Author: Azuma, Odaily Planet Daily

The two leading DeFi projects Aave (AAVE) and Chainlink (LINK) both saw a significant increase today, but the reason was not that Trump concept WLFI increased its holdings again (see "What assets may the Trump family project WLFI buy next?" for details), but that the two major projects have joined forces to promote a real cooperation, which is expected to help both parties increase their annual revenue by tens of millions of dollars.

OKX market data shows that as of around 11:00 Beijing time, AAVE was temporarily reported at 377.69 USDT, with a 24-hour increase of 16.66%; LINK was temporarily reported at 23.9 USDT, with a 24-hour increase of 5.8%.

Chainlink SVR

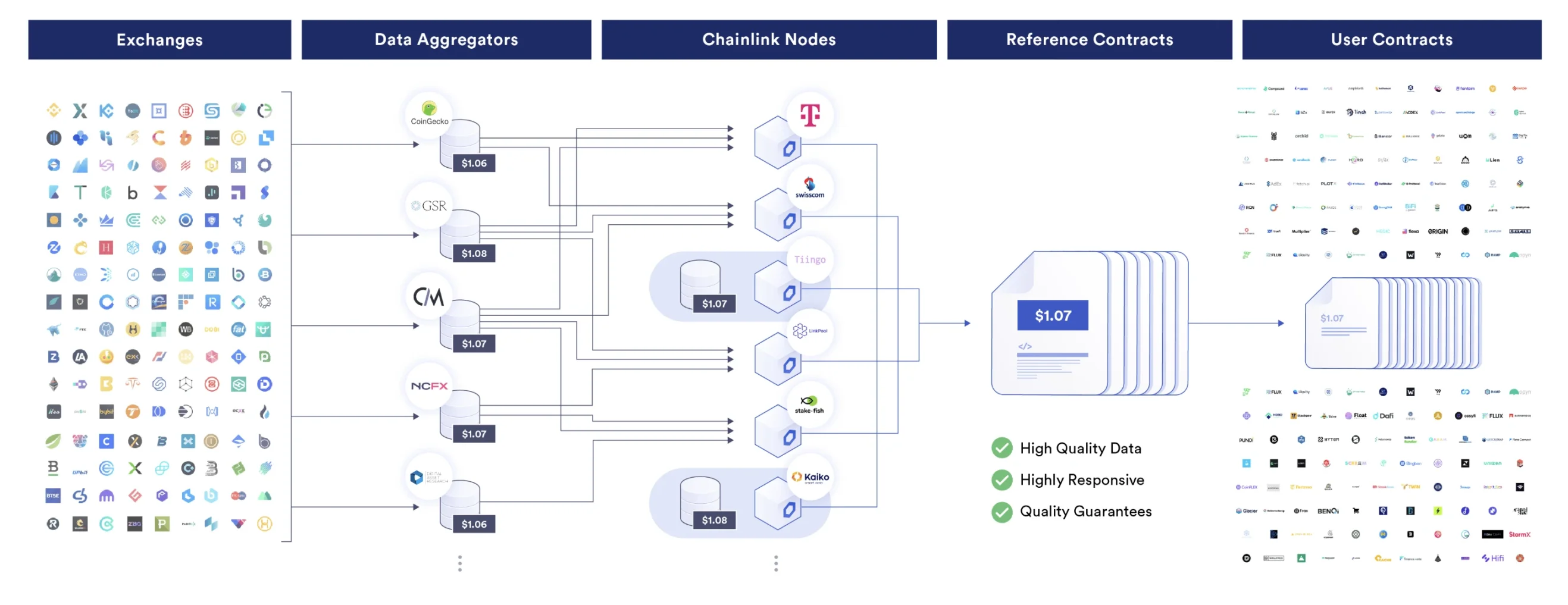

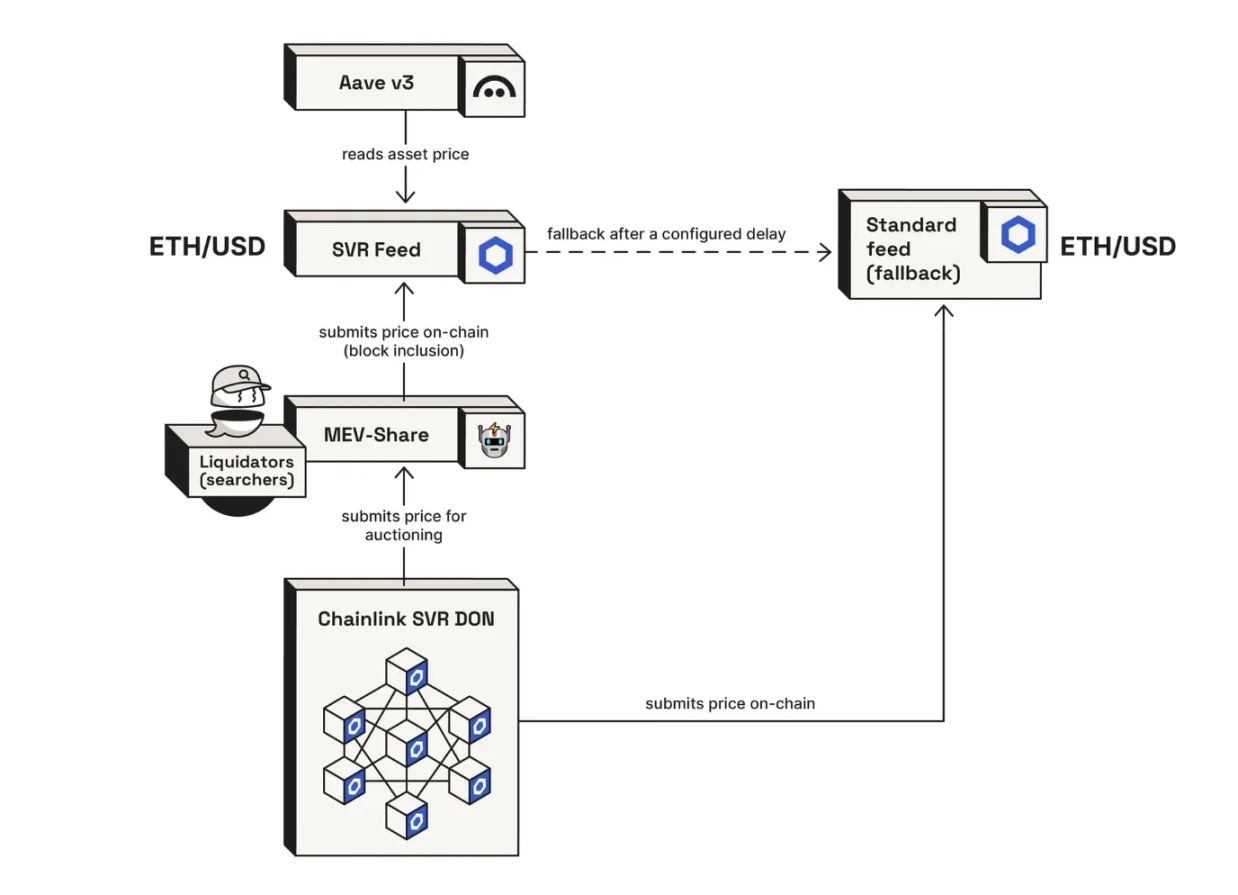

Early this morning Beijing time, Chainlink officially announced the launch of a new service called "Smart Value Recapture (SVR)", a new oracle solution designed to enable DeFi applications to recover MEV value in a "non-toxic" manner through Chainlink's quotes.

MEV, or "Maximal Extractable Value", refers to the value that a block proposer gains by including, excluding, or changing the order of transactions in a particular block. As a subset of MEV, OEV ("Oracle Extractable Value") refers to the MEV generated when oracle reports are transmitted on-chain and consumed by on-chain applications. The most common OEV opportunities occur in lending protocols, especially during liquidation.

Odaily Note: The term OEV is actually a habitual misreading, because it does not mean that the oracle will actively extract value from the user, but refers to the MEV associated with the oracle.

In the current DeFi operating environment, the value of MEV (especially OEV) is captured by participants in the block construction process, such as searchers, builders, and validators, without returning to the DeFi protocol, end users, and oracles that originally generated MEV. If there is a way to recycle these MEVs, it will help return the relevant value to its original creator.

This is the original intention of Chainlink to build SVR. From the perspective of application scenarios, Chainlink SVR cannot be used for controversial MEV plundering scenarios such as front-running or mezzanine attacks, but is built specifically for value recovery scenarios related to liquidation, that is, to solve the OEV problem that generally plagues lending protocols.

Aave Community Proposal Integration

As one of the partners in the development of the initial version of SVR (specifically including BGD Labs, Flashbots, and Aave DAO), as soon as Chainlink’s announcement was issued, BGD Labs immediately launched a preliminary proposal on the Aave community forum, proposing that Aave integrate SVR as soon as possible.

BGD Labs pointed out that Aave’s long-term stable operation has proved the effectiveness of its liquidation mechanism, but there are also obvious MEV arbitrage opportunities - in actual liquidation scenarios, builders often make considerable profits without the entity doing most of the work; at the same time, searchers, that is, protocol users, receive a much smaller proportion.

Chainlink's SVR is expected to properly solve this problem and more finely define who is the entity that benefits most from transaction ordering. Inexpensive For stability reasons, BGD Labs recommends deploying SVR on only 1-3 assets in the initial pilot to advance the integration work in a controlled manner.

Potential value capture scale

According to Chainlink data, after actual testing, Chainlink SVR is expected to achieve an actual value recovery rate of about 40% - for every $100 leaked through MEV liquidation, $40 can be recovered).

Chainlink added that while some alternative solutions claim to achieve higher liquidation recovery efficiencies, the team has yet to see hard real-world data to prove this. 40% is a conservative but realistic estimate for SVR, but actual performance is needed to collect real data.

BGD Labs added that the 40% recycling efficiency corresponds to the scale of past MEV leakage and is expected to achieve tens of millions of dollars in value recovery.

It is worth mentioning that BGD Labs added that in order to simplify the system, the asset form receiving the recovered value will be ETH.

Revenue Sharing Program

In its announcement about SVR, Chainlink stated that the value recovered by SVR is planned to be distributed between the integrated DeFi protocols and the Chainlink network according to a standard ratio, with 60% of the value flowing to the DeFi protocol and 40% to the Chainlink ecosystem - the ratio is not fixed and may be adjusted in the future.

For the first partner, in order to achieve long-term cooperation with Aave, Chainlink proposed to pay 65% to Aave and 35% to Chianlink in the first six months, but the relevant data must be approved by Aave community governance.

As for the final destination of the value after the division, Chainlink did not mention it explicitly, but only mentioned that "the economic sustainability of the Chainlink oracle can be supported by paying transaction gas costs and other ongoing infrastructure costs"; but on the Aave side, BGD Labs has clearly proposed to use recycled value to benefit users, such as providing incentives to pledgers of the Umbrella module - this may be one of the reasons why AAVE's current increase is more obvious than LINK.