Original text: 0xLouisT (L1D Partner); Translated by: Azuma; Edited by: Hao Fangzhou

Produced by | Odaily Planet Daily

Editor's note: The token economic model has always been an important criterion for investors to evaluate a certain target, but L1D partner 0xLouisT revealed in his recent article that in addition to the conventional token economic model shown to the market, many projects also hide another invisible "token economic model" underwater. Except for the team members and related persons, it is difficult for outsiders to know the true distribution plan of a certain token.

In the article, 0xLouisT compared the story of "Daedalus' Labyrinth" in Greek mythology, arguing that these hidden "token economic models" are like mazes, and the project parties that created these mazes are like Daedalus, who will eventually be trapped in their own cocoons and go to destruction.

The following is the original content of 0xLouisT, translated by Odaily Planet Daily.

In Greek mythology, there is a bloodthirsty creature called the Minotaur, which has a body structure of half man and half bull. King Minos was afraid of this creature, so he invited the genius Daedalus to design an intricate maze from which no one could escape. However, when the Athenian prince Theseus killed the Minotaur with the help of Daedalus, Minos was very angry and retaliated by imprisoning Daedalus and his son Ikaros in the maze built by Daedalus himself.

Although Ikaros ultimately fell because of his recklessness (he flew too high during his escape and the sun burned his wings), Daedalus was the true architect of their fate - without him, Ikaros would never have been imprisoned.

This myth reflects the hidden “insider trading” that is prevalent in the current cryptocurrency cycle. In this article, I will reveal these types of trades — the labyrinthine structures orchestrated by insiders (Daedalus) that doom projects (Ikaros) to failure.

What is "Insider Trading"

The "high FDV, low circulation" token structure has become a hot topic, and the market has debated a lot about its sustainability and impact. However, there is a dark corner in this discussion that is often overlooked - "insider trading". These transactions are often made by a small number of market participants through off-chain contracts and agreements, which are usually covered up and almost impossible to identify from the chain. If you are not an insider, you will most likely never know about these transactions.

In @cobie’s latest post, he introduced the concept of “phantom pricing”, highlighting how real price discovery is done in private markets. With this background, I want to introduce the new concept of “phantom tokenomics” to reveal how the public token economics model is used to disguise the real “phantom token economics model” - the publicly visible token economic model often only represents the “upper range” of a certain allocation category, but this is misleading, and the “phantom version” is the most accurate allocation.

While there are many types of "insider trading," some of the most noteworthy types of trading are listed below.

Advisor Allocations: Investors can earn additional tokens for advisor services, which are usually categorized under the team or advisor category. This is often a means for investors to reduce their costs, and they provide little or no additional advice. I have personally seen an institution where the advisor share was 5 times the investor share, and the institution's true cost was 80% lower compared to the official financing and valuation data.

Market making allocation: A portion of the token supply will be reserved for market making on centralized exchanges (CEX). This is positive in that it enhances the liquidity of the token, but it creates a conflict of interest when market makers are also investors in the project — allowing them to use their market making share to hedge their investment share, which is still locked up.

CEX listing: In order to list on top CEXs such as Binance, project owners often need to pay marketing and listing fees. If investors can assist and ensure that the token is listed on these exchanges, they sometimes receive additional business fees (which can be as high as 3% of the total supply). Arthur Hayes previously published a detailed article revealing that these fees can be as high as 16% of the total token supply.

TVL leasing: Whales or institutions that can provide liquidity are often promised a higher rate of return. Ordinary users may be satisfied with a 20% annualized rate of return, while some whales can quietly earn 30% with the same contribution through private transactions with the foundation. This practice may also have some positive significance and help maintain early liquidity, but the project party should disclose these transactions to the community in the token economic model.

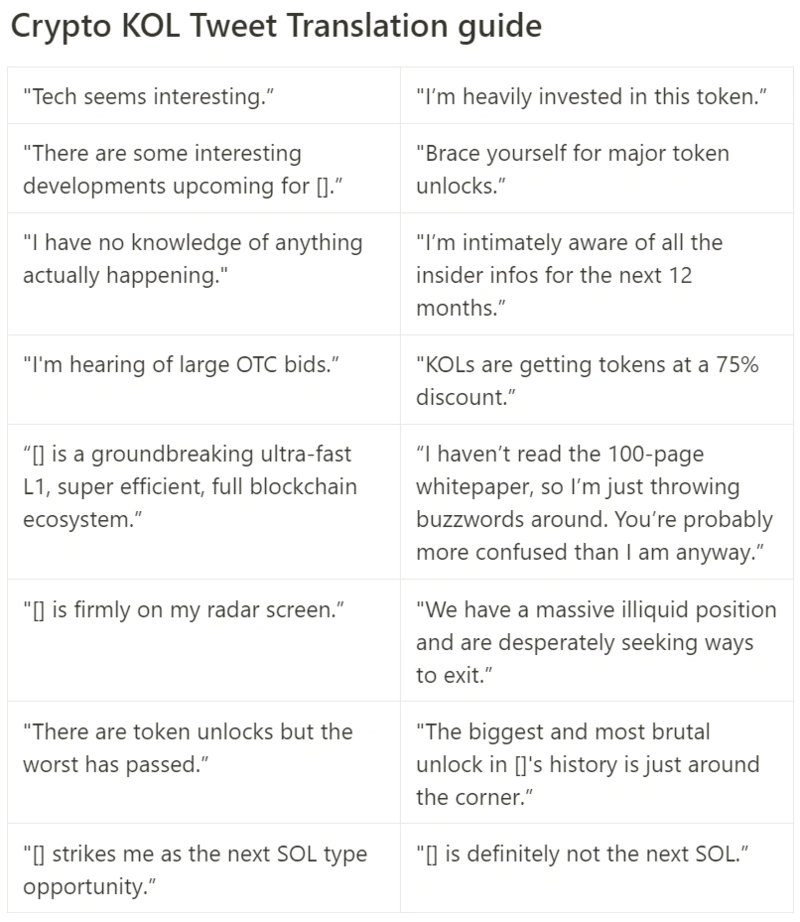

OTC “Fundraising”: OTC “Fundraising” is common and not necessarily bad in nature, but since the terms are usually not disclosed, these transactions often create a great deal of opacity. The most notorious of these is the so-called “KOL round”, which is seen as a short-term catalyst for token prices. Some top Layer 1s (I don’t want to reveal their names) have also recently adopted this strategy - KOLs can subscribe to tokens at a large discount (about 50%) and a short lock-up period (six months of linear unlocking). For the sake of their interests, they will work hard to market xxx as the next xxx (you can bring in a certain Layer 1 here) killer. If you have any questions, you can check out my previous KOL translation guide.

- Selling staking rewards: Since 2017, many PoS networks have allowed investors to stake locked tokens and claim staking rewards at any time, which has become a way for early investors to profit in advance. Celestia and EigenLayer have both been pointed out to have this situation recently.

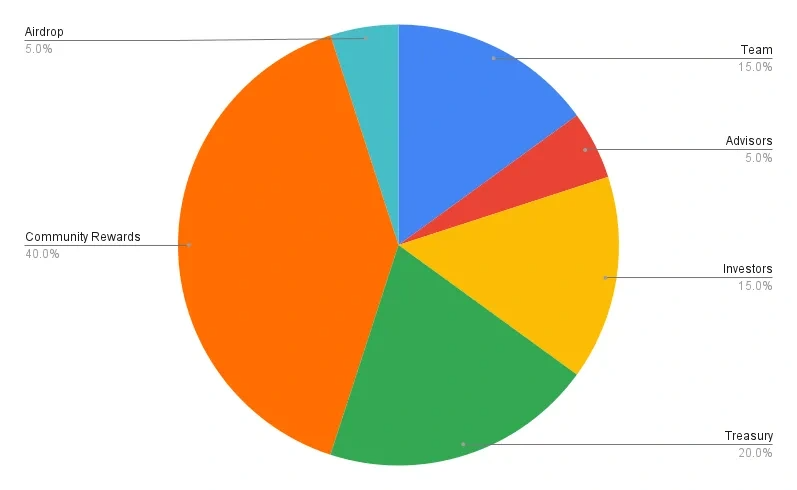

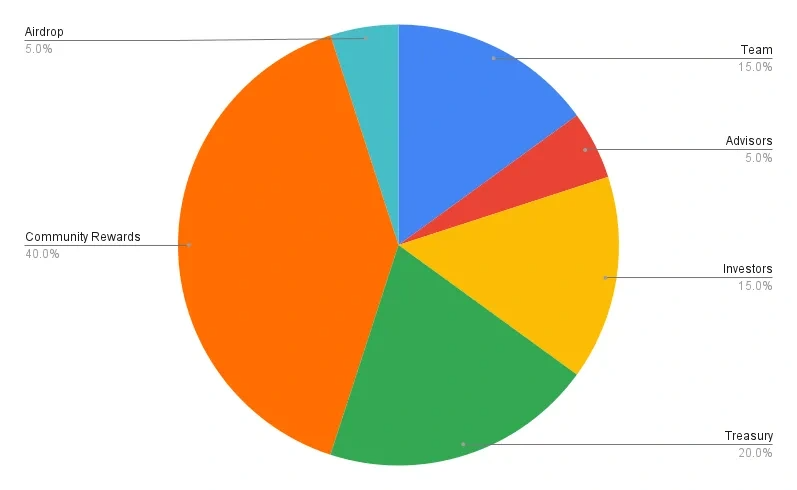

All these "insider transactions" together build a "ghost version of the token economic model". As a community member, you may often see the token economic model chart like the one below and be satisfied with its distribution and transparency.

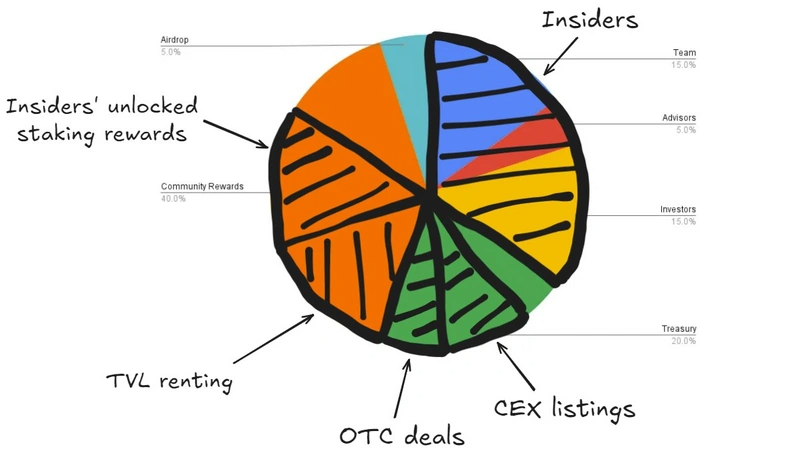

But if we peel off the layers of disguise and reveal the hidden "ghost token economic model", you will find that the real token distribution may look like the picture below, which does not leave much opportunity for the community.

Like Daedalus designing his own prison, this distribution sealed the fate of many tokens — insiders trapped their projects in a maze of opaque transactions, causing the tokens’ value to bleed away from them in all directions.

How did we get here?

Like most problems caused by market inefficiencies, this one stems from a severe imbalance between supply and demand.

There is an oversupply of projects entering the market, many of which are byproducts of the 2021/2022 VC boom, many of which have waited more than three years to launch a token, and now they are all crowded together, struggling to compete for TVL and attention in a colder market environment - please note that this is not 2021 anymore.

In turn, demand cannot keep up with supply, and there are not enough buyers to absorb the frantic influx of new listings. Similarly, not all protocols can attract funds and accumulate TVL, making TVL a scarce resource.

Instead of finding product-market fit (PMF), many projects fall into the trap of overpaying token incentives, artificially boosting key metrics and masking the lack of sustainable appeal.

Today, many deals are done privately. Most VCs and funds are struggling to maintain meaningful returns as retail investors flee, and their profits have shrunk, forcing them to generate excess returns through insider trading rather than simply picking appreciating assets.

One of the biggest issues remains token distribution, with regulatory barriers making it almost impossible for projects to distribute tokens to retail investors, leaving teams with limited options - generally only airdrops or liquidity incentives. If you are a project that is trying to solve the token distribution problem through IC0 or other alternative methods, you can talk to us.

Revelation

There is nothing inherently wrong with using tokens to incentivize stakeholders or accelerate project growth, and it can indeed be a powerful tool. The real problem is that it can easily lead to a complete lack of transparency in the token economic model.

Here are a few key takeaways for cryptocurrency founders to increase transparency:

Don’t offer advisory shares to investors: Investors should provide your company with as much help as they can without requiring additional advisory shares. If an institution requires additional tokens to invest, then they probably lack true confidence in your project. Do you really want such a person on your list of investors?

Find the right market-making quote: Market-making services are highly marketized, and you should look for competitive quotes. There is no need to overpay. In order to help founders solve this problem smoothly, I have written a guide (https://x.com/0xLouisT/status/1808489954869133497).

Don’t confuse fundraising with unrelated operational matters: During the fundraising process, you should focus on finding funds and investors that can help increase the value of your project. During the fundraising phase, you should avoid discussing market making or airdrops, and don’t sign any documents related to these topics.

Maximize on-chain transparency: The public token economic model should accurately reflect the true situation of token distribution. In the token genesis phase, tokens can be transparently distributed through different addresses to reflect the true token economic distribution. For example, in the following pie chart, you need to make sure you have six main addresses, representing the allocation of groups such as the team, consultants, and investors. You can proactively contact the following teams such as Etherscan, Arkham, and Nansen to mark addresses, contact Tokenomist to make unlocking schedules, and contact Coingecko and CoinMarketCap to display correct circulation and supply data.

Use on-chain unlocking contracts: For team, investor, OTC, or any type of unlocking, ensure it is transparently executed on-chain via smart contracts.

Locking up staking rewards: If you allow investors or insiders to stake locked tokens, at least make sure that the staking rewards are also locked up. You can read my detailed opinion on this practice in this article (https://x.com/0xLouisT/status/1840039173815681038).

Focus on the product and forget about CEX listing: Stop worrying about whether you can be listed on Binance. This will not solve your fundamental problems or improve your fundamentals. Take Pendle as an example. It only stayed on the decentralized exchange (DEX) at the beginning, but after finding the product market fit (PMF), it easily got the support of Binance. Focus on product construction and community growth. As long as your fundamentals are solid enough, CEX will rush to list tokens at more favorable prices.

Don’t use token incentives unless necessary: If you give away your tokens easily, there is something wrong with your strategy or business model. Tokens have value and should be used with caution for specific goals. Incentives can be a growth tool for a period of time, but they should not be a long-term solution. When planning a token incentive plan, you should ask yourself: "What metric will change once the incentive stops?" If you think a metric will drop by 50% or more when the incentive stops, then your token incentive plan is likely flawed.

In summary, if there is only one key takeaway from this article, it is "Prioritize transparency". I wrote this article not to blame anyone, but to spark a real debate to improve transparency in the industry and reduce the phenomenon of "ghost token economic models". I sincerely believe that this will improve over time.