As the virtual currency market gradually matures, more and more people are involved in virtual currency transactions and investments. However, due to the characteristics of decentralization, cross-border circulation and anonymous transactions of virtual currencies, criminals often use virtual currencies to engage in illegal and criminal activities. In this context, practitioners in the virtual currency industry often face many legal risks. In "How Can Web3 Project Parties and Practitioners Avoid Being Suspected of Aiding and Convincing? | Mankiw's Legal Education", Attorney Mankiw analyzed the application of aiding and convincing crimes in the web3 field. This article will continue to focus on the common crime of concealment in the Web3 field. Through cases, it introduces the legal elements of the crime of concealing and concealing criminal proceeds, and conducts legal risk analysis and puts forward corresponding compliance suggestions in combination with the actual situation of the virtual currency industry.

Related Cases

Case 1: Inadvertently providing a channel for criminal funds

As an intermediary for virtual currency transactions, U merchants often provide U exchange services to earn a small profit from the price difference. U merchant Lin placed an advertisement for his services on a virtual currency exchange. Because he trusted the exchange's KYC system, he neglected to fully review the identity of his customers and failed to conduct necessary compliance monitoring on the transaction amount and frequency. A criminal gang used the exchange method of the U merchant to place orders for illegally obtained funds through multiple accounts, exchanged them for relatively "clean" funds to complete the laundering transfer. Later, the police investigated and dealt with the upstream crime, and the court determined that Lin had committed the crime of concealing and hiding the proceeds of crime.

Case 2: Earning commissions by transferring accounts for others for profit

Wang was looking for a solution in his circle of friends due to the pressure of credit card repayment. Sun took the initiative to contact him and told him that he could provide a way to make money. His game company needed funds, so if Wang received the funds and purchased virtual currency to return for circulation, he could give him 1% of the circulation amount as a commission. After confirming that Sun's identity and the source of his funds were indeed related to the game company, Wang agreed to Sun's proposal out of urgent need for funds, and provided his Alipay account and bank account to assist in the circulation. During this period, many transactions triggered internal control anomalies and led to card freezing. Subsequently, the public security organs received a report and found during the investigation that the funds of the game company involved criminal proceeds. The court determined that Wang and Sun had made profits of 8,000 yuan and 30,000 yuan respectively, constituting the crime of concealing and concealing criminal proceeds.

It can be seen that, unlike collusion, crimes involving virtual currency concealment are mostly committed by individuals rather than project parties. Such people often believe that the risk of criminal involvement in earning only a small profit is very low, and they ignore or take chances on possible abnormal situations of upstream funds, thus falling into a criminal trap.

So, what is the crime of concealment? How is it different from the crime of aiding and abetting?

The legal definition and criminal standards of concealing and hiding the proceeds of crime

According to Article 312 of the Criminal Law of the People's Republic of China, the crime of concealing and hiding the proceeds of crime refers to the act of concealing and hiding the proceeds of crime knowing that they are proceeds of crime, including but not limited to laundering funds through fictitious transactions, transferring funds, etc., to help criminals hide or transfer the proceeds of crime.

The criminalization standards mainly involve the following aspects:

1. Knowing the proceeds of crime : The perpetrator must know or should know that what he is dealing with is the proceeds of crime or the proceeds generated by it. This requires the perpetrator to have the subjective awareness of "knowingly" or "should know".

2. Acts of concealment and concealment : The perpetrator hides or transfers the illegal proceeds of criminals through fictitious transactions, property transfer, fund laundering, etc.

3. Nature of assistance : The perpetrator does not directly participate in the commission of the crime, but helps to "cash in" the proceeds of the crime through means such as concealment and concealment, in order to achieve the purpose of legalization.

The biggest difference between it and the crime of aiding and abetting lies in the degree of knowledge of the upstream crime and the stage of intervention of the aiding and abetting behavior in the upstream crime. That is to say, unlike the crime of aiding and abetting, which requires the perpetrator to be aware that the source of funds may be abnormal, the crime of concealing requires the perpetrator to have knowledge or presumed knowledge of the upstream criminal behavior. However, although it seems that the standard for determining the degree of knowledge of the crime of concealing is relatively high, in practice it often expands the coverage. In addition to the relevant "knowing" presumption standard stipulated in the "Interpretation of the Supreme People's Court on Several Issues Concerning the Specific Application of the Trial of Criminal Cases Such as Money Laundering", in cases involving virtual currency concealment, the judicial authorities will analyze whether there is "knowing" based on objective factors such as past transaction history, counterparty situation, transaction method, and profit situation. In this case, simply proving "ignorance" cannot exonerate the crime; in addition, unlike the crime of aiding and abetting, which occurs during the process of the upstream crime, the crime of concealing occurs after the upstream crime is completed; however, it should be noted that in practice, the determination of whether the upstream crime is completed does not completely wait for the upstream crime to be verified. If the evidence in the case can provide an answer to the existence of a criminal situation, it will still be determined as a crime of concealing.

In addition, the statutory penalty for the crime of concealment is less than three years, and in serious cases, it is punishable by more than three years but less than seven years. Even if the illegal gains are minor, one will not be exempted from criminal liability, especially when it comes to virtual currency. The frequency of transactions or behaviors often reaches the standard of serious circumstances. Compared with the less than three years for the crime of aiding and abetting, the crime of concealment involving virtual currency generally starts at three years. Therefore, in practice, distinguishing the nature and requirements of aiding and abetting and concealing is also a crucial part of the lawyer's defense process.

Combined with case

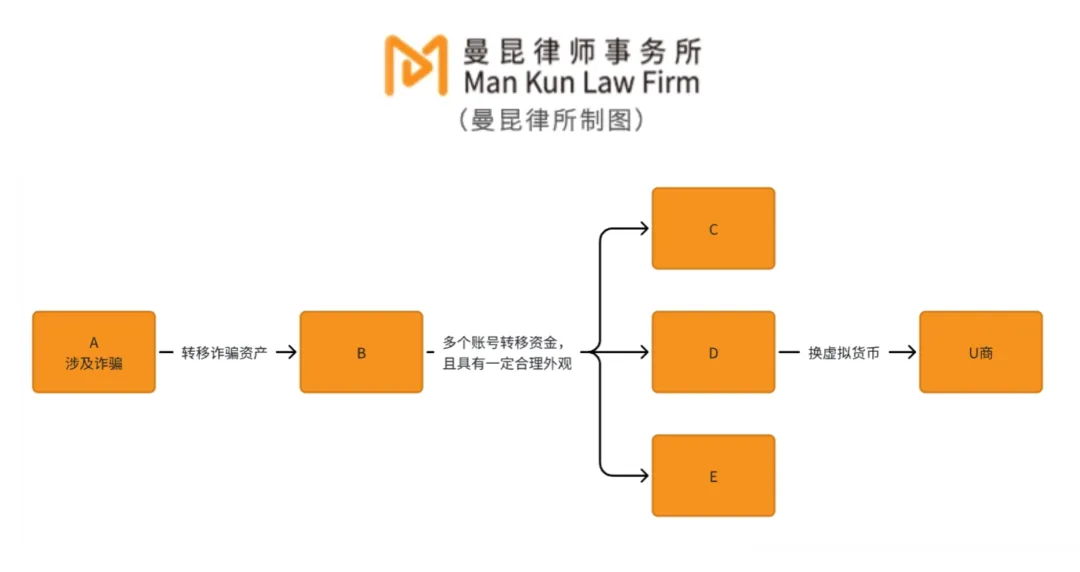

In Case 1, in addition to facing the risk of frequent freezing of bank cards in daily business, U Merchant may inadvertently become an intermediary for criminals to "launder money" if it fails to conduct sufficient identity verification of customers and ignores the monitoring of abnormal transactions. If U Merchant has a history of frozen cards, once it is involved in the transfer of stolen money of upstream crimes, even if it has no subjective intention to help transfer assets, considering the nature of the industry, in practice, such a situation is very likely to involve the crime of concealing and concealing the proceeds of crime. Of course, there will also be situations where direct customers are not involved in the crime but are still deemed to be concealed, such as the situation of multi-level nested transfer of stolen money. This situation needs to be grasped in combination with the overall link.

▲Mankiw’s drawing

Similarly, in Case 2, even if the perpetrator is not a U merchant and is not a regular virtual currency industry practitioner, if there are abnormal trading situations involving virtual currency transactions, such as abnormal prices - obviously different from the market price, abnormal trading methods - offline transactions or using non-regulated platforms for trading exchanges, abnormal transactions - fixed transaction objects or excessive transaction frequencies, etc., then it is also easy to be presumed to be "knowingly". Generally, in the presence of upstream crimes, there is a high possibility that the crime of concealment is constituted.

Attorney Mankiw recommends

Therefore, whether it is practitioners in the virtual currency industry or people who have access to the unstable circle of virtual currency, they should consciously take a series of compliance measures to prevent criminal risks involving concealing and hiding the proceeds of crime.

Strengthen the KYC process : Strengthen the counterparty identity review mechanism, clarify the counterparty's source of funds, and avoid transactions with customers without clear sources of funds. At the same time, for relevant practitioners, customer transaction restrictions should be set and suspicious transaction accounts should be checked regularly to ensure that no "money laundering" channels are provided for criminals. In addition, in order to prevent being deceived or clarify responsibilities, you can also communicate with customers through telephone and other means, provide detailed disclaimers and retain evidence.

·Reject suspicious transactions : If you know or judge that the counterparty is likely to engage in illegal or criminal activities, you must decisively reject the business. Don't be lucky because the profit is small or the funds look relatively credible. You need to have a penetrating understanding of the counterparty's transaction purpose to avoid falling into a criminal trap.

·Preventing running points : You should prevent large and frequent transactions, avoid providing assistance to potential illegal activities, and prevent yourself from being used by criminal gangs. At the same time, you should follow reasonable transaction prices, in line with market conditions, and avoid being included in abnormal situations due to card testing and other behaviors.

As the virtual currency industry continues to develop, relevant policies and practices are also being tightened. It is easier to identify the crime of concealment and the penalties are more severe. When engaging in related businesses, we must always be vigilant about the relevant criminal risks. Through rigorous identity verification, transaction and customer background checks, we can effectively reduce legal risks.