introduction

On December 6, 2024, Hong Kong took a major step forward in the digital asset industry by publishing its groundbreaking Stablecoin Act. This move underscores Hong Kong’s ambition to solidify its position as a global leader in digital asset regulation and sets a benchmark for other jurisdictions navigating the complexities of this emerging market.

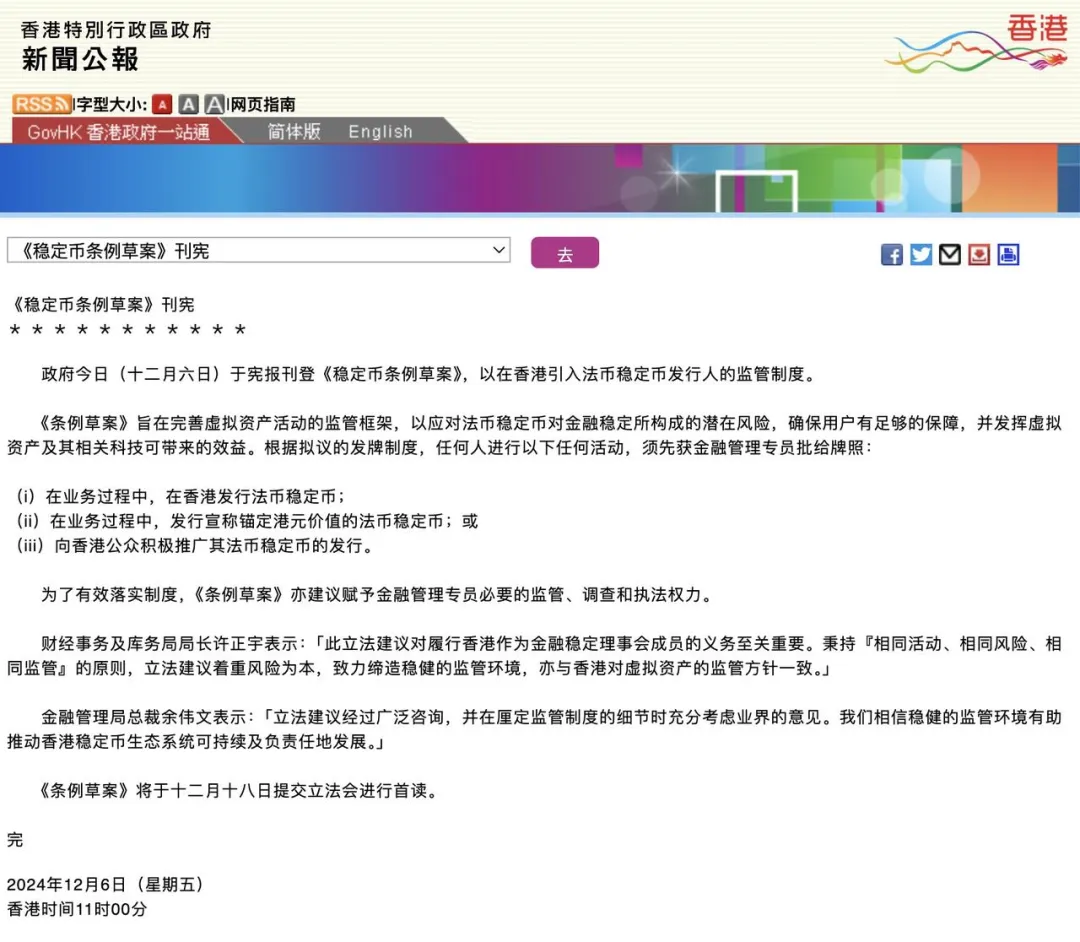

▲Related news screenshots

Stablecoins are often hailed as a bridge between traditional finance and blockchain technology, and have grown rapidly around the world. The price stability they provide and their potential for application in payments, remittances, and decentralized finance have driven their widespread adoption. However, the lack of comprehensive regulation has exposed the vulnerabilities of stablecoins, from systemic risks to consumer protection issues, forcing policymakers to take action.

The proposed legislation seeks to strike a delicate balance: ensuring financial stability and protecting public trust while promoting growth in the Web3 economy. But will it succeed in achieving this goal? This article will provide an in-depth analysis of whether the framework can align with Hong Kong’s dual goals of innovation and caution in the rapidly evolving stablecoin market.

The need for regulation

Regulation of fiat-pegged stablecoins (“FRS”) is critical to promoting a secure and innovative financial ecosystem. A major benefit of regulatory clarity is greater investor confidence. By establishing clear rules, regulators can ensure greater transparency into the operations of stablecoin issuers, thereby reducing the risk of fraud or mismanagement and attracting institutional and retail investors who might otherwise be hesitant.

In addition, the regulation of stablecoins plays a key role in preventing systemic risks. Stablecoins, especially those pegged to fiat currencies, are increasingly integrated into the financial system as vehicles for payments, transactions, and liquidity management. Without regulation, problems such as sudden redemptions, operational failures, or reliance on volatile collateral could spread to traditional financial markets and affect broader economic stability.

Regulation also promotes consistency with global standards, thereby enabling cross-border interoperability and increasing trust among international stakeholders. The European Union is moving towards developing a regulatory framework through the Markets in Crypto-Assets (MiCA) regulation, and the United States is also conducting legislative discussions on stablecoins. By aligning with these efforts, the proposed law in Hong Kong seeks to set a global benchmark for responsible innovation.

As a renowned financial center, Hong Kong's adoption of this legislation further solidifies its position as a gateway between the East and the West. By prioritizing investor protection, financial stability, and regulatory consistency, Hong Kong's move strengthens its position as a forward-looking, globally competitive financial center and attracts innovators and investors in the Web3 space.

Challenges and Trade-offs

As Hong Kong seeks to become a leader in stablecoin regulation, the proposed framework faces key challenges and trade-offs. These challenges include how to balance strict regulation with innovation promotion, and navigate the rapid development of the digital asset ecosystem in the complex environment of global coordination.

Potential barriers to innovation

The Stablecoin Act imposes strict licensing and compliance requirements on fiat-pegged stablecoins (FRS). While this approach is essential to ensure transparency, consumer protection, and system stability, it has the potential to exclude smaller or emerging market participants. Startups are often a hotbed of innovation in the Web3 space, but they may find it difficult due to high audit fees, strict governance requirements, and capital adequacy requirements.

For example, the EU’s MiCA framework includes detailed compliance obligations. Some startups have chosen to relocate their companies to less regulated jurisdictions, such as Switzerland or Dubai, to avoid these burdens. Hong Kong could face similar challenges if its regulatory costs are deemed too high, driving talent and innovation away.

In addition, there is a risk of regulatory capture, where the market could be dominated by only large, well-resourced players. For example, in the United States, important players such as Circle (issuer of USDC) have lobbied for stricter rules that could be difficult for smaller competitors to meet. If Hong Kong follows this trajectory, it could create an oligopolistic market that inhibits innovation in stablecoin design or application.

The role of global coordination

Stablecoins, due to their cross-border nature, require consistency in global regulatory frameworks to unlock their full potential. Different regulatory frameworks have posed challenges in the past. For example, the United States’ evolving approach to stablecoin regulation—which emphasizes bank-level reserve requirements—is significantly different from Japan’s system, which only allows licensed banks and trust companies to issue stablecoins. This fragmented regulatory system hinders interoperability and reduces the utility of stablecoins in international trade and remittances.

Hong Kong needs to navigate these complex issues carefully. As a gateway between China and the global financial system, Hong Kong has a unique opportunity to align with global standards, such as MiCA or the Financial Stability Board's recommendations on stablecoins. However, if it fails to align with international standards, local issuers in Hong Kong may face isolation, affecting their interaction with the international market. On the contrary, a flexible but internationally aligned framework will be able to enhance Hong Kong's reputation as a trusted digital asset center.

Attorney Mankiw's Summary

Hong Kong's Stablecoin Bill marks an important moment in the regulatory development of digital assets, reflecting Hong Kong's ambition to lead in this transformative industry. By emphasizing transparency, stability, and investor protection, the legislation lays a solid foundation for the stablecoin ecosystem to thrive. However, the bill's success depends on finding a delicate balance between protecting financial integrity and promoting innovation.

The implications of this question are huge—not just for Hong Kong, but for the global stablecoin market. Will this framework make Hong Kong a beacon of regulatory excellence, fostering innovation while ensuring stability, or will it become a cautionary tale of excessive restrictions that stifle growth and drive opportunities elsewhere?

The answer lies in execution, adaptability and global collaboration. The world is watching, and Hong Kong has the opportunity to set the gold standard for the industry.