reflection and adjustment.

The dual dilemma of insufficient effective demand and oversupply reveals the deep-seated contradictions in the current economic operation. The aging population and the weakening consumption power of the middle class have further weakened the vitality of the internal circulation of the economy; and the intensified competition and declining profits of enterprises under policy guidance have put the supply side into a dilemma. In this context, it is difficult to fundamentally solve the problem by relying solely on traditional economic stimulus measures. We need to re-examine the logic of growth, the mechanism of wealth distribution, and the opportunities and challenges of globalization.

This article proposes a way of thinking that breaks away from inertial thinking and focuses on the deep logic and future direction of the economy. From the rational redistribution of resources to the maximization of the existing supply, from asset allocation from a global perspective to forward-looking investment, we try to provide a broader approach for the Chinese economy. In this process, the choices of individuals and enterprises, the adjustment and implementation of policies, and changes in the international environment are all key variables.

The trend of deglobalization cannot be ignored, but it also brings us an opportunity to reposition and adjust. Whether it is to redefine the meaning of growth or to find a new balance for asset allocation, we need to meet the challenge with a more flexible and pragmatic attitude. To get through the fog, we need not only a clear understanding of the current situation, but also bold imagination and decisive action for the future. This may be the most powerful response we can find in the current complex situation.

Disclaimer: Please strictly abide by the laws and regulations of your location. This article does not represent any investment advice.