Written by Sonic Labs

Compiled by: Yangz, Techub News

Translator's note: The L2 track is bustling, while the L1 track is deserted. It has been a year since the Fantom Foundation announced the Sonic upgrade plan in October last year. Last week, Sonic Labs released Litepaper , which systematically presented the L1 blueprint of "DeFi King" Andre Cronje. At present, there are only about two months left before the expected launch of the Sonic mainnet. By then, can Sonic become the new generation of L1 and verify AC's previous sharp comment that "L2 as an application chain is illogical for developers"? Let us wait and see!

The following is a compilation of the full text from Sonic Litepaper.

summary

In the ever-evolving blockchain ecosystem, what can truly make a network stand out? For Sonic, we believe the key is to provide unique products and features that enable developers to build applications more competitively than developers on any other chain. Our focus is to provide tangible value to developers, increase their earnings, give them control over network fee pricing, and simplify user payment methods, all of which can be completed in seconds.

Many existing platforms do not adequately address developer-centric needs. Ethereum focuses on scalability through optimistic and zero-knowledge Rollups, and L2 currently has a TVL of over $34 billion . This shift to L2 solutions has inadvertently emphasized capturing value through centralized sorter fees rather than promoting high-quality application development. The incentive structure designed to increase valuations and fees through Rollup deployment has made L2 too commoditized and prioritized sorter revenue over security and decentralization. This trend has created an imbalance where sorters benefit too much while developers remain undercompensated. As a result, the adoption of innovative consumer applications has stagnated, limiting their potential to have a significant impact on the market.

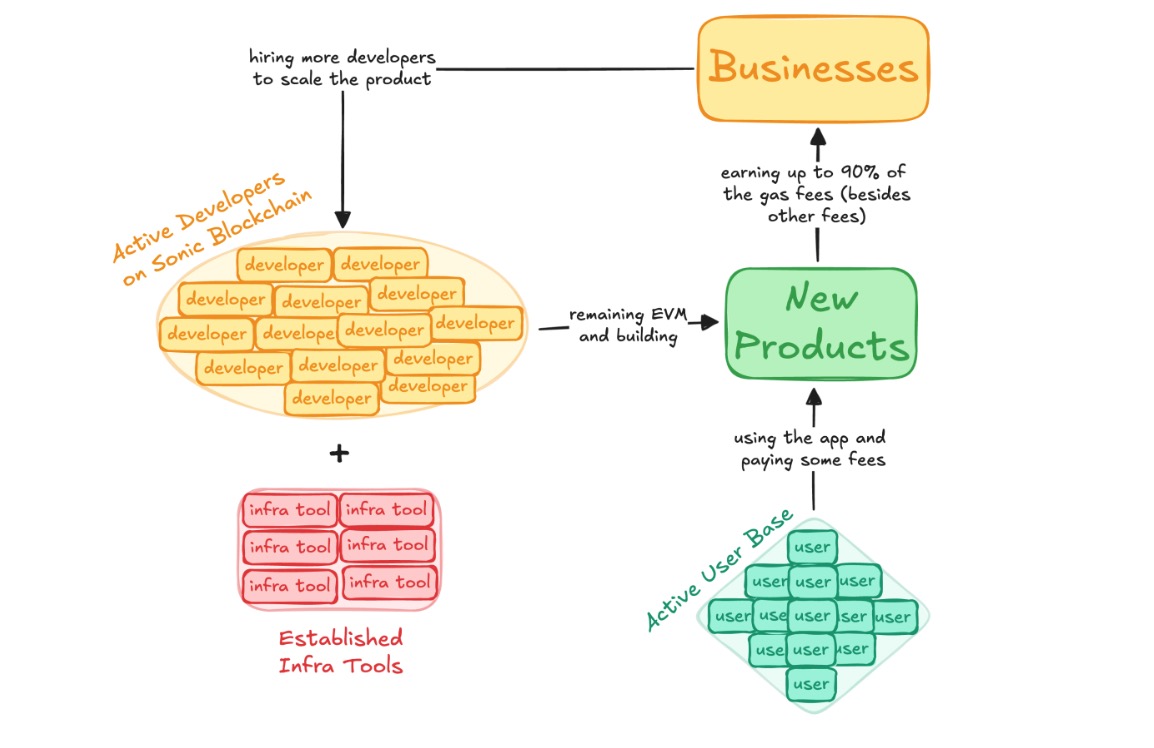

Sonic was launched in recognition of these challenges and is an L1 that aims to redefine the developer incentive model. Sonic's fee monetization program allows developers to earn up to 90% of the fees generated by their applications. Through features such as dynamic charging, fee subsidies, and native account abstraction, Sonic will provide flexible tools to improve user experience and promote adoption.

Traditional L1 is currently facing the dilemma of development or obsolescence, and Sonic is leading the transformation by providing unprecedented scalability, decentralization, and near-instant speed. Sonic combines the advantages of L1 and L2, providing 10,000 transactions per second, sub-second finality, and native decentralized cross-chain bridges connecting Ethereum and other enhanced liquidity and security.

By combining cutting-edge technology with a revolutionary developer-centric model, Sonic aims to redefine the blockchain industry, reinvigorate the focus on productive consumer-facing applications, and empower builders to create profitable on-chain businesses.

Business case and initial objectives

As a decentralized L1, Sonic primarily provides distributed computing power supported by fees. The current perverse incentive structure in the industry has led to the marginalization of basic productive applications and network revenue, and a shift towards short-term parasitic and extractive monetization, resulting in a decline in growth and momentum. Our measure of success is derived from a simple calculation, which is to check whether the network revenue is higher than the total cost of incentivizing validators.

We create demand for these transactions by enabling developers and businesses to build consumer or B2B applications that need to be written to the network and charge fees. Sonic's goal is to drive demand, utilizing the maximum volume of transactions that the network can efficiently provide without causing disruption, while charging enough fees per transaction to cover the costs of the network.

Sonic can easily handle up to 900 million transactions per day with sub-second TTF. This supply capacity far exceeds current demand. Currently, all L2s combined process about 12 million transactions per day, with peaks of about 17 million transactions. In addition, Solana recently peaked at 40 million transactions per day. Even adding these peaks together, the total transaction volume per day is only about 57 million transactions, which is only a fraction of our threshold.

With abundant block space and transaction capacity, our focus shifts to scaling demand. To enable more demand on one network than the industry as a whole currently handles requires bold moves such as:

Fee Monetization (FeeM), rewards builders with up to 90% of app fees

Sonic Gateway, allowing users and builders to access Ethereum’s liquidity through a secure native cross-chain bridge.

Organizing one of the largest airdrops in history, kickstarting a flywheel effect for the network with new users and new protocols.

Dynamic charging functionality allows developers to customize the gas cost of interacting with their contracts, promoting the creator economy on the chain.

The Innovator Fund allocates up to 200 million S tokens from the Sonic Labs treasury to acquire infrastructure and strategic partners to promote the long-term development of the network.

Sonic & Sodas, which drives the community to host developer-focused meetups around the world funded by Sonic Labs.

All of this will be done while deploying AAA infrastructure partners including Chainlink, Pyth, Dune, Alchemy, Safe, and more.

Incentive Mechanism

Peter Thiel invested heavily in user acquisition in the early days of PayPal, paying $10 to every user who signed up and referred a friend. Similarly, the Sonic Labs treasury will provide funding of up to 200 million S tokens for projects such as the Innovator Program to accelerate the immediate adoption of Sonic ecosystem applications and support new innovative businesses. In addition, the airdrop of 190.5 million S tokens will provide Sonic developers with the opportunity to attract more users by incentivizing the use of applications. In addition, Sonic is also rapidly simplifying its Liquid Staking Token (LST) market to provide more flexibility for dedicated token holders.

Currently, there is a group of mature developers ready to migrate from Fantom Opera to Sonic, but millions of users and thousands of developers are still needed to achieve the goal.

Sonic Labs Innovator Fund

The Sonic Labs Innovator Fund is funded directly from the Sonic Labs treasury and consists of up to 200 million S Tokens. This funding is currently being used to ensure Sonic integrates with top infrastructure, ensuring builders have access to the best tools in today's challenging market.

Sonic is currently actively working with dozens of applications and top infrastructure providers in the industry, including on-chain tools, compliance, native assets, real-world assets, cross-chain bridge integration, custody solutions, institutional adoption, exchange-traded products, wallets, Subgraph, strategic Web2 partnerships, etc. So far, public security infrastructure integrations include Chainlink, Dune, Safe, Pyth, Alchemy, Redstone, Tenderly, etc.

Airdrop Program

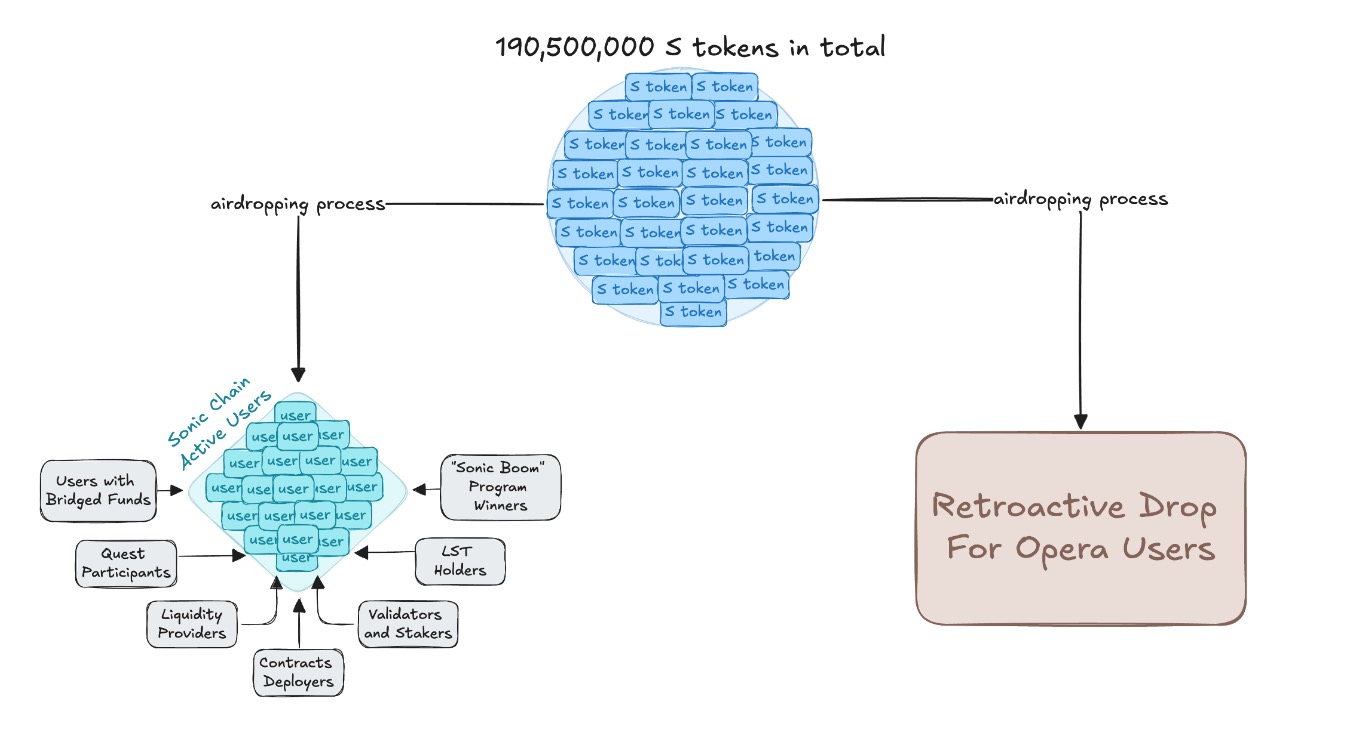

We plan to airdrop 190.5 million S tokens to incentivize user and developer activity on Opera and the new Sonic Chain.

The first major component of the airdrop program is Sonic Boom, which will distribute Sonic Gems (points for the airdrop program) to up to 30 winning projects as bonuses for developing various innovative applications. The program helps create a DeFi ecosystem on Sonic and start the adoption flywheel. Projects can distribute these points to users as rewards for using their applications, helping them maintain user activity by incentivizing use.

Sonic's goal is to identify promising teams and provide them with the tools they need to create successful applications in DeFi, Gaming, AI, etc. The airdrop is focused on getting the developer community to a critical mass so that we can continue to support their growth as they scale their business.

Airdrop Design

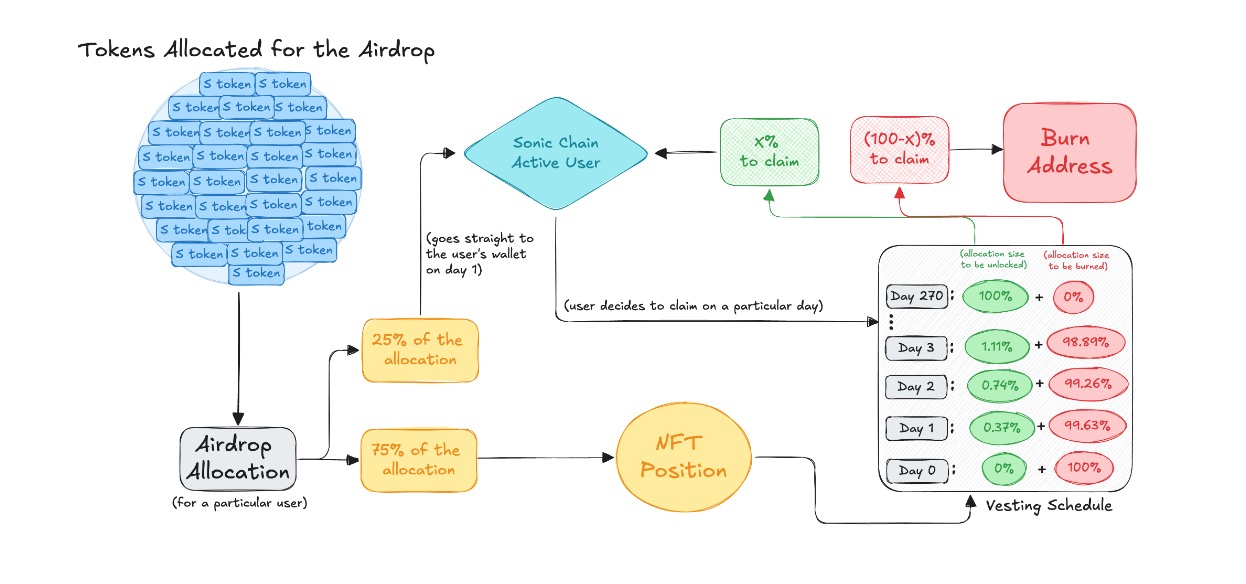

Sonic uses a deflationary airdrop system, and through a unique linear decay mechanism, introduces game theory to solve the challenging problem of the incentive mechanism for airdrops on active chains. Specifically, this type of airdrop needs to minimize the sudden dislocation of circulating supply in a short period of time, and linear decay and destruction can solve this problem.

Specifically, the destruction mechanism encourages airdrop recipients to increase on-chain activity while waiting for the preferred exit destruction. Recipients can either wait for the full unlocking of the airdrop position or redeem it in advance (but there will be a certain loss). For those who do not choose the above two options, their airdrops will be allocated to speculative buyers.

On the first day of the airdrop, 25% of the airdrop received by users will be liquid, while the remaining 75% will be vested as ERC-1155 NFT positions within 9 months (270 days). Sonic users can claim this 25% allocation immediately and have the flexibility to decide when to claim the final allocation according to the corresponding consumption rate.

Users who choose to hold NFTs but wish to trade them on the secondary market are free to do so, which will create a speculative market for individual users’ airdrop allocations while also creating deflationary pressure on airdrops. The following chart illustrates the number of S tokens that will be confiscated by the destruction mechanism if a user files a claim before the 270-day unlock period.

Fee Monetization

Sonic’s Fee Monetization Program (formerly known as Gas Monetization) will provide developers with up to 90% of the fees generated by their applications, providing them with sustainable income, thereby retaining great creators and supporting network infrastructure.

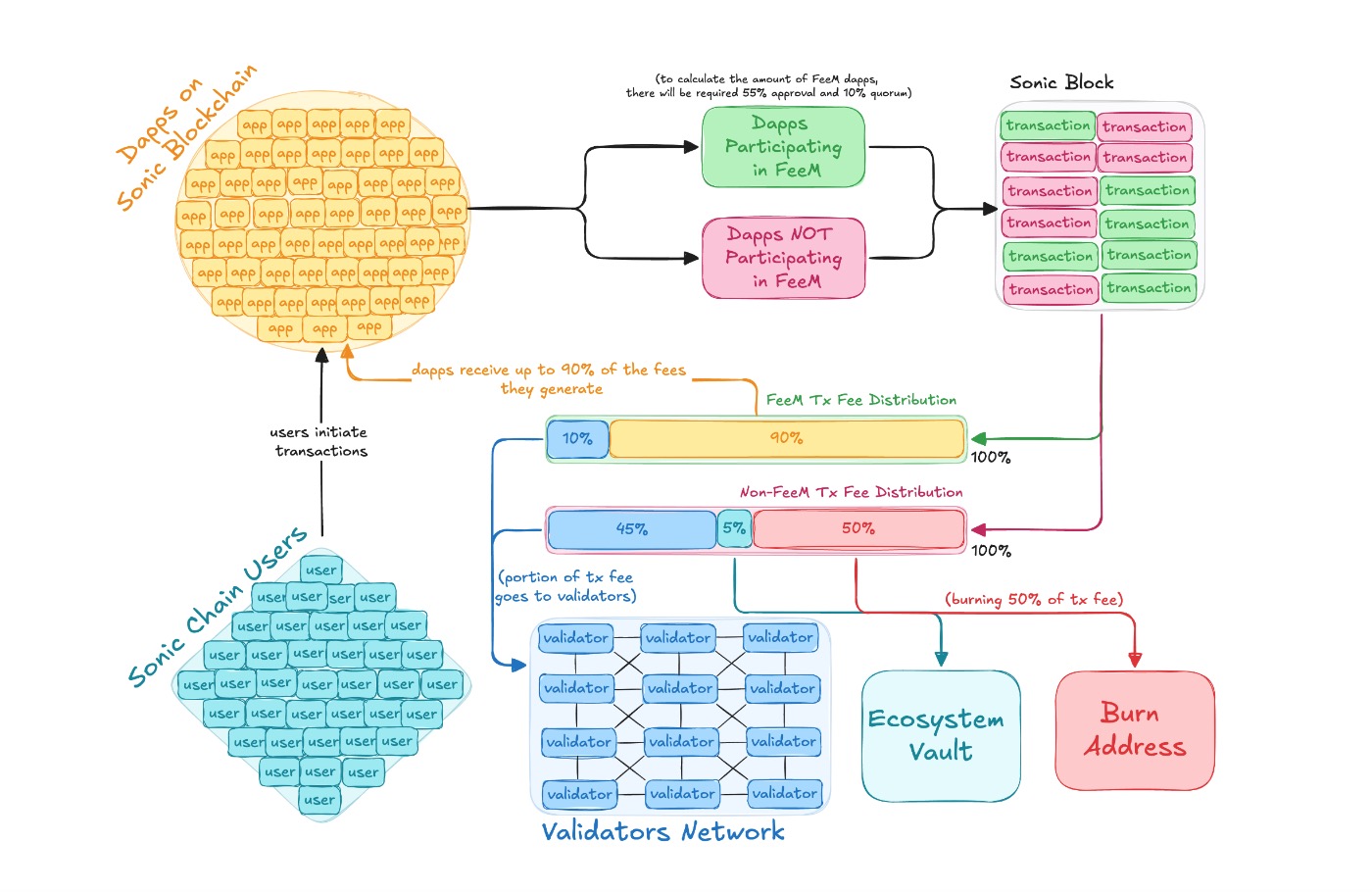

Through fee monetization, Sonic hopes to build a prosperous ecosystem for developers similar to the advertising revenue model on traditional network platforms. The transaction fee breakdown is as follows, including an innovative destruction mechanism:

Non-fee monetization of transactions on applications

If a user submits a transaction on an application that does not participate in FeeM, 50% of the transaction fee will be destroyed and the remaining amount will be given to the validator and the ecological treasury.

Fee monetization transactions on the app

If a user submits a transaction on an application participating in FeeM, 90% of the transaction fee will be given to the application developer and the rest will be given to the validator.

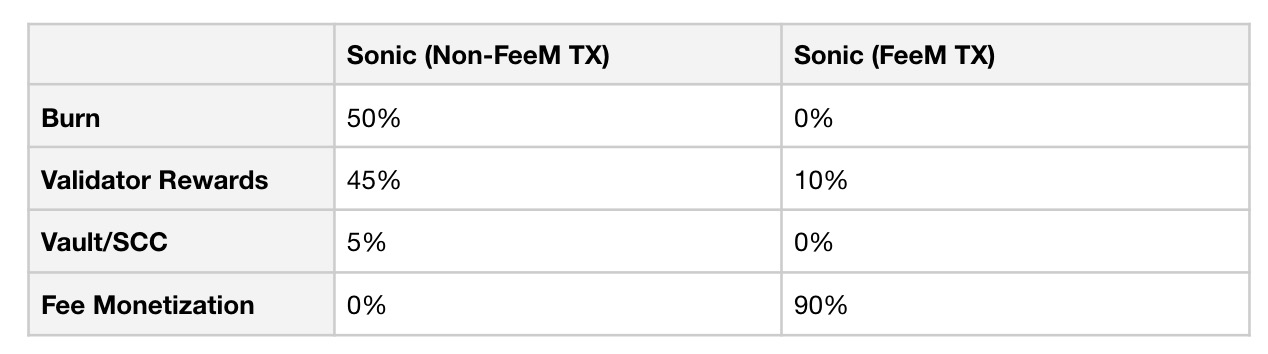

Fee Structure

Sonic's recommended 3.5% target block reward rate ensures that the network can continue to support its applications. The following table outlines the difference in transaction fee distribution between applications that do not participate in FeeM and those that participate in FeeM.

If the transaction fees earned by applications participating in FeeM are below the 90% cap, the remaining transaction fees will be sent to the validators.

Example of Destruction and FeeM Mechanism

Scenario: 50% of transactions come from applications participating in FeeM, and the remaining 50% are non-FeeM transactions

Average target cost: $0.01 per trade

Network Capacity: Sonic can process more than 900 million transactions per day

Prediction: Achieving 10 million transactions per day will result in:

About $100,000 in funds flow in every day

Annual capital inflow of approximately US$36.5 million

$9.125 million destroyed annually

$10,037,500 paid to validators annually

Annual payments to Sonic developers are $16.425 million

Sonic Liquid Staking Token

During the operation of Fantom, there were more than 40% of staking nodes, which is higher than Ethereum's approximately 30%. However, the complex staking mechanism has hindered the prosperity of the LST market and restricted the injection of millions of funds into the DeFi ecosystem.

Sonic’s new staking mechanism will have a 14-day lock-up period and a 7-day withdrawal period, creating an ideal structure for tapping into the LST market estimated to be over $500 million .

Technical Architecture

Sonic will provide developers with superior scalability and storage capabilities while providing a fast and seamless user experience. Sonic can perform up to 10,000 ERC-20 transfers per second with sub-second finality, enabling instant, irreversible transactions and utilizing cutting-edge storage systems for efficient data management.

Unlike L2 and Ethereum, truly final transactions only require 1 block to be implemented (there is no longest chain rule), and there is no need to package data and write it back to Ethereum.

Sonic Gateway

In the evolving blockchain ecosystem, a native, decentralized cross-chain bridge is essential for a healthy ecosystem, enabling strong interoperability and preventing network silos. However, current L1 and L2 solutions often force users to compromise on security, speed, and decentralization. At present, cross-chain bridge hacking incidents have caused losses of more than $2.5 billion .

Recognizing these systemic threats, Sonic’s cross-chain bridge has the following simple goals:

Safety: Safety is ensured through built-in fail-safe mechanisms.

Speed: Provide a smooth user experience and easily realize cross-chain assets.

Decentralization: Eliminates single points of control, ensuring only users have access to their funds.

Sonic Gateway is a trustless cross-chain bridge that facilitates ERC-20 token transfers between Ethereum and Sonic while achieving the above three points at the same time. By leveraging Sonic's own validator network (validators have operating nodes on both chains), Sonic Gateway establishes a secure decentralized channel between the two platforms.

Sonic Gateway provides asset security through built-in fail-safe mechanisms to protect the safety of users' funds in any situation. Most importantly, only users can access funds transferred through Sonic Gateway; it is impossible for any centralized institution to override user control or access funds through master keys.

In addition, Sonic Gateway is also designed to improve efficiency. Transfers from Ethereum to Sonic take up to 10 minutes, and transfers from Sonic to Ethereum take up to 1 hour (these intervals are called "heartbeats"). Although Sonic is not L2, it will still be an active participant in the Ethereum ecosystem because Sonic will spend ETH through Sonic Gateway to write transactions to the chain.

Fast-Lane TX

Users can choose to execute transactions immediately using “fast track transactions.” By paying for transactions that bypass standard “heartbeats” (which typically delay the availability of funds on the target chain), users can get their funds immediately.

Fast channel transactions transfer the entire state to the target chain, just like normal "heartbeats" transactions, benefiting all users, not just the user who submitted the transaction. In essence, it is equivalent to a "heartbeat" transaction, but submitted earlier. Importantly, fast channel transactions are added as an enhancement and do not change the standard "heartbeat" time.

For example, if the standard “heartbeats” from Ethereum to Sonic are every 10 minutes, then submitting a fast-track transaction 5 minutes before the next scheduled “heartbeat” will allow all users crossing from Ethereum to Sonic to access their funds immediately, while the next standard “heartbeat” interval is still 5 minutes.

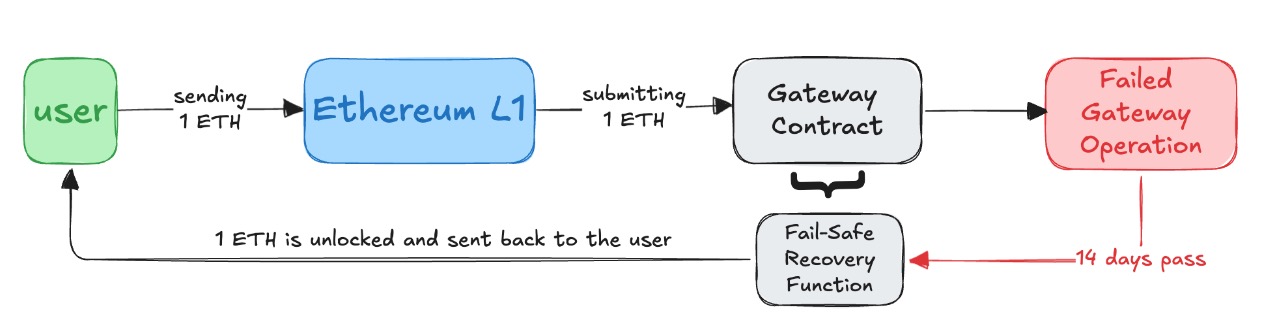

Gateway Fail-Safe Mechanism

Sonic Gateway has a built-in fail-safe mechanism that allows users to retrieve their cross-chain assets on the original chain in the event of a failure of Sonic or its gateway.

This fail-safe mechanism is activated after the gateway fails to operate for 14 consecutive days, providing protection for users to transfer assets from Ethereum to Sonic. As a form of insurance, the 14-day fail-safe period is immutable, meaning that once the Sonic Gateway is deployed, it cannot be changed by Sonic Labs or any other third-party entity.

Importantly, this period is not a competition period, but rather a fundamental function of ensuring users retain custody of their cross-chain funds on the origin chain.

How the fail-safe mechanism works

Sonic Gateway transmits “heartbeats” between chains, which include the Merkle root and block height of each blockchain. If the “heartbeats” stop for 14 days, it will signal the failure of the Gateway, allowing users’ funds to be unlocked on Ethereum.

Of course, only assets that were transmitted through the Sonic Gateway can be restored. The 14-day duration serves as a buffer period to resolve any issues before the Gateway is deemed unavailable.

Sonic vs. L2

Most L2s are optimistic Rollups, which operate under the assumption that all withdrawals are valid unless challenged (hence the term "optimistic"). To ensure security, these L2s have a 7-day challenge period that allows anyone to verify and challenge withdrawal claims on Ethereum. For example, if you want to withdraw 2 ETH from Optimism to any other platform, those assets will not actually be released on Ethereum until the 7-day challenge period is over. So why does it only take a few minutes to withdraw from platforms like Arbitrum and Optimism to exchanges like Binance?

In fact, when depositing from optimistic Rollup to exchanges such as Binance, the transfer may seem fast, but the exchange bears the risks associated with the challenge period; this is because Binance trusts most L2s. However, the funds deposited into your account by the exchange before the 7-day challenge window closes are technically not safe, which means that the exchange bears the risks during this period.

In contrast, Sonic, as an L1 with its own secure validator, can provide instant (single block) transfers to exchanges, without the associated risk, as these transactions are not subject to any challenge period, which would also be the case if USDC (and other ERC-20 tokens) became native tokens on Sonic. In addition, cross-chain assets from Ethereum through the Sonic Gateway are completed within an hour, which is a faster and more secure alternative to the 7-day challenge period required by most L2 solutions.

Sonic Database

Sonic uses a database to store its world state, including account information, virtual machine bytecode, smart contract storage, etc. The database has a feature called "live pruning" that automatically deletes historical data, thereby reducing storage requirements for validators.

Previously, pruning required validator nodes to be offline, which introduced financial and operational risks. Now, validators can use real-time pruning, which saves disk space and costs by discarding historical data in real time while ensuring continuous operation.

Live pruning works by dividing the database into two types, including LiveDB and ArchiveDB. LiveDB only contains the world state of the current block, while ArchiveDB contains the world state of all historical blocks. Validators only use LiveDB, while archive nodes have both LiveDB and ArchiveDB to handle historical data requests through the RPC interface.

Sonic's database storage uses an efficient tree or hierarchical structure, which simplifies data retrieval. Importantly, it still provides cryptographic signatures for world state and uses an incremental version of the prefix algorithm to provide archiving capabilities. In addition, it uses a local disk format instead of indirectly storing world state through a key-value store such as LevelDB or PebbleDB.

Sonic Virtual Machine

The Sonic virtual machine (VM) will replace the EVM and increase the execution speed of Sonic. The Sonic virtual machine will be fully compatible with Solidity and Vyper, so ecosystem developers can continue to use the same development tools. In addition, Sonic will support Geth 1.4.

The Sonic virtual machine uses dynamic translation, which translates the code into a more efficient instruction format within the client, allowing smart contracts to be executed more efficiently. This is achieved through more efficient execution techniques and "super-instructions" (efficient representations of patterns that frequently appear in the code).

Token Economics

Sonic's native token is S, which has multiple functions:

Pay transaction fees

Ensure the security of the chain by staking (minimum 1 S)

Run a validator to secure the chain (at least 50,000 S)

Participate in governance

When the Sonic mainnet is launched, the total supply of S will be 3.175 billion, corresponding to the total supply of FTM, and the circulating supply of S will correspond to the circulating supply of FTM at that time. Users holding FTM can exchange them for S at a 1:1 ratio. Based on the decisions of multiple governance proposals, the following additions will be gradually implemented into the token economics of the S token.

Airdrop Program

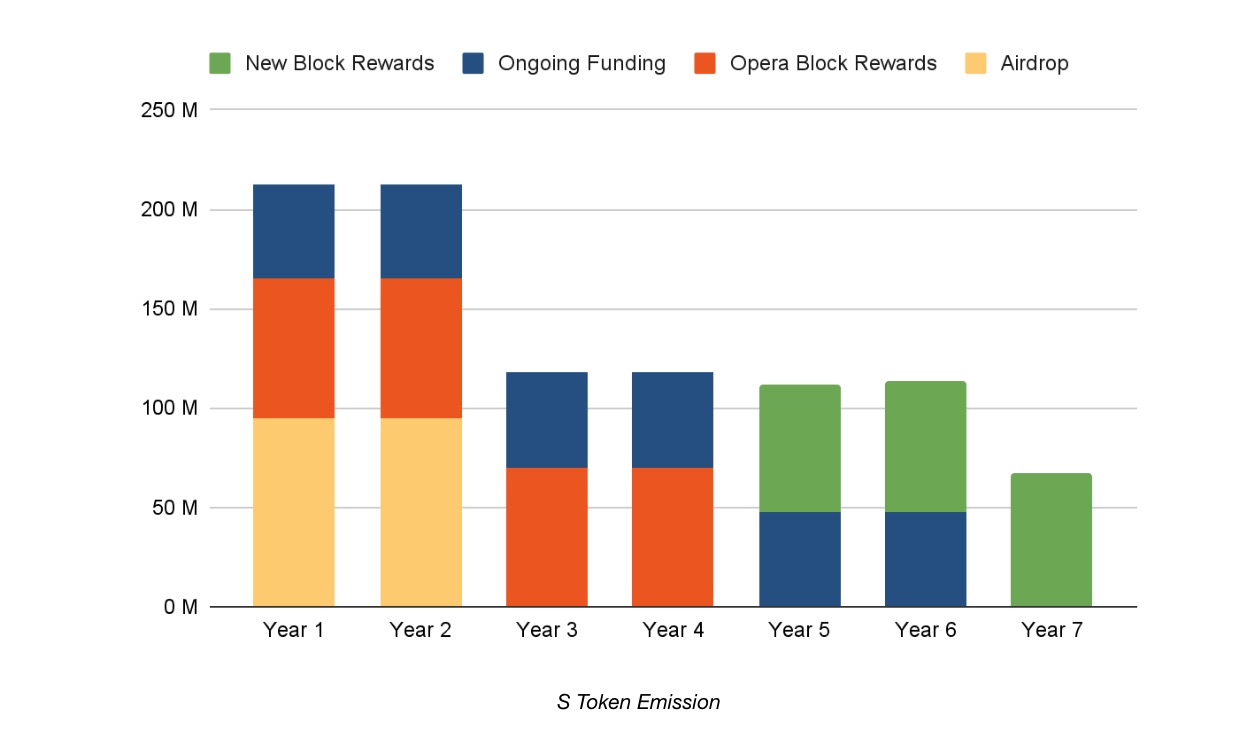

Six months after the launch of Sonic, 6% of the newly minted 3.175 billion S tokens were used for the airdrop program to reward Fantom Opera and Sonic users and builders. The airdrop program uses an innovative destruction mechanism to reward actively participating users and gradually reduce the total supply of S tokens.

Ongoing funding

Six months after Sonic’s launch, more S tokens will be minted to increase S’s adoption and global impact; grow the team and scale operations to increase adoption; implement strong marketing initiatives and DeFi activities; and launch the Sonic Spark and Sonic University programs to drive Sonic’s future development.

To fund the program, an additional 1.5% of the total initial S token supply (equivalent to 47,625,000 tokens) will be minted each year for six years, starting six months after the mainnet launch. However, to prevent inflation, Sonic will destroy the newly minted tokens that are not used that year, ensuring that 100% of all newly minted tokens generated by this initiative are used for network growth rather than being kept in the treasury for future use. For example, if Sonic Labs only uses 5 million tokens in the first year, the remaining 42,625,000 tokens will be destroyed.

Block Rewards

We are migrating validator rewards from Fantom Opera to Sonic. Opera validators will continue to receive rewards for the first few years. However, as validators and stakers transition to Sonic, their block rewards will be reduced. The funds saved from the reduction in rewards will be reallocated to reward Sonic validators. In the meantime, the Sonic Foundation will continue to maintain Opera validators for the foreseeable future.

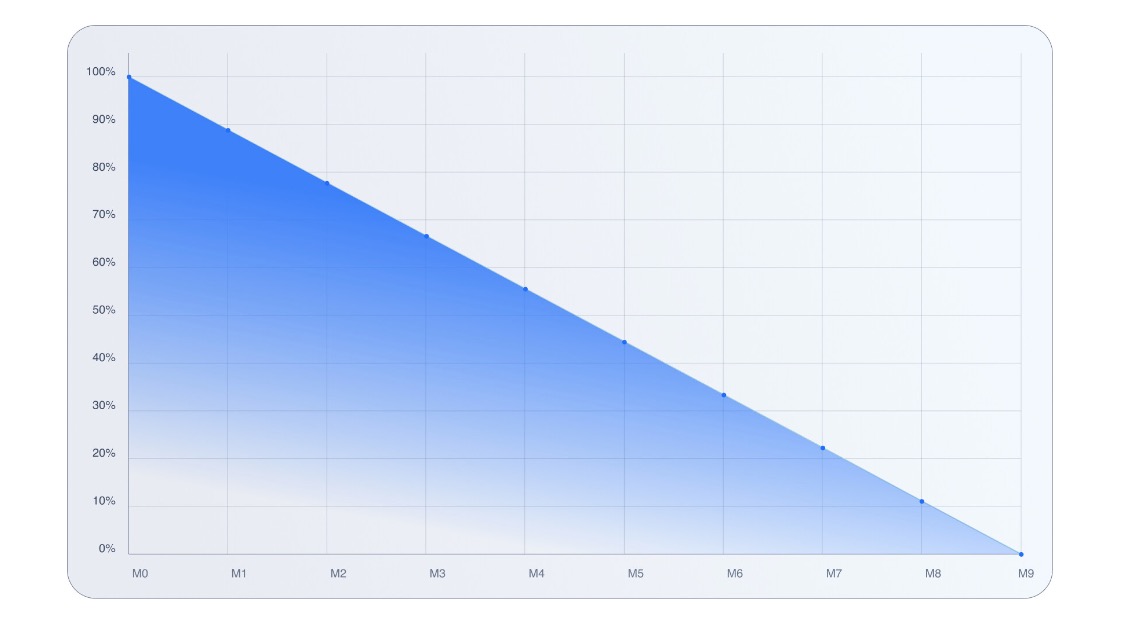

Sonic's target annual yield (APR) is 3.5%. In order to maintain this yield without causing inflation during the first four years, we will redistribute the remaining FTM block rewards in Opera to Sonic as rewards for validators and stakers. These rewards have been included in the initial supply of 3.175 billion S tokens.

While technically the total initial supply of S tokens is 3.175 billion, matching the total supply of FTM, at launch the circulating supply will be approximately 2,883,358,939 tokens. The difference (70,067,224 per year) will be distributed as rewards to validators over the first four years of Sonic. During this time, we can avoid minting new S tokens for block rewards.

As a result of these changes, Opera's annual interest rate will drop to zero after the launch of Sonic. In addition, in order to preserve value for all FTM and S token holders and eliminate the need for new inflation rewards at the beginning of Sonic's launch, we will not mint new tokens for validator security during the first four years of Sonic's deployment. After four years, S block rewards will continue to mint new tokens at a rate of 1.75% per year to reward validators.

The chart below shows the total issuance of S tokens in the first 7 years.

Token destruction mechanism

Sonic has three burn mechanisms that reduce the release of new S tokens:

Fee monetization destruction mechanism: If a user submits a transaction on an application that does not participate in FeeM, 50% of the transaction fee will be destroyed.

Airdrop destruction mechanism: If the user does not choose to wait for 75% of the airdrop to be unlocked within the 270-day unlocking period, some S tokens will be lost and destroyed.

Burn mechanism in ongoing grant: During the first six years of Sonic, 47,625,000 S tokens will be minted each year to fund growth, and unused tokens will be burned that year.

The following chart forecasts the circulating supply of S from launch to year 7. The blue line represents the circulating supply without any destruction, and the red line represents the supply with destruction.

To show the potential burn in the above chart, we assume that 50% of the S tokens from the ongoing grant will be burned. In addition, we also assume that there are 10 million transactions per day on Sonic, with a fee of about $0.01 per transaction, and assume that half of these transactions occur on non-FeeM applications, on which 50% of the fees will be burned. Finally, we assume that users will consume an average of 20% of the airdrop, as some will choose to claim it early.

Please note that the token economics calculations provided assume that Sonic launches in December 2024. If the launch date changes, the token economics will also be adjusted accordingly.

From Fantom to Sonic

After extensive discussions in the Fantom community and passing four governance votes (the voting results are as follows), Sonic will continue to represent Fantom as the new chain.

FTM holders can redeem S in one of two ways:

Centralized Exchanges: Sonic is working with most exchanges that currently list FTM to coordinate automatic swaps for users.

Self-custody/DeFi users: Sonic Labs will launch a simple bridge to enable 1:1 swaps from FTM to S. Two-way swaps will be supported for the first 90 days after the Sonic mainnet launch. After 90 days, starting at 4pm GMT on the 91st day, only one-way swaps from FTM to S will be allowed.

in conclusion

Sonic aims to revolutionize the blockchain industry by providing a next-generation L1 that combines speed, scalability, and security. By introducing innovative features such as fee monetization, a secure cross-chain bridge to Ethereum, and a simplified staking mechanism, Sonic positions itself as a developer-friendly platform that prioritizes builders and users.