Author: 0XNATALIE

Since the beginning of this year, the community has begun to discuss topics related to gas fee derivatives. In June, Finn, a researcher at Nethermind, proposed a model for pricing Ethereum base fee options, which attracted widespread attention from the community to gas fee derivatives. This financial instrument provides participants in the Ethereum ecosystem with a new means to deal with the uncertainty of gas fee fluctuations. It can not only help users hedge against fluctuations in operating costs, but also bring new opportunities for speculation.

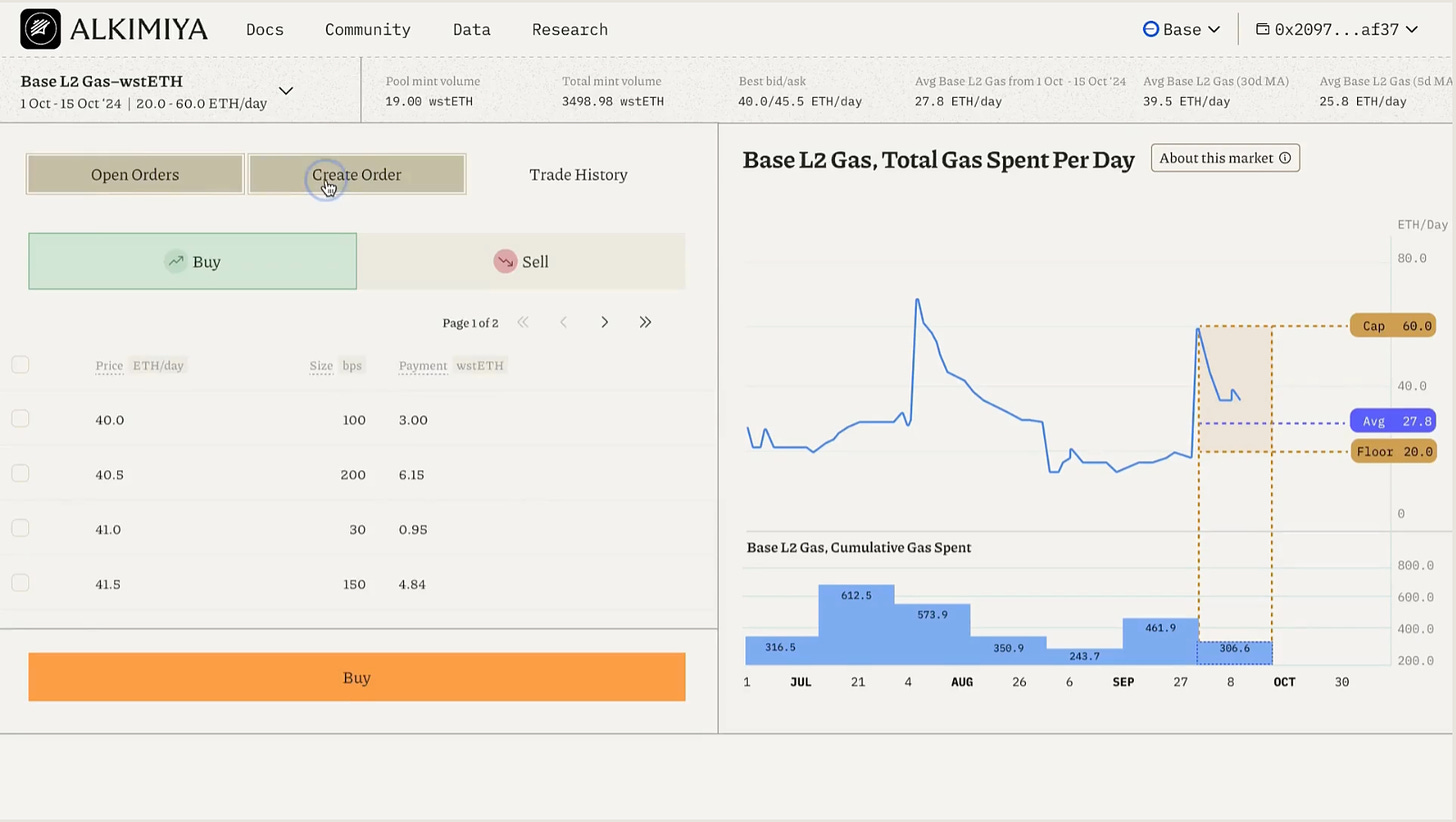

Base Gas Market: Betting on Future Gas Fee Fluctuations

Recently, Alkimiya has built a financial market on Base: Base Gas Market (not yet officially launched), which allows users to indirectly participate in changes in network economic activities by trading the fluctuations in the gas fees of the Base network. Alkimiya is a protocol that can trade block space resources (such as transaction fees). By converting resources such as blockchain transaction fees into tradable assets, it helps users hedge against fee fluctuations and provides more speculative opportunities.

In the Alkimiya Base Gas Market, users can bet on the growth or decline of Base's total Gas fees by going long (LONG) or short (SHORT). If a user believes that Base's revenue will increase in the future, he can bet on the increase in Gas consumption by going long; if he believes that revenue will decrease, he can go short. Since these fees are collected by Base's sequencer, Gas consumption actually reflects Base's usage and revenue. Therefore, this kind of transaction is essentially a speculation on the future development trend of the Base ecosystem.

In this market, each pool corresponds to a time period, which consists of all long and short positions in the same time period, and all users participating in the time period will gather in the same pool. Users can enter the pool at any time, and exit and settlement will occur at the end of the time period, when the user's reward or loss will be determined based on the change in total Gas consumption.

For example, suppose Xiao A sees that Base will have multiple airdrops in the next two weeks, predicting that these events will cause Base's total Gas consumption to increase significantly, so Xiao A decides to join a market pool from January 1 to January 15 (a period of 15 days). During this market cycle, the Gas fee is calculated based on the market between 20 ETH/Day and 60 ETH/Day (if exceeded, it will be limited to the maximum/minimum value). Xiao A chooses to enter the market at 42 ETH/Day, predicting that Gas consumption will exceed 42 ETH/Day, and buys 1% of the Gas fee share of the entire market, which means that he needs to pay an initial margin: (42-20)*15*1% = 3.3w ETH. If the actual value of daily Gas consumption is always higher than 42 ETH/Day, Xiao A will make a profit.

How to participate?

Base Gas Market provides a way for users to participate in the fundamental growth of Base. Unlike investing in Base governance tokens, users can directly bet on the usage and activity of the Base ecosystem by trading total Gas consumption. More users and higher activity levels mean more Gas fees. In this way, users can invest based on Base's Gas usage without having to rely on token price fluctuations. In addition, users can use this market to hedge against fluctuations in Gas fees and avoid the risks caused by unstable Gas prices.

External factors that may affect the Gas market include: Base may increase the Gas Limit, which will lead to a drop in Gas prices; Base needs to process transactions in batches to Ethereum L1 for settlement. With the adjustment of Blobs (such as the increase in Blob base fees), the settlement cost of L1 may change; changes in the rental of OP Superchain may also affect the Gas price of Base, etc.

Ordinary user participation process:

- Choose a bullish (long) or bearish (short) position based on your prediction of Base Gas consumption.

- Select the time period to participate and choose the corresponding market pool.

- Pay the corresponding margin, enter the market pool and start trading.

- Wait for the pool cycle to end, and receive rewards (wETH) based on the actual total Gas consumption. (For the specific calculation formula, see this document)

In addition to the transaction fee market on Base, Alkimiya also provides a Bitcoin transaction fee market to help users hedge against the volatility of Bitcoin network Gas. It also launched Bitcoin Transaction Fee Runes (BTC•FEERATE•RUNES), a synthetic asset (rune) directly linked to Bitcoin transaction fees. When transaction fees increase, the value of this rune will also increase. Users can buy and sell runes in the market for hedging or speculation. And they can pay a certain fee to redeem the rune for Bitcoin.