Last Friday, financial markets opened high and ended low, with bond yields seeming to be a "spoiler". The 10-year U.S. Treasury yield fell in the morning but quickly rebounded to 4.25% in the afternoon, causing an impact on risky assets such as stocks.

In the U.S. stock market, the three major stock indexes closed mixed, with the Nasdaq index up 0.56%, the Dow Jones index down 0.61%, and the S&P index flat.

Meanwhile, crypto markets quickly fell after The Wall Street Journal reported that Tether, the company behind the world's largest stablecoin USDT, was being investigated by federal agencies for possible violations of anti-money laundering rules and sanctions.

Tether CEO Paolo Ardoino responded decisively in a post calling it “old, cliched news.” Tether further stated on its website: “It is extremely irresponsible for the Wall Street Journal to write an article with reckless accusations so confidently without any authority confirming these rumors or revealing the source of the information.”

Although Tether responded quickly, the news still brought some FUD sentiment to the crypto market.

According to Bitpush data, after the news of Tether regulation came out, BTC fell from a high of $68,762 to a low of $65,816, and then rebounded to over $67,000 after Tether responded. As of press time, BTC is trading at $67,003, down 1.75% in 24 hours.

In terms of altcoins, most of the top 200 tokens by market cap are in the red.

Among the rising tokens, Safe (SAFE) led the gains with 14.7%, followed by Gnosis (GNT) with 11.7%, and ConstitutionDAO (PEOPLE) with 7.4%. Goatseus Maximus fell 12.4%, Book of Meme (BOME) fell 11.8%, and Popcat (POPCAT) fell 10.8%.

The current overall market value of cryptocurrencies is $2.28 trillion, with Bitcoin accounting for 58% of the market share.

Volatility is expected to continue until after the US election

In addition to the impact of the Tether news, analysts generally predict that cryptocurrencies will fluctuate during the US election as polls show that the campaign atmosphere is heating up and the competition between the two parties remains too close.

Ryan Lee, chief analyst at Bitget Research, said: “The US election is likely to have a significant impact on Bitcoin and the broader cryptocurrency market. Key factors such as regulatory policies, economic strategies, and investor sentiment play a vital role in shaping market dynamics. From a cryptocurrency and BTC perspective, it is crucial to understand the candidates’ attitudes on regulation, taxation, inflation, the economy, innovation, blockchain, and CBDCs and stablecoins.”

“If Kamala Harris wins, we may see more regulation, but also increased innovation in blockchain technology and digital currencies,” he said. “This could create a more structured, compliant, and mainstream environment for cryptocurrencies, although it could also lead to short-term market volatility due to regulatory concerns.”

“On the other hand, if Donald Trump wins, regulatory pressure may decrease, but market volatility related to economic and foreign policy may increase. Trump has shown support for Bitcoin, and if his chances of winning before the election are high, then a ‘Trump trade’ effect may emerge, driving institutional investors to profit through Bitcoin trading.”

“In both cases, broader economic policies such as inflation control, monetary policy, and international trade will be critical in shaping the price of Bitcoin and the overall direction of the cryptocurrency market,” the analysts concluded.

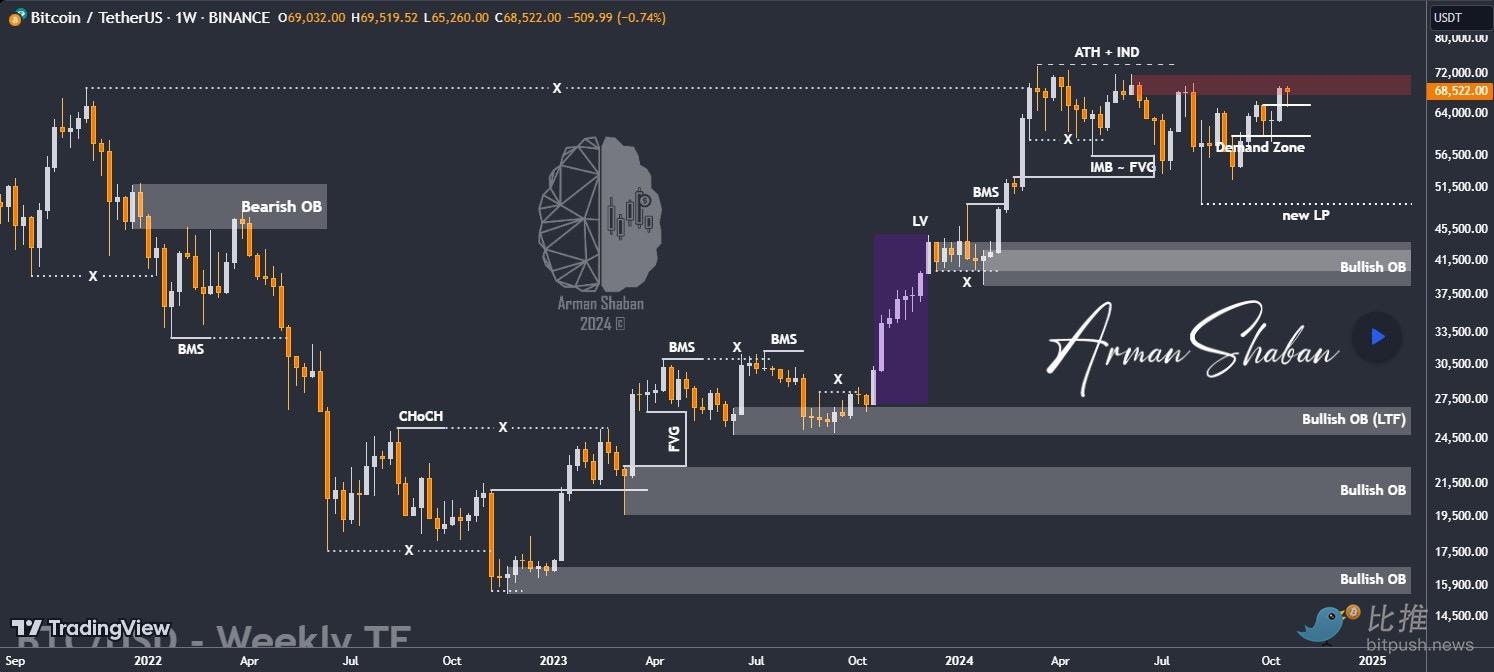

Technical charts suggest a breakout is imminent

“By analyzing the chart on the weekly timeframe, we can see that when the price was trading around $66,500, it was expected that Bitcoin would find support at this level and continue to rise, which is exactly what happened,” wrote TradingView analyst Arman Shaban. “We must monitor whether the price can maintain above $69,000 over the next two weeks, if so, we could see another rally and a new high above $74,000.”

And according to John Glover, chief investment officer at Ledn, if Bitcoin can climb above $73,000, it is expected to quickly rise to $80,000.

“Yesterday’s drop to just below $65K was a perfect retest of the top of the channel we broke out of last week,” Glover said in a note. “As expected, (the blue line in the chart) is now an area of support that would provide the basis for a short-term uptick to retest the previous high of $73K.”

John Glover believes: "Once the price of Bitcoin breaks through $73,000, it is expected to move quickly towards $80,000, completing the third wave of rise. However, I have slightly lowered my previous target of $87,000. Once it reaches $80,000, I expect the price to see a small correction, possibly falling below $70,000, but then it is expected to hit the $100,000 mark at the end of the first quarter or early second quarter of next year."