Original: Flo

Compiled by: Yuliya, PANews

Hyperliquid is a perpetual contract trading protocol built on its own L1 public chain. Its goal is to provide users with a trading experience comparable to that of centralized exchanges while providing a fully on-chain order book and decentralized trading capabilities. The protocol supports transactions in spot, derivatives, and pre-release markets.

This article will not delve into the specific operating mechanism of Hyperliquid or its differences from other perpetual contract DEXs. This article will focus on the market opportunities of Hyperliquid and the fundamental investment logic of $HYPE tokens.

As of writing, $HYPE is trading above $20, with a market cap of $7.5 billion and a fully diluted valuation (FDV) of over $20 billion, making it one of the top 30 cryptocurrencies by market cap. So, what exactly is driving this strong market performance?

This article will conduct an in-depth analysis from the following four aspects:

- Exchange Development Opportunities

- EVM Ecosystem Opportunities

- Revenue structure, valuation and comparison with peers

- Potential risks

Exchange Development Opportunities

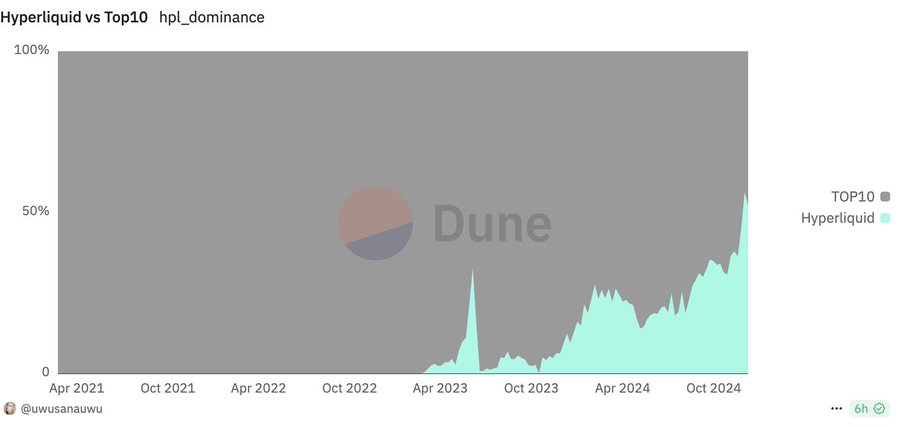

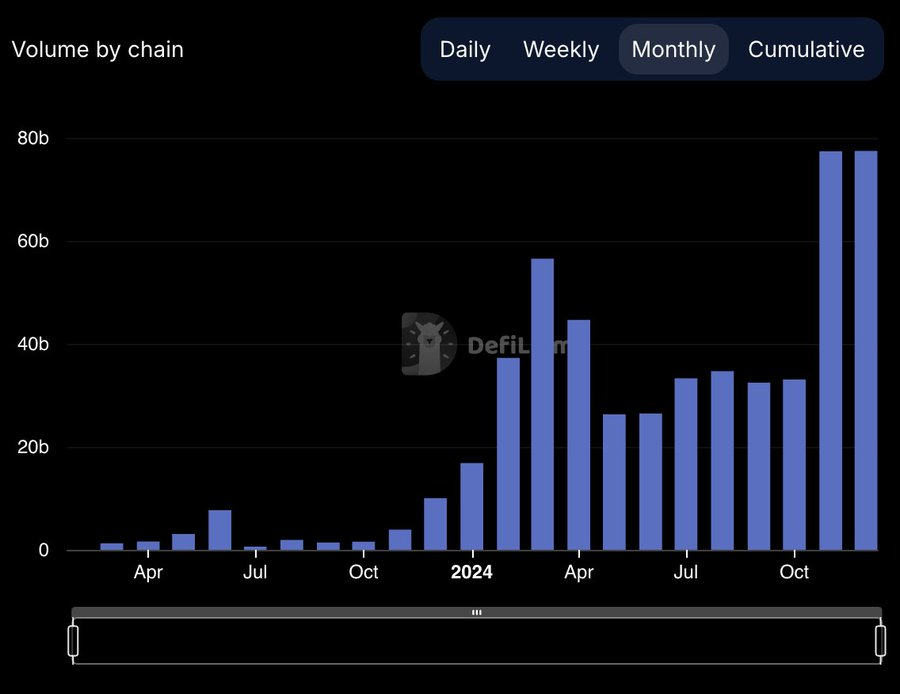

Hyperliquid dominates the perpetual contract DEX market, accounting for more than 50% of recent trading volume.

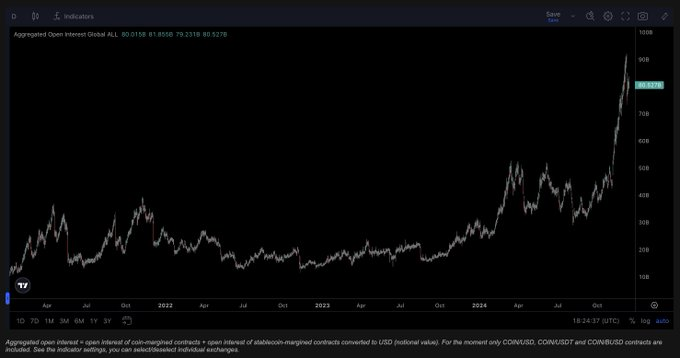

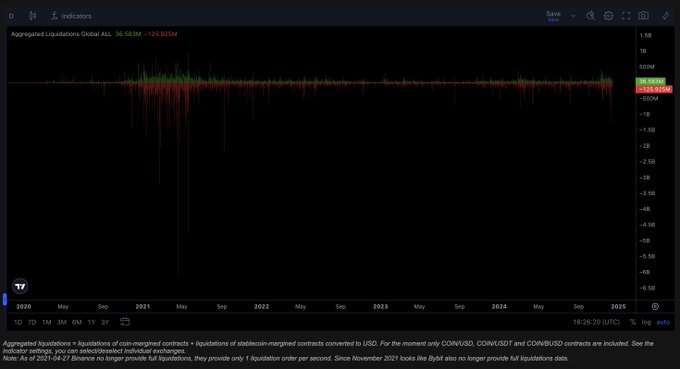

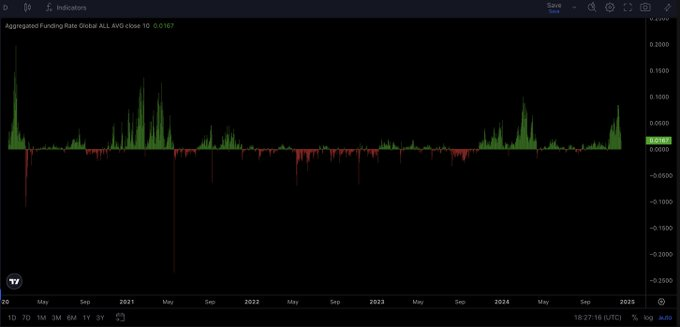

Currently, according to data from Coinalyze and CVI.Finance, its open interest (OI) is about 10% of Binance’s. As the bull run deepens and market volatility increases (the cryptocurrency volatility index is only 64), it is expected that open interest, trading volume, funding rate and liquidation volume will continue to rise.

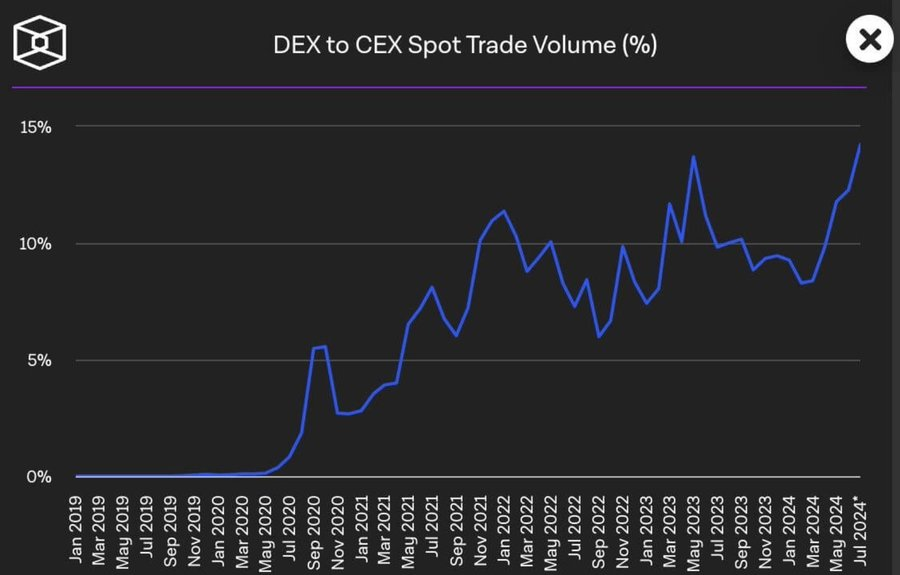

The market share of DEX over CEX in the perpetual contract market is expected to gradually increase like the spot market. This trend is similar to the previous process of AMM and Uniswap driving DEX's share in spot trading.

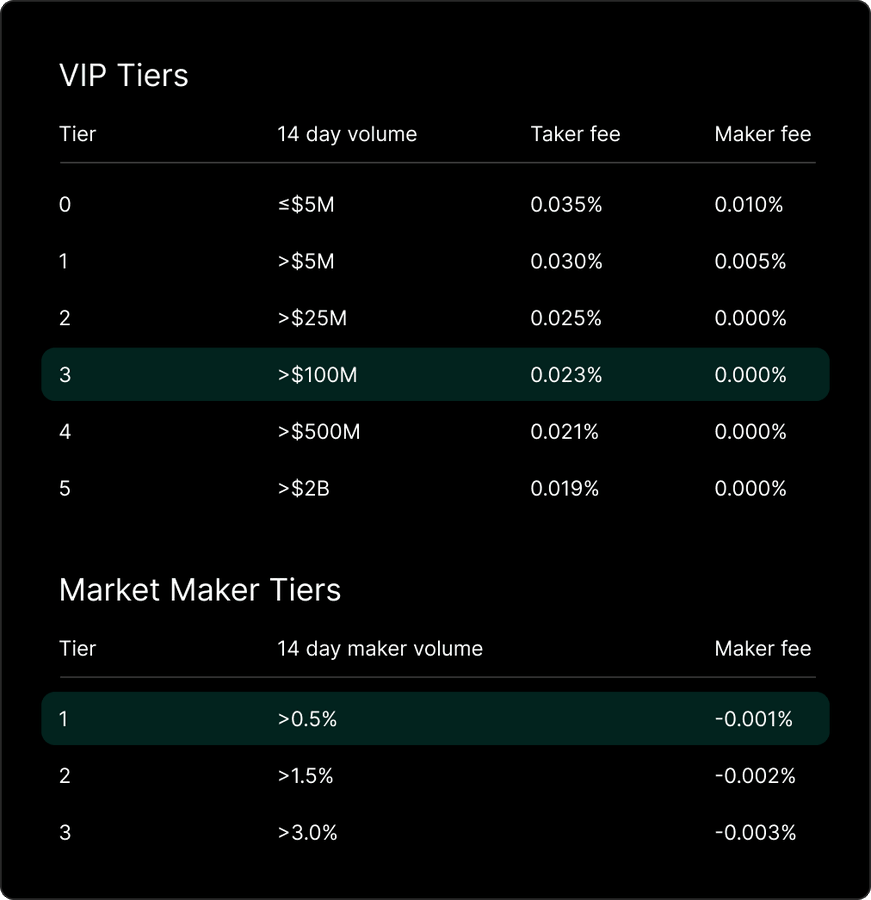

With lower transaction fees than CEX and more attractive incentives, Hyperliquid is expected to attract more users and funds from CEX. Its Token Generation Event (TGE) and the rapid rise in $HYPE price are the best marketing campaigns.

While the specific incentive structure has yet to be announced, it is foreseeable that perpetual contracts and spot trading volumes will be incentivized as over 40% of the token supply is reserved as community rewards.

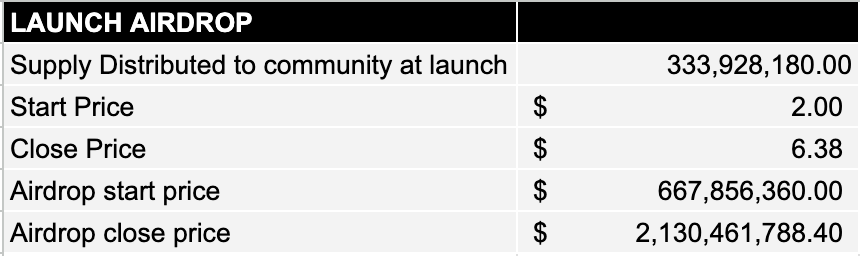

The initial airdrop is as follows:

Now assuming that 10% of the first year’s reserved supply is allocated for incentives, the situation would look like this:

Based on current prices, nearly $1 billion in incentives will be distributed in the first year, exceeding the allocation size of the $2 opening price during the first airdrop.

This will result in an inflation rate of approximately 11.65% (including staking rewards). However, as more users bring more trading volume, revenue, token burns, and buybacks, the actual dilution cost may be lower than this level. The team may also adopt higher inflation rates and incentives to attract users, which is why $HYPE's fully diluted valuation (FDV) has unique dynamics.

In terms of spot trading, Hyperliquid is expected to become one of the top three spot DEXs in the short term. Yesterday's trading volume was about $500 million, ranking fifth among all chains. As the EVM ecosystem develops, the addition of more utility tokens and native assets will bring more abundant trading pairs.

Trading tools based on Hyperliquid's open infrastructure and builder code continue to emerge, and projects such as Insilico Terminal, Katoshi AI and pvp.trade have shown good prospects. This will further improve the user experience and attract more capital inflows.

Exchanges and stablecoins are the most profitable businesses in the cryptocurrency space. Hyperliquid competing directly with major exchanges such as Binance, Coinbase, Bybit, OKX, etc. is a bullish factor in itself.

The most optimistic scenario is:

- Other exchanges use Hyperliquid as a decentralized backend

- Exchanges hedge risks by increasing their holdings of $HYPE

While these scenarios are unlikely in the short term, in the cryptocurrency market, anything is possible.

EVM Ecosystem Opportunities

HyperEVM is an important part of the Hyperliquid ecosystem, sharing the same state and consensus mechanism as Hyperliquid L1, but running as an independent execution environment.

- L1 is a permissioned chain responsible for running core components such as perpetual contracts and spot order books, and achieving programmability through APIs

- EVM is a universal Ethereum compatible chain that supports standard Ethereum development tools, and smart contracts can directly access the on-chain liquidity of the L1 layer

HyperEVM is scheduled to be launched in the next few months, and a large number of teams have already begun to actively prepare. Why is this development trend bullish? It is mainly reflected in the following aspects:

New DeFi Ecosystem

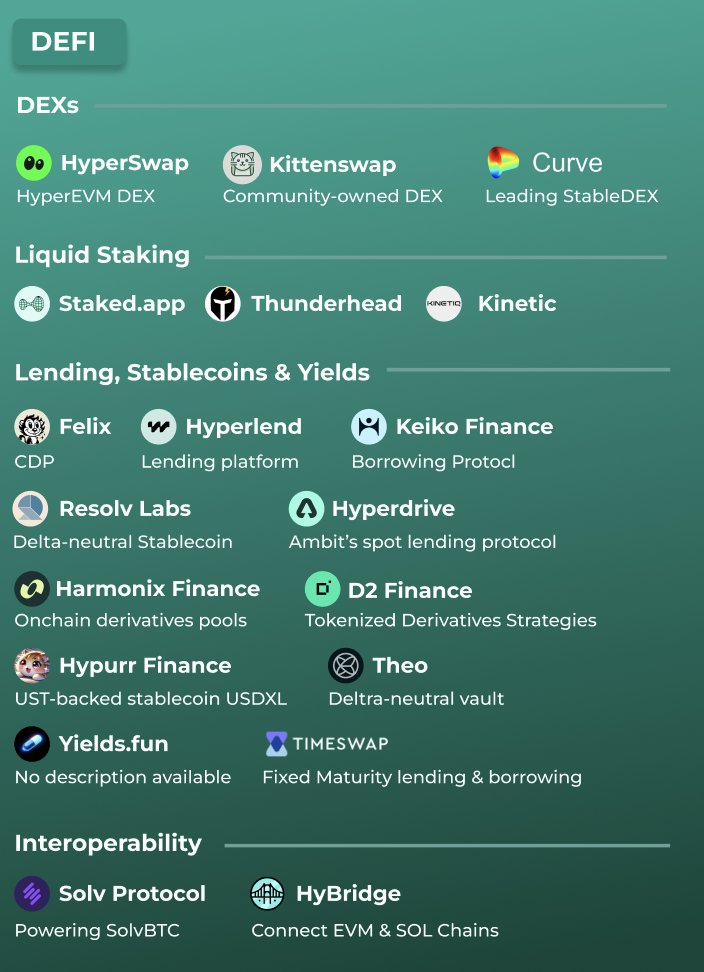

Many DeFi projects are preparing for the launch of HyperEVM. Mainstream DeFi protocol types, including automated market makers (AMMs), lending platforms, liquidity pledges, and CDPs (collateralized debt positions), will be launched simultaneously when EVM is launched.

These projects will significantly improve overall capital efficiency by allowing $HYPE holders to use $HYPE as collateral in lending and money market protocols.

In addition to traditional DeFi protocols, the characteristics of on-chain order book liquidity are likely to give rise to a number of innovative applications. This provides fertile ground for the birth of new DeFi native protocols, and Hyperliquid is expected to become the preferred platform for these innovative protocols.

Take Ethena Labs as an example. The project plans to reduce its reliance on CEX by integrating Hyperliquid. This will not only improve system resilience, but also reduce and diversify counterparty risk by decentralizing the hedging process. This strategy has been discussed in detail in its governance proposal.

Market demand for practical projects

Recent market trends clearly show that investors are interested in projects with real-world application value. This trend is fully reflected in the AI boom on Base and Solana, the outstanding performance of Hyena, and the strong demand for $HFUN and $FARM on the Hyperliquid platform.

With the upcoming expansion of the DeFi ecosystem, Hyperliquid is likely to become the main battlefield for practical investment in the short to medium term. It is worth noting that the AI infrastructure construction currently promoted by projects such as AI16Z and Zerebro on Solana is likely to extend to the Hyperliquid platform.

Hyperliquid's native vault feature is particularly eye-catching. Strategies running in these vaults can enjoy the same advanced features as DEX, including liquidation mechanisms for over-leveraged accounts and high-throughput market-making strategies. The inclusiveness of this mechanism is reflected in the fact that any entity - whether it is a DAO organization, protocol, institution or individual - can share the benefits by depositing funds. In return, vault owners can receive 10% of the total benefits.

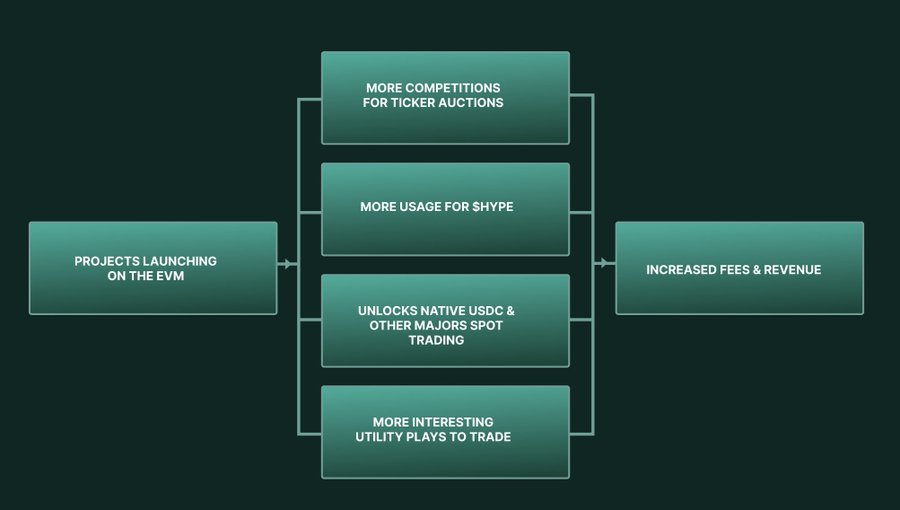

Other positive factors for HyperEVM launch

- Fee growth potential : The operation of HyperEVM will generate more fee income, which can be used for staking rewards, token destruction, etc. Take Base as an example, it has generated $15 million in fees in the past 30 days. It is expected that in the next few months, the activity of HyperEVM is expected to reach a level comparable to that of Base.

- $HYPE token utility improvement : The launch of EVM will significantly expand the application scenarios of $HYPE in the ecosystem. Users need $HYPE to pay gas fees, and can also perform operations such as lending, staking, and locking positions to earn income. These new applications will bring stronger buying pressure. Referring to Solana's meme coin craze in 2024 and Ethereum's DeFi and NFT wave in 2020-2021, the role of on-chain activities in driving demand for native tokens cannot be ignored.

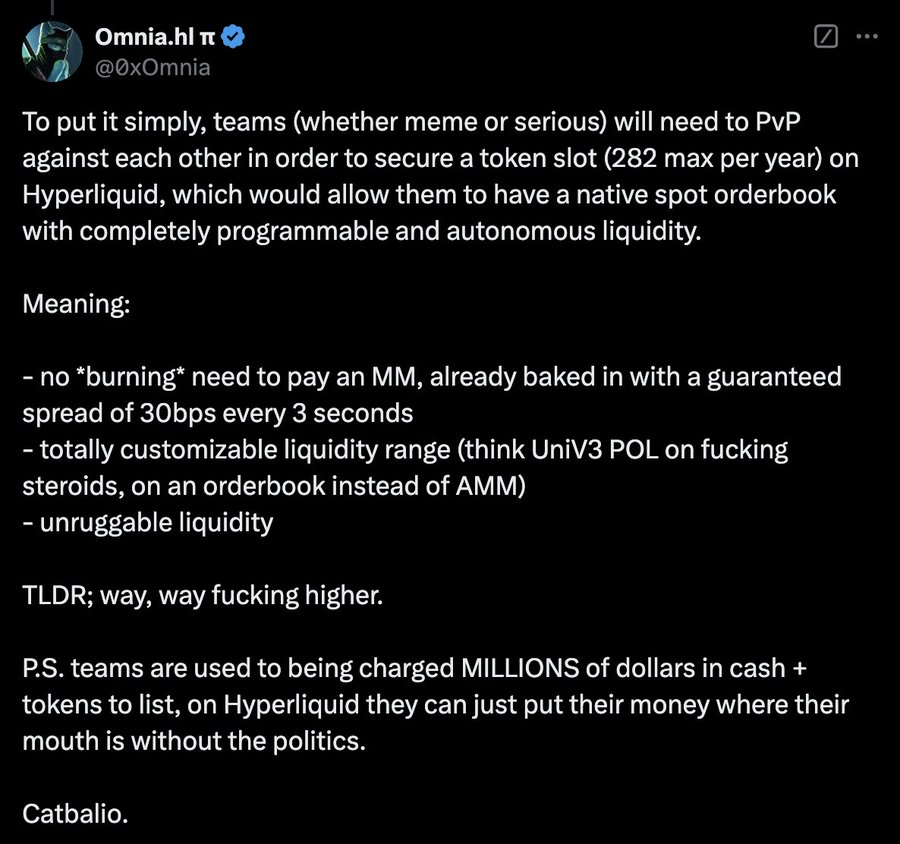

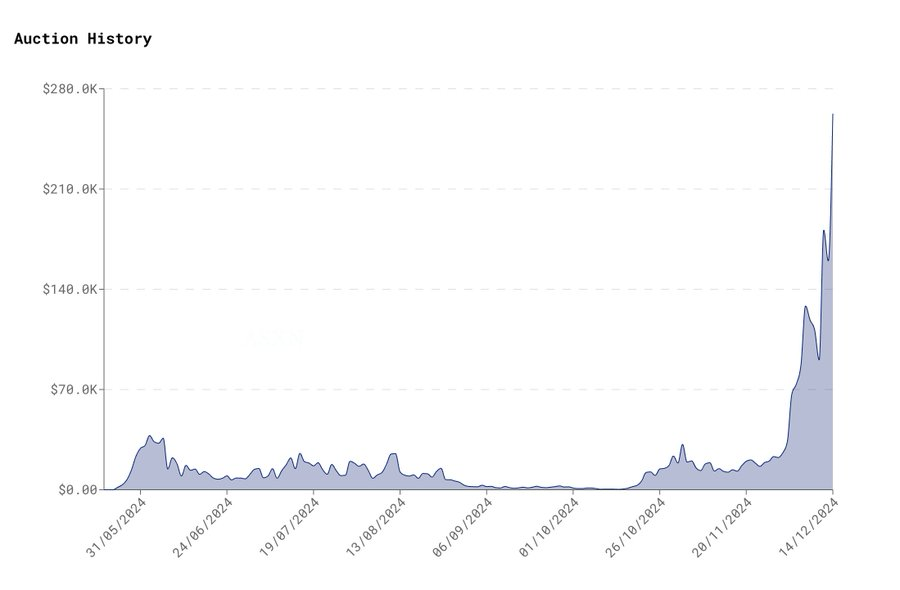

- Revenue growth path : The influx of high-market-cap utility projects, coupled with the emergence of more native asset bridging options (such as native USDC, spot BTC, SOL, ETH, etc.), will bring more spot trading volume, thereby increasing platform revenue. At the same time, as more projects are launched on the EVM, the price of token code auctions will also rise, bringing additional income to the platform.

- Improved Ecosystem Awareness : The launch of EVM will help Hyperliquid establish its position as an "orthodox" L1 public chain in the market and increase the exposure of its ecosystem. This may activate funds that are still on the sidelines to enter the market.

According to the latest ecosystem market map (although many new projects have joined since its release last week), Hyperliquid is forming a comprehensive blockchain ecosystem. This complete ecological layout will bring continued growth momentum to the platform.

The combined effect of these favorable factors is expected to bring significant value enhancement and ecological prosperity to Hyperliquid.

Revenue structure, valuation and comparison with peers

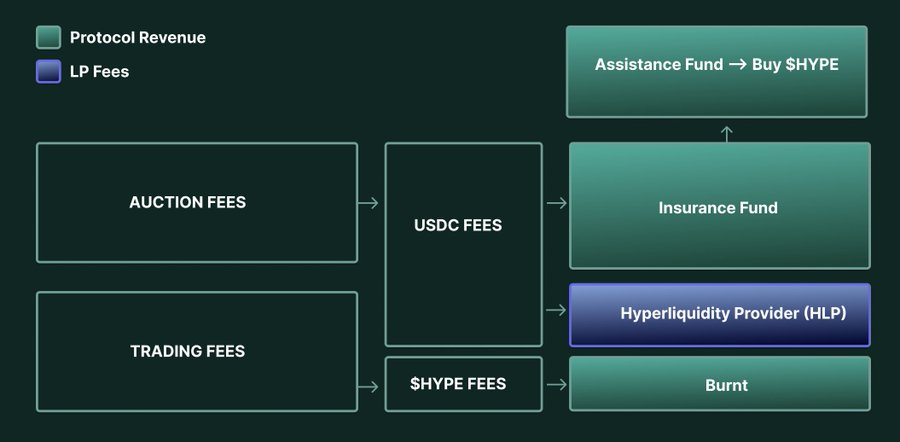

Hyperliquid mainly generates revenue through platform fees and token auctions.

(How fees flow on-chain)

Currently, the assistance fund holds about 10.76 million $HYPE (more than 3% of the circulation) and 3.14 million USDC, and the insurance fund has accumulated about 7.07 million USDC to be transferred to the assistance fund. A total of more than 10 million USDC may be used to repurchase $HYPE in the market.

Recent performance

In the past 30 days, Hyperliquid generated approximately $26.5 million in USDC revenue, including:

- Token auction revenue: $2 million

- Platform fee income of US$24.5 million

- Additional burnt of approximately 79,600 $HYPE (worth $1.75 million)

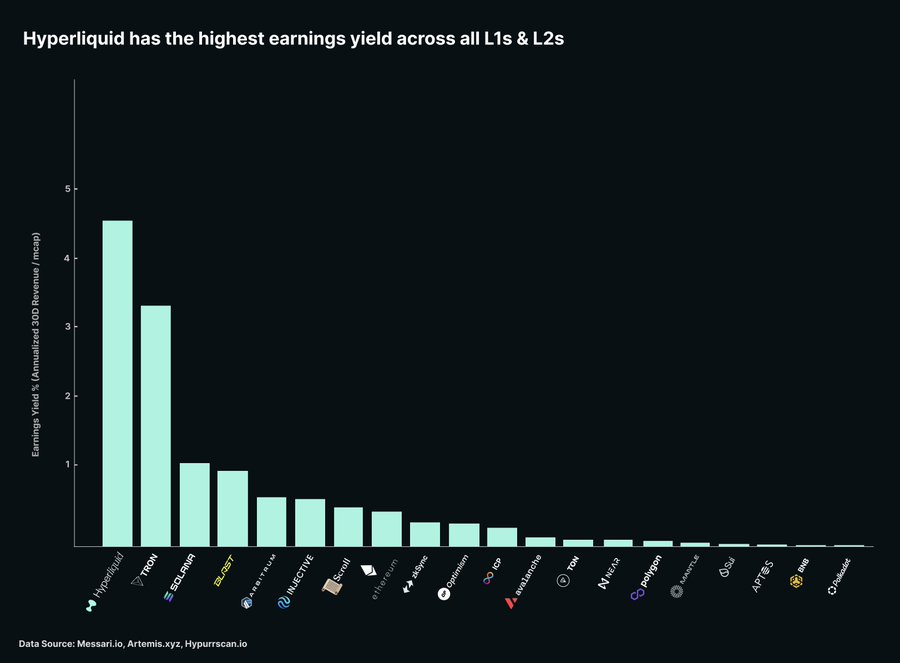

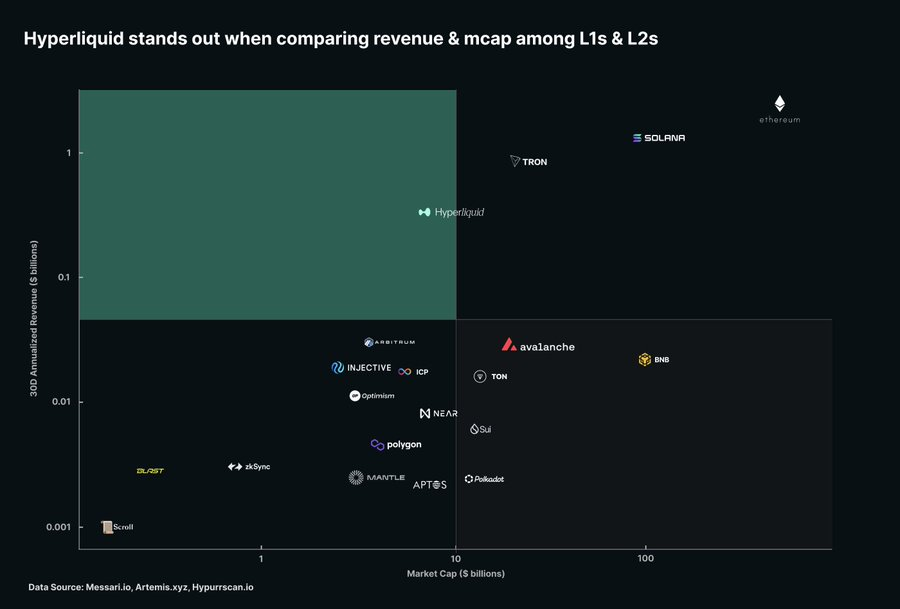

The annualized revenue exceeds 336 million US dollars, second only to Ethereum, Solana and Tron among all public chains, but its market value is significantly lower than these public chains. In terms of yield (annualized revenue/circulating market value), Hyperliquid far exceeds other L1 and L2.

Income growth potential

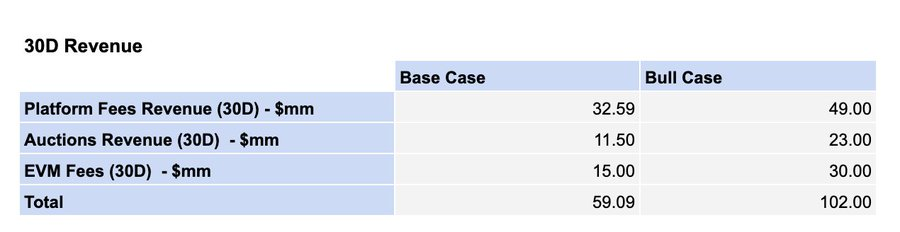

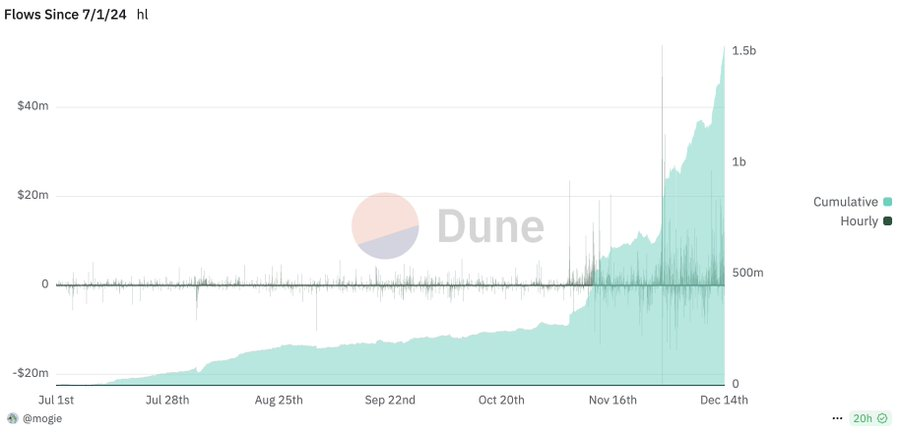

- Platform Fees : December transaction volume has reached the level of November, and is expected to increase by 100% month-on-month

- Auction revenue : The latest round of auctions saw prices approach $500,000, and prices are likely to continue to rise as competition for the available spots (282 per year) intensifies.

- EVM revenue : Referring to Base’s monthly fee revenue of $15 million, and considering that Hyperliquid has exceeded Base’s TVL, EVM is expected to achieve similar or higher economic activity after its launch

Valuation scenario analysis

Baseline scenario :

- Trading volume increased by 1/3 compared with the past 30 days

- Auction revenue remains stable

- EVM activity is on par with Base

Optimistic scenario :

- Trading volume doubled in the past 30 days

- Double the bid price ($1 million each)

- EVM activity is twice that of Base

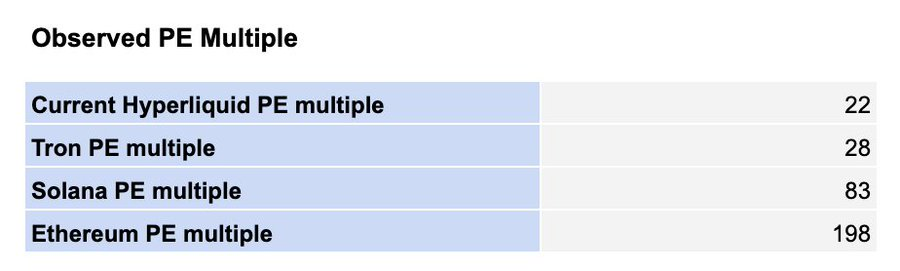

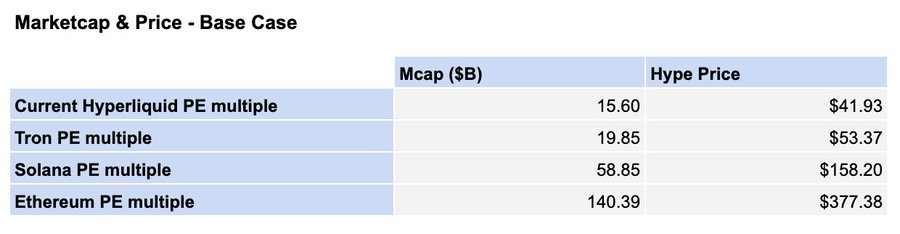

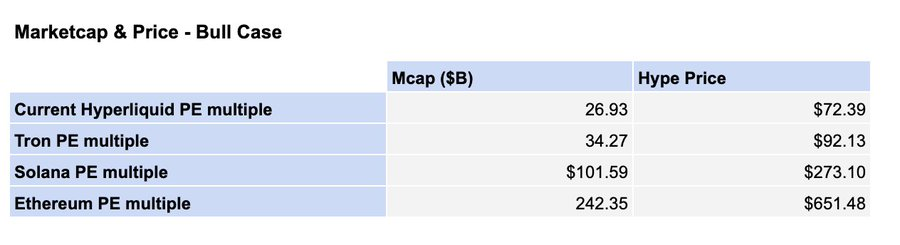

In the baseline scenario, 30-day revenue can reach $59 million; in the optimistic scenario, it can reach $102 million. The valuation uses the price-to-earnings multiples of the mainstream L1 public chain and is calculated in combination with annualized revenue.

Taking into account the current circulation and the 11.6% inflation rate (for incentives and rewards), the $HYPE price range is:

- Baseline scenario lower limit: $41.93 (minimum multiple)

- Optimistic scenario upper limit: $651.48 (highest multiple)

Reasonable valuation analysis

Compared to Solana and Ethereum, HYPE’s valuation multiple should be lower for the following reasons:

- The project is relatively immature

- Many risk factors

- Revenue mainly comes from DEX, which is different from Solana and Ethereum

"Reasonable" valuation reference:

- Using a 40x P/E ratio

- Annualized revenue of $1 billion (between the baseline and optimistic scenarios)

- That gives a market cap of $40 billion ($100 billion fully diluted)

- $HYPE price is around $100

Historical cycle comparison

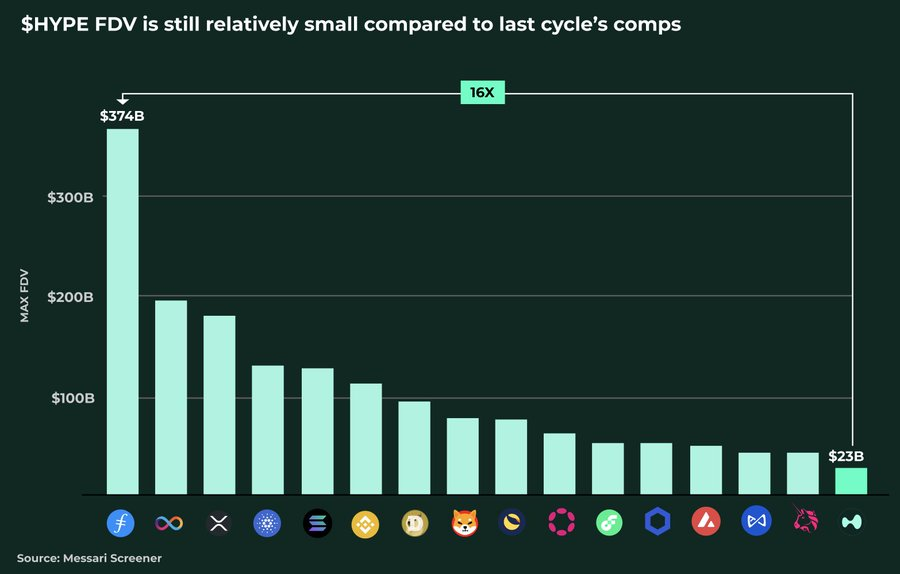

While a $40 billion market cap and $100 billion FDV seem high, the bull run could get even crazier.

In the 2021 bull market:

- BNB: $5 billion to $100 billion (20x)

- ADA: $5 billion to $95 billion (19x)

- SOL: $86 million to $77 billion (900 times)

- AVAX: $282 million to $30 billion (100x)

- MATIC: $85 million to $20 billion (235 times)

FIL’s FDV reaches $373 billion, 16 times today’s $HYPE

Capital Inflow Potential

Currently, there are about 60,000 $HYPE holders, which is relatively small:

- $KMNO: 55,000 holders

- $WIF: 211,000 holders

- $BONK: 861,000 holders

According to the capital inflow multiplier effect (10 times) studied by Messari, if it can attract capital inflows of 5% of the SOL market value and 1% of the ETH market value (about US$10 billion), it will have a significant impact on the price.

Potential risks

While this article presents a fairly optimistic forecast for Hyperliquid’s future prospects, it is not without risks.

Validator concentration risk

Currently, the validator nodes of Hyperliquid mainnet are still highly centralized, with only 4 validator nodes operated by the team in Tokyo. Although the testnet has more than 60 decentralized validators (including well-known institutions such as Chorus One, ValiDAO, B Harvest, and Nansen), the transition to a decentralized architecture still faces challenges. If the performance of the validator decreases, it may affect the user experience and trust.

EVM Ecosystem Risks

The quality of the ecosystem will directly affect the development of HyperEVM:

- High-quality projects are needed to maintain the vitality of the ecosystem

- Low-quality projects or simply copying other on-chain projects will reduce capital inflow and activity

- It is crucial to attract real builders rather than speculators

DeFi Innovation Risks

With the launch of EVM, $HYPE's capital efficiency will be improved through liquidity staking, lending, etc. New DeFi innovations may bring unprecedented risks:

- The interaction between innovative financial products and L1 layer may generate unknown risks

- New DeFi protocols may affect the value of $HYPE tokens

- Exchange operations may also be affected

Regulatory risks

Although there are regulatory risks, geographical restrictions and the attitude of the Trump administration have reduced this risk to some extent. However, as an exchange platform, it is still necessary to pay close attention to changes in the regulatory environment.

Market correlation risk

As an exchange token, $HYPE’s performance is highly correlated with the overall crypto market:

- The team needs to complete key milestones before the end of the market cycle

- Fluctuations in market sentiment can significantly impact token prices

- Need to seize development opportunities in the bull market cycle

Investment reminder

Cryptocurrency investment is highly risky, and any token, including $HYPE, is at risk of going to zero. Investors should:

- Conduct sufficient independent research

- Rationally assess risk tolerance

- Do not take this as investment advice

- Be cautious about market volatility