Stablecoins, as tokenized representations of legal tender circulating on blockchain, are undoubtedly the "killer app" of the crypto market to date. By the end of 2024, the total market value of this currency running parallel to traditional financial infrastructure has exceeded $200 billion. With the rise of stablecoins in the past five years and their continued penetration into the global economy, the endowment of blockchain as a financial infrastructure will inevitably be explored and fully utilized by the traditional financial world outside the crypto market.

VISA believes that stablecoins are a payment innovation that has the potential to provide safe, reliable and convenient payments to more people in more places. While we are still looking for and verifying the specific data on stablecoins being used for payments, Ripple, the earliest and most senior blockchain payment company in the market, and its token XRP have already been valued and revalued in the market.

The market always has only one direction, neither long nor short, but the correct direction.

This article aims to sort out the general trend of stablecoins and the logic of Ripple XRP’s value discovery. This is used to compare with PlatON, a payment project that has also been around for a long time, to find the next XRP, or in other words, when the trend comes, how can we capture the value?

1. The general trend of stablecoins

The State of Crypto Report 2024, recently released by A16z Crypto, clearly states that stablecoins have found product-market fit in the past year and have become one of the most obvious “killer apps” in the field of Web3.0.

Stablecoins make value transfer simple and enable fast global value transfer. Their quarterly transaction volume is more than twice that of VISA's 3.9 trillion US dollars, and they settle trillions of dollars worth of assets each year. In November 2024 alone, 28.5 million independent stablecoin users sent more than 600 million transactions , fully demonstrating their practicality. At the same time, stablecoin users are almost all over the world, because stablecoins provide them with a safe, cheap and inflation-resistant way to save and spend.

Y Combinator recently published an article stating that: Although there is a lot of debate about the practicality of blockchain technology, stablecoins will clearly become an important part of the future of currency. Almost 30% of global remittances are now conducted through stablecoins, and traditional financial institutions like VISA are also providing banks with platforms to issue their own stablecoins. In addition, Stripe recently acquired a stablecoin startup Bridge for $1 billion, which will attract more investor interest and capital into the field.

Mastercard also stated in its article on the top ten payment trends in 2025 that the maturity of blockchain and digital assets in recent years demonstrates the transformative potential of this technology in enhancing global financial and commercial systems. Cryptocurrencies, stablecoins, and tokenized assets have moved from concept to commercialization, especially in their applications related to real-world assets. By 2025, blockchain technology is expected to play a role in improving speed, security, and efficiency, especially in B2B and commercial payments.

2. The rise of Ripple and XRP

Whether it is crypto investment institutions, traditional payment networks or banking systems, they all recognize that the flow of value based on blockchain is a reasonable trend in the future development of financial technology. Therefore, payment must be the first application.

Ripple, also known as Ripple Labs, is a blockchain technology company that provides financial services solutions based on blockchain technology, aiming to increase the speed and reduce the cost of global financial transactions. Ripple's main products and services include (i) cross-border payments and remittances through RippleNet, which is seen as an alternative to the SWIFT payment network used by traditional financial institutions, and (ii) the recently launched RLUSD stablecoin.

Ripple's technology and services mainly rely on the XRP Ledger (XRPL), an independent distributed ledger that provides low transaction costs and high performance for recording and verifying transactions. It was developed by Ripple in 2012 and focuses on providing banking solutions for traditional financial institutions. The native token XRP is classified as a payment cryptocurrency and serves as a medium of payment for transaction fees on the XRP Ledger, providing a way to use a distributed network instead of centralized storage and value transfer.

The recent revaluation of XRP’s value is mainly due to the following reasons:

1. Expectations of changes in the regulatory environment: The Trump administration came to power, leading the market to expect a more friendly regulatory attitude toward cryptocurrencies. Some cryptocurrency supporters took up key positions, which boosted market confidence in XRP.

2. Positive progress in the SEC lawsuit: Ripple has achieved a partial victory in the lawsuit between it and the U.S. Securities and Exchange Commission (SEC). The judge ruled that XRP is not considered a security when it is sold to retail investors on an exchange, which is a major positive for XRP.

3. Increased ETF and institutional investment: Companies such as Grayscale have launched XRP trust products and applied to convert multi-currency funds containing XRP into ETFs, which has increased XRP's institutional investment appeal.

4. Enhanced scalability of XRP Ledger: Ripple announced that it will introduce advanced programmability, including smart contracts, to XRP Ledger. This will be achieved by introducing native smart contract functions and XRPL EVM Sidechain, enhancing the developer ecosystem of XRP Ledger.

5. Launch of RLUSD Stablecoin: Ripple announced the launch of RLUSD (Ripple USD), an enterprise-grade stablecoin pegged 1:1 to the US dollar, designed to enhance institutional liquidity, trust, and compliance within the Ripple ecosystem.

3. Looking for the next XRP — PlatON

In this context, how do we capture the value of projects like XRP?

Currently, the blockchain payment projects that have successfully issued tokens are mainly concentrated in: (i) relatively independent Payment Protocol applications; (ii) projects that use their underlying blockchain ledgers as payment settlement networks, such as Ripple, Stellar, etc. Market experts tell us that the value of payment networks will be greater and the ecological scalability will be stronger. Therefore, we turn our attention to PlatON.

In the early days, PlatON stood out among many public chains with its technical feature of "privacy computing". After accumulating sufficient technology, it began to apply its technological advantages to areas such as payment, providing financial-level system stability and performance, compliant digital asset management supported by cryptography, and encrypted payment and clearing solutions for multiple scenarios.

In terms of project affiliation, PlatON obviously belongs to the latter like Ripple, that is, using the underlying blockchain ledger as a payment settlement network to serve the entire Web3.0 ecosystem.

LAT is the native token of the PlatON network, which is mainly used for the governance of its decentralized network, to pay for the use of computing resources and data services on the network, and to incentivize network participants, including node operators and data providers, to maintain and promote the normal operation and development of the network.

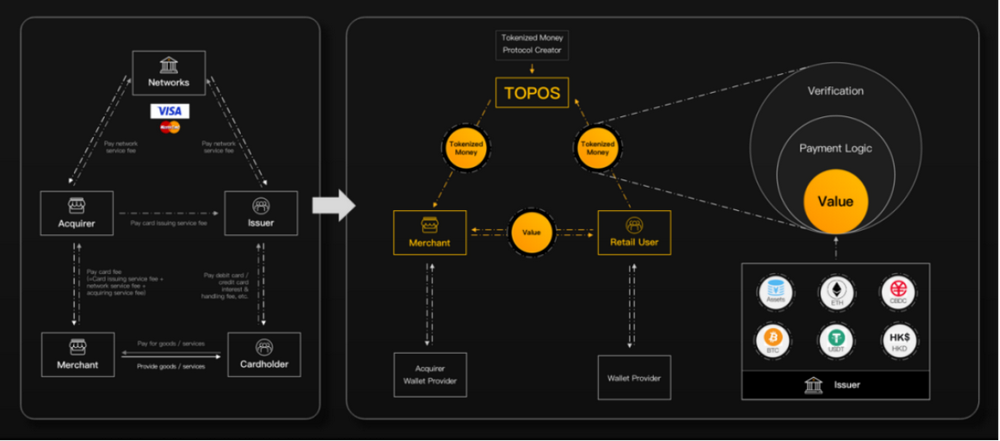

TOPOS is an open payment and clearing operating system based on PlatON. Its payment core is based on Tokenized Money. Through three levels of locked value, payment logic and authorization mechanism, it ensures that the "Money" of Web3.0 is self-minted by users and completes the controlled transfer of value safely.

Therefore, we can see from PlatON a business structure that is purer than XRP and more capable of reflecting value to LAT:

1. PlatON network (LAT network native token) for payment settlement - XRP network;

2. Open payment and clearing system TOPOS——RippleNet;

3. LatticeX, the initiator and promoter of open financial infrastructure, is a Ripple Labs company.

It should be noted that Ripple Labs is a private company, and the value of RippleNet and its stablecoin RLUSD cannot be fully reflected in XRP, while PlatON's business structure can fully release the value of LAT.

4. How does PlatON capture payment value?

Blockchain provides the technical background conditions for value transfer to completely unify information flow and capital flow. However, as Web3.0 has developed to date, the current blockchain-based payment architecture is still at the stage proposed in the early Bitcoin white paper, with peer-to-peer transfers as the core clearing rules. It has not yet formed a set of clearing and settlement standards that can cope with various complex payment scenarios and multi-party participation.

Although global stablecoin-based payments have become a real business with great potential, the simple logic of point-to-point transfers is currently difficult to support the rich scenarios of stablecoin payments. At the same time, due to the lack of clearing rules and standards on the blockchain, payment transactions still need to be separated from the blockchain ledger and return to the traditional payment and clearing system.

This situation cannot truly reflect the original primary value of the "Satoshi Nakamoto Proposition", which is also the core problem that needs to be solved in order to build stablecoins to enrich payment scenarios.

Therefore, PlatON is not like most crypto payment projects, which is just a simple peer-to-peer transfer replica built based on its own scenario channel advantages. PlatON attempts to use its network as the "main ledger" and application platform for future global cross-border payment settlements, and to deal with the distribution of interests among multiple payment participants and complex payment scenarios by establishing a set of clearing rules and standards on the blockchain. TOPOS is the carrier of this set of clearing rules and standards.

Simply put, PlatON's ultimate goal is to build "VISA in the Web3 era", and the VISA card organization happens to be the most highly valued entity in the entire global payment ecosystem, just like RippleNet, launched by Ripple, is seen as a replacement for the SWIFT payment network used by traditional financial institutions.

Therefore, PlatON uses TOPOS to make up for the lack of clearing rules and standards on the blockchain, and creates a win-win digital currency "VISA" network to attract the participation of multiple parties such as acquiring institutions, wallet institutions, consumers and merchants, thereby enriching the construction of payment scenarios.

As the ecological network is gradually built, the network effect will eventually emerge, and the ultimate value will be reflected in PlatON and LAT.

5. TOPOS opens up the financial ecosystem and shapes the PlatON payment landscape

The establishment of a digital currency payment system, in addition to benefiting from the emergence and large-scale popularization of transaction media such as stablecoins, also needs to rely on a large payment network. What PlatON wants to build is TOPOS, a large-scale open payment and clearing network built on the blockchain. Through an innovative payment and clearing system framework, we will reshape global payments in a Web3.0 way.

Through an open payment ecosystem, TOPOS can reduce the original high cross-border payment fees by at least 60%. Merchants and consumers can hold digital assets in a non-custodial manner and rely on acquiring institutions, wallet institutions, and Tokenized Money payment scenario standards to complete payments and value exchanges. Each participant in the payment process assumes different roles to complete their work and gain benefits.

TOPOS is not only a payment and clearing platform on the blockchain, but also the foundation of an open financial ecosystem. As an open operating system, it can adapt to different application scenarios and needs and is easy to integrate new technologies and functions.

At the same time, TOPOS is committed to building a bridge between Web2.0 and Web3.0, breaking down the barriers between the traditional financial system and emerging financial technology. This means that both traditional financial institutions and emerging blockchain projects can find their own position in the TOPOS ecosystem, achieving the free flow of funds and seamless transfer of value.

At present, TOPOS's payment solutions have covered stablecoin issuance (TOPOS MINT), cross-border remittances (TOPOS RemiNet), digital currency acquiring, cross-border trade, etc. Anyone can assemble the final payment service in this ecosystem through the underlying blockchain call capabilities provided by TOPOS.

In general, PlatON supports and encourages multi-party participation by launching clearing rules and standards on the blockchain. Multi-party participation brings about the construction of rich payment scenarios, thereby gradually forming PlatON's network effect and ultimately forming LAT's value capture.

6. Where will PlatON’s breakthrough point be in the future?

By building a "VISA in the Web3 era", PlatON can leave the value of the transaction chain to network participants and form an incentive system, rather than returning to the traditional clearing system and being divided up by various intermediaries. At the same time, the complex payment scenarios built by TOPOS can be perfectly combined with Web2.0 applications and payment scenarios, achieving cost reduction and efficiency improvement of applications, as well as better user experience for users.

Here, PlatON is not just focusing on digital currency and Web3.0 on the blockchain. In the long run, all the native innovations on the chain to date are the staged display and experience of this long-term wave. The fundamental breakthrough comes from the iterative upgrade of inter-bank financial infrastructure driven by a large number of actual business needs of Web2.0.

Therefore, PlatON will turn its attention to the richer Web2.0 market. This is the key to the large-scale popularization of the Web3.0 ecosystem and the fundamental breakthrough for encrypted payments!

Sun Lilin, founder of PlatON, believes: "The biggest market opportunity at present and in the next stage is the full migration of the core team and applications of Web2.0 to Web3.0, similar to the migration of Internet Web applications to mobile Internet apps ten years ago. Due to the limitations of technology and infrastructure capabilities, most core applications in the Web2.0 era cannot be directly and completely migrated to the chain, but can only use the characteristics of Crypto technology and incentive mechanisms to hand over the payment, clearing, trading, custody, verification and other services of assets/funds to the public chain and its ecosystem.

Therefore, the core demand is transformed into the deposit and withdrawal of legal currency and the payment/transfer of digital currency. This means that the subsequent competition of public chains will not mainly come from the native scenarios on the chain, but more from the transaction migration and user import of the original Internet outside the chain. The only channel for non-Web3.0 native users to enter the market is still through the applications/services they are familiar with, and it is very likely to be a B2B2C path.

In the Web2.0 era, the number of retail payment transactions processed worldwide exceeds 2 trillion per year. For PlatON, we must seize the opportunity of traditional retail gradually using digital currency as a new payment medium, follow the background of the era of data ownership and currency ownership belonging to the owners from Web2.0 to Web3.0, and build a decentralized open-loop standard similar to VISA to provide a good infrastructure for the transition from Web2.0 retail to Web3.0 retail. TOPOS is the innovative payment and clearing infrastructure we launched based on the above considerations. "

This view coincides with what JDI Labs has observed: influential big capitals in the new and old worlds are all investing in crypto payments, and there are more and more discussions about PayTech - crypto industry giants such as Binance and Coinbase are focusing on crypto payments, and traditional finance such as VISA , Sequoia Capital, and Temasek are also frequently investing in crypto payments. "After all, if the global payment market is compared to a dream wedding cake, then if a crumb falls off the cake, it will create a 100 billion giant, and this gold rush has just begun."

Doing the right thing is as important as doing things right. PlatON is undoubtedly a pioneer in this gold rush. As more and more institutions and partners run on the TOPOS system, the value of the PlatON network will eventually become apparent.

RippleNet has been built over a decade and has achieved initial results. So, we will have to wait and see how the TOPOS system and PlatON network, which are both popular, will perform.

—— END ——