This article will sort out the on-chain and exchange data from the past week to provide a panoramic view of token trading.

Written by: Pzai, Foresight News

On April 14, the ETH/BTC exchange rate fell to 0.01924, hitting a new low since January 2020. As the mainstream asset in the last bull market, Ethereum's performance in this cycle has caused many investors to complain. Faced with Bitcoin's strong performance in this cycle, Ethereum seems to be undergoing a double test of confidence and value. Some community members also said: "Although OM plummeted 90% today, its performance this year is still better than ETH." In the past week, some of the deposited whales on the chain are also ready to move. This article will sort out the on-chain and exchange data in the past week to take a panoramic view of token transactions.

On-chain data: “retreat” signals appear

Over the past week, some whales have been "pouring" into the market. According to Arkham data, a certain OG address group that initially purchased 100,000 ETH in 2015 has cumulatively sold 4,180 ETH on Kraken since April, worth about $7.05 million. Another 0x62A address sold a total of 4,482 ETH at an average price of $1,572 on April 12, worth $7.05 million. Such a price drop has triggered a lot of on-chain liquidations. For example, a whale reduced its position of 35,881 ETH at an average price of $1,562 on April 10, unloaded leverage, and sold the remaining 2,000 ETH at $1,575. The address currently still holds 688 ETH.

Since the Bitcoin halving in 2024, Ethereum has fallen 40% relative to Bitcoin, marking the first time that it has been weak for a year after the halving. In comparison, the SOL/ETH exchange rate has risen 49% so far this year to 0.0817. This shows that in 2025, SOL still performs significantly better than Ethereum. According to DeFillama data, the revenue of DEX on the Ethereum chain was only US$1.1 million in the past 24 hours, and TVL also dropped from a high of nearly US$80 billion to US$46.9 billion, a drop of nearly half. In the last cycle, Ethereum successfully became the second largest asset with a number of new assets (such as NFT and DeFi) and application advantages, but now, as the MEME trading boom has shifted to chains such as Solana, the on-chain circulation of its assets has slowed down relatively.

On-chain activity metrics

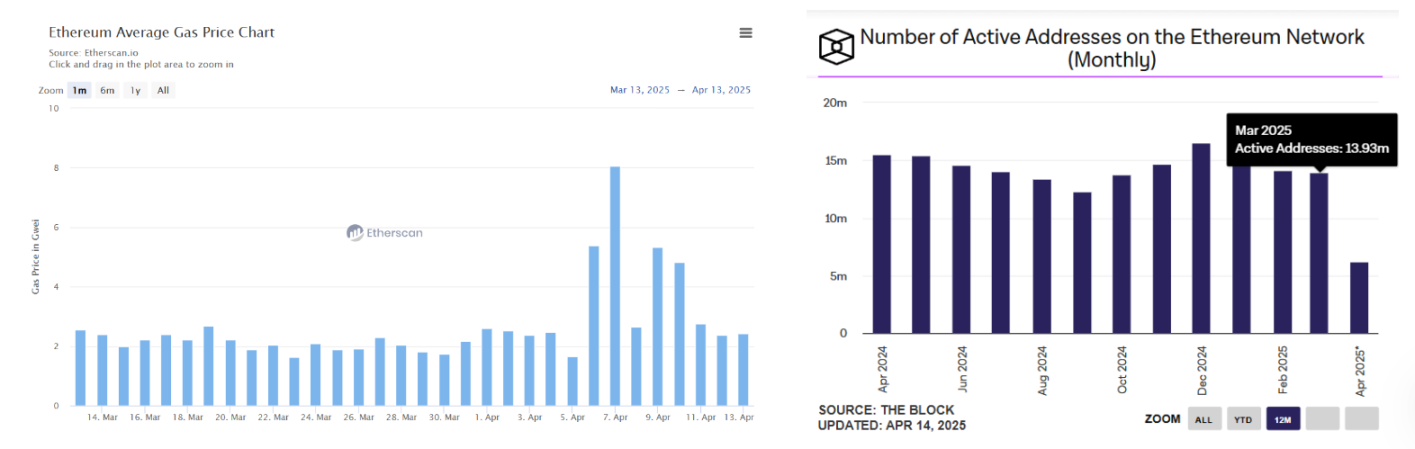

In the past month, except for the market crash on April 7, the Ethereum mainnet Gas has been maintained at 2 Gwei for a long time, which is reflected in the decline of on-chain activities. In addition, the monthly active addresses of the Ethereum mainnet have fluctuated, and the active addresses in March were less than 15 million.

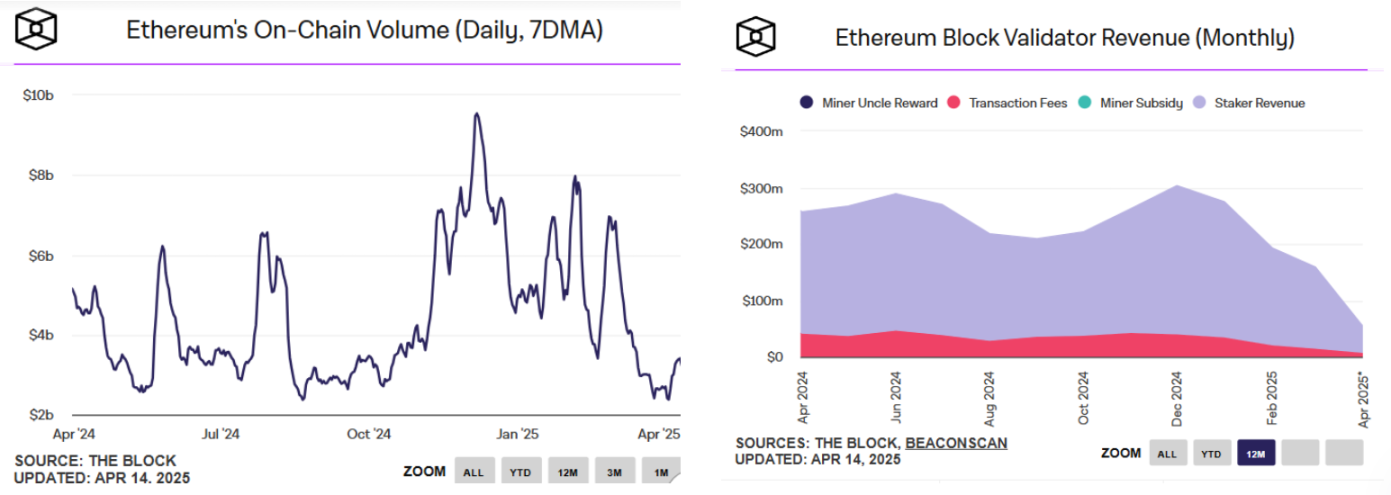

According to data from The Block, the average daily transaction volume on the Ethereum chain is less than $3 billion. Combined with the impact of the coin price, the monthly income of mainnet validators in March fell below $200 million. From the perspective of investor sentiment, the lower on-chain opportunities have caused some investors to take a wait-and-see attitude towards Ethereum's future growth potential in the short term.

CEX and ETF Data

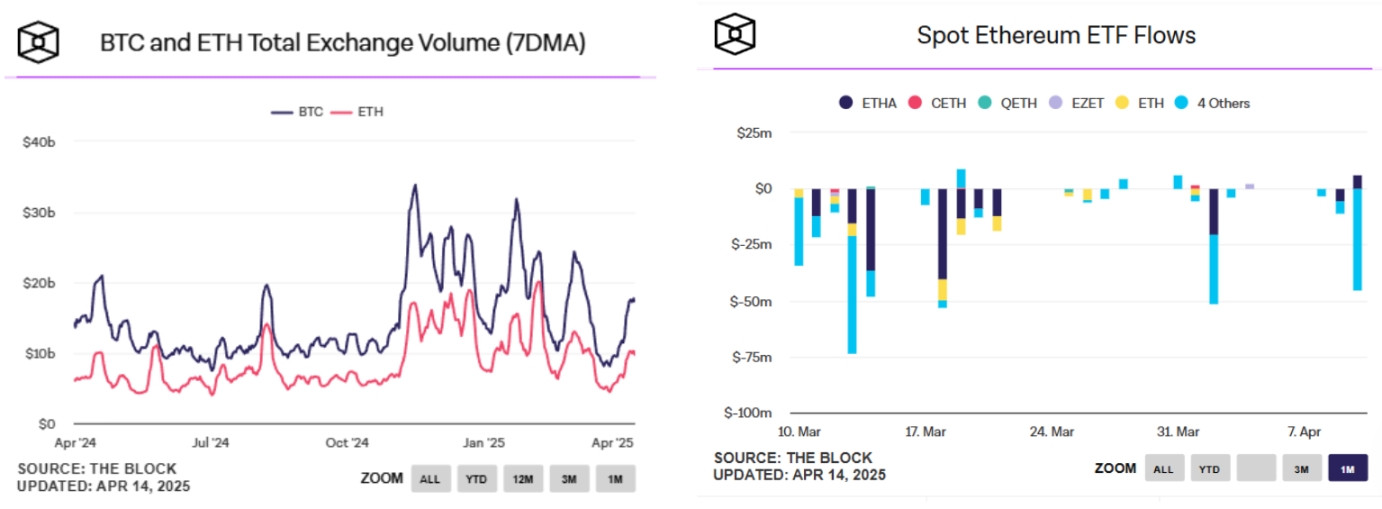

From the exchange data, it can be seen that the peak of Bitcoin in terms of trading volume is significantly larger and more volatile, indicating that more market funds are pouring into Bitcoin spot and derivatives trading. In terms of ETF data, Ethereum spot ETF has recorded multiple days of outflows in the past month, with the highest single-day outflow reaching US$75 million. From the difference in market performance, it can be further seen that the current risk preference of crypto assets shows significant differentiation characteristics. The withdrawal of funds from Ethereum spot ETFs exposes the market's concerns about the slowdown in the pace of the crypto ecosystem, especially in the context of intensified competition in Layer2 and diversion of developer resources by new public chains, some institutional investors have chosen to turn.

Macro environment: Bitcoin is the leader, Ethereum is waiting for the right opportunity

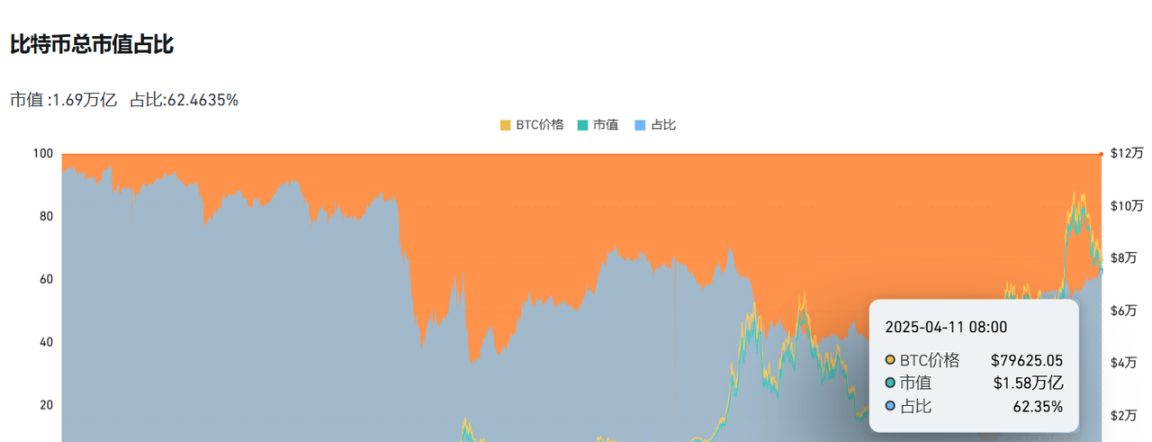

In the market environment where Bitcoin is the "Beta" of U.S. stocks, the total market value of Bitcoin is gradually exceeding 60%, and even reached 62.46% today. This shows that the current market has obvious "Bitcoin season" characteristics, high capital concentration, and the overall performance of altcoins is weaker than Bitcoin. In addition, the Crypto Fear and Greed Index is still in the "panic range", which reflects that investors are more inclined to "risk aversion" demand, and Bitcoin has become this target. And in the future strategic reserve plan of the United States, most states have proposed plans that only include Bitcoin in the reference range. This move has further promoted the status of Bitcoin as a mainstream crypto asset. If the ETH/BTC exchange rate falls below 0.018 in Q2 2025, it may trigger more leveraged position liquidations, further suppressing prices.

In the Ethereum ecosystem, the potential "Trump liquidity" is also the focus of the market. On March 25, the Trump family launched the US dollar-pegged stablecoin USD1 through "World Free Finance" (WLFI). The first batch will be issued on Ethereum and Binance Smart Chain. As one of the stablecoins dedicated to institutional liquidity, this liquidity window is expected to provide sufficient inflows for Ethereum. The current low ETH/BTC exchange rate is the result of the market's trade-off between short-term risks (halving siphoning, regulatory uncertainty) and long-term value (ecological innovation, market expectations). With the key progress of Ethereum's upcoming Pectra upgrade and account abstraction, in the future when Vitalik shouted "Build Ethereum L1 as the core of the "world computer"", can we see the revival of Ethereum again? Let's wait and see.