There's only one week left until the election.

The US election is approaching. As of the afternoon of October 27, local time, more than 41 million voters in the United States have voted in advance for the 2024 presidential election. Affected by this, the volatility of the crypto market has also intensified. Stimulated by the "election transaction", Bitcoin took the lead in starting the rally and returned to the long-lost level of $71,000 this week. Many crypto sectors have risen, and the MEME market is even more immersed in PolitiFi.

Back to the two candidates, the competition between Harris and Trump is becoming increasingly stalemate. Due to the poor handling of Hurricane Milton and the Iran-Israel conflict, Harris's support rate has dropped rapidly. Trump has successfully overtaken her. Not only has his advantage in betting odds and swing state polls continued to expand, but he is also catching up in traditional general polls. Judging from the current situation, Trump seems more likely to become the next US president, and the Trump deal is therefore imminent.

Looking back at the policy strategies of the two, the general direction is to use government subsidies as a means to promote capital repatriation, but the two methods are slightly different. Trump uses tax cuts to promote the development of private enterprises, while Harris tends to directly give money to subsidize residents. The capital repatriation is also different. Harris has inherited Biden's governing ideology and focused on key core industries such as chips and new energy; Trump still adheres to the principles of radical tariffs and America first.

Under the current situation, Trump has a higher chance of winning, and the financial market is naturally more concerned about his policy propositions. Specifically, citing CICC's view, domestic tax cuts, external tariffs, deregulation, expulsion of illegal immigrants, encouragement of fossil energy, emphasis on science and technology, and diplomatic isolationism are Trump's main governing directions. Considering the combined impact of the governing directions, Trump's coming to power may bring about an upward risk of inflation. Under this influence, the Federal Reserve may take measures to slow down the pace of interest rate cuts and regulate higher terminal interest rates. From the perspective of the capital market, if the economic resilience is maintained, a soft landing will benefit US stocks, cyclical products and Bitcoin, but in extreme cases, inflation will suppress the capital market, and anti-cyclical products such as gold will benefit.

Estimated impact of Trump’s policies on the US economy, source: CICC Research Institute

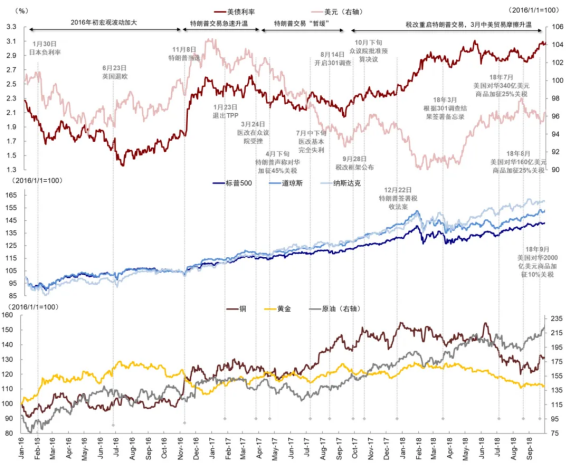

Here we can learn from the 2016 US election, when the market also triggered Trump's trade, especially after his victory in November 2016, when optimistic expectations rose sharply. The US Treasury bond interest rate rose from 1.7% to 2.6% within a month, and the US dollar index also broke through 103 from 97. From the perspective of US stocks, the three major indexes rose by 10% during this period. Looking at commodities, inflation expectations pushed copper and crude oil up sharply, while gold reversed and fell by 3% within a month after the election.

Source: Bloomberg, CICC Research

It is obvious that Trump's victory in 2016 was a black swan event, but the capital market has already priced in his victory. The most prominent variety is undoubtedly cryptocurrency. Since Trump has endorsed cryptocurrencies in public many times before and recently launched a family crypto project, the crypto market has high hopes for it.

According to the crypto prediction market Polymarket, the amount of bets has exceeded $2.1 billion, and Trump's chance of winning has reached 66.2%, far exceeding Harris by 33 percentage points, and the gap is still widening. The Bitcoin market has responded strongly to this. As the election approaches, Bitcoin continues to rise and has now reached above $71,000. Among them, expectations are undoubtedly one of the reasons for the rise.

What will happen to Bitcoin and the crypto market before and after the election? Major institutions and analysts have also had heated discussions on this.

Traders generally believe that the election is an important trading opportunity and are betting on a rebound from the election. According to Matrixport data, the US election is igniting market sentiment, and the funding rate for Ethereum perpetual futures has hit its highest level since May 2024, highlighting the strategy of buying on dips.

Top trader Eugene Ng Ah Sio also spoke on social media, believing that the positioning has been basically clear and the upward trend has started after the election. He also emphasized that the speculative long positions in October have been basically wiped out, and the vast majority of people will avoid risks a week after the election. SOL is a clear asset choice.

Derivatives have come to a similar conclusion. Deribit CEO Luuk Strijers said derivatives traders are positioning for a bullish move in Bitcoin in the days after the U.S. election on November 5. For options expiring on November 8, open interest is worth more than $2 billion, with major strike prices of $70,000, $75,000 and $80,000, and a put/call ratio of 0.55, indicating that the number of open call options is twice the number of put options. Compared with Mark IV, Forward IV has a clear lift, especially during election week, which suggests that traders expect higher volatility. The forward implied volatility is 72.29%, which suggests that prices could move about 3.78% in the days after the presidential election. And relative to put options, demand for call options is strong, and investors are less concerned about managing downside risk.

Institutions are also more optimistic. Just half a month ago, Standard Chartered Bank, which has always been known as an outrageous bank in the market, said that Bitcoin is showing strong upward momentum and may approach the historical high of $73,800 on the day of the US election. It believes that factors driving Bitcoin's rise include the steepening of the US Treasury yield curve, the inflow of funds from spot Bitcoin ETFs, and the increase in Trump's chances of winning the election. Judging from the current Bitcoin price, Standard Chartered may be right for once.

Matthew Sigel, head of digital asset research at VanEck, also made a prediction in an interview, saying that investors are preparing for the US election. He mentioned that this election will continue a similar path to 2020. After the winner is announced, Bitcoin will start to rise after a short period of fluctuations, and Trump has a higher chance of winning. Bernstein also reiterated that if Trump wins the US election next month, the price of Bitcoin may reach an all-time high of $80,000 to $90,000.

In this regard, hedge fund manager Paul Tudor Jones said that he does not need to be limited to the presidential candidate. He believes that no matter who ascends to the presidency, the policies adopted will "all roads lead to inflation", which will further push up the prices of BTC and other commodities.

Bitfinex added a quarterly factor to the election, believing that Bitcoin will experience turbulence in the coming weeks, and that election uncertainty, the "Trump trade" narrative, and historically favorable fourth-quarter conditions will create a perfect storm for market trends. The report released by Bitfinex shows that options expiring on key dates before and after the election have higher premiums, and implied volatility is expected to reach a peak in 100-day volatility on November 8, shortly after Election Day. Looking at the fourth quarters of previous years, the fourth quarters of halving years all ended with gains, with a median quarterly return of 31.34%, which may push Bitcoin to or even exceed historical highs after the election.

Of course, although most institutions and traders are optimistic, some analysts believe that betting on short-term fluctuations is short-sighted. Jean Boivin of BlackRock Investment Institute mentioned that the market underestimated the risk that some of the US presidential candidates would object to the election results next month, and a controversial election victory would usually lead to weeks of legal battles, which would also affect risky assets.

Copper analysts directly pointed out that the market may be at a temporary top before the US election because according to Bitcoin chain data, 98% of short-term holders' wallet addresses are now in profit. Historically, when this ratio rises sharply, investors want to lock in profits, so there tends to be rapid selling pressure.

Looking at the entire crypto market, it can be seen that market sentiment has not changed, but the macro factors affecting the performance of cryptocurrencies are shifting from monetary policy to the results of the US election. The crypto market prefers Trump, who is showing goodwill, and Trump's policy propositions will also push up Bitcoin and U.S. stocks that are highly correlated to it to a certain extent. Therefore, many analysts predict that Bitcoin is expected to break new highs in this trading cycle.

Even if we exclude the crypto space, in other financial sectors, the market has also revealed similar signals since the probability of Trump's victory increased in September. Given Trump's more aggressive tariff policy, he has claimed that he may impose an indiscriminate 10% base tariff on all goods entering the United States and impose 60% or higher tariffs on China. The exchange rates of the RMB, Mexico and Vietnam have weakened recently. In the traditional energy sector supported by Trump, according to data from CICC Research Department, as of October 24, since September 26, oil and gas energy has risen by 5.8%, while the clean energy index has fallen by 9.4%. In terms of social media, since September 23, Trump Media Technology Group (DJT) has risen by an astonishing 289.79%, and the trend of betting is obvious.

Of course, at present, it only reflects the market's pre-election transactions. Expectations are an important part of the current situation, but this means that expectations have also been taken into consideration, and there is a high probability that there will be a short-term decline after the expectations are realized. On the other hand, even if Trump comes to power, his policies must take into account the House of Representatives, which dominates fiscal and taxation policies, otherwise he will face constraints on his policies after taking office, just like Biden. However, according to the latest poll by the senior political observation website 538 (fivethirtyeight), Trump's chances of winning this year's presidential election have risen to 53%, while the Republican Party has an 87% chance of taking the majority of seats in the Senate from the Democratic Party, and the Republican Party has a 53% chance of continuing to hold the majority of seats in the House of Representatives, and the probability of the Republican Party winning a full victory has increased. In this sense, whether from the White House or Congress, the current competitive pressure on the Democratic Party has reached its peak.

In any case, the sharp fluctuations before and after the US election are inevitable, and any group betting on trading opportunities should remain vigilant. For the election, the winner will never be determined until the end, and even after the voting is completed, the judgment on the validity of the results will not stop.

The most active cryptocurrencies in the market during this period may only be Bitcoin and MEME.