Bai Qin, Mankiw LLP

As an international financial center, Hong Kong has a mature asset management system and has expanded it to the field of virtual assets. In particular, various crypto-friendly policies have attracted Web3 entrepreneurs to try to settle in since 2024. Bai Zhen, head of Mankiw Law Firm's Hong Kong office, found in past consultations that many Web3 entrepreneurs often have some confusion when choosing to set up a crypto fund in Hong Kong, such as not being able to distinguish some fund concepts and worrying about the complex regulatory environment and cumbersome procedures.

If you have the same confusion, don't worry, Attorney Mankiw will answer it for you.

3 core concepts

Before setting up a crypto fund, you first need to clarify three core concepts, which are often the "culprits" that cause confusion for fund setters.

1. Fund Manager

Fund Manager is the person responsible for making investment decisions.

Unlike the mainland, Hong Kong allows private funds to be independently managed by fund management companies without the need to designate fund managers. However, for public funds that invest in virtual assets, such as Bitcoin ETFs, the CSRC requires the appointment of at least one key investment person (KIP = Key Investment Personnel), that is, a qualified employee with relevant experience who is responsible for investment strategy and compliance.

2. Fund management companies

A Fund Management Company, i.e. a company operating a crypto fund, needs to obtain a Category 9 license (asset management) issued by the CSRC . This involves the following requirements:

- Capital requirements . Maintain a minimum level of capital, the amount of which depends on the size of your company.

- Compliance framework . Establish a comprehensive compliance framework, including anti-money laundering (AML) and counter-terrorism financing (CFT) measures.

- Risk management . Implement effective risk management strategies to reduce virtual asset investment risks.

3. Fund product structure

As an investment vehicle, fund products must ensure that their assets are completely separated from the personal assets of fund management companies and fund managers. This separate fund product structure is designed to reduce the risk of asset misappropriation and protect the interests of investors. Fund product structures usually include the following key points:

- Asset separation : Ensure that fund assets are independent of the assets of the fund manager and other related parties, and safeguard the property security of investors.

- Legal Entity . Funds are usually registered as separate legal entities to enhance asset protection and management transparency.

- Investor rights and interests . In the design of fund product structure, the rights and interests of investors must be clearly defined, including terms such as profit distribution and asset redemption.

After mastering these three key concepts, the next key topic is “how to set up the fund structure”.

Crypto Fund Establishment

Here are the key steps and elements to consider when setting up a crypto fund:

1. Choose the right fund type

To set up a crypto fund in Hong Kong, you first need to choose the right fund type. The two main categories are as follows:

- Private equity funds. They are aimed at high-net-worth individuals (individual professional investors), corporate professional investors (corporate professional investors) or institutional professional investors (institutional professional investors). They have a high investment threshold and relatively loose supervision at certain levels.

- Public offering funds. They are oriented to public investors and are more strictly regulated, such as Bitcoin ETFs. For crypto funds targeting the retail market, the following specific requirements also need to be considered:

- Investment scope . Only invest in virtual assets approved by the China Securities Regulatory Commission to reduce risks.

- Disclosure requirements . Provide investors with comprehensive disclosure of information, including the nature of investments, risks and fund structure.

- Ongoing reporting . Regularly report fund performance, compliance status and changes in management strategies to the CSRC.

2. Determine the fund structure

Here are some common fund structures:

- Unit Trust . Under this arrangement, investors purchase shares of a fund, which represent proportional ownership of the fund's underlying assets. The fund's assets are overseen by a trust company, which is tasked with managing and servicing those assets. The unit trust model is particularly good at pooling resources from multiple investors, which is very beneficial for the capital-intensive operations that are typically required to establish and manage crypto funds in Hong Kong.

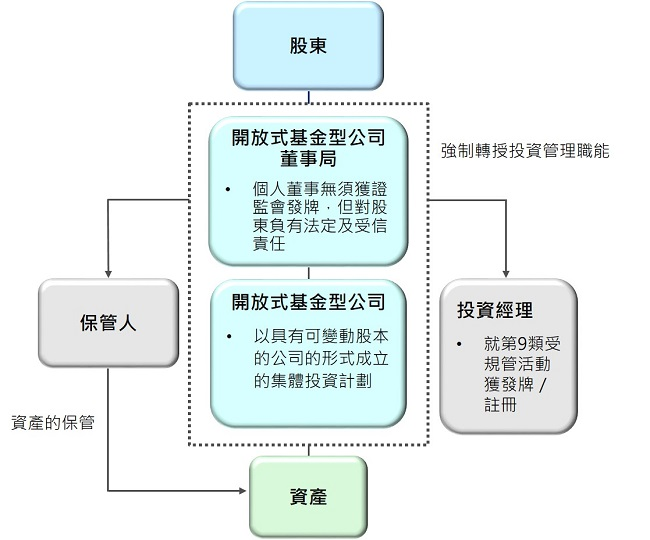

- Open-Ended Fund Company (OFC) . OFC is an investment fund registered in Hong Kong in the form of a company. It is different from a unit trust because it is an independent legal entity with a board of directors. Directors have fiduciary duties and statutory prudence, skill and diligence obligations to OFC. Note: Don't be confused by the name "open-ended". In the OFC fund structure of the Hong Kong Securities and Futures Commission, although the name refers to "open-ended", OFC can actually be closed, as long as the redemption restriction clause is stipulated in the OFC's offering document and the OFC's articles of association envision that OFC is a closed-ended fund.

- Limited Partnership . Partners include general partners and limited partners, with clear distribution of responsibilities and rights. Limited partnership structures are often used in private equity projects involving illiquid assets.

Below is an example of an OFC structure in Hong Kong. The SPC/SP structure in the Cayman Islands consists of a master fund ( SPC = Segregated Portfolio Company ) and multiple sub-funds ( SP = Segregated Portfolio ). Hong Kong also has a similar OFC open-ended fund company framework, which can reduce operating costs because there is no need to set up a new company for each sub-fund.

*Image source: SFC website

In the context of crypto funds, a structure like SPC or OFC has advantages because it allows fund managers to implement multiple strategies in different portfolios, which depend on the virtual assets in each portfolio. In this regard, it is a win-win for managers and investors, because investors can choose which portfolio they want to invest in without having to worry about their assets flowing into other portfolios, and managers do not need to set up separate portfolios, which is relatively convenient.

In addition to setting up a crypto fund, a key component needs to be considered - asset custody to ensure the independence, security and transparency of the fund's assets.

Fund asset custody

The quality of custody services directly affects investor confidence and the sound operation of the fund, so you need to be particularly careful when choosing. Hong Kong fund management companies usually adopt the following custody arrangements for different types of assets:

1. Separate accounts

Segregated Account means that each client's assets are stored in a separate account. This arrangement facilitates accurate calculation of each client's net asset value (NAV) and significantly reduces the risk of asset misappropriation. By managing segregated accounts, asset traceability and transparency are improved, meeting the strict requirements of Hong Kong regulators for fund asset management.

2. Hybrid Funds

A commingled account is a fund product in which an investment manager collects funds from different investors and combines them into one vehicle. This approach simplifies the management process and reduces operating costs through economies of scale. However, it also requires more complex administrative procedures and higher compliance requirements. In order to protect the interests of each investor, Hong Kong fund management companies have established a strict investment allocation and redemption mechanism and conduct regular audits to ensure the safety and fairness of the fund.

Additional custody measures and considerations for crypto fund management in Hong Kong include:

- Encryption technology. Custody services usually use advanced encryption technology to ensure the security of virtual assets during storage and transactions.

- Cold storage solutions. To prevent hacker attacks and asset theft, cold storage (offline storage) should be used.

- Compliance and regulation. Custody services in Hong Kong must comply with the regulatory requirements of the SFC, including but not limited to anti-money laundering and anti-terrorist financing requirements.

- Regular reporting. The custodian needs to provide regular asset reports to fund management companies and investors to ensure the timeliness and transparency of information.

- Risk management. Custody service providers must establish a comprehensive risk management system to cope with market fluctuations and potential risk events.

Through these measures, crypto fund management companies in Hong Kong can provide investors with a safe and reliable investment environment.

Next, when you officially start operating a crypto fund business, you can also pay attention to Hong Kong’s unified fund exemption scheme.

Can crypto funds obtain profits tax exemption in Hong Kong?

Hong Kong’s Unified Fund Exemption Scheme allows funds to be exempt from Hong Kong profit tax under certain conditions. This is irrelevant to the fund’s place of registration. Key conditions must be met, including:

- Must constitute a "fund". You will need to assess whether the structure you adopt meets the definition of a "collective investment scheme" under the Securities and Futures Ordinance.

- All transactions in the fund must be conducted through an entity holding a Type 9 SFC license.

- The fund's investment portfolio must include "securities" assets that meet the definition of "securities" under the Securities and Futures Ordinance.

It is important to note that conditions (I) and (II) are relatively clear, but condition (III) is uncertain for cryptocurrency funds. Therefore, you must be cautious when determining whether your virtual asset portfolio is a "securities" asset as defined in the Securities and Futures Ordinance!

Attorney Mankiw's Summary

Establishing a crypto fund in Hong Kong is full of opportunities, but it also requires careful handling of the complex regulatory environment. Understanding the roles of fund managers, fund management companies and fund products is crucial. Fund management companies can successfully operate crypto funds by complying with SFC regulations, choosing the right custodian and maintaining transparent communication with investors. As the virtual asset space continues to develop, understanding regulatory changes and market trends is essential for long-term success.