Author:Sha

1. When DeFi becomes popular again

Bitcoin finally reached its long-awaited high in November, and it is not far from the 100,000 mark. The long-dormant altcoin market has also ushered in an explosion. DeFi leaders such as UniSwap, AAVE, Compound, and MakerDAO have all achieved good gains recently. Looking back at the outbreak of DeFi in 2020 to the present, even though there are constant voices of pessimism, the DeFi world is still developing and expanding steadily, and gradually eroding the share of centralized exchanges. This is still a track full of innovation and huge potential, and there are still many possibilities waiting for us to explore. Today I want to talk about one of the most noteworthy projects in the recent DeFi ecosystem, which I think is the leader of Base derivatives, SynFutures. Explore how it combines its own advantages to lead a new round of DeFi innovation, how to stir up the entire decentralized derivatives track, and the reasons behind its rapid growth and future growth space.

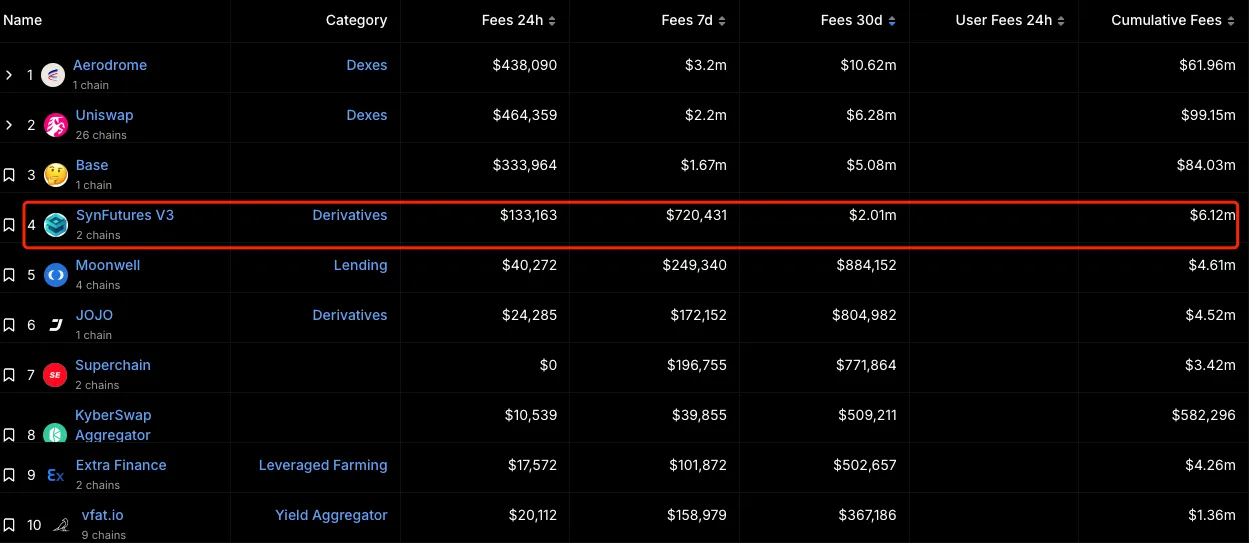

2. SynFutures’ performance after launching Base: 50% market share, and fee income ranked third among protocols

Let’s first look at SynFutures’ performance in the Base derivatives market:

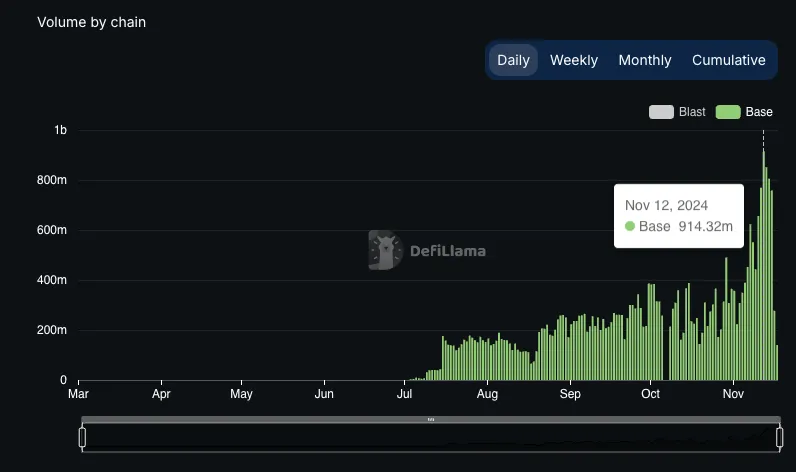

- Base was launched on July 1, and the transaction volume exceeded 100 million US dollars 10 days after launch

- On November 12, the trading volume exceeded 910 million US dollars.

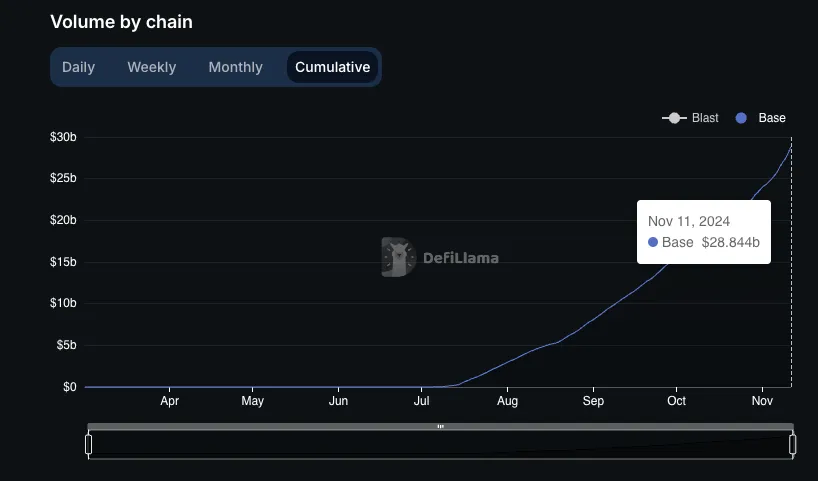

- Cumulative trading volume is close to 30 billion US dollars, with an average daily trading volume of 210 million US dollars

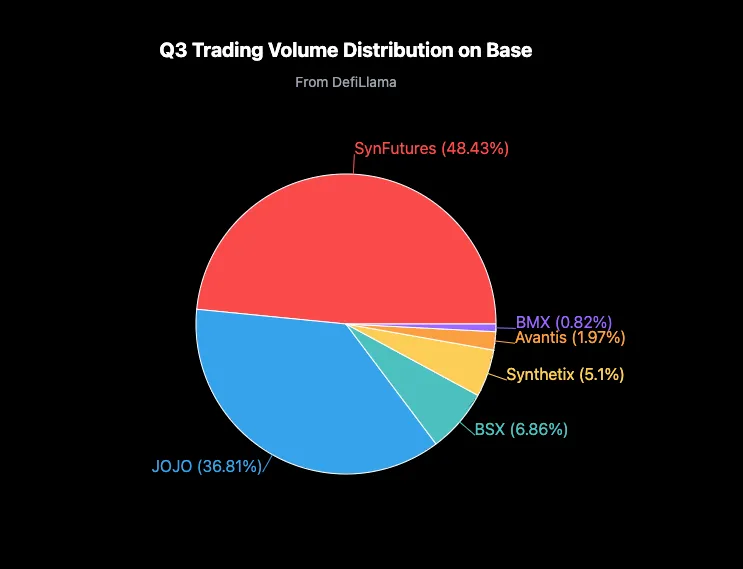

- Q3 transaction volume accounts for nearly 50% of the Base network

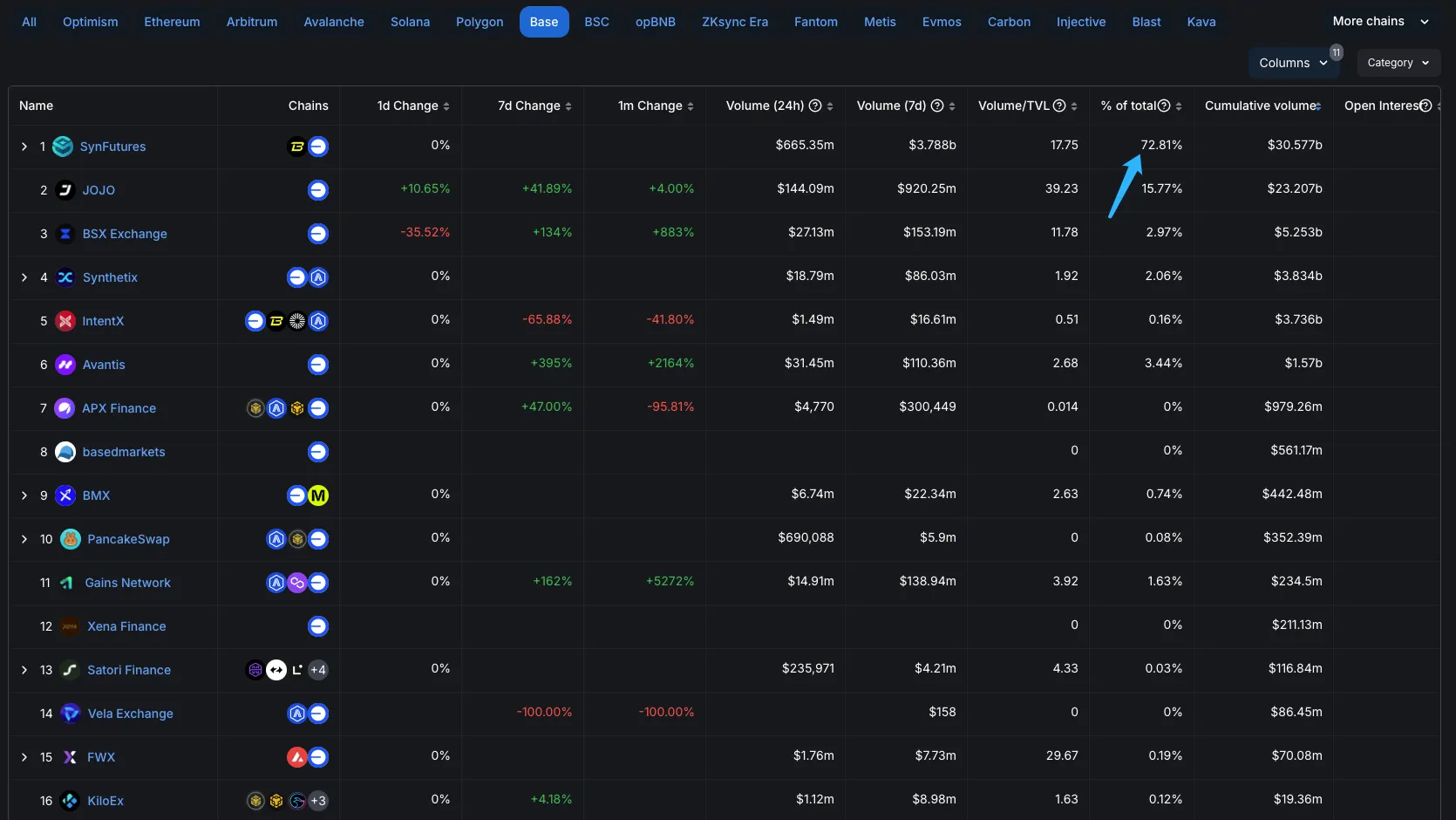

- The transaction volume in the past 24 hours accounted for 72% of the Base network, nearly 5 times that of the second place.

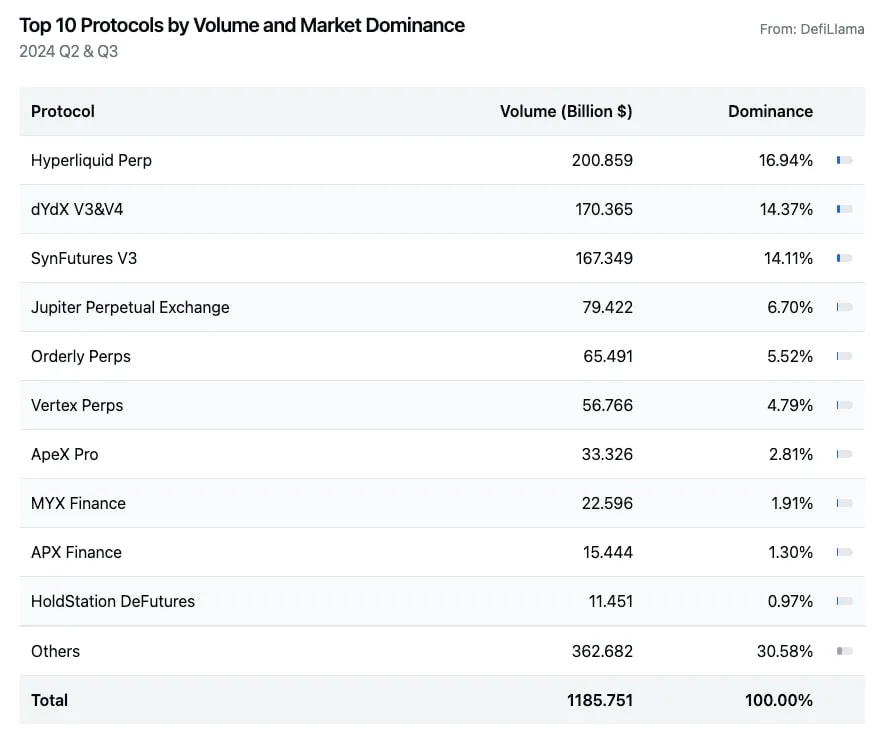

If we look at the entire industry, we can see that the growth of SynFutures V3 since its launch is not inferior to Hyperliquid, dYdX, Jupiter and other projects. According to DefiLlama data, the transaction volume of on-chain perpetual contracts in Q2 and Q3 was 1,185.7 billion US dollars, and the top three accounted for more than 45% of the transaction volume, namely Hyperliquid (16.94%), dYdX V3 & V4 (14.37%) and SynFutures (14.11%).

These impressive results make people curious, why SynFutures, and what is unique about it compared to other derivatives platforms?

3. SynFutures, a disruptor in the derivatives market: centralized liquidity + pure on-chain order book model

Looking back at the derivatives market over the past few years, there are three main types of derivatives models:

- The Vault model represented by GMX - LP acts as the counterparty of the Trader and uses an oracle for pricing. The representative products of this track are GMX and Jupiter. GMX supports more assets, and Jupiter has maintained a high yield and high TVL due to the popularity of SOL, becoming one of the hottest projects in the industry; however, the oracle risk of this type of model is still a hidden danger that cannot be ignored. In addition, since it uses an oracle for pricing, it cannot be used as a place for price discovery, and it is difficult to challenge centralized exchanges;

- Derivatives application chains represented by dYdX and Hyperliquid are favored by market makers and have a place in the market due to their high performance and experience comparable to centralized exchanges. However, the problem of over-centralization of off-chain order books and liquidity fragmentation is still a big challenge for traders and project parties.

- Another model that is more low-key but has already achieved a good market share is the on-chain AMM model represented by SynFutures. This model refers to the centralized liquidity model of UniSwap V3, and introduces an on-chain order book on this basis to further improve the overall system's fund matching efficiency. From the previous Q2 and Q3 derivatives trading volume rankings and market share rankings, it can be seen that in the past six months, SynFutures, a representative of this type of model, has a trading volume more than double that of Jupiter, which uses the Vault model. Even this momentum has not stopped. Judging from recent data, it is only a matter of time before the total trading volume exceeds that of the old decentralized derivatives exchange dYdX.

So, why can the on-chain AMM model represented by SynFutures achieve such a huge breakthrough in a short period of time? What are the advantages of this type of model compared with the other two mainstream models?

3.1 Centralized liquidity - improving capital efficiency

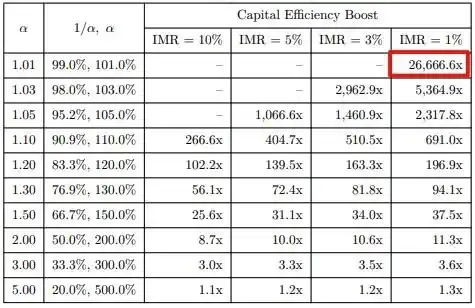

SynFutures' oAMM greatly improves the liquidity depth and capital utilization efficiency of AMM by allowing LP to add liquidity to a specified price range, while supporting larger and more transactions and creating more fee income for LP. From its documentation, we can see that its capital efficiency can be up to 26,666.6 times the original.

3.2 Pure on-chain order book — maintaining efficiency while being open and transparent

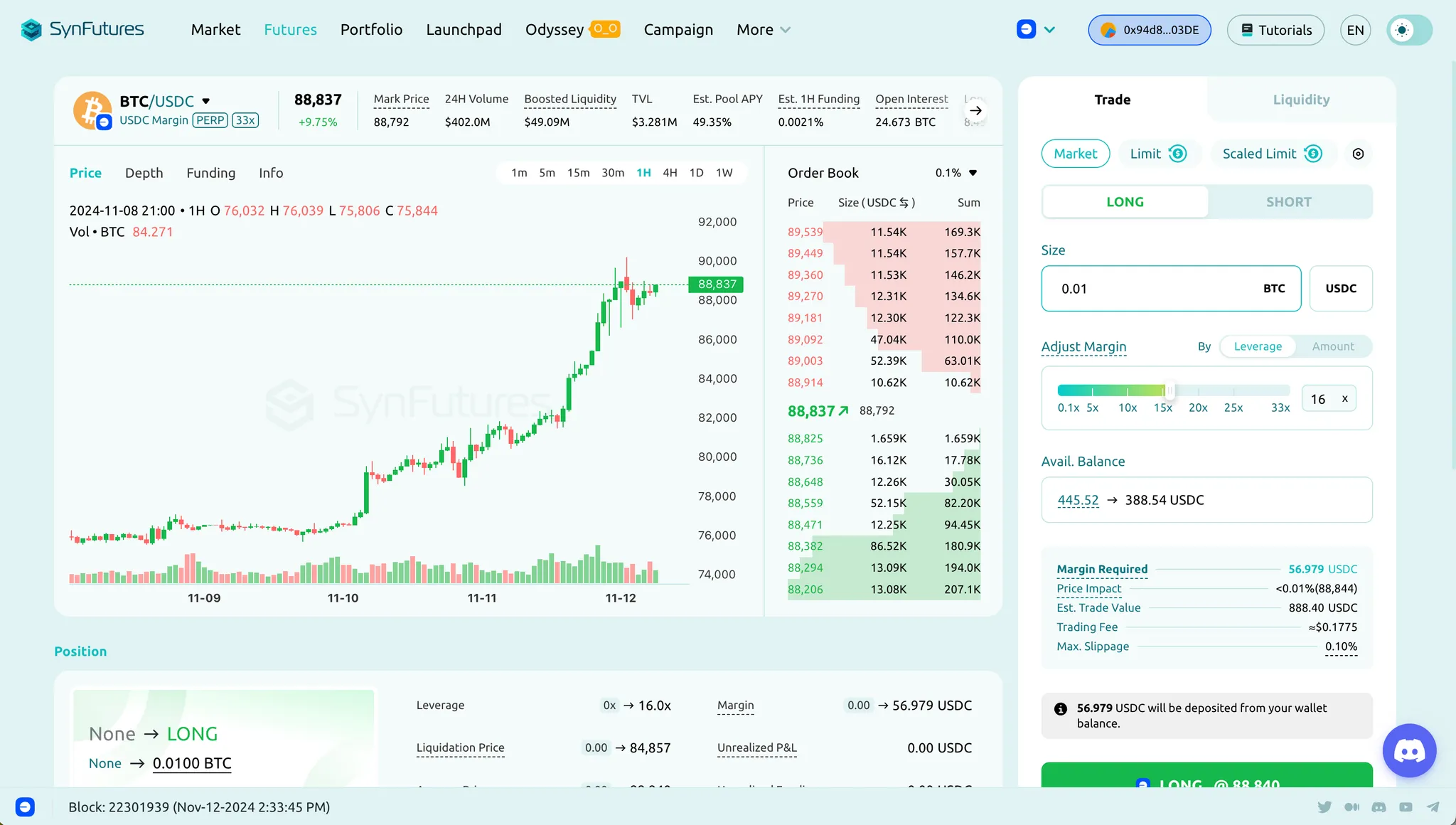

The liquidity of oAMM is distributed in a specified price range, and the price range is composed of several price points. For example, LP provides liquidity at [80000, 90000] of BTC-USDC-PERP. This price range can be divided into several price points, and each price point is allocated an equal amount of liquidity. You may think of it immediately, isn't this an order book? That's right!

oAMM implements on-chain limit orders by allowing users to provide liquidity at specified price points, thereby simulating the trading behavior of the order book and further improving capital efficiency. Compared with the market-making method of traditional AMM, market makers on centralized trading platforms are more familiar with the market-making method of limit orders, have a higher level of awareness, and are more willing to participate in it. Therefore, oAMM that supports limit orders can better attract market makers to participate in active market making, further improve the trading efficiency and trading depth of oAMM, and achieve a trading experience comparable to that of centralized trading platforms.

Unlike off-chain order books such as dYdX, oAMM is a smart contract deployed on the blockchain. All data is stored on the chain and can be verified by anyone. It is completely decentralized, and users do not need to worry about the trading platform's shady operations or false transactions.

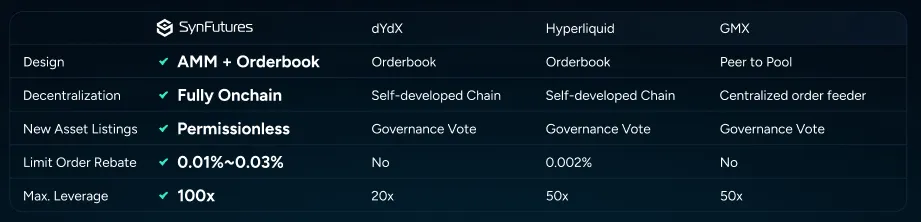

If you compare several projects together, you will find that SynFutures makes up for the shortcomings of the Vault model represented by GMX and the application chain represented by dYdX, while retaining high efficiency and high performance. At the same time, it can naturally combine with various assets of the underlying public chain and integrate into the entire DeFi ecosystem, which naturally has an advantage. With the technical upgrade of the underlying public chain in the future, this advantage will become more and more obvious.

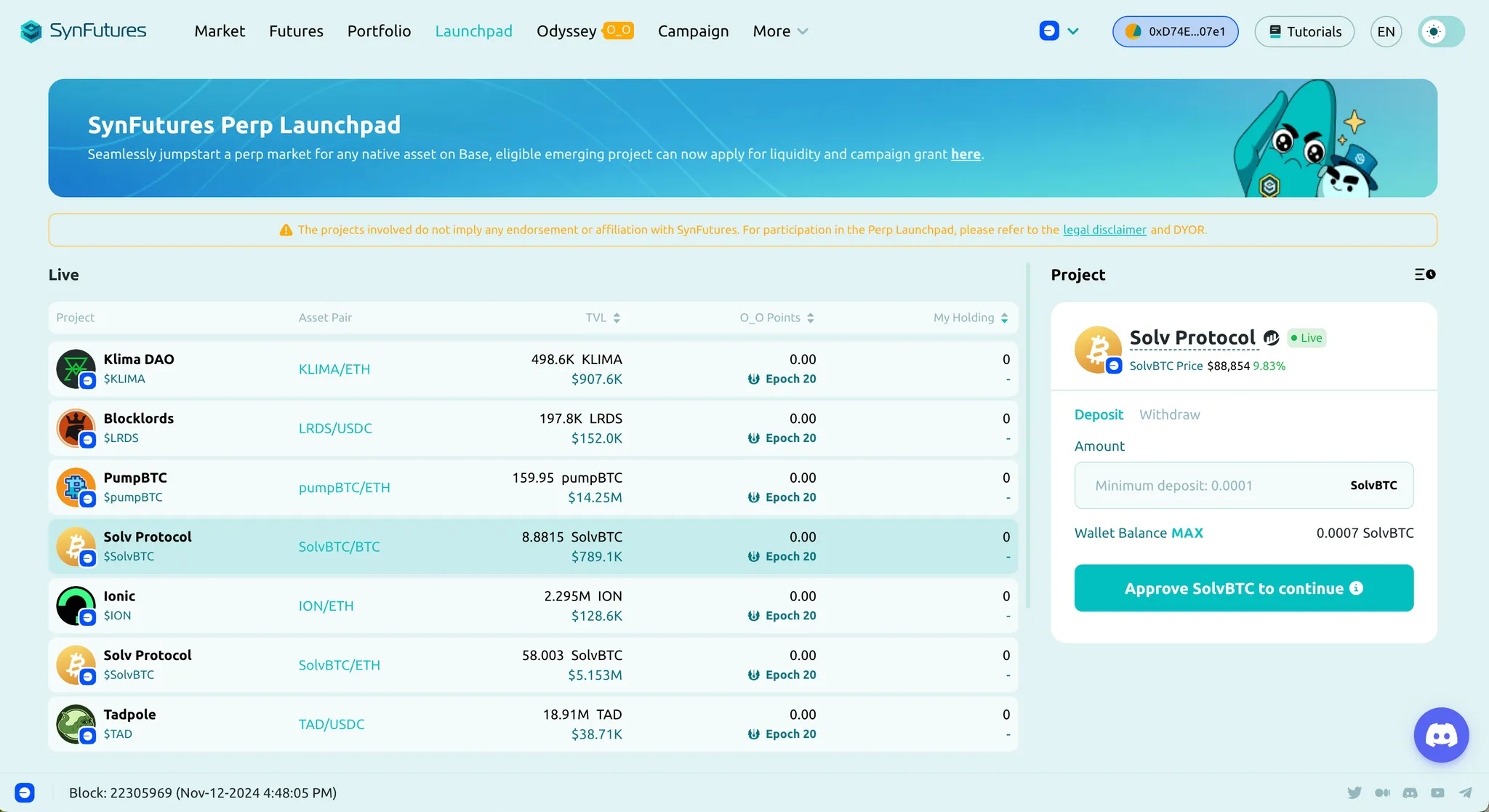

4. The flywheel effect that Perp Launchpad will bring

In addition to the characteristics of the model itself, SynFutures also refers to the model of Pump.fun and launches the industry's first derivative perpetual contract issuance platform. In the past year, it should be said that the most profitable track is asset issuance. From runes to inscriptions, from Pump.Fun to DAO.FUN, all of them continue to create wealth effects and attract more users to enter the market, which inevitably makes some friends who firmly believe in the value of blockchain feel empty. But this is the reality of the current stage of this industry. Whoever can issue assets, attract market attention, and create wealth effects can take advantage of the situation and become a trend-setter. Whether it is the success of Solana at this stage or the hundreds of millions of dollars in revenue from Pump.Fun, they are the best proof of this model. The Perp Launchpad recently launched by SynFutures is based on its own model innovation and new asset issuance methods. It is an innovative product that can open up more new gameplay for more on-chain Degen players.

**Imagine, a MEME token that has just reached 100 million US dollars can open the corresponding contract market by providing liquidity only by using its own project tokens. Wouldn't this coin be more fun? **If truth of terminals can use the $GOAT they hold to open a contract market independently in the early stage, for more aggressive traders, they can choose to use leverage to obtain higher returns, whether it is for bottom fishing or top escaping. When there is a contract market, transactions tend to become more complicated and there will be more trading opportunities. At the same time, in a highly volatile market, along with the price difference between spot and contract prices, arbitrageurs will also be dispatched, all of which are further expanding the popularity and number of holders of this token.

Still using the above example, if truth of terminals really opened a Perp Market with $GOAT, there would be a new narrative **"AI launched its own contract market"** to continue the market enthusiasm, and the market value of $GOAT might even rise further. After all, what this market needs most is dopamine, fun, and excitement, and contract trading is the most interesting means.

Of course, some people may ask, who will provide liquidity? The answer is the project owners and token supporters, who can gain benefits by providing liquidity - more tokens. When the holder holds more tokens, the project can develop in a healthier direction. More importantly, why do we need to wait for centralized exchanges to decide whether to list corresponding contracts and then eat up most of the profits generated by most contract transactions? Why can't the project owners and the community hold their own contract market? This is exactly what Perp Launchpad wants to try to do, to return the dominance of the contract market to the community.

In the past few years, we can see that the dominance of spot listing has returned to the community, with the on-chain liquidity pool as the starting point, and even more obvious in MEME transactions; and in the next few years, the dominance of contract listing will return to the community . This sounds crazy, but it is already happening, and it will happen faster and faster. From SynFutures’ recent announcement, we can see that its Perp Launchpad’s trading volume exceeded 100 million US dollars in the first week of its launch, and it is still growing rapidly.

In the future, we will see more and more project parties choose to dominate their own derivatives market after entering the spot market, master the liquidity of the derivatives market, and then use the profits obtained to help the project party develop or give back to the holder, entering a more benign and healthy development state. "Trading as Margin" has become one of the practicalities of tokens, and "dividends" have become the standard of tokens. All of this is happening in full swing under the promotion of SynFutures.

When this prairie fire starts, it will be like providing a huge pump for SynFutures, which is very beneficial to the rapid growth of its TVL and trading volume, and it will be one step closer to the leading position in the derivatives track. Let the dominance of the perpetual contract market return to the chain and the community. This is a market of at least 1 billion US dollars. Taking the Base network as an example, Aerodrome currently has a TVL of 1.4 billion US dollars. Even if only 1/10 of the funds choose to have its own derivatives market, it is close to 150 million US dollars in TVL. And this is just the TVL of one protocol on the Base network. Looking at the entire market, the only one that can do this is SynFutures. Its oAMM built for specialized contract transactions will be the biggest beneficiary of this trend.

In terms of revenue, SynFutures will have the opportunity to compete with top protocols such as AAVE and MakerDAO in the future. Without considering Launchpad, its fee income in the past 30 days has exceeded 2 million US dollars, ranking third among protocols (the third place is Sequencer of Base network).

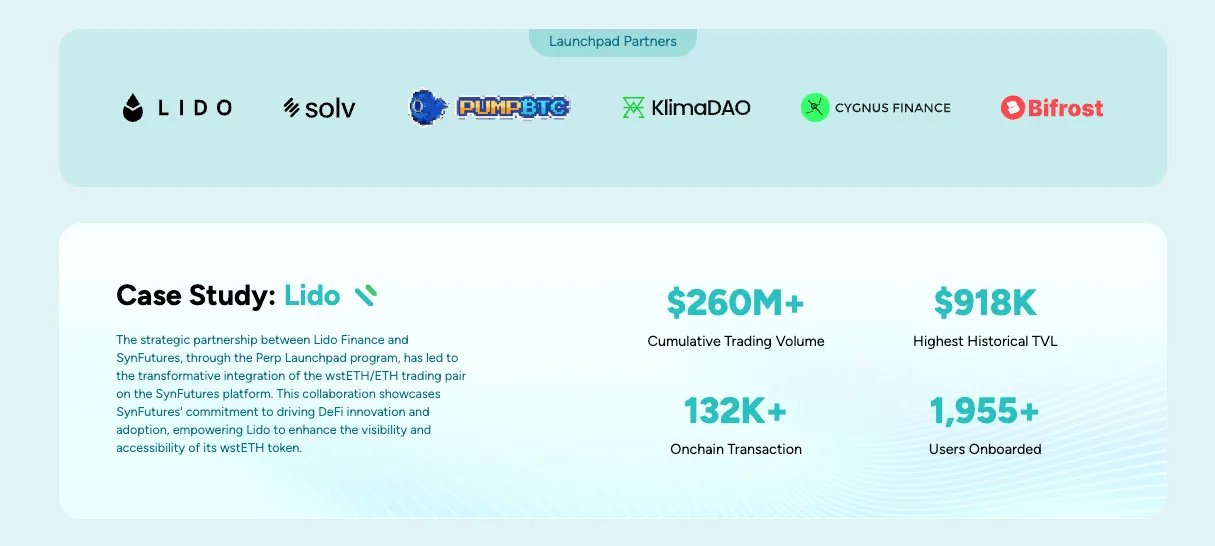

These potential revenues can help SynFutures quickly expand its market share of Perp Launchpad and become the leader in this track. Currently, in the first grant, SynFutures has set up a funding plan of 1 million US dollars, aiming to provide coin listing support, event support, etc. for emerging projects, while helping projects increase their exposure and activity in the on-chain market.

The participation of more project parties can help SynFutures gain more support from the project community, which means more users and more income, which can further help SynFutures expand its influence in the market and build a growth flywheel. This is without considering the incentives of its token economic model to the ecosystem. Don't forget that SynFutures is a project that has received a total of US$38 million in financing from well-known industry institutions such as Pantera, Polychain, Dragonfly, Standard Crypto, and Framework. The potential incentives of its future tokens and the promotion of the growth flywheel will reach an astonishing level.

5. SynFutures will lead a new round of innovation in the decentralized derivatives track

If you can see this, you may be able to feel the author's love for SynFutures and his optimism about its future development. Because in my opinion, the derivatives track in the DeFi field has not had a new story or new direction for a long time. We all know the oracle risk of the Vault model, and we also know the centralization problem of the application chain, but what about the solution? This track has been silent for a long time, and it needs new forces to stir it up in order to further compete with the centralized market. **In my opinion, SynFutures is undoubtedly the most innovative derivatives project in this stage that keeps pace with market demand. From its AMM model designed specifically for derivatives to the recently launched Perp Launchpad, all of them are leading a new round of innovation in the decentralized derivatives track and pushing this track to a better direction. **In the new round of DeFi market, SynFutures is playing the role of a game-changer in the derivatives track, pushing the entire track towards a new round of innovation and more benign development!