The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

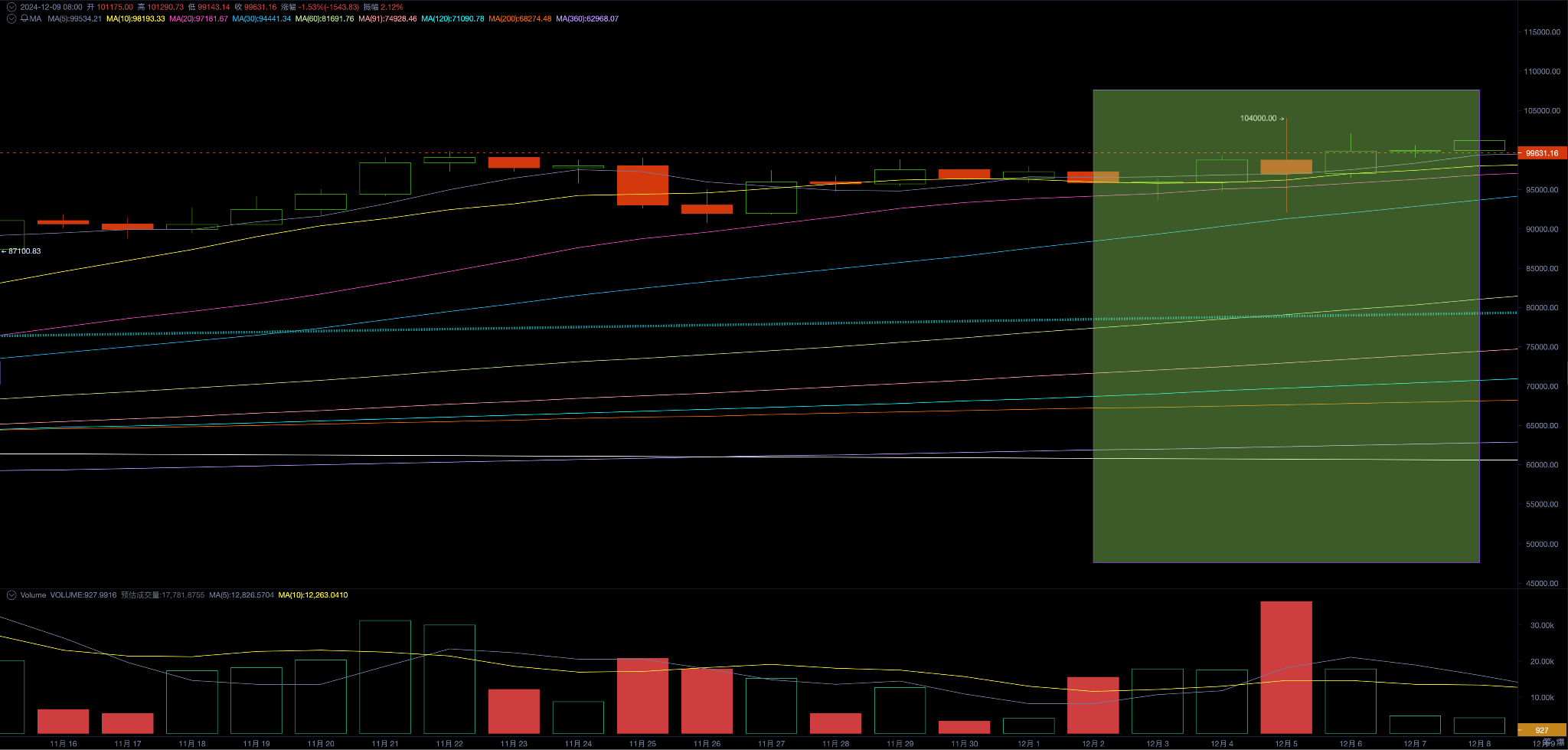

Since approaching the psychological mark of $100,000, BTC has been fluctuating around the $90,000 to $100,000 range. As the moving averages gradually stick together, forming a psychological support , BTC broke through $100,000 twice this week , reaching a high of $104,000.

This week, BTC opened at USD 97,259.17 and closed at USD 101,174.99, up 4.02 % for the week , with the trading volume effectively amplified.

Although the political turmoil in South Korea has a short-term impact on the price of BTC, and as we emphasized in our weekly report last week, there is a need for consolidation in the market. In the past week, there have been some adjustments, with the maximum amplitude reaching 12.26%. However, at present, both sentiment and funds are in an effective support stage, which is difficult to affect the medium- and long-term upward trend of prices.

Federal Reserve and economic data

The U.S. non-farm data released this week was as good as "expected", but expectations for a December Fed rate cut soared to 86%.

In an interview, Fed Chairman Powell said that "we feel very good about the current state of the economy and monetary policy, so we can be more cautious in lowering interest rates to a neutral rate." This statement is only slightly hawkish. His statement that "the good relationship between the Fed and the Treasury will continue under the new administration" made the market more reassured.

Powell also specifically talked about his views on BTC - "BTC is used as a speculative asset; BTC's competitor is gold, not the US dollar." This statement is also very meaningful.

The three major stock indexes were mixed, with the Nasdaq up 3.34%, the S&P 500 up 0.96%, and the Dow Jones down 0.6%.

The US dollar index fell slightly this week, closing at 106.06. Gold continued to fall slightly.

Stablecoins and BTC Spot ETF

Funds from the two channels continue to flow in explosively. The total weekly inflow exceeded 8.7 billion, showing that BTC at $ 100,000 still has strong buying power . As BTC approaches $100,000, the already opened Altseason continues to attract inflows of funds from the stablecoin channel.

This week, the inflow of BTC Spot ETF exceeded 2 billion US dollars, which is still at a relatively high level. Especially considering that BTC was close to the 100,000 mark last week, and the funds in this channel were outflowing in the week of adjustment, the recovery of inflow this week has eliminated some market concerns.

The stablecoin channel inflow was 5.881 billion , the second largest inflow week since this cycle. Currently, a large number of stablecoins have been injected into centralized exchanges and smart contract lending DApps, providing sufficient funds for the market.

This also directly triggered the Altseason, with markets rising across the board and market sentiment extremely high.

Sell off

As the market starts to move, selling also occurs simultaneously.

According to the monitoring of EMC Labs eMerge engine, more than 240,000 BTC flowed into centralized exchanges this week, mainly short-selling. However, with the support of strong buying power, all the selling pressure was absorbed, and centralized exchanges recorded a net outflow of more than 28,000 BTC.

The continuous selling by short-hands has caused a significant decline in the floating profit level of this group, from the previous highest 34% to the current 24%.

For the continued upward trend in November, the selling pressure is currently normal and is decreasing. This provides support for the BTC price to completely stand above $100,000.

Cycle Indicators

The EMC BTC Cycle Metrics indicator is 0.875, and the market is in an upward phase, showing a vigorous upward state.