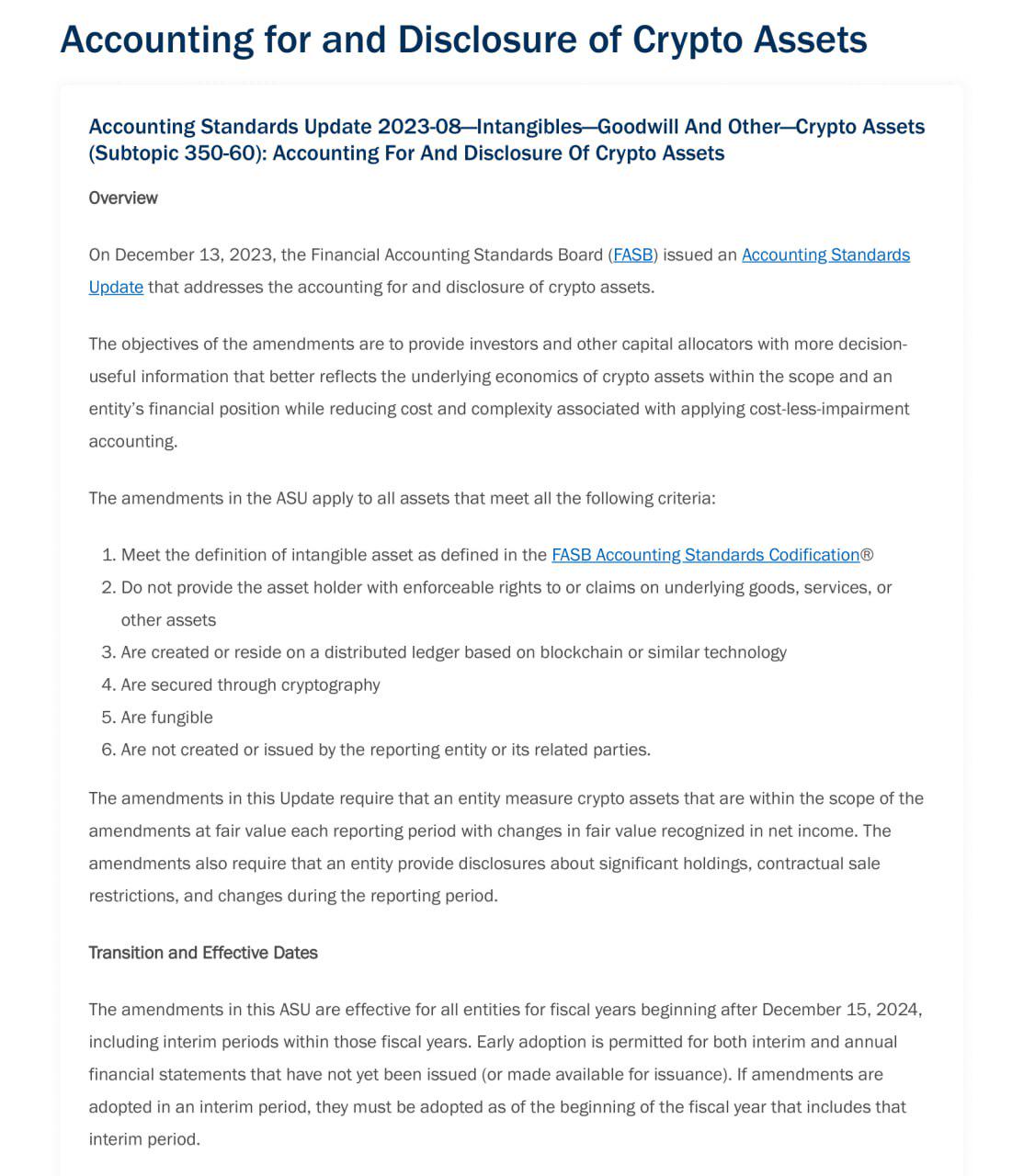

PANews reported on December 17 that the U.S. Financial Accounting Standards Board (FASB) recently issued Accounting Standards Update (ASU) 2023-08, which clarified the accounting and disclosure requirements for crypto assets such as Bitcoin. The standard requires that crypto assets that meet six conditions be measured regularly at fair value, with changes in value directly included in net income and listed separately in the financial statements. Companies are required to disclose detailed information including the name, fair value, number of units and restrictive conditions of major crypto assets. The standard applies to fiscal years after December 15, 2024 , and early adoption is allowed.