Financial markets surged on Tuesday as bulls gained momentum, with Bitcoin, gold and the Nasdaq advancing in unison, while the U.S. dollar index and U.S. Treasury yields moved lower.

The latest data from the Bureau of Labor Statistics showed that the number of job openings in the U.S. at the end of September was 7.44 million, down from 7.86 million in August, which was also revised down from the initially reported 8.04 million vacancies. The CME FedWatch tool shows that the probability of a 25 basis point rate cut in November is nearly 99%, while the probability of another 25 basis point cut in December is 74%.

The Nasdaq climbed to a new all-time high, driven by strong performance from technology stocks, closing up 0.78% to a new all-time high. The S&P also closed higher, up 0.16%, but below its high for the day, while the Dow fell 0.36%.

Spot gold continued its momentum towards record highs, hitting $2,775 an ounce at one point before retreating slightly.

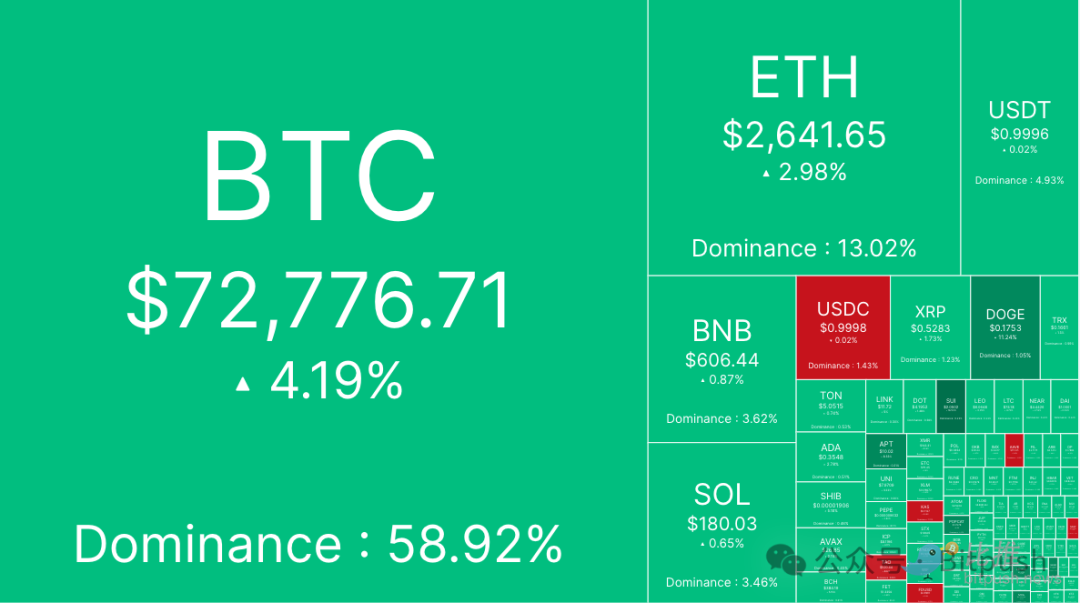

According to Bitpush data, during the U.S. stock trading session that day, Bitcoin once rose to US$73,500, only 0.4% away from the historical high of US$73,750.07 set on March 14 this year (coinmarketcap data). As of press time, BTC was trading at US$72,776, and the 24-hour increase narrowed to 4.19%.

Almost all of the top 200 altcoins by market cap rose, with Mask Network (MAS) leading the gains with a 19.2% increase, followed by Sui (SUI) and WOO (WOO), which rose 17.1% and 15.7% respectively.

Almost all of the top 200 altcoins by market cap rose, with Mask Network (MAS) leading the gains with a 19.2% increase, followed by Sui (SUI) and WOO (WOO), which rose 17.1% and 15.7% respectively.

The current overall market value of cryptocurrencies is $2.44 trillion, and Bitcoin’s market share is 58.9%.

The next phase of the bull market has begun

Data shows that CME's open interest continues to grow, and Bitcoin futures open interest has hit the largest single-day increase since June 3, with a total value of nearly $42.6 billion, indicating that institutional investors' interest in Bitcoin is heating up. In addition, since mid-September, the funding rate has continued to rise, which also reflects the market's optimistic attitude towards long positions.

In the crypto ETF space, the Bitcoin ETF attracted a large amount of inflows, totaling $479.4 million, most of which came from BlackRock. In contrast, the Ethereum ETF saw a small outflow of $1.1 million.

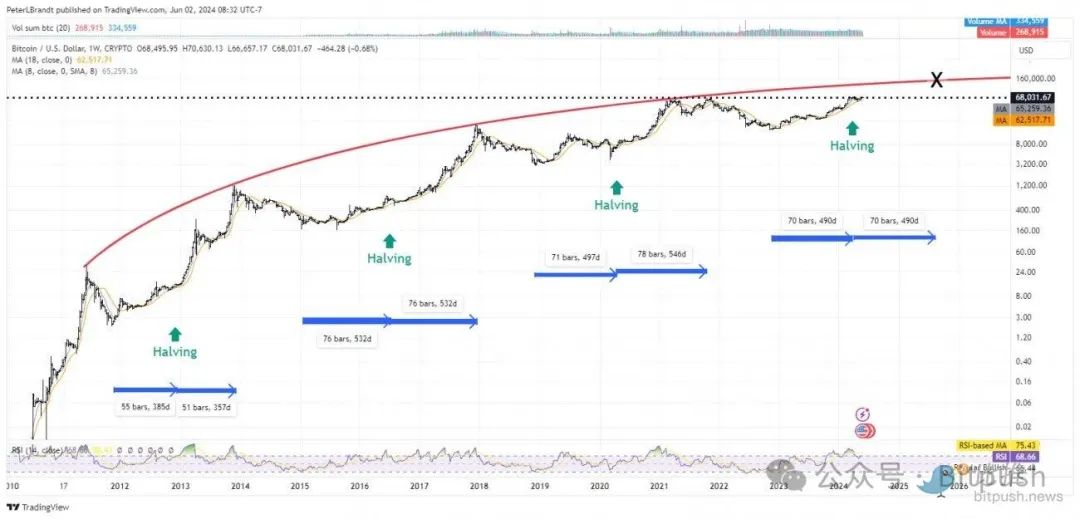

Veteran trader Peter Brandt analyzed several scenarios for the future trend of Bitcoin prices on the X platform, using different technical analysis methods for each scenario.

In the first scenario, one variable is whether to use a semi-log or linear scale. Brandt’s data shows that from the breakout level on the semi-log chart, BTC breaks out of the triangle pattern with a “measured move” that could lead to a rally to $94,000.

In the second scenario, Brandt takes the price fluctuations between November 2022 and March 2024 as a reference and projects them onto future price movements. Using this method, Brandt calculated a potential target price of more than $200,000. He said: "At the moment, I think this is a bit exaggerated. My principle is to aim for one target at a time."

The third scenario uses the symmetry of Bitcoin's price movement over time for a cyclical analysis. The chart given by Brandt shows that the high point of the next bull cycle may appear in August or September 2025, with a potential target price of $160,000. He said on X: "If this trend continues, the high point of the next bull cycle should appear in late August/early September 2025. Of course, all of these targets may be wrong. Therefore, I always keep risk management in mind when trading."

Michaël van de Poppe, founder of MN Consultancy, discussed Bitcoin’s rally past $73,000, saying: “Today’s market isn’t entirely shocking. Bitcoin ETFs are seeing massive inflows. Job openings (first data point) are the worst since April ’21. The last data point is a market driver for yields. If unemployment and the labor market weaken–> yields start to fall–> DeFi picks up–> ETH picks up–> altcoins start to boom, that’s the big internet bull cycle we’re all looking for.”

He added: “Technically, that’s what we’ve seen today, that’s why the reversal happened, and it all comes down to macroeconomic data, which shows that we are at the stage of becoming a mature asset class for cryptocurrencies. There is huge, relatively unlimited upside coming, and most people can’t even imagine how big it is.”

Market analyst Keith Alan expects the rally to approach all-time highs, followed by a possible pullback, saying, “A breakout above $72,000 could put bears into hibernation, but be prepared to retest support before chasing all-time highs.”