introduction

In the rapidly developing field of cryptocurrency, financial innovations continue to emerge, providing investors with a variety of tools and opportunities. The innovative product recently launched by BIT Exchange and VETA Finance, Square Options, allows users to trade structured products in the form of spot trading, greatly simplifying the trading process and bringing users an unprecedented convenient experience. This innovative move not only provides investors with opportunities for high leverage returns, but also further promotes the development of the cryptocurrency financial market.

1. Financial innovation in the field of cryptocurrency

In recent years, the cryptocurrency market has experienced explosive growth. With the popularity of mainstream cryptocurrencies such as Bitcoin and Ethereum, the market demand for new financial products is also increasing. Investors hope to participate in the market in a more efficient and convenient way and obtain higher returns. In this context, major exchanges and financial technology companies have launched various innovative products to try to meet the needs of investors.

As a leading cryptocurrency trading platform, BIT Exchange has been committed to providing users with the most cutting-edge trading tools and products. In addition to derivatives such as contracts and options similar to those in the traditional financial field, as well as structured financial products such as dual-currency financial management and shark fin, the Square Option launched by BIT Exchange in cooperation with VETA Finance is the latest attempt under this concept, and is also another concrete manifestation of financial innovation in the field of cryptocurrency.

2. What is a square option?

Square Options are a financial instrument designed as a spot token that allows investors to invest in rising or falling prices of Bitcoin or Ethereum and earn exponential returns when the market moves in the direction of their investment.

Specifically, square options on BIT are divided into four types:

BTC²UP: Generate exponential gains when the price of Bitcoin rises

BTC²DOWN: Generate exponential gains when the price of Bitcoin falls

ETH²UP: Generate exponential gains when the price of Ethereum rises

ETH²DOWN: Generate exponential gains when Ethereum price drops

Through this design, investors can choose corresponding Square option products based on their judgment of market trends and maximize their returns under different market conditions.

3. The operation mechanism of Square Options

The operating mechanism of Square Options is relatively simple, and is designed to provide users with a convenient trading experience. Users can easily purchase Square Options on the BIT Spot Plus market just like buying spot cryptocurrencies. This design greatly reduces the complexity of transactions, making it easy for even users without extensive investment experience to get started.

Square Option Tokens are packaged with European options. Holders can exercise their options on the expiration date or trade them before expiration. Similar to regular European options, Square Options are mainly affected by factors such as the price, volatility and expiration time of the underlying asset.

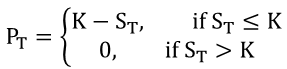

Non-linear income structure

Square options use a nonlinear profit structure, which means that when the price of the underlying asset changes, the profit of the option does not simply grow linearly, but grows exponentially. This feature allows investors to quickly magnify their profits when the market conditions are favorable.

No risk of liquidation

Compared with traditional high-leverage transactions, Square Options has no risk of liquidation. Investors do not need to worry about forced liquidation due to market fluctuations and can invest with greater peace of mind.

Easy trading

The trading process of Square Options is very simple. Users only need to select bullish or bearish option products on the BIT exchange and then purchase them based on their own judgment. The whole process is similar to purchasing spot cryptocurrencies, which greatly reduces the trading threshold.

Monthly maturity mechanism

Square Options are monthly tokens that expire on the last Friday of each month, which is consistent with the trading hours of the BIT options market. This design allows investors to better plan and manage their investment strategies.

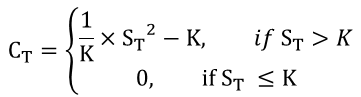

4. Calculation of Expiration Profit of Square Option Tokens

Square option expiration income (per contract):

in

CT: USDT income corresponding to each call square option at expiration

ST: The delivery price of the underlying asset, which is the average price of the underlying asset index 30 minutes before the option token expires

K: Strike price of the square option

PT: USDT income corresponding to each put square option at expiration

Please note the number of Square options corresponding to each token, for example, BTCUP represents 0.01 BTC call Square option.

Compare this to the payoff to expiration of a vanilla option:

It can be seen from the above formula that due to the different calculation methods of the returns of square options and ordinary vanilla options, when the market rises sharply, the returns brought by the call square option will be significantly greater than those of the ordinary call option, and vice versa.

Comparison of expiration returns between Square option and ordinary option

5. Actual case analysis

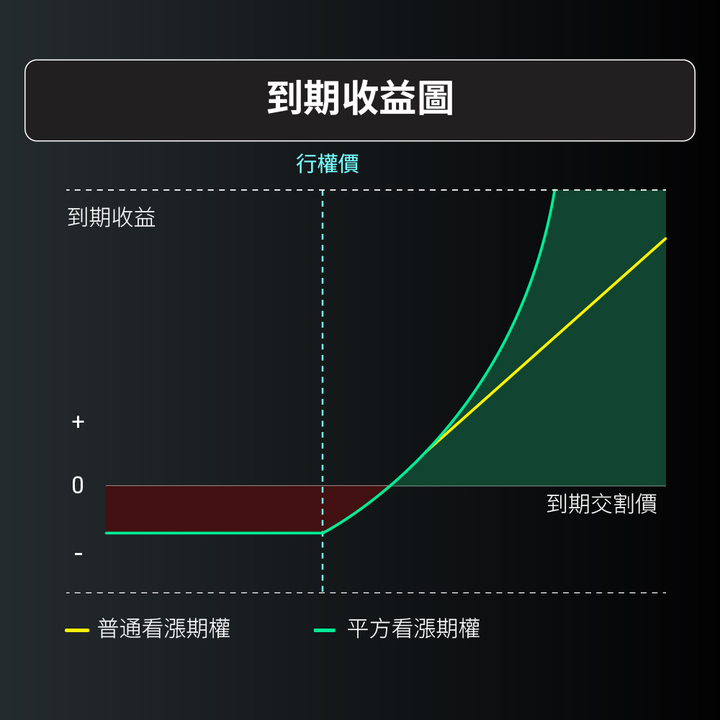

On May 21, the Bitcoin (BTC) and Ethereum (ETH) markets suddenly saw a sharp rise. BTC broke through $70,000, up 6%; ETH rose 14.5% to $3,518. This was mainly attributed to investors' enthusiasm for spot ETFs and a broad market rebound.

Case 1: Short-term high returns

Suppose you bought an ETH call Square option with an exercise price of $4,100 when it expired on May 31. The current latest price is $17.08, which has increased by 972.25% in 24 hours. If the investor bought the option at $1.58 last night, he could sell it at $17.08 today, with a return rate of nearly 10 times. This case shows the potential of Square options to achieve high returns in the short term.

Case 2: Long-term exponential growth

Suppose you buy an ETH bullish Square option with an exercise price of $3,400 and an expiration date of June 28. The latest price is $135.81, a 24-hour increase of 300.33%. This option has exceeded the exercise price, which means that every time the price of ETH rises again, the return will grow exponentially. This case shows the exponential growth potential of Square options in long-term investment.

BIT Spot Plus Square Option Token Profit Chart on May 21

6. Comparison of Square Options with other financial products

Perpetual Contract

Although perpetual contracts provide high leverage, they are prone to liquidation when volatility is large; square options have no risk of liquidation and are more suitable for investors who pursue stable returns.

Altcoins

While other alternative coins offer high returns, they are extremely risky and susceptible to market manipulation; Square options offer a more stable and reliable path to high returns.

Traditional Options

Traditional options are complex and require high expertise; Square options are simple in design and suitable for more investors. This feature makes Square options highly acceptable to a wide range of investor groups.