Background: Stablecoins have become a battleground

Cryptocurrency has always been known to the outside world for its high volatility and the rapid rise and fall of tokens, which seems to have little to do with "stability". Stablecoins are mostly anchored to the US dollar, which can not only be used as chips to exchange for other tokens, but also for payment services and other functions. The overall market value of this sector exceeds 200 billion US dollars, which is already a relatively mature sector in the crypto market.

However, the most common USDT and USDC on the market are both centralized institutions, and their combined market share is close to 90%. Other projects also want to grab a piece of this pie. For example, Web 2 payment giant PayPal launched its own stablecoin pyUSD in 2023 to take a position in advance; recently, XRP's parent company Ripple also issued RLUSD in an attempt to challenge the stablecoin market.

The above two cases are more about payment services using stablecoins, most of which are backed by US dollars or short-term government bonds as collateral. Decentralized stablecoins place more emphasis on yield, anchoring mechanism, and composability with DeFi.

The market's desire for decentralized stablecoins has never diminished. From DAI to UST, from the types of collateral behind it to the anchoring mechanism, the development of decentralized stablecoins has gone through several iterations. The USDe, which was pioneered by Ethena and uses futures arbitrage + staking to generate income, opened up users' imagination of interest-bearing stablecoins. The market value of USDe stablecoin is also the third in the market, reaching US$5.9 billion. Recently, Ethena and BlackRock have cooperated to launch the USDtb stablecoin with income provided by RWA. This product avoids the risk of negative funding rates and can generate stable interest regardless of bull or bear markets, complementing the overall product line and making Ethena the focus of market attention.

In view of the success of Ethena, more and more interest-bearing stablecoin protocols have emerged in the market, such as Usual, which recently announced a partnership with Ethena; Anzen, which is built on the Base ecosystem; and Resolv, which uses ETH as collateral. What are the anchoring mechanisms of these three protocols? Where do the revenue sources behind them come from? Let WOO X Research show you.

Source: Ethena Labs

USUAL: Strong team background and Ponzi-like token design

RWA is an interest-bearing stablecoin. The interest-bearing assets behind it are short-term government bonds, and the stablecoin is USD0. After staking USD0, you will get USD0++, and $USUAL is used as a staking reward. They believe that the current stablecoin issuers are too centralized, just like traditional banks, and rarely distribute value to users. USUAL will make users the same owners of the project, and 90% of the value generated will be returned to users.

In terms of the project's background, CEO Pierre Person was a member of the French Parliament and a political advisor to French President Emmanuel Macron. Yoko, an executive in Asia, was a fundraiser for the former French presidential election. The project has good political and business relations in France, and the most important thing about RWA is to transfer physical assets to the chain. Supervision and government support are the key to the success of the project. Obviously, USUAL has good political and business relations, which is also a strong moat for the project.

Back to the project mechanism itself, the USUAL token economics has Ponzi properties. It is not just a mining coin and has no fixed issuance volume. The issuance of USUAL is linked to the TVL of the staked USD0 (USD0++), which is an inflation model. However, the issuance volume will vary according to the "income growth" of the protocol, strictly ensuring that the inflation rate < the protocol growth rate.

Every time USD0++ bond tokens are minted, a corresponding proportion of $USUAL will be generated and released to all parties. The minting rate will be the highest at the beginning after TGE, and it is a gradually declining exponential curve. The purpose is to reward early participants and create token scarcity in the later stage, thereby driving up the intrinsic value of tokens.

Simply put, the higher the TVL, the less USUAL is emitted and the higher the value of a single USUAL.

The higher the USUAL price is -> more incentives to stake USD0 -> higher TVL -> lower USUAL emissions -> higher USUAL price

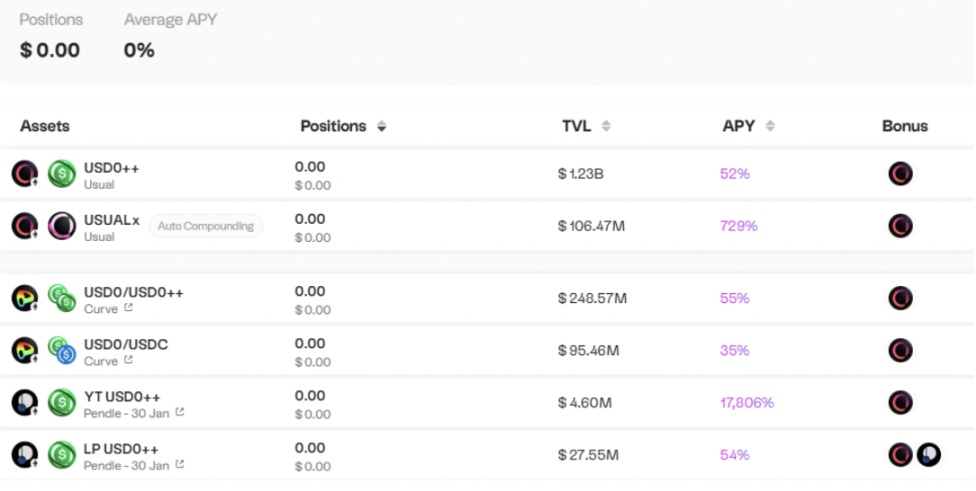

USD0's market value increased by 6.6% in the past week, reaching 1.4 billion US dollars, surpassing PyUSD, and USD0++ APY is also as high as 50%

Recently, Usual has also reached a cooperation with Ethena to accept USDtb as collateral, and then migrated part of the supporting assets of the stablecoin USD0 to USDtb. In the next few months, Usual will become one of the largest minters and holders of USDtb.

As part of this collaboration, Usual will set up a sUSDe vault for bond product USD0++ holders, allowing Usual users to receive sUSDe rewards while continuing to maintain base exposure to Usual. This will enable Usual users to take advantage of Ethena's rewards while increasing Ethena's TVL. Finally, Usual will incentivize and enable swaps between USDtb-USD0 and USDtb-sUSDe, increasing liquidity between core assets.

Recently, they also opened USUAL staking, with rewards shared by stakers at 10% of the total USUAL supply, and the current APY is as high as 730%.

generally:

- Current Price: 1.04

- Market capitalization ranking: 197

- Market value: 488,979,186

- TVL: 1,404,764,184

- TVL/MC: 2,865

Source: usual.money

Anzen: Tokenization of Credit Assets

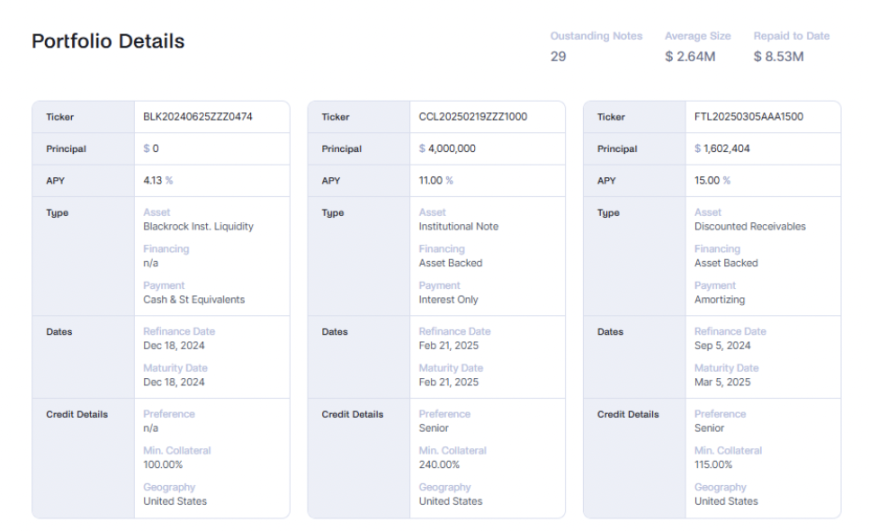

USDz issued by Anzen currently supports five supply chains, including ETH, ARB, MANTA, BASE and BLAST. The assets behind it are private credit asset portfolios. USDz can obtain RWA income by staking to obtain sUSDz.

The asset behind it cooperates with Percent, a licensed US broker-dealer. The portfolio risk exposure is mainly in the US market. The maximum proportion of a single asset does not exceed 15%. The portfolio is diversified into 6-7 assets, and the current APY is about 10%.

The partners are also well-known in traditional finance, including BlackRock, JP Morgan, Goldman Sachs, Moody's Ratings, and UBS.

Source: Anzen

In terms of financing, Anzen received $4 million in seed round financing, with participation from Mechanism Capital, Circle Ventures, Frax, Arca, Infinity Ventures, Cherubic Ventures, Palm Drive Ventures, M31 Capital, and Kraynos Capital. It used Fjord to raise funds in the public offering and successfully obtained $3 million.

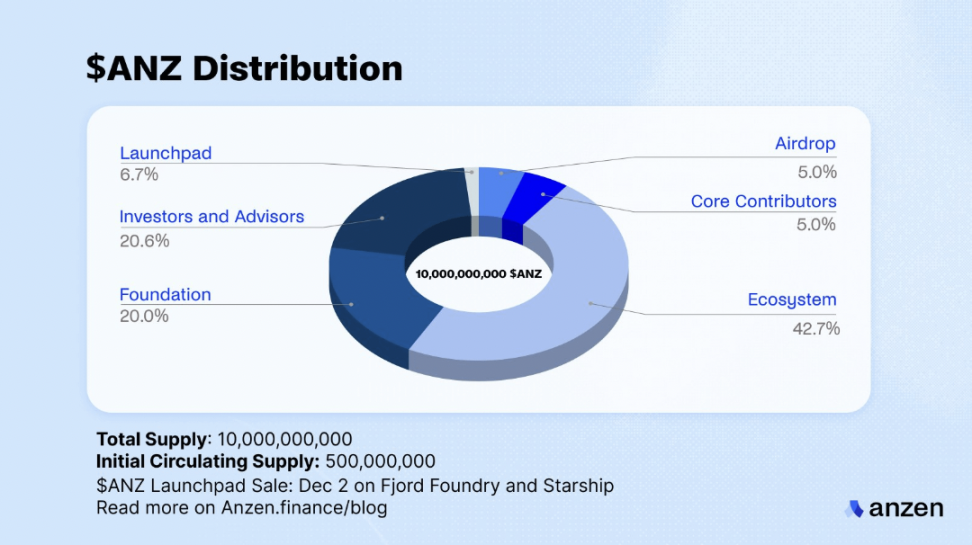

In terms of ANZ token design, using the ve model, ANZ can lock up and pledge to obtain veANZ and obtain a share of the protocol revenue.

Source: Anzen

ANZ:

- Current price: 0.02548

- Market capitalization rank: 1,277

- Market capitalization: 21,679,860

- TVL: 94,720,000

- TVL/MC: 4,369

Resolv: Delta Neutral Stablecoin Protocol

Resolv has two products, USR and RLP.

- USR: A stablecoin minted with ETH as collateral and minted with excess collateral. The price is pegged by RPL, and you can pledge USR to obtain stUSR and earn income.

- RLP: USR has more than 100% collateral, and the excess collateral is used to support RLP. RLP is not a stablecoin. The amount of collateral required to mint or redeem RLP tokens is based on the latest RLP price.

Resolv uses a Delta-neutral strategy to generate ETH for USR, with most of the collateral stored directly on the chain and pledged. A portion of the collateral is kept by institutions as futures margin.

100% of the on-chain collateral is deposited in Lido, and the short collateral margin is between 20% and 30%, which means using 3.3 to 5 times leverage, of which 47% is in Binance, 21% in Derlibit, and 31.3% in Hyperliquid (using Ceffu and Fireblocks as Cex custodians)

- Source of income: on-chain staking and funding rate

- Base Rewards (70%): stUSR + RLP Holders

- Risk Premium (30%): RLP

Assume the collateral pool realizes a profit of $20,000:

- The basic reward calculation formula is $20,000*70%=$14,000, and it is distributed proportionally based on the TVL of stUSR and RLP

- The risk premium calculation formula is $20,000*30%=$6,000, which is allocated to RLP.

From this we can see that RLP gets more commissions, but if the funding rate is negative, funds will be deducted from the RLP pool and the RLP risk will also be higher.

Recently, Resolv launched the Base network and also launched a points activity. Those who hold USR or RLP can earn points, paving the way for the subsequent coin issuance.

Related data:

- stUSR: 12.53%

- RLP: 21.7%

- TVL: 183M

- Collateralization rate: 126%