Author: Ltrd

Compiled by: 1912212.eth, Foresight News

This plunge is the biggest liquidation since 2021. I want to analyze the whole situation from a microstructural perspective.

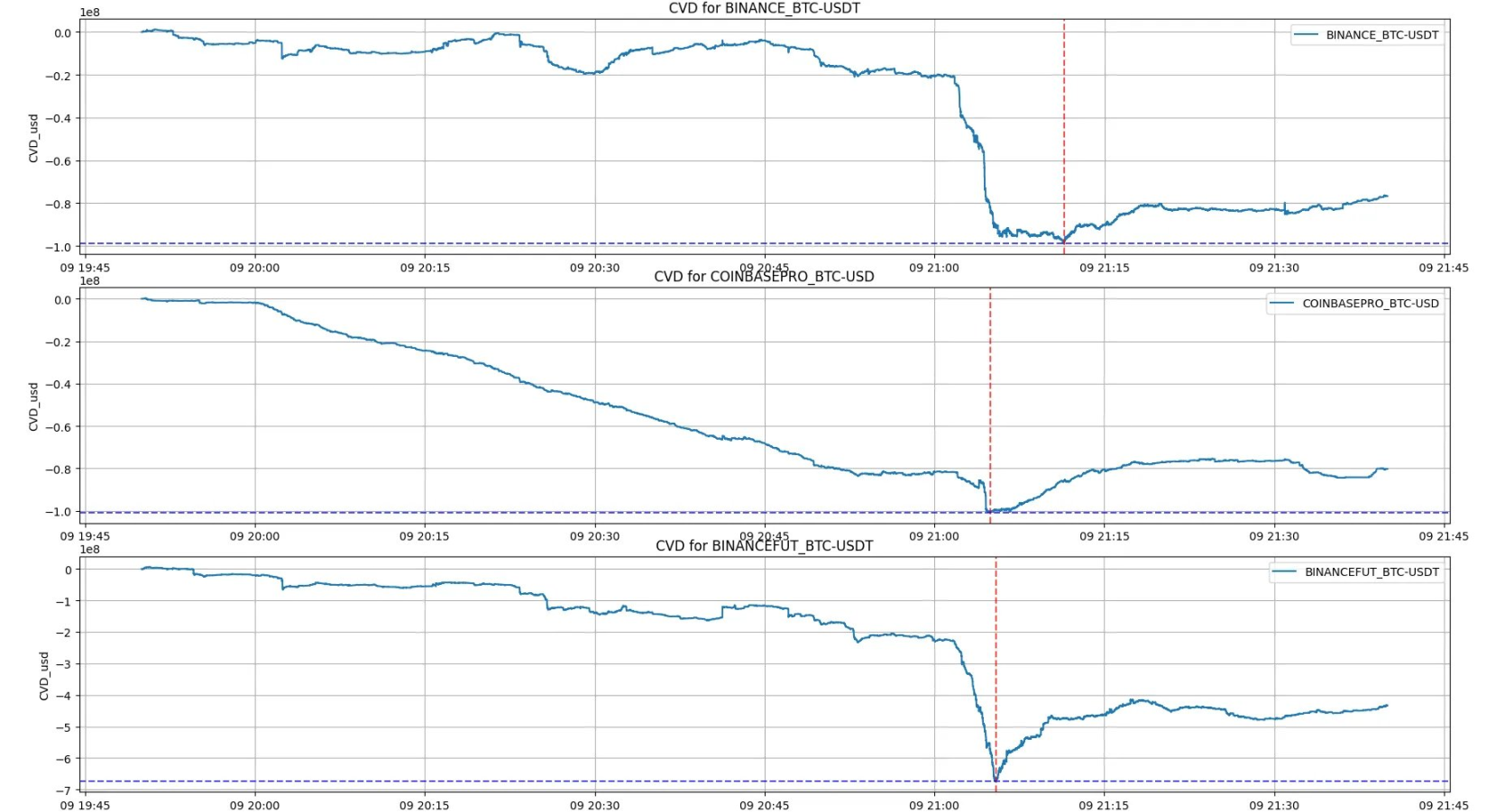

First, we need to identify where the selling pressure was greatest. We found that traders on Coinbase began to sell aggressively nearly an hour before the massive crash.

Of course, the biggest drop was triggered by the cascading liquidations, but this continued selling pressure played a major role in pushing the price into the leveraged liquidation zone. So how do we tell if the market is overheated? It's simple - the funding rate and the growth in the number of open contracts. These two factors are the drivers of the current market, and it shows that people are using excessive leverage.

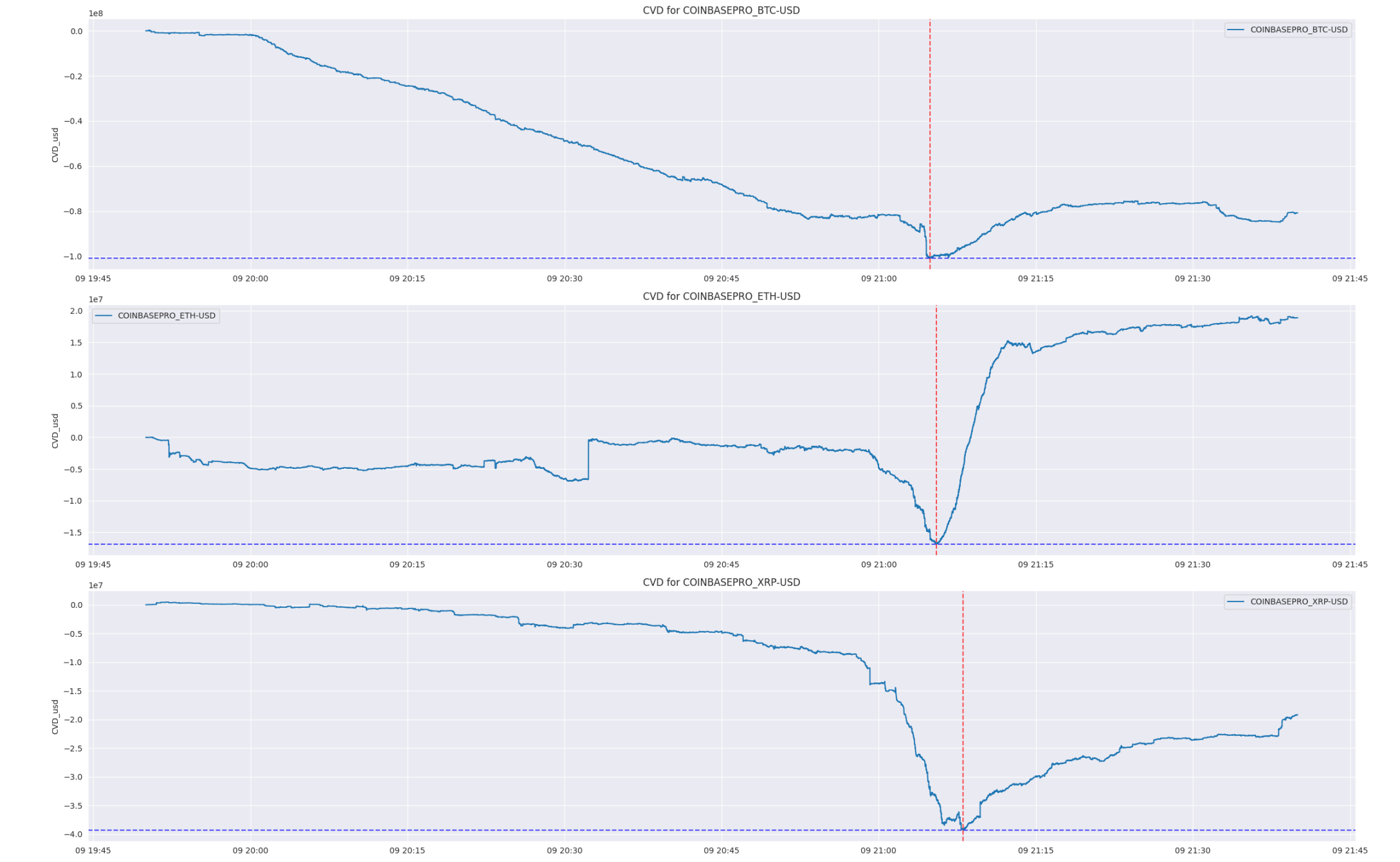

ETH has seen strong buying following the crash. Relative strength has also been evident in recent days - could someone be buying?

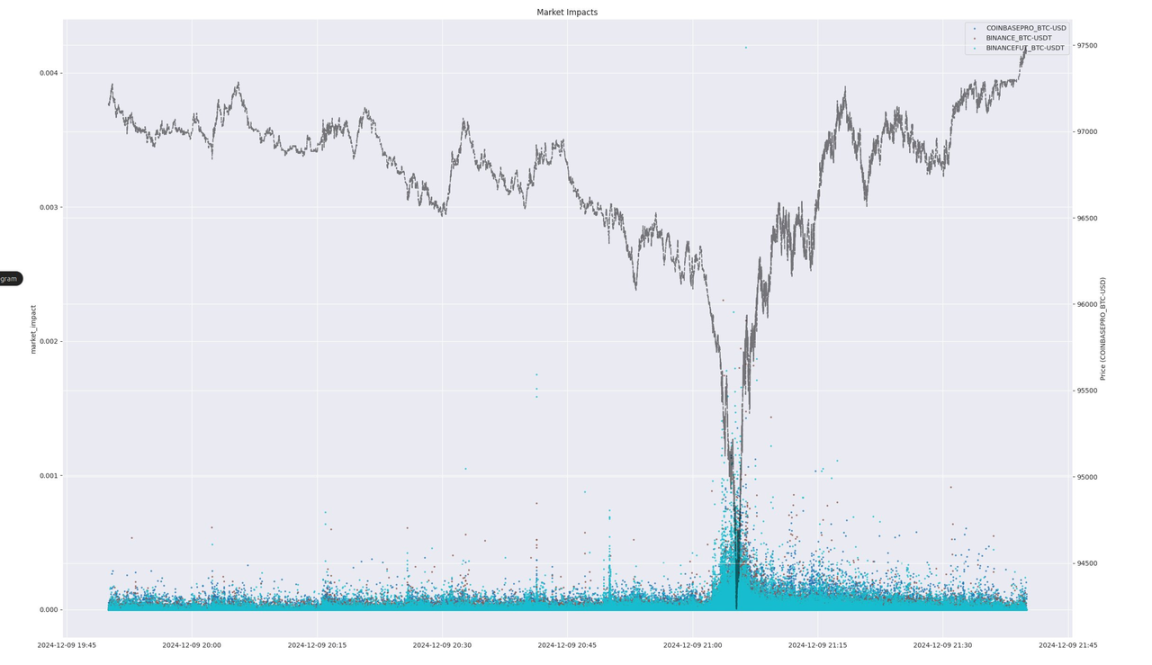

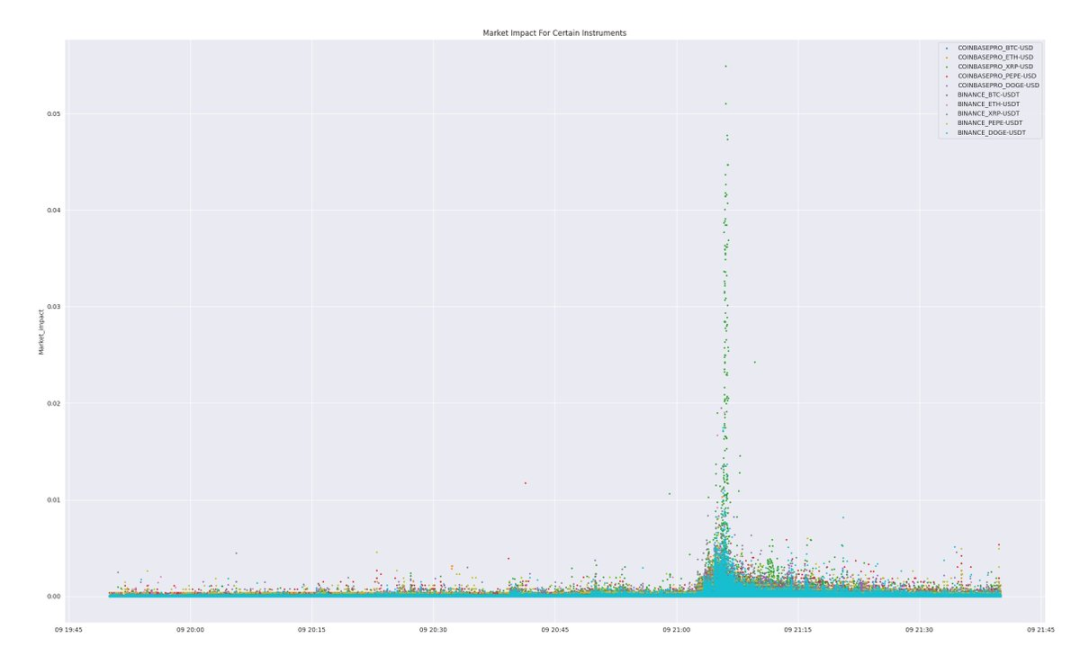

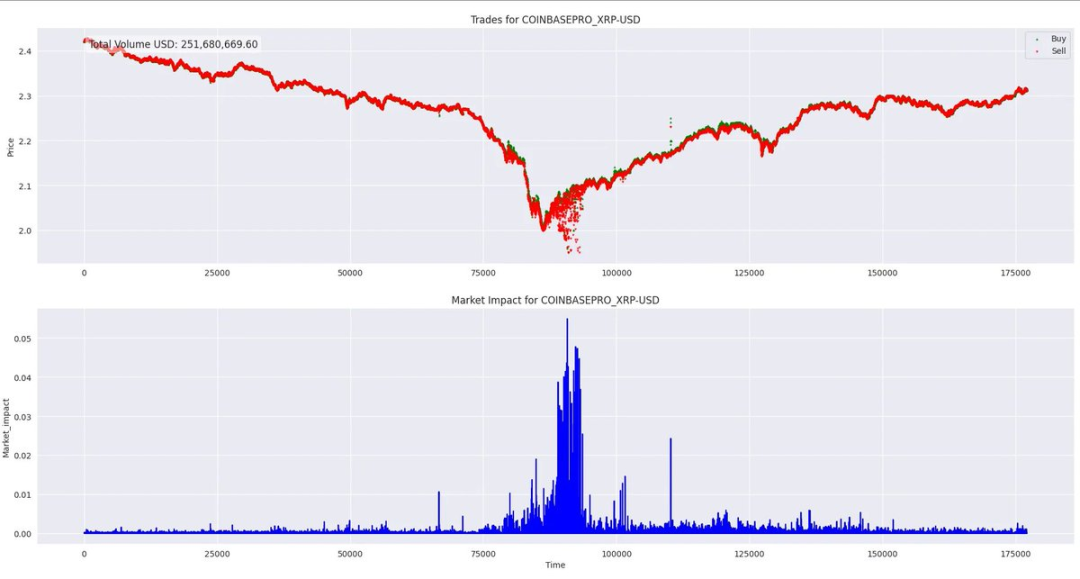

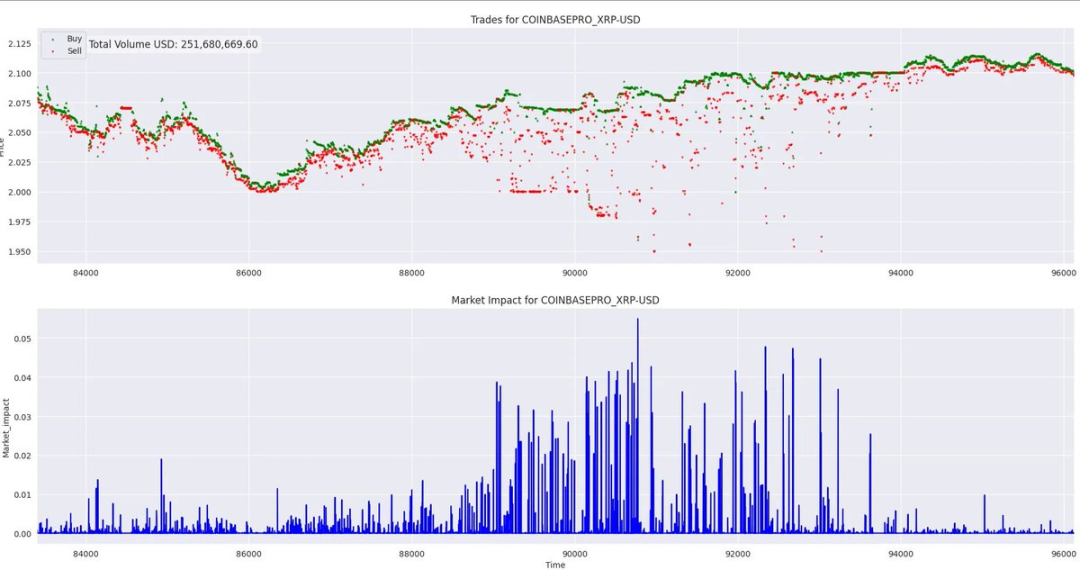

I personally love analyzing market impact. If I could only focus on one feature in the market, it would have to be market impact. Here you’ll see something astounding — the market impact of XRP on Coinbase is pretty large.

In a relatively mature large market, we witnessed a series of large sell orders, which caused the market to fall by more than 5%. We don't know exactly what happened, but it is obviously unusual.

You can see that these sell orders are not normal. This situation may be worth watching in the next few days. Maybe some big player is forced to sell.

When something like this happens, it’s usually a chain reaction of sell orders that are forced to close. Market makers absorb this selling pressure and hedge, causing the signal to propagate across major exchanges. For perpetual contract exchanges, this means that stops and liquidations are triggered, and the final impact is more significant, especially when this happens within a few minutes.

A coin like XRP, even with a market cap comparable to the largest U.S. company, can surge by hundreds of percentage points. XRP liquidity in the market remains poor relative to market cap.

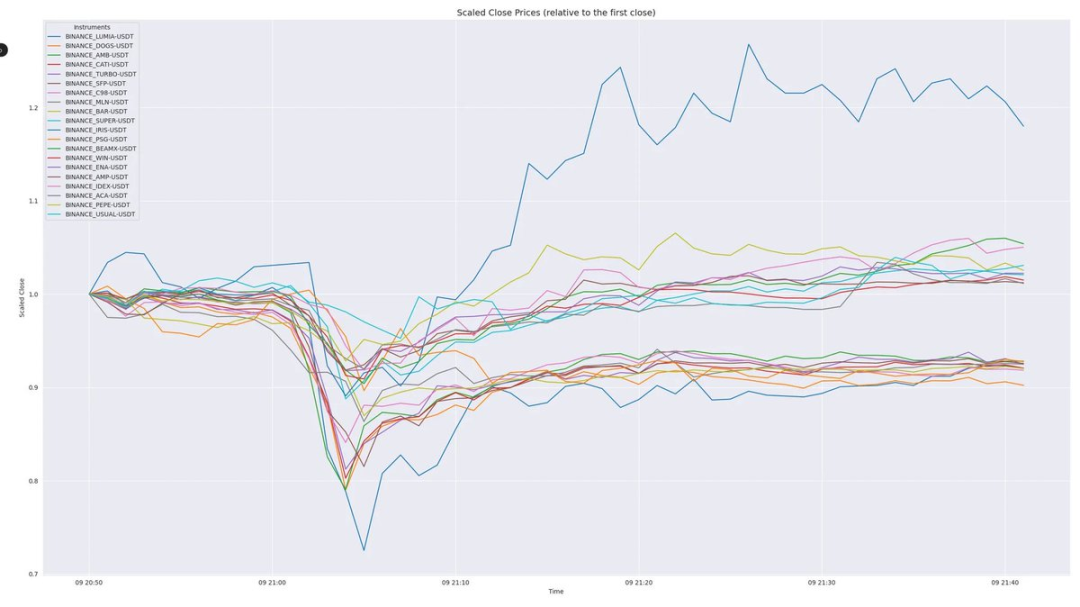

In a hot market, the next common phenomenon is that the price quickly reverses from the lowest point. At this time, there will be a lot of liquidations, liquidity restrictions, and many profitable players want to buy at the bottom.

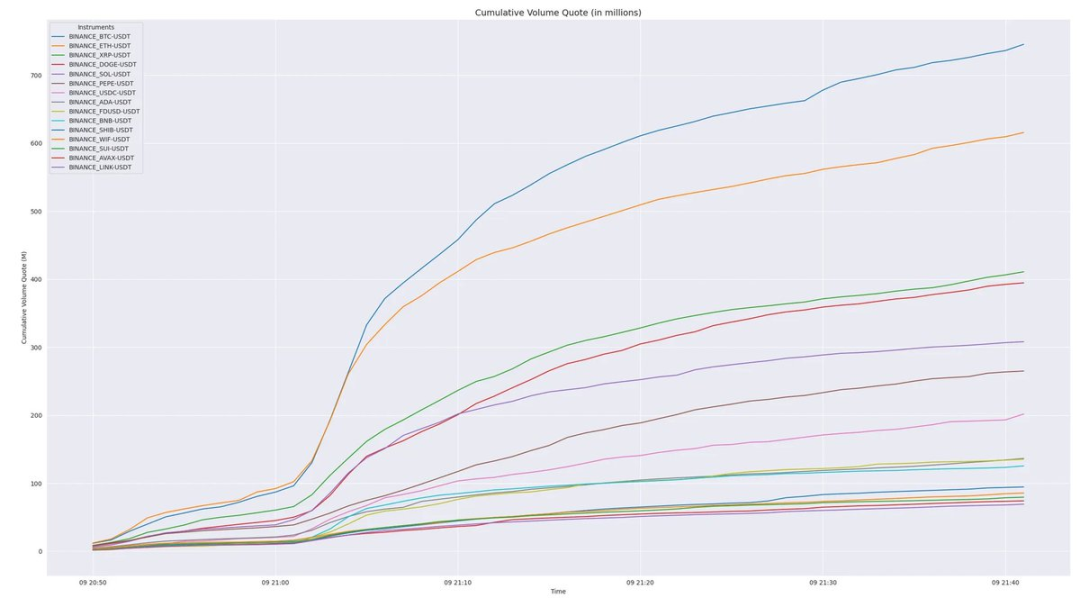

The volume chart shows the cumulative volume during the crash. Surprisingly, both USDC and FDUSD had significant volume, but ADA had exceptionally high volume.