The 2024 US presidential election has come to an end, and the Trump camp, which is very popular in the crypto industry, has declared victory. This election can be regarded as a collective "team building" for the crypto industry. From the strong support of top Web3 projects and companies to the large-scale betting by retail investors on various prediction platforms, it shows that Trump and his team are accepted by the crypto industry.

However, if we look back at his first term, Attorney Mankiw found that his relationship with the crypto industry was completely opposite to what it is now. Why is there such a dramatic change from opposition to support? The reason is simple: the enemy of my enemy is my friend, not to mention that this friend has proposed a large number of policies that are beneficial to the crypto industry.

However, although the promise is beautiful, it also needs to be implemented. So, why not take stock of the key favorable policies proposed by our crypto president and whether these policies have begun to be implemented?

Building a Bitcoin Powerhouse

At the Bitcoin Conference in Nashville, Tennessee in June 2024, Trump dropped a bombshell on the global cryptocurrency industry: he promised that if elected, he would adopt a series of policies to push the United States to become the absolute leader in the global Bitcoin field. This plan is based on two major directions: establishing a national strategic Bitcoin reserve and building a Bitcoin mining powerhouse , aiming to establish the United States' technological commanding heights in the global digital economy.

Trump plans to use Bitcoin confiscated by federal law enforcement as the initial reserve assets, and set annual purchase targets through legislation to gradually expand the country's Bitcoin holdings. This move will not only elevate Bitcoin from a "speculative asset" to the level of a "sovereign reserve asset", but may also trigger a global policy chain reaction, prompting other countries to follow suit. At the same time, the signal that the United States directly holds Bitcoin will significantly enhance its legitimacy and liquidity, providing strong support for the internationalization of digital assets.

At the same time, Trump proposed the goal of making the United States a Bitcoin mining powerhouse through policy support and technological innovation. He plans to cut energy taxes on mining companies and provide tax incentives and special subsidies to companies using renewable energy to reduce their operating costs. At the same time, the United States will fund the research and development of high-efficiency mining hardware to reduce dependence on overseas supply chains. Through these measures, Trump hopes to combine Bitcoin mining with the green energy revolution and set sustainable development standards for the global mining industry.

The potential impact of this series of policies is far-reaching and complex. The establishment of a national Bitcoin reserve will significantly enhance Bitcoin's position in the global financial system, and the increase in computing power will further consolidate the United States' dominant position in the Bitcoin network. At the same time, green mining technology innovation will help the industry respond to environmental criticism and set an environmental benchmark for the global mining industry. However, the centralization of computing power may raise concerns about the decentralized nature of Bitcoin, which is also an issue that needs to be paid attention to in future policy implementation.

At present, these plans have begun to take shape. In August, U.S. Senator Cynthia Lummis submitted the Bitcoin Strategic Reserve Act to Congress, proposing to purchase 200,000 bitcoins each year and reach a total of 1 million bitcoins within five years. In November, the Pennsylvania House of Representatives proposed the Pennsylvania Bitcoin Strategic Reserve Act, allowing the state's treasury to allocate 10% of its approximately $7 billion in state funds to Bitcoin. In addition, Texas took the lead in piloting an energy subsidy program for mining companies, working with a number of companies to use wind and solar energy for mining. At the same time, the Trump team is also promoting federal legislation, trying to pass the Bitcoin Energy and Technology Innovation Act to provide legal protection and financial support for the development of green mining technology.

Supporting the further development of stablecoins

Trump promised that after his election, he would formulate more relaxed policies to support the development of stablecoins, aiming to push stablecoins from existing local applications to a wider range of payment and settlement areas, while accelerating the deep integration of traditional finance and cryptocurrency through compliance improvement. He further stated that he would not promote the central bank digital currency (CBDC) issued by the Federal Reserve, believing that CBDC may threaten the innovative spirit of private cryptocurrencies and expand the government's control over the financial system.

Trump's stablecoin policy will develop in three directions:

First, he proposed a clearer regulatory framework for stablecoin issuers to reduce the ambiguity and restrictiveness of current laws.

Secondly, he plans to allow stablecoin issuers to directly access the Federal Reserve payment system to shorten settlement time and reduce transaction costs.

Finally, he specifically proposed that he hopes to optimize international trade payments through stablecoin technology and open up new paths for the international status of the US dollar.

In the past two years, other regions in the world have also been actively promoting the development of stablecoins. The MiCA regulations passed by the European Union in 2023 set strict capital requirements and transparency standards for the issuance of stablecoins. Although it protects the safety of user funds, it also raises the compliance threshold of the industry. Hong Kong is exploring the launch of an official stablecoin to optimize cross-border payments and trade settlements. This officially endorsed stablecoin may become an important payment tool in the Asian market.

In contrast, Trump's policy path is more flexible and market-oriented, and by supporting private stablecoins to replace the CBDC model, he further maintains the dominance of private cryptocurrencies in payments and cross-border settlements. His opposition to the Fed's issuance of CBDCs reserves space for the development of private stablecoins and allows market forces to continue to play a leading role in financial digitalization.

At present, the policy has shown initial signs. In August this year, the U.S. Treasury Department jointly launched the "Payment Stablecoin Regulatory Standards Program" with several stablecoin issuers, intending to develop an international stablecoin payment framework within five years. In addition, the Federal Reserve is conducting tests with several financial technology companies to explore how stablecoins can reduce transaction friction in cross-border payments. However, some traditional banks still have doubts about the rapid development of stablecoins, believing that they may pose competitive pressure on existing payment networks.

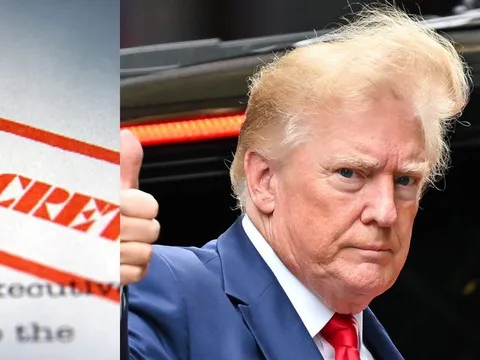

Fire the current SEC chairman

During the 2024 presidential campaign, Trump publicly expressed his dissatisfaction with the current Securities and Exchange Commission (SEC) Chairman Gary Gensler on many occasions, and promised to fire Gensler on his first day in office if elected. He criticized Gensler for being too tough on the regulatory policy of the crypto industry, saying that this law enforcement attitude stifled the United States' potential for innovation in crypto technology and damaged the country's global competitiveness.

For a long time, the SEC, led by Gary Gensler, has taken severe legal actions against a number of cryptocurrency exchanges and projects, and has classified crypto assets as securities and imposed strict supervision. Although this policy attempts to protect investors, it has also caused great dissatisfaction in the crypto industry, which believes that excessive regulation has become a major obstacle to innovation . If Trump fulfills this promise, fires Gensler and appoints a leader who is more friendly to the crypto industry, it will bring about a significant policy shift, which will help boost industry confidence, attract more capital into the U.S. market, provide a more favorable operating environment for crypto companies, and promote the rapid development of the industry.

However, the plan faces legal and political challenges. Under current law, the SEC is an independent agency and its chairman cannot be directly removed by the president unless there is a clear legal basis, such as malfeasance or illegal behavior. However, there are historical precedents that show that many leaders of independent agencies choose to resign when a new president takes office.

In addition, Trump hinted in a tweet on November 10 that he might bypass the traditional Senate confirmation process and directly appoint the next SEC chairman through a recess appointment. He also mentioned that he would work with potential Senate majority leaders to promote recess appointments to "immediately" fill vacancies in important positions. According to the U.S. Constitution, recess appointments allow the president to grant temporary appointments during the Senate recess, which are valid until the end of the next Senate session.

Repeal of SAB121

Trump made a clear promise during his campaign that if elected, he would repeal the accounting announcement SAB 121 issued by the SEC in 2022. The requirements of this announcement are widely considered to be too harsh, especially for crypto asset custody platforms and exchanges, which have almost become a heavy financial burden. According to SAB 121, companies need to treat crypto assets held for customers as a liability and list an asset of the same amount in the balance sheet to reflect the company's responsibility to protect customers' crypto assets. Although this regulation is intended to improve transparency, it actually greatly expands the company's balance sheet, directly restricts the capital operation space, and affects the company's development and expansion capabilities.

Trump said that this policy not only burdened companies with unnecessary costs, but also seriously restricted the competitiveness of American companies in the encryption field. If SAB 121 is repealed, the financial pressure on companies will be greatly alleviated, especially custody platforms and exchanges, which will have more flexible capital for technology research and development and business expansion, thereby promoting the development of the entire industry.

Previously, some Republican lawmakers had proposed specific actions for the reform of SAB 121. In September this year, led by House Financial Services Committee Chairman Patrick McHenry and Senator Cynthia Lummis, 42 Republican lawmakers jointly wrote to SEC Chairman Gary Gensler, demanding the repeal of SAB 121. Although both houses of Congress had previously passed a bill to overturn SAB 121, the bill was vetoed by President Biden in May 2024, stalling the reform process.

As of now, the SEC has not officially responded to the requests of these lawmakers, and SAB 121 remains in effect. However, continued pressure within Congress shows a strong desire to reform cryptocurrency accounting rules, and there may be further legislation or policy adjustments in the future.

Ending Operation Stranglehold 2.0

Trump made it clear during his campaign that if elected, he would immediately end the regulatory action known as "Operation Choke Point 2.0" to ensure that the banking system can provide a fair service environment for crypto companies . He believes that this implicit policy has not passed a transparent legislative process and has restricted the ability of cryptocurrency companies to access the traditional banking system, which is one of the main reasons hindering the development of the US crypto industry.

"Operation Stranglehold 2.0" is widely regarded by the crypto industry as a hidden suppression by regulators. Its core means is to put pressure on banks to reduce or interrupt services to cryptocurrency companies. This approach not only puts a large number of crypto companies in financial difficulties, but also directly affects the competitiveness of the United States in the global crypto economy. Therefore, Trump's promise to end "Operation Stranglehold 2.0" can not only create a fairer financial environment for the crypto industry, but also restore the market's trust in the US financial system.

At present, although there is no definite plan to abolish it, Trump's statement has won widespread support from the crypto industry. Many practitioners believe that if this policy can be truly implemented, it will greatly improve the living environment of crypto companies, especially in terms of banking channels and capital flows, and eliminate unfair treatment of the industry.

Attorney Mankiw's Summary

Trump's victory has undoubtedly injected a shot of adrenaline into the crypto industry in the United States and even the world. Whether it is to establish a national strategic Bitcoin reserve, support the development of stablecoins, or abolish the SEC's SAB 121 policy, these promises directly target the pain points of the industry and attempt to fundamentally change the regulatory environment of the U.S. crypto industry. However, although these policy promises are exciting, their implementation path and operability are still full of unknowns. After all, whether these policies can be smoothly promoted still depends on the complex legislative and administrative system of the United States.

However, these proposals also provide some reference for the regulation of the global crypto industry, such as how to balance innovation and risk, stablecoins and cross-border payment paths. In the context of global economic integration, the US policy choices will inevitably have spillover effects on other countries . In particular, the opposition between the development of stablecoins and CBDC is more likely to become a key area of international financial competition in the future. Countries may need to rethink the balance between international settlement and financial sovereignty.

For China, these changes are both challenges and opportunities. We need to continue to pay attention to the dynamics of international encryption policies, especially the potential leading role of US policies in the formulation of industry rules. At the same time, we should actively explore regulatory paths that are in line with international standards and promote the encryption industry to find a balance between compliance and innovation. In the future, both enterprises and legal service agencies need to face the changes in the global encryption economy with a more open vision and provide support for Chinese companies to seize emerging markets.