Author: Kevin, the Researcher from BlockBooster

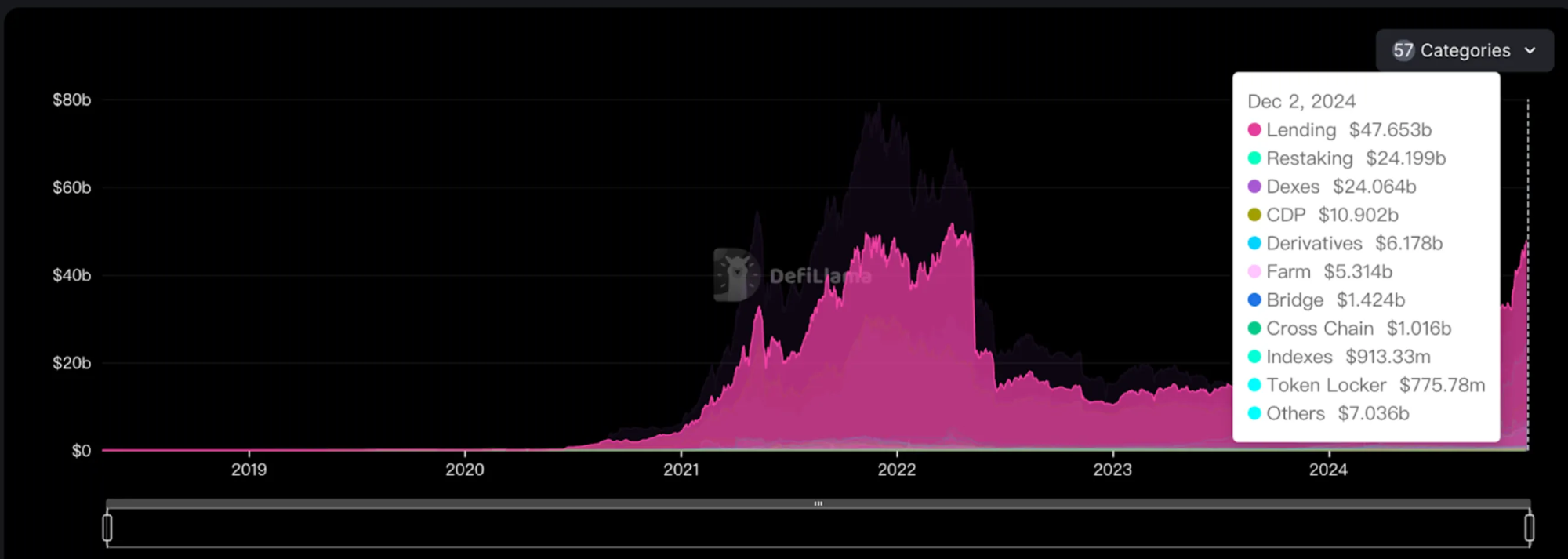

The funding capacity of lending protocols ranks first in the DeFi track, and it is the sector with the largest amount of funds absorbed in DeFi. In addition, lending is a market with proven demand, a healthy business model, and a relatively concentrated market share.

Source: defillama

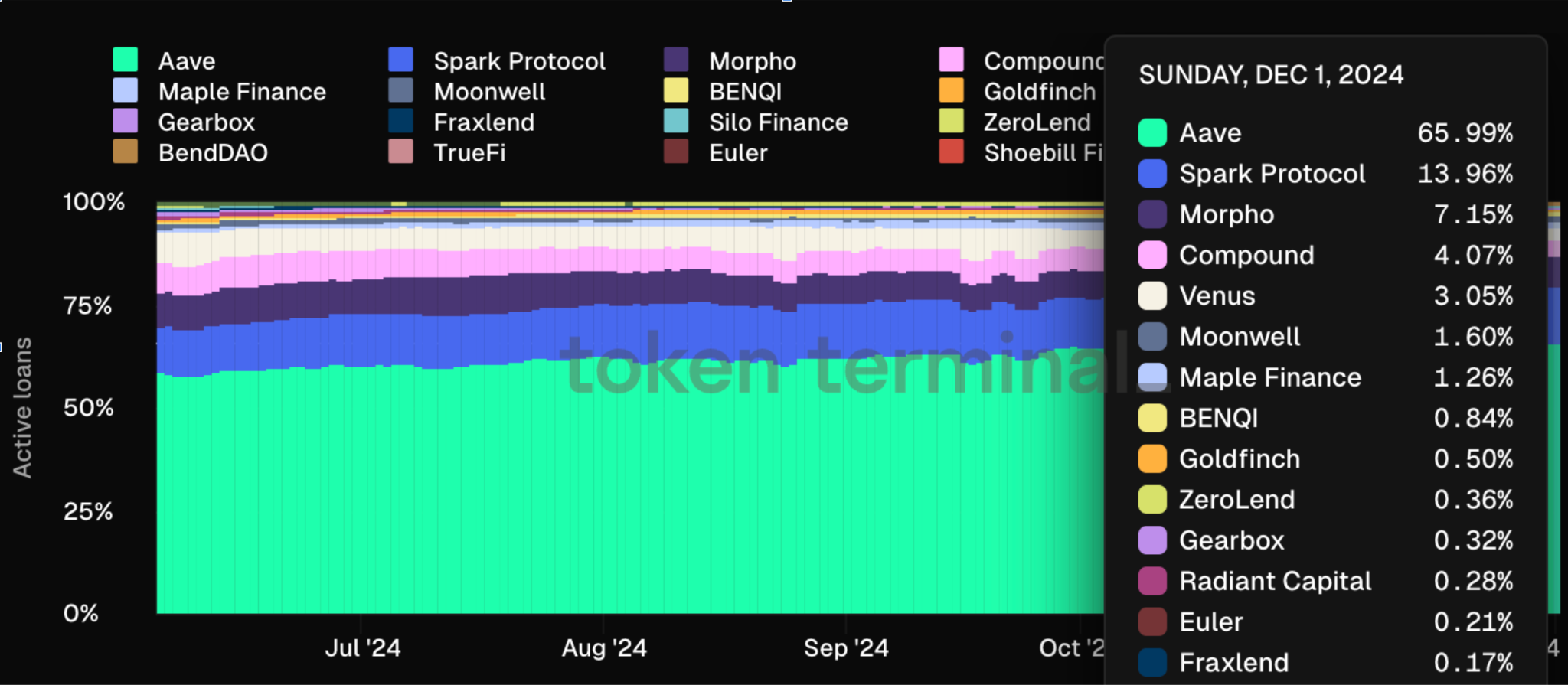

The moat of the decentralized lending market is clear: Aave's market share has further increased, stabilizing at 50-60% in 2023 and currently rising to the 65-70% range.

Source: https://tokenterminal.com/explorer/markets/lending

After years of accumulation, the token subsidy of Aave is gradually decreasing, but at present, in addition to Aave, other lending protocols still need sufficient additional token incentives, including Morpho. Observing the development history of Aave, we can conclude that its core advantages in achieving its current market share are:

- Long-term and stable security performance : Aave has many fork projects, but they were all shut down in a short period of time due to theft or bad debts. In contrast, Aave has maintained a relatively good security record so far. It provides an irreplaceable trust foundation for deposit users. On the other hand, some emerging lending protocols, although they may have innovative concepts or higher short-term yields, often find it difficult to win the trust of users, especially large capital users, before they have experienced several years of market testing.

- More adequate security investment : With higher revenue and sufficient treasury funds, the top lending protocols can provide strong resource support for security audits and risk management. This budget advantage not only ensures the security of new feature development, but also lays a solid foundation for the introduction of new assets, which is crucial to the long-term development of the protocol.

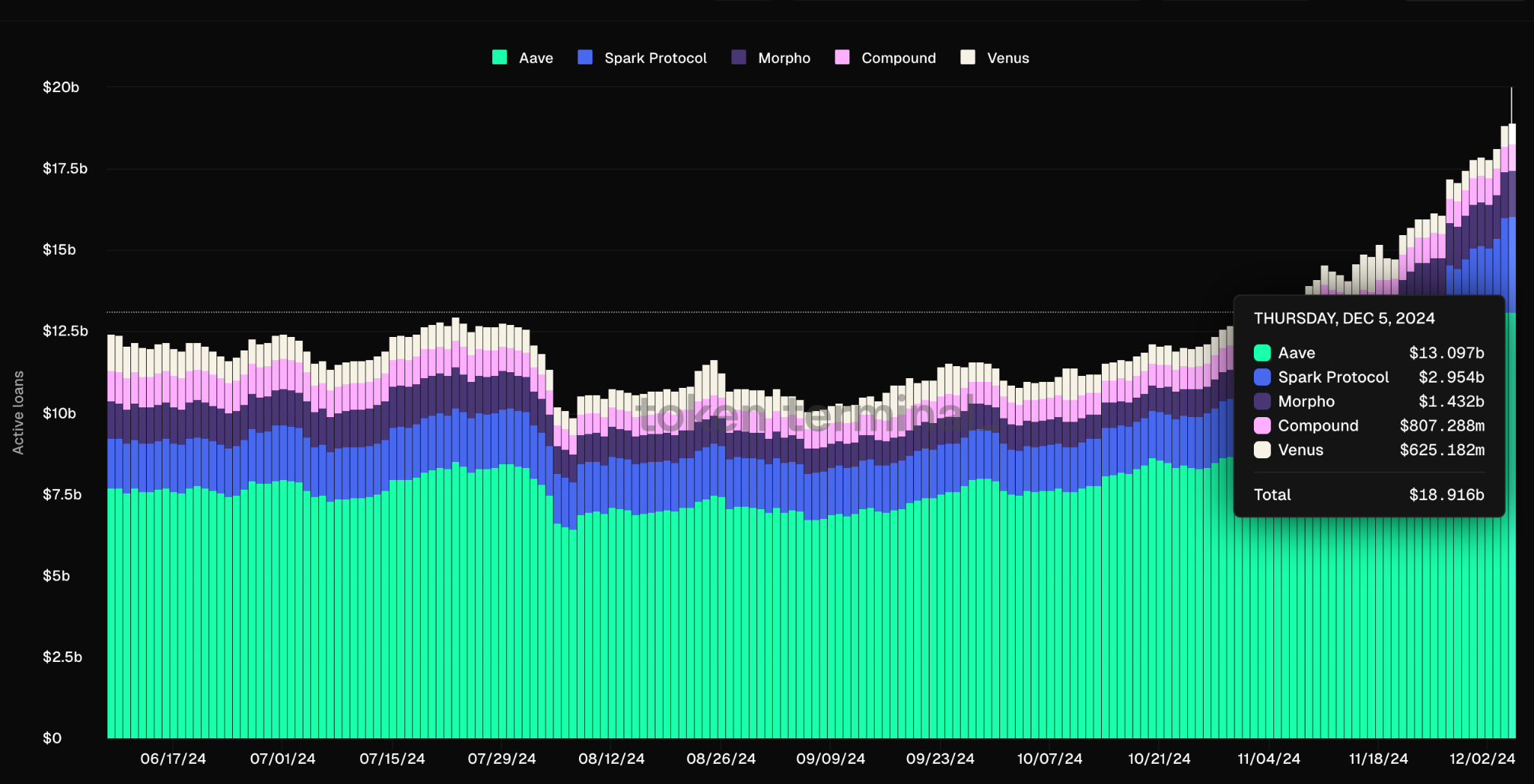

Since Morpho received financing from a16z in the second half of 2022, it has achieved a curve overtaking in the lending track within 2 years. As shown in the figure below, Morpho's current lending funds have reached $1.432b, second only to Aave and Spark.

Source: https://tokenterminal.com/explorer/markets/lending

Morpho's successful experience can be roughly divided into two periods. It is precisely through the accumulation and leap achieved in these two periods that Morpho's market share has steadily increased.

The first transition: Optimizing Aave and Compound to achieve rapid growth

Morpho's initial business model focuses on improving the efficiency of capital utilization in lending protocols, especially the problem of incomplete matching of funds in peer-to-peer pool models such as Aave and Compound. By introducing a peer-to-peer matching mechanism, it provides users with better interest rate options, that is, higher deposit rates and lower borrowing rates.

The core limitation of the peer-to-pool model is that the total amount of deposits in the fund pool often far exceeds the total amount of loans. This imbalance brings about efficiency problems: the interest of deposit users is diluted by idle funds, and borrowers need to bear the interest cost for the entire fund pool instead of only paying interest on the part they actually use.

Morpho's solution is to introduce a new workflow: users' deposits and collateral are allocated to Aave and Compound to ensure base interest rates. At the same time, Morpho uses a peer-to-peer matching mechanism to prioritize large orders and allocate deposits directly to borrowers, thereby reducing idle funds. In this way, deposits can be fully utilized, and borrowers only pay interest on the required funds, achieving interest rate optimization.

The biggest advantage of this matching mechanism is that it eliminates the efficiency bottleneck in the traditional model:

- Depositors enjoy higher returns, borrowers pay less interest, and the interest rates of both parties tend to be consistent, which greatly improves the user experience.

- Morpho operates on Aave and Compound, using their infrastructure as a capital buffer pool to keep risks at a level similar to those of these mature protocols.

For users, this model is very attractive:

- Regardless of whether the match is successful or not, users can at least get an interest rate comparable to Aave and Compound, and when the match is successful, the benefits or costs will be further optimized.

- Morpho is built on mature protocols, and its risk control model and fund management are completely based on Aave and Compound, which greatly reduces the user's trust cost for emerging platforms.

Through innovative design, Morpho cleverly utilizes the composability of DeFi protocols, successfully attracting more user funds under the premise of low risk and achieving more efficient interest rate optimization services.

The second leap: from applications to decentralized infrastructure, separating risks and building an independent ecosystem

As mentioned before, the Morpho optimizer only completed the first transition of Morpho, allowing it to stand out among a number of lending protocols and become a platform that cannot be ignored in the market. However, whether in terms of product or protocol positioning or ecological development openness, the optimizer cannot bring a broader imagination space. Because, first of all, the growth of the optimizer is limited by the current design of the underlying lending pool, because it relies heavily on its DAO and trusted contractors to monitor and update hundreds of risk parameters or upgrade large smart contracts every day. If it stands still, Morpho will not be able to attract a wider range of dev and native protocols, and can only be positioned as an ecological protocol of Aave and Compound for the market. Therefore, Morpho adopts a product idea similar to Uni V4, that is, it only makes a basic layer of a large financial service, and opens up all modules above the basic layer, that is: minimize the product, which the team calls "primitive", and open all lending parameters to individuals and ecological protocols without permission. After transferring the risk from the platform to a third party, Morpho's own ecological value will continue to increase.

Why does Morpho want to make the smallest component and open risk parameters to third parties?

- Risk isolation: Lending and borrowing markets are independent of each other. Unlike multi-asset pools, the liquidation parameters of each market can be set without considering the riskiest asset in the basket. Morpho's smart contract has only 650 lines of Solidity code and cannot be upgraded, making it simple and secure.

- Customizability of vaults: For example, suppliers can lend at a higher LLTV while taking the same market risk as when supplying to a multi-asset pool with a lower LLTV. It is also possible to create markets with any collateral and loan assets and any risk parameterization.

- Reduced costs: Morpho is completely autonomous, so there is no need to introduce fees to pay for platform maintenance, risk managers, or code security experts. Singleton contracts based on simple code significantly reduce gas costs by 70%

- Lego Base Layer: Third-party protocols or individuals are allowed to add more logic layers on top of Morpho. These layers can enhance the core functionality by handling risk management and compliance, or simplify the user experience for passive lenders. For example, risk experts can build non-custodial curated vaults that allow lenders to passively earn yield. These vaults recreate the current multi-collateral lending pools.

- Bad debt handling design: Morpho adopts a different strategy from conventional lending agreements in handling bad debts. Specifically, if an account still has unpaid debts after liquidation and there is no collateral to make up for it, this part of the loss will be borne by all lenders in accordance with the established proportion. In this way, Morpho will not go bankrupt due to bad debts. Even if there are bad debts, it will only affect specific independent markets. Unless there are problems in large-scale markets, Morpho's own ecological value will not be damaged.

- Developer-friendly: Account management implements GAS-free interaction and account abstraction functions, and free flash loans allow anyone to access assets in all markets simultaneously with a single call.

The Morpho platform provides users with a completely autonomous construction space, on which any individual or institution can design and implement their own lending risk management mechanism. Professional financial institutions can also use the platform to cooperate with other market participants and earn fees by providing management services. Its permissionless nature allows users to flexibly set various parameters and independently create and deploy independent lending markets without having to rely on external governance to add assets or adjust market rules. This flexibility gives market creators a high degree of freedom, allowing them to independently manage the risks and returns of lending pools based on their own risk assessments, thereby meeting the diverse needs of different users in terms of risk preferences and usage scenarios.

But looking further, the trustless design is actually to accumulate reputation and TVL at low cost. There are currently hundreds of Vaults on Morpho, but most of those listed on the Morpho Interface are designed by risk management experts. Morpho allows anyone to create a Vault, which can increase TVL without risk. Even if most of these Vaults fail, it will not cause any impact. However, the Vaults with excellent operations will stand out, and their positioning will be upgraded to the level of risk management experts, enjoying the user volume brought by the Morpho platform. Before this, Vaults created by individuals need to go through a long period of operation.

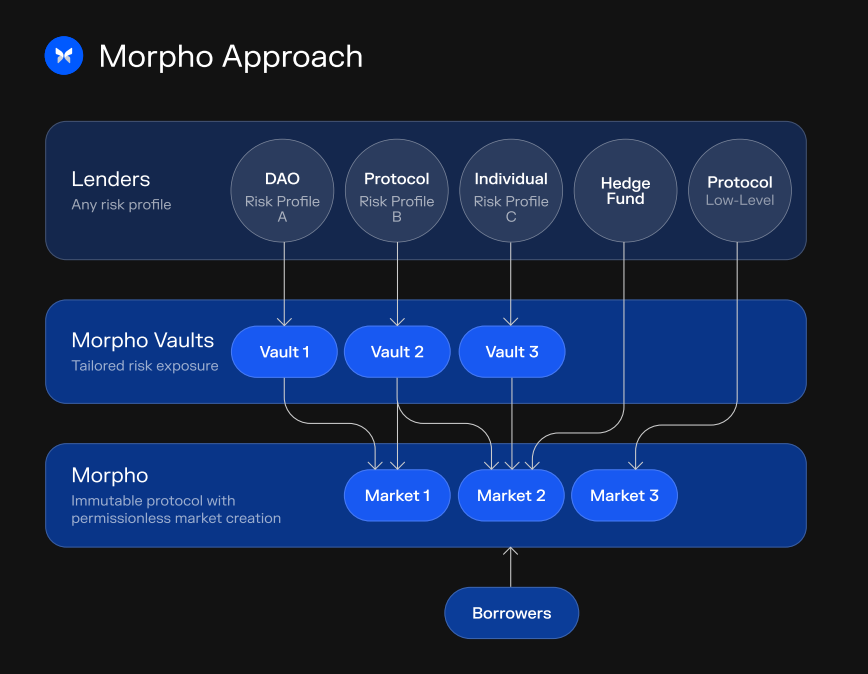

How does MorphoVault work?

Morpho Vault is a lending vault system built on the Morpho protocol, designed for the management of loaned assets. Whether it is a DAO, protocol, individual investor or hedge fund, you can freely create and manage vaults on Morpho Vault. Each vault focuses on a loan asset and supports customized risk exposure, and can allocate funds to one or more Morpho markets.

Source: Morpho

This design greatly optimizes the lending process, improves the overall user experience, and effectively aggregates market liquidity. Users can not only enter independent markets and lending pools to participate in transactions, but also easily provide liquidity, thereby earning interest in a passive way.

Another notable feature is that Morpho Vault provides a highly flexible risk management and fee structure. Each vault can flexibly adjust the risk exposure and performance fee settings according to needs. For example, a vault focusing on LST assets will only involve relevant risk exposure, while a vault specializing in RWA assets will focus on this type of assets. This customized function allows users to choose the most suitable vault for investment based on their personal risk tolerance and investment goals.

Morpho has passed the token transfer proposal since late November. For the current model that relies on subsidizing Morpho tokens to attract users, the tradable Morpho tokens can attract more users to participate. And since the launch of Base in June, various data have continued to rise, making it a popular DeFi protocol in the Base ecosystem. Due to the potential staking possibility of ETH ETF, the discussion of RWA is also increasing. Morpho has launched the first Coinbase-certified RWA vault deployed on the Base chain. The two vaults curated by SteakhouseFi and Re7Capital will support a variety of RWA collateral options, putting Morpho in a very special position in the Base ecosystem.

Looking back at the development history of Morpho, what other lending protocols can learn from may be the effort Morpho has put into building its own reputation, starting with the initial Morpho optimizer, using Aave and Compound as capital buffers, and relying on the historical security assumptions of the two to quickly build its own brand; when the time was right to develop its own ecosystem and become an independent protocol, Morpho opened up the lending dimension to third parties, greatly reducing the risks it might face, and developing the ecosystem in a low-cost way to create native applications in its own ecosystem. Morpho clearly recognizes that for lending protocols, a history of smooth operation is crucial to building a security brand, and this is also the foundation of Morpho.