2024 is a turbulent year for the crypto industry. The launch of Bitcoin spot ETFs, the accelerating institutional adoption, the industry boom brought about by Trump's crypto-friendly stance, and BTC breaking through the $100,000 mark for the first time, all indicate that cryptocurrency has become an unstoppable force, and profound changes are shaping the future of the industry, providing unlimited imagination for 2025.

A review of the crypto industry in 2024

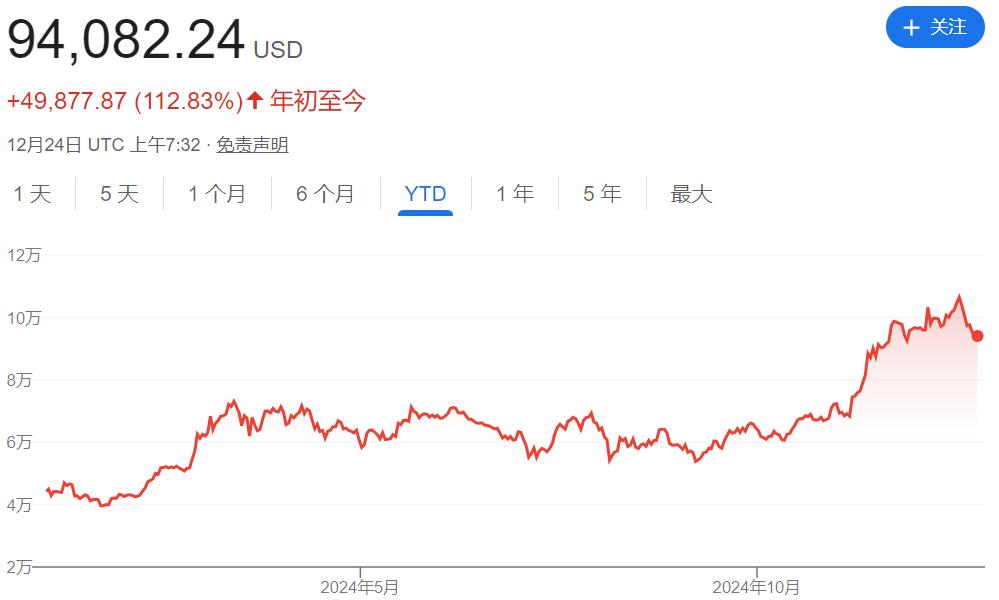

In 2024, many things happened in the crypto market. Changes in the industry structure and fluctuations in market sentiment are shaping the unique industry landscape of this year. Looking back on this year, Bitcoin's performance is particularly eye-catching, with its price soaring by more than 110%, highlighting the unique charm and potential of cryptocurrency as an emerging investment field.

1. The ETF era begins

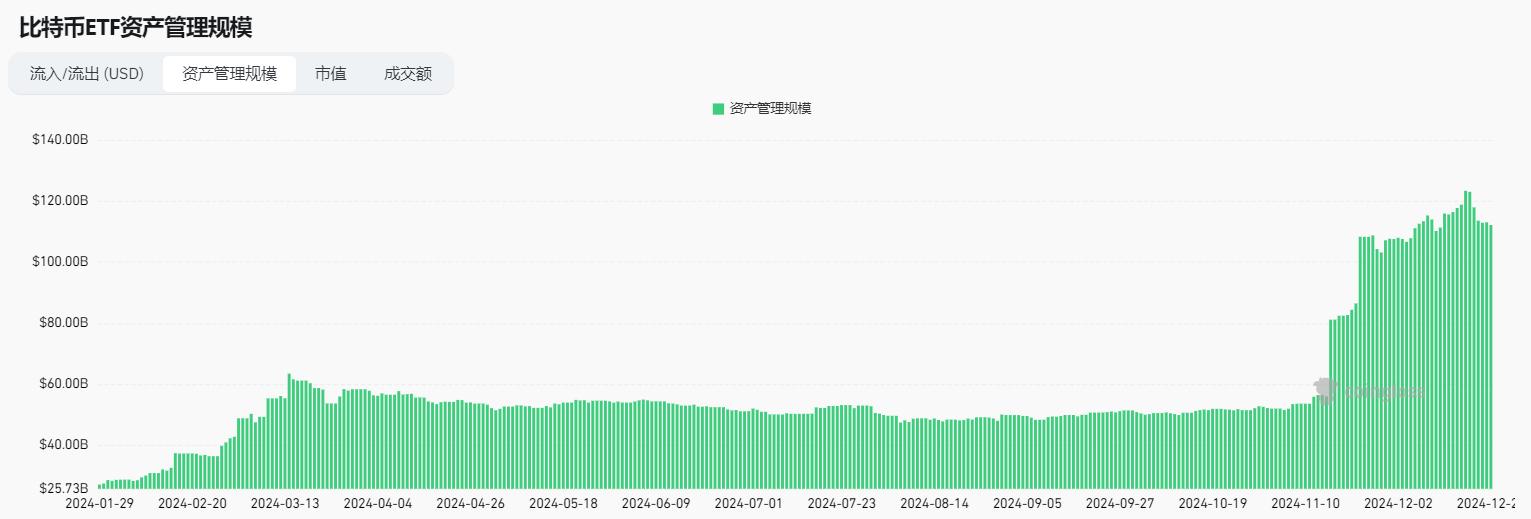

At the beginning of the year, the U.S. Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETF. This milestone decision marked the official entry of crypto assets into the mainstream financial market. Funds poured in like a tide, pushing the price of Bitcoin to a record high in March. The enthusiasm of institutional investors and the high recognition of the market laid a solid foundation for the prosperity of the cryptocurrency market throughout the year.

2. Bitcoin’s fourth halving

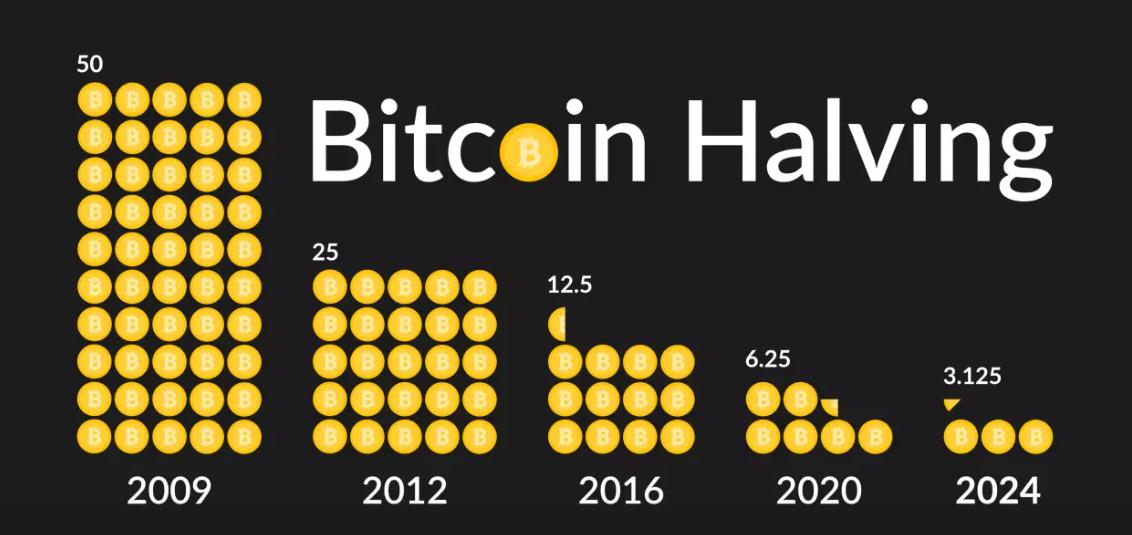

At the end of April, Bitcoin ushered in the fourth halving event in history, which once again highlighted the unique status of Bitcoin as a scarce asset. Although the market did not continue to strengthen after the halving, but entered a correction period after May, historical data shows that the supply reduction effect brought about by the halving cannot be ignored in the long-term promotion of Bitcoin prices, and has become an important catalyst for market optimism in 2024.

3. Market adjustment and the rise of memes

Around the middle of the year, the crypto market began a painful adjustment period. Affected by multiple factors such as global macroeconomic uncertainty, geopolitical conflicts and the German government's sell-off, market volatility intensified, and major market indicators fell sharply from the highs in the first half of the year. Altcoins even fell to the lows of the bear market. The industry faced a difficult period and skepticism arose. During this period, the listing of Ethereum spot ETF brought a glimmer of hope to the market, but failed to replicate the rise of Bitcoin ETF. Ethereum and its ecosystem, which were highly expected, led the decline. When market sentiment was low, Meme coin emerged with its unique value capture model and community consensus, becoming an emerging track with a market value of over US$100 billion, triggering in-depth discussions on its core value in the industry.

4. The Federal Reserve starts a rate cut cycle

In September, the global financial market ushered in a major turning point. The Federal Reserve cut interest rates for the first time in four years, forcing major central banks around the world to follow suit and release money, and the world entered a relatively loose monetary policy environment. The interest rate cut cycle is often closely related to the rise in risky asset prices. After a period of downturn, the confidence in the crypto market began to boost. The trading volume and the total supply of stablecoins showed signs of recovery to a certain extent, and the market funds and activity have recovered.

5. “Trump deal” pushes Bitcoin past $100,000

The fourth quarter was a historic moment for the crypto market. During the US election, the topic of cryptocurrency took center stage on the US political stage for the first time. The Trump team’s explicit commitment to promote a more friendly regulatory framework greatly stimulated market sentiment, and the “Trump trade” continued to heat up and continued to ferment after his victory.

Since then, Trump has successively appointed crypto supporters as heads of various departments, such as the Secretary of the Treasury, Secretary of Commerce, Chairman of the SEC, leader of the Department of Government Efficiency, and head of cryptocurrency affairs, and promoted the Bitcoin Strategic Reserve Plan in various states, stimulating the price of Bitcoin to rise steadily and break through the $100,000 mark for the first time in history. Bitcoin and other cryptocurrencies have not only achieved a leap in value at the economic level, but have also gained unprecedented recognition and attention at the political and social levels.

Events to watch in 2025

On January 20, 2025, the United States will hold the presidential inauguration ceremony, and Trump will officially take office. Compared with the Biden administration, the new administration led by Trump is more friendly to the crypto market. The increasingly open and transparent regulatory environment will provide broad imagination space for the future of the crypto market, and the market is highly concerned and looking forward to it.

1. Promotion of the Bitcoin Strategic Reserve Plan

Trump's idea of "US Strategic Bitcoin Reserve" is undoubtedly one of the most noteworthy focuses in 2025. If Bitcoin obtains strategic reserve status, it will achieve a gorgeous transformation from a niche market asset to a public asset of the treasury, and its legitimacy and recognition will be greatly improved. As a strategic reserve asset, Bitcoin will fight side by side with traditional assets such as gold and foreign exchange reserves to provide protection for national economic stability and financial security.

Trump has repeatedly raised the idea of establishing a national Bitcoin reserve during his campaign, and recently hinted at the creation of a Bitcoin reserve in an interview at the New York Stock Exchange. Whether this ambitious proposal can be implemented in the short term remains to be seen, but it is expected to be actively promoted in 2025. Any remarks by Trump suggesting that this plan is being promoted will bring obvious upward support to the market and send a clear crypto-friendly signal to the market, expanding the influence of Bitcoin in the global financial system.

At the federal level, several states have submitted proposals for strategic Bitcoin reserves, and more and more US listed companies have begun or are discussing Bitcoin reserve plans. At the global level, these US "pioneer moves" are expected to be followed soon, and many countries may start a round of Bitcoin reserve competition. For example, Forbes predicts that the G7 or BRICS countries will establish strategic Bitcoin reserves in 2025.

2. Bitcoin ETFs continue to grow, and new cryptocurrency ETFs are born

Perhaps the most important thing for Bitcoin this year is that the US SEC approved the listing applications of multiple Bitcoin spot ETFs in early January. In less than a year after their launch, these ETF products have attracted nearly US$120 billion in funds.

The success of Bitcoin and Ethereum ETFs makes 2025 a turning point for other cryptocurrency ETFs, including SOL and XRP, as well as the staking function of Ethereum spot ETFs. Although the SEC previously rejected some applications for Solana ETFs, it is still reviewing more than 10 related applications, showing its continued interest in expanding crypto investment options. As the market matures and regulations become clearer, more types of cryptocurrency ETFs are expected to be approved, thereby enhancing market liquidity and investor confidence.

3. The crypto market has reached the peak of this bull market

Historical data shows that the Bitcoin halving effect usually brings about a one-year price increase cycle. It is expected to boost market optimism and drive price increases until the first half of 2025.

On the other hand, historical experience shows that the peak of the crypto bull market usually does not occur during the interest rate cut cycle, but is more likely to occur at the end of the interest rate cut cycle or when the interest rate hike cycle is nearing its end or even just starting. For example, the extremely loose policy caused by the epidemic in 2020 kicked off the crypto bull market. As the Federal Reserve gradually released signals of tightening policies, the market peaked at the end of 2021, and then interest rate hikes officially began in 2022.

From a macro perspective, the first phase of the current round of interest rate cuts by the Federal Reserve has ended, and a new phase will begin next year. The latest dot plot shows that there are expected to be two more interest rate cuts totaling 50 basis points next year. It is expected that the benchmark interest rate will fall to a neutral level by mid-2025. Whether there will be further interest rate cuts or tightening signals will depend on the inflation level at that time and whether Trump can successfully influence the Federal Reserve. If the Federal Reserve releases tightening signals to deal with inflation, the market may enter a period of adjustment.

However, it should be noted that this round of bull market is very different from the historical crypto cycles, and the bull market may have multiple development paths in the end, especially in the context of Trump's implementation of fiscal expansion policies and the release of unprecedented crypto-friendly signals, which is expected to usher in a stronger and longer bull market. In this process, Bitcoin will gain more stable support and gradually become a core dollar asset in addition to the dollar industry cycle (such as AI), and the decoupling trend of Bitcoin and the altcoin market is expected to be further strengthened.

Summarize

2024 is undoubtedly the most milestone year for cryptocurrency to enter the mainstream financial market, and it also opens up unlimited possibilities for 2025. Although the current market is experiencing fluctuations and adjustments, with the Trump administration taking office to further promote crypto-friendly policies, as well as the launch of more cryptocurrency ETFs and the adoption of more and more institutions and sovereign countries, the market is at the forefront of innovation and expansion, full of attraction, and the industry is expected to usher in broader development prospects and richer investment opportunities.