Original | Odaily Planet Daily (@OdailyChina)

Author|Nan Zhi (@Assassin_Malvo)

The recent launch of MOVE and ME has shown the enthusiasm of the masses and the ferocity of new coins in the bull market. Looking back, for example, the new coin OL on OKX left a deep impression on people. After a short correction at the opening, it continued to rise like a "bulldozer".

So, is the strategy for new coins different in a bull market, and does it not have to be sold as early as before? In this article, Odaily will review the new coins launched on several exchanges recently to try to answer this question.

Basic information

This article selects new coins launched by Binance, OKX, Bybit and the entire network, and the time limit is within the past two months.

The whole network will include MOVE and ME;

Binance includes SCR and USUAL (pre-market);

OKX includes MAJOR, MORPHO, MEMEFI, OL and X (in fact, multiple exchanges are launched at the same time, but not including Binance, etc.);

Bybit selected MOZ (Lumoz) and XION.

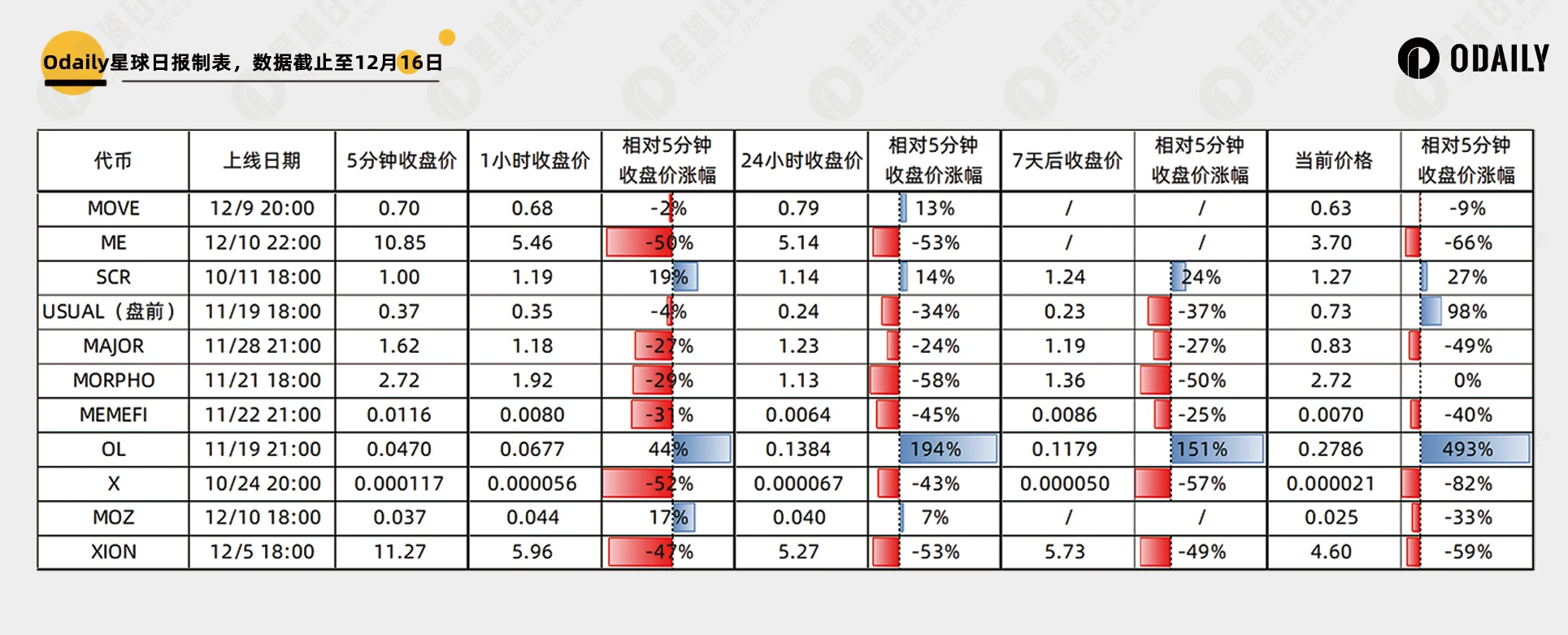

In terms of time, the 5-minute closing price, 1-hour closing price, 24-hour closing price, 7-day closing price and current price (as of 15:00 Beijing time on December 16) of the above tokens are counted.

Then compare the increase or decrease of each token, such as the 1-hour closing price relative to the 5-minute closing price, to determine whether it is the "opening high".

Does the opening high still exist?

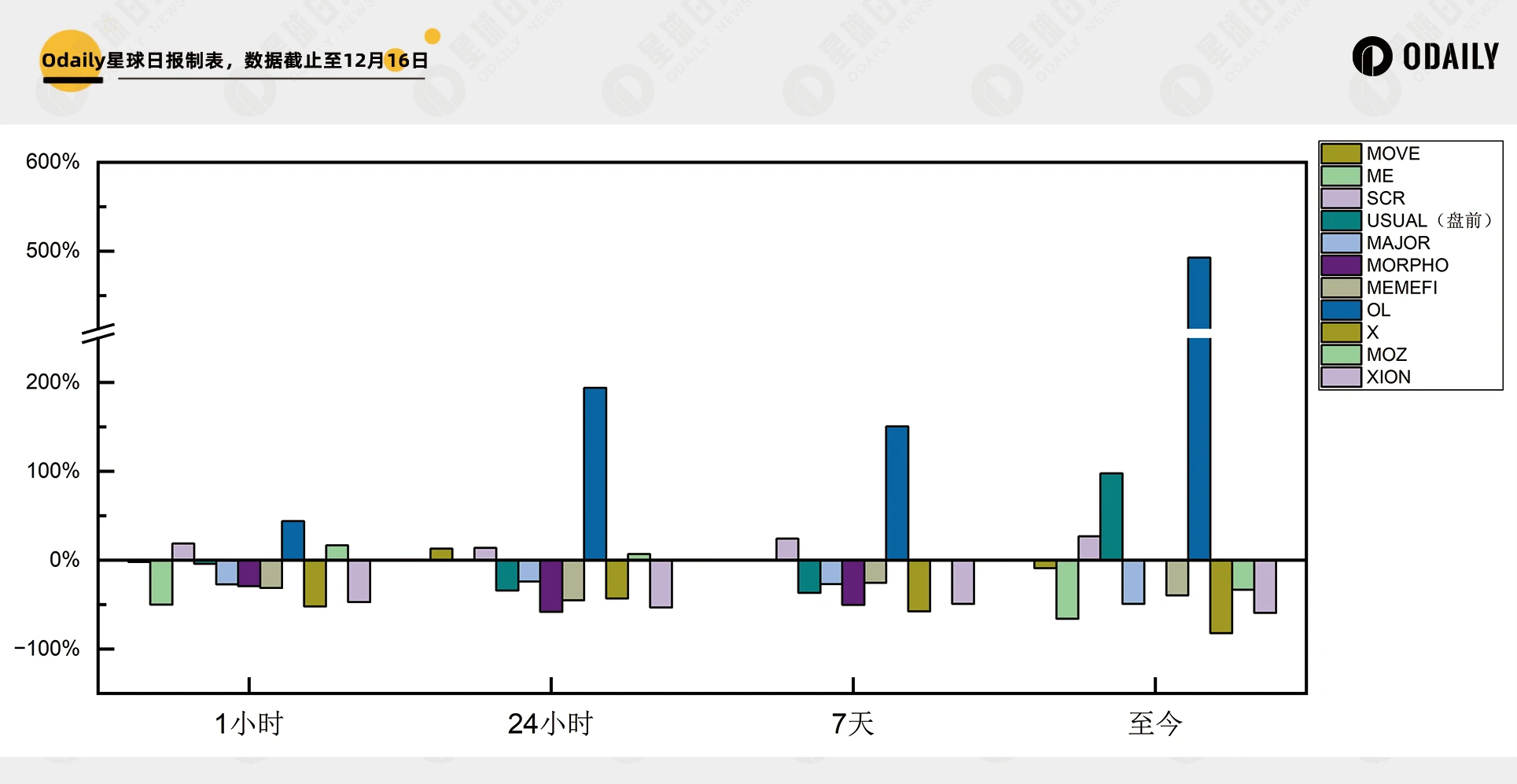

The rise and fall data of each token are shown in the figure below. The 1-hour closing price fell by an average of 14% relative to the 5-minute closing price, and the 24-hour closing price fell by an average of 7%.

It can be seen that in the shorter term, the opening 5 minutes is still the high point. If you can get the tokens within this time point, it is still recommended to sell them.

There are eight tokens that have been online for 7 days. The 7-day closing prices of these tokens fell 8.7% relative to the 5-minute closing prices, indicating that the medium-term situation remains unchanged and the opening price is still at a high point.

Would the situation change if the time frame was longer?

The current price of 11 tokens has increased by an average of 25% relative to the 5-minute closing price, but after excluding OL, it has fallen by an average of 21%, and the decline has further widened.

The opening is still at its peak

In summary, for most tokens, the opening is still likely to be the highest point. The bull market may bring a higher opening price, rather than a long-term increase. And it will take one or two months to eliminate the excessively high prices caused by the overheated sentiment at the opening. According to statistical rules, it is still recommended to sell if you can get the token within 5 minutes.

Binance's new coin VANA price estimate

Based on the past 21 Binance Launchpool data, we get the estimated price of VANA to be 15.9 USDT, corresponding to an FDV of 1.911 billion US dollars and an initial circulating market value of 479 million US dollars.

The algorithm is as follows: the average annualized return in the past 21 periods is 96%, assuming that this period is also 96%; based on the average amount of BNB invested in the past 21 periods and the BNB price of 726 USDT, it can be obtained that in order to achieve the same annualized return, the price of VANA needs to reach:

16973725 × 726 ÷ 4080000 × 2 ÷ 365 × 96%=15.93