Author: TechFlow

If there are newcomers entering the industry, airdrop will most likely be their first stop.

From pure wool-pulling to complex game between project parties and users, airdrops have gradually made people love and hate them.

For users, they love it because successful airdrops bring huge rewards, but hate it because of the complicated rules, cumbersome tasks and even opaque distribution mechanism;

For the project, airdrops can still bring short-term traffic and attention, but the practice of inflating traffic and the decline in community trust also give them headaches.

People change.

After experiencing multiple rounds of bull and bear cycles, crypto market users still expect a "free lunch", but their behavior has become more rational. Project owners have gradually realized that simple airdrops can no longer meet the needs of community building, and have turned to more complex and transparent distribution mechanisms.

For example, Hyperliquid’s airdrop was highly regarded for rewarding early users, while Redstone’s airdrop sparked strong community opposition due to the temporary change in the distribution ratio.

It’s 2025 now. Can airdrops still play their role?

Recently, Binance Research released a report titled "Where Are Our Airdrops Going?", which provides us with an in-depth perspective. By analyzing the current situation, problems and improvement directions of airdrops, we may be able to find better solutions for project owners and users.

TechFlow has organized and summarized the core content of the report, and the core points are as follows.

Key Takeaways

- Although the airdrop model still has many shortcomings, its position in the industry cannot be ignored.

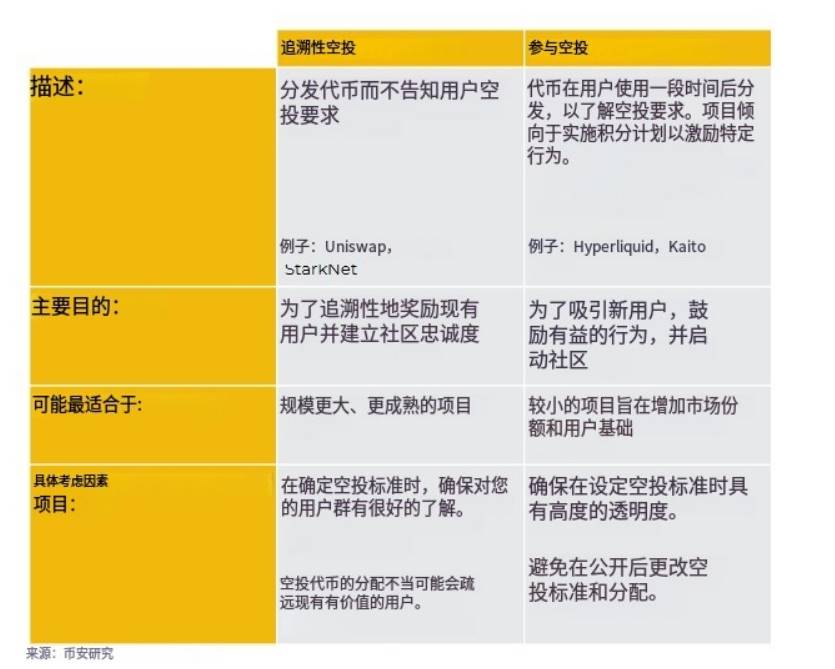

- There are two popular airdrop categories:

- Retroactive Airdrops: Mainly reward existing users, distribute tokens based on their historical behavior, aiming to enhance community loyalty.

- Engagement Airdrops: Attract new users and increase project exposure by notifying users in advance and setting up task incentives. It is more suitable for early-stage projects to seize market share and build an initial user base.

- Points for improvement:

- Clear allocation rules and criteria can help reduce user dissatisfaction and misunderstandings.

- Project owners need to listen more to the voice of the community.

- Avoid excessive allocation of resources to internal teams or large customers to avoid damaging the interests of ordinary users.

- The introduction of on-chain monitoring tools and “human identity verification” technology is expected to reduce the practice of airdrop fraud and make airdrops more fair and efficient.

Through these core points, the report provides us with a clear framework to help us understand the current status of airdrops and possible future development directions.

From simple distribution to complex game

Counting from the first airdrop event in 2014, airdrops have a 10-year history in the industry.

The first notable airdrop was Auroracoin in 2014, which aimed to promote the national cryptocurrency to Icelandic residents. At that time, users only needed to enter their permanent resident ID card on the Auroracoin website to receive tokens.

More recently, Hyperliquid’s HYPE airdrop (November 2024) was perhaps one of the largest and best reviewed airdrops to date, further solidifying airdrops as a powerful user engagement tool. At a peak valuation of over $10 billion, the HYPE token airdrop surpassed Uniswap as the largest airdrop by peak price.

However, in order to cope with the increase in witch attacks, the project team has also increased the complexity of the requirements for obtaining airdrop qualifications.

Unlike early airdrops, today’s airdrops often require users to complete multiple tasks, such as using a testnet, participating in social media activities, participating in governance, downloading a mobile app, and transferring funds across chains. These required actions often also directly benefit the project, such as increasing on-chain revenue/activity or boosting social media exposure.

The current airdrop can be divided into the following two parts.

Type 1: Retroactive Airdrops

Some of the earlier airdrops, such as those from Auroracoin, Uniswap, and StarkNet, did not disclose any relevant information to the public before allocating the airdrop; the purpose was to reward existing community users and enhance their loyalty.

Features:

- More user-centric

- Typically performed by protocols that already have a large user base and market share.

- There is no need for an airdrop to launch the initial user base.

Applicable scenarios: Mature protocols that are used to give back to existing users and consolidate community relationships.

Type 2: Engagement Airdrops

Incentivize users to participate in specific activities by notifying them of upcoming token generation events.

Features:

- More project-centric.

- Mainly used to attract new users and help projects gain initial market share.

- User behavior is often incentivized through points programs and other forms.

Typical examples: Redstone, Kaito and Hyperliquid.

Applicable scenarios:

Emerging projects need to stay competitive through airdrops and competing protocols (which may also use token incentives).

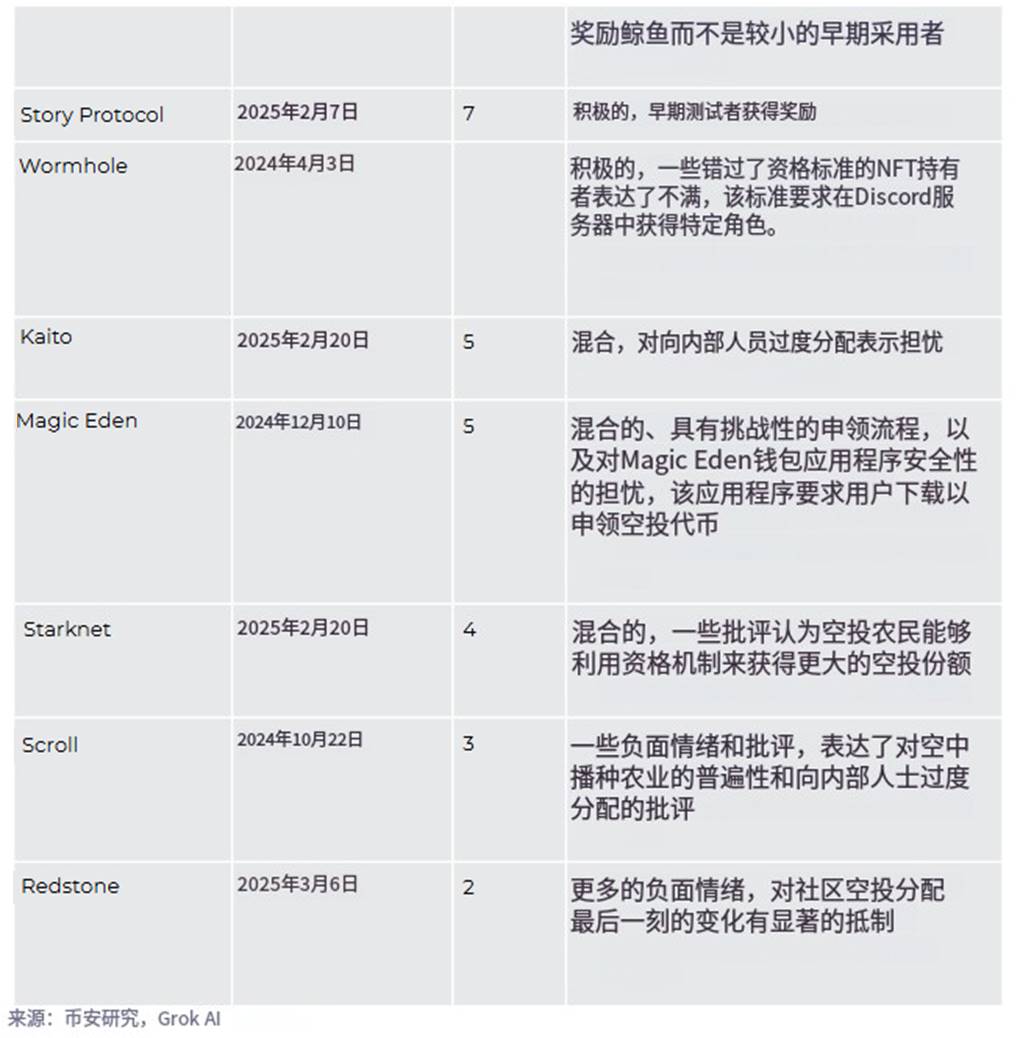

Sentiment analysis of token airdrops in the last year

To better understand the recent development of airdrops, this report also used Grok AI to conduct a brief sentiment analysis and score some notable airdrops in the past year.

Sources for sentiment analysis: Posts on X, including but not limited to community feedback, including the ratio of positive to negative comments, interaction levels, and specific criticism or praise content.

Grok also reviewed official announcements, tokenomics, and airdrop eligibility criteria in network articles. Sentiment was categorized as positive, negative, or mixed based on the dominance of the reaction.

The following is the original table in the report. We used AI to translate it, so some of the text may be ambiguous; but the scoring values in the original table reflect the community’s different views on different airdrops, and the higher the score, the more positive it is.

Experience and lessons learned from past airdrops

Last minute reduction in allocation

Some crypto projects initially promised to allocate a certain percentage of tokens to the community, but later reduced this percentage and redistributed the tokens to insiders or project treasuries. Recently, the Redstone airdrop caused strong opposition from the community because the team cut the community allocation from 9.5% to 5% before the token distribution date. Many community members believed that this action was unfair.

Lessons Learned

- Clarify the token distribution ratio in advance: Clearly communicate the token distribution plan before the Token Generation Event (TGE).

- Avoid last-minute changes: Try not to make last-minute adjustments to your assignments.

- Consult with stakeholders when necessary: If the distribution ratio does need to be changed, avoid making unilateral decisions. Discussions should be held with key stakeholders (e.g., investors, communities, exchanges) to ensure adequate communication.

Opaque eligibility criteria and mismatched expectations

Some projects have communicated unclear criteria for airdrop eligibility, resulting in uneven rewards distribution that does not accurately reflect users’ actual activity. Scroll’s October 2024 airdrop, which distributed 7% of its total SCR token supply, or 70 million tokens, was criticized for its arbitrary snapshot mechanism and hidden rules.

Lessons Learned

- Clearly communicate allocation rules: Make sure the rules are transparent to avoid excessive guesswork by users, which often leads to mismatches between expectations and reality.

- Preventing Sybil Attacks: Consider using on-chain monitoring tools or “Proof-of-Humanity” tools to reduce abuse.

Internal staff and KOLs account for too much of the allocation

Many projects allocate a larger percentage of tokens to the team, investors, and venture capital institutions (VC), leaving a smaller percentage for the community. For example, KAITO allocated 43.3% of tokens to the team and investors in its February 2025 airdrop, leaving only 10% to the community, which sparked public debate on the X platform.

Some projects will allocate a large number of tokens to influencers, who may choose to sell immediately, thereby diluting the value of the tokens and harming the interests of real users. KAITO has also reportedly caused controversy for allocating a large number of tokens to influencers, who sold the tokens shortly after the token generation event (TGE), affecting the token price and eroding the trust of the community.

Lessons Learned

- The allocation ratio should be cautious: learn from the token allocation results of projects of similar scale or nature, and pay attention to the market's reaction to the allocation plan.

- Implement vesting periods and lock-ups: Implementing vesting periods and token lockups for insiders and influencers can reduce the initial selling pressure after the TGE and better align their interests with the long-term goals of the project.

Technical barriers in the collection process

A complex or buggy claiming process will discourage users from claiming tokens, effectively reducing payout amounts and largely defeating the intended purpose of the airdrop claiming process.

For example, Magic Eden’s airdrop in December 2024 attempted to promote its mobile wallet application through airdrops, but feedback on bugs and unclear instructions on the X platform reportedly seemed to lead to user frustration rather than anticipation.

Lessons Learned

- Airdrop collection is an important first touchpoint for many potential users. Make sure the process is smooth and convenient to increase the likelihood of user retention.

How can airdrops get better?

Increase transparency

- Set clear goals: Project teams need to set clear goals for airdrops or token incentive programs and ensure that these goals are aligned with the project’s long-term vision.

- Clearly communicate goals: Align the community's actions with the project's goals and vision through clear communication, reducing resentment caused by inconsistent allocation of behavioral weights.

Enhance community participation

- Community is the core competitiveness of the project: Technology and products can be iterated quickly, but community building takes time and patience. The long-term success of the project depends on a solid and loyal community.

- Balance between transparency and participation: Transparency is the foundation, but transparency alone is not enough. The project team needs to allow the community to participate more deeply in project development through interaction and feedback mechanisms to enhance a sense of belonging and loyalty.

- Challenges brought by user liquidity: The open crypto industry reduces users' switching costs, so projects must retain users through stronger community stickiness and sense of belonging.

Increase monitoring mechanisms

Some projects (such as LayerZero) have partnered with on-chain analysis companies (such as Nansen) to identify and cancel the airdrop qualifications of "Sybil Attack" perpetrators by analyzing on-chain data.

As technology advances, on-chain monitoring tools will become more sophisticated and widely used, making it easier for project teams to detect and troubleshoot bad behavior.

Proof-of-Humanity tools are expected to help prevent airdrops from being abused in the future while protecting users’ anonymity and privacy. Such tools could be a key means of addressing the “gamification” of airdrops.