BenFen is an ecosystem based on stablecoins, consisting of the high-performance underlying public chain BenFen chain (underlying infrastructure), native stablecoin BUSD, BenPay, BenPay DEX, merchant services, etc. As various countries introduce stablecoin regulatory policies, we believe that the external environment for scenarios such as cross-border payments based on stablecoins is gradually maturing, and may partially replace the traditional payment system. BenFen is positioned as the Web3 version of the Swift system, focusing on stablecoin application scenarios, and reshaping the future of cross-border payments by building its own high-performance public chain.

TLDR

- The cross-border payment system based on the interbank communication network has a long settlement time and high costs. The payment system based on blockchain can solve this problem.

- BenFen Chain is the world's first stablecoin payment public chain, positioned as the Web3 version of the Swift system, designed for stablecoin payment and other scenarios

- High security, high throughput & low gas fee: BenFen chain adopts Move programming language and DAG-based enhanced consensus to achieve a throughput of tens of thousands of transactions, a latency of less than 0.5 seconds, and a gas fee of less than 0.1 cents, ranking first among all public chains.

- Innovative stablecoin issuance and stabilization mechanism: BenFen permanently places 50% of the governance token BFC in the treasury to issue the native stablecoin BUSD. At the same time, it designs a variety of stabilization mechanisms such as flexible currency supply mechanism and exchange rate regression mechanism to ensure price stability.

- BenPay: A super application that integrates deposits and withdrawals, exchange, pledge lending, offline consumption, and on-chain red envelope transfers. Compared with Ethereum and Solana, which regard governance tokens ETH and SOL as first citizens, BenFen regards BUSD as the first citizen in the ecosystem, which is used for various scenarios such as gas fee payment and on-chain staking.

- Smooth user experience: Supports zkLogin login, users can choose Google/Apple account to log in directly without complicated mnemonics

- High-value governance token BFC: The governance token BFC essentially captures the value of the entire BenFen ecosystem, including the BenFen chain, multiple stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, and merchant services. From a valuation perspective, the value of the governance token BFC should be the sum of the values of all these projects.

- Compared with other stablecoin solutions (infrastructure + stablecoin mechanism), BenFen's high-performance underlying public chain + native stablecoin BUSD solution leads other solutions in terms of security, throughput, latency, gas fees, user experience, etc.

- BenFen is a high-potential project in the rising track, with strong competitiveness, high customer stickiness, a long track and a large space. BenFen has strong chain performance, low latency, low gas fees, valuation supported by income, and good user experience. It has built applications such as stablecoins, payments, cards, P2P, and merchant services (Merchant). The ecosystem is gradually prospering and has high investment value.

Introduction of BenFen

Using stablecoins to solve the stubborn problems in cross-border payments : high fees and long settlement cycles

According to the Society for International Interbank Financial Telecommunication (SWIFT), traditional cross-border payments take 2 to 3 working days, and require 5% to 10% of the total amount as payment fees. This model is costly and inefficient, seriously hindering the development of global finance and trade.

At the same time, since traditional cross-border payments rely on banking networks, and banks do not open operating outlets in some poor areas of the world because they are not profitable, this has led to about 2 billion people not having bank accounts, depriving these people of their legitimate rights and interests.

The payment solution based on blockchain and stablecoin can solve the above problems. This solution is usually composed of the underlying infrastructure (public chain) and the stablecoin issued on the chain. The underlying public chain is similar to the SWIFT system, and the stablecoin is similar to the US dollar in SWIFT. The combination of blockchain and stablecoin can achieve instant settlement (less than 1 second or a few seconds) and fees at the cent level. At the same time, there is no need for a bank account, which also means that it can cover the world 24/7 without blind spots.

| Comparison between traditional cross-border payments and stablecoin payments | ||

| Traditional cross-border payments ( SWIFT, etc.) | Blockchain & Stablecoin Payments ( BenFen chain and BUSD, etc.) | |

| Settlement speed | 2-3 days | Instant (less than 1 second or a few seconds) |

| Billing Model | Billed based on total payment amount | Billed by number of payments |

| cost | 5%~10% of the total payment amount | Less than 1 cent per transaction |

| Cost ( US$ 100,000 ) | USD 5,000-10,000 | Less than 1 cent (based on 1 payment) |

| condition | Bank account required | No bank account required |

| Coverage | Bank network coverage area | Global coverage without blind spots |

BenFen Chain: Web3 version of the SWIFT system, a public chain designed for stablecoin payment scenarios

The creation of a cross-border payment system first requires a secure, reliable, high-performance, and low-cost infrastructure, namely the underlying public chain. However, existing public chains have problems such as low security, high costs, or poor performance. For example, the application development language of Ethereum, Arbitrum, and Base chain is Solidity, which is less secure than the Move language. Another example is that Ethereum has a latency of more than 10 seconds and a Gas fee of more than $20.

In order to completely solve the above problems, BenFen chose to give up building applications based on existing public chains, and instead decided to develop a bottom-level public chain based on the Move language from scratch, and develop upper-level applications. BenFen has assembled a team of nearly 100 people, and after more than 2 years of unremitting development, it has achieved a transaction throughput of tens of thousands of transactions and a latency of less than 0.5s. At the same time, it has developed components such as the native stablecoin BUSD, BenPay, BenPay DEX, and BenFen Oracle. As the Web3 version of the SWIFT system, the BenFen chain promotes the development of cross-border payments and is designed for stablecoin payment scenarios!

Using the Move programming language for greater safety

The Move language was first used in Facebook's Diem project. In terms of code, many common errors can be caught during compilation due to the strict type system. At the same time, its unique resource concept ensures that resources can only be used for the intended purpose and not for other purposes, thus avoiding reentrancy attacks, resource leaks and other issues. In addition, different control permissions can be set for different groups of people, so that some unauthorized access can be prohibited.

The Move language advocates the use of immutable data structures and functional programming paradigms, which can reduce code complexity. In addition, formal verification tools are provided to perform static analysis and verification of the code, which can discover and fix potential security issues.

Move also defines a language called Move Specification Language (MSL) to ensure that programs can run correctly, reduce on-chain computing overhead and improve security. Once the program is described by MSL and its specifications are defined, the Move to Boogie compiler is used to convert these programs into Boogie, an intermediate verification language with formal semantics. Finally, an automatic theorem prover is used to verify whether the program meets the specifications.

Move language can also rely on modular design, advanced abstraction capabilities, custom data structures, flexible permission control and cross-platform compatibility, making BenFen chain flexible and meeting the development of different applications. BenFen also provides a standard library, including more than 40 common functional modules such as accounts, transfers, and transactions.

Improved consensus mechanism and multiple cost optimizations to achieve higher performance & lower gas fees

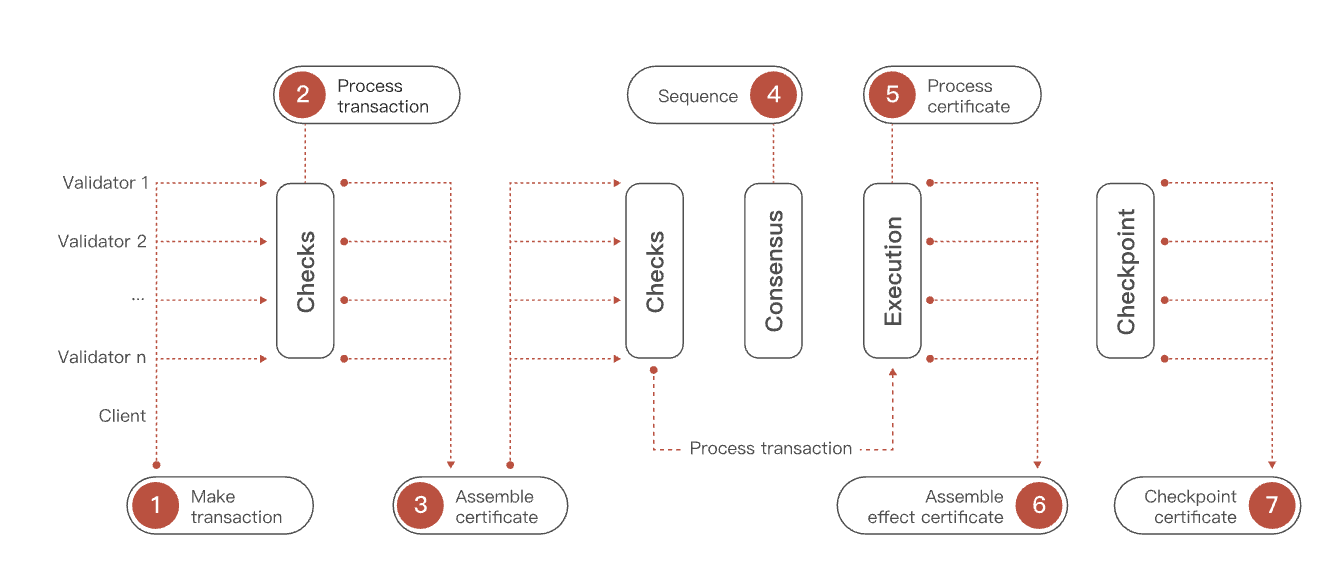

In order to achieve higher performance and lower gas fees, the BenFen chain combines DAG-based consensus with no consensus. When a user creates and signs a transaction with his private key, the transaction will be sent to each validator of the BenFen chain. After that, the validator will perform a series of validity checks and return the signed transaction to the client. After that, the client collects the replies from most validators to form a transaction certificate.

When it comes to transactions involving user-owned objects, transaction certificates can be processed directly without waiting for the consensus engine to intervene. All certificates are processed using the DAG consensus protocol and executed by the validators of this branch chain. Each consensus submission forms a checkpoint to ensure the long-term stability of the network. After the above process optimization, the BenFen chain can achieve a transaction delay of less than 0.5s and a transaction throughput of tens of thousands of transactions per second.

Source of BenFen chain flow chart: BenFen White Paper

In terms of gas fees, the Move language used by the BenFen chain can significantly reduce fees. The object-based storage type and the consensus mechanism used can also reduce gas fees. Generally speaking, gas fees are composed of computing fees and storage fees. The storage mechanism of this sub-chain provides storage fee refunds when a transaction deletes previously stored objects. In addition to supporting BFC to pay gas fees, this sub-chain also supports BUSD and BJPY to pay gas fees. After the above optimization process, the gas fee of this sub-chain will be less than 1 cent.

No mnemonics required: supports zk -Login , users can log in via Google/Apple accounts

Traditional users often need to record mnemonics when entering Web3, and this cumbersome process hinders user adoption. BenFen chain supports zk-Login, and users can log in with one click through Google/Apple accounts without mnemonics, which greatly reduces the threshold for Web2 users.

zk-Login allows users to use a third-party OAuth login method to generate a primary address, and the OAuth provider cannot obtain the user's temporary private key.

zk-Login login interface Source: Official website

Native stablecoin that supports gas fee payment and on-chain staking

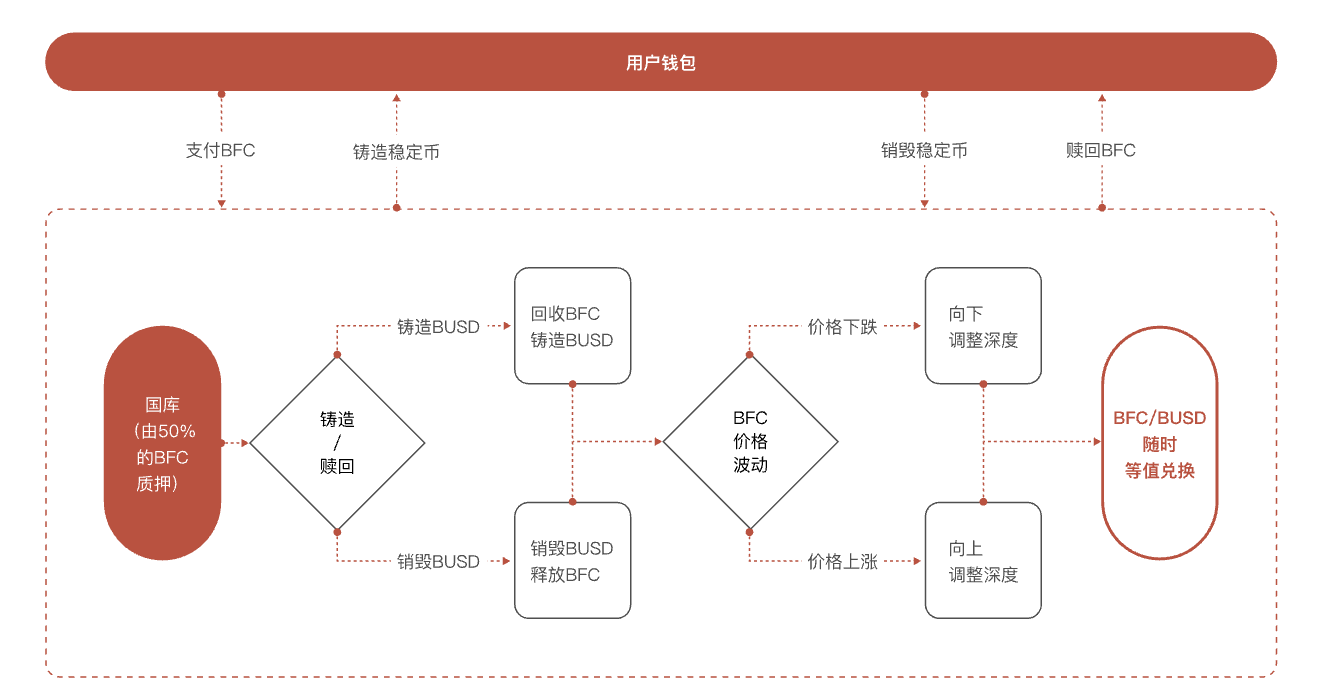

Benpay will launch a variety of stablecoins, among which BUSD will be issued by staking 50% of the BFC in the treasury, achieving flexible supply through BenPay DEX, and ensuring the relative stability of the exchange rate through a dynamic liquidity mechanism.

When minting BUSD, BenPay DEX will recycle BFC; when destroying BUSD, BenPay DEX will release BFC. In this process, the price of BFC will inevitably fluctuate. When the price falls, the system adjusts the depth downward; when the price rises, the system adjusts the depth downward. In terms of user experience, users pay BFC to obtain stablecoins; when users redeem BFC, the system destroys stablecoins.

BUSD minting and redemption process Source: BenFen White Paper

In terms of the degree of deep regulation, if the trading volume of BUSD increases, the system will automatically increase liquidity to reduce trading friction. Conversely, if the trading volume decreases, the system will reduce liquidity.

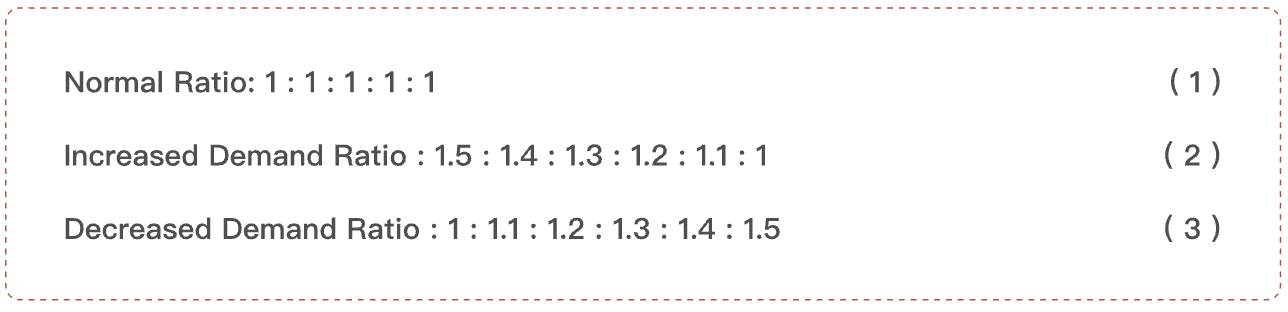

By dynamically managing the liquidity of Benfen, the Benfen Stablecoin Protocol can guide the price trend to a certain extent. For example, when the price rises, the system can provide more liquidity to suppress the rise. On the contrary, when the price falls, the system will reduce liquidity to prevent excessive decline. The specific liquidity adjustment ratio is shown in the figure below.

Liquidity Adjustment Ratio

For other stablecoins, Benfen issues stablecoins of other currencies based on the native exchange rate oracle. Take BJPY as an example. Users obtain it through BFC casting or cross-chain exchange, and then cast BJPY according to the price of the exchange rate oracle. When the user does not need BJPY, the user redeems BUSD at the current oracle price through the redemption process. At this time, the liquidity of BJPY in the market decreases.

BenPay : A super application integrating deposit and withdrawal, exchange, pledge lending, offline consumption, and red envelope transfer

BenPay is the core application of the BenFen ecosystem, with payment as the core scenario. In order to facilitate user adoption, BenFen has developed a one-stop service. Users can use BenPay P2P services to deposit and withdraw funds, use BenPay DEX to exchange other tokens, and use BenPay Card for consumption and payment. Among them, BenPay DEX obtains prices through oracles to realize spot and perpetual contract transactions. For merchants, BenPay has also developed an encrypted payment channel BenPay Merchant to help merchants realize payment collection and refund.

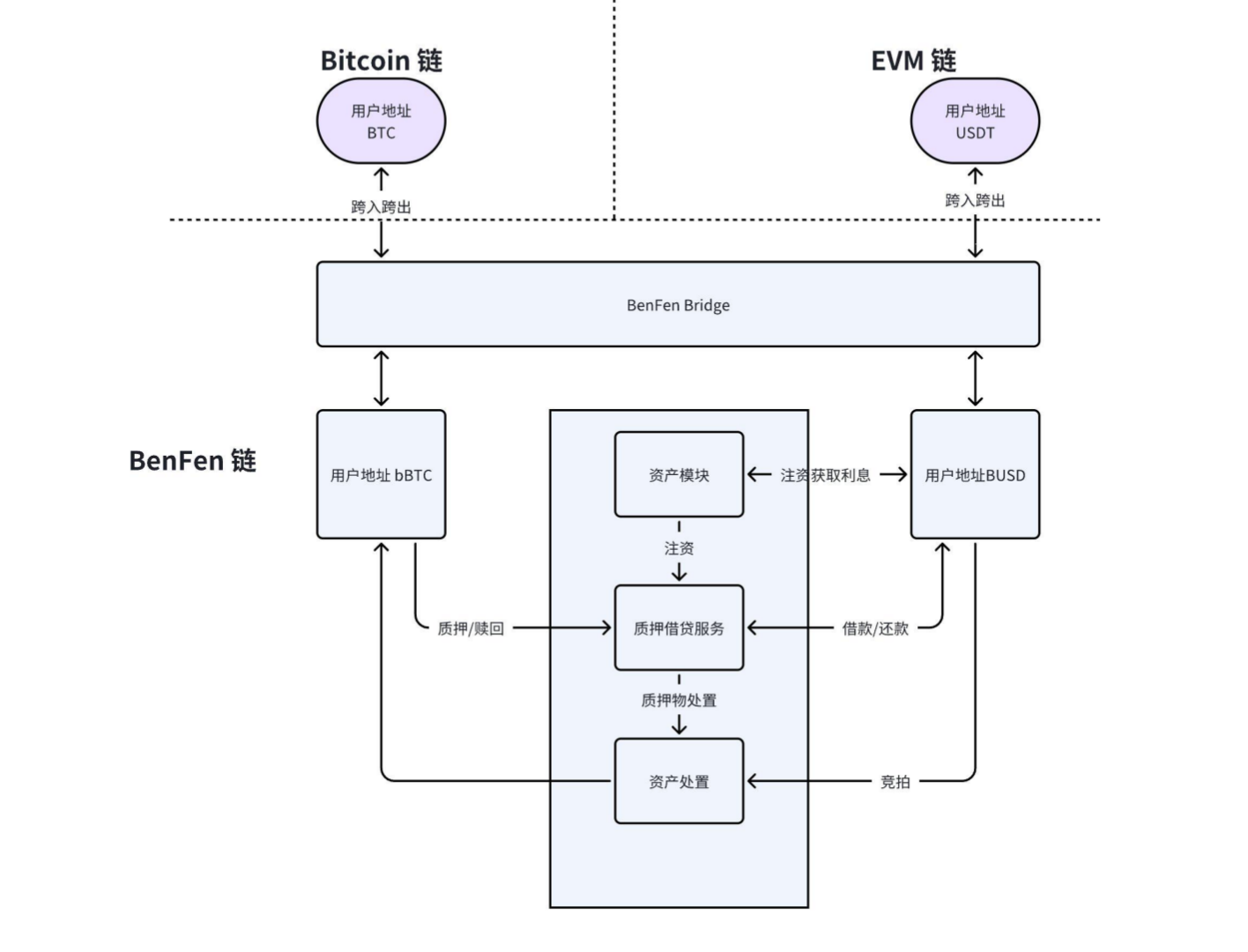

During the bull market, many users do not want to sell their BTC, but want to have liquidity. At this time, users can use the pledge lending function in BenPay to pledge BTC to borrow USDT. Users can obtain bBTC on the BenFen chain, then pledge on the BenFen chain, borrow BUSD, and then convert BUSD into USDT through the BenFen Bridge and cross out to the user's address on the EVM chain.

Schematic diagram of BenPay’s pledge lending function

BenPay has also developed a transfer function between users, similar to the transfer and red envelope functions between users in WeChat. When sending red envelopes, users can choose ordinary red envelopes, lucky red envelopes, etc. The user who sends the red envelope designs the red envelope password and then pays the gas fee to send red envelopes to other users.

BenPay red envelope diagram

High-value governance token BFC fully captures the value of the entire ecosystem

From a valuation perspective, the value of the chain is the discounted sum of the gas fees received in the future, and the value of DEX is the discounted sum of the transaction fees it will receive in the future. The same is true for stablecoins, payments and other projects.

Compared to other chains’ governance tokens that only capture the value of the chain, BenFen’s governance token BFC captures the value of the entire BenFen ecosystem, including the chain, stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, merchant services, etc. Therefore, the value of BFC is the sum of the values of all these projects.

In addition, there are usually multiple projects with the same function on a chain. For example, in the DEX track, in addition to Uniswap, there are also Balancer, Sushi, etc. There is obvious value loss in the competition among multiple projects. Since the existing models in the market are relatively mature, such as the DEX of the CLMM model. Therefore, generally speaking, only one product with the same function is developed within the BenFen ecosystem, there is no internal competition, and it has a higher value capture efficiency.

| Comparison of Governance Token Value Capture | ||||

| BenFen | Ethereum | Solana | Uniswap | |

| Governance Tokens | BFC | ETH | SOL | UNI |

| property | Diversity (entire ecosystem) | single | single | single |

| Capture range | BenFen Chain + DEX + Stablecoin +Pay+Card and other income | Ethereum chain gas fee | Gas Fees on Solana Chain | Uniswap Transaction Fees |

| Same function Amount of projects | 1. No competition Value Concentration | Multiple, competing with each other Value Dispersion | Multiple, competing with each other Value Dispersion | / |

Diversified ecosystem: from deposits and withdrawals, asset entry, exchange to offline consumer payments

BenFen has a diversified ecosystem, including:

- BenPay DEX : A Swap application within the BenFen ecosystem that can provide transactions for multiple tokens

- BenFen Bridge : A decentralized cross-chain bridge that serves as a medium for users to transfer their assets into the BenFen system

- BenPay Card : Users can use BenPay Card to make offline purchases and pay with cryptocurrencies. Users can top up BUSD and make offline purchases. BenPay Card also supports other cryptocurrencies and multi-country fiat currencies.

- BenPay Merchant : is a crypto payment channel that enables more functions for users, such as purchasing BUSD with fiat currency, instant transfers between users, merchant payment solutions, refunds, etc.

- BenFen KYC: On-chain identity authentication and authorization system, aggregating the authentication results of major KYC providers, realizing one-click query and peer-to-peer identity authentication of multi-platform KYC

- BenFen P2P : A guaranteed trading platform that solves the problem of lack of deposit and withdrawal channels for users

Token Function and Distribution

This sub-plan will issue 1 billion tokens (BFC), of which:

- 5% (50 million BFC) for staking rewards

- 5% (50 million BFC) will be used for community incentives and the Foundation to support and reward community contributors, as well as the operation and development of the Foundation.

- 37.84% (378 million BFC) are used for node rewards, which are produced through node mining.

- 2.16% (21.59 million BFC) belongs to the development team to encourage and support the core developers and team's contribution to the continued development of the project

- 50% (500 million BFC) is used for the stablecoin treasury to maintain the price stability and liquidity of the stablecoin

Investment logic and business analysis

Scale and potential: By 2030 , the total amount of stablecoin transfers may reach 38 trillion US dollars per year

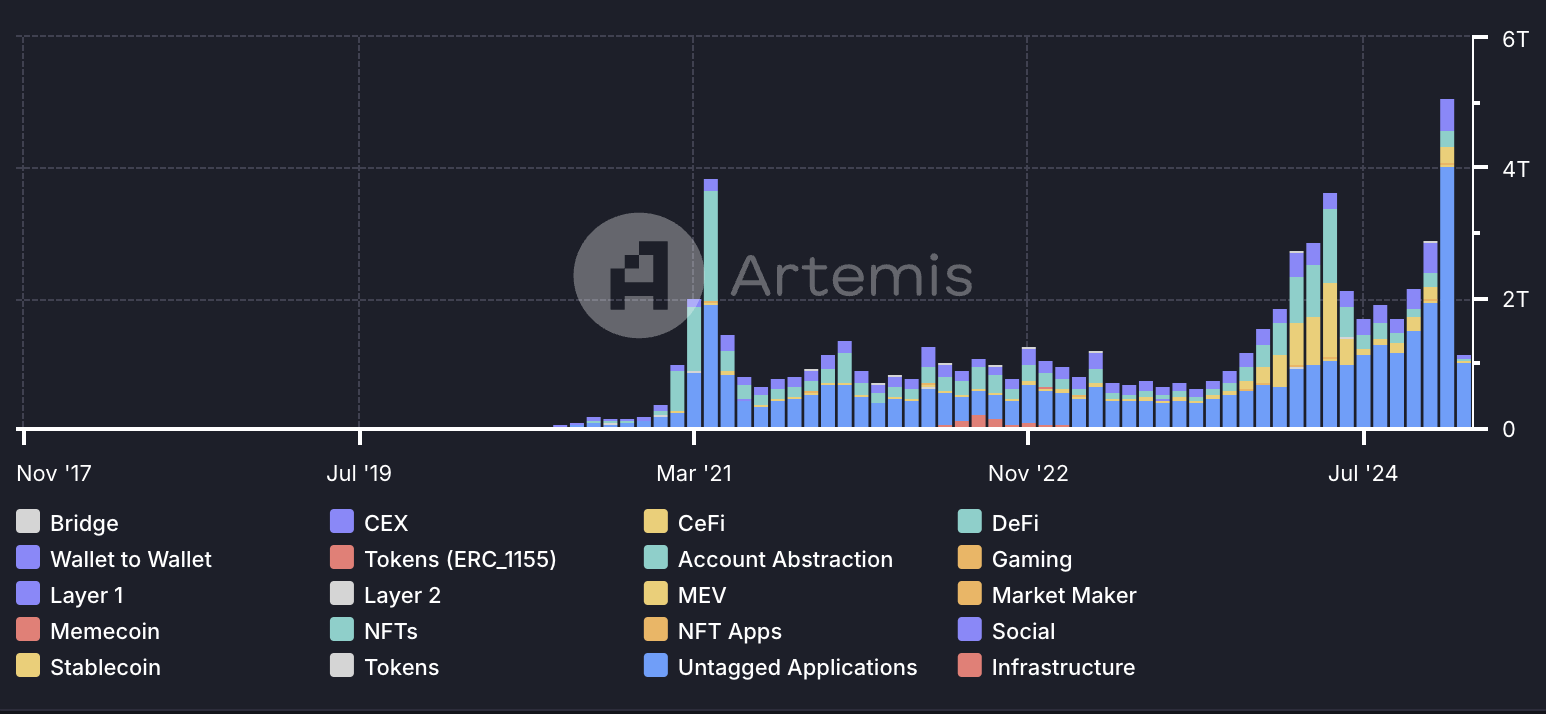

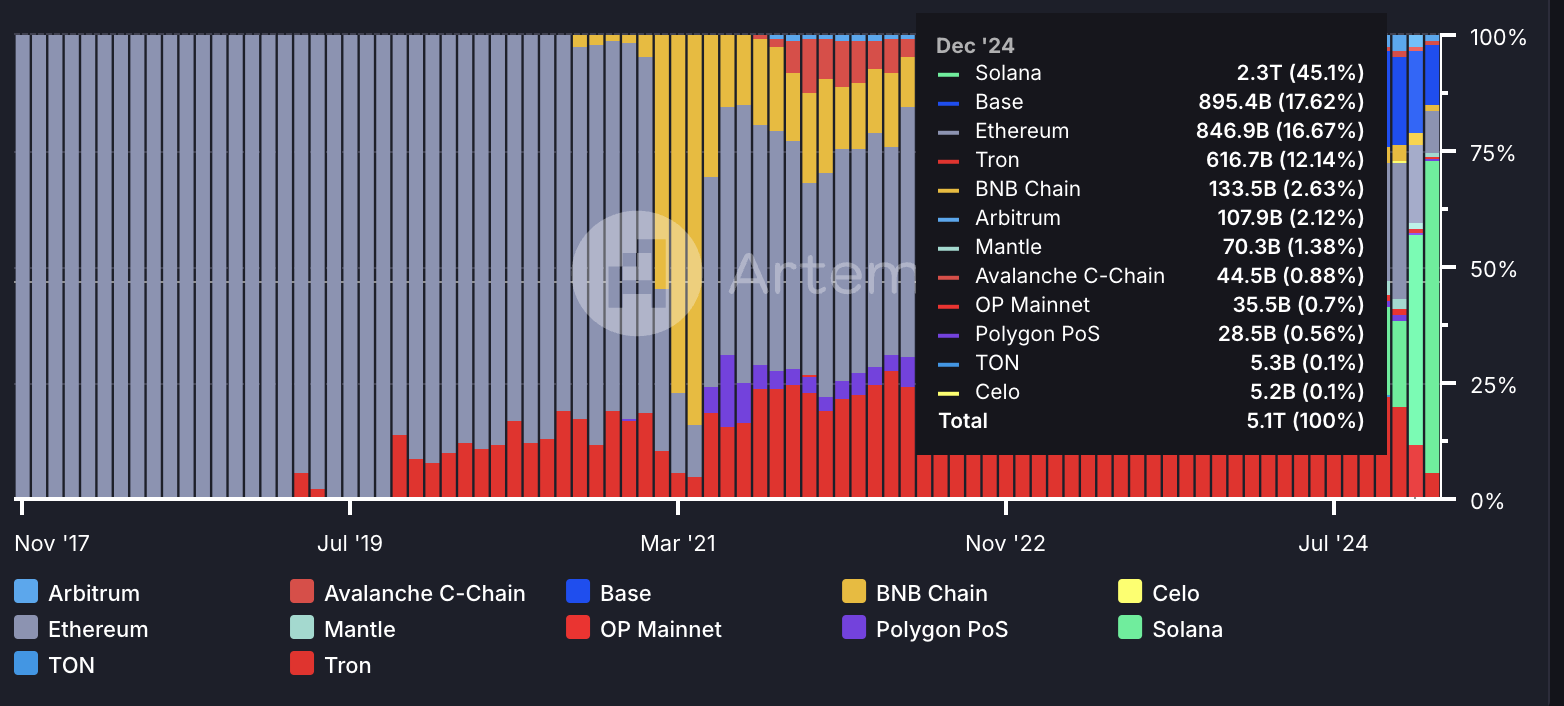

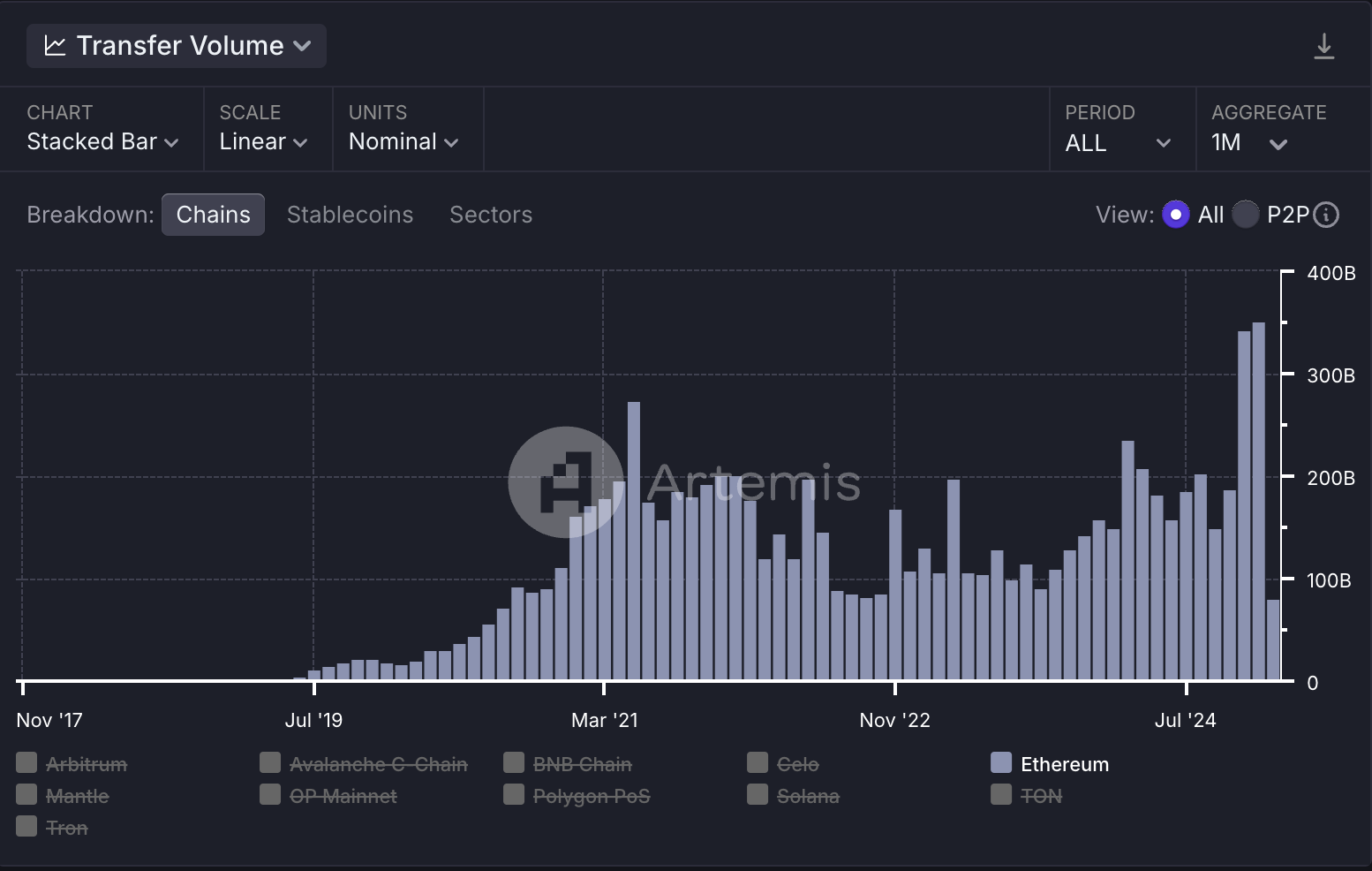

From a historical perspective, according to Artemis data, in December 2024, the monthly settlement amount of stablecoins will be US$5.1 trillion (equivalent to an average daily transaction volume of approximately US$170 billion), more than three times the 1.2 trillion in December 2023. The monthly settlement amount in December 2021 was only US$218.2 billion, an increase of more than 22 times in three years.

In addition, referring to VanEck's forecast for 2025, the global daily settlement volume of stablecoins is expected to reach a staggering $300 billion , with the main increase coming from the adoption of some technology giants and payment networks (Visa, Mastercard, etc.). The cross-border remittance market will also explode, for example, stablecoin transfers between the United States and Mexico may increase fivefold.

Monthly stablecoin settlement volume Source: Artemis

From a longer-term perspective, according to statistics from the International Fund for Agricultural Development, FXC Intelligence and Statista, the capital flow involved in cross-border commercial transactions, international commercial retail and global remittances will reach US$45 trillion in 2023, and this amount may rise to US$76 trillion by 2030. Due to the instant settlement, low cost, 7/24-hour service and transparent characteristics of stablecoins, they will partially replace existing payment methods. We assume that stablecoins will account for 10%, 20%, 30% and 50% of the total in 2030 to calculate the scale of stablecoin transfers. By 2030, the total amount of transfers based on stablecoins may reach as high as US$38 trillion.

| Estimation of the total amount of stablecoin cross-border transfers in 2030 * Cross-border transfer refers to cross-border commercial transactions, international commercial retail, global remittances, etc. | ||||

| Traditional Payments in 2030 Transfer size | Total stablecoin transfers ( 10% ) | Total stablecoin transfers (accounting for 20% ) | Total stablecoin transfers ( 30% ) | Total stablecoin transfers (accounting for 50% ) |

| $76 trillion | $7.6 trillion | $15.2 trillion | $22.8 trillion | $38 trillion |

Competition landscape: USDT and USDC dominate, Solana , Base , and Ethereum occupy the top three

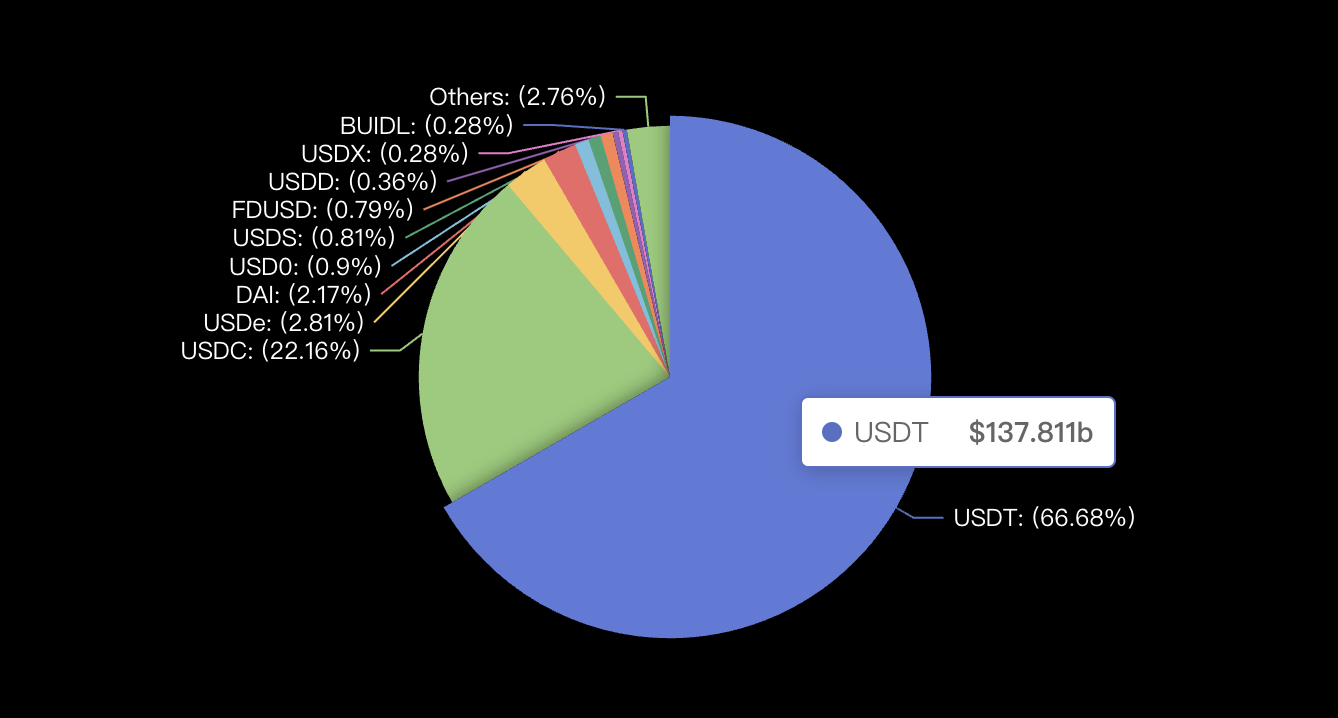

In terms of issuance scale, according to DeFillama's data, as of January 2025, USDT ranked first with US$ 137.8 billion , accounting for 66.7%; USDC ranked second with an issuance scale of US$45.8 billion, accounting for 22.16%; USDe ranked third with US$5.81 billion, accounting for 2.81%; DAI ranked fourth with a scale of US$4.48 billion, accounting for 2.17%.

Stablecoin competition landscape by issuance scale Source: DeFillama

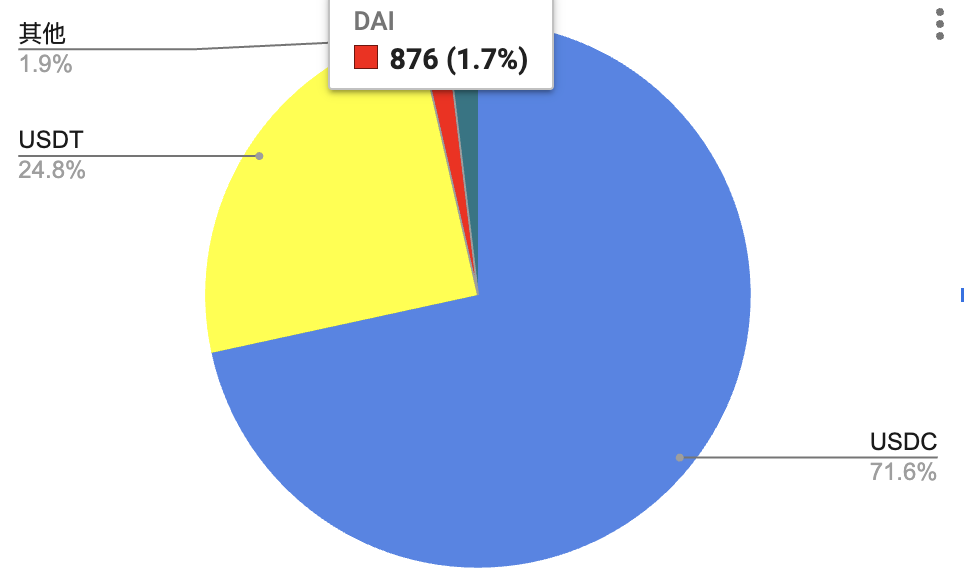

In terms of settlement volume, according to Artemis data in December 2024, USDC's monthly settlement amount was 3.6 trillion US dollars, accounting for 71.6%, ranking first; USDT ranked second with 1.3 trillion US dollars, accounting for 24.8%; DAI ranked third with a monthly settlement amount of 87.6 billion US dollars, accounting for 1.7%.

Stablecoin competition landscape by total settlement amount Source: Artemis

In terms of infrastructure, according to Artemis data, in December 2024, Solana ranked first with a monthly settlement volume of US$2.3 trillion, accounting for 45.1%; Base ranked second with US$895.4 billion, accounting for 17.62%; Ethereum ranked third with US$846.9 billion, accounting for 16.67%.

Stablecoin infrastructure (underlying public chain) competition landscape Source: Artemis

Comparison with competitors' data

Since stablecoin-based applications are closely related to the underlying infrastructure (public chain) in addition to the stablecoin itself, we have selected several stablecoin solutions with the highest settlement volume in the market as competitors of BenFen Chain and BUSD, and compared them in multiple dimensions. These competitors are Solana Chain + USDC, Base Chain + USDC, Ethereum Chain + USDT, and Tron Chain + USDT.

Infrastructure

The infrastructure of stablecoins is mainly the underlying public chain, and its own security, performance, fees and other characteristics will affect the development of stablecoin applications.

In terms of security, compared with other solutions, BenFen chain uses Move language as the application development language. Due to the properties of the language itself, its security is higher than Ethereum and Solana which use Solidity and Rust languages.

| Security comparison with other stablecoin solutions | ||||||

| BenFen Chain + BUSD | Solana Chain + USDC | Base Chain + USDC | Ethereum chain + USDT | Tron Chain + USDT | ||

| Infrastructure (chain) | Application development language | Move | Rust | Solidity | Solidity | Solidity |

| Security | High (from Move language) | generally | generally | generally | generally | |

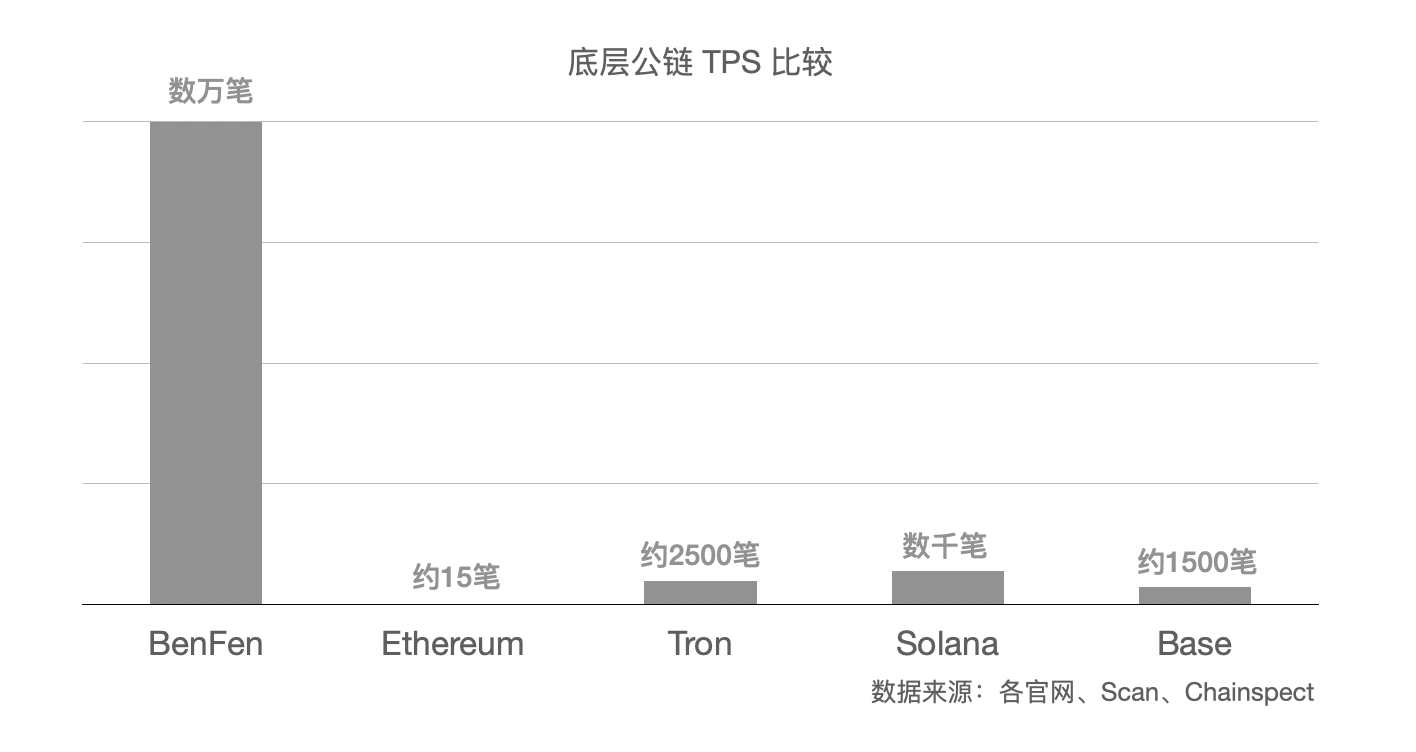

In terms of TPS, the BenFen chain has tens of thousands of transactions per second, which is higher than other chains. The higher the TPS, the greater the settlement volume that can be carried, and it can support larger-scale payment and transfer businesses.

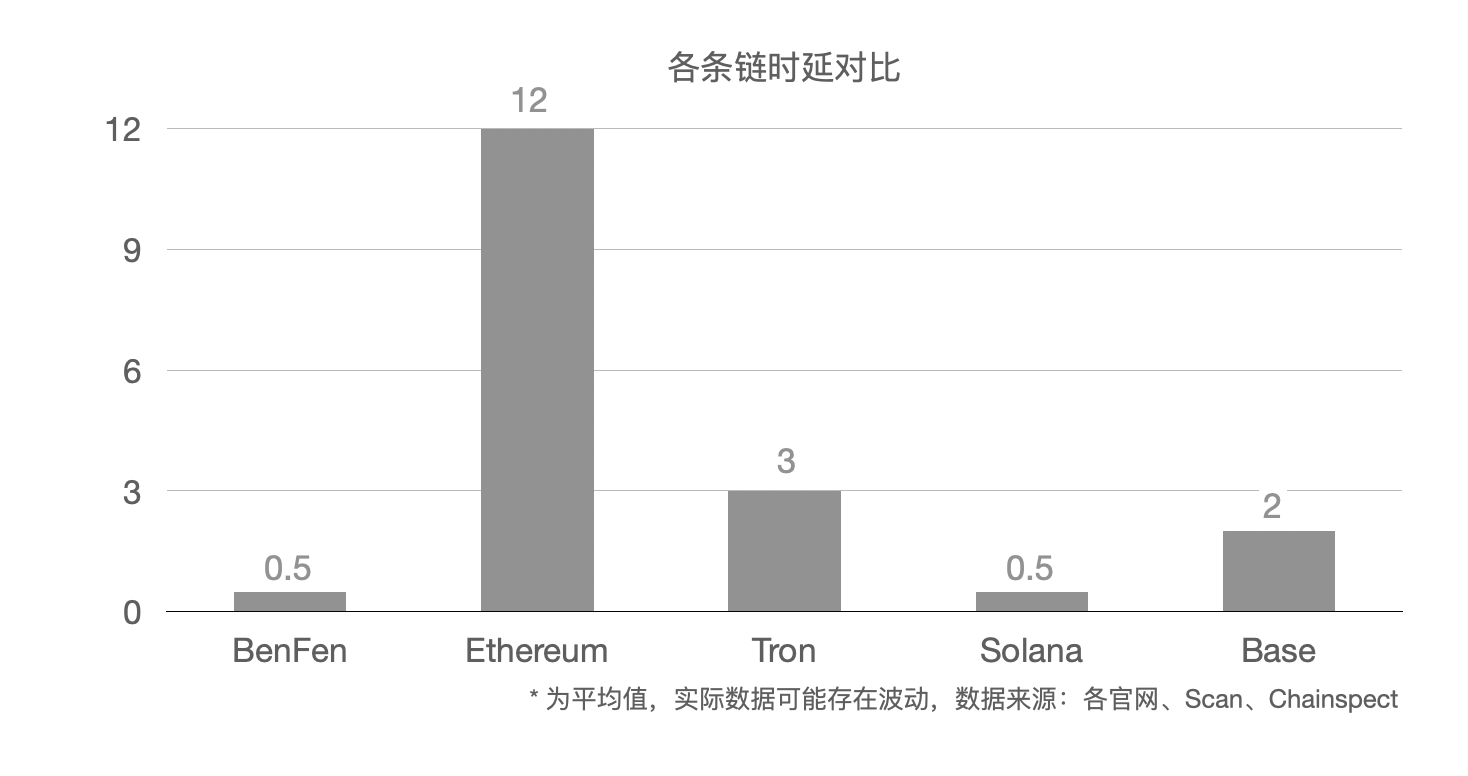

In terms of latency, the BenFen chain has a latency of 0.5s, which is in the first echelon of the industry. The lower the latency, the faster and smoother the payment experience users experience, without having to wait too long.

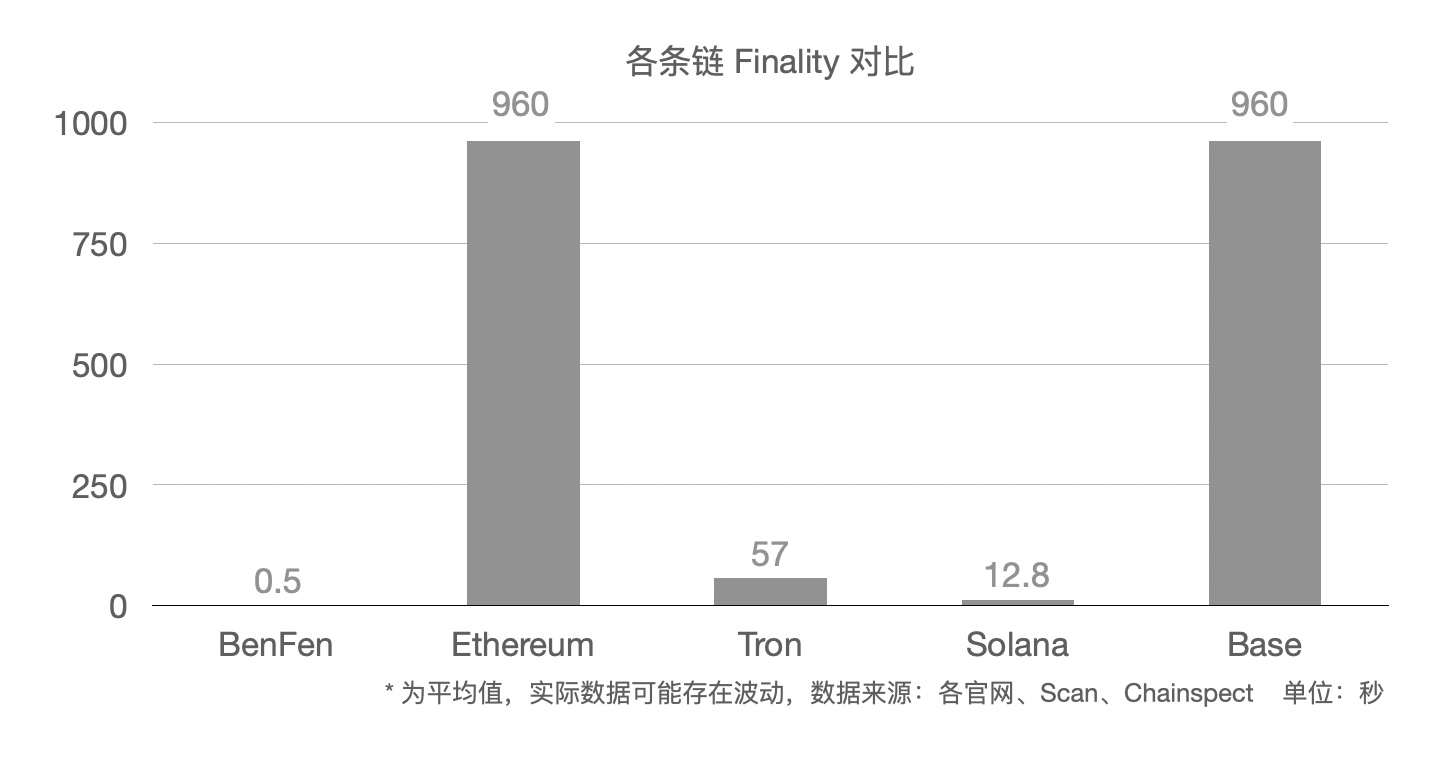

In terms of Finality, BenFen Chain is in an advantageous position because it is a single-chain structure, and Finality is almost the same as latency. Finality means the time of real record on the blockchain. The shorter the Finality, the shorter the time from transaction to account entry (on the chain), the higher its security and reliability, and the better the user experience.

In contrast, L2 such as Base needs to pass transactions to Ethereum and complete the final settlement (on-chain) through the Ethereum chain. Therefore, it is consistent with Ethereum's Finality and requires a settlement time of more than 15 minutes.

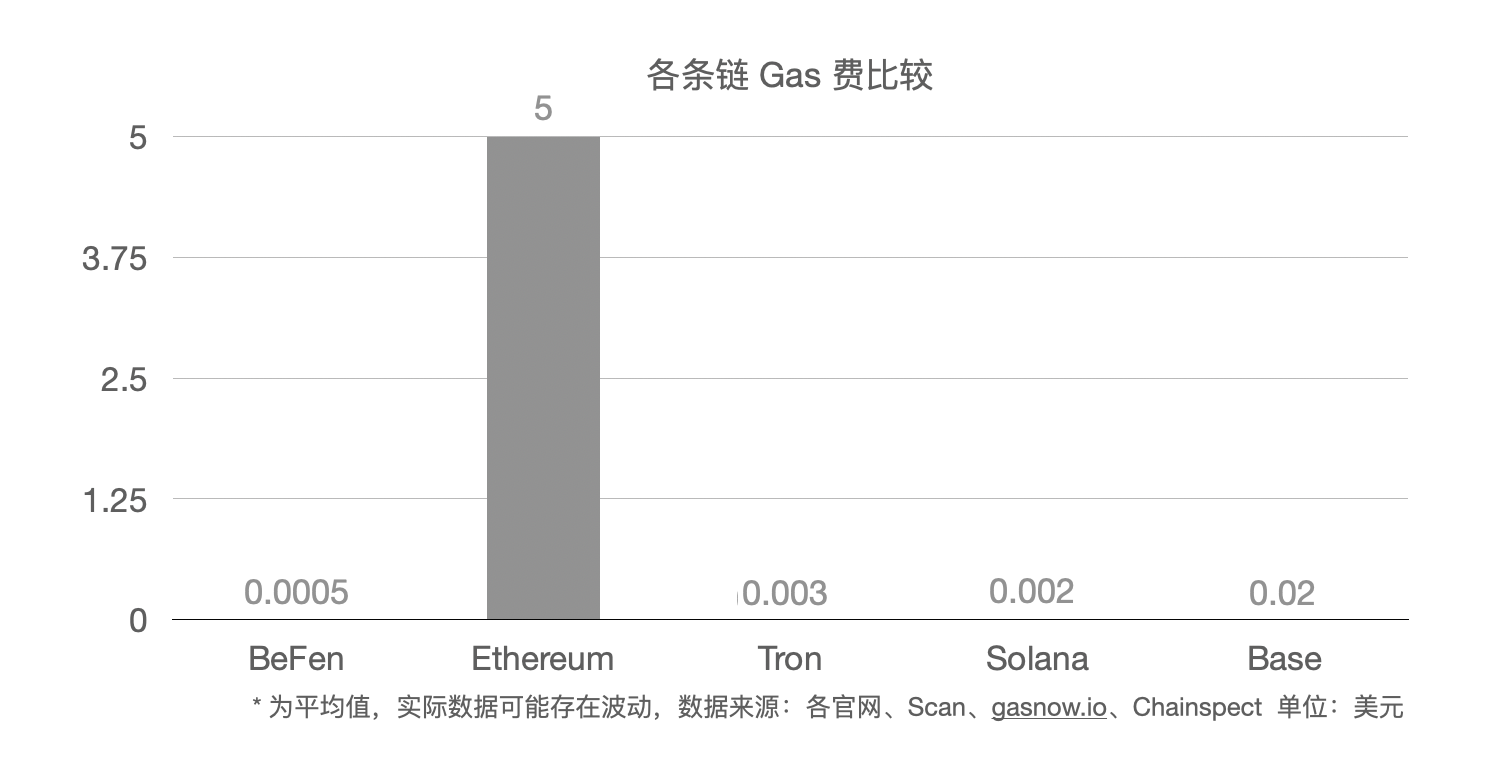

In terms of gas fees, the BenFen chain has extremely low fees. The lower the fees, the more conducive it is to be adopted in actual payment scenarios. The BenFen chain can achieve a gas fee of less than 0.1 cents per transaction, while Ethereum's gas fee is about 5 US dollars.

Stablecoin mechanism

Compared with other stablecoins that are issued with USD collateral, BenFen not only allows users to pledge their USDC to mint BUSD at a 1:1 ratio, but also provides a BFC pledge model for issuing BUSD.

In terms of anchoring mechanism, BUSD has designed a dynamic liquidity management mechanism, price guidance mechanism, gain depth adjustment mechanism, and arbitrage mechanism to achieve BUSD price stability.

| Comparison of Stablecoin Issuance & Anchoring Mechanism | ||||||

| BenFen Chain + BUSD | Solana Chain + USDC | Base Chain + USDC | Ethereum chain + USDT | Tron Chain + USDT | ||

| Stablecoins | Issuance Mechanism | BFC and USDC mortgage issuance | US dollar collateral issuance | US dollar collateral issuance | US dollar collateral issuance | US dollar collateral issuance |

| Anchoring Mechanism | Dynamic liquidity management mechanism Price guidance mechanism Gain depth adjustment mechanism Arbitrage Mechanism | Equal amount reserve Arbitrage Mechanism | Equal amount reserve Arbitrage Mechanism | Equal amount reserve Arbitrage Mechanism | Equal amount reserve Arbitrage Mechanism | |

User adoption

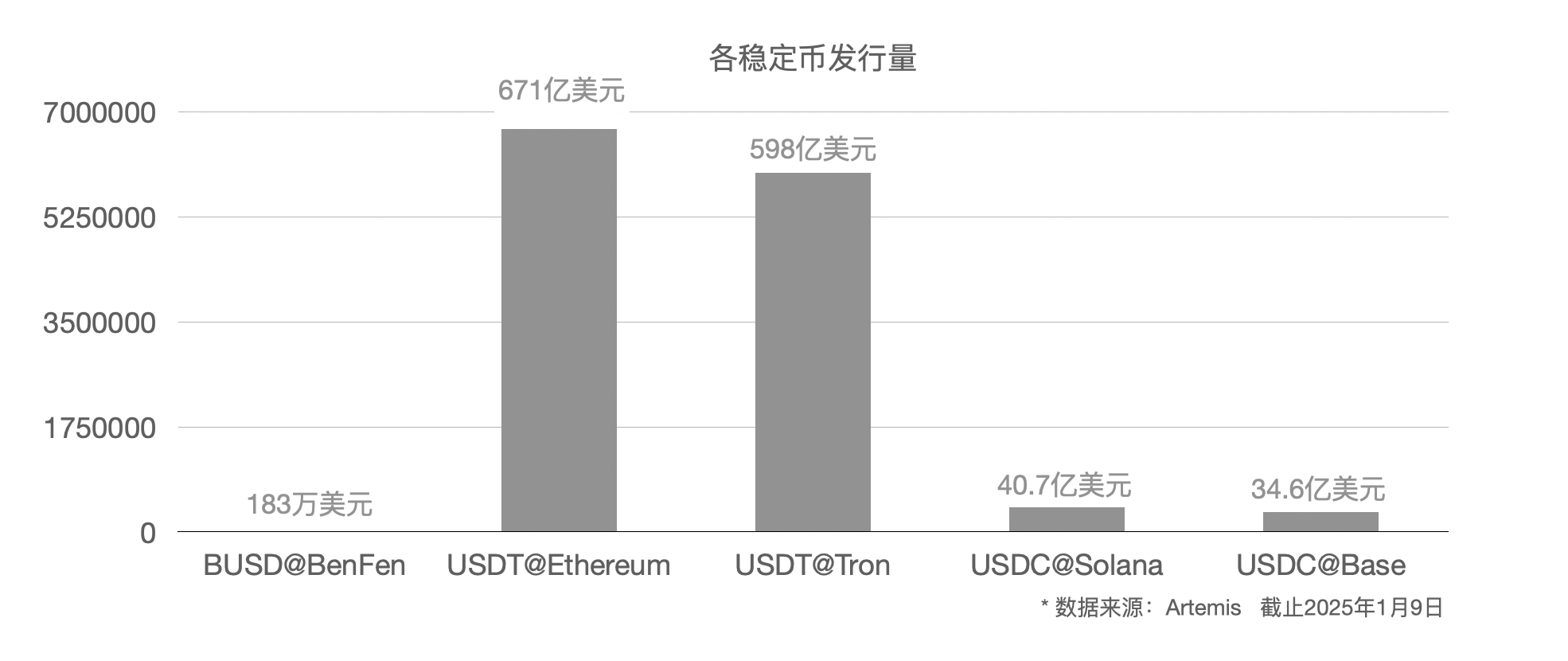

In terms of issuance volume, as BenFen was launched not long ago, the total issuance volume is 1.83 million US dollars. USDT's issuance volume on Ethereum is 67.1 billion US dollars, ranking first, and its issuance volume on Tron is 59.8 billion US dollars, ranking second. USDC's issuance volume on Solana and Base is 4.07 billion US dollars and 3.46 billion US dollars, ranking third and fourth.

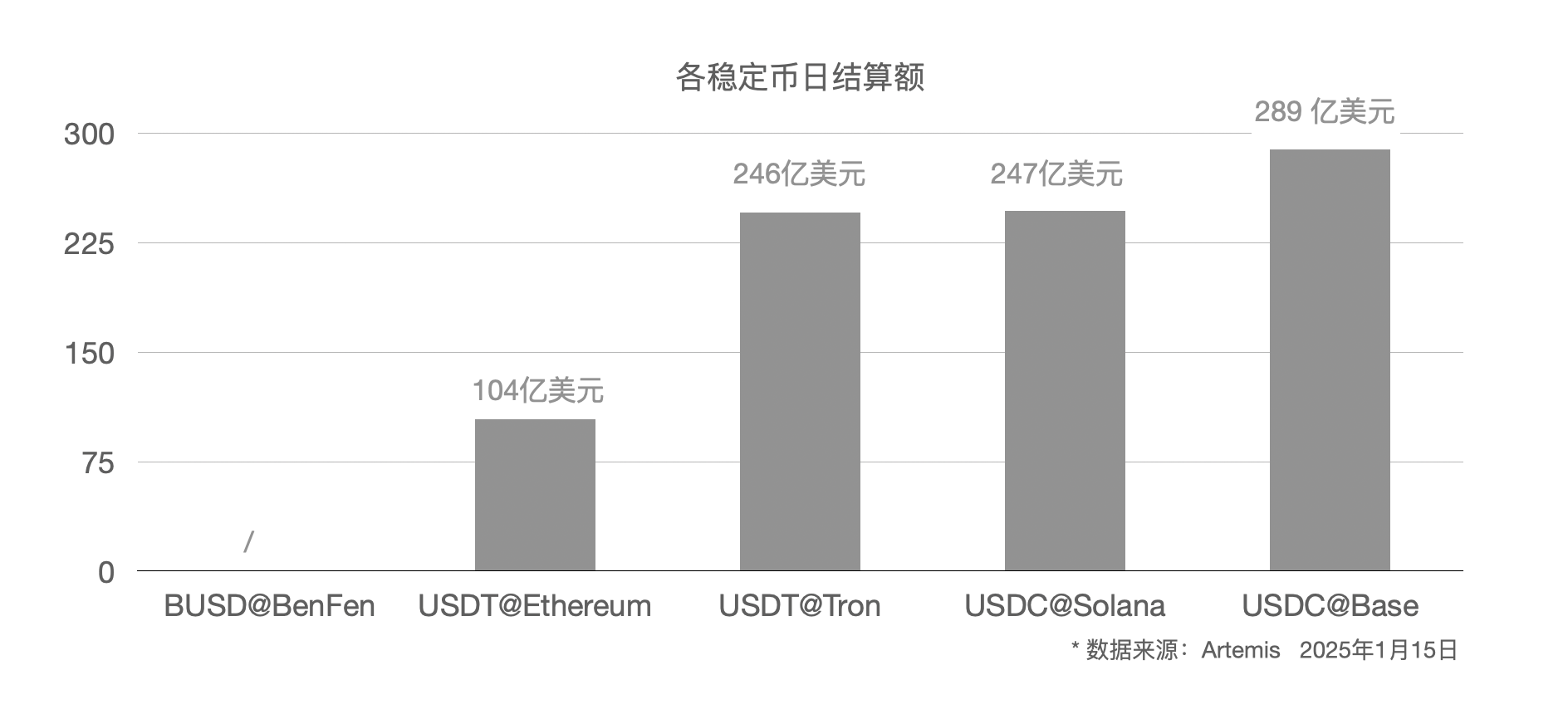

In terms of settlement amount, BenFen's BUSD has been online for a short time, so its settlement amount is negligible. USDC on Base performed well, ranking first with a daily settlement amount of US$28.9 billion, and USDC on Solana ranked second with a settlement amount of US$24.7 billion. USDT's settlement amounts on Tron and Ethereum ranked third and fourth with US$24.6 billion and US$10.4 billion, respectively.

Main competitors

Solana Chain + USDC

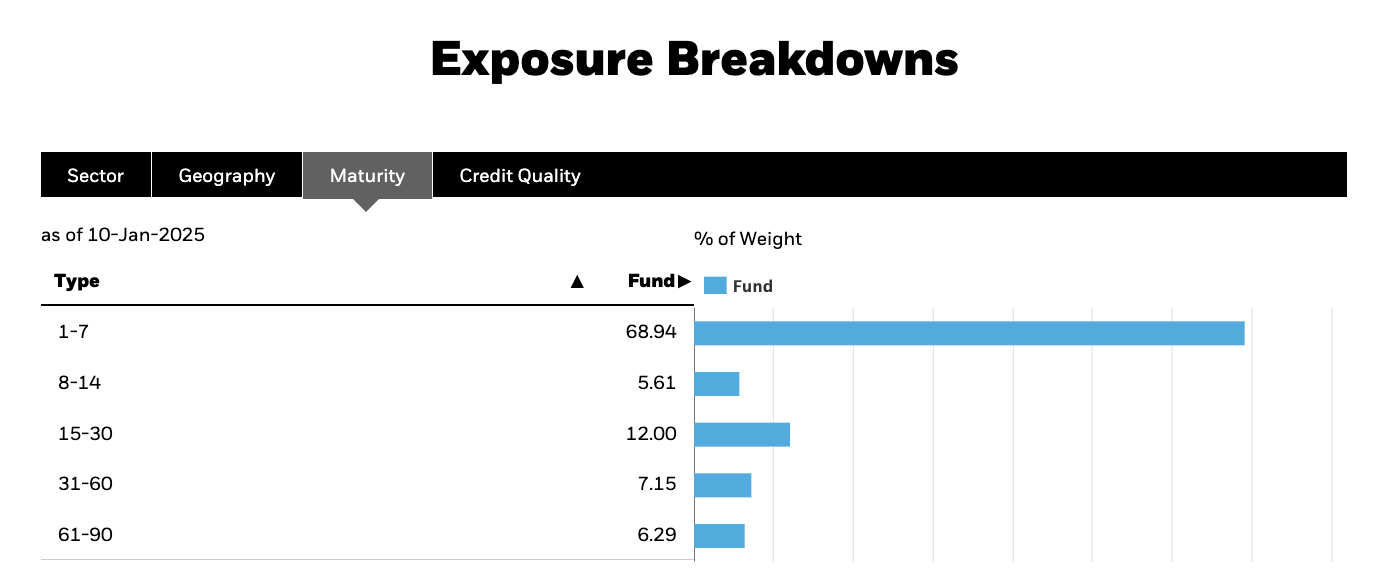

Although the issuance volume of USDC on Solana is only 4.37 billion US dollars, the daily settlement volume has reached 24.7 billion US dollars. The stablecoin solution of Solana chain and USDC can achieve such excellent performance. First of all, Solana, as the underlying infrastructure, has the characteristics of high TPS and low gas fee, which lays the foundation for the application of stablecoins. Secondly, Circle regularly discloses the details of reserves , and Deloitte regularly presents audit details . Most of the funds are managed by Blackrock to obtain income. In terms of risk control, the amount of funds due in 1-7 days accounts for 68.94%. Users can view the relevant income on its website. Therefore, USDC has high transparency and compliance.

Blackrock’s liquidity management of USDC reserves Source: Blackrock official website

In addition, the cooperation between Circle and Solana Foundation, especially the incentive policy adopted for USDC, such as some DeFi projects directly subsidizing USDC to fund developers to develop applications on the Solana chain. In addition, the launch of the Cross-Chain Transfer Protocol (CCTP) has improved the liquidity and availability of USDC. At the same time, Circle has simplified the development of smart contracts, making it easier for developers to adopt USDC.

However, Solana uses Rust as the application development language, which is relatively less secure than the Move language.

Base Chain + USDC

Base chain and USDC, as another stablecoin solution, have achieved rapid growth in daily settlement volume in the past few months, reaching US$28.9 billion , ranking first. This performance is based only on the issuance volume of US$3.47 billion.

In the second quarter of 2024, Coinbase's trading revenue fell 50% year-on-year, USDC issuance shrank 41% in 5 months, and ETH staking business faced regulatory pressure. Under the SEC's accusations, Coinbase was in a difficult situation. Under regulatory pressure, Coinbase had to fight a desperate battle, and infrastructure such as the Base chain was the focus of the breakthrough.

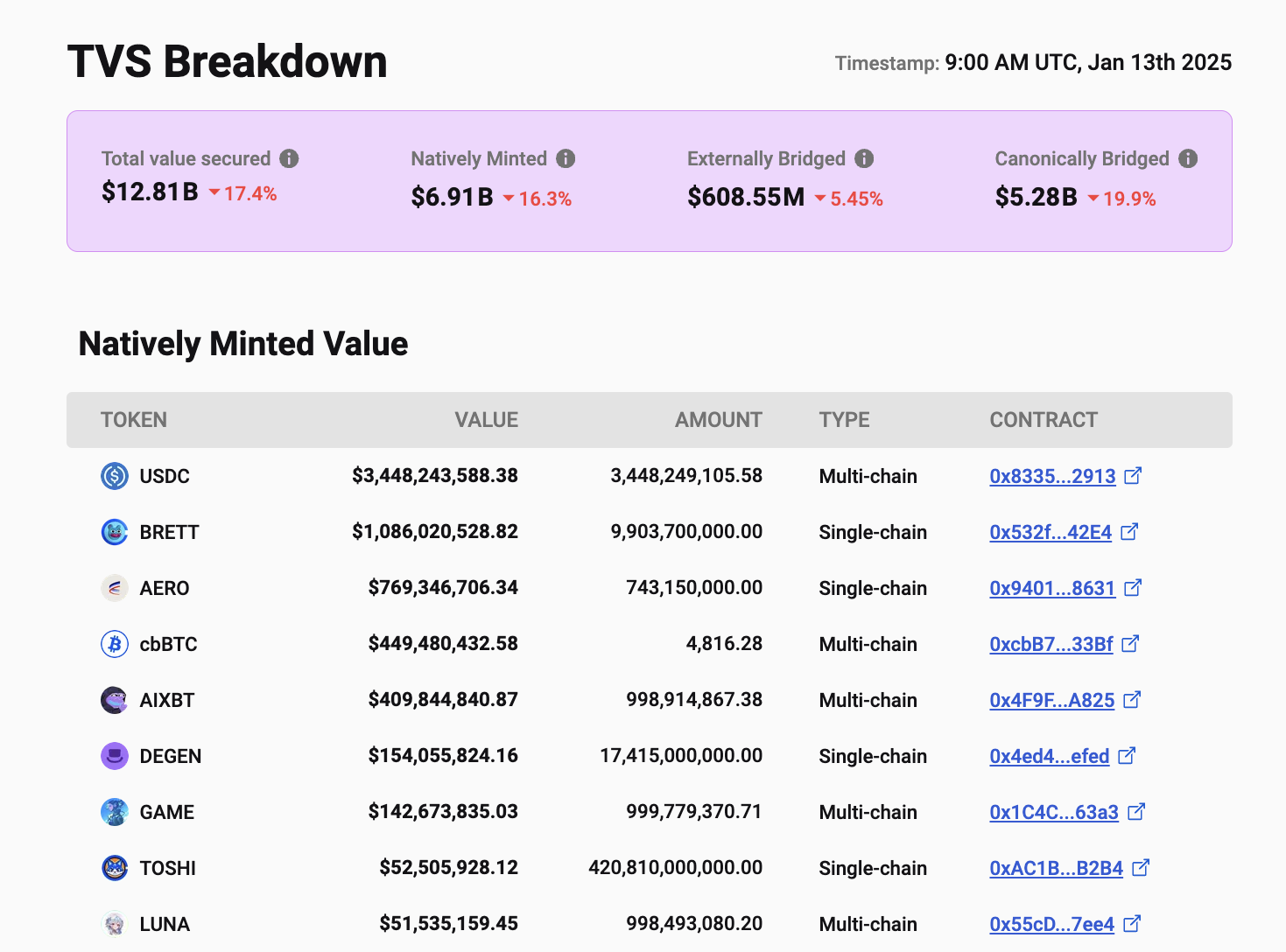

As Coinbase continues to focus on the Base chain, the total value of assets on the Base chain has reached 12.8 billion US dollars, with USDC having the largest value, totaling 3.448 billion US dollars.

Source of asset distribution on Base chain: L2Beat

In general, the stablecoin solution of Base chain + USDC has many advantages. First, Coinbase has the resource advantage. Coinbase will spare no effort to support the Base chain. Second, the barriers brought by compliance. Since the Base chain is backed by Coinbase, its compliance requirements are higher. Among stablecoins, USDC is more suitable for adoption on the Base chain due to its higher compliance, which also creates barriers for the entry of other stablecoins. Third, as an infrastructure, the Base chain is suitable for various applications of stablecoins with its high TPS and low gas fees.

However, since the Base chain is developed using OP Stack and the application development language is Solidity, it is less secure than the Move language. At the same time, since the final chain needs to submit transactions to L1, making Finality consistent with the Ethereum chain will take more than 10 minutes, and this process will reduce the stability and reliability of the entire system.

Ethereum chain + USDT

The Ethereum chain + USDT solution is an earlier stablecoin solution. Although the total issuance has reached 67.2 billion US dollars, the daily settlement volume is 10.4 billion US dollars, which is about 15.4% of the total issuance. In contrast, in the Solana chain + USDC solution, the daily settlement volume is 5.6 times the issuance volume, and in the Base chain + USDC solution, the daily settlement volume is 8.3 times the issuance volume.

Although the monthly settlement amount of USDT has an upward trend, the growth rate of USDT is obviously lower than that of USDC on the Solana chain and Base chain.

USDT settlement amount on Ethereum chain (monthly) Source: Artemis

The main reason is that the Ethereum chain itself has low throughput, high gas fees, long duration, and long Finality, which makes it very difficult for users to use USDT, resulting in a significant reduction in the frequency of adoption. Because of these problems, the Ethereum chain itself will lag behind other high-performance, low-gas-fee public chains in capturing the dividends of stablecoin growth.

Tron Chain + USDT

Since the cost of stablecoin transfers on Tron is much lower than that of other chains, Tron has seized the large application scenario of stablecoin transfers. As a result, the issuance of USDT on the Tron chain has reached 59.7 billion US dollars, second only to the Ethereum chain, and the daily settlement amount has reached 24.6 billion US dollars, accounting for 41% of the issuance. Compared with Ethereum's stablecoin transfers due to the demand for on-chain applications, the main driving factor for stablecoin transfers on Tron is low fees, and many users prefer to transfer from exchanges to chains. In the second half of 2024, Justin Sun proposed a gas-free stablecoin transfer solution to meet the needs of the financial and payment fields. Driven by the demand for stablecoin transfers, Tron's on-chain users have exceeded 200 million.

For the Tron chain, its revenue mainly comes from two parts, the first is stablecoin transfers, and the second is Meme coin transactions. Stablecoin transfers are Tron's core source of revenue and have an indispensable strategic value in the Tron ecosystem. Tron will inevitably focus on consolidating this business.

For USDT, transfers on Tron are its biggest application scenario, and its importance is self-evident. In the competition with USDC, USDC has a clear advantage on Solana and Base chains.

Competitive advantages of BenFen Chain + BUSD

Focus on the positioning of stablecoin application scenarios

The BenFen chain + BUSD solution focuses on stablecoin application scenarios, including PayFi, Card, Gas fee payment, P2P, etc., while other chains and stablecoins target all ecological applications, including DeFi, GameFi, Social, Meme, AI, etc., and lack sufficient focus.

BenPay , an integrated super app : deposits and withdrawals, exchange, pledge lending, offline consumption, and red envelope transfers

BenFen has built a super application BenPay with a complete closed loop and rich functions. Users can realize various functions such as deposits and withdrawals, exchanges, pledge loans, offline consumption, red envelope transfers, etc. in the BenPay application. One application meets the multiple needs of users.

Security advantages brought by Move language

BenFen uses Move as the application development language. Compared with languages such as Solidity and Rust, it has special requirements in terms of security, such as strict type system and resource concept, which greatly improves the overall security. Stablecoin applications are high-value applications, and security is the first priority.

Improvements in consensus mechanisms and cost optimization lead to high performance and low gas fees

The application scenarios of stablecoins require an underlying public chain with high performance and low gas fees. BenFen has achieved a throughput of tens of thousands of transactions, a latency of 0.5s, and a gas fee of less than 0.1 cents by improving the consensus mechanism and optimizing fees, which is far better than the Ethereum chain. The excellent underlying public chain has laid the foundation for the application of stablecoins.

High-value governance token BFC

Compared with the decentralized value capture mechanisms of other chains and applications, such as ETH capturing the gas fee of the Ethereum chain and UNI capturing the transaction fee of Uniswap, BenFen's governance token BFC can fully capture the value of the entire ecosystem, including the BenFen chain, BenPay DEX, BenPay, BenPay Card, merchant services, etc. Therefore, its value is the sum of the values of all ecological projects, and its gold content is higher.

Smooth user login experience: Support zk -Login , no mnemonic required to log in

Cumbersome mnemonics have always been an obstacle for users to enter Web3 applications. BenFen chain supports zk-Login, and users do not need mnemonics, and can enter BenFen chain and its applications with only Google/Apple accounts. In contrast, other chains and stablecoin-related applications require users to record mnemonics, and the operation steps are complicated, which greatly hinders user adoption.

Driving factors and trends: Advantages of blockchain and stablecoins themselves and policy support

Blockchain & stablecoin solutions have advantages over traditional payments

Since the emergence of Bitcoin and Ethereum, blockchain has been running stably for many years. Various stablecoin applications (Lending, DEX, Staking, etc.) including USDT, USDC, DAI, etc. have emerged one after another, which has basically proved the stability and reliability of this system. However, traditional payment systems such as Swift have been criticized by users for their slow settlement and high fees.

Therefore, based on the advantages of blockchain and stablecoins themselves, they will replace traditional cross-border payment solutions.

Policy support: Policy support from the United States, Europe, Japan, etc.

With the end of the US election, more than half of the Trump team members support crypto assets. It is foreseeable that as team members take office, more policies that are beneficial to the crypto market will be formulated and promulgated one after another. At the same time, Europe has also promulgated the Crypto Asset Market Regulation Act (MiCA). In addition, Hong Kong, Japan, Singapore, and the United Kingdom have all introduced stablecoin bills.

The introduction of these policies and bills indicates that countries hope to regulate the development of the stablecoin market and make it move in a more compliant direction.

Key risks

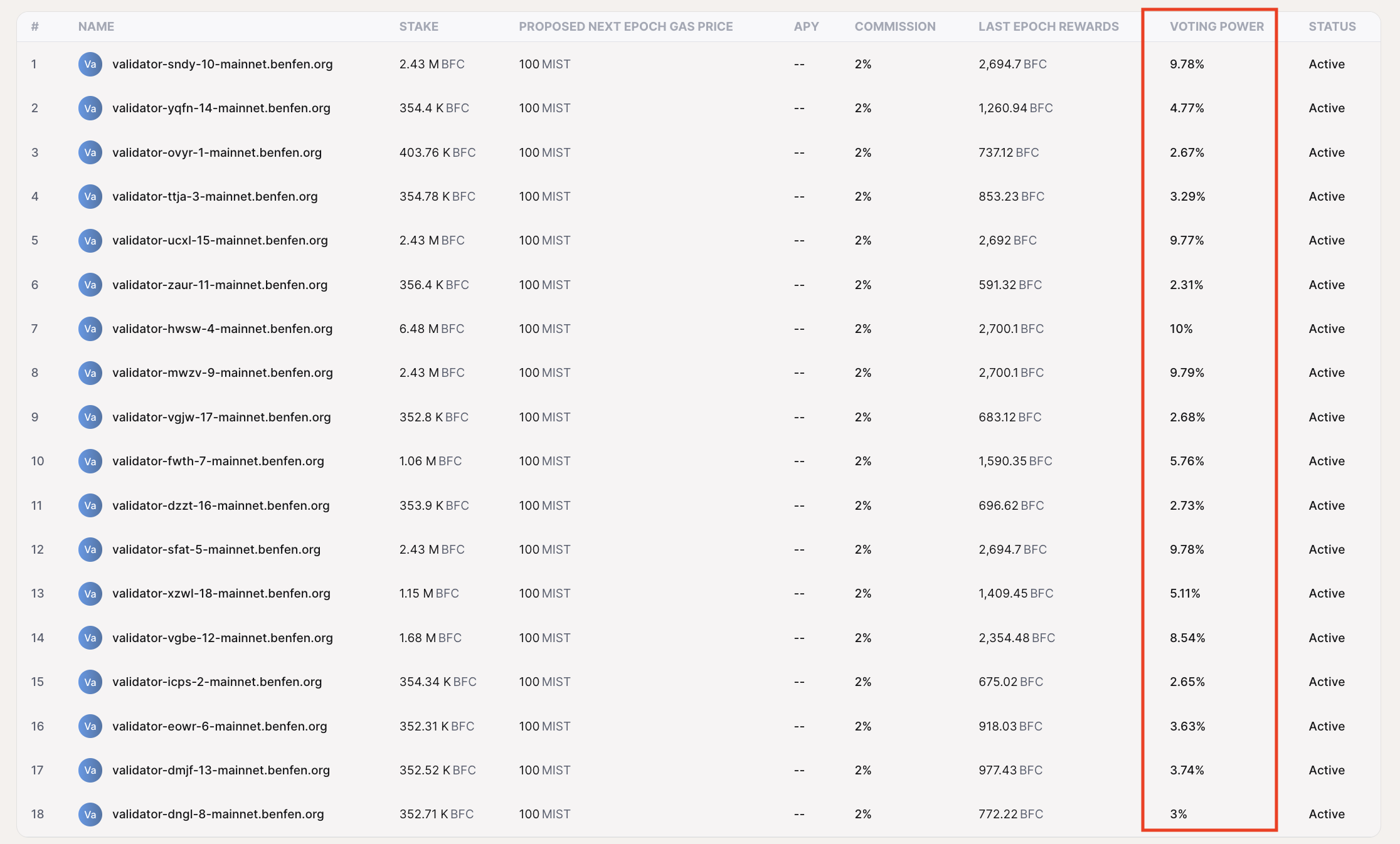

Centralization Risk of Validators

Since there are only 18 active validators at present, which is relatively small compared to other public chains, there is a certain risk of validator centralization. However, the Voting Power is relatively evenly distributed, ranging from 2% to 10%, which reduces the risk of centralization to a certain extent.

Distribution of Voting Power Source: BenFen Explorer

Security risks of smart contracts

The security risk of smart contracts is faced by all public chains and Dapps. Relatively speaking, since BenFen uses Move language as the application development language, the security of smart contracts has been greatly improved. However, due to the complexity of smart contracts themselves, there may be certain security risks in some areas.

Value Assessment

The logical fulcrum of investment

a) Application scenarios based on stablecoins, including cross-border payments, P2P deposits and withdrawals, off-chain consumption, etc., are a rigid demand, and this demand is huge in scale and full of potential.

b) The policy side has been or will be relaxed, and the formulation of policies and bills has laid the necessary development soil for the prosperity and development of the industry. Especially with the inauguration of Trump's pro-crypto team, the policy advantages have gradually become prominent.

c) BenFen's high-performance underlying public chain, multi-national anchored stablecoins and payment solutions just meet the core requirements of stablecoin application scenarios, namely security, fast settlement, low fees and smooth access.

High investment value compliance assessment

| project | Evaluation content |

| Market space and commercial value | The cross-border payment, P2P deposit and withdrawal, off-chain consumption and other markets based on stablecoins have a large industry space and a long track |

| barrier | The development of BenFen chain, Ben Pay, BenPay DEX, BenPay Card, etc. is difficult, takes a long time, and has high barriers. |

| Valuation support | The valuation is supported by the income of the entire ecosystem, including the gas fees of the BenFen chain, the transaction fees of BenPay DEX, and the income of applications such as BUSD, BenPay, BenFen P2P, and BenPay Card. |

| Customer stickiness | The stickiness is strong. Once users use products such as BUSD, Ben Pay, and BenFen P2P, they are unlikely to transfer in the short term. |

| Competitiveness | TPS, latency, gas fees, security, user experience, etc. are all at the top of the industry and highly competitive |

| Periodicity | Affected by the macro epidemic, the income of BenFen ecosystem has a certain periodicity |

| Team and Governance | The team is large, with strong R&D capabilities, strong technical and professional strength, and adopts the Dao governance model, which is more open and fair. |

| Extended Sustainability | Due to its own characteristics, BenFen chain can develop other sectors, such as various AI-related applications and infrastructure, and has good expansion sustainability. |

| Growth rate | The issuance of stablecoin BUSD is growing rapidly |

| Summarize | A high-potential project in the rising track, with strong competitiveness, high customer stickiness, long track and large space. BenFen has strong chain performance, low latency, low gas fee, valuation supported by income, and good user experience. It has built stable currency, payment, Card, P2P and other applications, and the ecology is gradually prosperous, with high investment value. |