1. Market observation

Keywords: MOVE, ETH, BTC

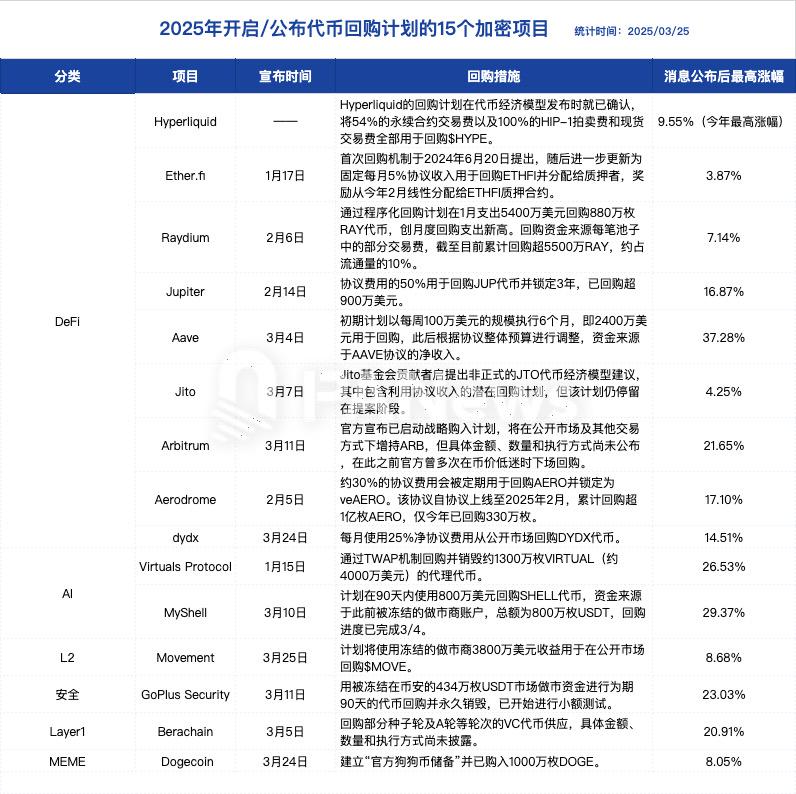

A "buyback wave" has swept the crypto industry, with 15 projects including Aave, Arbitrum, and Movement announcing token buyback plans, ranging from millions to tens of millions of dollars. The sources of buyback funds include protocol income, confiscated assets, and fund expenditures. This move is not only a stopgap measure to save the market in the short term, but also an important strategic layout for projects to reshape the token economy and give long-term value. At the same time, Immutable received a notice of termination of the SEC investigation, bringing a clear signal of regulation to the Web3 gaming industry.

Bitcoin prices continue to show a trend that is highly correlated with the U.S. stock market, with volatility remaining several times higher than that of U.S. stocks. Investors on both sides focus on the Fed's expectations of rate cuts. Analyst Daan Crypto Trades pointed out that Bitcoin is still trading at a solid premium, and if it can maintain this level and slowly recover to more than $90,000, it is expected to create a new high. The Greeks.live community briefing shows that the market is divided on the trend of cryptocurrencies. Some investors believe that it is suitable to buy on dips, while short sellers expect Bitcoin to fall to the $84,500 range.

In the regulatory field, the SEC announced that it will hold four roundtable meetings from April to June 2025, covering key topics such as crypto trading, custody, asset tokenization and DeFi. Commissioner Hester Peirce called this move a "spring sprint to crypto clarity," showing that regulators are shifting from an enforcement orientation to a constructive dialogue. It is worth noting that traditional financial institutions are increasingly accepting Bitcoin, and the GameStop board of directors has unanimously approved an update to its investment policy to include Bitcoin as one of the company's reserve assets. At the same time, the Oklahoma House of Representatives passed the Strategic Bitcoin Reserve Act, further demonstrating the recognition of Bitcoin by institutions and governments. In addition, Ripple reached a preliminary settlement agreement with the SEC, and the SEC agreed to refund a $75 million fine, marking the end of the long-term legal dispute between the two parties.

At the macro level, the market generally expects the Fed to shift from quantitative tightening (QT) to quantitative easing (QE), which may inject new liquidity into the financial market. However, Benjamin Cowen, CEO of crypto research firm IntoTheCryptoVerse, reminded that quantitative tightening has not completely ended, but has only reduced its scale from $60 billion per month to $40 billion. In addition, Goldman Sachs' latest report warned that Trump's upcoming reciprocal tariff policy may cause the market to experience "first collapse and then stability" and violent fluctuations, and the actual tax rate may be twice as high as market expectations.

2. Key data (as of 13:30 HKT on March 26)

Bitcoin: $87,346.87 (-6.65% year-to-date), daily spot volume $28.634 billion

Ethereum: $2,055.65 (-38.48% year-to-date), with a daily spot volume of $11.309 billion

Fear of corruption index: 47 (neutral)

Average GAS: BTC 1.4 sat/vB, ETH 0.36 Gwei

Market share: BTC 60.7%, ETH 8.7%

Upbit 24-hour trading volume ranking: MOVE, XRP, LAYER, BTC, CRO

24-hour BTC long-short ratio: 1.0496

Sector ups and downs: Meme sector rose 4.74%, Layer2 sector rose 4.62%

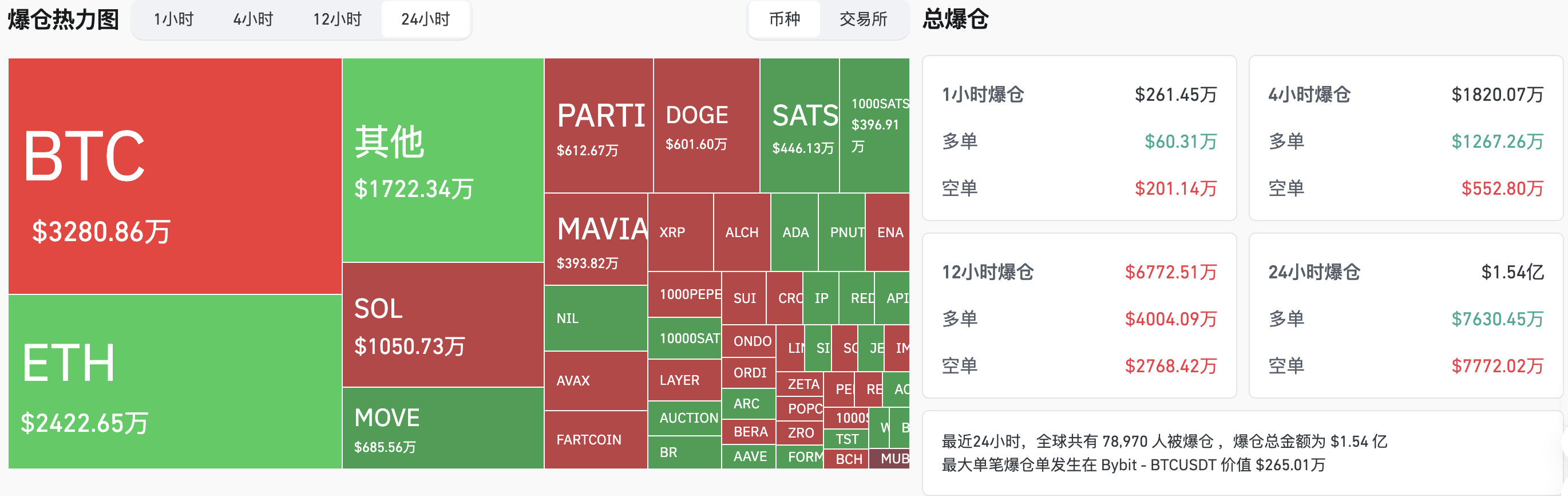

24-hour liquidation data: A total of 78,970 people were liquidated worldwide, with a total liquidation amount of US$154 million, including BTC liquidation of US$32.8 million and ETH liquidation of US$24.22 million

3. ETF flows (as of March 25 EST)

Bitcoin ETF: $26.83 million

Ethereum ETF: -$3.21 million

4. Today’s Outlook

Celo officially activates Ethereum L2 mainnet, hard fork block height 31057000

U.S. Senate holds hearing on Paul Atkins' qualifications to serve as SEC Chairman on March 27

GRASS Airdrop One claim ends (planned for March 27, block 329341917)

Blockchain game Immortal Rising 2 completes $3 million in financing, TGE scheduled for March 27

Binance Launches Solv Protocol (SOLV), the 7th Phase of BNSOL Super Staking

Yield Guild Games (YGG) will unlock approximately 14.08 million tokens at 22:00 on March 27, accounting for 3.28% of the current circulation and worth approximately US$3 million.

The biggest gainers among the top 500 stocks by market capitalization today: WhiteRock (WHITE) up 64.41%, Movement (MOVE) up 29.04%, Gigachad (GIGA) up 26.88%, Particle Network (PARTI) up 25.61%, and Solayer (LAYER) up 17.92%.

5. Hot News

Movement wallet address has received 10 million MOVE USDC from Binance in the early morning Treasury minted 300 million USDC on Ethereum in the early morning Ripple will recover $75 million in court fines from the SEC and withdraw its appeal

US SEC terminates investigation into Immutable and related parties, finding no violations

Paidun: GMX and MIM Spell hacker attacks have caused losses of about $13 million

Bithumb will list Redstone (RED) and Nillion (NIL) Korean Won trading pairs

Arbitrum DAO proposes to withdraw 225 million ARB game incentive plan, questioning mismanagement

Dogecoin Foundation sets up official reserve, first purchases 10 million DOGE