Author: DeFi_Cheetah, former Binance researcher

Compiled by: zhouzhou, BlockBeats

Editor's Note: This article will provide you with the most comprehensive overview of POL and its potential impact on the ecosystem, especially the price of BERA. The content covers basic mechanisms, inflation emission plans, token economic models, and key strategies (or tips) for absorbing inflationary pressure. Berachain's PoL mechanism promotes ecological growth through liquidity incentives and delegation rewards, creates a positive cycle and capital efficiency, and provides liquidity and staking rewards through iBGT and iBERA to promote the revival of the DeFi ecosystem.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

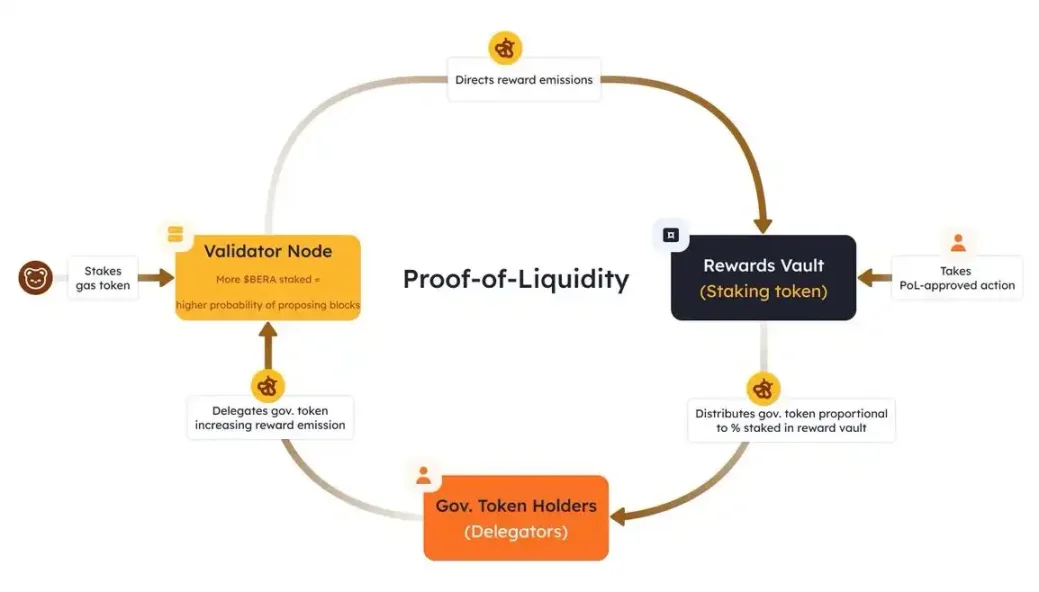

berachain's liquidity proof mechanism is designed to solve the incentive mismatch problem of consensus mechanism in traditional proof-of-stake (PoS) blockchains. Under the PoS mechanism, users need to lock assets to obtain staking rewards, but this leads to incentive mismatch because DeFi projects also need assets and liquidity, which ultimately leads to their direct competition with the PoS mechanism. PoL redesigns the incentive mechanism so that it can promote DeFi activities while improving network security and decentralization, rather than relying solely on asset locking.

Basic Mechanism

There are two core native assets in the Berachain ecosystem: BERA and BGT:

- BERA is a gas fee and staking token, mainly used for validator selection (see below for details).

- BGT is a governance token (non-transferable, 1:1 redeemable for BERA). In addition, it determines the economic incentives and emissions that can be allocated to the whitelisted DApp reward treasury.

BGT can be redeemed (or destroyed) for BERA at a 1:1 ratio, but more importantly, BERA cannot be converted back to BGT.

Note: The more BGT a validator holds, the higher the reward they receive whenever they produce a block. However, whether they are selected to produce a block and thus receive a reward depends entirely on the amount of BERA they stake.

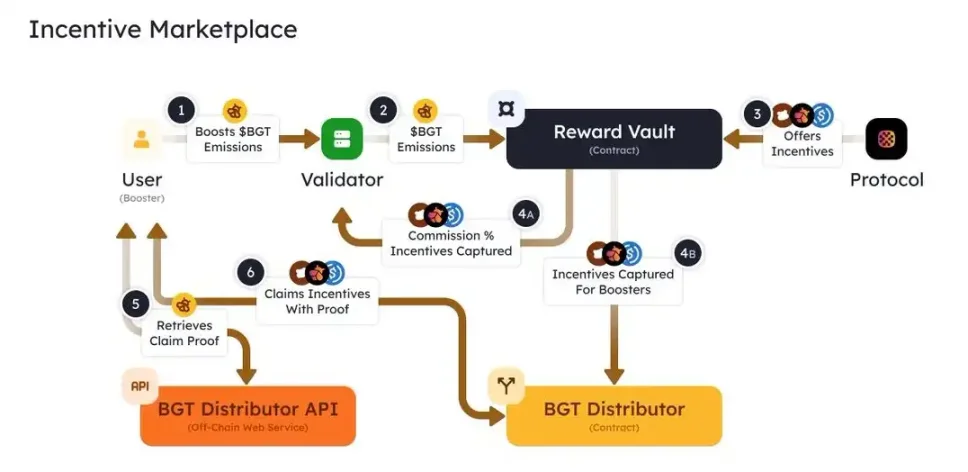

Unlike traditional PoS, in the traditional PoS mechanism, validators are rewarded directly from the blockchain by verifying transactions, and users who delegate to validators also receive rewards in proportion to the amount of stake. In Berachain, validators receive BGT (BlockRewardController contract authorizes Distributor smart contract to mint and distribute BGT). However, they must immediately allocate most of the BGT to the reward vaults of whitelisted DApps.

Protocols then compete for these validators’ BGTs through bribes (usually the protocol’s native token), with the incentive rate for bribes being related to the emission of 1 BGT. The more attractive the bribe, the more likely the validator will direct BGT to the DApp reward vault that offers the highest return.

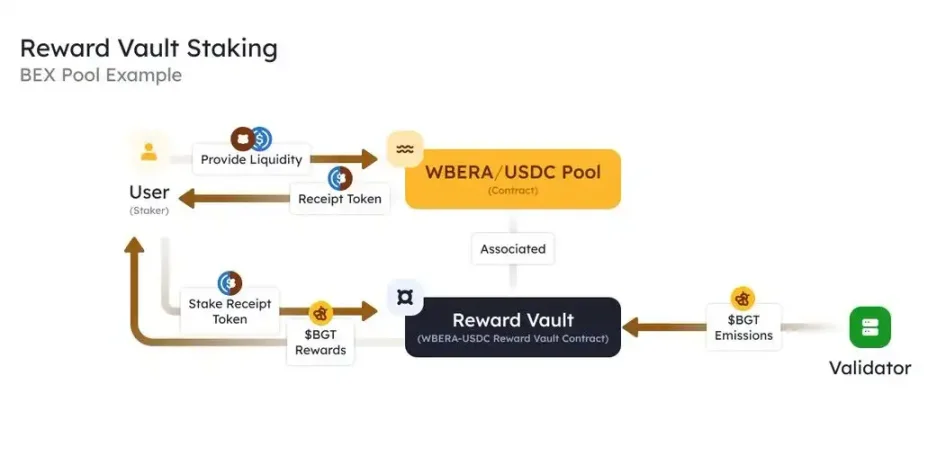

For example, users can provide liquidity in certain liquidity pools of native DEX to earn LP transaction fees. Then, by depositing LP tokens into the DEX reward vault of a specific trading pair, users can receive additional BGT issuance rewards on top of the LP fee income.

After receiving BGT rewards, users can choose to delegate BGT to validators or stake BERA. The BGT emission of validators will increase as the number of BGT delegated increases.

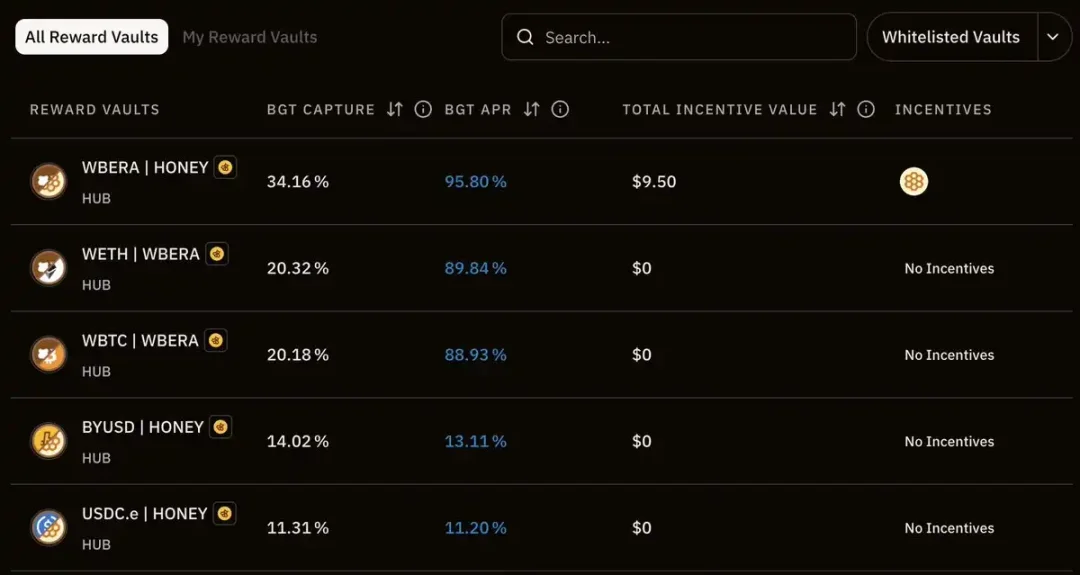

Since POL is now live, the number of whitelisted vaults has increased significantly.

Regarding BGT delegation, validators can actively or passively decide which reward vaults to direct the release of BGT to, depending on the amount of bribes offered by the dapp. As a delegator, users can choose to delegate based on the validator's strategy and the bribes they expect to earn for the delegator. Therefore, validators who can bring the most benefits to delegators are more likely to receive more BGT delegation.

Regarding BERA staking, stakers contribute to the validator’s self-bond and therefore receive a portion of the BGT and BERA earned by the validator.

Block Production and BGT Release

Validator selection criteria: Only the top 69 validators with the highest BERA stake are eligible for block production (minimum 250kBERA, maximum 10MBERA), and their block production probability is proportional to the amount of BERA staked, but this will not affect the amount of BGT released from the reward treasury.

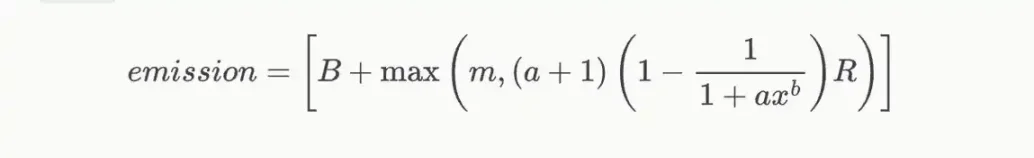

BGT release per block: This part is crucial because the lockup of BERA depends on how the formula is designed.

The release of BGT consists of two parts: Base Emission and Reward Vault Emission.

Base Release: A fixed amount (currently 0.5 BGT) paid directly to the validator who gave the block.

Reward Treasury Release: This part is highly dependent on the "boost", that is, the proportion of BGT delegations obtained by a validator to the total BGT delegations of the entire network.

Parameters a and b affect the degree to which the "increase" affects the final release of the reward treasury. In other words, the larger a and b are, the more significant the impact of the "increase" on the release of the reward treasury. The amount of the reward treasury released is proportional to the weight in the validator's reward distribution formula.

In other words, the more BERA is staked, the higher the probability that the validator will be selected to produce a block; the more BGT is delegated, the more BGT will be minted from the BlockRewardController smart contract, which can be directed to more reward vaults, allowing validators to obtain more incentives (in the form of various tokens) from various protocols through reward vaults.

Summarize the process

- The first 69 validators with the most BERA staked are eligible to produce blocks.

- They decide how to allocate BGT to the reward treasury, and receive part of the incentive tokens according to the commission ratio, and the rest is distributed to the delegators according to the reward ratio corresponding to 1 BGT.

- BGT in the reward treasury will be distributed to users who provide liquidity to the relevant liquidity pool.

After obtaining non-transferable BGT, liquidity providers can:

As a delegator, you delegate BGT to the validator and earn bribes provided by the protocol;

Irreversibly redeem BERA and gain instant profit.

At Berapalooza 2, the first day of RFRV submissions attracted over $500,000 in bribes. If this momentum continues and doubles before PoL goes live, weekly bribes could reach $1 million, creating a massive incentive flow within the Berachain ecosystem.

At the same time, Berachain releases 54.52MBGT per year, about 1.05 million BGT per week. Since 1BGT can be burned and exchanged for 1BERA, and the BERA price was 8.43 at the time, it means that the incentive value allocated by Berachain each year is as high as 8.8M.

But it is worth noting that only 16% of BGT release goes directly to the validator, and the remaining 7.4M goes into the reward treasury every week. Therefore, for every $1 million in bribes invested in the protocol, $7.4 million in BGT incentives can be obtained, forming a very attractive ROI (return on investment).

How Bribery Improves Capital Efficiency

For the protocol, this mechanism is a game changer. Compared with directly investing huge amounts of money to attract liquidity, the protocol can amplify the incentive effect through the bribery model.

For users, the annualized return of PoL in the early stage may be extremely high. In order to compete for liquidity, the protocol will provide high BGT incentives and bring rare mining opportunities. If you want to maximize your returns, now is the best time to calculate strategies and plan ahead.

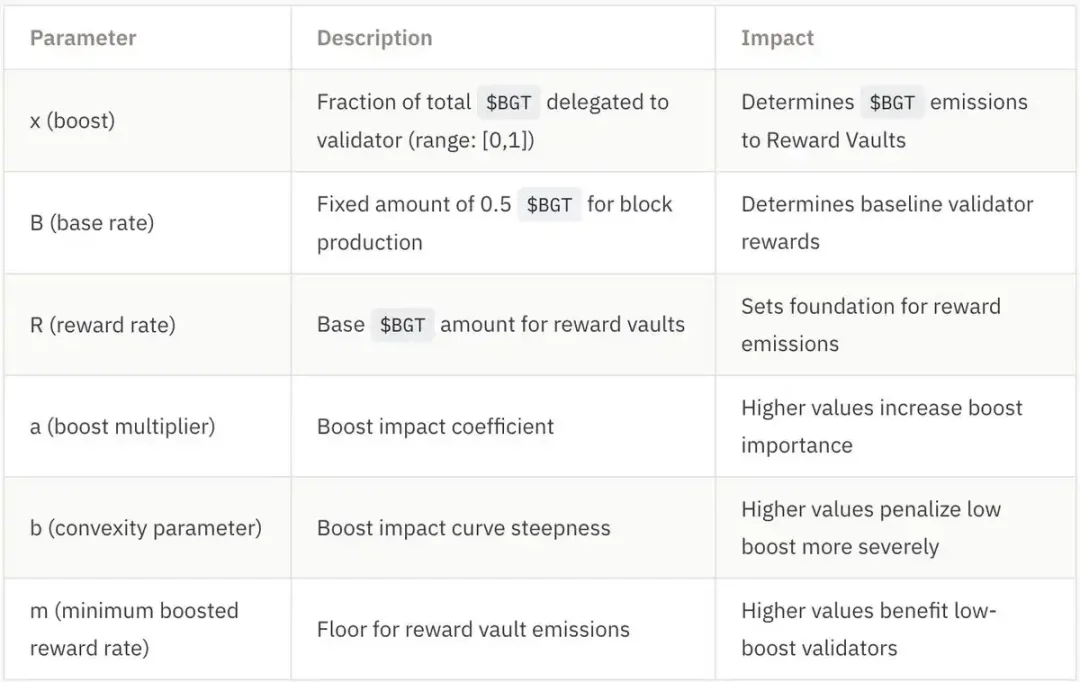

Self-circulating positive feedback flywheel

Berachain’s growth logic:

- More BGT was commissioned for bribery,

- Validators can get more BGT incentives to guide liquidity.

- Increased liquidity and deeper liquidity pools for trading pairs,

- Slippage is reduced and trading volume is increased.

- Higher transaction fee income,

- Attract more BGT to be released to the corresponding liquidity pool.

- Further promote ecological growth and form a self-reinforcing flywheel effect.

This mechanism creates a self-reinforcing cycle in which:

- More liquidity → more rewards for users.

- More delegated BGT → more incentives for validators.

- More validator incentives → stronger security alignment with DeFi growth.

PoL creates a positive-sum economy

Unlike traditional staking, PoL improves capital efficiency while continuously expanding Berachain’s economic activity.

The specific process is as follows:

- Users provide liquidity → earn BGT → delegate BGT to validators.

- Validators guide issuance → incentivize DeFi protocols.

- More liquidity → more users → more rewards → the cycle repeats.

Why this matters

- More liquidity → better trading conditions, lower slippage, deeper lending markets.

- Developers are more likely to build on a blockchain where liquidity is stable and growing.

This flywheel effect ensures that as more liquidity enters the ecosystem, it will attract more users, developers, and capital, thereby enhancing long-term sustainability and network security.

Berachain’s Magical Token Economics

Regardless of how the team defines it, the core of all token economics design ultimately comes down to one thing: minimizing sell pressure and smoothing the launch process.

It can be decomposed into two dimensions:

- Inflationary “faucet”: partially redeem BGT for BERA (only “partially” because it is subsidized by incentive tokens from other protocols in the Bera ecosystem)

- Deflationary “drain”: BERA is pledged to obtain block production qualifications and has a higher probability of being selected to produce the next block frequently; BGT is delegated to validators to obtain more benefits; the irreversible effect of BGT redemption (especially the inability to obtain BGT in the secondary market) acts as a deterrent; due to smaller slippage, more fees are generated with the help of more liquidity provided by PoL, resulting in a deflationary effect.

In traditional POS staking, validator selection and bonuses are determined by the ratio of the number of staked native tokens to all staked tokens. A little trick is used here: separating gas and security staking from governance and economic incentives. The key is to assign the guiding role of economic incentives to an illiquid token so that the threshold for receiving economic incentives is higher (i.e. people cannot easily obtain it in the secondary market), thereby deterring holders from selling in large quantities.

For example, veCRV is a classic example of a voting custody token, but BERA goes a step further - while veCRV can be converted from CRV purchased on the secondary market, BGT can neither be obtained on the secondary market nor converted from BERA. This creates a greater deterrent effect on BGT holders - if they hold a large number of BGT soul-bound tokens and sell most of them, they will need to go through a high threshold when they want to receive economic incentives from ecosystem projects - by providing liquidity to liquidity pools for specific trading pairs and participating in certified reward treasuries.

In addition, the forked dual-token POS model is also worth noting: validators must stake BERA, but this only means that they are eligible to produce blocks, so they must stake more BERA to increase the probability of producing the next block. At the same time, validators also need to obtain more incentive tokens from the protocol to attract more BGT delegators. This dynamic mechanism can create a strong deflationary force to absorb the initial large amount of selling pressure caused by the high inflation BGT issuance plan. This is because validators must stake more BERA to increase the probability of producing the next block, and users must hold and delegate BGT to obtain high returns.

The one fatal risk I can think of right now is that the intrinsic value of BERA exceeds the yield of BGT, so that BGT holders may line up to redeem and sell BERA. The key to realizing this risk lies in a game dynamic in which BGT holders must judge whether holding BGT in exchange for yield is more profitable than simply redeeming and selling BERA. This depends on how prosperous the Bera DeFi ecosystem can be - the more competitive the incentive market is, the higher the yield of BGT delegators.

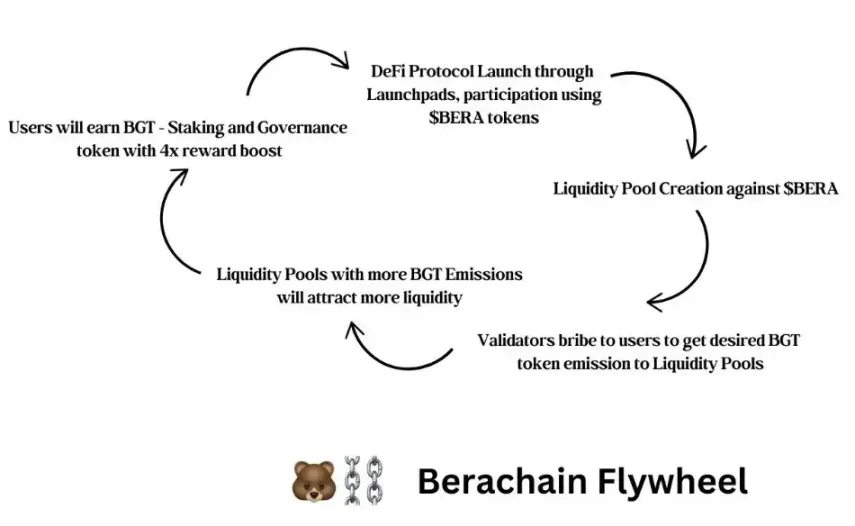

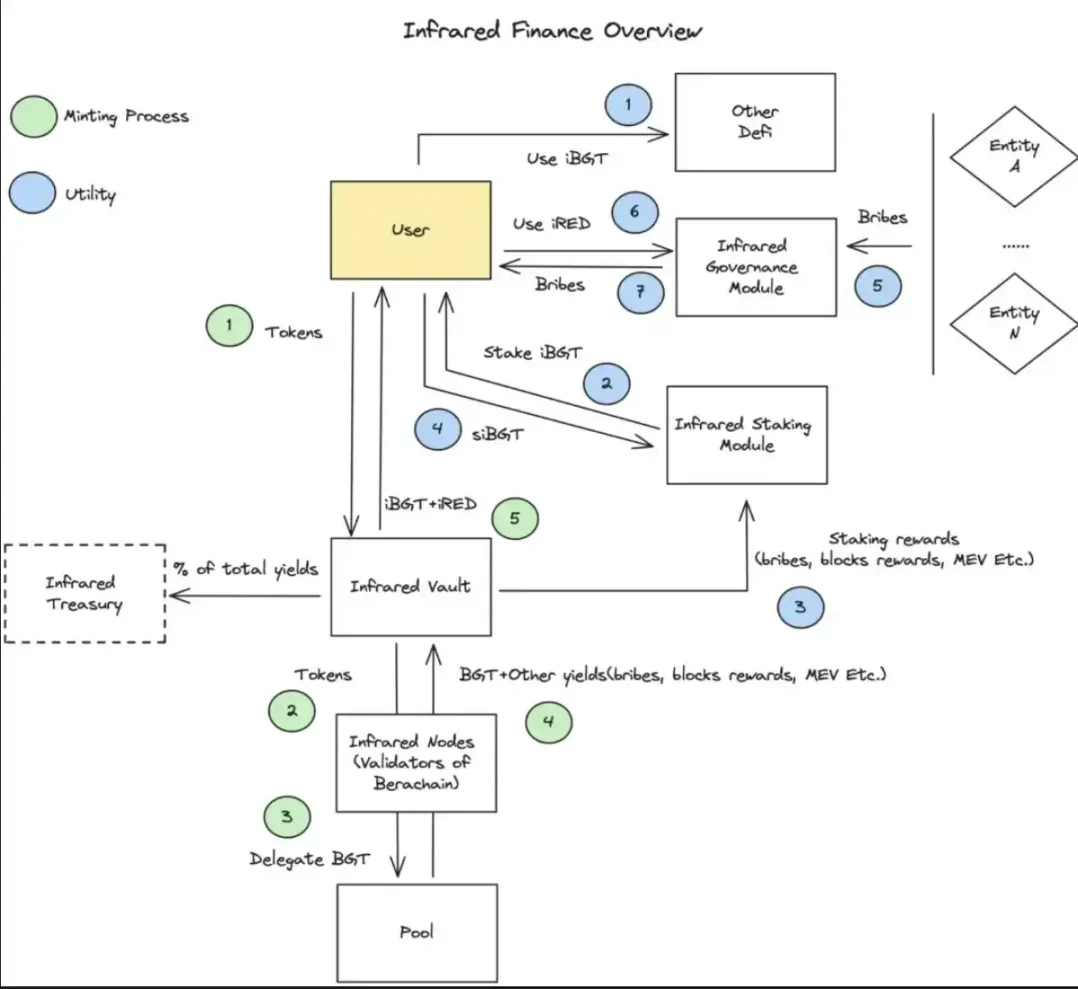

Infrared Finance - A leading liquid staking protocol with over $2 billion in TVL.

In simple terms, it offers iBGT and iBERA, which are liquid versions of staked BGT and BERA, respectively, allowing users to earn staking rewards while maintaining liquidity, which can be used for other DeFi activities such as trading on DEX or lending markets.

iBGT is collateralized with BGT at a 1:1 ratio. It is worth noting that unlike the non-transferable nature of BGT, iBGT can be directly transferred. @InfraredFinance operates as a validator, allowing users to deposit PoL assets into the vault to earn iBGT, which can be used in Berachain's DeFi ecosystem.

Users can also choose to further stake iBGT to obtain staked iBGT (siBGT), thereby capturing the returns of BGT. siBGT can amplify the returns of BGT because iBGT holders are more inclined to choose liquidity rather than returns, which creates a multiplier effect of returns among siBGT holders. At the same time, iBGT aims to build a monetary premium that reflects the potential utility of iBGT as a liquidity token.

Not going to dive into the details of every protocol in the ecosystem, but judging by Bera’s design, it’s very DeFi-centric. It will be interesting to see how @AndreCronjeTech’s @soniclabs and Bera can potentially revive the golden age of DeFi, especially after the collapse of the Luna ecosystem.