Perps, from off-chain to on-chain

In the world of Web3, fully on-chain has always been a political correctness. The process of confirming the ownership of assets and publicly recording all transactions through blockchain ledgers has brought with it the historical wave of decentralization, and has continuously rolled up huge waves of money 24 hours a day. Even though the chain is also a dark forest, it is the soil we rely on for survival. It is an indisputable fact that blockchain is leading human financial civilization forward.

In this context, the on-chain trading of perpetual futures (Perps) is a market opportunity with huge incremental space. Perps is different from traditional futures. It has no expiration date and can be held indefinitely, so it is called "perpetual". Its high leverage ratio and flexibility in switching between long and short positions are deeply loved by the majority of Web3 investors. For example, we can imagine a scenario where an unexpected event occurs. Based on their trading experience, investors judge that there is a high possibility of benefiting Bitcoin, so they buy high multiples of long positions. Soon, when the impact of the event spreads, the investor will reap a lot of benefits from this transaction. One of the advantages of Perps is to leverage huge returns with small funds. This is why in traditional centralized exchanges, Perps has formed a highly active market with an annual trading volume of trillions of US dollars.

However, we have seen that there are many disadvantages in the perpetual contract trading venue provided by CEX. Compared with the Perps in CEX, the Perps on the chain have the following advantages:

1) Self-custody and security of funds

In the on-chain Perps mode, user assets are always kept in personal wallets, achieving complete self-custody and ensuring fund security. All transaction data is stored on the chain, and users can trace it at any time to ensure information transparency. In contrast, CEX centrally holds user assets in platform wallets. Once attacked or the platform does something malicious, user assets face significant risks (such as encountering endless exchange theft incidents). In addition, CEX usually sets rules such as withdrawal limits, further weakening users' autonomous control over their assets.

2) Simplified transaction process

CEX usually requires users to complete multiple steps such as top-up, transfer and withdrawal, and the process may be extended due to the lack of currency. PerpDEX runs directly based on the user's wallet, eliminating the transfer link of CEX and significantly improving transaction efficiency and convenience.

3) Transparency and risk control

All operations of PerpDEX are performed on the chain, ensuring 100% transparency, eliminating malicious behaviors such as "plugging", and effectively preventing misappropriation of funds. Taking the FTX incident as an example, its valuation of $32 billion was reduced to zero due to misappropriation of user funds, highlighting the opacity and potential trust crisis of CEX off-chain matching transactions and liquidations.

4) System stability

PerpDEX directly executes operations through smart contracts to avoid withdrawal obstacles caused by liquidity issues. Some platforms support multi-chain operation, reducing dependence on a single chain, further improving system stability, and maximizing the security of user funds.

5) Regulatory restrictions

Due to the long-term existence and strict regulation, users in some countries or regions cannot open CEX, or can only use some functions of CEX. At this time, the advantages of Perp DEX can be fully reflected. Crypto assets are the money of the Internet. Users can trade as long as they can connect to the Internet.

It is precisely because of these reasons that we see that not only the proportion of spot on-chain transactions is continuously increasing, but also the proportion of Perps on-chain transactions is growing rapidly. In this trillion-dollar track, there are already previous-generation products such as GMX and DYDX. At the same time, we see that the new generation of KiloEx, which has more product power and creativity, has emerged and is making Pareto improvements on the next generation of on-chain transactions.

Bottleneck on the chain: Gas fee

Although there are many advantages on-chain compared to CEX, there are also some disadvantages. For example, the high gas fee on-chain is an unavoidable problem. CEX can achieve lower friction costs due to centralized data processing, while on-chain, every operation of the user needs to contribute to the node gas fee to maintain the stability of the overall network. The existence of gas fees has become a constraint for some users. So, how to solve this problem and give users a better trading experience?

There are two ideas here: First, to subsidize users’ gas consumption. Although this method realizes the user’s 0 gas experience, on the one hand, there is a delay in transactions, and on the other hand, the platform actually bears the transaction costs. When transactions occur frequently, the platform will have certain cost expenditures and cannot maximize the value fed back to the ecosystem.

Another idea is that KiloEx chose to innovate at the smart contract level. The current main ways to implement gasless are EOA Based Paymaster based on EIP-4337 and Meta-Transaction based on ERC-2771. KiloEx chose the latter technical path. For specific technical details, please refer to the relevant documents, which will not be elaborated here.

Gasless implementation process of Meta-Transaction

Simply put, KiloEx has created a trading environment close to 0 gas through smart contract innovation, which is comparable to CEX (even CEX needs to charge some transaction fees). Of course, this direction still needs to be explored in some non-EVM public chains, but at least it can be basically realized in mainstream EVM public chains such as opBNB, BNB, and base.

In addition, KiloEx has other innovations in creating a trading-friendly environment, such as:

- One-click trading: KiloEx's 1CT wallet eliminates the need for users to interact with the wallet during transactions, achieving more efficient one-click trading. Due to the introduction of the transaction authorization mechanism, users do not need to manually sign each transaction, but the 1CT wallet automatically executes the transaction submission, thereby greatly improving transaction efficiency.

- Extreme optimization of transaction speed: KiloEx has significantly shortened the transaction time through innovations in code and contracts, and is currently faster than more than 90% of Perp DEX.

KiloEx's product and mechanism features

After understanding the inevitability of the migration from off-chain to on-chain and solving the problem of insufficient on-chain trading experience, we can truly begin to examine the value of KiloEx and recognize its mission as an iconic product. KiloEx is reshaping the usability standards of perpetual contract trading through the product philosophy of "CEX-level experience, DEX-level control".

As the champion project of Binance Labs' sixth season MVB, KiloEx provides up to 125x leverage trading for more than 70 crypto assets (covering BTC, ETH, Meme coins, DeFi tokens, AI concept assets and foreign exchange trading pairs) through a fully decentralized perpetual contract agreement, and achieves breakthroughs in liquidity efficiency and income stability with its unique Vault fund pool model. It currently ranks first in TVL and trading volume in the entire opBNB track, and continues to lead in the derivatives track of Manta and Taiko, and is rapidly growing into a benchmark protocol for multi-chain derivatives DEX.

So far, KiloEx has accumulated a total transaction volume of more than 34 billion US dollars, with an average daily transaction volume of about 100-200 million US dollars on various chains. There are nearly 800,000 total users, and more than 1 million users in the Telegram application. Since its launch, TVL has continued to rise, reaching a peak of 50 million US dollars, and is currently close to 40 million US dollars.

KiloEX’s TVL, source: DefiLlama

In addition to the optimization of gas fees and the improvement of transaction performance mentioned above, there are also the following product features:

Dual-pool risk isolation architecture

KiloEx abandons the traditional order book model and adopts a liquidity pool (LP) direct trading mechanism to completely eliminate the slippage problem. Users can directly complete instant exchange with the capital pool. If there is only one capital pool, liquidity problems may occur in extreme market conditions. Therefore, KiloEx has set up a dual capital pool to effectively resist the liquidity risks brought by unilateral market conditions:

- Base pool: It is composed of USDT/USDC deposited by users (accounting for 70%) and 30% of platform fee income, providing a stable income base. The annualized rate of return on the opBNB chain is 22% (Taiko chain 29%).

- Buffer pool: absorbs trading profit and loss fluctuations and funding rate income and expenditure, serving as a buffer layer for the Base pool. The Base pool will only bear losses when the Buffer is exhausted, significantly improving the stability of stakers' income.

The underlying logic of this design is the key point for a Perp DEX platform: the ability to resist unilateral market conditions. Vault 2.0, launched by KiloEx in Q1 2024, uses a dynamic rebalancing mechanism to convert the surplus of the Buffer pool into the Base pool reserve during the unilateral rise phase of the bull market, reducing the impact of extreme market conditions on staking returns. Actual measured data shows that the volatility of returns during the period when BTC broke through $70,000 was 63% lower than that of the older version.

Innovation in revenue distribution

Due to the existence of dual pools, KiloEx has innovated the distribution of revenue. 30% of the user's transaction fees will be contributed to the Vault, which gives KiloEx's Vault a source of stable growth. When traders make a profit, funds are spent from the Buffer pool; when they lose money, funds are injected into the Buffer pool. Base pool stakers always receive a share of the transaction fees, and the long-term positive accumulation of the Buffer pool forms a "safety cushion" of revenue, making the yield during the bear market outperform mainstream yield aggregators (such as Yearn, Convex).

At the same time, KiloEx has also learned from the successful path of CEX and created a multi-level rebate system, which currently has more than 1,700 first-level nodes. After deducting 30% of the user's handling fee that enters the Vault, 20%-40% of the remaining part will be returned to the channel. This is one of the reasons why KiloEx can achieve fission growth. In the rebate design of CEX, there is a possibility of "killing the donkey after it has done its job", that is, after some channels bring users to CEX, when the brand reaches a certain level, these channels are no longer needed, and the channels cannot continue to enjoy dividends from the revenue. However, KiloEx helps the channel lock in this part of the revenue through smart contracts, and grows mutually beneficially with partners.

After the KILO token is issued, users can mint xKILO with their KILO tokens at a 1:1 ratio. Stake xKILO. Stake xKILO will share trading fees and gain VIP privileges. xKILO will also be used to incentivize users and partners in operational activities, as well as for treasury and other purposes. Trading fees will be allocated to the xKILO unilateral staking pool, ecosystem and liquidity pool, and all referral rewards and copy trading profit sharing will be directly paid in USDT for trading fees. 40% of trading fees will go to the ecosystem, 30% will go to $xKILO holders, and the remaining 30% will go to the liquidity pool.

Hybrid Vault

KiloEx's Hybrid Vault allows users to provide underlying liquidity in a variety of currencies, further optimizing the capital structure while providing real and substantial returns for LST and other mainstream assets. The Hybrid Vault consists of two parts, of which USDT accounts for half of the total Vault amount, and other currencies (non-USDT) account for the other half of the Vault. The source of this high return is the handling fees provided by users in the Vault model.

For mainstream assets such as BTC, BNB, and MANTA, it is difficult to find products that can provide stable and high returns in the market, but KiloEx Hybrid Vault has achieved a real yield of 12.87% for WBNB on opBNB settled in USDT, and a real yield of 16.21% for FDUSD. This gives it a clear leading advantage among all staking yield products.

For many non-mainstream coins, KiloEx also provides relatively high real returns for these tokens. For example, in the LST field, compared with the re-staking agreement that can only provide point rewards, KiloEx directly provides USDT returns to ensure the stability of returns. For example, STONE holders on the Manta network can obtain about 8% of USDT real returns by staking them in the KiloEx Hybrid Vault.

In addition, KiloEx has also developed a currency-based trading contract. In the contract transaction, the handling fee, margin, and Vault can be any project's own token, further lowering the threshold for contract issuance. After the successful TGE, KiloEx will also open the Staking function. Users who participate in Staking can get a share of the handling fee. The circulation of KILO will be further reduced, which is conducive to price increases. The price increase will attract more users to Staking, further reducing liquidity and forming a deflationary effect with a virtuous cycle.

Multi-chain deployment

In order to break down the barriers between chains, KiloEx has been deployed on multiple mainstream blockchains such as BNB Chain, opBNB, Manta, Taiko, and Base, and has built-in cross-chain bridging functions, allowing users to seamlessly switch network environments, reducing gas costs while enjoying a smooth cross-chain transaction experience. After that. Currently, KiloEx is already the largest application on opBNB. In addition, KiloEx will also be connected to public chains such as Solana and Move, and ultimately achieve multi-chain interoperability and open up the underlying liquidity.

The product is extremely user-friendly

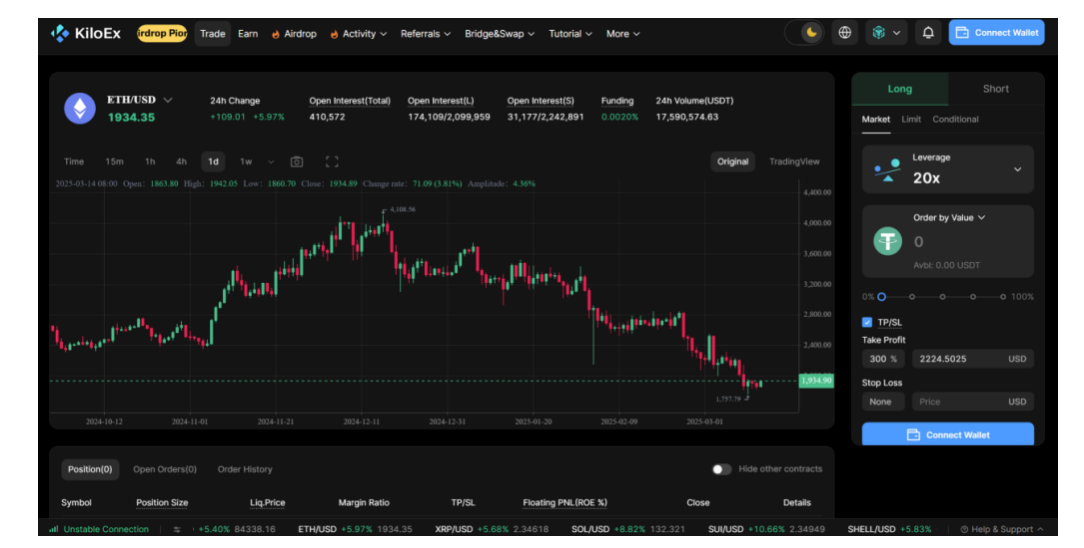

For novice users, the platform has designed a minimalist trading interface, hiding complex parameters such as funding rates and position sizes, and condensing the opening and closing operations to within three steps; even if facing the risk of forced liquidation, some of its liquidation mechanisms will only reduce positions proportionally to prevent users from losing their principal due to a single market fluctuation.

KiloEx Trading Interface

KiloEx team and financing

The KiloEx team demonstrates the dual characteristics of a CEX veteran and a DeFi innovator. Its strategy of "pragmatic and fast-paced, long-term and in-depth" is unique in the field of derivatives DEX. Through the key endorsement and efficient execution culture of Binance Labs, the project has built a triangular moat of products, resources, and experience. In the future, if it can moderately improve transparency while maintaining technological iteration, it may further leverage institutional funds and mainstream users to enter the market.

The KiloEx team is composed of core members of top exchanges such as Binance and OKX, with rich experience in CEX operations, DeFi protocol development, and traditional financial derivatives design. As early as 2022, the team participated in the sixth MVB incubation program of Binance Labs with a scale of 5-6 people, and won the title of "Most Valuable Project (MVB)" with its excellent product prototype landing capabilities, and then successfully obtained Binance investment.

KiloEx has always adhered to the core culture of pragmatism and efficiency, and advocated a "minimalist execution" working method. For example, during the incubator period, after the mentor of Binance Labs suggested developing a product landing page, the team completed the design and deployment that night, and delivered the complete page the next day. Its execution efficiency far exceeded the industry average. In addition, KiloEx adheres to the development strategy of low-key and deep cultivation, knowing that the core of the DEX track lies in the long-term accumulation of user trust rather than relying on short-term traffic speculation. The team is firmly optimistic about the long-term potential of perpetual contract DEX, and believes that only by continuously polishing products and building a stable channel ecology can we truly promote the realization of Mass Adoption.

KiloEx received strategic investment through Binance Labs MVB incubator in its early stage, and investors include Yzi Labs (formerly Binance Labs), Foresight Ventures, Crescendo Ventures, Manta Foundation, etc. Different from competitors who rely on capital accumulation, KiloEx impressed Binance with its clear track recognition and team execution. For example, the ability to quickly verify products during the incubation period became a key plus point.

Competitive product analysis

Overview

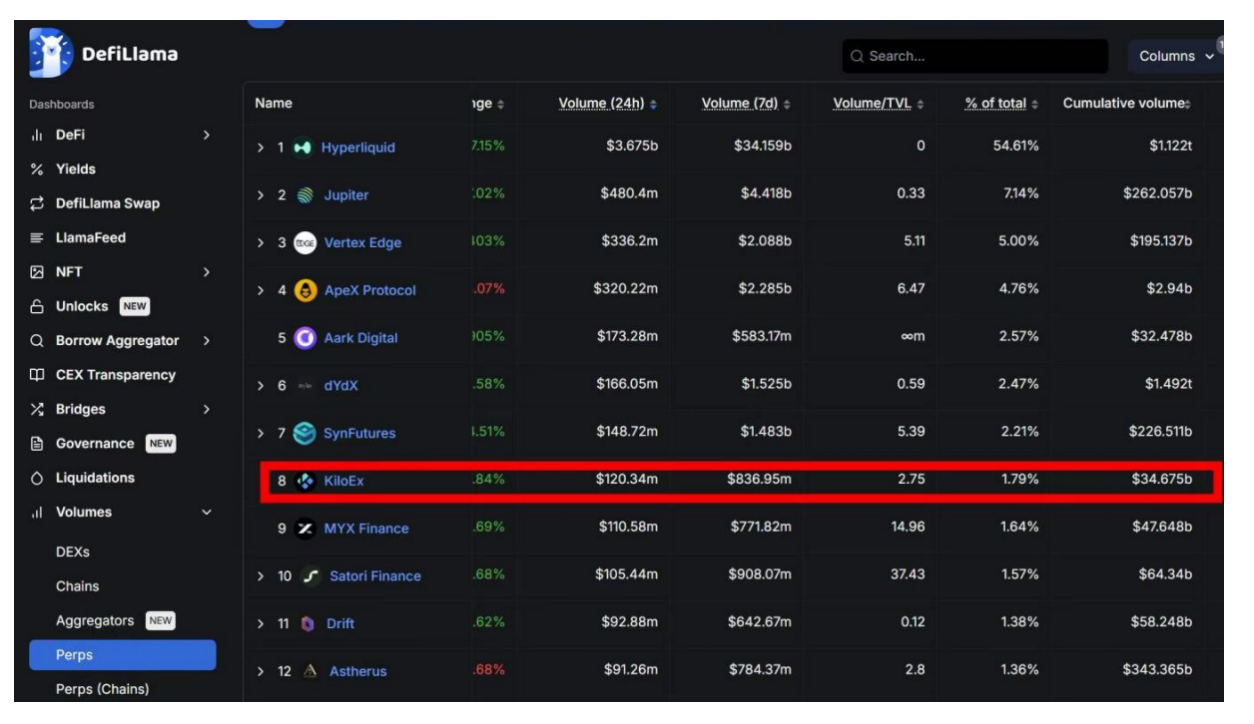

In the current Perp DEX field, TVL is an important indicator to measure the scale of the platform and user trust. As a rising star, KiloEx quickly reached a TVL of about 40 million US dollars, which is an achievement that cannot be underestimated in Perp DEX. In addition, trading volume is also a crucial indicator that reflects the user usage of the platform. In Defilama's Perp DEX, Kilo ranked 8th in 24-hour trading volume and 9th in 7-day trading volume. This is enough to prove that KiloEx has already ranked first in the Perp DEX track where strong players gather.

Perp Dex 24-hour trading volume ranking, 25/3/18, data source: DefiLlama

DYDX

dYdX is the earliest established decentralized digital currency derivatives trading platform. It is a decentralized derivatives exchange for perpetual contracts and margin trading. dYdX reached its peak in 2022, with a TVL of nearly $1.2 billion. But then it declined significantly in the bear market. In 2024, after the launch of dYdX V4, on-chain transaction volume rebounded, but has not yet returned to its early peak level. Compared with dYdX's early dominance in the decentralized derivatives market, today's market competition is more intense, and other Perp DEXs have gradually taken away part of the transaction flow.

The biggest feature of dYdX is that it provides traders with an off-chain order book for on-chain settlement, and off-chain matching for on-chain settlement. However, there are two major problems with this mechanism design:

(1) Centralization risk: Users cannot verify order matching in real time, which lacks transparency. At the same time, centralized storage increases the possibility of the platform manipulating market prices and is more susceptible to intervention than AMM.

(2) Liquidity issues: When the order book depth is insufficient, prices are susceptible to large transactions and fluctuate violently, affecting user returns. Off-chain matching mechanisms may cause transaction delays due to insufficient liquidity or network congestion, resulting in poor user experience.

Compared with dYdX, the AMM mechanism adopted by KiloEx is a more optimized solution. The on-chain AMM mechanism can avoid market maker manipulation, rely on the price curve to allocate liquidity, and is more friendly to retail investors. Through the oracle to aggregate price data and use the most reasonable AMM curve, 0 slippage transactions are achieved. So far, there has been no "pin plugging" or downtime, ensuring price stability. At the same time, KiloEx's point-to-pool dual-Vault mechanism can also ensure sufficient liquidity.

GMX

As the leading platform of Perp DEX, GMX has introduced many innovative features in its V2 version. The biggest feature after the change is that the transaction is supported by a unique multi-asset pool. In the V2 version, each trading pair has a corresponding LP. Although it can make GMX less risky, with a larger trading capacity and support more asset transactions, multiple LPs will inevitably lead to liquidity dispersion. Compared with GMX, KiloEx adopts a unique Hybrid Vault model.

Compared with GMX V2, KiloEx aggregates liquidity more. At present, CEX still occupies a large market share and seizes DEX liquidity. Therefore, whether liquidity is concentrated is the key to Perp DEX, which determines the trading depth, capital efficiency and market competitiveness. At the same time, the high yield of Hybrid Vault can have a siphon effect on many non-mainstream coins, further obtaining market liquidity.

Hyperli q uid

Hyperliquid is a decentralized trading platform designed for efficient transactions. Its core advantages lie in transaction efficiency and no gas fees. Although it has achieved a high TVL and market share, Hyperliquid still has major limitations in terms of on-chain support and ecological openness. Hyperliquid only supports its own native L1 and lacks support for other chains, which limits its adaptability in the multi-chain ecosystem. The platform is overly dependent on the mainnet.

In addition, the construction of the Hyperliquid mainnet still needs to be further improved, which limits the interactivity with other on-chain ecosystems, user expansion, and diversity of application scenarios.

KiloEx currently supports 6 networks including BSC, OpBNB, Base, and Manta, and has both excellent trading experience and important status. In the BSC + OpBNB ecosystem, KiloEx occupies a very important market position, especially in the OpBNB ecosystem. In terms of TVL, KiloEx is the largest DEX in the OpBNB ecosystem. On the Base network, KiloEx supports users to trade directly through USDT without paying any handling fees or holding native currencies, further improving the convenience of transactions. In addition, KiloEx plans to launch the Solana ecosystem in the next stage, and launch spot DEX to expand more trading categories.

In addition, Hyperliquid's strategy design is highly risky, especially when high-leverage traders use margin strategies, which may cause LPs to incur huge losses. Although the platform has tried to reduce risks by increasing the maintenance margin requirements for large positions by adjusting the maximum leverage multiples of BTC and ETH, this is only a remedial measure and cannot fundamentally solve the potential high-risk problems in the mechanism. The strategy may still continue to harm the interests of LP users during extreme market fluctuations. Recently, there was an incident in which its mechanism was exploited, resulting in a loss of $4 million for HLP (a market-making fund composed of user funds). The core problem was that high-leverage traders took advantage of the defects in margin strategies and mechanism design, resulting in abnormal market liquidations, which were eventually taken over by HLPs, resulting in huge losses.

Compared with Hyperliquid, Kilo reduces the risk of LPs directly bearing losses from extreme market fluctuations through a dual-Vault mechanism. When extreme situations occur in the market, Buffer will first bear part of the losses as a buffer, rather than letting liquidity providers bear the losses directly. This reduces the impact of high-leverage position liquidation on LPs and maximizes user interests.

Jupiter

Jupiter’s trading aggregation section in Solana is excellent, and it aggregates more than half of the trading volume. Jupiter’s corresponding Perp DEX also performed well. Although it declined slightly and the decline was large, it also occupied 7% of the market share.

However, in comparison, Jupiter also has certain flaws. For example, Jupiter supports few tokens: including SOL, ETH, WBTC, USDT, etc., which means that it can only realize leveraged trading of limited currencies. KiloEx can support multiple tokens on multiple chains.

In addition, Jupiter has not established a user marketing mechanism. Compared with other mainstream public chains, Sol chain still has certain limitations in liquidity depth and user base. If Perp DEX wants to achieve long-term stable development, it must establish a complete user marketing mechanism to enhance user stickiness and market competitiveness. KiloEx has established a complete rebate mechanism and trading competition incentive mechanism. So far, it has attracted more than 1,800 channel users and a considerable number of direct customers, and the transaction volume provided is also very impressive.

Compared with KiloEx, Jupiter also has the problem of higher fees. As the transaction frequency increases, the gas fee that users need to pay will increase exponentially. Since the essence of an aggregator is a high-frequency on-chain transaction behavior, it optimizes the user's transaction price by obtaining liquidity from multiple sources. Jupiter optimizes the user's transaction price by aggregating liquidity from multiple sources, and frequent transactions inevitably push up the gas fee. In addition, Jupiter's JLP pool also has cost issues. Due to the target ratio setting for each token in the pool, once the token ratio deviates from the target, it will result in higher fees. KiloEx's low fees are mainly achieved through wallet authorization mechanisms and gas payment.

Competitive product summary

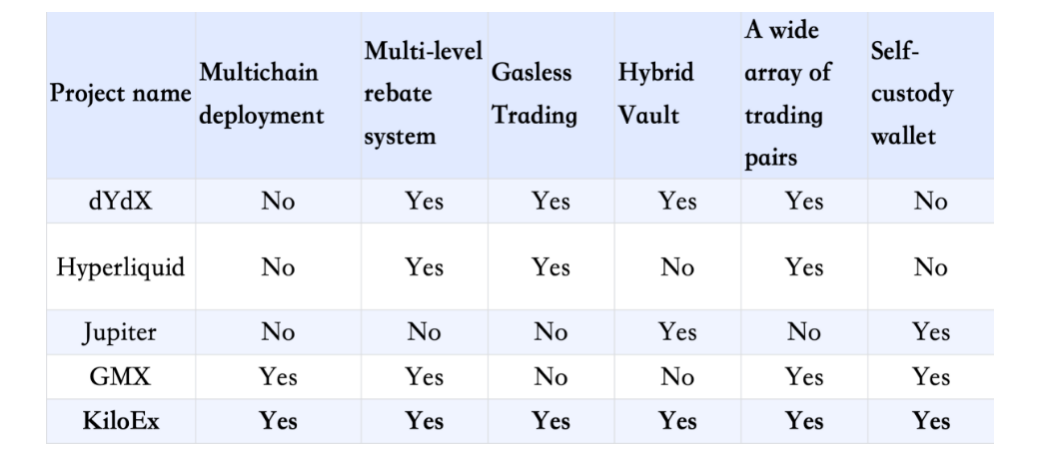

We compared and analyzed several outstanding and distinctive Perp DEXs:

To sum up, KiloEx has the following advantages:

- 0 Gas Transactions

- Create a trading-friendly environment, with an order-placing experience comparable to that of CEX

- The oracle guarantees zero slippage for BTC, ETH and other currencies, and the price is stable without any "plug-in" or downtime, ensuring the safety of user funds

- The mechanism is perfect, and traders and stakers can achieve a win-win situation in one-sided market conditions

- Hybrid Vault has a rich variety of assets and higher returns than general DeFi protocols

- Support multiple chains and occupy an important position in the ecosystem

In the future, the ruler of the on-chain trading platform

The market is moving forward in twists and turns. TGE is the end point of many projects, but we believe that the TGE that may come next month is the starting point of KiloEx. What we can see is the broad prospects of the on-chain trading market. In the off-chain era, many CEX giants were born, and in the on-chain era, the trading competition has just begun. Only in the huge market space can great projects be born.

The rise of KiloEx is not accidental. It uses "CEX efficiency, DEX trust" as an anchor point to tear open a structural crack in the derivatives track. While the market is still debating whether DEX can subvert CEX, KiloEx has written the most straightforward answer with 29% risk-free returns on the chain, cross-chain transactions completed in seconds, and a daily contract liquidation volume of tens of millions of dollars.

This may be exactly what Web3 finance should look like: there is no need to compromise between efficiency and security, and all value will eventually find the wildest and most rational outlet.