Original: Flipside

Compiled by: Yuliya, PANews

With the rapid development of the Web3 ecosystem, 2024 has become a milestone year for blockchain user growth. Major blockchain networks have set new records in the number of new users and the scale of super users. Among them, emerging public chains such as Base have redefined the possibility of user growth, while Ethereum and its L2 network have demonstrated the ability of mature ecosystems to adapt to evolving user needs.

However, in-depth analysis of on-chain data shows that there are significant differences in the quality of user growth. This phenomenon highlights that when evaluating on-chain activities, it is necessary to pay attention not only to quantitative indicators, but also to the quality dimension of user participation. Based on Flipside's 2024 on-chain crypto user real-time data, this report comprehensively evaluates the annual cryptocurrency ecosystem development status by combining traditional performance indicators with multi-dimensional operational indicators, and provides a new analytical framework for the 2025 on-chain user health assessment.

TL;DR

Beneath the surface of record user growth lies a deeper challenge: how to build ecosystems that create meaningful, lasting engagement, rather than short-lived speculative activity. In short, most blockchains are still in their infancy in converting average users into high-value contributors.

New user information:

- Base set a record of 19.4 million new users in October 2024, of which Base contributed 13.7 million, almost eight times that of the second-place Polygon.

- Although the price of Bitcoin has exceeded $100,000 to set a record high, its average monthly new users are only 935,900, indicating that speculative activities among existing users are more common rather than significant entry of new users.

- Ethereum added an average of 1.56 million new users per month, surpassing Arbitrum and Optimism, and grew by 33.4% month-on-month in March. It is worth noting that Arbitrum’s monthly new users peaked at 3.3 million in May.

Super User Performance:

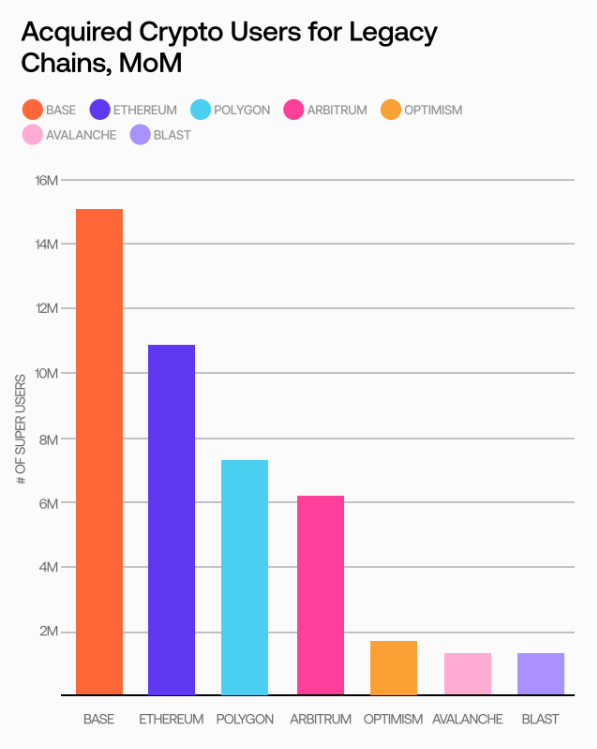

- Base attracted 15.1 million wallets that performed 100+ DeFi transactions, 38.4% more than the second-place Ethereum’s 10.7 million super users.

- Ethereum’s 10.9 million DeFi-related super users exceed the combined total of Arbitrum and Optimism (6.2 million and 1.8 million, respectively), highlighting Ethereum’s advantages in liquidity and convenience.

- Polygon added 1.5 million super users in 2024 and recorded 867.7 million super user transactions throughout the year, highlighting its success in application scenarios beyond DeFi.

DEX usage:

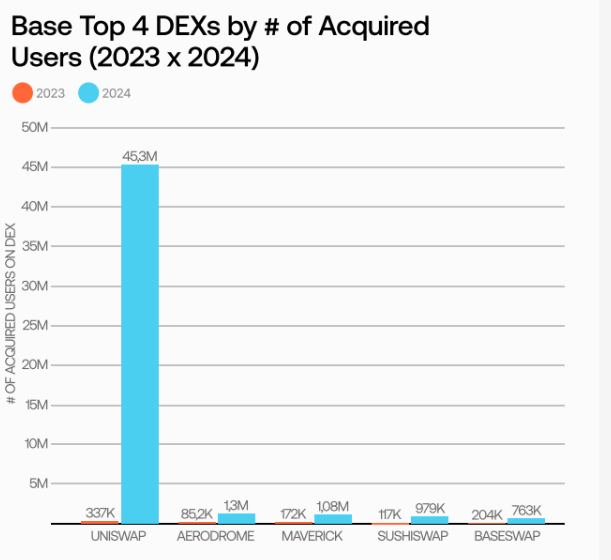

- Uniswap expanded its dominance on major public chains, accounting for 91.3% of new user DEX activity on Base and a 27.72% increase in market share on Ethereum from 2023.

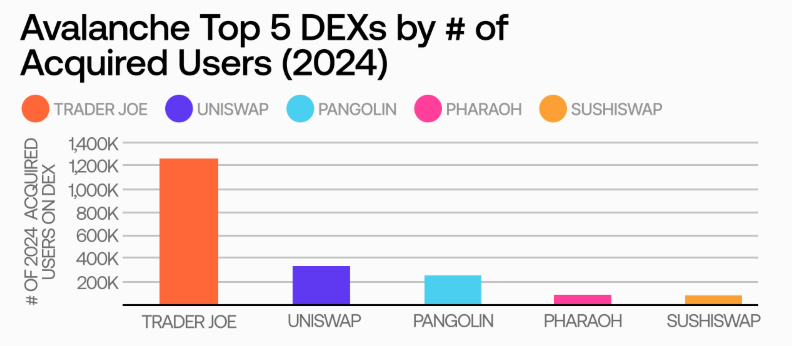

- Despite Uniswap’s continued expansion, Trader Joe’s maintained its lead over Avalanche with 61.1% market share, up 6.1% from 2023.

- Unlike 2023, the top three DEX rankings for new users and super users on each chain remain consistent.

Add a new user

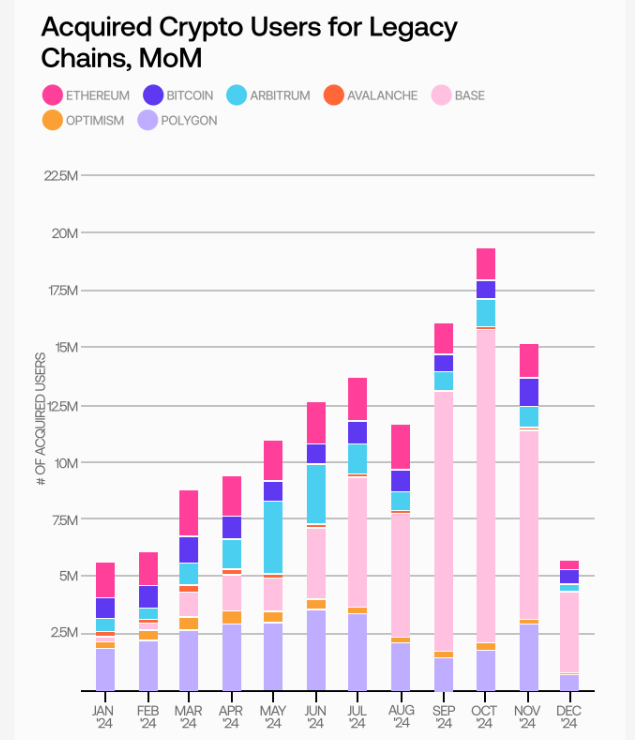

In October 2024, the number of new users reached a monthly high of 19.4 million.

This year's on-chain user growth was led primarily by Base, which contributed 13.7 million new users this month - almost eight times the second-place Polygon. Overall, this was an impressive year for on-chain user growth industry-wide, with new users continuing to rise throughout 2024, with only a small pullback in August.

*Note: "New users" here are defined as users who have conducted at least 2 transactions on a certain chain, and their second transaction occurred in 2024.

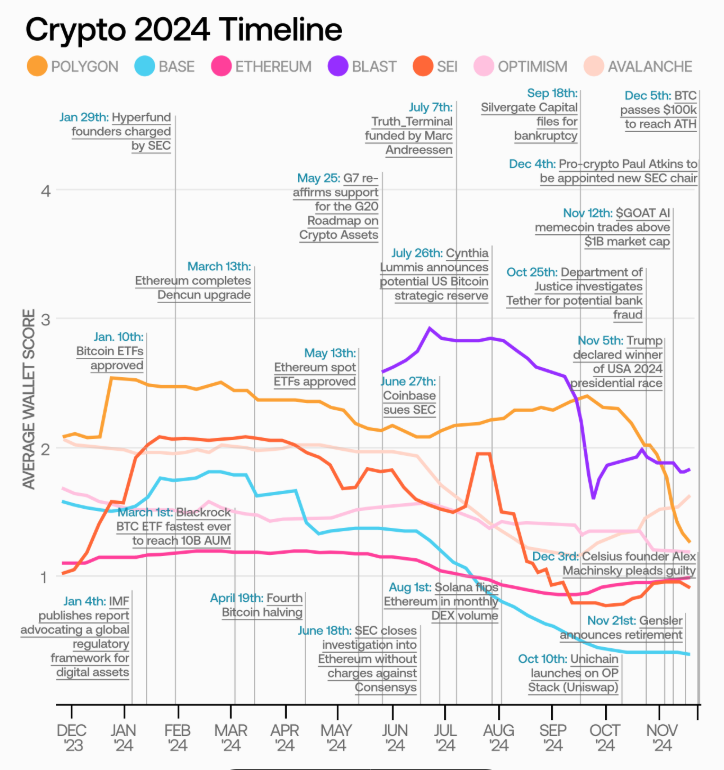

This continued growth may have been influenced by the growing institutional acceptance of cryptocurrencies, as evidenced by the slew of BTC and ETH ETFs announced earlier this year.

Other exciting developments in the first half of 2024 may also have fueled this optimism, such as Grayscale’s inclusion of multiple new cryptocurrencies among its “assets under consideration” and the September 2024 Federal Open Market Committee (FOMC) meeting, at which the Fed cut U.S. interest rates by 50 basis points — its first rate cut in four years.

Base's performance

Base had a slow start in 2024, but its monthly new users have skyrocketed 56-fold since January.

Base only had 244,700 new users in January, but experienced steady and significant growth throughout the year.

By its peak in November, the chain’s monthly number of new users had increased 56 times compared to January, with an average of 4.7 million new users per month in 2024.

The chain benefits greatly from Coinbase’s massive user base, which collectively controls around $130 billion in assets.

Popular DeFi protocols like Aerodrome may have also attracted users from other EVM chains, while Base has successfully attracted attention in hot areas such as meme coin trading and on-chain AI through new initiatives such as Based Agents.

Bitcoin Performance

Despite record high prices, Bitcoin has not attracted a large number of new users this year.

In 2024, the number of new Bitcoin users remained relatively stable, despite the significant appreciation of BTC value. Overall, Bitcoin averaged 935,900 new users per month this year, ranking third from the bottom among the seven traditional chains observed in this report.

This suggests that Bitcoin’s price gains are primarily driven by enthusiasm and speculation from its existing user base, while BTC price growth has had mixed results in attracting new users.

In March 2024, BTC’s first major price surge coincided with a 19.2% month-over-month increase in new users, but in November — when BTC reached the long-awaited $100,000 milestone amid an ongoing price rally — new users actually fell by 28.5% month-over-month.

Ethereum and Layer 2 Performance

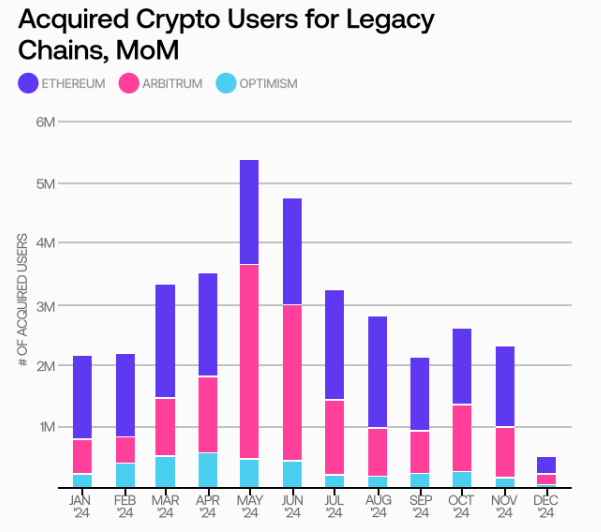

Ethereum’s new users overall outpaced its legacy L2 counterparts, but Arbitrum also saw impressive monthly growth.

In 2024, Ethereum’s growth exceeded that of its two major L2 chains, with an average of 1.56 million new users per month, compared to 1.2 million for Arbitrum and 348,800 for Optimism. Excluding December, Ethereum only saw a month-on-month decline in four months, reaching a peak of 1.9 million new users per month in March - a month-on-month increase of 33.4%.

Both Arbitrum and Optimism started the year with fairly strong momentum, reaching their peak new user growth in April and May, respectively, before user growth declined for the rest of the year.

It is worth noting that Arbitrum’s 3.3 million new users in May exceeded any single-month peak of Ethereum in 2024. In this context, Arbitrum’s new user growth continued to exceed Optimism throughout the year, thanks to the success of its Arbitrum One program and the expansion of GameFi and SocialFi integrations. With 169 builder grants approved in the first half of 2024, coupled with many behind-the-scenes progress, it remains to be seen whether the chain can regain its position as the world’s leading EVM L2 chain.

Performance of the new release chain in 2024

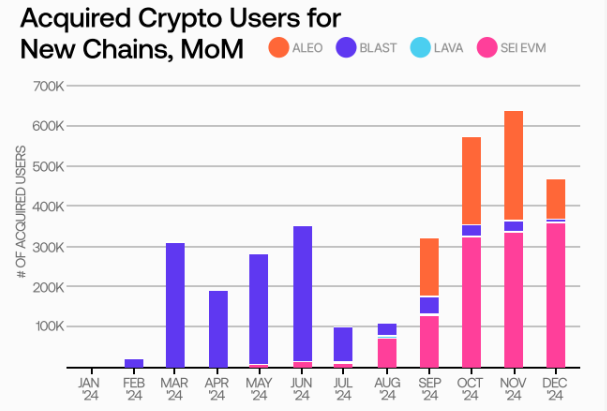

Among chains launched in 2024, Aleo achieved the highest average growth in new users, while Blast faded after setting a single-month record.

In terms of newly launched chains, Aleo achieved the highest growth in new users in the month the chains were launched, with an average of 175,200 new users per month, while Blast and Aleo had 134,900 and 90,700 users respectively. This can be attributed to the sharp decline in user acquisition of Blast since July, and the slow start of Sei, which did not reach a peak of 324,500 users month-on-month until October despite its mainnet launch.

Whether these chains can regain momentum in 2025 is unclear — especially considering that Base experienced a similar post-launch slump before surging in 2024. Of the four new chains tracked, Lava’s performance so far has been overshadowed by its competitors, and while Blast posted the highest monthly new user growth of any newly launched chain in June, it still has a lot of catching up to do.

Super User

Base's performance

As of December 2024, Base has the most DeFi-related super users, with 15.1 million wallets performing 100 transactions or more.

In addition to gaining the most new users, Base also attracted the largest number of DeFi-related super users, with 38.4% more users performing 100 or more transactions than the second-place Ethereum. It was followed by Ethereum with 10.7 million new super users and Polygon with 7 million.

*Note: "Super user" here is defined as a user who has performed at least 100 transactions on a certain chain, regardless of the time when the relevant wallet was created or the time when the last transaction occurred.

Given Base’s explosive growth this year, its impressive number of super users may not be surprising. This success is likely due to Base surpassing many traditional chains in multiple hot areas this year, including but not limited to Meme coins and NFT transactions.

On the other hand, Avalanche and Blast have similar numbers of super users this year, averaging around 1.3 million, while Optimism has performed slightly better with 1.7 million users making at least 100 DeFi transactions.

Polygon performance

Polygon added the most new super users in 2024, and its non-DeFi related super user activity continued to outperform.

Polygon has attracted 1.5 million new super users so far in 2024 — almost double the number of second-place Base.

Polygon’s superuser activity also outpaced all other observed chains, averaging 867.7 million monthly superuser transactions this year. In addition to Base’s impressive 786.3 million superuser transactions, Arbitrum has also had a strong year to date in 2024, with 365.3 million superuser transactions.

Polygon’s strong performance is a continuation of the chain’s multi-year dominance in super user activity beginning in 2021. The chain’s performance in 2021 continues to hold the record for super user activity among all observed chains, reaching 1.14 billion transactions.

However, despite having the highest super user activity of all observed chains, Polygon ranks third in terms of the number of DeFi-related super user wallets. This shows that the chain has successfully incentivized high transaction volume through GameFi and other alternative use cases.

Ethereum’s performance

Ethereum has more DeFi-related super users than Arbitrum and Optimism combined.

Ethereum has 10.9 million active super users in the DeFi space so far in 2024, second only to Base. This represents a larger base of DeFi super users than Arbitrum and Optimism combined (6.2 million and 1.8 million, respectively).

Considering that EVM L2 is generally faster and less expensive, this may indicate that many users still consider bridging assets across chains too inconvenient or risky, or that they value the advantages brought by Ethereum’s deeper liquidity and dominant market position.

Regardless, it’s clear that Ethereum’s L2s need to find more ways to attract activity than simply highlighting their on-chain performance advantages over Ethereum mainnet.

DEX Use

Uniswap’s Market Dominance

Uniswap has grown its market share across all major chains, further strengthening its dominance in the DEX space.

Uniswap ranked first on all observed chains except Avalanche and Blast. Its largest growth occurred on the Base chain, where Uniswap’s user base grew from 36.8% of total DEX activity to 91.3% — a particularly significant increase considering Base’s exponential user growth this year.

Likewise, Uniswap has seen growth on other major chains:

- Relative DEX activity on Ethereum is up 27.72% from 2023

- Polygon grew 12.57% (the chain has historically had more widely distributed DEX activity across the user base)

Leaving aside Uniswap’s protocol upgrade, this may reflect a “winner-takes-all” trend in the DeFi space, disproportionately favoring large incumbent players with deeper liquidity and greater brand awareness.

Trader Joe's Leads on Avalanche

Despite Uniswap’s rise in the rankings, Trader Joe’s increased its lead over Avalanche:

- Uniswap is now the second most popular DEX on Avalanche (barely making the top 5 in 2023)

- Trader Joe’s remains the most popular DEX on Avalanche, accounting for 61.1% of all DEX activity

- Market share has increased by approximately 6% since 2023

As the first major DEX built natively on Avalanche, Trader Joe’s has made a number of efforts to maintain and expand its leading position:

- Auto-Pools was launched in April to facilitate LP automatic rebalancing of positions and compound interest rewards

- Liquidity staking enabled for various Avalanche assets

- Actively expanding to new chains such as Arbitrum and BNB Chain, proving the viability of its unique Liquidity Ledger (LB) model

DEX usage trend analysis

DEX preferences of super users and newly acquired users are converging, but trading activity is less concentrated among super users :

- Unlike 2023, the top three used DEXs for each observed chain are the same among both super users and newly acquired users

- The trading activity of super users is more evenly distributed across multiple DEXs

- This may reflect their familiarity with the wider DeFi protocols and their willingness to seek more favorable opportunities outside of mainstream protocols such as Uniswap.

Looking forward to 2025: Opportunities and challenges of Web3

On-chain data shows that Web3 user growth continues to rise in 2024, and both traditional chains and new competitors are under pressure to differentiate themselves and provide attractive use cases for new and old users. In addition, the data clearly shows that the rise in the price of public chain native tokens does not necessarily lead to more diverse on-chain activities, and emerging DeFi protocols have also encountered difficulties in challenging existing projects that have established advantages.

Here are some key trends to watch as we head into 2025:

- Base as a model for ecosystem expansion

Base achieved unprecedented user growth in 2024, setting a benchmark for new user introduction and activation, which may be instructive for other new public chains trying to gain momentum. Base's success in Meme coin trading and on-chain AI shows that innovative application scenarios in emerging fields will continue to drive growth in 2025.

However, how to translate these activities into higher user quality through sustained and diverse user engagement remains a key challenge.

- Ethereum’s growing user base is an opportunity for L2

Despite the performance advantages of L2 networks, Ethereum’s growing user base and liquidity advantage further strengthen its position as the base layer of the Web3 economy. Chains like Optimism may improve their strategies to remain competitive and convince Ethereum’s growing number of ordinary users to enter their on-chain ecosystem.

- Success requires differentiation or economies of scale

Uniswap’s growing dominance suggests a “winner takes all” trend in most major DeFi markets. Nevertheless, public chains like Avalanche and Polygon are proving that targeted innovations like Trader Joe’s automated pools or Polygon’s GameFi program can carve out sizable market segments.

In 2025, protocols that focus on developing differentiated on-chain products that go beyond “basic” DeFi activities will be key to gaining more market attention.

- As new users enter the market, chains will shift from focusing on quantity to focusing on quality

Ecosystem builders who can find ways to incentivize consistent, balanced participation in multiple activities beyond trading, such as governance and staking, will be better positioned for sustainable growth. Chains that prioritize high-quality participation will see long-term ecosystem health as wallet growth accelerates.

Summarize

Overall, as the number of wallets across chains has grown and overall transaction volume has increased this year, the quality of users has decreased. Given the recent record highs in user activity and token valuations, this reflects the influx of new users into the industry - users who currently participate only occasionally, but who are likely to be guided to the various different use cases that Web3 offers.

(User quality trends of each public chain)

Key findings include:

Base's performance

- Base is one of the biggest success stories of 2024 in terms of user growth.

- The chain’s lower user quality score is therefore not a negative for Base’s overall performance. Rather, it highlights that its large new user base currently participates in a narrow range of on-chain activities — while also highlighting the upside potential to guide these users towards deeper, more multifaceted on-chain activities.

Ethereum’s performance

- Ethereum saw the biggest drop in user quality ahead of the launch of multiple SEC-approved ETH ETFs.

- This suggests that institutional buying may trigger wallet growth, but will not necessarily lead to broader and deeper on-chain activity without more incentives and easy on-ramps (such as protocol governance).

Blast Performance

- Blast’s user base demonstrated broad and deep engagement at launch, reflecting the chain’s ability to incentivize a variety of gamified on-chain activities.

- While Blast’s user growth declined significantly in Q4 2024, its remaining users remain active across multiple fronts, suggesting the chain has the potential to transcend its initial hype and achieve greater success.