Author: AlΞx Wacy

Compiled by: TechFlow

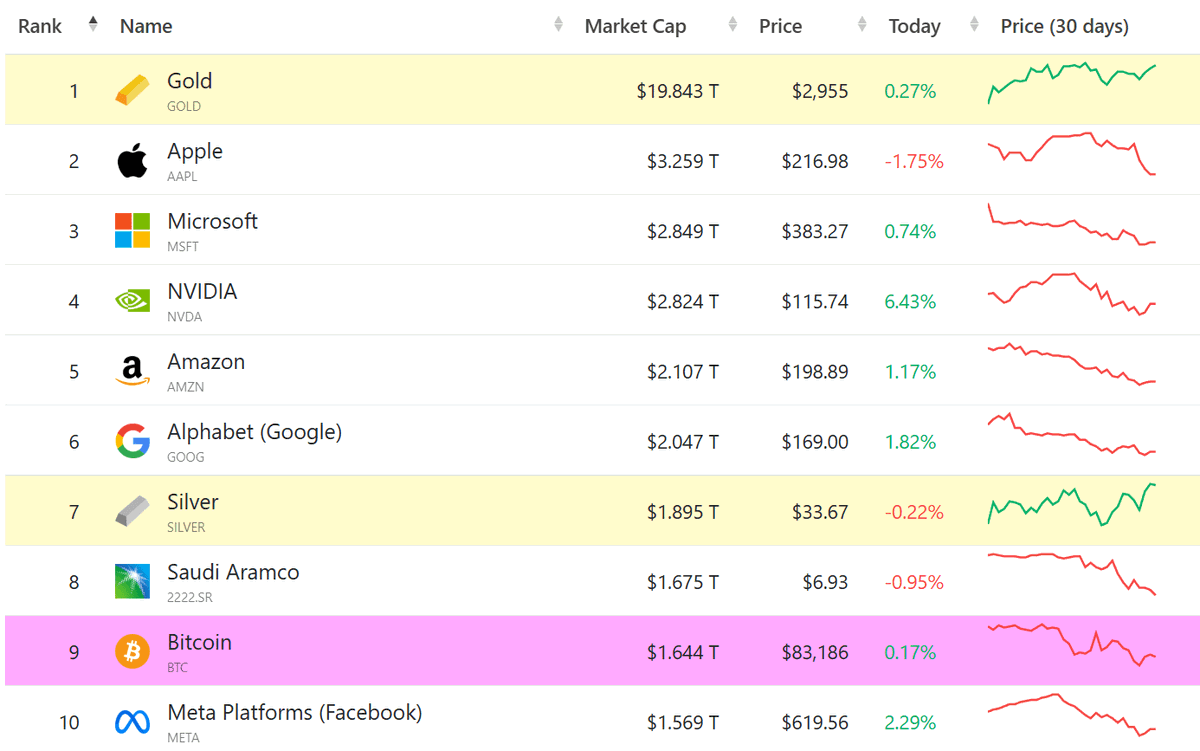

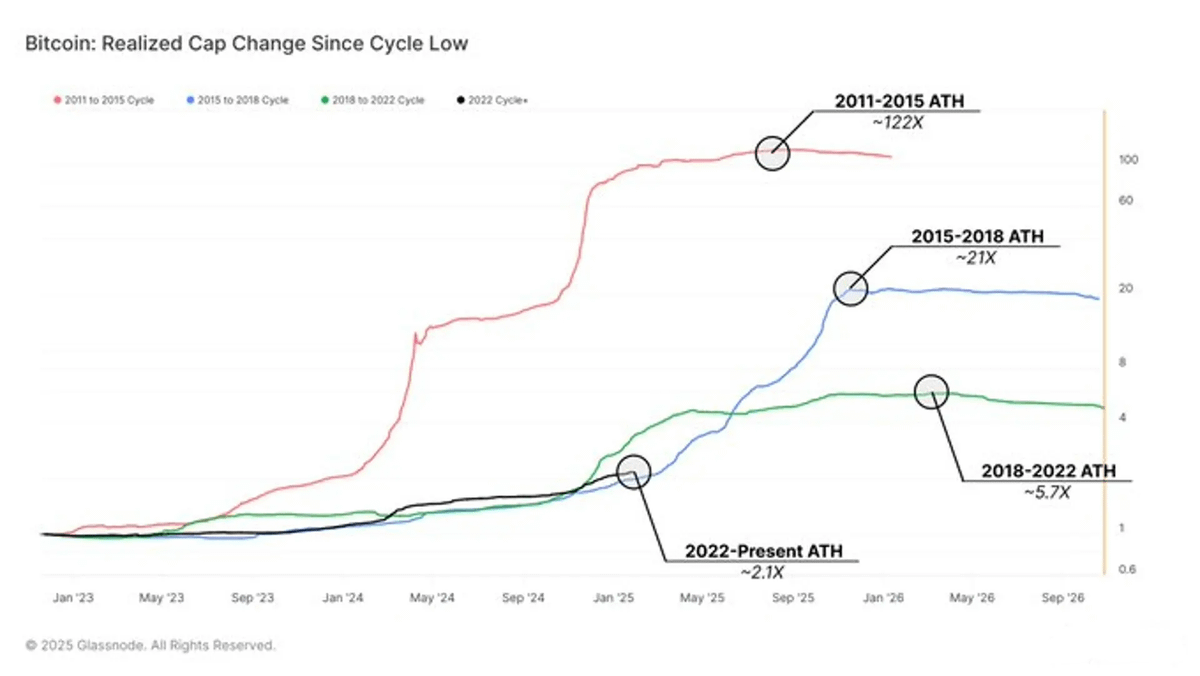

Bitcoin cannot replace gold

Gold has a market cap of about $19 trillion, and even in the most optimistic scenarios, Bitcoin ($BTC) is nowhere near touching. Digital gold? Yes. Real gold? Forget it.

Market liquidity is decreasing

Spot ETFs have attracted institutional money, but retail liquidity is drying up. Market enthusiasm alone is not enough to support the next stage of development.

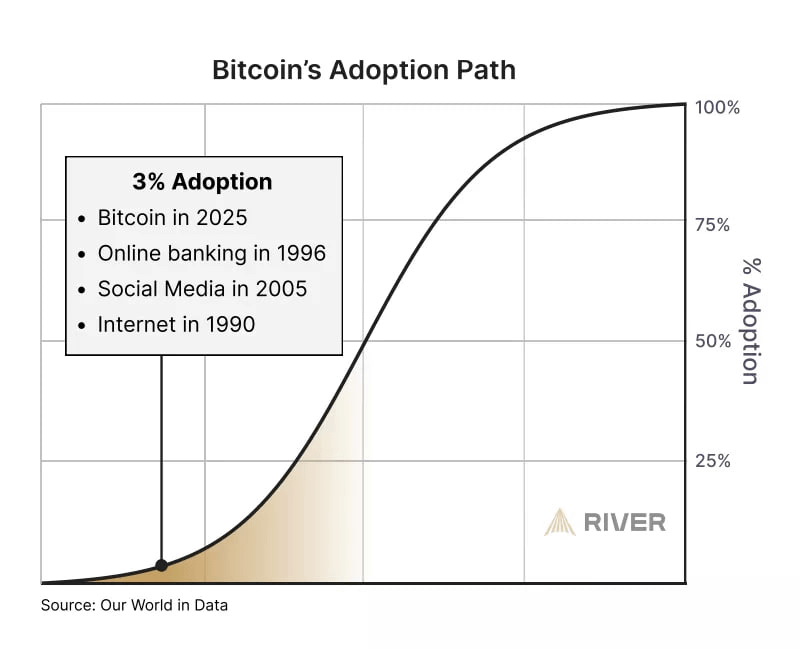

Popularization has not yet begun

While cryptocurrency is frequently in the news, actual real-world applications remain limited. It remains primarily a playground for speculators rather than an everyday financial tool.

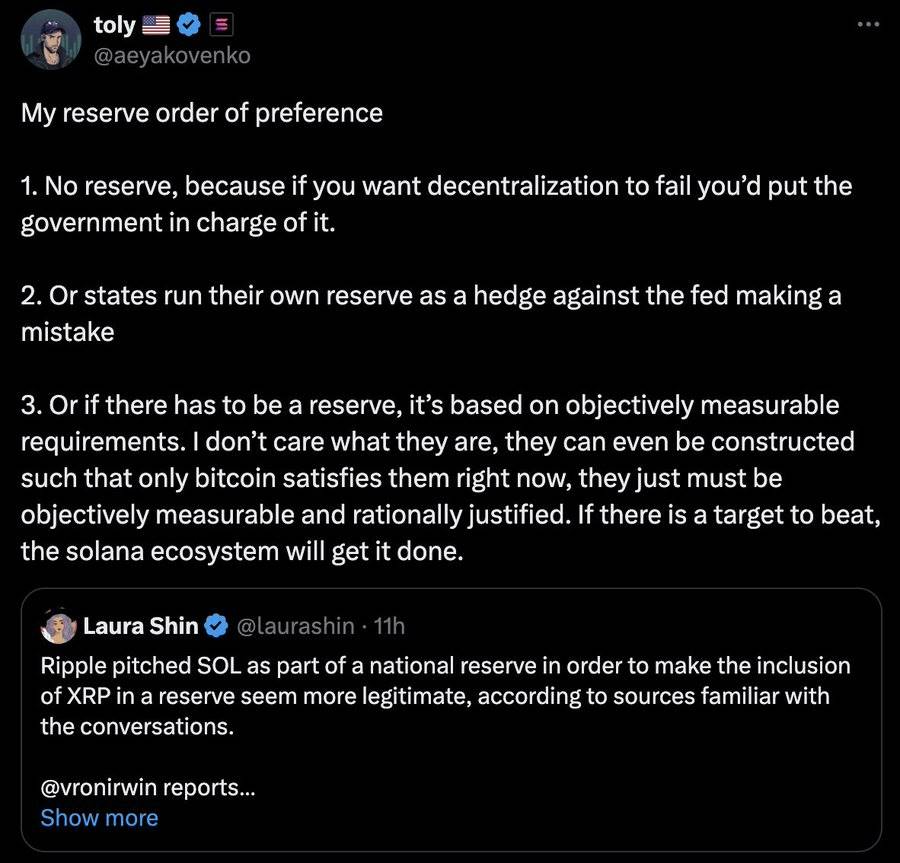

The dream of decentralization is shattered

The dream of a fully decentralized cryptocurrency is fading. Today, centralized exchanges, regulators, and big money players are in control.

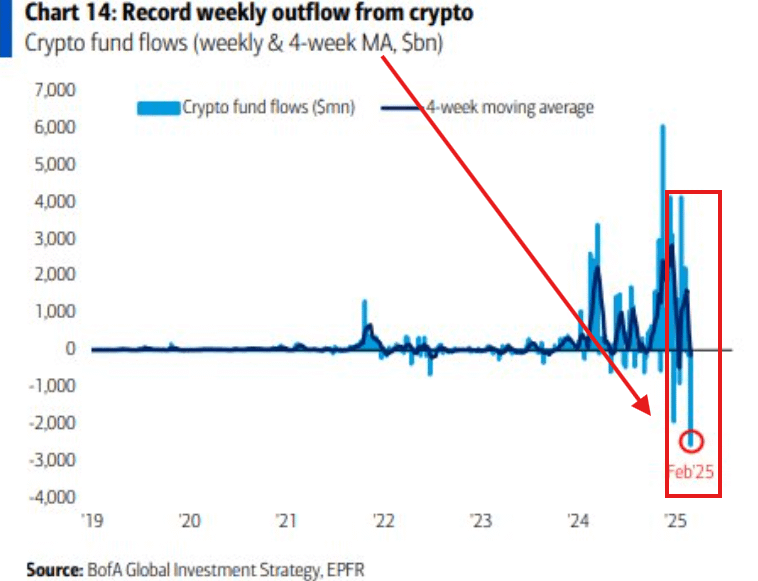

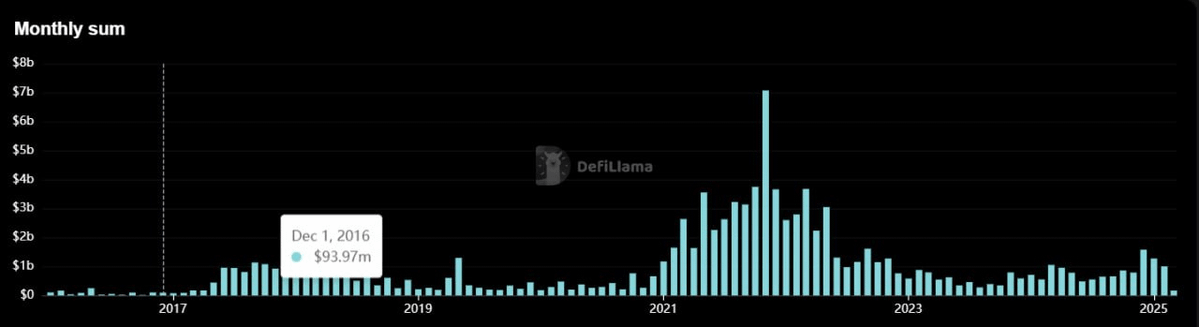

Funds are moving away from crypto investments

Despite unprecedented government support and growing legitimacy for the industry, venture capital investment in crypto projects is below levels seen during the 2017-2018 boom.

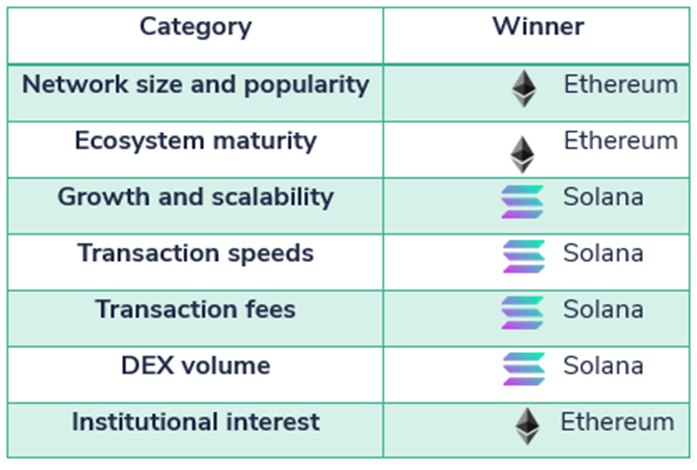

Solana will surpass EthereumSolana ($SOL) is faster, cheaper, and growing rapidly in NFT, DeFi, and meme coins. Ethereum ($ETH) struggles with high fees and internal chaos. It's a matter of when, not if.

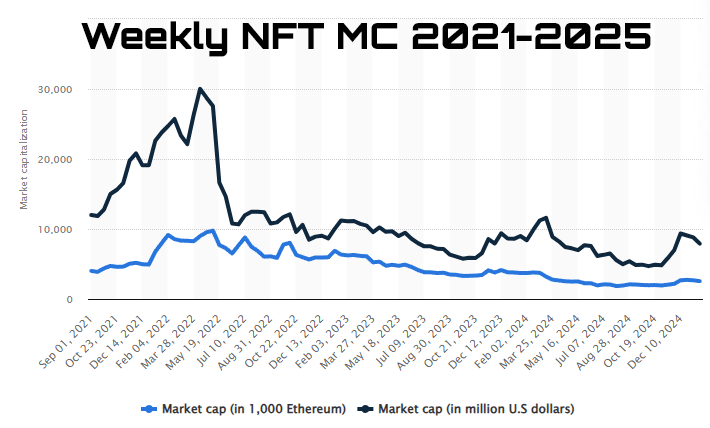

NFTs Are Dead

The craze of PFP (avatar NFT) has passed. Without practical application scenarios, NFT will not be able to recover unless new use cases emerge.

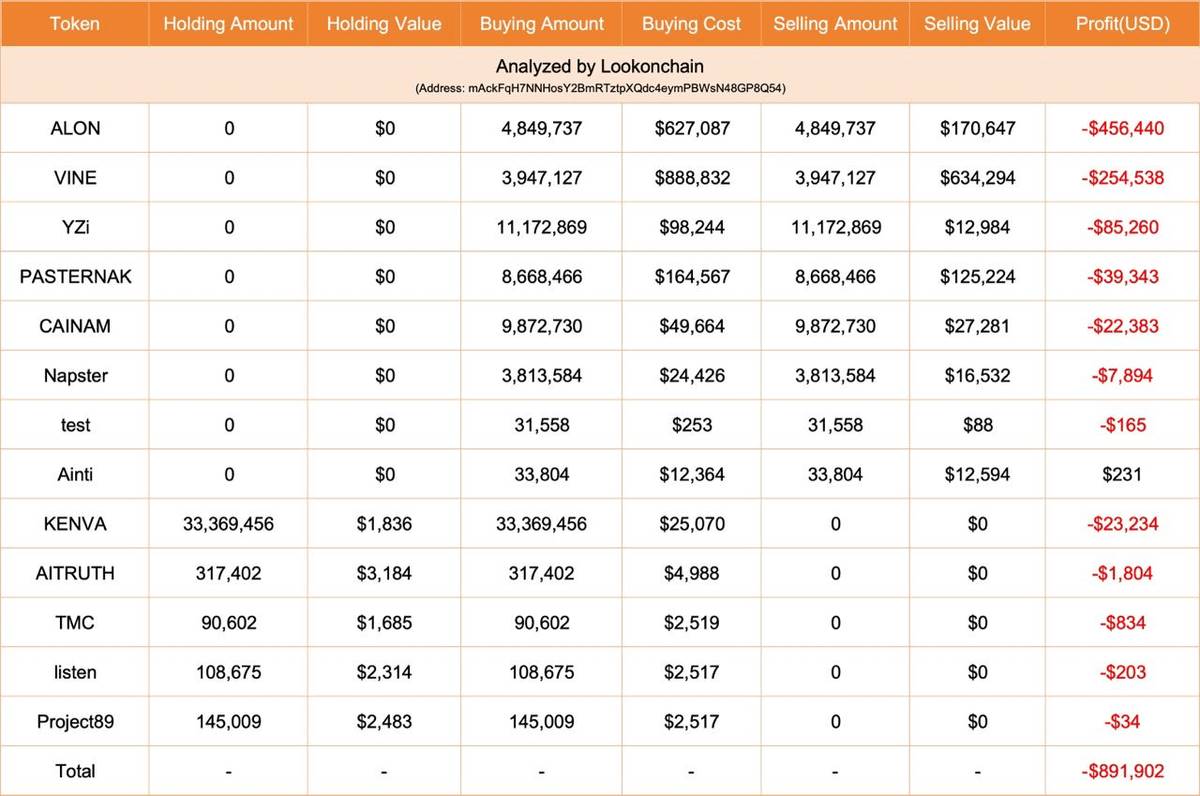

Retail investors are the “takers”

Smart money entered the market early and sold to retail investors at a high point, but most people ultimately failed to make a profit.

If Solana doesn’t have a new “explosion point”, it will be difficult to hit a new high

Meme coins have been the biggest catalyst for $SOL. Without a new wave of enthusiasm, market attention will gradually fade.

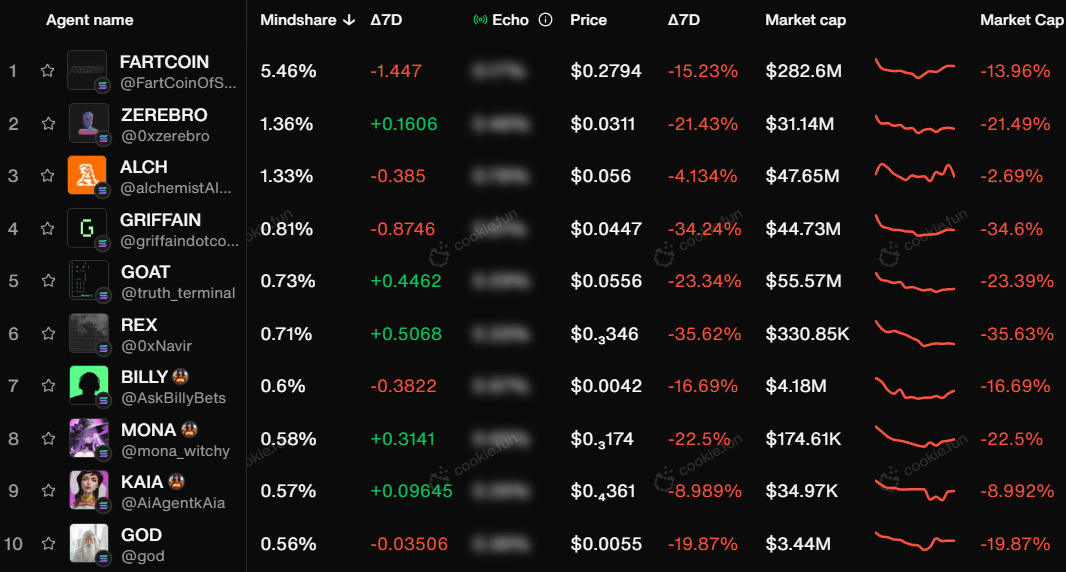

The next wave of AI agents is coming

While the first wave of AI agents are just chatbots, more advanced technologies are coming that will change the way we interact with cryptocurrencies.

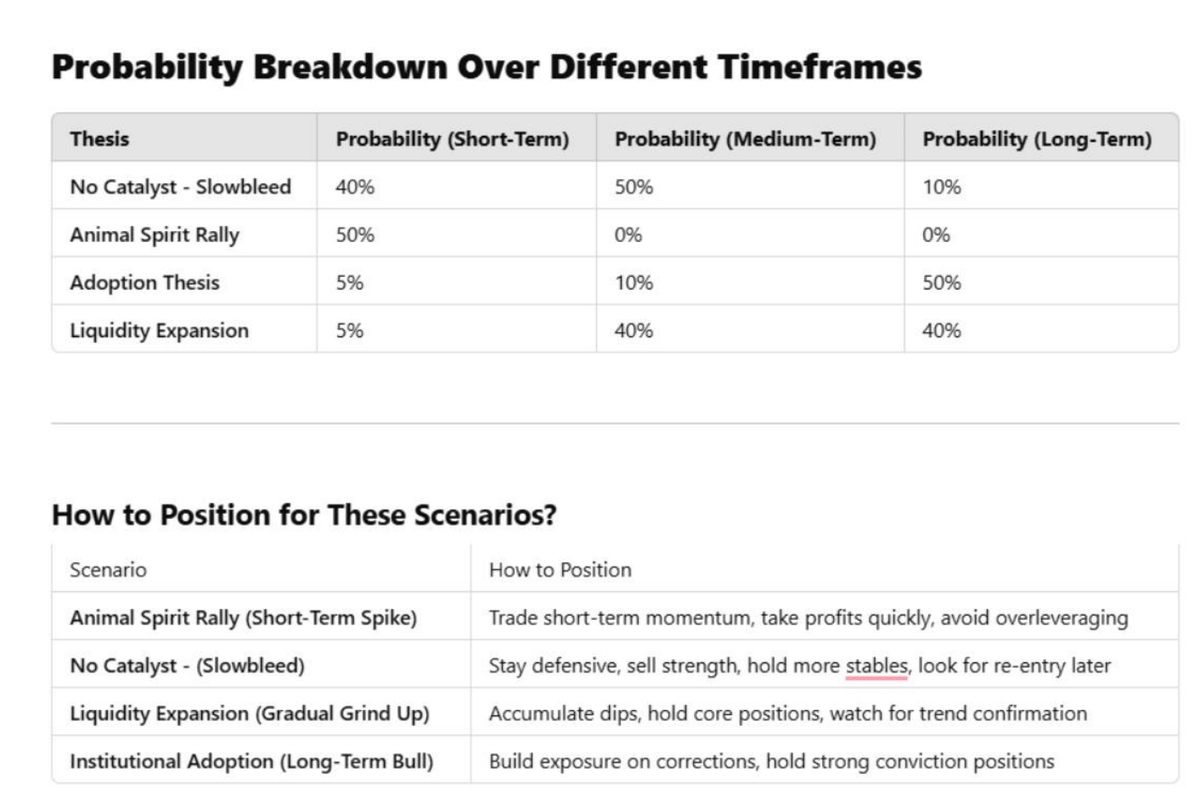

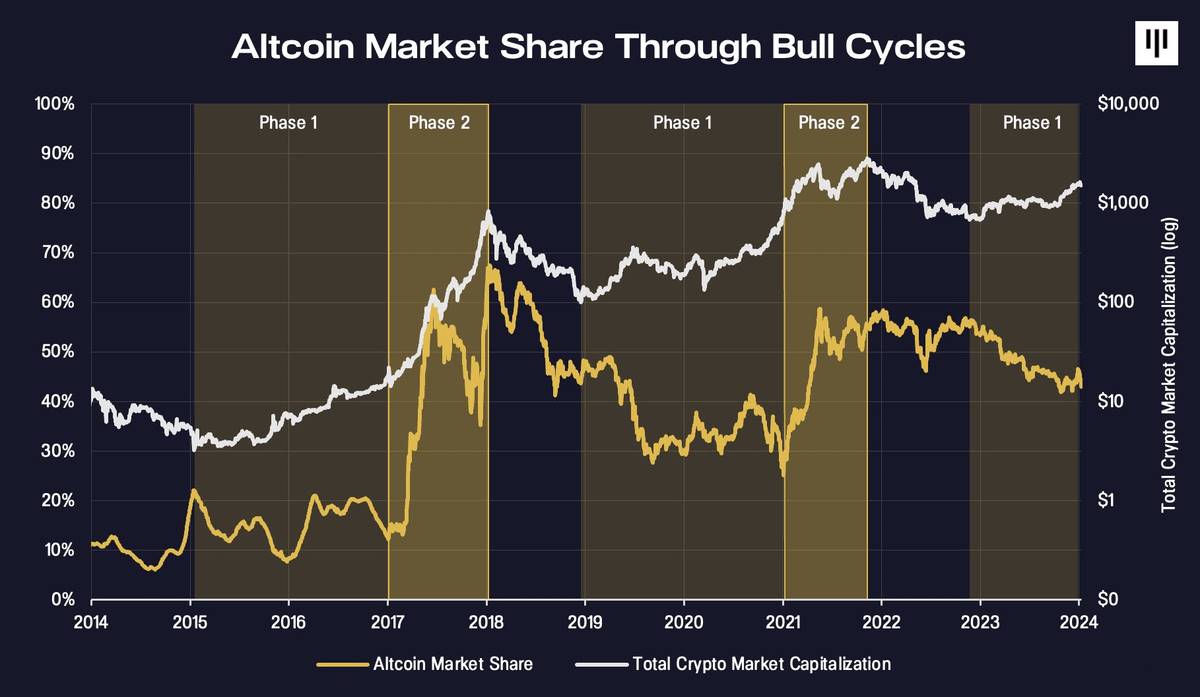

Market cycles and indicators no longer work

Traditional market cycles? Technical analysis (TA) model? Today, the market is more influenced by liquidity games and macro events.

The fuel for the altcoin season has run out

Money is no longer flowing into the altcoin market like it once did. Without new capital infusions, a full-blown altseason may never happen.

Bitcoin could drop to $40,000

Yes, such a deep correction is possible. Market structure and liquidity suggest that a major correction is brewing.

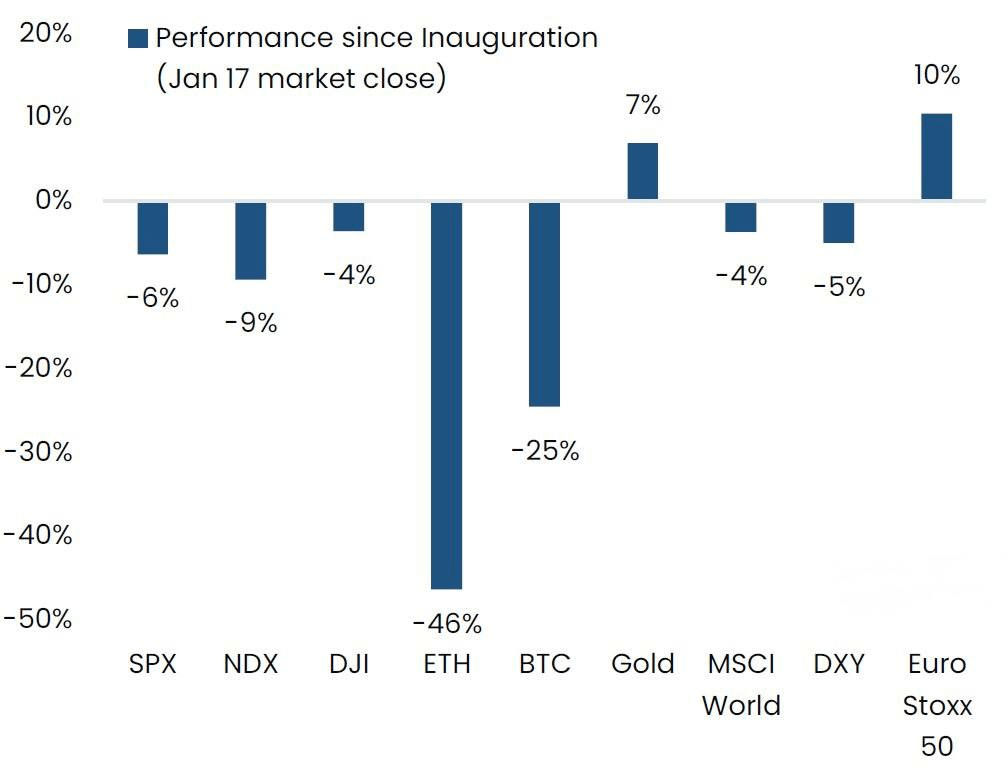

Trump is not a silver lining for the crypto market

The market has performed better under Biden. Trump's policies may be more favorable to institutions rather than retail investors.

GameFi is about to have a renaissance

Web3 games are gradually maturing. If Grand Theft Auto 6 integrates blockchain technology, it may completely change the gaming industry.

SocialFi will become the next wave of trend

Tokenized communities, interactive rewards, and content monetization will become the inevitable development direction.

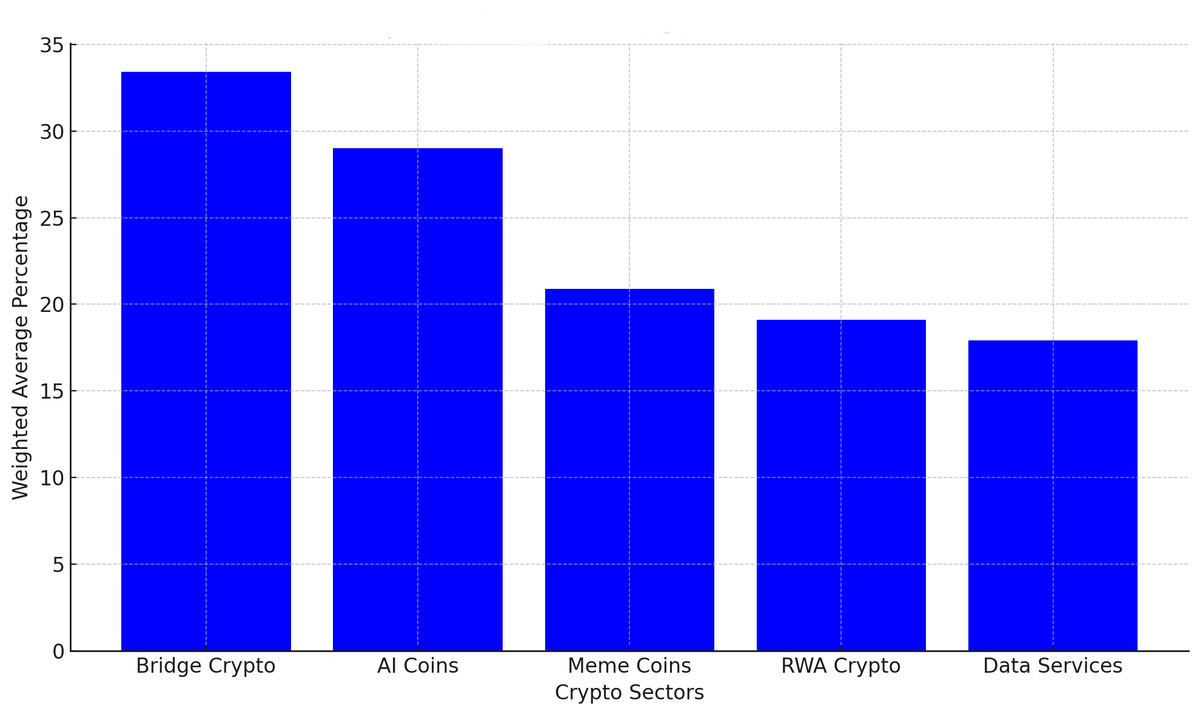

Complex technology is no longer the hot topic in this cycle

The simpler the project, the more popular it is. Artificial Intelligence (AI), Decentralized Internet of Things (DePIN), and Real World Assets (RWA) are easy to understand, but modular blockchains are not.

Binance's new listings no longer mean a surge

Most of the new coins listed on Binance eventually fall. The hype cycle of the market has changed.

A full-blown altcoin season may never return

Yes, some altcoins may see 10x or even 100x gains, but a huge rally covering all altcoins? Almost impossible.

Crypto markets never work as expected

If you think you have it all figured out, the market will prove you wrong. Adapt or be eliminated.