Author: Ostium , Crypto Analyst

Compiled by: Felix, PANews

This article will introduce 12 cycle determination tools and exit indicators, most of which are little known. Here are the details:

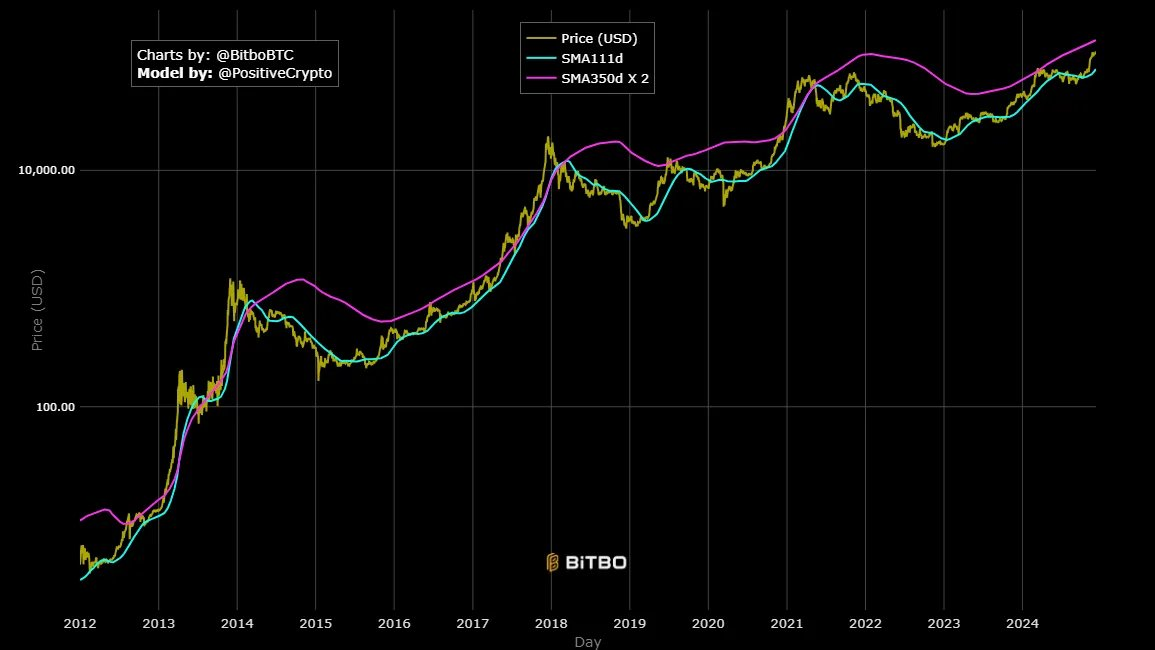

PI Cycle

The PI Cycle Top indicator has successfully captured the tops of the previous three cycles. The indicator uses the 111-day moving average (dMA) and 2 times the 350 dMA price. In the past three cycles, when the 111 dMA broke through the 2 times 350 dMA, it marked the top of the BTC/USD cycle. The reason why it is called the PI cycle top is that 350/111 = 3.153, which is not far from 3.142.

Expect this time to be different as the expected crossover is over $400k (hard to achieve), but expect a final phase of excitement after Bitcoin reaches 2x the 350 dMA (currently around $126k).

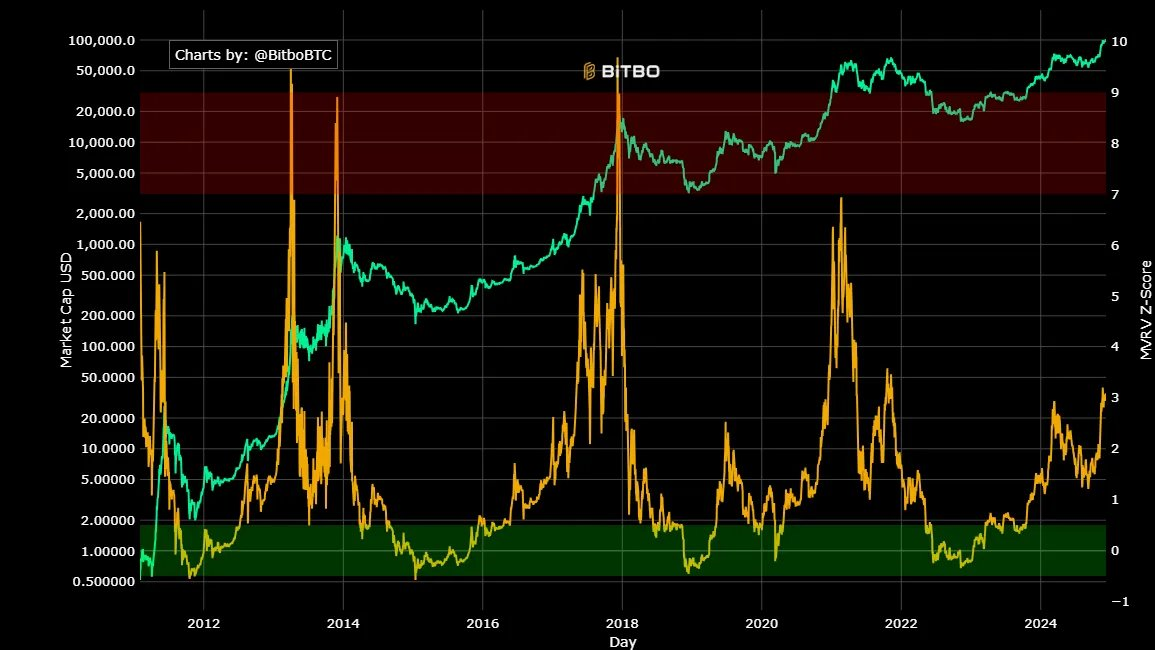

MVRV Z Score

Another on-chain metric that has been highlighted before is the MVRV Z-Score, a tool for assessing periods of extreme bubbles. The MVRV Z-Score can help identify where Bitcoin may be overvalued or undervalued to an extreme degree relative to fair value.

The indicator takes Bitcoin’s market value (price x circulating supply) and real value (average price of each Bitcoin’s last move x circulating supply) and calculates a Z-Score between them, identifying extreme values.

Historically, BTC/USD has formed cycle highs within a few weeks of the peak in this ratio. Expect this cycle to see at least 4; if above this level, you can start looking at other exit indicators.

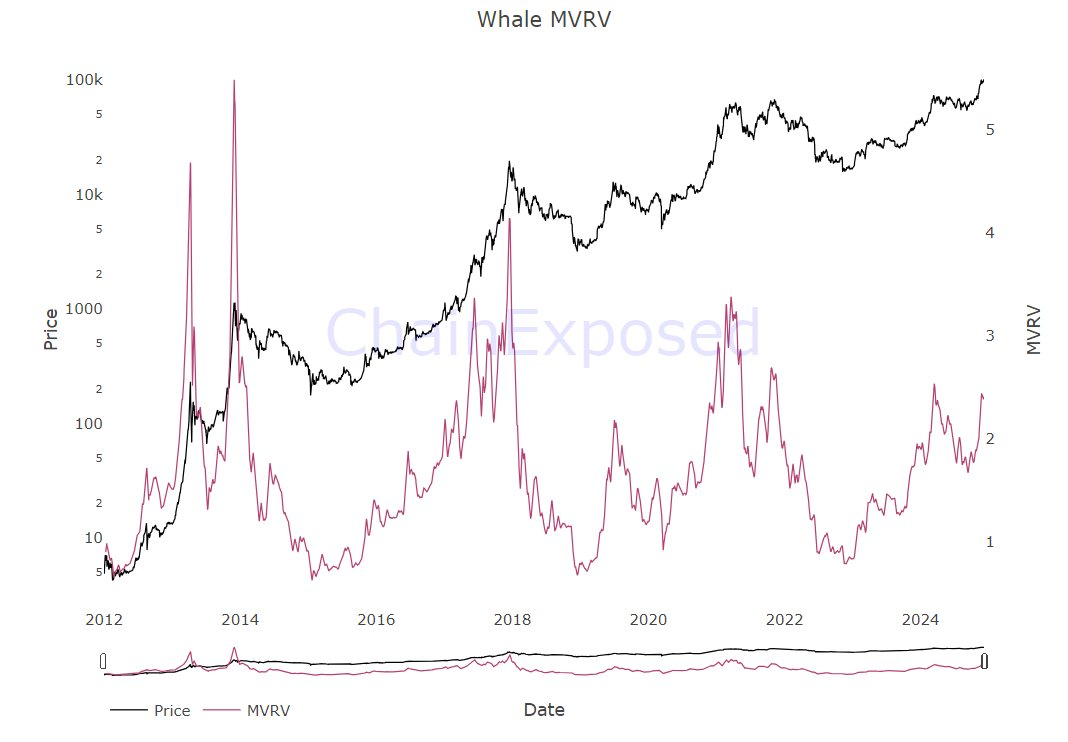

A more interesting version of this metric that is less well known is the Whale MVRV (holding between 1,000 and 10,000 BTC), see the chart below:

Data Source

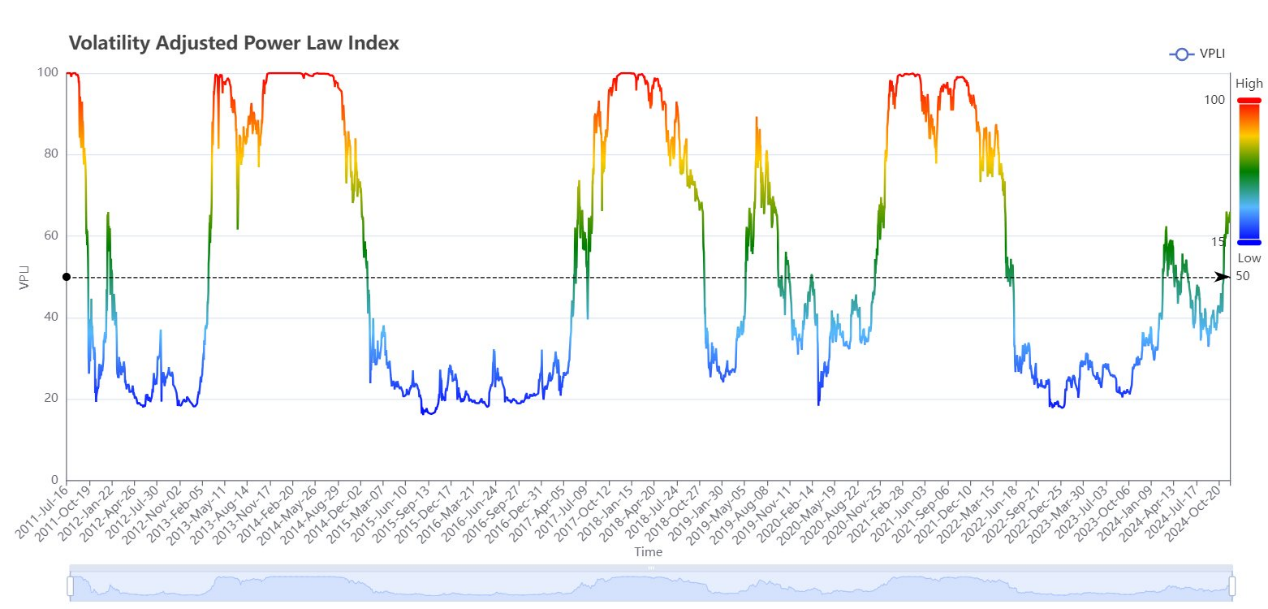

VAPLI and Decay Oscillator

The Volatility Adjusted Power Law Index (VAPLI) indicator is built on the concept of power law and is used to measure the deviation of Bitcoin prices from the fitted power law curve, and is adjusted for volatility to account for changes in market structure over time. Looking at the chart below, you can see that the period when the index pushed to 100 and then turned and began to decline was consistent with the top of the cycle. Currently, this number has once again exceeded 100.

Data Source

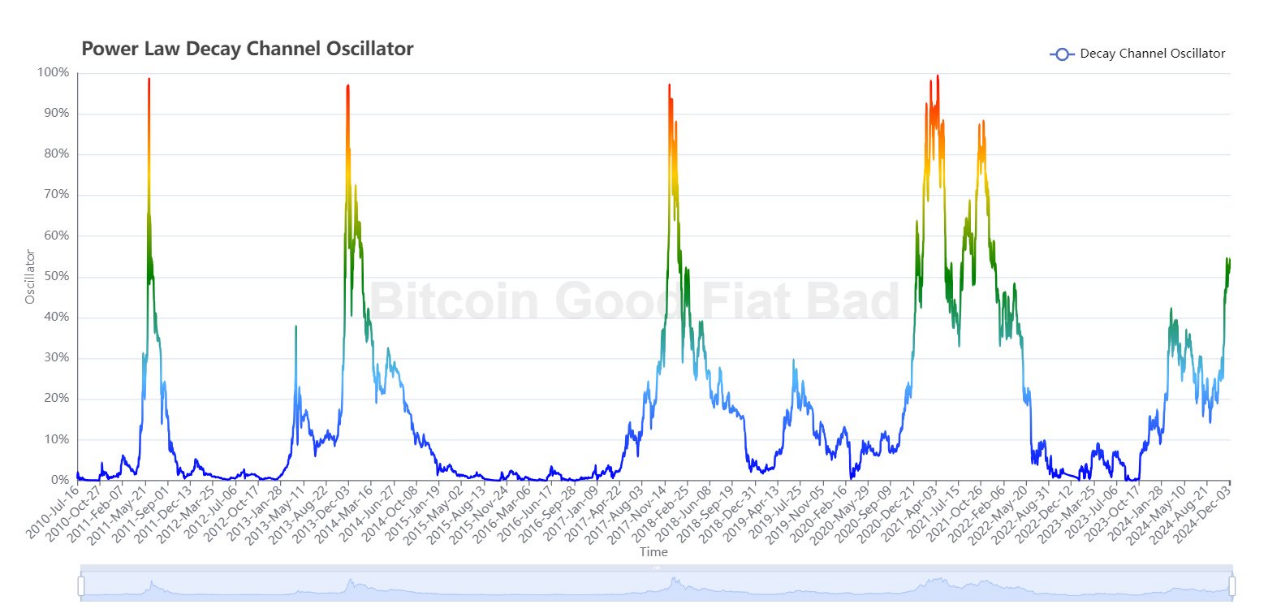

Similar to the Volatility Adjusted Power Law, the following Power Law Decaying Channel Oscillator is modeled by Sminston With. The peak of this oscillator has almost locked the top of the previous cycles for a few days, but obviously there is no way to really determine in real time where the peak will be reached: But when the indicator reaches above 90%, then looking at other exit signals, there is a 95% chance that you are close to the position you want to exit. At present, the indicator is still below 60%, indicating that this market cycle is still in the up phase:

Mayer Multiple

The Mayer Multiple is a multiple of the 200 dMA at the time the price is trading. While the above chart is helpful, it is actually more helpful to normalize it given that volatility has decreased over time. The chart below shows the adjusted Mayer Multiple indicator. It is nowhere near its all-time highs relative to the 200 dMA, and in fact, it is not even back to the March 2024 highs. Looking forward to surpassing the March 2024 highs and moving towards the 0.9 area:

Data Source

NUPL

NUPL, or Net Unrealized Profit/Loss, uses the market value and realized value (as highlighted in the MVRV Z Score section above) and subtracts the realized value from the market value. It is then divided by the market value, using the formula: (Market Value - Realized Market Value) / Market Value.

This chart provides a visual understanding of market sentiment and what stage of the market cycle we may be currently in. Historically, when approaching or exceeding 75%, a cycle top is not far away.

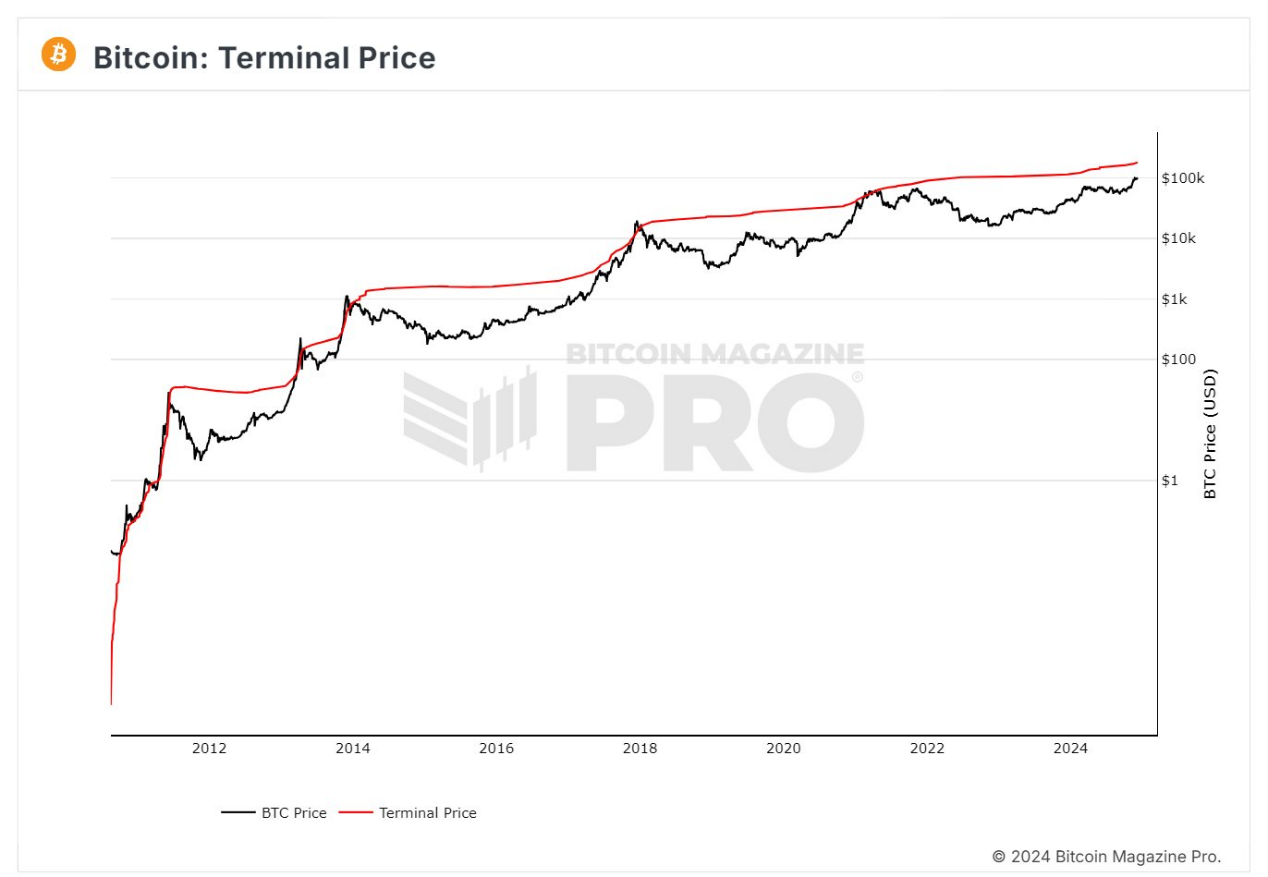

Terminal Price

Terminal Price is a tool created by analyst Checkmate. To calculate the metric, the number of days Bitcoin is destroyed is divided by the existing Bitcoin supply and its circulation time. This is considered the "transfer price", which is multiplied by 21.

The way to use it is simply as a reference area where you want to make sure positions are proportionally sized - right now it's at $180,000. This does not mean to wait until $180,000 to exit any long exposure, but it is used in conjunction with all other exit indicators. When looking for exit signals, more emphasis needs to be placed on the other on-chain indicators that have been discussed.

4 -year MA multiple

The 4-year MA multiple is pretty straightforward: plot the 4-year moving average and calculate how far the price deviates from that multiple. Historically, peaks have been above 4.5 times the 4-year MA, but when that multiple approaches 4, you need to start paying attention to all the other exit indicators:

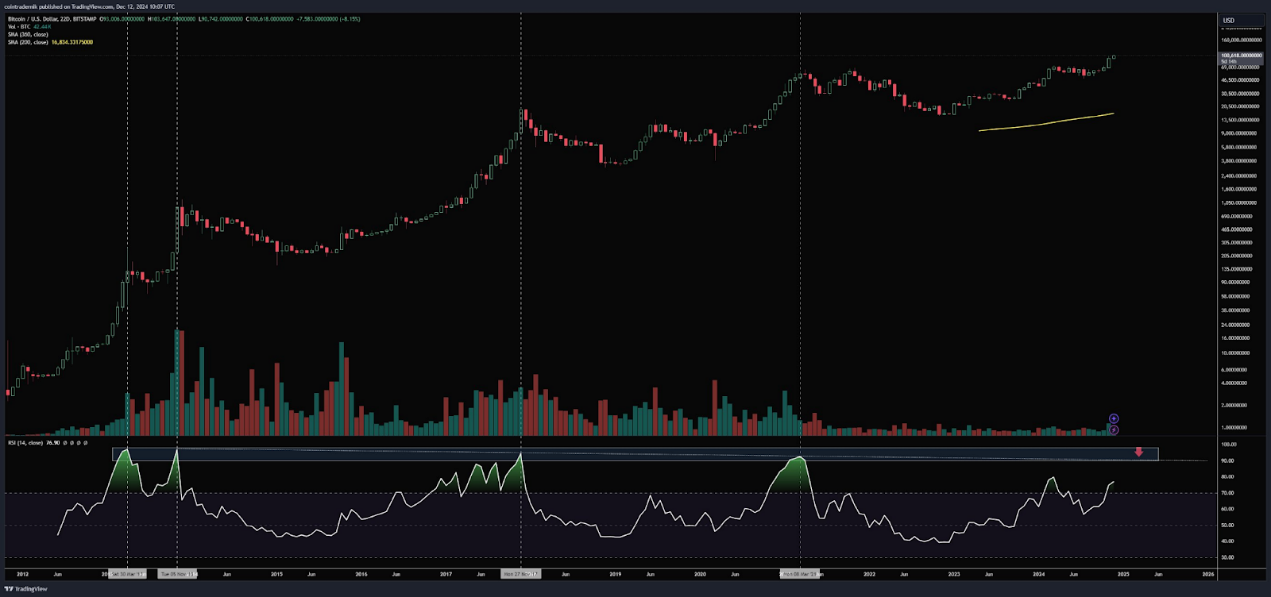

22 -day RSI

The 22 day RSI indicator is very useful, and of course the 2 week or monthly RSI can also be used, but the 22 day is particularly clear for major swing points. In fact, every time the 22 day RSI peaked above 90, a cycle peak was formed within the next 22 days (excluding the high on November 21st).

You can refer to BTC's 22-day RSI. When the indicator is above 90, you can exit your position within the next 3-6 weeks:

Coinbase / Phantom / Moonshot app rankings

Now, there is a lot of supporting evidence related to the cryptocurrency life cycle, with Coinbase app store ranking #1 among “all apps”, a clear sign that we are at the peak of the cycle.

Phantom and Moonshot can be used as potential signals. Phantom ranking #1 on all apps would be a sure exit indicator. Usually Coinbase App Store ranking trends have peaks and troughs in the last few months of the cycle, and when it ranks #1 on all apps, it often sees a major top in less than 4 weeks. This indicator also needs to be used in conjunction with other indicators.

You can use AppFigures to track in real time, or you can follow bots like Coinbase App Store Rankings for daily updates. Bitcoindata21 also provides regular updates with sentiment analysis.

Search Trends

You can use Google search trends to determine market sentiment and get a sense of what the public is interested in at any given moment, but most people search for very superficial keywords like "bitcoin" or "cryptocurrency". You need to be more specific to really get some signals. For example: BINANCE LOGIN, CHEAPEST CRYPTO, CRYPTO APP, COINMARKETCAP, BUY CRYPTO, CRYPTO PRICES, etc.

TOP X Market Cap

This is a method of evaluating market cycles that has been monitored since 2020 and is very helpful in tracking the peak of the mid-cycle in 2021. If the expectation is long-term growth in cryptocurrencies, then market capitalization is expected to grow across the board. Whatever the peak of the TOP 10, TOP 25 or TOP 100 tokens, etc. in the previous cycle was, it will be surpassed before the peak of this cycle arrives.

For example, in the last cycle, to enter the top 100 at the peak in November 2021, a market cap of about $1.2 billion was required. Today, to enter the top 100 on Coinmarketcap, a market cap of $1.25 billion is required. It has slightly exceeded the peak of the previous cycle. Based on the view of total market capitalization, a conservative expectation is that the market cap of the top 100 should reach at least about $2 billion before the cycle peaks. Once this area is reached, there is no doubt that you should start looking for exit opportunities.

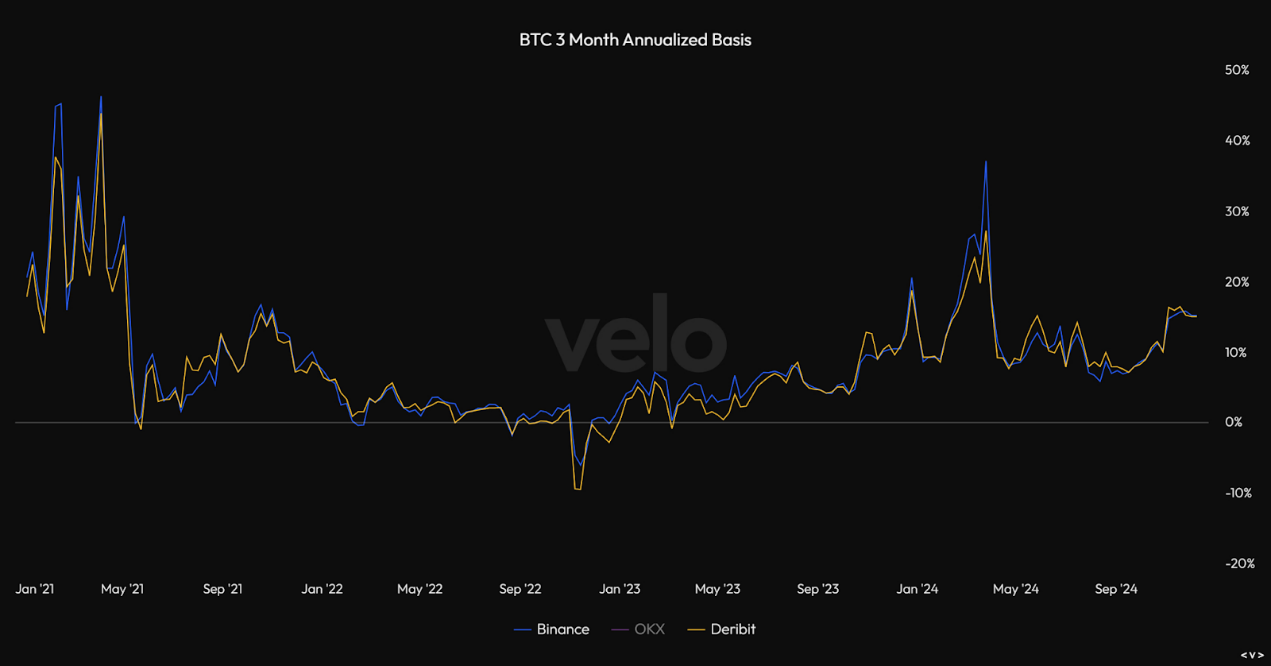

3 -month annualized basis

The 3-month annualized basis is just one quick way to see froth in derivatives markets, but it is more useful for highlighting when it is prudent to reduce risk rather than exit the cash portfolio completely in anticipation of a cycle peak. Nevertheless, historically, when the 3-month annualized basis exceeds 30%, things start to get dangerous, as derivatives tend to get more frothy, not less, as they approach cycle peaks (even interim peaks).

Data Source

Related reading: Viewpoint: BTC’s last mega cycle: BTC’s value and price theory