By Daniel Ramirez-Escudero, CoinTelegraph

Compiled by: Deng Tong, Golden Finance

As speculation grows that incoming President Donald Trump could sign an executive order declaring a Bitcoin reserve on day one, or pass legislation to establish a reserve during his term, many are wondering if such a move could lead to a cryptocurrency supercycle.

Since Wyoming Senator Cynthia Lummis introduced the Bitcoin Reserve Act earlier this year, states such as Texas and Pennsylvania have introduced similar proposals. Russia, Thailand and Germany are reportedly considering their own proposals, further increasing the pressure.

If governments race to protect their Bitcoin stocks, are we saying goodbye to a four-year boom-bust cycle in cryptocurrency prices?

Iliya Kalchev, an analyst at cryptocurrency lender Nexo, believes that the “Bitcoin Reserve Act could be a milestone moment for Bitcoin, marking its “recognition as a legitimate global financial instrument.”

“Every Bitcoin cycle has a narrative that tries to push the idea that ‘this cycle is different.’ The conditions have never been more ideal. The crypto space has never had a pro-crypto U.S. president controlling the Senate and Congress.”

Lummis’ proposed Bitcoin Act of 2024 would enable the U.S. government to include Bitcoin in its treasury as a reserve asset, purchasing 200,000 Bitcoins per year over five years, accumulating 1 million Bitcoins and holding them for at least 20 years.

Strike founder and CEO Jack Mallers believes it’s “possible that Trump will issue an executive order to buy Bitcoin on day one,” though he cautioned that would not be the same as buying 1 million Bitcoins.

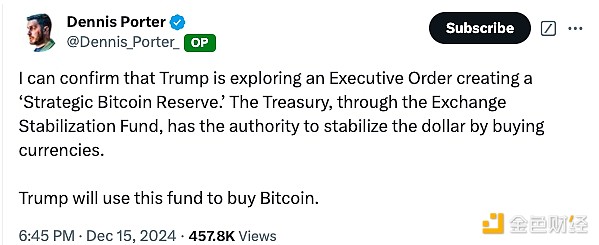

Dennis Porter, co-founder of the Satoshi Act Fund, a nonprofit that supports the Bitcoin U.S. Policy Act, also believes that Trump is exploring enabling a strategic Bitcoin reserve through executive order.

Dennis Porter announced that Trump is working on an executive order for a strategic Bitcoin reserve. Source: Dennis Porter

So far, Trump’s team has not directly confirmed claims of an executive order, but Trump was asked on CNBC whether the U.S. would create a BTC reserve similar to its oil reserves (which would likely mean legislation).

However, executive orders lack stability, as subsequent presidents often overturn such orders. The only way to ensure the long-term future of the Bitcoin strategic reserve is through legislation that has majority support.

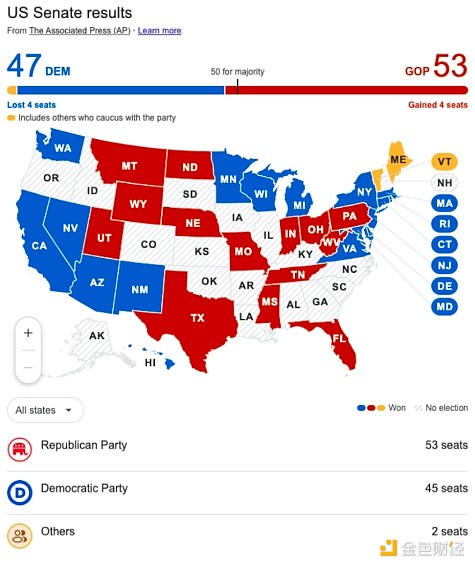

With Republicans dominant in Congress and holding a slim majority in the Senate, Bitcoin advocates on Trump’s team have a solid base to push Lummis’ bill. However, only a few Republican defectors could derail the bill amid growing anger over handing government wealth to Bitcoin supporters.

U.S. Senate and Congress results after the 2024 elections. Source: Associated Press

"Stop comparing this cycle to previous cycles"

Earlier this month, Alex Krüger, economist and founder of macro digital asset advisory firm Asgard Markets, said the election results convinced him that “Bitcoin is most likely in a super cycle.”

He believes that Bitcoin’s unique situation can be compared to gold, which surged from $35 an ounce in 1971 to $850 in 1981 when former U.S. President Richard Nixon took the U.S. off the gold standard, ending the Bretton Woods system.

Krüger did not rule out the possibility that Bitcoin could experience a bear market like in past cycles. However, he urged cryptocurrency investors to “stop comparing this cycle to previous ones” because this time could be different.

Trump’s actions so far certainly point to an administration that is well-positioned for the future. Following the resignation of Gary Gensler, he nominated crypto-friendly and deregulatory backer Paul Atkins to serve as SEC chairman.

He also nominated Scott Bessent, a crypto-backed senator, as Treasury secretary and designated David Sacks, former PayPal chief operating officer, as artificial intelligence and cryptocurrency czar, tasked with developing a clear legal framework for the industry.

Supercycle theory has never had super results

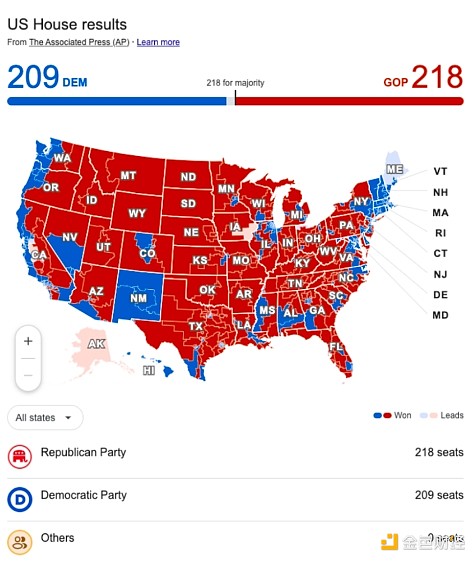

However, the notion that “this cycle is different” has emerged in every past Bitcoin bull run, each time supported by a narrative around mainstream and institutional adoption.

During the 2013-2014 bull run, the super cycle theory was supported by the theory that Bitcoin would gain international attention as an alternative asset to fiat currencies.

During the 2017-2018 cycle, rapid price appreciation was considered a sign of mainstream financial adoption and the beginning of mainstream acceptance of Bitcoin, with institutional interest set to flourish.

When tech companies like MicroStrategy, Square, and Tesla entered the Bitcoin market during the 2020-2021 cycle, they believed that many tech-related companies would follow suit.

Bitcoin's price performance has seen peaks and lows in previous cycles. Source: Caleb & Brown

However, in each cycle, the supercycle narrative failed to materialize, ultimately causing prices to plummet and wiping out supporters as they entered a secular bear market.

Su Zhu, co-founder of Three Arrows Capital, is the most famous supporter of the super cycle theory since 2021. He believes that the crypto market will continue to be in a bull market without a sustained bear market, and that Bitcoin will eventually reach a peak of $5 million.

Three Arrows certainly borrowed money as if the super cycle theory was real, and when it was finally liquidated, the cryptocurrency market cap fell by nearly 50% after the news broke, and the collapse led to the bankruptcy and financial difficulties of lenders including Voyager Digital, Genesis Trading and BlockFi.

Therefore, the super cycle is a dangerous theory to bet your life savings on.

For Chris Brunsike, partner at venture capital firm Placeholder and former head of blockchain products at ARK Invest, the Bitcoin super cycle is just a myth.

“The super cycle is undoubtedly a collective delusion.”

However, the U.S. election results overwhelmingly provide unprecedented and extremely bullish conditions for Bitcoin given the support of the President of the United States, who appears to be making good on his promises to support cryptocurrencies, including never selling any of the Bitcoin in the U.S. Bitcoin Treasury.

Potential global domino effect

If the Bitcoin Reserve Act is passed, it could spark a global race to hoard coins, with other countries following suit to avoid being left behind.

Attorney George S. Georgiades, who pivoted from advising Wall Street firms on financing to working with the cryptocurrency industry in 2016, told Cointelegraph that enactment of the Bitcoin Reserve Act “could mark a turning point in global Bitcoin adoption” and could “spark other countries and private institutions to follow suit, driving broader adoption and enhancing market liquidity.”

Basel Ismail, CEO of crypto investment analytics platform Blockcircle, agreed, saying approval would be “one of the most bullish events in the history of cryptocurrency” because “it will set off a race to get as many Bitcoins as possible.”

"Other countries will not have a say, they will be forced to act. Either pivot and compete, or die."

He believes that “most G20 countries will follow suit and build their own reserves.”

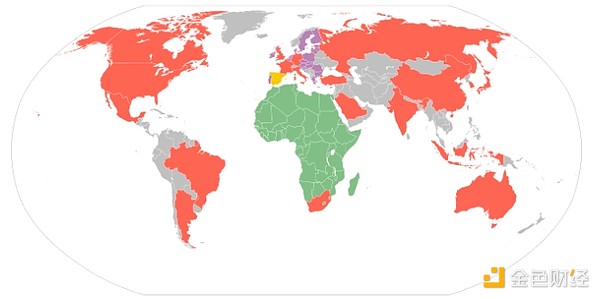

G20 map in 2024. Red: G20, purple: EU representative countries, green: African Union representative countries. Yellow: permanently invited countries. Source: Wikipedia

Veteran crypto investor and Bitcoin educator Chris Dunn noted that this FOMO-based competitive buying spree between countries could completely change the current crypto market cycle.

“If the U.S. or another major economic powerhouse starts accumulating Bitcoin, Bitcoin could induce FOMO, which could create market cycles and supply and demand dynamics unlike anything we have seen to date.”

The president of the OKX exchange noted that other countries may be ready for such a competition.

“It’s very possible that game theory has quietly come into play.”

However, Ismail said that most of the bitcoin purchases will be done through over-the-counter brokers and settled in block trades, so "it may not have an immediate direct impact on the price of bitcoin," but will create long-term and lasting demand forces that will eventually drive the price of bitcoin higher.

A new wave of crypto investors could change crypto market dynamics

If countries become buyers in the market, the Bitcoin market could change fundamentally. A new wave of new investors from global financial centers would flood into the cryptocurrency market, changing market dynamics, psychology, and reactions to certain events.

Nexo analyst Kalchev said that while it remains speculative to assume that the legislation could disrupt Bitcoin’s well-known four-year halving cycle, some dynamics could change.

Bitcoin is a unique market that has been driven so far by retail buying and selling, with prices highly sensitive to market psychology. The emergence of new types of investors could change market dynamics and alter historical cycles.

Ismail believes that "stock market investors will behave differently from retail investors who overreact." Institutional investors have deep pockets and advanced risk management strategies, which allows them to treat Bitcoin differently from retail investors.

“Over time, Wall Street’s involvement could help create a more stable and less reactive market environment.”

Stability is another way of saying less volatility, which logically means that bear markets will be less aggressive than past cycles.

Georgiades believes that “price cycles will persist,” but “continued demand from large buyers such as the United States is likely to reduce volatility and the swings we have witnessed in past cycles.”

Ismail also pointed out that the performance of the Bitcoin market has been different from the previous four-year cycle. The price of Bitcoin in the current cycle fell below the all-time high (ATH) of the previous cycle, "which everyone thought was impossible", and then Bitcoin reached a new ATH before the official halving.

“The four-year cycle has now been debunked and broken many times.”

Bitcoin has only experienced four halvings to date, with nearly three dozen more to come. “It’s hard to imagine that all of these halvings will follow the same predictable four-year pattern,” Kalchev said, especially when broader macroeconomic and political factors, such as central bank policy and regulatory developments, have a more significant impact on Bitcoin’s market trajectory.

Kalchev believes that Bitcoin’s price action will be less influenced by internal mechanisms such as halvings and more by external factors such as institutional adoption and geopolitical events.