By E. Johansson, L. Kelly, DL News

Compiled by: Tao Zhu, Golden Finance

Venture capital will return strongly in 2025.

That's according to venture capital firms and market watchers interviewed before the new year.

What will drive the market higher and how much money will investors want to invest?

Mike Giampapa, General Partner, Galaxy Ventures

Mike Giampapa, General Partner, Galaxy Ventures

With the creation of the most pro-cryptocurrency executive and legislative branches in U.S. history, it’s hard to overstate the impact this could have on the cryptocurrency industry.

With a more supportive SEC, we expect to see fewer enforcement actions, more regulatory clarity, and an increase in the likelihood of blockchain companies going public in the U.S.

We are also more optimistic than ever about banks becoming more open to engaging with cryptocurrencies, the introduction of stablecoin legislation, and the broader Crypto Market Infrastructure Bill.

These measures will create necessary transparency, guardrails and protections for contractors and users across the industry.

Against this backdrop, the adoption of stablecoins and the use of underlying blockchains as financial rails are expected to accelerate in 2025.

Fintech companies — from upstarts to incumbents, from consumer-facing businesses to B2B enterprises — will increasingly integrate with cryptocurrency rails to provide customers with faster, cheaper, and more efficient financial services.

Stablecoin adoption will continue to grow beyond savings and payments to spending use cases. We expect merchant acquirers and card networks to increasingly enable crypto payments at checkout, allowing users to spend stablecoins as easily as fiat currencies.

Alex Botte, Partner at Hack VC

By 2025, we expect venture capital investment in the cryptocurrency and blockchain sectors to return to previous highs.

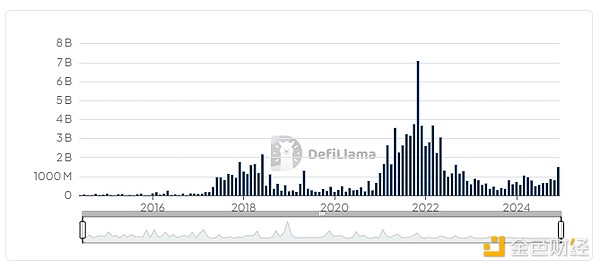

Currently, venture capital is still significantly behind its peak in the first quarter of 2022, when about $12 billion was invested in about 1,350 deals, Galaxy data shows.

In the third quarter, that figure was $2.4 billion, down 80%, across 478 deals (down 65%).

This gap is at least partly due to the continued lack of traditional venture capital and institutional investors, especially in the United States.

Private markets, especially early-stage venture capital, tend to lag behind liquid markets, with major tokens like Bitcoin and Solana recently hitting all-time highs.

However, as the market cycle matures and investor confidence rebounds, we expect venture capital investment to increase and potentially even exceed previous highs.

With the advent of a pro-cryptocurrency Trump administration and Congress, increased regulatory clarity in the U.S. is likely to attract more institutional players than in previous cycles, and venture capital investment will accelerate.

Robert Le, Cryptocurrency Analyst

Robert Le, Cryptocurrency Analyst, Pitchbook

We forecast a recovery in venture capital investment in the cryptocurrency space in 2025, with total funding exceeding $18 billion for the year and multiple quarters exceeding $5 billion.

This would mark a significant recovery from the annual average of $9.9 billion and quarterly average of $2.5 billion in the 2023-2024 period.

Macroeconomic stability, institutional adoption, and the return of generalist venture capital are likely to drive this trend.

Heavyweights such as BlackRock and Goldman Sachs are likely to increase their involvement in cryptocurrencies, which in turn would bolster investor confidence and regulatory trust, paving the way for broader institutional participation.

Their participation could drive mainstream adoption and attract asset managers, hedge funds and sovereign wealth funds into the cryptocurrency space.

Generalist VCs returning after a period of retreat will shift their focus to startups that demonstrate traditional metrics like recurring revenue and measurable traction.

This approach could foster the broader integration of cryptocurrencies with artificial intelligence, fintech and traditional finance, emphasizing sustainable growth rather than speculative investment.

Improved global liquidity and falling interest rates will further boost venture capital, with token prices rising in line with public and venture markets.

However, this optimistic scenario is contingent upon regulatory stability, particularly in the United States, and continued macroeconomic conditions.”

Karl Martin Ahrend, Founding Partner of Areta

Karl Martin Ahrend, Founding Partner of Areta

In 2025, we expect a surge in M&A and IPOs, which will highlight the transformative shift in the industry.

Traditional financial institutions are increasingly entering the space, seeking exposure to crypto projects with strong product-market fit. These firms often lack the expertise to build solutions in-house, driving a wave of partnerships and acquisitions.

At the same time, political tailwinds, including the possibility that the U.S. Securities and Exchange Commission under new leadership may be friendly to cryptocurrencies, are creating optimism for clearer regulation. This regulatory clarity, coupled with advances in security, is boosting investor confidence and paving the way for more public offerings and strategic transactions.

Looking ahead, this intersection of institutional interest and favorable regulatory shifts will likely continue to drive M&A and IPO activity, shaping the future of the industry.