Narrative

RWA (Real World Assets) literally means real-world assets. Its value lies in building a bridge between traditional assets and the Web 3 world to realize the digital presentation of real assets, which can effectively utilize or dispatch real assets (such as real estate, artworks, etc.) and improve the liquidity of assets. And with the combination of RWA and blockchain technology, RWA can transcend geographical restrictions. Regardless of geographical location, monetary system or other influencing factors, through the combination of the two, users can easily complete transactions or other use of assets. When it comes to RWA, people often think of real estate, stocks, etc., and from the basic characteristics of RWA tokenization, stablecoins are also products in the RWA track. It seems that RWA is closer to us. This is also another level of narrative of RWA, namely "inclusiveness", which can enable investors who do not have enough capital to enter high-value markets to invest in high-value markets in disguised form by investing in corresponding high-value RWA tokenized products.

What does the future hold?

In the past year, the overall TVL of RWA has fluctuated upward. In this cycle, RWA, AI, MEME, etc. are all relatively popular tracks. RWA has always been one of the more popular tracks.

Image source: https://defillama.com/protocols/RWA

In the future, RWA is likely to continue its trend, and the combination of RWA and DeFi may attract more and more investors. In fact, similar high-value assets such as real estate and commodities face settlement difficulties in transactions, and the relevant laws and regulations of each country are also different. It is very likely that projects related to this type of high-value assets will be constrained by implementation and supervision. Therefore, if this type of project in the RWA track wants to achieve better development, before that, there must be greater progress in PayFi or cross-border settlement supervision and RWA asset certification, rather than entrusting third parties from all over the country to help with liquidation or certification. In addition, the RWA project on stablecoins is relatively stable. Basically, the mainstream market may still be dominated by the US dollar, followed by the euro. However, in the future, this type of project may be divided into countries/regions, that is, "investors in a certain country/region basically choose a certain type of stablecoin." And in this case, stablecoins that have obtained local regulatory licenses can take the lead in the market. The last one, which should be a relatively large trend in the future, is that the anchor value of stablecoins is bonds, securities, stocks or funds and other assets. More products and projects may appear in the future. The reason is that the settlement and supervision mentioned above have better advantages than assets such as real estate. However, in the early future, only related projects with institutions that have a certain voice in the traditional financial world (such as BlackRock) may have a considerable wave of economic benefits. After that, some projects with the participation of institutions/organizations with a certain voice in the web 3 world may have more community cultural characteristics.

project

Below is an overview of the projects that have received recent financing, which is only used for discussion from an objective perspective.

OpenTrade

OpenTrade was founded at the end of 2022 and is headquartered in London, UK. Its investors include a16z CSX, Circle, Draper Dragon, CMCC Global, Ryze Labs, Polygon and Kronos Ventures. The total financing amount has reached US$8.7 million.

Four products are currently available:

- U.S. Treasury Vaults: Regular; fixed-term, fixed-rate USDC returns, secured by U.S. Treasury bonds;

- USDC Vault: USDC with a variable yield. Backed by short-term U.S. Treasury bills, money market funds, and other cash equivalents;

- EURC Vault: Demand; variable-yield EURC, backed by euros and short-term eurobonds, money market funds and other cash equivalents;

- Rate+ Vault: Regular; secured by investment-grade corporate bonds, commercial paper, emerging market bonds, etc.

Use Vault tokens as indicators in operations such as accounting.

USUAL - Government Bonds

It has currently raised a total of US$8.5 million and is Binance’s Launchpool project.

Overall, it revolves around three types of tokens:

- USD0: This is a permissionless and fully compliant stablecoin backed 1:1 by real-world assets (RWA), an aggregation of various US Treasury tokens.

- USD0++: It is an enhanced treasury bond that uses USD0 to lock the principal as collateral and USUAL as an incentive.

- USUAL is its governance token.

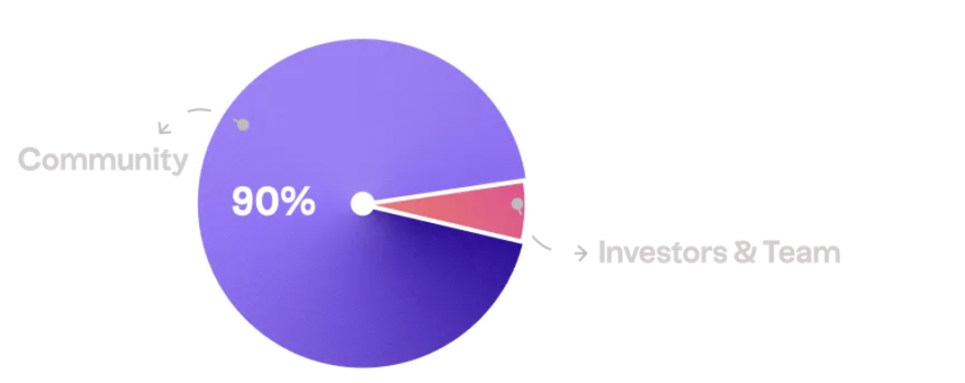

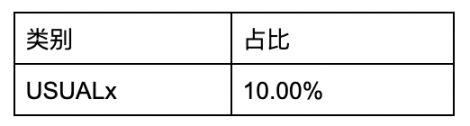

Token economics: total amount is 4 billion, with initial circulation accounting for 12.37%.

Image source: https://docs.usual.money/usual-products/usual-governance-token/usual-tokenomics/distribution-model

The token distribution is as follows:

Huma Finance

The total financing is currently $46.3 million, and the co-founder is Chinese. In general, it is a PayFi lending project. The latest round of financing includes $10 million in equity investment and $28 million in physical assets investment in the Huma platform. Distributed Global led the investment, with Hashkey Capital, Folius Ventures, Stellar Development Foundation and others participating. It will merge with Arf on April 17, 2024, focusing on PayFi related to the tokenization of real-world assets.

Use Huma Points to track contributors to the protocol. Currently provides cross-border payment financing and digital asset-backed credit cards. This is done through some funding pools, such as Arf-Cross-border Payment Financing Pool (based on USDC instant settlement, simplifying cross-border payments); Rain Accounts Receivable Pool (helps entities such as DAOs manage expenses through payroll cards); Jia Pioneer Fund Pool (provides decentralized financing for small businesses, rewards borrowers who repay with ownership. That is, "small business credit") and other funding pools to help achieve cross-border payment financing.